International prepaid cards

Compare fees, accessibility and more before choosing a prepaid travel card..

Compare international prepaid cards

We compare the following brands

In this guide

3 factors to consider when comparing international prepaid cards

Is an international prepaid card right for me, what is an international prepaid card, prepaid travel money cards pros and cons, get an international prepaid card online, 5 international prepaid card fees and how to avoid them.

- What if my prepaid card doesn't support the local currency?

- What's the default currency order?

Alternatives to international prepaid cards

Prepaid guides

There are plenty of ways to take your cash overseas, but the right option will depend on your finances, travel plans and spending habits. Weigh the features, fees and benefits of a prepaid travel money to help you find the best travel money option for your next overseas trip.

To get the best international prepaid card for you, compare the following info:

- Fees. Most prepaid cards come with high fees, so you’ll want to choose one with the lowest monthly fee and one that has low fees for things like ATM withdrawals and foreign transactions.

- Accessibility. Make sure it services the currencies you’ll be using. And make sure it’s widely accepted wherever you’re going.

- Exchange rates. You want the most competitive exchange rates — which is why using an international prepaid card is much more beneficial than exchanging cash at an airport kiosk.

We love Wise for being super transparent about all of the above, so it’s worth looking into if you’re on a tight timeline and want a no-BS experience.

An international prepaid card might be a good option if you want to:

- Visit a country whose currency is available on the prepaid money card.

- Avoid fees, including the currency conversion fee and the foreign transaction fee.

- Lock in your exchange rate before traveling.

- Preload a debit card that is separate from your personal banking accounts.

- Have an acceptable form of non-cash payment.

An international prepaid card — also known as a prepaid travel money card — is a debit card that allows you to add money and converts it into several types of currency that you can spend when traveling. This ultimately allows you to spend overseas without paying a currency conversion fee. Before traveling to your destination, make sure your card supports the local currency to ensure you’ll benefit from its features.

Prepaid travel cards also let you lock-in exchange rates before you travel. By knowing exactly what exchange rate you’re getting and how much money you have on the card, you’ll be able to budget more efficiently.

Here are a few advantages and concerns with using a travel money card on your next trip abroad.

- Spend like a local. Prepaid travel cards allow you to preload multiple foreign currencies while avoiding the currency conversion fee.

- Backup card. Prepaid travel cards come with a backup in case the first card is lost or stolen.

- Manage your travel budget. Reload the card when you need funds with a locked-in exchange rate. This protects you from exchange rate fluctuations and also allows you effectively budget.

- Travel card fees. Each card will come with different fees such as initial load fees, reload fees, ATM fees and inactivity fees. Look at the Travel Money Card , as it waives most of these charges.

- Reloading time. It can take anywhere from two to three business days for the transaction to process — don’t forget about extra time for holidays or weekends.

- Weaker exchange rate. Although travel money cards protect you from unpredictable fluctuations in exchange rates, your exchange rate is generally lower than the market rate.

The best place to get international prepaid cards is online, since you can compare the different fees and terms without squinting at the fine print. If you want to pick up an international prepaid card from a physical location, contact your bank to see if you can open one at a branch.

While some grocery stores and chain retailers like Walmart and Costco do sell prepaid cards and gift cards, many of these cannot be used internationally — or they’ll charge hefty fees when used internationally — so we strongly recommend going to your bank or getting one online.

Take a look at some fees associated with travel money cards and a few hacks to reduce or avoid them entirely.

What if my prepaid card doesn’t support the local currency?

Most prepaid travel cards — like the Travelex Money Card — support about six currencies that have their own currency wallet. When you load funds onto your card, you’ll have to choose which currency you’d like to top up so you can use those funds in that country without having to pay a currency conversion fee.

If you don’t have the funds loaded in that particular currency wallet, or if your card doesn’t support that local currency, you’ll get hit with a currency conversion fee whenever you use your travel card in that country.

Your card provider withdraws funds from your account according to the default currency order at their existing exchange rate, and charges you an additional fee for converting currencies.

What’s the default currency order?

Currency order matters when you withdraw or spend money in a currency that your card doesn’t preload and can’t support. When this happens, your purchase amount is taken from the available currency highest on the default currency order list. Your card provider typically determines the default currency order.

For instance, a typical currency could be:

- United States dollars (USD)

- Great British pounds (GBP)

- Euros (EUR)

- Canadian dollars (CAD)

- Australian dollars (AUD)

- Japanese yen (JPY)

- Mexican pesos (MXY)

If you have preloaded USD, EUR and AUD on your card, and you are spending Thai baht in Bangkok, the card will convert whatever USD you have into baht for your purchase.

If you have insufficient USD preloaded on your card, it will convert the remaining USD you have into baht, and then withdraw the difference from your EUR wallet. A currency conversion fee will generally apply in these instances.

If an international prepaid card isn’t quite what you’re looking for, consider these alternatives:

- Borderless accounts. A virtual bank account designed to streamline the process of withdrawing cash and paying in different currencies, with low fees and transparent exchange rates. We like Wise because it offers free ATM withdrawals all around the world.

- Cash management accounts. These are tech-savvy accounts offered by nonbank financial service providers, Aspiration and Betterment. They’re considering because they have a reputation for low fees and offer more flexibility when it comes to managing your money. For example, Betterment reimburses you for all ATM and foreign transaction fees.

- International debit cards. Debit cards that won’t ding you for withdrawing money from a foreign ATM or stocking up on souvenirs in a foreign country.

- Travel credit cards. These typically come with zero foreign transaction fees and rewards you for buying travel items like plane tickets, hotel reservations, car rentals and more.

- Compare travel money

Kyle Morgan

Kyle Morgan is SEO manager at Forbes Advisor and a former editor and content strategist at Finder. He has written for the USA Today network and Relix magazine, among other publications. He holds a BA in journalism and media from Rutgers University. See full profile

More guides on Finder

Kraken T&Cs

Chime is better known for traditional banking products, while Cash App is widely known for its peer-to-peer (P2P) money transfer services.

Symple Lending isn’t transparent about its products and services.

Which cash advance apps work with Credit Karma?

Bluevine and Novo are both strong business bank accounts, but Bluevine wins for its bigger perks and more account offerings.

Both fintechs have no-fee business checking, but Mercury offers a few more perks.

Chime is better for bigger bonuses and extra features, but Varo offers cash-back rewards. Our team thinks Chime is the winner by a hair.

A review of FastLoanAdvance shows a lack of transparency about lenders and loan details.

Copper Banking has closed all of its accounts. Here are top banking apps and cards for kids and teens to try instead of Copper.

Some of the best family chore apps include Greenlight, GoHenry, FamZoo, Current, BusyKid, Chores & Allowance Bot and Things 3.

Ask a Question

Click here to cancel reply.

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Advertiser Disclosure

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Are Prepaid Travel Cards a Good Idea?

They can help with budgeting but compare them with other debit and credit card options before you go.

Getty Images

A prepaid travel card can offer fraud protection, with your liability limited to $50 if you report it within two business days of learning of the theft.

Whether you're planning a trip to Bali or Boston, staying on a budget and keeping your money safe is essential. A prepaid debit card can help.

Prepaid travel cards function similarly to general-purpose prepaid debit cards but offer extra perks that can make your life a little easier when you're abroad. However, they also come with limitations and other drawbacks that may give the casual traveler pause.

What Are Prepaid Travel Cards?

Prepaid travel cards, also sometimes called international prepaid cards, can make spending easier when you're outside the country.

There are two primary types of prepaid travel cards:

Multicurrency prepaid travel cards. These cards allow you to load cash in specific currencies onto your card before you go on your trip, letting you lock in your exchange rate instead of paying the current rate at the ATM or point of sale.

You can then use the card wherever its payment network, such as Visa or Mastercard, is accepted.

You can't load cash with just any currency, though. Even major prepaid cards may be limited to only a handful of currencies. For example, some have only six currencies available: the euro, British pound, Australian dollar, Canadian dollar, Japanese yen and Mexican peso.

General travel prepaid cards. These cards don't differ much from traditional prepaid debit cards. However, they're more likely to offer certain features that can come in handy when you're overseas.

Examples include chip and PIN capability, emergency cash and card replacement, and international ATM use.

Not all prepaid cards have a chip though, and that can be a problem, says Quentin Telep, director of financial services for AAA National. "In many countries, especially in Europe, they've had the chip functionality for many years."

You may have difficulty using a chipless card at unmanned kiosks and other automated payment points.

What Are the Benefits of Having a Prepaid Travel Card?

If you're planning a trip within the U.S., you likely won't need a travel prepaid debit card. But if you're traveling internationally, you may gain some benefits from doing so.

It can help with budgeting. Sticking to your vacation budget can be tough. Traveling is a time to let loose and live a little, and it can be easy to spend more than you originally planned.

"It's a little easier perhaps to overrun the credit card when you're on vacation and you're not really thinking about how much you're spending," says Mike Clark, co-founder of PrepaidCards123, an online tool for comparing prepaid debit cards. "You may want to set aside a specific amount for your spending money while you're on your trip, and people use prepaid cards for that purpose."

You'll be protected from fraud. Prepaid debit cards are required to give cardholders the same level of fraud protection as traditional debit cards.

This means that if someone uses your card without your permission, your liability is limited to $50 if you report it within two business days of learning of the theft.

Some prepaid cards may go above and beyond this standard, providing a zero-liability policy that protects you from losing any money, even if you don't report the theft before charges show up on your account.

Prepaid cards offer a buffer for your accounts. If you're wary about using your debit or credit card on your trip, a prepaid card can help. While all three types of cards offer some level of fraud protection, it might take time to recover.

A thief who gets access to your debit card could do serious damage to your bank account right when you need funds the most. For example, you may not be able to get reimbursed right away, or it may take some time to receive a replacement credit card . If any kind of theft happens with your prepaid card, the stakes are much lower.

What Are the Disadvantages of Using a Prepaid Travel Card?

While prepaid travel cards can have their perks, watch out for some potential pitfalls, too.

They can cost more. General prepaid debit cards typically charge foreign transaction fees on purchases made in a foreign currency. And though many travel credit cards waive that fee, prepaid travel cards don't. That means you may be paying 3% on top of every purchase you make on your trip.

Even if you exchange your currency before you go with a multicurrency card, you can expect to pay a premium. For example, you may pay a fee of 5.5% to exchange U.S. dollars to an available currency.

Prepaid travel cards could be a more expensive option than other methods of obtaining foreign currency, such as withdrawing cash from an ATM at your destination. "The exchange rate is not nearly as favorable as you would even have if you prepurchase currency at a bank," says Clark.

And if you don't use all the money on the card, you may be subject to a fee to get a refund of your remaining balance.

Prepaid travel cards can also come with other costs, such as fees to load money onto the account, inactivity fees, ATM fees and even a fee to set up your account.

They don't provide rewards or perks. If you're a disciplined spender and can stick to your budget while traveling, a travel rewards credit card may give you a lot more value than a prepaid travel card. Not only do most travel credit cards charge no foreign transaction fees, but you could get access to rewards and other perks such as statement credits for select travel-related expenses, travel insurance protections , complimentary airport lounge access and more.

Most benefits aren't unique. There are some clear benefits of using a prepaid travel card when you're out of the country, but other products could offer the same benefits.

For example, both traditional debit and credit cards offer fraud protection, and you can also avoid debt by using your regular debit card. And while prepaid travel cards come with a built-in limit as to how much you can spend, it's possible to do the same thing with your checking account – you'll just need to make sure your overdraft protection is disabled to avoid nonsufficient funds charges.

You may run into limitations. If you're hoping to get a multicurrency card, you'll only be able to use it if you're visiting a country that uses an eligible currency.

"It's kind of limited in terms of the geography where it's viable," says Telep, "and it also is really only suitable for frequent international travelers or people who are on very extended international trips."

Should You Consider Using a Prepaid Travel Card?

Prepaid travel cards may sound appealing because they're geared toward travel use. But they don't always provide more than what you get from using your regular debit card and a travel rewards credit card.

And while a multicurrency prepaid travel card sounds like it can make your life easier, you'll pay a premium to preload the currency of your choice. Credit and debit cards may assess fees, but many of them are easier to avoid than on prepaid card fees.

Some prepaid cards charge high monthly fees, for example, which may feel unnecessary if you're only using it when you travel. If you're thinking about using a prepaid debit card when traveling overseas for the forced budgeting feature, avoid limiting your search to cards that brand themselves as prepaid travel cards. Instead, also consider general-purpose prepaid cards that allow for international ATM withdrawals and don't charge a lot of fees.

"Look for a card that has a fee structure that's not going to penalize you if you only use the card two or three times a year when you’re going on various vacation trips," says Telep.

You'll also want to make sure you don't run into limitations on how and when you can use your card while you're traveling.

"If I'm traveling abroad, I have to make sure that my prepaid card is going to work for both cash access and for purchases abroad," says Clark. "And you're always going to want to go with a Visa or Mastercard network because of the acceptance abroad."

Consider Using a Mix of Payment Methods

Instead of focusing your vacation spending on just one form of payment, consider using more than one. For example, a travel rewards credit card may be best for most purchases because you can avoid the foreign transaction fee and earn valuable rewards on each transaction. Then use a traditional or prepaid debit card to withdraw cash from ATMs, since credit card issuers will charge a cash advance fee on these transactions.

By having multiple payment options, you can judge which one is the best every time you need to make a purchase. It can also help if one of them gets stolen. While some credit cards and prepaid debit cards offer emergency cash and card replacement services, having a backup ready to go can be a major stress reliever.

Whatever you do, take some time to compare your options to make sure you're getting the most value out of your trip.

Tags: credit cards

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Most links in our content provide compensation to Slickdeals. Applying for and maintaining consumer credit accounts is an important financial decision, with lasting consequences, and requires thought, planning and comparison shopping for the offer that best suits your personal situation. That's why we offer useful tools to evaluate these offers to meet your personal objectives. Be sure to verify all terms and conditions of any credit card before applying.

Search Slickdeals Money

Featured articles.

Southwest Credit Card Offers: Earn 120,000 Bonus Points

Earn an Amazon Gift Card When You Open a Prime Visa Credit Card

Amazon’s Prime Visa Credit Card Review: Generous Rewards for Amazon Power Shoppers

Axos Business Checking: Up to $400 Bonus

Tips and guides to help you navigate the world of personal finance

How Do Prepaid Travel Credit Cards Work?

- Share on Twitter

- Share on Facebook

- Share on Email

Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain.

Sticking to your travel budget isn't always easy. Using a prepaid travel card is one way to help keep your money safe, and can make sense for those who want to avoid overspending while on vacation.

Prepaid travel cards are an alternative payment option to consider, especially when traveling outside of the U.S. They work like other prepaid debit cards but often come with valuable extra benefits that are perfect when traveling abroad, like loading other currencies onto them.

Keep reading to learn more about prepaid travel cards, how they work and whether they are right for you.

What Are Prepaid Travel Cards and How Do They Work?

Prepaid travel cards are prepaid debit cards that make spending easier when traveling outside of the U.S. Sometimes referred to as international prepaid cards, these cards allow you to load funds using specific currencies before you travel, making them a good tool if you're trying to stick to a specific trip budget. Cardholders can even reload additional funds as needed.

Several payment networks like Mastercard and Visa offer prepaid travel cards. These cards are accepted almost anywhere worldwide and allow you to lock in exchange rates before traveling internationally. They also provide an extra level of security with zero liability protection from unauthorized purchases if your card is lost or stolen.

Types of Prepaid Travel Cards

Most prepaid travel cards fall into two categories.

1. Multicurrency Prepaid Travel Cards

Multicurrency prepaid travel cards allow you to lock in a specific exchange rate in several currencies before you travel. You avoid paying current exchange rates at an international ATM or merchant by loading funds ahead of time.

These cards can be used wherever they are accepted. Since many of these cards are tied to payment networks like Visa or Mastercard, consumers have few limits when using prepaid travel cards.

Not all multicurrency prepaid travel cards offer the same currency options. Some cards only offer a handful of the more popular currencies — the Australian dollar, British pound, Canadian dollar, the euro, Japanese yen and Mexican peso. Other cards offer over 50 different currencies.

2. General Travel Prepaid Cards

General travel prepaid cards work like other prepaid debit cards where you can preload funds into the card, but with a few extra features handy for travelers.

Some features of general travel prepaid cards can include:

- International ATM Use

- Modern Features Like Chip and PIN Capability

- Emergency Cash Assistance

- Quick Card Replacement

How Are Prepaid Travel Cards Different from Credit Cards?

Many consumers are familiar with travel rewards credit cards that can be used to rack up points for travel expenses, but not many know about prepaid travel cards. Prepaid travel cards are different from regular credit cards in a variety of ways, but they work similarly to secured credit cards with self-loaded funds acting as your credit line. Money is deducted from the prepaid card balance with every transaction until the funds are exhausted. However, consumers can add more funds to their prepaid cards using an outside funding source.

Here are the major differences between prepaid travel cards and credit cards.

- Prepaid cards are preloaded with your own money. You can control your spending with a prepaid travel card based on how much money you load onto the card.

- Prepaid cards don't charge interest . That's because you can only use funds loaded onto the card, not borrow from a credit line like a credit card. You could end up paying foreign exchange fees with a prepaid travel card or a credit card, although many of the top travel rewards credit cards don't charge this fee.

- Prepaid travel cards don't have any bearing on your credit score or history . They can't help boost your credit or hurt it because they're not reported to the credit bureaus since you use your own money to fund the card.

Pros & Cons of Using a Prepaid Travel Card

Just like any payment option, there are benefits and drawbacks to using prepaid travel cards. Here are some of the pros and cons to consider before getting a prepaid travel card.

Pros of Prepaid Travel Credit Card

- Helps you stay within your travel budget.

- Lock in the currency exchange rate in advance.

- Safer than a debit card or carrying cash.

- Load multiple currencies onto one card.

- Chip and PIN technology.

- Use at ATMs and shopping online.

Cons of Prepaid Travel Credit Card

- Foreign transaction fees and ATM fees, among other fees.

- Doesn't help you build credit.

- No overdraft option.

- May not be able to use at hotels that only take credit cards.

- Few (if any) travel protections.

- No travel rewards.

Are There Fees With Prepaid Travel Cards?

While there are several benefits to using prepaid travel cards, there is one negative attached to most cards — extra fees. You could face several fees if you choose to use a prepaid travel card, including:

- Foreign transaction fees : Many cards charge a fee when you use a prepaid card while traveling abroad. You could see charges of up to 4% or higher on some prepaid cards.

- Monthly fees : You could also pay a monthly fee for using a prepaid card. Some cards have fee structures that include a monthly fee, while others opt to charge cardholders per transaction instead. Some cards charge fees upwards of $9.95 per month. Some cards waive the monthly fee by meeting balance or deposit requirements.

- ATM fees : Using a prepaid card at an ATM typically involves paying a fee, whether used at a domestic or international ATM.

Other common prepaid card fees include:

- Initial load fee

- Inactivity fee

- Transaction fee

- Cash reload fee

- Balance inquiry fee

- Replacement card fee

Fees attached to your card may depend on the specific card, payment network or how you use the card.

Is My Money Safe On A Travel Card?

One big benefit of prepaid travel cards is the security they provide, such as:

- Funds are not linked to your bank : Unlike a debit card, a prepaid card isn't attached to your bank account. If your card is lost or stolen, you're less likely at risk of someone emptying your checking account. Your exposure is limited only to the funds on the card itself.

- Chip and PIN authentication : Many prepaid cards also feature chip and PIN technology, giving you another safeguard if your card is stolen. You can contact your card provider to freeze the card account if necessary.

- Zero-liability fraud protection : Several popular travel prepaid cards come with zero-liability fraud protection. Regardless of the card, prepaid cards must carry the same level of fraud protection as debit cards.

Can I Get A Prepaid Travel Card If I Have Bad Credit?

Because prepaid cards are secured with cash, there’s typically no credit check involved. That's what makes prepaid cards an attractive good option for individuals with bad credit who may have a hard time qualifying for a travel credit card. If you have cash, generally, you can get a prepaid card.

Unfortunately, prepaid travel cards don't help you build credit either. There are no monthly payments to report to credit bureaus. Prepaid cards also don't impact your credit utilization ratio, credit mix or length of credit history, all factors that could improve your credit. A prepaid card could be a good option short term when traveling but shouldn't be a substitute for other payment options that can help improve your credit.

Are Prepaid Travel Cards Worth It?

A prepaid travel card could be worth it for individuals who are seeking a safe payment option when traveling internationally and want to keep their spending abroad in check. It can also help to lock in a lower exchange rate instead of leaving it to chance with fluctuating rates.

But prepaid cards have their limitations too. They usually do not come with travel rewards or allow the cardholder to build credit by using the card. Don't forget that most prepaid cards also charge foreign transaction fees and other fees like monthly fees or inactivity fees.

Shop around if you're thinking about getting a prepaid card for your next international trip. Compare card fees, features and benefits to find one that fits your needs and is accepted in places you travel. Another option is to use multiple payment options when you travel. Using a prepaid card in combination with a credit card and debit card allows you to use each card in situations where it's advantageous. This also protects you if you run into any issues with your prepaid card.

Kevin Payne

Kevin Payne is a personal finance, credit card, and travel writer. He is the family travel and budget expert behind FamilyMoneyAdventure.com. Kevin lives in Cleveland, Ohio, with his wife and four kids. His work has appeared on several websites, including FinanceBuzz, Credit Karma, Millennial Money, Club Thrifty, Student Loan Planner and Slickdeals.

Follow the Money

Get all the latest finance topics and tips delivered straight to your inbox weekly.

Slickdeals Money Guide Tips and guides to help you navigate the world of personal finance Learn More

How to Rent a Car if You Don’t Have a Credit Card

3 Best Credit Cards for International Travel

4 Ways to Send Money Internationally

Venmo Debit Card Review: Is It Worth It?

6 Best Banks for Global Travelers

How Do Gas Credit Cards Work?

A Simple Guide to Credit Card Travel Protections

9 Most Common Bank Account Fees (and How to Avoid Them)

AT&T Points Plus Credit Card from Citi Review: Up to $240 in Annual Statement Credits

Citigold® Checking: Earn Up to $2,000 for Opening a New Account

How to Dispute a Charge on a Debit Card

Where to Store Your Crypto: Online, Hardware or Paper Wallets?

Terms & conditions on your card may vary by card issuer. Please refer to your issuing financial institution for more details.

*Card registration required. Certain exceptions apply. Click here for terms and conditions.

†Requirements may vary. See card packaging or ask in-store for details.

Travel Technology: Should I Use a Prepaid Travel Credit Card Like Wise?

by Carolyn Ray | Apr 9, 2024

- Toggle High Contrast

- Toggle Font size

Last updated on April 19th, 2024

How to save money and convert multiple currencies while travelling

by Carolyn Ray

Welcome to our Travel Technology column, where I attempt to answer your questions about the mystifying, ever-changing and evolving world of technology. Having spent years working in the technology industry with IBM and other notable firms, I have always been an early adopter and feel qualified to share my personal experiences or find those who know more than me, which often includes our readers. I always encourage you to review other sources and consult with experts.

Topic of the week: Prepaid travel credit cards

One of the most frequent questions on our private Solo Travel Wisdom group is about prepaid travel credit cards.

Question: “Does anyone have experience with a Wise card? How are the exchange rates going from Canadian dollars to other currencies? Thank you for any guidance you can give me.” — Cheryl T.

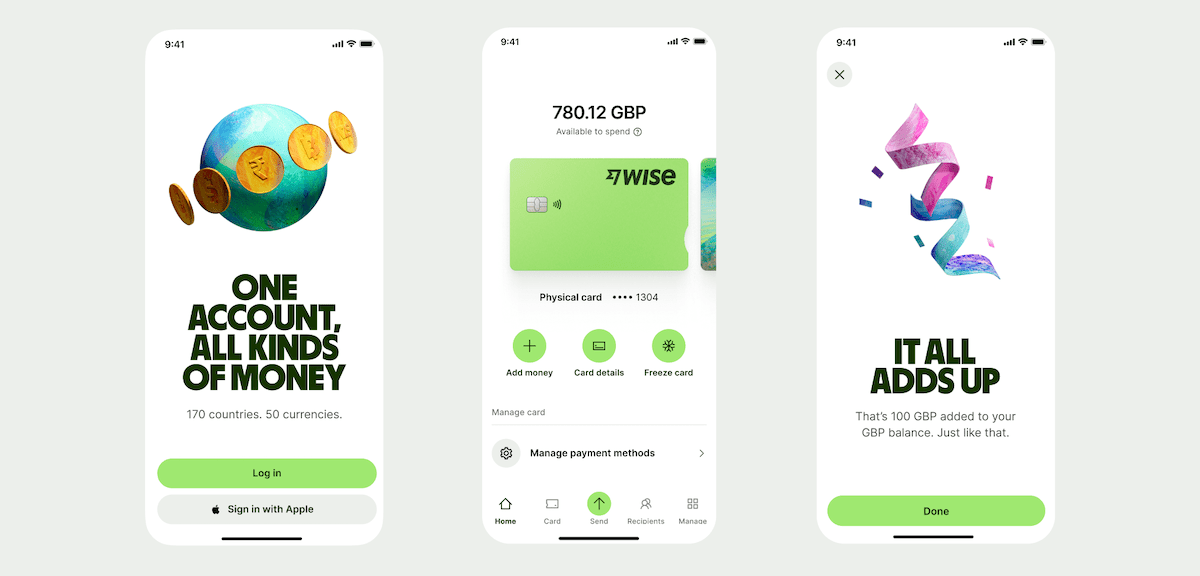

My take : I much prefer having a digital card like Wise on my phone versus pulling my credit card out of my wallet when I want to pay for public transit or make payments at stores and restaurants. In most European countries, you can tap on and off public transportation, such as the metro, subway, or bus with your phone using your Wallet (on iPhone) which uses facial recognition for additional protection.The other feature I enjoy is currency exchange, which can be done at the touch of a button for a small fee. For example, if I am travelling to Switzerland and don’t have Swiss Francs, I can convert my Euros into this currency at the touch of a button, and then convert unused funds into a currency I need. As a business owner, I use Wise to make payments in different currencies and have found the fees significantly lower than Paypal. Wise also has a plastic credit card as well but I just use the digital one.

Editorial note: JourneyWoman may earn revenue from this article from the company mentioned if you choose to purchase their product, but there is no cost to you for this. Our perspective is informed by our readers and our personal experiences, not influenced by advertisers. We wouldn’t recommend a product we haven’t used ourselves and will state if an article of this type is paid for or sponsored by a company, which it is not in this case. Read our disclaimer here .

What is a prepaid travel card?

A travel money card, also called a currency card, is a type of card which allows you to keep multiple currencies and use the card while travelling the world with no hidden fees to worry about.

Read More: How to Save Money on Travel: Tips From Experienced Solo Travellers

Benefits of a prepaid travel card.

Prepaid cards like Wise offer several benefits over physical credit cards, including no foreign transaction fees and lower rates than traditional credit cards.

Exchange rates : Both Revolut and Wise use the mid-market exchange rate, which is much better than the rate we might get at a bank, which also charges hidden fees. One difference with Revolut is that there is an extra 1.0% fee if you’d like to move RUB, THB or UAH. Revolut also charges a fee outside exchange hours, which can range between 0.5% – 2.0%.

Sending money : Fees vary slightly when sending money depending on the source of the funding. For example, if you’re funding your Wise account from your bank account, there is an Interac fee. I use Wise for business so the fees may be slightly higher than on personal accounts.

Receiving money : There is no charge to receive non-wire money on Wise . There is a fixed fee depending on the amount for SWIFT or wire transactions, between $4 and $10.

Read More: Travel Technology: What is an eSIM or Electronic Sim Card for Mobile Phones?

What women say about Wise and prepaid travel credit cards

“ Wise is an amazing resource. If you get the debit card, you can transfer money into a local currency account and use the debit card to withdraw it when in the country. You save a LOT on fees and currency conversion charges. — Mariellen W.

“Reminder to check which credit cards don’t have international fees. I forgot all about it this last trip & boy did those fees add up.” — MaKoa N.

“I have (a Wise card). I can’t really speak to your question about exchange rates but I have found it to be a great way to carry money internationally. It’s easy to load money onto it. It’s not connected to my own bank account so the risk of losing it is less damaging. It’s widely accepted so less need to carry anything else. I have nothing but positive experiences with it.” — Nancy T.

“I have Wise and I totally love it. You can go on their website and see that day’s exchange rate I believe. What you are not paying with this card is the 2 to 3% above that rate that bank cards charge to do a foreign transaction!!” — Cathi W.

“I used Wise to transfer money to an overseas vendor to pay for a trip in their currency. The exchange rate and service fees were less than using my credit card. It was easy once I read through the steps and provided confirmation of the transaction and delivery of the funds. I continue to weigh the savings vs credit card use (not accumulating points and insurance).” — Helen C.

“I also use Wise as a way to receive money from retreat participants in the currency of their choice and so that I can easily and seamlessly move through countries and access that same currency, having never paid exchange rates. I will caution anyone who holds large amounts (50K+) in any digital service, however. They are not a bank, and while highly regulated are not under the same protection as an institution.” — Tania C.

Please note: We make every effort to provide accurate and up-to-date information. While we may highlight certain positives of a finanical product, there is no guarantee that readers will benefit from the product. To the extent any recommendations or statements of opinion or fact made in a story may constitute financial advice, they constitute general information and not personal financial advice in any form. Readers of our stories should not act on any recommendation without first taking appropriate steps to verify the information in the stories consulting their independent financial adviser in order to ascertain whether the recommendation (if any) is appropriate, having regard to their investment objectives, financial situation and particular needs. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by JourneyWoman. Read more in our Terms of Use of this site.

Learn More About Travel Technology

Travel Technology: What is a VPN or Virtual Private Network?

by Carolyn Ray | May 18, 2024

Our Travel Technology series answers the question: ‘what is a VPN’, to help you protect your privacy on public networks.

Travel Technology: What is an eSIM or Electronic Sim Card for Mobile Phones?

by Carolyn Ray | Mar 31, 2024

Our Travel Technology series starts with a look at eSIMs, a new, cost-effective way for women to save money and stay connected on mobile phones.

Hold The Phone, Grandma: Safe Etiquette for Grandkid Holiday Snaps and Social Media

by Kathy Buckworth | Dec 22, 2023

Suggestions for grandparents when posting holiday photos on social media, particularly when traveling with grandchildren.

Carolyn Ray

As the CEO and Editor of JourneyWoman, Carolyn is a passionate advocate for women's travel and living the life of your dreams. She leads JourneyWoman's team of writers and chairs the JourneyWoman Women's Advisory Council and Women's Speaker's Bureau. She has been featured in the New York Times, Toronto Star and Zoomer as a solo travel expert, and speaks at women's travel conferences around the world. In March 2023, she was named one of the most influential women in travel by TravelPulse and was the recipient of a SATW travel writing award in September 2023. She is the chair of the Canadian chapter of the Society of American Travel Writers (SATW), a member Women's Travel Leaders and a Herald for the Transformational Travel Council (TTC). Sometimes she sleeps. A bit.

We always strive to use real photos from our own adventures, provided by the guest writer or from our personal travels. However, in some cases, due to photo quality, we must use stock photography. If you have any questions about the photography please let us know. Disclaimer: We are so happy that you are checking out this page right now! We only recommend things that are suggested by our community, or through our own experience, that we believe will be helpful and practical for you. Some of our pages contain links, which means we’re part of an affiliate program for the product being mentioned. Should you decide to purchase a product using a link from on our site, JourneyWoman may earn a small commission from the retailer, which helps us maintain our beautiful website. JourneyWoman is an Amazon Associate and earns from qualifying purchases. Thank you! We want to hear what you think about this article, and we welcome any updates or changes to improve it. You can comment below, or send an email to us at [email protected] .

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Submit Comment

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

MASTERCARD BENEFIT INQUIRIES Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

1. Card registration required. Certain restrictions apply. Contact the issuer of your card immediately to report your lost or stolen card. You can use the customer service toll-free number listed on the back of the card. Be sure to keep a record of the Mastercard card number. Your issuer may need this information to cancel the card and issue a replacement. You can also contact Emergency Services for additional assistance. In the event your card is lost or stolen, your card issuer will not hold you responsible for unauthorized purchases made on your card. Terms and Conditions . ↩

2. Certain terms, conditions and exclusions apply. Cardholders need to register for this service. This service is provided by Iris® Powered by Generali. Please see your guide to benefits for details or call 1-800-MASTERCARD. ↩

3. These are summary descriptions only. Certain terms, conditions and exclusions apply. To learn more about Zero Liability, visit mastercard.com/zeroliability . Contact your issuing financial institution for complete coverage terms and conditions or call 1.800.Mastercard (1.800.627.8372) for assistance. Applicable to U.S. cardholders only. ↩

4. HealthLock is an end‑to‑end analytics‑driven platform that helps protect cardholders’ medical identities and data and monitors their medical claims for errors, fraud and overbilling. HealthLock provides three plan levels:

- Medical Claim Monitor: Helps guard against medical fraud and privacy intrusions by monitoring medical data breaches, providing alerts and helping remediate medical fraud issues.

- Medical Claim Auditor: Organizes, tracks and audits all healthcare bills (24‑month retroactive audit and ongoing auditing) in one place, verifying that all bills are accurate and identifying potential overcharges and insurance errors. This level includes everything from the previous plan.

- Medical Claim Saver: Provides access to medical bill negotiation with providers and insurance companies to potentially help reduce bills and reverse claim rejections. This level includes everything from the previous plan.

Enrolled users receive, at no cost, Medical Claim Monitor, plus a premium upgrade to Medical Claim Saver for the first 90 days. After 90 days, users will continue to receive Medical Claim Monitor at no monthly cost and have the option to continue with Medical Claim Auditor for $4.99 per month or Medical Claim Saver for $19.99 per month. See full terms here . ↩

MASTERCARD BENEFIT INQUIRIES

Your benefits may vary by card type and by issuing financial institution. Refer to your issuing financial institution for complete benefit coverage terms and conditions or call Mastercard (0800-96-4767) for assistance. Certain terms, conditions and exclusions apply.

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

16 Best Travel Credit Cards of July 2024

ALSO CONSIDER: Best credit cards of 2024 || Best rewards credit cards || Best airline credit cards || Best hotel credit cards

The best travel credit card is one that brings your next trip a little closer every time you use it. Purchases earn points or miles you can use to pay for travel. If you're loyal to a specific airline or hotel chain, consider one of that company's branded travel credit cards. Otherwise, check out our picks for general-purpose travel cards that give you flexible travel rewards without the restrictions and blackout dates of branded cards.

250+ credit cards reviewed and rated by our team of experts

80+ years of combined experience covering credit cards and personal finance

100+ categories of best credit card selections ( See our top picks )

Objective comprehensive ratings rubrics ( Methodology )

NerdWallet's credit cards content, including ratings and recommendations, is overseen by a team of writers and editors who specialize in credit cards. Their work has appeared in The Associated Press, USA Today, The New York Times, MarketWatch, MSN, NBC's "Today," ABC's "Good Morning America" and many other national, regional and local media outlets. Each writer and editor follows NerdWallet's strict guidelines for editorial integrity .

Show summary

NerdWallet's Best Travel Credit Cards of July 2024

Chase Sapphire Preferred® Card : Best for Max flexibility + big bonus

Capital One Venture Rewards Credit Card : Best for Flat-rate rewards

Capital One Venture X Rewards Credit Card : Best for Travel portal benefits

Chase Freedom Unlimited® : Best for Cash back for travel bookings

American Express® Gold Card : Best for Big rewards on everyday spending

Wells Fargo Autograph℠ Card : Best for Bonus rewards + no annual fee

The Platinum Card® from American Express : Best for Luxury travel perks

Ink Business Preferred® Credit Card : Best for Business travelers

Citi Strata Premier℠ Card : Best for Triple points on multiple categories

Bank of America® Travel Rewards credit card : Best for Flat-rate rewards + no annual fee

Chase Sapphire Reserve® : Best for Bonus rewards + high-end perks

World of Hyatt Credit Card : Best for Best hotel card

Bilt World Elite Mastercard® Credit Card : Best for Travel rewards for rent payments

United℠ Explorer Card : Best for Best airline card

PenFed Pathfinder® Rewards Visa Signature® Card : Best for Credit union benefits

Wells Fargo Autograph Journey℠ Card : Best for Booking directly with airlines/hotels

Best Travel Credit Cards

Find the right credit card for you..

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Max flexibility + big bonus

Flat-rate rewards, travel portal benefits, cash back for travel bookings, big rewards on everyday spending, bonus rewards + no annual fee, luxury travel perks, business travelers, triple points on multiple categories, flat-rate rewards + no annual fee, bonus rewards + high-end perks, best hotel card, travel rewards for rent payments, best airline card, credit union benefits, booking directly with airlines/hotels, full list of editorial picks: best travel credit cards.

Before applying, confirm details on the issuer’s website.

Capital One Venture Rewards Credit Card

Our pick for: Flat-rate rewards

The Capital One Venture Rewards Credit Card is probably the best-known general-purpose travel credit card, thanks to its ubiquitous advertising. You earn 5 miles per dollar on hotels and car rentals booked through Capital One Travel and 2 miles per dollar on all other purchases. Miles can be redeemed at a value of 1 cent apiece for any travel purchase, without the blackout dates and other restrictions of branded hotel and airline cards. The card offers a great sign-up bonus and other worthwhile perks ( see rates and fees ). Read our review.

Bank of America® Travel Rewards credit card

Our pick for: Flat-rate rewards + no annual fee

One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards. Bank of America® has an expansive definition of "travel," too, giving you additional flexibility in how you use your rewards. Read our review.

Chase Sapphire Reserve®

Our pick for: Bonus rewards + high-end perks

The high annual fee on the Chase Sapphire Reserve® gives many potential applicants pause, but frequent travelers should be able to wring enough value out of this card to more than make up for the cost. Cardholders get bonus rewards (up to 10X) on dining and travel, a fat bonus offer, annual travel credits, airport lounge access, and a 50% boost in point value when redeeming points for travel booked through Chase. Points can also be transferred to about a dozen airline and hotel partners. Read our review.

Chase Sapphire Preferred® Card

Our pick for: Max flexibility + big bonus

For a reasonable annual fee, the Chase Sapphire Preferred® Card earns bonus rewards (up to 5X) on travel, dining, select streaming services, and select online grocery purchases. Points are worth 25% more when you redeem them for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. The sign-up bonus is stellar, too. Read our review.

Wells Fargo Autograph Journey℠ Card

Our pick for: Booking directly with airlines/hotels

The Wells Fargo Autograph Journey℠ Card stands out among general-purpose travel cards because it pays its highest rewards rates on travel bookings made directly with airlines and hotels, rather than requiring you to go through the issuer's travel agency, where prices might not be competitive. The points are flexible, you get a good bonus offer, and the card comes with a few other nice perks. Read our review.

Wells Fargo Autograph℠ Card

Our pick for: Bonus rewards + no annual fee

The Wells Fargo Autograph℠ Card offers so much value, it's hard to believe there's no annual fee. Start with a great bonus offer, then earn extra rewards in a host of common spending categories — restaurants, gas stations, transit, travel, streaming and more. Read our review.

Citi Strata Premier℠ Card

Our pick for: Triple points on everyday categories

The Citi Strata Premier℠ Card earns bonus points on select travel, supermarkets, dining, gas stations and EV stations. There's a solid sign-up bonus as well. Read our review.

U.S. Bank Altitude® Connect Visa Signature® Card

Our pick for: Road trips

The U.S. Bank Altitude® Connect Visa Signature® Card is one of the most generous cards on the market if you're taking to the skies or the road, thanks to the quadruple points it earns on travel and purchases at gas stations and EV charging stations. It's also a solid card for everyday expenses like groceries, dining and streaming, and it comes with ongoing credits that can offset its annual fee: $0 intro for the first year, then $95 . Read our review .

Capital One Venture X Rewards Credit Card

Our pick for: Travel portal benefits

Capital One's premium travel credit card can deliver terrific benefits — provided you're willing to do your travel spending through the issuer's online booking portal. That's where you'll earn the highest rewards rates plus credits that can make back the bulk of your annual fee ( see rates and fees ). Read our review.

Chase Freedom Unlimited®

Our pick for: Cash back for travel bookings

The Chase Freedom Unlimited® was already a fine card when it offered 1.5% cash back on all purchases. Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. On top of all that, new cardholders get a 0% introductory APR period and the opportunity to earn a sweet bonus. Read our review.

The Platinum Card® from American Express

Our pick for: Luxury travel perks

The Platinum Card® from American Express comes with a hefty annual fee, but travelers who like to go in style (and aren't afraid to pay for comfort) can more than get their money's worth. Enjoy extensive airport lounge access, hundreds of dollars a year in travel and shopping credits, hotel benefits and more. That's not even getting into the high rewards rate on eligible travel purchases and the rich welcome offer for new cardholders. Read our review.

American Express® Gold Card

Our pick for: Big rewards on everyday spending

The American Express® Gold Card can earn you a pile of points from everyday spending, with generous rewards at U.S. supermarkets, at restaurants and on certain flights booked through amextravel.com. Other benefits include hundreds of dollars a year in available dining and travel credits and a solid welcome offer for new cardholders. There's an annual fee, though, and a pretty substantial one, so it's not for smaller spenders. Read our review.

Bilt World Elite Mastercard® Credit Card

Our pick for: Travel rewards on rent payments

The Bilt World Elite Mastercard® Credit Card stands out by offering credit card rewards on rent payments without incurring an additional transaction fee. The ability to earn rewards on what for many people is their single biggest monthly expense makes this card worth a look for any renter. You also get bonus points on dining and travel when you make at least five transactions on the card each statement period, and redemption options include point transfers to partner hotel and loyalty programs. Read our review.

PenFed Pathfinder® Rewards Visa Signature® Card

Our pick for: Credit union rewards

With premium perks for a $95 annual fee (which can be waived in some cases), jet-setters will get a lot of value from the PenFed Pathfinder® Rewards Visa Signature® Card . It also offers a generous rewards rate on travel purchases and a decent flat rate on everything else. Plus, you’ll get travel credits and a Priority Pass membership that offers airport lounge access for $32 per visit. Read our review.

United℠ Explorer Card

Our pick for: B est airline card

The United℠ Explorer Card earns bonus rewards not only on spending with United Airlines but also at restaurants and on eligible hotel stays. And the perks are outstanding for a basic airline card — a free checked bag, priority boarding, lounge passes and more. Read our review.

» Not a United frequent flyer? See our best airline cards for other options

World of Hyatt Credit Card

Our pick for: Best hotel card

Hyatt isn't as big as its competitors, but World of Hyatt Credit Card is worth a look for anyone who spends a lot of time on the road. You can earn a lot of points even on non-Hyatt spending, and those points have a high value compared with rival programs. There's a great sign-up bonus, free nights, automatic elite status and more. Read our review.

» Not a Hyatt customer? See our best hotel cards for other options.

Ink Business Preferred® Credit Card

Our pick for: Business travelers

The Ink Business Preferred® Credit Card starts you off with one of the biggest sign-up bonuses of any credit card anywhere: Earn 100,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠. You also get bonus rewards on travel expenses and common business spending categories, like advertising, shipping and internet, cable and phone service. Points are worth 25% more when redeemed for travel booked through Chase, or you can transfer them to about a dozen airline and hotel partners. Learn more and apply .

Are you in Canada?

See NerdWallet's best travel cards for Canada.

OTHER RESOURCES

How travel rewards work.

Modern-day adventurers and once-a-year vacationers alike love the idea of earning rewards toward their next big trip. According to a NerdWallet study , 68% of American adults say they have a credit card that earns travel rewards.

With a travel rewards credit card, you earn points or miles every time you use the card, but you can often earn more points per dollar in select categories. Some top travel credit cards, such as the Chase Sapphire Reserve® , offer bonus points on any travel spending, while the Marriott Bonvoy Boundless® Credit Card grants bonus points when you use the card at Marriott hotels, grocery stores, restaurants or gas stations.

Not all points and miles earned on travel rewards credit cards are the same:

General-purpose travel credit cards — including the Chase Sapphire Preferred® Card , the American Express® Gold Card and the Capital One Venture Rewards Credit Card — give you rewards that can be used like cash to pay for travel or that can be exchanged for points in airline or hotel loyalty programs. With their flexible rewards, general-purpose options are usually the best travel credit cards for those who don't stick to a single airline or hotel chain.

Airline- and hotel-specific cards — such as the United℠ Explorer Card and the Hilton Honors American Express Card — give points and miles that can be used only with the brand on the card. (Although it's possible in some cases to transfer hotel points to airlines, we recommend against it because you get a poor value.) These so-called co-branded cards are usually the best travel credit cards for those who always fly one particular airline or stay with one hotel group.

How do we value points and miles? With the rewards earned on general travel cards, it's simple: They have a fixed value, usually between 1 and 1.5 cents per point, and you can spend them like cash. With airline miles and hotel points, finding the true value is more difficult. How much value you get depends on how you redeem them.

To better understand what miles are worth, NerdWallet researched the cash prices and reward-redemption values for hundreds of flights. Our results:

Keep in mind that the airline values are based on main cabin economy tickets and exclude premium cabin redemptions. See our valuations page for business class valuations and details about our methodology.

Our valuations are different from many others you may find. That’s because we looked at the average value of a point based on reasonable price searches that anyone can perform, not a maximized value that only travel rewards experts can expect to reach.

You should therefore use these values as a baseline for your own redemptions. If you can redeem your points for the values listed on our valuations page, you are doing well. Of course, if you are able to get higher value out of your miles, that’s even better.

HOW TO CHOOSE A TRAVEL CREDIT CARD

There are scores of travel rewards cards to choose from. The best travel credit card for you has as much to do with you as with the card. How often you travel, how much flexibility you want, how much you value airline or hotel perks — these are all things to take into account when deciding on a travel card. Our article on how to choose a travel credit card recommends that you prioritize:

Rewards you will actually use (points and miles are only as good as your ability to redeem them for travel).

A high earning rate (how much value you get in rewards for every dollar spent on the card).

A sign-up bonus (a windfall of points for meeting a spending requirement in your first few months).

Even with these goals in mind, there are all kinds of considerations that will influence your decision on a travel rewards credit card.

Travel cards are for travelers

Travel cards vs. cash-back cards.

The very first question to ask yourself when choosing a travel credit card is: Should I get a travel card at all? Travel credit cards are best for frequent travelers, who are more likely to get enough value from rewards and perks to make up for the annual fees that the best travel credit cards charge. (Some travel cards charge no annual fee, but they tend to offer lesser rewards than full-fee cards.) A NerdWallet study found that those who travel only occasionally — say, once a year — will probably get greater overall rewards from cash-back credit cards , most of which charge no annual fee, than from a travel card.

Flexibility and perks: A trade-off

Co-branded cards vs. general travel cards.

Travel credit cards fall into two basic categories: co-branded cards and general travel cards.

Co-branded cards carry the name of an airline or hotel group, such as the United℠ Explorer Card or the Marriott Bonvoy Boundless® Credit Card . The rewards you earn are redeemable only with that particular brand, which can limit your flexibility, sometimes sharply. For example, if your credit card's co-branded airline partner doesn't have any award seats available on the flight you want on the day you want, you're out of luck. On the other hand, co-branded cards commonly offer airline- or hotel-specific perks that general travel cards can't match.

General travel cards aren't tied to a specific airline or hotel, so they offer much greater flexibility. Well-known general travel cards include the Capital One Venture Rewards Credit Card and the Chase Sapphire Preferred® Card . Rewards on general travel cards come as points (sometimes called "miles" but they're really points) that you can redeem for any travel expense. You're not locked into using a single airline or hotel, but you also won't enjoy the perks of a co-branded card.

Evaluating general travel credit cards

What you get with a general travel card.

The credit cards featured at the top of this page are general travel cards. They're issued by a bank (such as Chase or Capital One), carry only that bank's name, and aren't tied to any single airline or hotel group. With these cards, you earn points on every purchase — usually 1 to 2 points per dollar spent, sometimes with additional points in certain categories.

Issuers of general travel cards typically entice new applicants with big sign-up bonuses (also known as "welcome offers") — tens of thousands of miles that you can earn by spending a certain amount of money on the card in your first few months.

» MORE: NerdWallet's best credit card sign-up offers

What do you do with those points? Depending on the card, you may have several ways to redeem them:

Booking travel. With this option, your points pay for travel booked through the issuer's website, using a utility similar to Orbitz or Expedia. For example, if points were worth 1 cent apiece when redeemed this way, you could book a $400 flight on the issuer's portal and pay for it with 40,000 points

Statement credit. This lets you essentially erase travel purchases by using your points for credit on your statement. You make travel arrangements however you want (directly with an airline or hotel, through a travel agency, etc.) and charge it to your card. Once the charge shows up on your account, you apply the necessary points and eliminate the cost.

Transferring to partners. The card issuer may allow you to transfer your points to loyalty programs for airlines or hotel chains, turning your general card into something like a co-branded card (although you don't get the perks of a co-brand).

Cash back, gift cards or merchandise. If you don't plan to travel, you can burn off your rewards with these options, although you'll often get a lower value per point.

Airline and hotel cards sharply limit your choice, but they make up for it with perks that only they can offer, like free checked bags or room upgrades. General travel cards, on the other hand, offer maximum flexibility but can't provide the same kinds of perks, because the banks that issue them don't operate the airlines or hotels. Still, there are some noteworthy perks on general travel cards, including:

Travel credit. This is automatic reimbursement for travel-related spending. Some top travel credit cards offer hundreds of dollars a year in travel credit.

Trusted traveler reimbursement. More and more travel credit cards are covering the application fee for TSA Precheck and Global Entry, programs that allow you to move through airport security and customs more quickly.

Airport lounge access. Hundreds of lounges worldwide operate separately from airlines under such networks as Priority Pass and Airspace, and several general travel cards offer access to these lounges.

Points programs

Every major card issuer has at least one travel card with a points program. American Express calls its program Membership Rewards, while Chase has Ultimate Rewards® and Citi pays in ThankYou points. Wells Fargo has Wells Fargo Rewards, and U.S. Bank has FlexPerks. Bank of America® travel cards offer points without a fancy name. Travel cards from Capital One, Barclays and Discover all call their points "miles."

These programs differ in how much their points are worth and how you can use them. Some offer the full range of redemption options, including transfers to loyalty programs. Others let you use them only to book travel or get statement credit.

» MORE: Travel loyalty program reviews

Evaluating airline credit cards

What you get with an airline credit card.

Airline credit cards earn "miles" with each purchase. You typically get 1 mile per dollar spent, with a higher rate (2 or more miles per dollar) on purchases with the airline itself. (Some airline cards have also begun offering extra miles for purchases in additional categories, such as restaurants or car rental agencies.) These miles go into the same frequent-flyer account as the ones you earn by flying the airline, and you can redeem them for free flights with the airline or its alliance partners.

Co-branded airline cards typically offer sign-up bonuses (or welcome offers). But what really sets them apart are the perks they give you. With some cards, for example, the checked-bag benefit alone can make up for the annual fee after a single roundtrip by a couple. Common perks of airline cards include:

Free checked bags. This commonly applies to the first checked bag for you and at least one companion on your reservation. Some cards extend this perk to more people, and higher-end cards (with higher annual fees) may even let you check two bags apiece for free.

Priority boarding. Holders of co-branded airline credit cards often get to board the plane early — after the airline's elite-status frequent flyers but before the general population. This gives you time to settle in and gives you a leg up on claiming that coveted overhead bin space.

In-flight discounts or freebies. You might get, say, 25% off the cost of food and beverages during the flight, or free Wi-Fi.

Airport lounge access. High-end cards often include a membership to the airline's airport lounges, where you can get away from the frenzy in the terminal and enjoy a complimentary snack. Some less-expensive airline cards give you only limited or discounted lounge access; others give you none at all.

Companion fares. This perk lets you bring someone with you for a lower cost when you buy a ticket at full price.

A boost toward elite status. Miles earned with a credit card, as opposed to those earned from actually flying on the airline, usually do not count toward earning elite status in an airline's frequent-flyer program. However, carrying an airline's high-end card might automatically qualify you for a higher tier within the program.

The biggest U.S. airlines — American, United and Delta — offer an array of credit cards. Each airline has a no-annual-fee card that earns miles on purchases but provides little in the way of perks (no free bags or priority boarding). Each has a high-end card with an annual fee in the neighborhood of $450 that offers lounge access and sumptuous perks. And each has a "middle-class" card with a fee of around $100 and solid ongoing perks. Southwest offers three credit cards with varying fees; smaller carriers may just have a single card.

» MORE: NerdWallet's best airline credit cards

Choosing an airline

Which airline card you get depends in large part on what airline you fly, and that's heavily influenced by where you live. Alaska Airlines, for example, has an outstanding credit card, but the airline's routes are concentrated primarily on the West Coast. So it's not a great option for those who live in, say, Buffalo, New York, or Montgomery, Alabama.

If your local airport is dominated by a single airline, then you're probably flying that carrier most (or all) of the time by default. Delta, for example, is the 800-pound gorilla at Minneapolis-St. Paul and Salt Lake City. United has the bulk of the traffic at Newark and Washington Dulles. American calls the shots at Charlotte and Dallas-Fort Worth. That airline's credit card may be your only realistic option. If you're in a large or midsize market with frequent service from multiple airlines, you have more choice.

» MORE: How to choose an airline credit card

Evaluating hotel credit cards

What you get with a hotel card.

Hotel credit cards earn points with each purchase. As with airline cards, you typically get more points per dollar for purchases from the co-brand partner, and some cards also give bonus points in additional categories. (Hotel cards tend to give you a greater number of points overall than airline cards, but each individual point is generally worth less than a typical airline mile.) Similar to the airline model, the points you earn with the card go into the same loyalty account as the points you earn from actually staying at a hotel. You redeem your points for free stays.

Hotel cards usually offer a sign-up bonus, but like airline cards, they really make their bones with the ongoing perks. Common perks on hotel cards include:

Free nights. Several cards offer this perk, which can make up for the card's annual fee. You may get a free night automatically every year, or you may unlock it by spending a certain amount within a year. In the latter case, it comes on top of the points you earn for your spending.

Upgrades and freebies. Cardholders may qualify for automatic room upgrades when available, or free or discounted amenities such as meals or spa packages.

Early check-in/late check-out. No one likes having to cool their heels in the hotel lobby waiting for 3 o'clock to check in. And no one likes have to vacate their room by 11 a.m. when their flight doesn't leave till evening.

Accelerated elite status. Some hotel cards automatically bump you up a level in their loyalty program just for being a cardholder.

» MORE: NerdWallet's best hotel credit cards

Choosing a hotel group

If you decide to go the hotel-card route, you'll need to decide which hotel group gets your business. Hotels aren't as market-concentrated as airlines, so if your travels take you mostly to metropolitan areas, you'll have a decent amount of choice. Keep in mind that even though there are dozens of nationally recognizable hotel brands, ranging from budget inns to luxury resorts, many of them are just units in a larger hotel company, and that company's card can unlock benefits across the group.

Marriott, for example, includes not only its namesake properties but nearly 30 other brands, including Courtyard, Fairfield, Renaissance, Residence Inn, Ritz-Carlton, Sheraton and Westin. The Hilton family includes DoubleTree, Embassy Suites, Hampton Inn and Waldorf-Astoria. InterContinental includes Holiday Inn, Candlewood, Staybridge and Crowne Plaza. Wyndham and Choice have more than 15 mid-tier and budget-oriented brands between them.

HOW TO COMPARE TRAVEL CREDIT CARDS

No travel rewards credit card is going to have everything you want. You're going to be disappointed if you expect to find a high rewards rate, a generous sign-up bonus, top-notch perks and no annual fee. Each card delivers value through a different combination of features; it's up to you to compare cards based on the following features and choose the best travel credit card for your needs and preferences.

Most of the best travel cards charge an annual fee. Fees in the range of $90 to $100 are standard for travel cards. Premium cards with extensive perks will have fees of $450 or more. Weigh the value of the rewards and perks you'll get to make sure they'll make up for the fee.

Can you find good cards without an annual fee? Absolutely! There are no-fee options on our list of the best travel credit cards, and we've rounded up more here . Just be aware that if you go with a no-fee travel card, you'll earn rewards at a lower rate, your sign-up bonus will be smaller, and you won't get as many (if any) perks.

Rewards rate

Rewards can be thought of in terms of "earn rate" and "burn rate".

The earn rate is how many points or miles you receive per dollar spent. Some general travel cards offer flat-rate rewards, meaning you get the same rate on all purchases, all the time — 2 miles per dollar, for example, or 1.5 points per dollar. Others, including most co-branded cards, offer a base rate of maybe 1 point per dollar and then pay a higher rate in certain categories, such as airline tickets, hotel stays, general travel expenses or restaurant meals.

The burn rate is the value you get for those points or miles when you redeem them. The industry average is about 1 cent per point or mile. Some cards, particularly hotel cards, have lower value per point on the "burn" side but give you more points per dollar on the earning side.

When comparing rewards rates, don't just look at the numbers. Look at the categories to which those numbers apply, and find a card that matches your spending patterns. Getting 5 points per dollar seems great — but if those 5X points come only on purchases at, say, office supply stores, and you don't spend money on office supplies, then you're getting lousy value.

Sign-up bonus

Travel cards tend to have the biggest sign-up bonuses — tens of thousands of points that you earn by hitting a certain amount of spending. But there's more to consider when comparing sign-up bonuses than just how many points or miles you earn. You must also take into account how much you have to spend to earn the bonus. While cash-back credit cards often require just $500 to $1,000 in spending over three months to unlock a bonus, travel cards commonly have thresholds of $3,000 to $5,000.

Never spend money you don't have just to earn a sign-up bonus. Carrying $3,000 in debt for a year in order to earn a $500 bonus doesn't make economic sense — the interest you'll pay could easily wipe out the value of the bonus.

Finally, keep in mind that the biggest bonuses will come on cards with annual fees.

Foreign transaction fees

A good travel card will not charge a foreign transaction fee. These fees are surcharges on purchases made outside the U.S. The industry standard is about 3%, which is enough to wipe out most if not all of the rewards you earn on a purchase. If you never leave the U.S., then this isn't much of a concern, but anyone who travels abroad should bring a no-foreign-transaction-fee card with them.

Some issuers don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

International acceptance

Not all travel credit cards are great companions for international travel. While Visa and Mastercard are good pretty much worldwide, you may encounter limited acceptance for American Express and, especially, Discover, depending on the destination. This doesn't mean world travelers should dismiss AmEx and Discover. Just know that if you take one of these cards with you overseas, you'd be smart to bring along a backup in case you run into acceptance problems. (Having a backup card is good advice within the U.S., too, really.)

Travel protections

Consider which travel protections — car rental insurance , trip cancellation coverage , lost baggage protection — are important to you.

"Rewards" are what you get for using a credit card — the points earned with each transaction and the bonuses you unlock with your spending. "Perks" are goodies that you get just for carrying the card. There's a very close correlation between the annual fee on a card and the perks you get for carrying it. Cards with no annual fee are all about rewards and go very light on perks. Premium cards with annual fees of $450 or more are laden with perks (although sometimes their rewards aren't too special). Midtier cards (in the $100 range) tend to have solid rewards and a handful of high-value perks.

Assuming you take advantage of them, the perks often make up for the annual fee on a card quite easily. This is especially true with co-branded cards. Free checked bags can pay for an airline card several times over, and a free night is usually worth more than the fee on a hotel card. When comparing the perks of various cards, be realistic about which ones you will and won't use. Sure, that card may entitle you to a free spa package the next time you're at a five-star hotel, but how often do you stay at five-star hotels?

SHOULD YOU GET A TRAVEL CARD? PROS AND CONS

Pros: why it's worth getting a travel card.

The sign-up bonus gives you a big head-start on travel. Bonuses on the best travel credit cards typically run $500 or more — enough for a roundtrip ticket in many instances.

Perks make travel less expensive and more relaxing. You won't have to worry about cramming a week's worth of clothes into a carry-on if your travel credit card gives you a free checked bag (or automatically reimburses you for the bag fee). Hate the crush of travelers in the terminal? Escape to the airport lounge. Renting a car? Use a travel card that provides primary rental car insurance.