Get Your Schengen Insurance

- Hospitalisation expenses up to 30,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area

Extend Your Coverage

- Hospitalisation expenses up to 60,000€

- Assistance in the event of illness/injury and death

- Coverage in the Schengen area + European Union

- Return/relocation and lodging expenses of a companion

Before traveling, please check the guidelines provided by the World Health Organization, the European Union and your local government. Important restrictions are applied to the Schengen Area and visas are likely to be limited to specific travels only. Our travel insurance policies are made to protect you against unforeseeable events, such as sudden illnesses or accidental bodily injuries. We remind you that epidemics and/or infectious diseases such as CoVid 19 are excluded from our policies.

Schengen travel insurance

Europ Assistance makes it easy for you to select and purchase your travel insurance online. Your insurance will be ready in a matter of minutes and our insurance certificates are recognized by embassies, consulates and visa centers around the world , which helps you acquire a Schengen visa for your next trip to Europe. You will immediately receive the certificate and you will be able to download it at any time in any of our six languages : English, French, Spanish, German, Russian or Chinese.

Which countries are in the Schengen area?

The Schengen area is made up of 26 countries (and 3 microstates) where travelers and residents can move freely from state to state without a passport, as there is no longer common border control between Schengen states. Travel insurance is highly suggested for all travelers, and for most countries is mandatory , as it is needed to obtain the visa to enter the Schengen area. You can obtain your visa application form from the country you plan to enter through first or the one you plan to spend the most time in.

The leading Schengen travel insurance provider

When you choose Europ Assistance as your Schengen visa travel insurance provider, you also get the support and expertise of 750,000 partners . If something goes wrong, not only will your medical expenses be properly reimbursed, but you will also get help from competent medical professionals at qualified medical centers, no matter where you are. During stressful situations or emergencies abroad, communicating in your native language can be a source of comfort. When such a situation occurs, you can trust that Europ Assistance will be there to help you 24/7 .

If you wish to subscribe for more than 20 people, please contact us

Travel dates

- Country of residence All travellers are from the same country of residence : Yes No

A Schengen visa is not required for your trip, however, you should still consider purchasing travel insurance. You can travel with peace of mind and are covered throughout the European Union with our Schengen Plus cover.

- Hospitalisation expenses up to 60,000€

- Coverage in the Schengen area + European Union

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

5 Tips for Buying Schengen Visa Travel Insurance

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Decide which type of insurance you’d like

2. get multiple quotes, 3. use this as an opportunity to maximize credit card bonus points, 4. double-check the policy before purchasing, 5. consider using a credit card that provides trip insurance instead of buying a new policy, if you’re looking to buy travel insurance for a schengen visa.

Travel insurance can be a very important accompaniment to your trip, especially when you’re traveling throughout multiple countries. Europe is a prime example of this, where the border-free Schengen zone allows you to traverse multiple countries without passing passport control. Finding Schengen visa travel insurance isn’t always simple, however, and you’ll want to ensure that you have coverage regardless of your location.

There are plenty of things to think about before buying travel insurance when traveling throughout Europe, including: the coverage you’re looking for, how you’ll be paying and whether your credit card already offers insurance.

Let’s take a look at Schengen travel insurance and five easy tips for making sure you’re good to go — no matter where you travel within the region.

Although there aren’t generally any Schengen visa travel insurance requirements, there are multiple types of travel insurance coverage available depending on your needs. Consider carefully the type of coverage you’re looking for. Common types includes:

Travel medical insurance .

Trip interruption insurance .

Cancel for any reason insurance .

Trip cancellation insurance .

Lost luggage insurance .

Rental car insurance .

Accidental death insurance .

Emergency evacuation insurance.

Note that the U.K. left the Schengen zone a few years ago, so you’ll want to double-check whether coverage in the U.K. is valid for your travel insurance policy.

» Learn more: Is travel insurance worth it?

It’s always in your best interest to get multiple quotes before purchasing insurance. The amount you’ll pay will be heavily dependent on the type of coverage you receive, its length and any deductibles that you may have.

Cancel For Any Reason insurance, or CFAR, allows you to recoup most or all of your nonrefundable costs — no matter why you’ve chosen not to travel.

There are plenty of different websites that’ll allow you to compare different insurance plans such as TravelInsurance.com or SquareMouth.com (a NerdWallet partner), which will gather together multiple quotes in one easy search.

There are several details you’ll need to have on hand when looking for quotes. These include:

The total cost of your trip.

Your destination.

Your dates of travel.

The number of travelers.

The age of travelers.

Where you live.

When you booked your trip.

Once you’ve got all your information gathered together, it’s simple to find a policy that fits your need for travel insurance in the Schengen zone on one of the comparison websites.

» Learn more: What is travel insurance?

If you’re planning a vacation to Europe, hopefully you’ve already acquired a travel credit card or two. However, cards that focus on travel rewards won’t necessarily optimize insurance purchases.

» Learn more: How to choose a credit card for Europe travel

In this case, you’ll want to double down on rewards with a card that’ll maximize everyday spend. These cards will give you bonus points on all purchases, no matter their category. Great options for this include:

Capital One Venture Rewards Credit Card : Earn 2x Capital One Miles per dollar spent on all purchases.

Citi Double Cash® Card : Earn 2% cash back in the form of Citi ThankYou points on all purchases: 1% when you make your purchase and another 1% when you pay your bill. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal .

Chase Freedom Unlimited® : Typically earn 1.5% cash back on all non-bonus category purchases.

The Blue Business® Plus Credit Card from American Express : Earn 2 American Express Membership Rewards on the first $50,000 in purchases each year. Terms apply.

Pair your Chase Freedom Unlimited® card with a Chase Sapphire Preferred® Card card or Chase Sapphire Reserve® card to unlock the full suite of Chase Ultimate Rewards® transfer partners. This strategy is sometimes referred to as the Chase Trifecta .

While you likely won’t be earning a ton of points for your travel insurance purchase (unless your costs are exorbitantly high), maximizing your earnings is always a good idea. Don’t leave money on the table.

» Learn more: The best travel insurance companies

Not all travel insurance policies are created equal. This is probably no great revelation, but it’s definitely something of which you’ll want to be aware.

This is especially pertinent when it comes to the current travel climate in the COVID-19 era. While you may purchase a health insurance plan that covers most medical costs, it may specifically exclude those incurred by COVID-19. And even if it does reimburse you for any hospital costs, it may not pay for a forced quarantine in the event of illness.

These are things you’ll want to check for when buying travel insurance for any trip. Be sure to read the terms and conditions of your policy carefully, and if there’s very specific coverage you’re looking for (such as that offering protection in the event you catch COVID-19), you can often use search filters to narrow down your options.

» Learn more: Is there travel insurance that covers COVID quarantine?

One great feature of travel credit cards is the complimentary trip insurance they often provide. In order for your trip to be eligible for coverage, you’ll need to use the card to pay for your trip. In exchange, however, you can receive some pretty powerful benefits without needing to pay out of pocket.

The Chase Sapphire Preferred® Card card, for example, provides primary rental car insurance. This means that when you decline the insurance offered at the counter, your entire rental will be covered against collision up to the actual value of the rental car.

What’s most powerful about this feature is that, as primary, it comes before your own personal insurance — possibly saving you expensive premium jumps and claims on your policy.

Other cards that include powerful travel insurance protection such as interruption, cancellation or baggage coverage include The Platinum Card® from American Express and the Chase Sapphire Reserve® card. Terms apply.

» Learn more: The cheapest flights to Europe on points

It makes sense to purchase travel insurance in many circumstances, especially with the uncertainty in today’s travel world. Take advantage of these five tips to make sure you’re properly prepared for your trip — whether you’re heading to France, Finland or any of the over two dozen Schengen countries.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, which are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

licensed agents available

- International Travel Insurance Dubai

- Single Trip

- Schengen product

- Annual Multi-Trip

- Hajj & Umrah

- Inbound to UAE

- Sports Cover

- Policy Document

- Travel Tips

- Glossary of Terms

- Privacy Notice

- Health declaration & health exclusions

- Blogs & Newsletters

- BUY ALLIANZ TRAVEL

SCHENGEN TRAVEL INSURANCE

Our schengen travel insurance offers essential coverage for your trip, including the required insurance certificate for schengen visa applications, why is it crucial to have schengen insurance while travelling in europe.

Schengen Visa, which allows for travel within 26 European countries, comes with specific insurance requirements, as Schengen Visa Info outlines. Travellers must meet these requirements, which include coverage for emergency medical expenses, repatriation of remains, and a minimum coverage of €30,000.

Medical costs in some European countries can be excessive. For instance, according to the World Health Organization, a single day's hospitalisation in Switzerland can cost around US$1,000. Having Schengen insurance is a must to avoid unexpected financial burdens.

This insurance isn't limited to a particular demographic; it's designed to offer coverage for global travellers, including

- Senior citizens up to the age of 85

- Individuals traveling for work

- Children between the ages of 1-18 and

Not every traveller needs a Schengen Visa for Schengen Area visits, given that countries such as the U.S.A., Mexico, Brazil, and Canada maintain visa-free agreements with the Schengen Zone. Nevertheless, it is highly advisable to secure insurance since your medical expenses, or any potential costs arising from unexpected incidents during your journey, may lack coverage without proper travel insurance. Opting for travel insurance is particularly beneficial if you intend to explore multiple Schengen countries or desire flexibility in your itinerary, offering comprehensive coverage across most European nations.

Why Choose Allianz Schengen Travel Insurance?

Our Schengen travel insurance will help you get your Schengen visa and offer protection while travelling in Europe. You’ll receive the mandatory insurance certificate for your Schengen visa application.

Different benefits are available within this travel insurance product:

- Up to US$50,000 in emergency medical expenses in case of accident, sickness, illness or injury.

- Up to US$200 if your baggage is delayed.

- Up to US$2,000 in case of trip cancellation.

Insure your next European holiday, starting from AED 56 per person.

Schengen Product

Travel insurance, is especially for medical issue, into documents are well splatted and explained the travel issue (baggage, equipment, ...) but not in the same clear details the medical policy and condition, this is a possible room to improve., schengen travel visa insurance requirements – europe travel insurance.

Swipe to view more

Schengen Travel Insurance

Travel Schengen Single Trip

From 56 AED

Everything you need to know about Schengen Travel Insurance

What does a schengen insurance policy usually cover .

A Schengen insurance policy is a specific type of travel insurance designed to fulfil the visa requirements for individuals travelling to the Schengen Area. The Schengen Area comprises 26 European countries that have abolished passport control at their mutual borders, allowing for easier travel within the region. A Schengen insurance policy typically covers the following:

1. Medical expenses: Coverage for emergency medical expenses, including hospitalisation, surgery, and outpatient treatment. As Schengen visa regulations require, the policy usually covers a minimum amount, such as €30,000.

2. Emergency evacuation and repatriation : Coverage for the cost of emergency evacuation and repatriation to your home country in case of a medical emergency.

3. Repatriation of mortal remains: Coverage for the cost of repatriating the insured person's remains in the unfortunate event of death during the trip.

4. Travel assistance services : Access to 24/7 emergency assistance services, including a helpline for medical advice, travel assistance, and coordination of medical services.

5. Coverage for multiple Schengen countries : The policy should cover the entire itinerary if you plan to visit multiple Schengen countries.

6. Minimum coverage amount : Schengen insurance policies must meet minimum coverage amounts as specified by the Schengen visa requirements. As of my last knowledge update in January 2022, the minimum coverage is €30,000.

7. Emergency dental treatment : Coverage for emergency dental treatment due to an accident.

It's important to carefully review the terms and conditions of the Schengen insurance policy to ensure that it meets the specific requirements of the Schengen visa application. Additionally, check if the policy covers additional features or optional add-ons that may benefit your travel needs.

When considering a Schengen insurance policy, opt for a reputable and globally recognised insurance provider like Allianz Travel that offers comprehensive coverage for individuals travelling to the Schengen Area. You can benefit from a range of features designed to meet the specific requirements of Schengen visa applications. Schengen travel insurance from Allianz Travel includes coverage for medical expenses, emergency evacuation, repatriation, travel assistance services, personal liability, and more.

All Outbound travel insurance products from Allianz Travel UAE are schengen-compliant meaning all products meets the Schengen visa requirements. The Extra and Gold products however go beyond the basic Schenge coverages to offer maximum peace of mind.

Does my Schengen travel insurance need to cover all Schengen are countries?

Yes, your Schengen travel insurance should typically cover all Schengen Area countries you plan to visit. When you apply for a Schengen visa, one of the visa requirements is proof of travel insurance that meets specific criteria. The insurance coverage is expected to be valid for your stay in the Schengen Area and should include coverage for medical emergencies and repatriation.

Key points regarding Schengen travel insurance coverage for multiple countries:

1. Coverage for the entire itinerary : The insurance policy should cover the entire duration of your stay in the Schengen Area, from entry to exit.

2. Minimum coverage amount: The insurance coverage must meet the minimum amount specified by the Schengen visa requirements. As of our last knowledge update in January 2022, the minimum coverage amount is €30,000.

3. Coverage for all countries : The policy should explicitly mention coverage for all Schengen Area countries you plan to visit. When purchasing the insurance, it's important to list the countries you intend to travel to.

4. Insurance certificate : The provider typically issues a certificate or confirmation letter specifying the coverage details, including the countries covered. This certificate is submitted as part of your Schengen visa application.

When obtaining Schengen travel insurance, communicate your travel itinerary and ensure the policy explicitly mentions coverage for all the Schengen space. This is crucial for meeting the visa requirements and ensuring adequate travel coverage within the Schengen Area. Always check the latest visa requirements and guidelines from the consulate or embassy of the country you are applying to, as they may be subject to change.

When obtaining Schengen travel insurance that covers all your needs across multiple countries, Allianz Travel emerges as a reliable choice. Allianz Travel offers comprehensive Schengen insurance coverage that aligns with the specific criteria set by Schengen visa requirements. Whether you're planning to explore the enchanting cities of Europe or embark on a multi-country journey within the Schengen Area, Allianz Travel provides policies that cater to your travel itinerary

What is excluded from a Schengen travel insurance policy ?

- Exclusions in a Schengen travel insurance policy can vary depending on the insurance provider and your specific policy. However, there are common exclusions often found in Schengen travel insurance policies. It's essential to carefully review the terms and conditions of your policy to understand what is excluded. Here are some common exclusions:

- 1. Pre-existing medical conditions : Many Schengen travel insurance policies exclude coverage for pre-existing medical conditions. Any medical condition you had before purchasing the insurance may not be covered.

- 2. Medical treatment not deemed necessary : Expenses for medical treatments not considered necessary by the attending physician or that can be postponed until your return to your home country may be excluded.

- 3. Medical treatment resulting from intentional acts : Medical treatment resulting from self-inflicted injuries, suicide attempts, or participation in risky activities may be excluded.

- 4. War and terrorism : Injuries, damages, or losses resulting from war, acts of terrorism, or participation in military activities may be excluded.

- 5. Alcohol and drug-related incidents : Incidents related to the consumption of alcohol or drugs that a licensed medical professional does not prescribe may be excluded.

- 6. Participation in hazardous activities : Injuries or incidents resulting from participation in high-risk or hazardous activities such as extreme sports or adventure activities may be excluded.

- 7. Nonmedical coverage exclusions: Non-medical coverage exclusions may include events such as trip cancellations for reasons not specified in the policy, lost or stolen belongings, and other nonmedical incidents.

- 8. Failure to follow medical advice : Expenses incurred due to your failure to follow the prescribed medical advice or treatment plan may be excluded.

- 9. Excess/deductibles : Some policies may have deductibles or excess amounts, meaning you are responsible for a certain portion of the expenses before the insurance coverage takes effect.

- 10. Pregnancy and childbirth : Some policies may exclude coverage related to pregnancy and childbirth, especially within a certain period before the expected due date.

- It's crucial to carefully read the policy documentation and ask your insurance provider for clarification. Understanding the exclusions will help you make informed decisions about your coverage and ensure that you have appropriate protection for your travels within the Schengen Area.

- When navigating the intricacies of Schengen travel insurance exclusions, choosing a reliable insurance provider prioritising transparency and comprehensive coverage is imperative. Allianz Travel stands out as a reputable and globally recognised option, offering policies that address the specific needs of Schengen visa applications while minimising uncertainties related to exclusions.

How long do I need Schengen travel insurance?

The duration you need Schengen travel insurance depends on your planned stay in the Schengen Area. Schengen travel insurance is typically required for your intended stay, including the entry and exit dates specified in your travel itinerary.

Here are some key points to consider regarding the duration of Schengen travel insurance:

1. Coverage period : The insurance coverage should be valid for the entire duration of your stay in the Schengen Area, starting from your entry date until your planned exit date.

2. Non-Flexible coverage : You cannot change the dates of your travel insurance once it is issued. That is why you need to make sure you have your final trip dates before you puchase your travel insurance. You will not be able to renew your Schengen travel insurance while your trip has started : it is therefore important to know your dates before your purchase your policy..

3. Return to home country : The insurance coverage should lastuntil your planned return to your home country.

When securing Schengen travel insurance that aligns seamlessly with the duration of your stay, Allianz emerges as a dependable choice. Allianz Travel offers policies designed to cater to the unique needs of your travel itinerary, ensuring comprehensive coverage for the entirety of your visit to the Schengen Area.

Is there an age limit for Schengen travel insurance?

Schengen travel insurance has no strict universal age limit, as insurance providers' eligibility criteria vary. However, certain insurance companies may have age-related restrictions or considerations for travel insurance policies.

Here are some points to remember regarding age and Schengen travel insurance:

1. Age categories : Some insurance providers categorise age groups differently, offering specific policies for adults, seniors, and children. The terms and conditions, as well as coverage options, may differ based on these categories.

2. Elderly travellers : While many insurance providers offer coverage for elderly travellers, there might be age limits for certain policy features or types of coverage. It's essential to check with the insurer to understand any age-related restrictions.

3. Premiums and coverage options : Premiums for Schengen travel insurance may vary based on age. Elderly travellers may experience higher premiums due to potential health risks and the likelihood of medical expenses.

At Allianz Travel, we made it easy, you just need to follow our online booking funnel to see if you are eligible to purchase our Schengen Travel insurance.

Can I get a Schengen visa without travel insurance?

Travel insurance is mandatory for obtaining a Schengen visa. The Schengen visa application process requires applicants to provide proof of travel insurance that meets certain criteria. Travel insurance is considered an essential part of the visa application, and failing to provide adequate insurance may result in rejection.

Key points regarding Schengen visa and travel insurance:

1. Mandatory requirement : Schengen visa applicants must provide proof of travel insurance as part of the visa application process.

2. Minimum coverage requirements : The insurance coverage should meet specific minimum requirements, including a minimum coverage amount (commonly €30,000) and coverage for the entire duration of the intended stay.

3. Insurance certificate : Applicants must submit an insurance certificate or confirmation letter issued by the insurance provider, clearly stating the coverage details, including the coverage amount, coverage period, and countries covered.

Failing to provide the required travel insurance or submitting insurance that does not meet the criteria may lead to the rejection of the visa application.

At Allianz Travel, we provide the required Certificate of Insurance by email after you pruchased your travel insurance online.

Selecting a dependable travel insurance provider is crucial when dealing with Schengen visa prerequisites. Allianz Travel distinguishes itself as a reputable and internationally acclaimed choice, presenting customised solutions that effortlessly adhere to the obligatory criteria set for Schengen visa applications.

Can I purchase Schengen travel insurance after arriving in the Schengen Area?

Can i get a refund on my travel insurance if my schengen visa application is refused.

Whether you can get a refund on your travel insurance after a Schengen visa application is refused depends on the terms and conditions of the insurance policy you purchased. In general, travel insurance policies have different refund policies, and it's essential to review the specific terms outlined in your policy documentation or contact your insurance provider for clarification. Here are some factors to consider:

1. Refund policies: Some travel insurance policies may have a refund provision in case of a visa refusal. This could be subject to certain conditions outlined in the policy.

2. Reasons for refusal: The refund eligibility may depend on the visa refusal. Some policies may only offer refunds in specific situations, such as visa denials due to unforeseen circumstances beyond the applicant's control.

3. Documentation requirements: You may need documentation confirming the visa refusal to request a refund. This could include the visa rejection letter issued by the consulate or embassy.

4. Cancellation period: Policies often have a specific period during which you can cancel and seek a refund. This period may vary among insurance providers.

5. Administrative fees: Some insurance providers may charge administrative fees for processing a refund request. Be aware of any associated fees that may apply.

6. Policy exclusions: Check the policy exclusions to understand if visa refusal is explicitly addressed as a covered event for refund purposes.

7. Communication with insurance provider: If you find yourself in a situation where your Schengen visa application is refused, promptly communicate with your insurance provider. They can provide guidance on the refund process and any applicable terms.

It's crucial to thoroughly review your insurance policy and contact your provider to understand the specific refund conditions and requirements. Remember that each insurance provider may have different policies, so that the refund process can vary. Additionally, check the policy's cancellation period and act within the specified timeframe if you decide to pursue a refund.

When facing the intricacies of obtaining a travel insurance refund post-Schengen visa application refusal, reviewing your policy's terms carefully is crucial. Allianz Travel emerges as a dependable and transparent insurance provider, offering a customer-friendly approach to the refund process. With a commitment to transparency, flexibility, and customer satisfaction, reaching out to Allianz Travel ensures reliable support during challenging situations. For a trustworthy solution, consider Allianz Travel as your go-to provider for confidently navigating the refund process.

Do I need Schengen travel insurance as a passport-holding UAE resident?

The need to apply for a Schengen visa if you want to visit the Schengen space does NOT depend on your country of residence but on your nationality.

For example: if you are an American citizen living in the UAE, you do not need to apply to a Schengen visa before your trip. You will get a visa on arrival. However, if your are an Indian citizen living in the UAE, you will need to apply for a Schengen visa before your trip.

Therefore, you need to check what the requirements are for your nationality - if you plan to travel with friends, you may not need to follow the same steps even if you are travelling together on the same dates.

If you need a Schengen visa, then the visa requirements are the same for all when it comes to travel insurance:

1. Mandatory requirement : Schengen visa regulations typically mandate that applicants provide proof of travel insurance coverage as part of the visa application.

2. Minimum coverage requirements : The insurance coverage should meet specific requirements, including a minimum amount (commonly €30,000) and coverage for your intended stay in the Schengen Area.

3. Insurance certificate : You must submit an insurance certificate or confirmation letter from the insurance provider along with your visa application. This document should clearly outline the coverage details, including the coverage amount, coverage period, and countries covered.

4. Coverage for medical emergencies : The insurance should cover medical emergencies and repatriation, ensuring you have financial coverage in case of unexpected medical expenses during your stay in the Schengen Area.

Failure to provide the required travel insurance or submitting insurance that does not meet the specified criteria may result in rejection of your Schengen visa application.

Before securing Schengen travel insurance, it's advisable to carefully review the consulate or embassy requirements of the Schengen country you plan to visit. Allianz Travel's commitment to compliance, comprehensive coverage, and clear documentation makes them a trusted choice for meeting Schengen travel insurance requirements.

Do I need COVID protection for my Schengen travel insurance?

COVID-19 travel insurance depends on each country - therefore there is not any specific requirement that covers all Schengen space countries. You need to check the particular country or countries you are planning to visit.

Once you have checked what the COVID-19 requirements are for the country of destination, you can then check what the insurance provider covers - if somehting is unclear to oyu, do not hesitate to contact the travel insurance company who will be able to help you.

Remember that travel regulations and insurance coverage related to COVID-19 may evolve, so it's essential to stay informed and check for any updates or changes in requirements before your trip.

Given the evolving nature of travel regulations and COVID-19 coverage. Allianz Travel's proactive approach, comprehensive coverage, and customer-focused communication make them reliable for addressing your COVID-19-related travel insurance needs.

How do I make a claim?

Claiming your Schengen travel insurance involves a series of steps, and it's important to follow the process outlined by your insurance provider. Below is a general guide on how to make a claim:

1. Review policy documents : Carefully review your policy documents to understand the coverage details, terms, and conditions. Take note of the specific events and situations covered and any exclusions.

2. Contact your insurance provider : Notify your insurance provider immediately after an event that may lead to a claim. Most insurance companies have a helpline or a claims department that you can contact for guidance.

3. Obtain claim form s: Request claim forms from your insurance provider. At Allianz Trave, you can submit your claim online here

4. Complete claim forms : Fill out the claim forms accurately and provide all the required information. Include supporting documents, such as medical reports, police reports (if applicable), receipts, and other relevant documentation.

5. Submit claim documents : Submit the completed claim forms and supporting documents to the insurance company per their instructions. Some insurers may allow you to submit claims online or via email, while others may require physical documentation.

6. Claim processing : The insurance company will review your claim and assess whether it meets the criteria outlined in the policy. This process may involve verifying the details of the incident and checking the documentation provided.

7. Follow-up and communication : Stay in communication with the claims department. Be responsive to any requests for additional information or documentation. You may also receive updates on the status of your claim during the processing period.

8. Claim approval or denial : Once the insurance company completes its assessment, you will be informed of the claim decision. If the claim is approved, the insurer will provide details on the amount to be reimbursed. If the claim is denied, the insurer will provide reasons for the denial.

9. Reimbursement or payment : If your claim is approved, the insurer will arrange for reimbursement or payment per the policy terms.

It's important to initiate the claims process promptly and provide accurate and complete information to expedite the assessment. Keep copies of all documentation for your records, and maintain open communication with the insurance provider. Always refer to your specific policy documents for detailed instructions on the claims process, as procedures can vary among insurance providers. If you have any questions or concerns, don't hesitate to contact your insurance provider for guidance.

For a hassle-free claims process and reliable support, choose Allianz Travel. Their customer-focused approach, efficient communication, and commitment to transparency make them a trusted partner for addressing your Schengen travel insurance claims.

Is Allianz Travel Insurance safe?

Allianz is a well-established and reputable insurance company whose travel insurance products are generally considered reliable and trustworthy. Allianz is one of the largest and most recognised insurance providers globally, offering a range of insurance products, including travel insurance, to individuals and businesses.

Key points regarding the safety and reliability of Allianz Travel Insurance:

1. Financial stability : Allianz is known for its financial strength and stability. It is a leading global insurer with a strong financial standing, which is an important factor in evaluating the reliability of an insurance provider.

2 . Global presence : Allianz operates in many countries worldwide, and its global presence often contributes to its reputation for reliability and customer service.

3. Customer reviews : While individual experiences may vary, you can look at customer reviews and ratings to gain insights into the satisfaction of other travellers who have used Allianz Travel Insurance. Online reviews can provide valuable perspectives on the quality of service and claims processing.

4. Coverage options : Allianz offers a variety of travel insurance plans with different coverage options, allowing travellers to choose plans that suit their needs. The flexibility in coverage options is a positive aspect for many travellers.

5. Claims process : The efficiency and transparency of the claims process are crucial indicators of the reliability of an insurance provider. Allianz generally has a well-structured claims process, and it's important to follow the specific procedures outlined in your policy when making a claim.

6. Industry recognition : Allianz has received industry recognition and awards for its insurance products and services, further affirming its standing in the insurance sector.

While Allianz Travel Insurance is generally considered safe and reliable, it's essential to read and understand the terms and conditions of the specific policy you are considering. Pay attention to coverage details, exclusions, and any specific requirements related to your travel plans.

Additionally, if you have specific questions or concerns, contact Allianz directly to seek clarification and ensure that the travel insurance plan aligns with your needs and preferences.

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

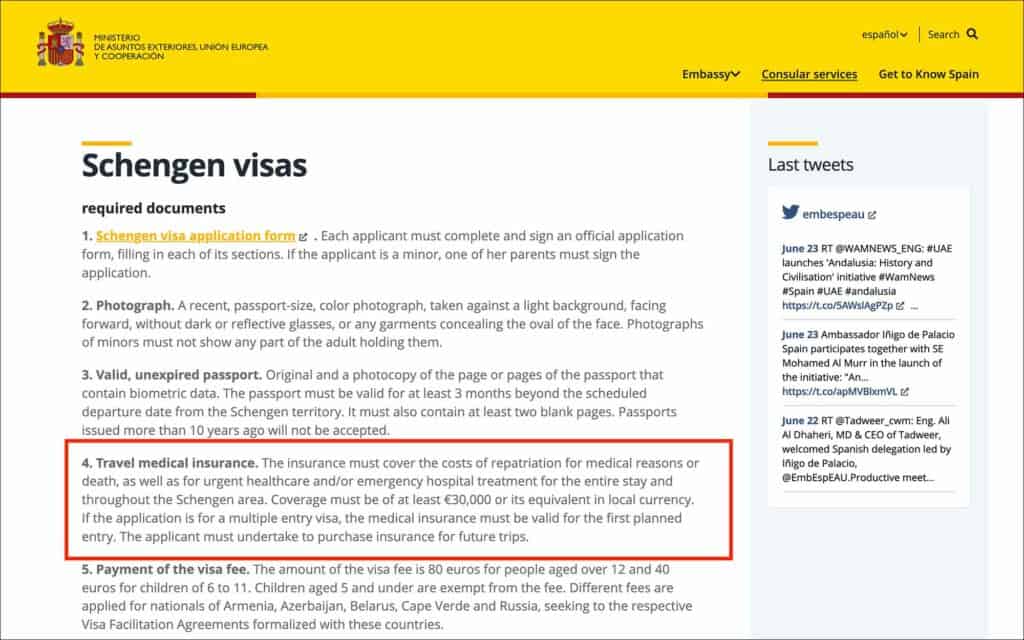

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

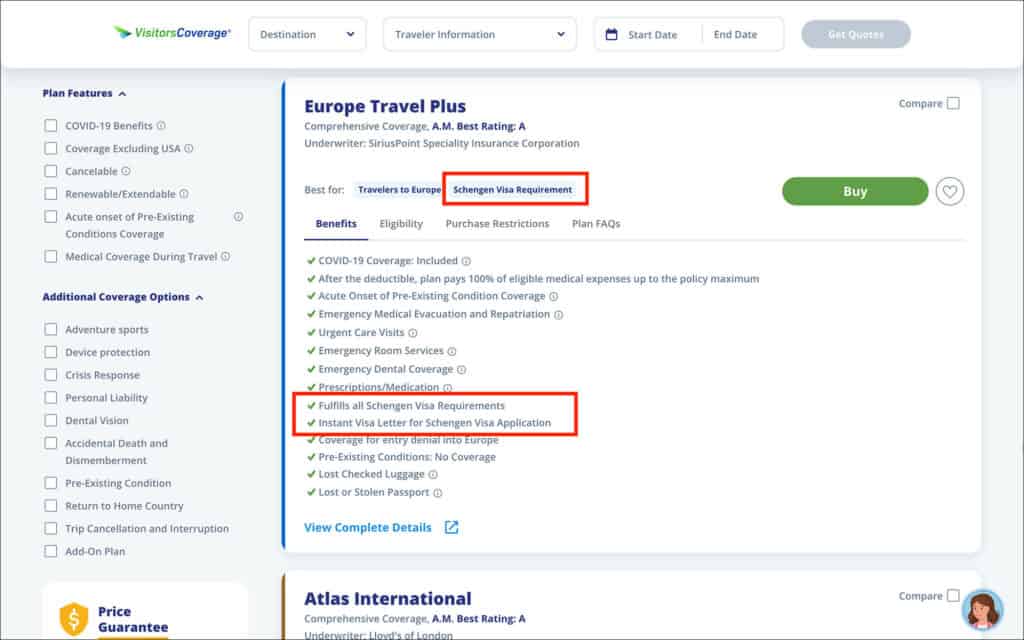

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

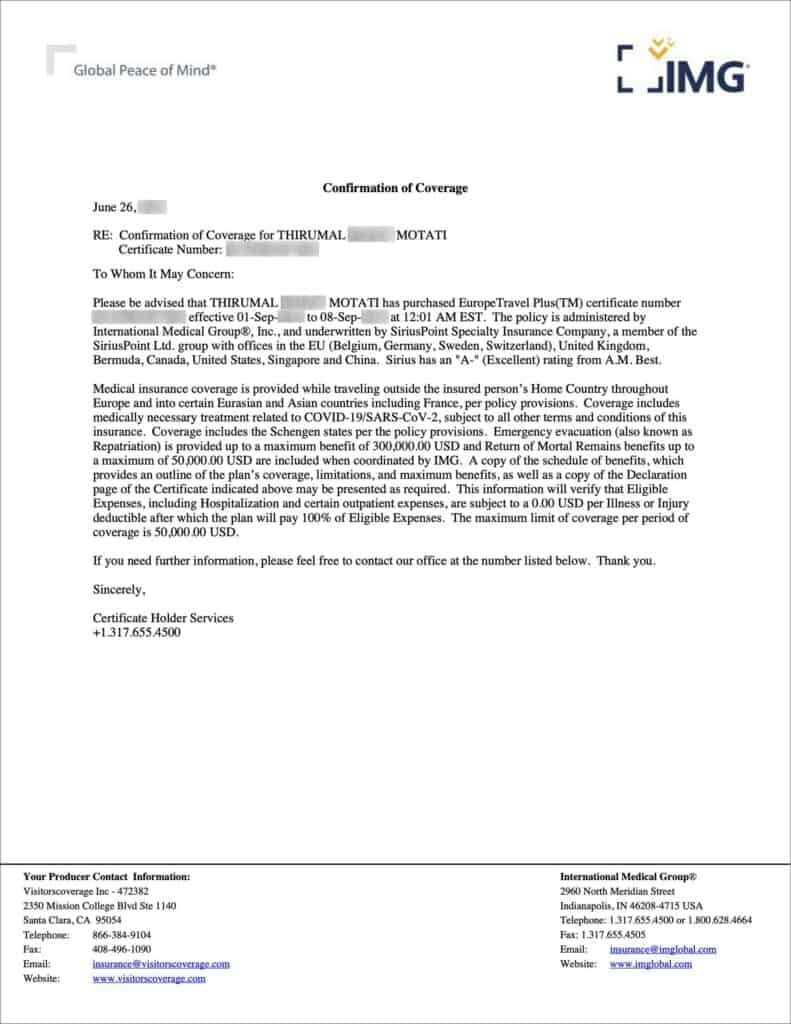

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from SafetyWing . Insurance from SafetyWing covers COVID-19 and also comes with a visa letter which you can use for your visas.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Free Time Tracking Apps

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Cheap Window Replacement

- Window Replacement Cost

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Texas Electricity Companies

- Texas Electricity Rates

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Compare Car Insurance Quotes

- Best Car Insurance for New Drivers

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Is Pet Insurance Worth It?

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

- Travel Medical Insurance

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

Guide to Schengen Visa Travel Insurance (2024 )

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Sabrina Lopez is a senior editor with over seven years of experience writing and editing digital content with a particular focus on home services, home products and personal finance. When she’s not working, Sabrina enjoys creative writing and spending time with her family and their two parrots.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

Is Insurance Required for a Schengen Visa?

With a few exceptions, travelers from the U.S. do not need a visa for the Schengen area if staying for 90 days or less. Americans visiting for over three months, permanent residents without citizenship and foreign nationals traveling from the U.S. will need a Schengen visa if they are citizens of a country without a visa-free arrangement with Schengen countries.

The countries in the Schengen area are: Austria , Belgium, Croatia, Czech Republic, Denmark , Estonia, Finland, France , Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovenia, Slovakia, Spain, Sweden and Switzerland. Bulgaria, Cyprus, Ireland and Romania are currently not Schengen countries.

Travelers from the U.S., Canada , and other visa-exempt countries only have to go through immigration and customs in the first country they visit in the Schengen zone. After that, they can travel to any other nation in the alliance without taking out their passport. For instance, you can fly, drive or take a train from Sweden all the way to Spain on the same visa.

Citizens from visa-exempt countries like the U.S. don’t need a visa or travel insurance to visit Europe. However, because of the high price of healthcare in Europe, travel insurance is still a good idea for visa-free travelers. But note that if you have to visit with a Schengen visa, you need to meet specific health insurance mandates.

Schengen visa holders must have comprehensive health insurance coverage. It should last for the length of their stay in the area (but does not need to cover the duration of the visa).

When you apply for a Schengen visa at the consulate or embassy of the country you plan to visit first or spend most of your time in, they will explain the specifics of the travel insurance requirements. You will need proof of a travel insurance plan for visa approval.

Schengen Visa Insurance Requirements

Schengen visa applicants need travel medical insurance . However, the policy must have specific features and minimum limits for medical coverage and medical evacuation.

Here is a closer look at the requirements for Schengen visa eligibility.

- Medical emergency insurance

- Repatriation coverage for death

- Medical evacuation insurance if you need long-term care in your home country

- Coverage limits of at least €30,000 (US$32,000)

- Coverage lasting for the entire length of your stay in the Schengen area

The purpose of these requirements is to ensure you can pay for medical treatment without requiring assistance from your host country’s healthcare system.

You need a document from your travel insurance company as proof that you have a visa-compliant policy. This insurance certificate shows that you have met the minimum requirements. It is a vital part of your visa application, and you won’t gain approval without it.

Types of Travel Insurance Policies

Schengen visa insurance plans focus on medical expenses, but travel policies can also offer other protections. Comprehensive travel insurance covers additional risks, including those related to cancellations and delays.

Here is a look at the different travel insurance coverages.

- Medical, evacuation and repatriation coverage is required for visa approval.

- Trip cancellation insurance provides reimbursement if your trip gets canceled due to covered reasons, such as an unexpected illness or injury or a crisis or disaster in your European destination.

- Trip delay and interruption coverages pay for expenses related to delays or incidents that cancel your journey earlier than planned.

- Baggage delay or loss reimburses you for missing items so that you can replace necessities and continue your travels.

- Add-ons to standard policies may include rental car insurance, pre-existing condition coverage and insurance for exclusions from standard insurance like scuba diving or climbing.

Schengen visa applicants can purchase travel insurance with comprehensive coverage to protect the non-medical aspects of their trip. International travel can be expensive, so cancellation insurance and other protections available through a complete travel policy can save you from frustration and financial loss.

Which Insurance Provider is Best for Schengen Visa?

Use the table below to compare the top recommended choice for travel insurance for a Schengen visa.

- Travelex offers budget and mid-range plans for international travelers. You can opt for both medical and trip cancellation coverage.

- Trawick International travel insurance offers stand-alone medical and cancellation policies, so you can opt for minimum requirements for your Schengen visa if you wish.

- AIG Travel Guard offers several tiers of travel insurance, all of which offer comprehensive coverage and provide optional add-ons.

- Seven Corners has customizable travel plans that include medical emergency, evacuation, and repatriation coverage necessary for a Schengen visa

- IMG offers stand-alone medical insurance policies and separate plans providing cancellation, lost baggage and delay benefits.

Choosing the Right Schengen Visa Insurance

There are several factors to consider when selecting travel insurance.

- Coverage limits are the maximums that the insurer will pay for each claim type. Schengen visas require €30,000 (about $32,800) in medical emergency, evacuation, and repatriation insurance, but you can get a policy with higher limits if you wish.

- Pre-existing conditions are another important factor. Insurers may or may not cover them on a standard policy, but those that do not provide coverage directly may sell waivers that add coverage for your conditions.

- Deductibles are another factor to consider. This amount is an out-of-pocket payment you have to make before the insurer takes over payment. Some low-cost policies have high deductibles.

Finally, you should always get insurance with a reputable company that can provide the necessary documentation for your visa application.

Applying for Schengen Visa with Travel Insurance

You apply for a Schengen visa at the consulate or embassy of the country you intend to travel to first or spend most of your time during your stay.

You must purchase a policy that covers the entire duration of your stay and is valid throughout the Schengen area, not just in the countries you plan to visit.

You need proof of insurance to include with the rest of application documents when applying for the visa. This means you need to purchase the insurance before submitting your application. You should only choose insurance companies able to provide the necessary documentation to include with your application.

Additional Expert Tips

There are some other considerations for Schengen visa insurance.

First, you should make copies of your insurance card, policy documents and other information and bring them with you on your trip.

Second, regulations require that you have coverage for the entire duration of your stay. If you have a multi-trip visa, you will need insurance that provides benefits for the entire stay. The best option in these cases is to get an annual or multi-trip policy that meets visa requirements for coverage types and limits.

Before leaving, you should perform a thorough policy review to ensure you have the appropriate coverage. You can consider the potential costs of medical care in your host countries and decide if the coverage you have is sufficient.

Frequently Asked Questions About Schengen Visa Insurance

Do you need travel insurance to visit schengen countries.

Travelers from visa-exempt countries can visit Europe without insurance, though they would not be protected from medical expenses or cancellations. However, those requiring a Schengen visa need €30,000 worth of medical coverage for approval.

Is Schengen travel insurance refundable?

You would be able to cancel your insurance if your visa application is not approved. Most companies will allow you to cancel the policy and get a full refund if you show evidence that your visa application was not approved.

Does travel insurance cover all of Europe?

Travel insurance for a Schengen visa must cover all 27 countries. However, some travel insurers may require that you specify all the countries you plan to visit to get comprehensive coverage.

What are the benefits of Schengen visa insurance?

In addition to being a requirement for the visa application process, Schengen insurance will cover medical costs if you get sick or suffer an injury during your Europe travel experiences. While travel health insurance is the only necessary policy component for the visa application, you can get additional benefits by purchasing a comprehensive policy.

If you have feedback or questions about this article, please email the MarketWatch Guides team at editors@marketwatchguides. com .

MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed.

You are using an outdated browser. Please upgrade your browser to improve your experience.

- For Individuals

- For Governments

- #TravelAgain

- #DoNotFallForFraud

Secure your overseas trip with Travel Medical Insurance

Get your Travel Medical Insurance with COVID-19 coverage from reputed global insurers for travel in the new normal.

Travelling from*

*Please select Travelling from country

- South Korea

- Afghanistan

- Aland Islands

- Antigua Barbuda

- Ascension and Tristan da Cunha

- Bosnia & Herzegovina

- Burkina Faso

- Cape Verde Islands

- Cayman Islands

- Central African Republic

- Christmas Islands

- Cocos Islands

- The Democratic Republic of the Congo

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- French Polynesia

- Guinea Bissau

- British Indian Ocean Territory

- British Virgin Islands

- Caribbran Netherlands

- Ivory Coast

- Faroe Islands

- French Guiana

- Liechtenstein

- Marshall Islands

- Saint Barthelemy

- Saint Kitts Nevis

- Saint Martin

- Saint Pierre and Miquelon

- Hong Kong SAR

- Isle of Man

- Korea, Republic of

- Myanmar (Burma)

- The Netherlands

- New Caledonia

- New Zealand

- Norfolk Islands

- Northern Mariana Islands

- North Macedonia

- Palestinian Territories

- Papua New Guinea

- Philippines

- Puerto Rico

- Saint Helena

- Saint Lucia

- Saint Vincent Grenadines

- Sao Tome & Principe

- Saudi Arabia

- Sierra Leone

- Sint Marteen

- Solomon Island

- South Africa

- South Sudan

- Sudan, Republic of

- Svalbard and Jan Mayen

- Switzerland

- Taiwan, China

- The Holy See

- Timor Leste

- Trinidad & Tobago

- Turkmenistan

- Turks Caicos Islands

- United Arab Emirates

- United Kingdom

- United States of America

- Vatican City

- Virgin Islands of the United States

- Western Sahara

- Vietnam (Online eVisa)

- Lesotho Permits

- Korea, Democratic People's Republic of

- Ghana Permits

- Lithuania Temporary Residence Permit

- Lithuania (E-Resident card)

- Lithuania TRP and National Visa

- Finland Residence Permit

- Thailand (Online eVisa)

- American Samoa

- Pitcairn Island

- Wallis and Futuna Islands

- Bouvet Island

- Akrotiri and Dhekelia

- Baker Island

- Clipperton Island

- South Georgia and the South Sandwich Islands

Travelling to*

*Please select Travelling to country

- Schengen countries

- Faroe Iceland