- Home ›

- Travel Money ›

Compare US dollar travel money rates

Get the best US dollar exchange rate by comparing travel money deals from the UK's top foreign exchange providers

Best US dollar exchange rate

It may come as no surprise that the US dollar is the most popular and widely-traded currency in the world. According to the Bank for International Settlements, nearly 90% of all foreign exchange trades involve the US dollar on one side of the transaction, and it's estimated that more than 60% of all the cash reserves held by central banks around the world are stored in US dollars.

If you're travelling to the USA, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best US dollar exchange rate by comparing a wide range of UK travel money suppliers who have US dollars in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Compare before you buy

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Order online

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

The best US dollar exchange rate right now is 1.2488 from Travel FX . This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of US dollars for home delivery.

The best US dollar exchange rates are usually offered by online travel money companies who have lower operating costs than traditional 'bricks and mortar' stores, and can therefore offer better currency deals than their high street counterparts.

For supermarkets and companies who sell travel money online and on the high street, it's generally cheaper to place your order online and collect it from the store rather than turning up out of the blue and ordering over the counter. Many stores set their 'walk-in' exchange rates lower than their online rates because they can. By ordering online you're guaranteed to get the online rate and you can collect your order from the store as usual.

US dollar rate trend

Over the past 30 days, the US dollar rate is up 0.08% from 1.2488 on 29 Mar to 1.2498 today. This means one pound will buy more US dollars today than it would have a month ago. Right now, £750 is worth approximately $937.35 which is $0.75 more than you'd have got on 29 Mar.

These are the average US dollar rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to US dollar currency chart .

Timing is key if you want to maximise your US dollars, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the US dollar rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the US dollar rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their US dollars as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your US dollars sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better US dollar rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your US dollars first before you collect them from the store so you benefit from the supplier's better online rate.

US dollar banknotes and coins

US dollars are governed and issued by the central bank of the United States, the Federal Reserve, while the physical production of US dollar banknotes and coins is managed by the Department of the Treasury. Banknotes are printed by the Bureau of Engraving and Printing in Washington D.C., and coins are minted by the United States Mint which has facilities in various US cities including Philadelphia, Denver and San Francisco.

One US dollar ($) can be subdivided into 100 cents (¢). There are seven denominations of US dollar banknotes in circulation: $1, $5, $10, $20, $50 and $100 which are frequently used, plus a rarer $2 bill which is not as widely circulated but is still printed and is legal tender.

All US dollar banknotes feature two insignias that are intended to represent different aspects of American culture and history. The first insignia, known as the Great Seal, depicts a bald eagle with a shield on its chest, holding an olive branch and arrows in its talons. Above the eagle's head is a banner with the Latin phrase "E Pluribus Unum" which means "Out of Many, One", and a constellation of 13 stars representing the original 13 American colonies. The second insignia is the seal of the Federal Reserve System. The front of the seal features an eagle holding a key which represents the Fed's role in controlling the money supply, and a scroll which represents the Fed's responsibility to regulate and oversee banks.

There are four US dollar coins in frequent circulation: 1¢, 5¢ (nickel), 10¢ (dime) and 25¢ (quarter). 50¢ and $1 coins are also minted but are not as widely used.

Dollars are colloquially referred to as 'bucks'. The name was originally used as slang term in 19th century poker games, where a 'buck' was a buck-handled knife that was passed from player to player to indicate whose turn it was to deal. If a player didn't want the responsibility of dealing, they could 'pass the buck' to another player. Over time, the term 'buck' came to be used more broadly to refer to a bet or a wager; eventually becoming synonymous with dollars.

There's no evidence to suggest that you'll get a better deal if you buy your US dollars in the USA. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your US dollars in the USA:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy US dollars when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in the USA

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Tips for saving money while visiting the USA

The USA has a high standard of living, and prices are generally comparable to the UK for things like accommodation, food and transport. Hawaii, New York and California are generally considered to be the expensive states to visit, while Kentucky, Mississippi and Arkansas are among the cheapest.

- Research your accommodation: One of the best ways to save money is by opting for budget accommodation. Hostels, guest houses and AirBnB can be much more affordable than hotels, especially if you rent a room instead of an entire apartment. Hostel chains like Hostelling International, Freehand Hostels and Selina operate modern, budget-friendly accommodation in most large US cities.

- Use public transport: Private taxis and rental cars are an expensive way to get around, so make the most of busses, trains and metros wherever possible. Look out for discounted travel passes like CityPASS and Go Card to save even more on standard fares.

- Eat like a local: The USA is synonymous with fast food restaurants, but diners are another major staple of American dining which offer large portions of classic American dishes at affordable prices. Or, for a healthier option, consider shopping in local grocery stores and cooking your own meals if your accommodation has a kitchen.

- Plan your itinerary: Research free attractions in whatever city you're staying in and plan your itinerary around these. Many museums, botanical gardens and historical sites offer free entry, and there are over 60 National Parks across the US, many of which are free to enter such as Great Smoky Mountains in Tennessee, Olympic National Park in Washington D.C. and Acadia in Maine.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or US dollars - always choose US dollars. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- United States Australia Canada France --> Germany --> Holland --> India Japan --> Ireland --> Malaysia --> Mexico --> New Zealand Philippines --> Singapore Spain --> UAE United Kingdom Other countries Global

- Profile -->

- My Rates -->

- Search Rates

Home Currency Exchange

- Currency Exchange

Buy or Spend which Currency? USD EUR CAD GBP All Currencies

actions right hide768">-->

transfers"> -->

Plane2"> -->, cards"> -->, compare exchange rates, fff500" fill-opacity="0.71"/>, 00f0ff" fill-opacity="0.63"/>.

heading suffix">

How to Save on Currency Exchange and Travel Money

Best Exchange Rates makes it easy to compare retail FX rates from trusted, regulated currency exchange specialists to use when you Travel and Spend abroad.

We show you how to use a multi-currency card or order foreign cash online for better currency exchange rates, convenience and save money for your next trip or overseas online purchase.

Here are a few ways you can save on currency exchange when traveling overseas:

- Compare exchange rates: Shop around to get the best exchange rate. Compare rates from banks, currency exchange offices, and online providers to find the best deal.

- Use a credit card: Credit cards often offer favorable exchange rates, so using one to make purchases in Portugal can save you money. Just be sure to pay off the balance in full each month to avoid interest charges.

- Use a debit card: Debit cards linked to a foreign currency account can also offer good exchange rates. This can be a good option if you don’t have a credit card or don’t want to use one for your trip.

- Avoid exchanging currency at the airport: Currency exchange offices at airports often have lower exchange rates than other options. If possible, wait until you get to your destination to exchange currency.

- Consider using a travel money card: Travel money cards are prepaid cards that you can load with multiple currencies. They can be a convenient and cost-effective way to pay for things while traveling.

- Use ATMs: ATMs often offer competitive exchange rates, and you’ll usually only pay a small fee to your bank for using an ATM abroad. Just be aware of any fees your bank charges for foreign transactions.

- Pay in the local currency: Some merchants may offer to charge you in your home currency instead of the local currency. This is called “dynamic currency conversion.” While it may be convenient, it often results in a less favorable exchange rate for you. It’s usually better to pay in the local currency.

- Best Rate Calculator

- Foreign Transfers

- Large Transfers

- Cross Rate Matrix

- Rate Tracker

- Market Update

- Currency Forecasts

- Country guides

- Log in to BER

- Content Hub

- How-to-Save Guides

- User Forums

- BER.me Profile

- Local Sites

- Transfers - Quote

BER is operated by Best Exchange Rates Pty Ltd, a company incorporated under the laws of Australia with company number ABN 68082714841. BER is a comparison website only and not a currency trading platform. BestExchangeRates.com uses cookies. Disclaimer & Terms of Service Privacy

- Money Transfer

- Rate Alerts

Xe Currency Converter

Check live foreign currency exchange rates

Xe Live Exchange Rates

The world's most popular currency tools, xe international money transfer.

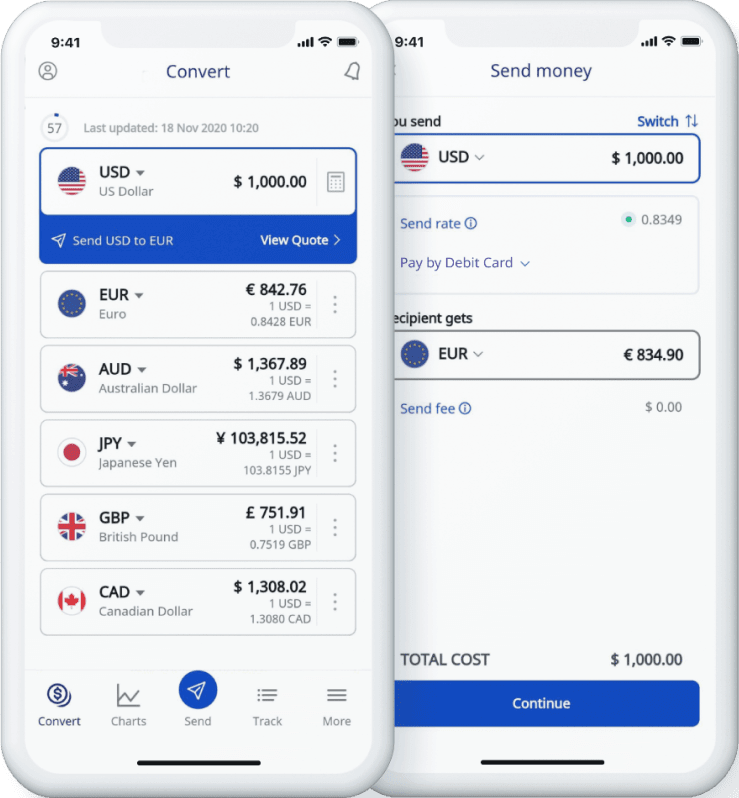

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Xe Currency Tools

Recommended by 65,000+ verified customers.

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

Daily market updates straight to your inbox

Currency profiles, the original currency exchange rates calculator.

Since 1995, the Xe Currency Converter has provided free mid-market exchange rates for millions of users. Our latest currency calculator is a direct descendent of the fast and reliable original "Universal Currency Calculator" and of course it's still free! Learn more about Xe , our latest money transfer services, and how we became known as the world's currency data authority.

Today's best US dollars - Euro exchange rates

Compare usd-eur exchange rates and fees before your next money transfer, the usd to eur exchange rate: how much is $1 worth to a euro, conversion rates usd/eur, conversion rates eur/usd, key facts about usd and eur, about the us dollar, about the euro, where to get the best exchange rate for dollars to euros.

MoneyGram and Wise have fought for the top spot as the cheapest money transfer providers from the US dollar to Euro from March 2021 to March 2022 on Monito. Instarem and OFX earned the third and fourth-best spots during this 12-month period.

Big banks can send your dollars to Europe, but they often apply weak exchange rates and charge high fees. International money transfer specialists almost always offer lower transfer fees and better exchange rates when sending money to Europe.

US dollars (USD) and euros (EUR) exchange rates with other main currencies

How to get the best usd to euro exchange rate online.

Exchange rates fluctuate at every moment of the day. The cheapest money transfer provider today may not be the cheapest tomorrow, which is why Monito's comparison engine helps you to instantly compare exchange rates and fees of the best international money transfer services.

To optimize your transfer from USD to Euros:

- Check the US dollar to Euro mid-market exchange rate (i.e. the rate you see on Google or xe.com);

- Find services that convert your dollars at or near this rate, and charge low commission fees;

- Sign up for the best service on their site or app;

- Confirm your transfer and recipient details.

Find the service with the best USD to Euro exchange rate

Faq about the best usd to eur exchange rates.

1. Check the USD mid-market exchange rate against the Euro. 2. Compare services with low fees and strong rates. 3. Sign up for the best service. 4. Confirm your transfer to the Eurozone.

This answer depends on your timeframe. The US dollar has gained value against the Euro throughout 2021, making now a good time to exchange dollars for euros. In 2020, however, the dollar dropped against the Euro. With that in mind, the dollar's value in March 2022 is fair but has not reached its previous peak.

$1 US = €0.96242

On December 21st, 2016, the US dollar reached its highest value against the Euro in the ten year period between 2012 and 2022.

If you are going on holiday in the Eurozone, then the best way to get Euros is to sign up for a multi-currency travel debit card, such as the Wise Multi-Currency Card . Spend like a local and make transactions at the real mid-market exchange rate .

Other options for exchanging US dollars in Europe include:

- Using an ATM with your foreign debit card;

- Signing up for a debit card or credit card that waives foreign transaction fees .

Never use a bureaux de change at the airport and avoid withdrawing cash with a credit card. Otherwise, your bank will charge you interest daily on those cash advances.

As a general rule, no. Despite commonly heard advice, credit unions and banks have become outdated money transfer providers. New companies are offering innovative ways to obtain foreign money cheaply and digitally.

We found that America First Credit Union was converting $1 USD into 0.85019 Euros even though the mid-market exchange rate was at $1 USD = 0.90201 Euros*.

Experts at Monito have reviewed several travel money cards that convert your currency at the true mid-market exchange rate , which you can access from your phone or a debit card. Services that offer these cards include Wise , Revolut , N26 , and Monese .

*Exchange rates recorded on 3 March 2022 11:27 CEST.

Top Exchange Rate Guides

- Turkish Lira

- Australian Dollars

- Canadian Dollars

- Polish Zloty

- VIEW ALL CURRENCIES

- canadian dollars

- ALL BUY BACKS

- US Dollar Card

- Multi-currency Card

Travel Money Comparison

Get the best exchange rates when you buy or sell foreign currency online

- buy Currency

- sell Currency

What Currency do you want to buy?

How much do you want to spend, what currency do you want to sell, how much do you want to sell, buy currency, sell currency, why use a travel money comparison site.

Have you ever started researching the best rates between different travel money providers?

We know it can be overwhelming: the different suppliers, their different offers and of course, the ever-changing currency exchange rates. It's a lot of information to process and compile!

Our comparison site takes the stress out of researching and does it all for you. FInd the travel money supplier that will get you the best rate today.

- ✓ Compare Travel Cash is a non-biased travel money comparison site.

- ✓ To ensure our independence, we always use transparent, objective and verifiable criteria in our comparisons.

- ✓ Our mission is to show you the best rates so you can save when buying your travel money.

- ✓ We constantly update our exchange rates as they change for each money exchange supplier, and whilst we try to do this in almost real-time, there will be times when our data is slightly out of date (in normal circumstances, not more than 5 minute). Our travel money comparison site is designed to save you money by showing you the latest rates.

- ✓ We check out all the companies we list, ensuring they are reputable suppliers and pass our standards before we list them.

- ✓ We value your privacy. We do not sell your data - you don't even need to give us your information to use our site. Even if you choose to, it is safe with us, we will never pass it on to third parties.

- ✓ You won't get cheaper rates if you go directly to the supplier, at times, we may have discounts and incentives that you would not get by going direct!

- ✓ We do sometimes make money - but we don't make it from you. We will never add fees or commissions to the travel money rates on the site.

Frequently asked questions

It's a great idea to buy your currency online to ensure you get the best exchange rate. You can often get much better deals online compared to what you can find on the high street or the airport. In fact ccording to recent surveys, 9 out of 10 tourists find that exchanging money at airports is the most expensive option.

The best thing about buying your travel money online through a comparison site is seeing all currency prices in one place, so whether you are buying euros , buying dollars or other currencies you get the best rate for your travel money and more importantly save time!

The quickest way to get the best currency exchange rate is by using our comparison tool . We compare the latest information from all the best travel money providers in the market to show you the best currency exchange rates.

Keep an eye out for the following when searching for the best currency exchange deals so you can choose the best option for buying your holiday money:

- High exchange rate - The higher the exchange rate number, the more holiday money you will get to the pound

- Delivery Charges - different currency providers charge different amounts for delivering your holiday money to your door

- Special offer - We will let you know if the providers are offering travel money deals

Commission is the fee that travel money providers charge for the service to exchange your money into foreign currency . The charge is usually included in the exchange rate they advertise. You will see that many foreign exchange companies advertise 0% commission, they are still charging you by including the charge in the rates.

All the travel money prices we quote include any fees and commissions, including delivery!

The simple answer is yes! Usually, the minimum order amount for foreign currency is £100, and the maximum is usually £7,500, although some providers allow you to exchange more.

Travel money is normally sent via special delivery service with Royal Mail. Travel cash orders worth more than £2,500 will be sent via a courier or multiple Royal Mail packages. This is for insurance reasons, making sure your travel money is safe.

This depends on the currency provider. Some providers offer next-day delivery, sending your travel money using Royal Mail's Special Delivery Guaranteed by 1pm service. There will be an extra cost for this and you can see how much when you compare the holiday money prices.

Don't forget, many foreign currency providers also allow you to pre-order currency and you can collect it in store, this means you can avoid delivery charges.

Most do, any holiday money that you have leftover after your trip abroad can be sold using a buy-back service that will convert it back to pounds. Our comparison tool will show you the providers offering the best buy-back rates .

Every few of minutes we compare the exchange rates and latest currency deals from the best travel money providers in the UK. You can see instantly who is offering the best deals and choose a service that suits your needs best.

Also, if you've come home from a trip abroad and have leftover currency, we compare many foreign currency buy back companies, showing the best rates to convert your foreign currency back into pounds.

Hundreds of customers order travel money through our site daily and have a great experience. However, as with ordering anything online, the process is never completely risk-free and you should always take care when transfering money to any company.

We undertake comprehensive checks on all of our providers and monitor them to make sure they meet our high standards and continue to do so. Having said that, no company is guaranteed not to come into trouble and we cannot guarantee the solvency of any of the providers listed on our website. We always recommend that you conduct your own due diligence before placing an order with any company.

There are many destinations where taking some local currency is extremely useful to make sure you are covered in places where credit cards are not accepted. Many of the smaller retailers globally will not allow credit cards, so cash is the only option.

Read our blog post on taking cash on holiday .

The best time to buy any travel money is when the pound is performing strongly relative to the currency you are buying, this means it will have a higher exchange rate, so will give you more currency for your money. The amount you receive is calculated by multiplying the exchange rate by the amount of pounds you want to spend, so the higher the exchange rate, the more foreign currency you get.

Exchange rates are constantly changing but we show you the historical exchange rate performance for each of the currencies so you can have more of an idea of whether now is a good time to buy your travel money.

Exchange rates tend to be very similar wherever you are in the world to those offered in the UK, however waiting until you are away means you may be stuck with poor exchange rates, fewer options of places to offer competitive rates or even worse, you may have to pay big additional fees and commissions. By buying your travel money in the UK there are no hidden fees, charges or nasty surprises, you know exactly how much you are getting.

Once you have found the best rate, place an order on the currency suppliers’ site, and pay for your currency.Each currency supplier has different payment options, including bank transfer, debit card, with some suppliers offering payment by Apple pay and Android pay. Once your order has been confirmed your order will be prepared and your currency sent to you by registered delivery, some suppliers even offer next-day delivery.

LATEST CURRENCY NEWS

The 8 Best Travel Money Belts of 2024: Secure Your Valuables on the Go

The best travel money belts of 2024 excel in comfort, style and security. These belts are not just fashionable, they are also equipped with the latest technology like RFID-blocking to protect your personal information from theft. Particularly noteworthy is a model that offers sizes adaptable to multiple waist measurements. After all, securing your cash and

The Perfect Carry-on Case for Airline Travel: Top Recommendations and Tips

The perfect carry-on case for airline travel fits within the usual size limits of 22 x 14 x 9 inches. This ensures it complies with most airlines’ overhead bin space restrictions. Despite this uniformity, some international airlines may have varying rules, so cross-checking with your specific airline before purchasing a case is a smart move.

What currency is used in Dublin, Ireland? A clear answer for travellers

Dublin, the capital city of Ireland, is a popular tourist destination known for its rich history, vibrant culture, and stunning architecture. As a result, many people who plan to visit Dublin may wonder what currency is used in the city. The official currency of Ireland is the Euro, which is used throughout the country, including

Join newsletter

- Best Euro Rate

- Best US Dollars Rate

- Best Turkish Lira Rate

- Best Australian Dollars Rate

- Best Thai Baht Rate

- Best UAE Dirham Rate

- Best Canadian Dollars Rate

- Best Polish Zloty Rate

- Best Croatian Kuna Rate

- Buy Travel Money

- Sell US Dollars

- Sell Turkish Lira

- Sell Australian Dollars

- Sell Thai Baht

- Sell UAE dirham

- Sell Canadian Dollars

- Sell Polish Zloty

- Currency buy backs

- Currency Online Group

- Sterling FX

- Covent Garden FX

- The Currency Club

- Tesco Money

- Sainburys Bank

- Virgin Money

- Natwest Travel

- Post Office

- Thomas Cook

- Marks and Spencer

- No1 Currency

- Rapid Travel Money

- Best Supermarket Euros

- Privacy Policy

@2024 Comparison Technology Ltd, 71-75 Shelton Street, Covent Garden, London, WC2H 9JQ | Company Registration Number 12065287

CompareTravelCash.co.uk is a travel money comparison service that's designed to help you save money – whilst we do our best to ensure the site is 100% up-to-date, we cannot guarantee this. We advise you to carry out your own due diligence before buying or selling travel money.

Best US Dollars Exchange Rates

Make sure to get the best rates by comparing prices on pounds to US dollars

Delivery Options

Established since 2010. Home delivery is free above £700 with a postal charge of £5 for orders below £700. Payment for your currency can be made via Visa, Mastercard, Apple Pay or Google Pay but using these services incurs a 0.1% additional fee. There are no charges if you pay using the “pay by bank app” or for make a manual bank transfer.

Covent Garden FX

Established in 2001. Home delivery is free above £750 with a postal charge of £6 for orders below £750. “Click & collect” is available from their London store and they also deliver to offices in the City of London.

ACE-FX Delivery

Established in 2007. Home delivery is free above £750 with a postal charge of £4.99 for orders below £750. Has 3 “click and collect” outlets in London.

Currency Online Group

Established in 2006. Home delivery is free above £750 with a postal charge of £5 for orders below £750. “Click and collect” is available in 2 London locations.

Established in 1972. Home delivery is free above £700 with a postal charges of £6 for orders below £700. “Click and collect is available via their London W2 office.

NM Travel Money

Established in 2018 and part of the NM Money Group which includes eurochange. Home delivery is free above £500 with postal charges of £5 for orders below £500. Has access to the 192 eurochange “click and collect” outlets

Established in 1975. Home delivery free above £500 with postal charges of £5 for orders below £500. Has 192 “click and collect” outlets throughout the UK.

The Currency Club

Established since 2010. Home delivery and payment via bank transfer is free. Payments via debit card incur a fee of 0.29%. There is no “click & collect” service available.

Provide travel money services via John Lewis Finance and First Rate Exchange Services. Home delivery is free above £500 with a postal charge of £5.50 for orders below £500. Waitrose and John Lewis have over 350 stores and “click & collect” is available at a selected number of stores -check to see if there is one near you.

Part of the John Lewis partnership and provide travel money services via John Lewis Finance and First Rate Exchange Services. Home delivery is free above £500 with postal charges of £5.50 for orders below £500. Waitrose and John Lewis have over 350 stores and ‘click & collect’ is available at a selected number of these stores -check to see if there is one near you.

Travel Money Club

Established since 2016. Home delivery charge is £14.95 regardless of how much you buy. There is a monthly option of £5.99 which allows unlimited deliveries. There is no “click & collect” service available.

First Choice

Provided by TUI Travel Money. Home delivery is free above £600 with postal charges of £4.99 for orders below £600. ‘Click & collect’ is available in a selected number of the 550 plus TUI stores throughout the UK. Check to see if this service is available at a store near you.

Part of the TUI Travel Agent Group. Home delivery is free above £600 with a postal charge of £4.99 for orders below £600. ‘Click & collect’ is available in a selected number of the 550 plus TUI stores throughout the UK. Check to see if this service is available at a store near you.

Established in 1976. Home delivery is free above £600 with postal charges applied on a tiered basis, ranging from £2.99 to £7.49 depending on the amount purchased. ‘Click & collect’ service available. Many of their outlets are at airports and transport hubs -check to see if there is a location convenient to you.

Travel money services offered in conjunction with Travelex. Home delivery is free above £500 with a postal charge of £3.95 for orders below £500. Asda has over 500 stores throughout the UK – check to see if the “click and collect” service is available at a store near you.

Tesco provide travel money services in conjunction with Travelex. Home delivery is free above £500 with postal charges of £4.99 for orders below £149 and £3.95 for orders below £500. Tesco has over 2,500 stores throughout the UK. Check to see if ‘click & collect’ is available at a store near you.

Sainsbury’s have offered a travel money service as part of their bank offering since the late nineties. Home delivery is free above £400 with a postal charge of £4.99 for orders below this amount. ‘Click & collect’ is available in Sainsbury’s stores throughout the UK. Check to see if this service is available at a store near you

Rapid Travel Money

Powered by the Currency Club and part of the Sterling Consortium that was established in 1972.Home delivery is free over £1500 with a postal charges of £8.99 for orders below £1500. There is no ‘click & collect’ service available

The Post Office

Post Office has provided travel money services in conjunction with First Rate Exchange Services since 1994. Home delivery is free above £500 with a postal charge of £4.99 for orders below £500. “Click and collect” is available at 100’s of Post Offices throughout the UK. Check to see if this service is available near you.

Currency Exchange Corp

- Established in 1999.

- Home delivery is Free above £800 but postal charges of £6.95 apply to orders below £800

- There is a ‘Click & Collect’ service available in some 16 stores in London & surrounding area but check this service is available at a store convenient to you.

ABTA Travel Money

ABTA – The Travel Association knows travel, having been a recognised and reassuring source of advice, guidance and support to travellers for over 70 years. ABTA is now bringing you one of the essentials when travelling abroad – a foreign exchange service, ABTA Travel Money.

With competitive rates on over 60 currencies. Order Online for Click & Collect in just 60 seconds later (depending on branch opening hours and stock availability) from over 190 locations or order before 2:30pm for next working day home delivery.

Established since 2007 and part of the Equals Money Group. Requires you to register for an account before ordering currency. Home delivery is free above £750 with postal charges of £7.50 for orders below £500 & £5 for orders between £500 & £750. “Click and collect” is available in a store in London.

No1 currency - Home Delivery

Established over 20 years ago and part of the Fexco Group. Home delivery is free above £800 with a postal charge of £6.95 for orders below £800. Has 180 “click and collect” outlets throughout the UK.

Established since 2018. Home delivery is free above £750 with a postal charge of £7.50 for orders below £750. Available for “click and collect” from their office in Slough.

Thomas Exchange

Established in 1993. Home delivery is free above £800 with a postal charge of £6.95 for orders below £800. “Click and collect” is available in 9 outlets throughout London.

Linkfx Home Delivery

Linkfx Home Delivery was established in 1995. Home delivery is free above £750 with a postal charge of £5 for orders below £750. There is no ‘Click & Collect’ service available.

The travel money service is only available to HSBC, First Direct and Marks and Spencer Account holders. Offers free delivery by post or to HSBC branches

All orders must be paid for with a Barclays debit card or a Barclaycard. Travel money can be collected from Barclays branches or delivered free to your home address. Minimum order £50.

Currency Commentary

The US dollar is the most widely used currency in international transactions, as well as the one considered to be the safest. The US dollar is the most traded currency in the world and is often called the worlds ‘reserve currency’ (so for instance crude oil is always denominated in US dollars).

This also means that in many other places in the world, but typically developing countries many shops and restaurants (and tour guides and taxis) will also accept US dollars. In fact, in some countries such as Argentina the dollar goes a lot further than the peso.

Countries that you can use the US dollars include Puerto Rico, Ecuador, British Virgin Islands, Turks and Caicos Islands, although many of the countries in the Caribbean also accept US dollars.

Citizens of counties often give their currency nick names and the US is no different calling the dollar ‘bucks’. This probably comes from the trading of deer skins in the 1700’s, which then over time became the name for the US dollar.

How to get the best deal on your travel money

How do you get the best exchange rate for US dollars?

If you are buying US dollars to get the best exchange rate you should always use a travel money comparison website, they are easy to use and provide a simple way of finding the best price. You don’t have to choose the best rate, so for example if you would prefer a well-known brand which maybe costs more, you can do so but at least you understand the difference in cost. The difference in cost between the best and worst rate can be significant, up to £20 on a currency purchase of £750.

How do you get the best on-line exchange rate for US dollars?

If you want to order and buy your US dollars on-line, then to get the best on-line exchange rate always use a comparison website. You will be provided with a list of travel money suppliers usually in order of the best price first. If you want a larger number of US dollars, say above £500 the best price will almost certainly be a small direct supplier with a less well-known brand. You then have a choice as to whether you would prefer to have the money delivered to your home or to collect the money from a local store on the ‘High St’.

How do you get the best exchange rate for US dollars for home delivery?

If you would like the money delivered to your home, when you are choosing the provider make sure that you understand the postal delivery charges, particularly for amounts below £500 as any additional postal costs will effectively mean that you are receiving less US dollars for the £sterling you pay. That is why at besttravelmoney.com we include postal charges for the specific amount of US dollars requested within the rate you are shown. So, what you see is the cost to you.

There are some practical considerations when choosing home delivery, like making sure the travel money supplier you have chosen for US dollars delivers to where you live. Some of the smaller suppliers with the best rates will only deliver to a small geographical area. Also, remember this is ‘cash’ you are having delivered, so you need to be at home when your US dollars arrive.

How do you get the best exchange rate for US dollars on the High St?

If you only require a small number of US dollars or would prefer the convenience of collecting your US dollars from a local store, we would still recommend you use a travel money comparison website. Choose the travel money provider which you consider having the best combination of rate and convenience for you. Check the supplier you have chosen (whether for example it is Tesco, Sainsbury’s or eurochange) really does have a collection point near you as not all stores will have the facility.

We still recommend that you order on-line going from the comparison website to your chosen provider website to ensure you get the best deal. You will almost certainly getter a better rate via ‘click & collect’ than just walking into a store and purchasing your US dollars.

Keep in mind our FAQ's to make sure your holiday money goes further

Always understand the charges for debit and credit cards.

Many of the costs that you incur while abroad are driven by your UK bank account or credit card, so understanding the costs for your debit or credit cards abroad is important.

Whilst using your debit card in the UK is usually free, using your card abroad often incurs extra charges. Apart from most European holiday destinations the major banks charge a fixed fee every time you use your debit card. There is also a foreign exchange fee (typically 2.99%) on the amount you spend when using your debit card. The newer banks tend to offer better deals. Starling bank and Revolut being two of the better examples.

We have put a table together of debit card charges for most UK banks within the Debit Card FAQ section .

Most credit cards don’t charge a fixed fee for using the card but still charge a percentage on any transaction that you make in a shop or restaurant. Also be careful using your credit card for cash from an ATM as it may be considered a cash advance and incur interest immediately. One of the better credit cards to use abroad is the Halifax Clarity card .

We have put a table together of credit card charges for the major UK card providers within the Credit Card FAQ section .

Always select the local currency in a shop or at an ATM

Something that is becoming more frequent when you go abroad is at an ATM or in shops and restaurants, you may be offered the option to pay in pounds sterling or local currency. Always choose the local currency otherwise you will get a very poor exchange rate and the cost to you can be surprisingly high.

This tiktok we saw explains it well for ATM transactions.

Check overseas ATM charges before pressing 'enter'

Understanding the differing charges applied by ATMs abroad is not easy. In theory ATMs are required to explain their charges before you press enter. Apart from any charges applied by your bank or credit card provider the local ATM owners may have differing exchange rates or local charges. Don’t be afraid to check out several local ATMs and see which offers the best deal.

Simpler options can be to take more local currency with you or use an ATM from a big local bank. ATMs from banks tend to charge less than independent local operators sited in stores or garages for example.

Our travel guides provide the names of the major banks in some different countries

Our travel money guide to the US plus a few others you may be interested in

United states, check out our blog posts.

All you need to know about cash and cards on a Caribbean cruise

Holidaymakers miss out on over £150m a year by not shopping around for currency

All you need to know about cash and cards when travelling to New Zealand

3 Easy Ways to Boost your Holiday Spending Power

Automated page speed optimizations for fast site performance

Compare Best US Dollar to Philippine Peso Exchange Rates

Find the best philippine peso rate on the foreign exchange market by comparing international payments and unbiased uk travel money rates, 1.000 usd = 57.646 php ▲ 0.00%.

- Compare Money Transfers

- « Best US Dollar exchange rates

We've found holiday money providers offering 10000 worth of PHP for delivery. The best travel money exchange rate right now is from .

What is the Best US Dollar to Philippine Peso Exchange Rate Today?

The best Philippine Peso exchange rate for international payments right now is 57.0683* from TorFX. This is when compared to a range of global and UK high street banks.

* Money transfer exchange rates are indicative only.

US Dollar Philippine Peso Rate History and Recent Trend

Looking at the chart below that shows the past 30 days, you can see today's interbank Philippine Peso rate of 57.646 is 2.63% higher compared to 56.1666 on March 29. Currently 750USD is worth approximately 43234.5 which is 0.0149PHP more than you'd have got on March 29. Therefore, at this conversion, one US Dollar will buy more Philippine Pesos today compared to thirty days ago.

When is the Best Time to Buy your Philippine Peso?

The best time to buy Philippine Peso is generally on Fridays and Saturdays, according to data analysis performed by WeSwap and The Telegraph. These days tend to offer the best currency exchange rates, providing an opportunity to maximise the value of your money when purchasing the Philippine Peso.

Additionally, monitoring the Philippine Peso rates leading up to your travel date can help you identify optimal times for buying Philippine Peso currency based on market conditions and personal travel plans. To hedge your bets, you can buy some of your holiday money in advance, and the remainder just before you travel. This means if the exchange rate goes up or down, you've mitigated any difference!

Personal Money Transfers - Sending International Payments

Are you buying or selling a foreign property, emigrating, or investing abroad?

Services like forward contracts and our digital currency wallets allow you to secure an exchange rate in advance or purchase funds beforehand.

Whether you're emigrating, purchasing property abroad, sending money to family, or transferring wages or a pension, navigating the world of currency exchange can be intimidating.

Exchange rates constantly fluctuate, making it challenging to budget effectively or identify the best timing for your transfer.

Moreover, some currency providers levy transfer fees and offer uncompetitive rates, potentially leaving you at a loss. Fortunately, this need not be the case. Brokers such as TorFX are committed to simplifying currency transfers and helping your money extend further.

Studying, working, or retiring abroad? Paying an overseas mortgage, maintenance costs, or bills? Sending money to family?

If you need to transfer money abroad regularly, a foreign exchange broker can automate the process, making it both cost-effective and hassle-free.

Additionally, with an online service and app, you can monitor live rates around the clock and arrange your transfers within minutes. You also have the option to purchase currency when rates are favourable and transfer it as needed from your currency wallets.

You should be able to manage your currency transfers effectively!

* Please note, exchange rates quoted in the table above are not live dealing rates. Rates compared on 3rd April 2024. The exchange rate comparison is calculated on data supplied by TorFX/ FXC Intelligence. FXC Intel source exchange rate quotes for the example transfer amounts and currency pairs from nine different UK banks.

Compare our best travel money deals

Get maximum value for your travel money, currency calculator.

Join our personal finance newsletter for top deals and insight

You can unsubscribe at any time - privacy notice .

Today’s best exchange rates

How do you get the best holiday money exchange rate, high exchange rates, delivery charges, special offers, pros and cons, five golden rules of travel money, 1. know how much cash you'll need.

Carrying around a large amount of cash isn't the safest thing to do. At the same time, not having enough cash can cause a lot headaches too. It's a good idea to take a little more than you think you'll need.

But it's also good sense to have a backup prepaid , debit or travel credit card that you can rely on - assuming you're going to a destination that widely accepts card transactions.

2. Shop around

Not all currency exchange companies are created equal. Some may have good exchange rates, but higher fees. Others may have higher rates, but no fees. You have to make sure which one offers the best value to you.

This is why it’s worth comparing the deals on offer from several companies before ordering your travel money. Factor in the fees and the exchange rate and see where you end up better off. Often the amount of money you're exchanging can be a deciding factor.

3. Don't buy your travel money at the airport

Airport holiday money providers have notoriously high prices because they offer a last-chance solution for those who are just about to board a plane. By planning ahead you can save a small fortune.

4. Don't carry too many large notes

Notes of large denominations can be tricky, as small shops and taxi cabs, which are more likely to require cash, might not have enough change to accept a large note.

Some retailers are also often wary of accepting large notes. Smaller notes and change can also be handy when it comes to tipping or buying small everyday items.

5. Don't use your credit card to buy travel money

Avoid buying foreign currency with a credit card as credit card providers treat the transaction as a 'cash advance' . Not only will you be charged daily interest, you're also likely to be hit with a fee.

Budgeting for your holiday

How much travel money you need to take depends on your plans . You'll need to budget for your holiday to make sure you don't run out of money before the end.

Deciding how much money to take depends on were you're going, whether debit or credit card usage is prevalent, and if you want to have some local currency on hand for emergencies.

Having some cash is extremely important , as there's always a possibility your cards could get declined or blocked for some reason, and it may take some time to resolve the issue.

Also, some countries still rely predominantly on cash transactions , so you should factor that into how much cash you decide to take.

What are the top alternatives to buying travel money?

Travel credit cards.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money:

Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer

Purchase protection – for purchases costing between £100 and £30,000 you're covered by Section 75 of the consumer credit act , meaning if something goes wrong you can make a claim with your card provider should the vendor fail to pay up

However, not everywhere accepts travel credit cards and using them at a cash machine abroad can come with hefty fees. It can also be easier to overspend on a credit card, leaving you with debts on which interest is charged.

Travel money cards

Currency cards and travel bank accounts let you spend overseas without being charged a foreign transaction fee. Their key strengths are:

Great exchange rates - you card provider will pass on the Mastercard or Visa rate to you without adding extra charges

No charges for ATM use overseas - if you need extra cash on holiday, you can withdraw it without being charged by your provider. Watch out for local ATM fees though, as these might still apply

The downsides include that there can be limits on how much you can withdraw abroad using a travel money card, and that they're not accepted quite as widely as cash. Some travel current accounts also come with fees.

Prepaid travel cards

Prepaid travel cards can be loaded with currency and used abroad without paying foreign exchange fees. You can load a prepaid card with a specific foreign currency or a variety of different currencies, depending on your travel plans. The key advantages are:

Low or no fees to use abroad – prepaid travel card providers charge far less than traditional banks for overseas usage

Safer than carrying cash - you can cancel or freeze the card if it's lost or stolen, protecting your balance

However, you’ll need to watch out for general usage fees, which often apply when you load the card with cash and may also be charged monthly.

Can you get commission-free travel currency?

Yes and no. It depends on how you define it. Commission refers to the service fee that a currency exchange broker charges for exchanging your money.

Many companies advertise 0% commission to exchange money online or on the high street, but, instead of charging commission, they offer a less competitive exchange rate. This is why you need to compare the whole deal rather than just opting for a zero-fee travel money deal.

Are there restrictions on getting currency delivered?

When you buy your currency online, it's normally sent via Royal Mail's Special Delivery service. This means you have to sign for the package. Cash orders that exceed £2,500 will be sent in batches because that's the maximum value that can be insured for each delivery.

Can you get next-day delivery for currency?

Some travel money providers do offer next-day delivery. These brokers send out currency using Royal Mail's Special Delivery Guaranteed by 1pm service.

Our comparison shows which operators offer this option and how much they charge for it. With some companies, you also have the option to pre-order your travel money for collection in person from a local branch, meaning you don't have to pay for delivery.

Will anyone buy my currency back?

If you've got leftover travel money from a trip abroad, you can use a buy-back service to convert it back into pounds.

The buy-back rate tells you how much sterling you'll get back.

Remember to factor in the rate and delivery costs, and compare exchange rates. You can check out the best euro-to-pound exchange rate by looking at our comparison table.

About our comparison

Who do we include in this comparison.

We include every company that gives you the option of buying euros online. Discover how our website works .

How do we make money from our comparison?

We have commercial agreements with some of the companies in this comparison. We get paid commission if we help you take out one of their products or services. Find out more here .

You do not pay any extra and the deal you get is not affected.

Learn more about travel money

About the author

Didn't find what you were looking for?

Below you can find a list of currencies to exchange

Other products that you might need for your trip

We’ve been featured in

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

YOUR MONEY YOUR WAY

Travel money, hays travel foreign exchange, 4 great ways to buy your holiday money, click & collect.

Great rates & currency expertise come as standard with our Click & collect service & with no minimum spend, your holiday money is just a few clicks away.

This brings the total quotes to £000.00

£000.00 for currency

£000.00 for Buy Back Guarantee

Guarantee Peace of mind when buying your currency from Hays Travel

Save money on your unused currency with our Buyback Guarantee^

Return your unused currency for the same rate as you purchased it.

Available on all currencies sold in cash.

Available on multiple currency transactions

Available Instore & online

Terms & Conditions

Exchange Rates

Always great value and no minimum spend*

- Euro 1.1444

- US Dollar 1.2224

- Australian Dollar 1.8419

- Bulgarian Lev 2.1461

- Canadian Dollar 1.6466

- Czech Koruna 27.2795

- Danish Krone 8.2858

- Hungarian Forint 432.7513

- Icelandic Krona 161.0111

- Indonesia Rupiah 18419.0014

- Mexican Peso 19.7083

- New Zealand Dollar 2.0143

- Norwegian Krone 13.1104

- Polish Zloty 4.6966

- South African Rand 22.4749

- Sweden Krona 13.0114

- Swiss Franc 1.1016

- Turkish Lira 37.0108

- Thai Baht 42.9036

- United Arab Emirates Dirham 4.2657

Travel Money Card

- Use anywhere Mastercard® prepaid is accepted worldwide.

- Carry less cash.

- Top up in 15 currencies including Euro, US Dollar, Australian Dollars and UAE Dirhams.

- Phone support available worldwide 24/7.

- Manage on the go via Hays Travel Currency Card App.

Connect to your google pay wallet

You can now link your Hays Travel Mastercard with Google Pay for swift and secure transactions wherever you go. Say goodbye to carrying physical cards and hello to effortless payments with just a tap of your phone. Simplify your travel experience today!

BUY YOUR HAYS TRAVEL MASTERCARD

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

- BUY IN BRANCH

WHY CHOOSE HAYS TRAVEL?

For your next departure, buy your holiday money from Hays Travel. Always commission free currency with competitive online and high street exchange rates.

- Wide selection of currencies available

- Hundreds of nationwide Hays Travel branches offering on-demand Foreign Exchange; buy from branch to receive high quality customer service from the travel experts or order online for convenient home delivery

- 0% commission when we buy and sell foreign currency

Home Delivery

Ordering currency from the comfort of you own home has never been easier, with our great rates & over 60 currencies to choose from as well as next day delivery why not chose your currency to be delivered to your doorstep?

Holiday Money to your door

Order before 3pm for next working day home delivery via Royal Mail Special Delivery. *Customer must be home to sign for delivery. Over 60 currencies to select from. Free delivery on all orders £500 and over Convenient Saturday delivery available for no extra charge Minimum order value of £200 up to a maximum of £2500 Peace of mind, your local Hays Travel branch will buy back any leftover currency purchased through Hays Home Delivery commission free

Call Into a Branch

With over 400 branches to choose from arranging your holiday money has never been more convenient – Why not call into branch today where one of our experienced & Friendly Foreign Exchange Consultants will be on hand with our great rates, expert advice & fantastic service.

Bank on our branches for your Holiday Money

Over 400 branches Nationwide - Use our branch locator to find your nearest Hays Travel branch.

A wide selection of currencies & Hays Travel Money Cards available Instantly in-store

Competitive high street rates and always commission free

Exotic Currency Ordering service – Over 70 currencies available to order

Buyback Guarantee – Save money on your leftover Currency.

All major currencies Bought Back Commission Free

Experienced & Friendly Staff instore

- FIND YOUR NEAREST BRANCH

IMAGES

VIDEO

COMMENTS

We found 17 travel money suppliers offering £750 worth of US dollars for delivery and accepting payment by debit card. You receive $927.83. Exchange rate 1.2371. Insured delivery Free. Buy Now. Currency Online Group . You receive $926.85. Exchange rate 1.2358. Insured delivery Free.

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

Get the best currency exchange rates for international money transfers to 200 countries in 100 foreign currencies. Send and receive money with best forex rates. ... Travel Expenses Calculator. Currency Email Updates. More tools. Recommended by 65,000+ verified customers ... NZD - New Zealand Dollar. CHF - Swiss Franc. ZAR - South African Rand ...

Average of Bank Fees : 11.1%. Conversion Fees shown as percentages against the USD-EUR interbank exchange rate: 1USD = 0.9356 EUR : 4/24/2024, 7:34:39 AM. This table compares estimated exchange rates & fees from selected FX providers for USD to EUR currency exchange to the midrate.

Whether you need to check the latest exchange rates, compare historical trends, or send money abroad, Xe Currency Converter is the ultimate tool for you. You can easily convert between any of the world's major currencies, including crypto and precious metals, and get the most accurate and up-to-date rates. Xe Currency Converter is free, fast, and simple to use.

Compare travel money with MoneySavingExpert. Find a better exchange rate for spending overseas. Choose from a number of different currencies. Compare rates in minutes. Compare rates. Explore page: Pros and cons. Top tips.

Take dollars to euros. On a day when currency markets suggest $100 should buy you €93, a currency exchange desk might hand you just €81, while a more modern method would net you a rate closer ...

1 USD = 0.8984 EUR. 5 USD. 249.97 EUR Check rates. Bank of America USD to EUR rate: 1 USD = 0.9111 EUR. 26 USD. Go to full comparison. Compare for a specific amount, different pay-in and pay-out options, and see transfer speed and Monito Scores on our dedicated comparison page. See 7 more results.

Many U.S. banks will exchange USD for foreign currencies without charging a fee, but there are often stipulations. For instance, Bank of America customers can exchange foreign currencies for free ...

Right now, the U.S. dollar is extremely strong in Japan, making some of the best food and drinks in the world mind-bendingly cheap for U.S. travelers. It's part of why travel to Japan is so popular right now. JPY to USD exchange rate as of Feb. 20, 2024.

We compare the tourist exchange rates from all the UK's top travel money providers to help you save time and money when you buy or sell foreign currency online. ... Best Rate: US Dollars: 1.2642: Best Rate: Canadian Dollars: 1.7227: Best Rate: Thai Baht: 47.048: Best Rate: Indonesian Rupiah: 21034.6: Best Rate: Bulgarian Lev: 2.3169:

NM Travel Money. Established in 2018 and part of the NM Money Group which includes eurochange. Home delivery is free above £500 with postal charges of £5 for orders below £500. Has access to the 192 eurochange "click and collect" outlets. USD Rate 1.2408. You get $ 930.60.

Travel credit cards - i.e. the ones with no foreign transaction fees - offer two key advantages over travel money: Great exchange rates - when you spend on a travel credit card you get the Mastercard or Visa exchange rate, which is about the best you can find as a regular consumer. Purchase protection - for purchases costing between £100 and £30,000 you're covered by Section 75 of the ...

For near-perfect rates each and every time you go away, consider a top specialist overseas credit or debit card instead. These cards charge no fees on spending worldwide, so you can just use them as you would at home. You'll also be able to use them to withdraw cash overseas with the same great exchange rates - though a specialist travel debit ...

The best travel money exchange rate right now is from . What is the Best US Dollar to Philippine Peso Exchange Rate Today? The best Philippine Peso exchange rate for international payments right ...

1 EUR = 0.867 GBP. Amount received (after accounting for delivery fees) 750 GBP = 864.75 EUR. Show Results. Great. 1,060 reviews on. On this page. Top tips Best rates How to get the best rate Pros and cons Alternatives Budgeting for a holiday FAQs. Author.

Travel Money Hays Travel Foreign Exchange, 4 great ways to buy your holiday money ... Exchange Rates. Always great value and no minimum spend* Euro. 1.1444 US Dollar. 1.2224 Australian Dollar. 1.8419 Bulgarian Lev. 2.1461 ... US Dollar, Australian Dollars and UAE Dirhams. Phone support available worldwide 24/7.

Use our currency converter to find the live exchange rate between XPM and USD. Convert Primecoin to United States Dollar ... Credit Card Comparison Best Travel Credit Cards Best Cash Back Credit ...