This browser is not supported. Please use another browser to view this site.

- All Save & Spending

- Credit cards

- Newcomers to Canada

- All Investing

- ETF finder tool

- Best crypto

- Couch potato

- Fixed rates

- Variable rates

- Mortgage calculator

- Income property

- Renovations + maintenance

- All Insurance

- All Personal Finance

- Finance basics

- Compound interest calculator

- Household finances

- All Resources + Guides

- Find a Qualified Advisor

- Monthly budget template

- ETF Finder Tool

- Student money

- First-time home buyers

- Guide For New Immigrants

- Best dividend stocks

- Best online brokers

- Where to buy real estate

- Best robo-advisors

- All Columns

- Making sense of the markets

- Ask a Planner

- A Rich Life

- Interviews + profiles

- Retired Money

Advertisement

By Winston Sih and Courtney Reilly-Larke on March 31, 2022 Estimated reading time: 6 minutes

TD First Class Travel Visa Infinite Card review

This premium TD card lets travellers redeem flexible rewards through a partnership with Expedia.

With a plethora of travel-focused credit cards on the market, the TD First Class Travel Visa Infinite Card may not be the obvious choice—especially considering how many Aeroplan cards TD currently has on its roster. That said, the TD First Class Travel Visa Infinite Card is worth considering. Why? It boasts a flexible redemption program and a partnership with Expedia. Cardholders get access to Expedia For TD online portal to redeem rewards for flights, hotels and car rentals on expediafortd.com.

Add to that comprehensive insurance coverage and generous earn rates and the TD First Class Travel Visa Infinite Card becomes a solid choice for avid travellers.

TD First Class Visa Infinite Card

Annual fee: $139

- Up to 8 TD Rewards points per $1 on travel

- 6 points per $1 on groceries and restaurants

- 4 points per $1 on recurring bills

- 2 points per $1 on all other purchases

Welcome offer: earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

Card details

The TD First Class Travel Visa Infinite Card

- Three things you need to know about the TD First Class Travel Visa Infinite Card

- How to redeem your TD Rewards

- What are the best ways to benefit from this card?

Are there any drawbacks to the TD First Class Travel Visa Infinite Card?

4 things to know about the td first class travel visa infinite card, 1. the you earn points under the td rewards program.

T he TD points system is easier to understand than the point system for the bank ’ s Aeroplan credit cards. Your Point values stay the same no matter where you ’ re flying, so it ’ s easy to work out how much they ’ re worth. Plus, TD Points can be redeemed on any airline, not just Air Canada or Star Alliance Partners. While Aeroplan Miles are valuable, if you prefer simplicity the TD First Class Travel Visa Infinite Card might be more up your alley.

2. Your points go farther when you book with ExpediaForTD.com

If you already use Expedia to book your travel, this card is a savvy choice. When you book travel online through Expedia For TD, you earn 8 TD points per $1.

3. The card comes with a generous welcome bonus

You can earn up to $700 in value, including up to 75,000 TD Rewards Points and no Annual Fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.. Plus, earn a birthday bonus of up to 10,000 rewards points (conditions apply). You can also receive a $100 TD travel credit when you spend at least $500 at Expedia for TD.

4. You’ll get great travel insurance

The TD First Class Travel Visa Infinite Card comes with up to $2 million of travel medical insurance coverage for the first 21 days of a trip. Trip cancellation, trip interruption, common carrier travel accident insurance, travel assistance services, flight delay insurance, auto rental collision insurance, and delayed and lost baggage insurance round out the card’s benefits. For a premium rewards card, The TD First Class ’ s insurance is fairly standard, however; so, if you ’ re looking for more comprehensive credit card insurance , you could consider a card like the National Bank World Elite Mastercard, * which comes with up to $5 million in out-of-province-of-residence medical/hospital insurance for trips up to 60 days (if you ’ re under 54).

How to redeem your TD Points:

You can redeem your TD Points for travel in two ways. The best—and most valuable—way is through the Expedia For TD online portal, where you can redeem 200 TD points per $1 in travel credit (0.5%) and pay the balance of the cost (if any) using your credit card (you’ll also earn Points on this spend).

Your other redemption choice is the “Book Any Way” option, which lets you book via other travel websites; however, your bookings can cost up to 25% more if you go this route. When using “Book Any Way” you’ll redeem at 250 TD points per $1 (0.4%) applied as a statement credit on your first $1,200 in travel purchases and 200 TD points per $1 (0.5%) for your travel purchases over $1,200. In comparison, with Expedia For TD, you’ll get a better and more consistent return of 0.5% on all your travel spending.

In both cases, the TD First Class Travel Visa Infinite Card allows you to redeem for any seat on any airline. Additionally, you can redeem points for rewards in small increments (minimum 200), so this means you don’t need to build up a large pool of points before you’re able to apply them towards travel.

Finally, through the TD Rewards site, you can shop for items such as a Vitamix blender, a Dyson vacuum or gift cards. However, you won’t get the same value as you would booking travel. For example, a $50 gift card at Best Buy will cost you 20,000 TD points, whereas you can use the same amount of points for $100 in travel on the Expedia For TD portal.

How to optimize the TD First Class Travel Visa Infinite Card

Ultimately, your best bet is to redeem points for travel from ExpediaForTD.com . Generally, prices on the website are similar to those on the main Expedia website, and you’ll be able to redeem at the rate of 200 points per $1. If you redeem points for travel outside of the TD portal, your points can lose up to 25% in value; however this could be a smarter route if you find a really good deal on another travel portal.

If you do find a better hotel or flight deal elsewhere, you have the option to price match, but there are some restrictions: you must have booked within the last 24 hours; your travel plans must be at least 48 hours away; and travel dates, and flight and hotel classes must all be the same to submit a claim.

Does the TD First Class Travel Visa Infinite Card have travel insurance?

With this card you’ll get an extensive suite of travel insurance coverage, for big and small emergencies. For frequent travellers and those who cross the border often, this is a must. The card includes travel medical insurance of up to $2 million of coverage for the first 21 days. (If you or your spouse are over 65 or older, you’re only covered for the first four days of your trip.) You’ll also get up to $1,500 of trip cancellation insurance with this card up to a maximum of $5,000 for all insured persons. For trip interruption insurance, you get $5,000 per insured person, up to $25,000 for all the insured people on the same trip.

You’ll also get common carrier travel accident insurance, emergency travel assistant services and delayed/lost baggage insurance (up to $1,000 per insured person if your baggage is delayed for more than six hours or gets lost ultimately).

There is a minimum personal income requirement of $60,000 or a household income of $100,000. However, this is a common requirement for many cards in the same category.

Other cards offer more incentive to spend in categories like groceries, dining and entertainment. The TD First Class Travel Visa Infinite Card only offers three times the Points earn on travel booked through the Expedia For TD portal (4.5%)—everything else is at the base three TD points per $1 (1.5%) rate. To compare, the Scotiabank Gold American Express has a five-times Points accelerator on restaurants and groceries (5% per dollar).

Finally, the TD First Class Travel Visa Infinite Card doesn’t offer airport lounge access , and you’ll be charged foreign transaction fees . So, if you like to use airport lounges, or you often find yourself shopping in a foreign currency, you may want to consider a card that offers those perks.

Bottom line

TD’s unique partnership with Expedia, accelerated earn rates and incremental points redemption structure make the TD First Class Travel Visa Infinite Card a worthwhile consideration as a travel credit card . However, the biggest boost in earning points you’ll get with this card is by booking with ExpediaForTD.com. If you don’t want to be locked into booking that way, you may want to explore other travel card options.

More on credit cards :

- Canada’s best travel cards 2022

- Canada’s best credit cards for gas

- Canada’s best credit cards for grocery purchases 2022

- Best cash back credit cards

What does the * mean?

Affiliate (monetized) links can sometimes result in a payment to MoneySense (owned by Ratehub Inc.), which helps our website stay free to our users. If a link has an asterisk (*) or is labelled as “Featured,” it is an affiliate link. If a link is labelled as “Sponsored,” it is a paid placement, which may or may not have an affiliate link. Our editorial content will never be influenced by these links. We are committed to looking at all available products in the market. Where a product ranks in our article, and whether or not it’s included in the first place, is never driven by compensation. For more details, read our MoneySense Monetization policy .

Share this article Share on Facebook Share on Twitter Share on Linkedin Share on Reddit Share on Email

Comments Cancel reply

Your email address will not be published. Required fields are marked *

One of the TD First Class Infinite VISA Benefits List include : “ Earn 3 points per $1 on everything spent “ Could you clarify why on my recent Bill Statement, showed $5 earned for 1,178 points Wouldn’t 1,178 points translate into 1178 divided by 3 ?

I have this card, but rarely use except for buying something on a trip to get the insurance coverage. The issue I have is I like to book my travel through web sites like tripcentral.ca (better for packages), VRBO (for condo rentals) and booking.com (much better selection), so only end up rarely using Expedia for TD and end up getting 1.2% back on my purchases, unless I want to wait until I have over $1,200 of points and then buy a major trip, getting 1.5% on the part over $1,200.

So, its pretty good and the insurance is good, but its not as great for travel as they like to claim.

I have had this card for about 2 years now and I am so dessapointed with it. I will stop using it from now on and I will tell everybody I know NOT to get this card or anything related to TD Bank. I changed to this card because they assured me I have full trip coverage with it so I booked my last vacation with it and considering that I did not get what I wanted on my trip they will take some responsibilities and give me some refund after my claim was with them for 8 months. They kept asking me for documents that I provided every time they asked and at the end they kept asking for documents I already submitted three times before. TD is a disgrace for Canadians. I wish the government take actions and do a deep audit on these guys. I will slowly withdraw everything I have with TD to go to another bank. Anything is better than this. Please people, do not do anything with this bank and definitely nothing with this credit card. I am been having issues with this bank since 2008 and it’s time to move on to a better service.

This is the all lying I have issues with that I lost my luggage on my way back home and my flight cut and delayed for 5 months they don’t cover anything’s this massage is for the Visa highly in-charge manager if you guys don’t find me solution I have to take legal step and say bye to TD my whole family since they denied my claim it’s really really broke my heart. I was really trust them never ever again.

I want to redeem my points from my business travel which I have accumulated as I switched to the rewards cash card now .How do I do this June 15,2022

This card is excellent and works well if you are looking to use it for travel specifically. I find it comes in handy when even needing a car rental or a hotel stay on the fly.

We have this card and use it often, we had enough points to use it for 5 hotels on our roadtrip last spring (booked them through expedia). I guess it all depends on what you plan to do. We often go on little roadtrips to Canmore, Banff or Jasper and use it to stay there as well so it really saves us for accommodations. Also not having to get separate car insurance for rental cars is a big plus.

I just got back from Cuba. Unfortunately my flight from Ottawa to Cuba was delayed by 4 hours. And from Cuba to Ottawa for 14 hours. I want to be reimbursed because I bought a ride on my The TD First Class Travel Visa Infinite. Please give me the contact information to whom to apply for compensation. Thank you,

I have First Travel Visa card. My trip is more than 21 days. How can I get travel insurance for the days after first 21 days?

This is incorrect. the $100 travel credit is only for hotels and vacation rentals ALONG with flights. Not if your travel consists only of flights. It is a Hotel credit and NOT a travel flight credit. Beware! This credit card is absolutely useless.

Related Articles

Are GICs a good investment right now?

Presented By

MCAN Wealth

Making sense of the markets this week: August 11, 2024

Japan’s carry trades spook the markets, mixed U.S. earnings are in, Shopify surges, oil and potash remain profitable.

Credit Cards

The best travel credit cards in Canada for 2024

These impressive travel cards can help turn your everyday spending into flights, hotels and more.

Real Estate

Yes, a cottage is an investment property—here’s how to minimize capital gains tax

Should you “invest” in a cottage? And if you do, what happens when you sell it, give it away...

The after-effect of market lows: a drop in fixed mortgage rates

Some investors might look at their portfolios, but Canadians getting a mortgage (or renewing one) should keep an eye...

Why did the stock markets fall?

Financial markets around the world stabilize after Monday’s fall. Here’s what to know about how we got here.

The best no-fee credit cards in Canada for 2024

These cards have no annual fee and still boast perks like cash back, travel insurance and more.

The best credit cards in Canada for 2024

Find the credit cards in Canada that offer the most rewards and the lowest fees, based on the latest...

The best secured credit cards in Canada for 2024

For those unable to qualify for a traditional credit card, a secured card can be an important tool for...

Why is booze so expensive in Canada?

Making, let alone serving, alcoholic beverages is an invariably complex manufacturing process that’s affected by cost inflation from all...

TD First Class Travel® Visa Infinite* Card review

Welcome Offer Ends Sep 3, 2024

Earn up to $700 in value†, including up to 75,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by September 3, 2024.

- Rates & Fees

- Eligibility

8 Points Earn 8 TD Rewards Points for every $1 you spend through ExpediaForTD†

6 Points Earn 6 TD Rewards Points for every $1 you spend on groceries and restaurants.†

4 Points Earn 4 TD Rewards Points for every $1 you spend on recurring bill payments.†

2 Points Earn 2 TD Rewards points for every $1 you spend using your card.†

10% Bonus Points Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

$100 Get an annual TD Travel Credit when you book at Expedia For TD†

USD The annual fee is in USD

20.99% Purchase APR APR for purchases 20.99%†

22.99% Balance Transfer Rate APR for balance transfers 22.99%†

22.99% Cash Advance APR APR for cash advances 22.99%†

$139 Annual Fee Annual fee is in USD. First additional cardholder is $50, subsequent cardholders are $0.

Good Recommended Credit Score

$60,000 Required Annual Personal Income

$100,000 Required Annual Household Income

By Tyler Wade & Scott Birke

Updated: July 17, 2024

- Compare credit cards in Canada

- Best Canadian credit cards

- Best cash back credit cards

- Best travel credit cards

- Best rewards credit cards

- Best no annual fee credit cards

- Best credit card offers

- Best credit cards for rental car insurance

- Best student credit cards

This offer is not available for residents of Quebec.

The TD First Class Travel® Visa Infinite* Card stands out among travel credit cards for its nice welcome bonus, strong rewards rate on all purchases, and particularly massive earn rate for purchases via through Expedia® For TD†. It also offers substantial long-term value for those who have a TD All-Inclusive Banking Plan, as that membership rebates the card’s annual fees for the primary cardholder and an Authorized User.

This could underwhelm some travelers but may be forgivable for those who are just focused on getting as many free flights and hotel nights as possible.

Who's the TD First Class Travel® Visa Infinite* Card for?

A travel lover who wants to accumulate points fast on everyday spending without any loyalty to a particular brand of store, but ideally can be loyal to TD Bank and their booking portal Expedia For TD to find the best travels deals.

TD First Class Travel® Visa Infinite* Card Welcome bonus

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card † .

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening † .

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

Pros and Cons of the TD First Class Travel® Visa Infinite*

Major combined value for the welcome bonus (up to $700 in value)†

Good base earn rate on all purchases

Huge earn rate when you book travel through Expedia® For TD†

Very flexible redemption options

$100 TD Travel Credit†

Visa Infinite Benefits

Great savings on annual fees for accountholders of TD’s All-Inclusive Banking Plan

Does not provide free lounge access

Charges foreign transaction fees

How to earn TD Points with the TD First Class Travel Visa Infinite

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†

- Earn 2 TD Rewards Points For every $1 you spend on other purchases made using your card†

Points don’t expire as long as your account is active, and the card has no caps on the total amount of TD Points that can be earned.

How to redeem your TD Points

Though there are a number of redemption options with TD Points, you get the best value when redeeming for travel via one of two methods:

1. Book Any Way†

The Book Any Way† redemption path allows you to charge eligible travel expenses to your credit card and then retroactively redeem your points for those expenses within 90 days of the expense date. Travel expenses may include but are not limited to:

- Air travel taxes

- Baggage fees

- Airport parking and shuttles

- Car rentals

- Local commuter transport, like trains, buses or subways

- Travel attractions and entertainment

Each point redeemed via Book Any Way† is worth $0.004 for the first $1,200 of any redemption and $0.005 for the remainder of any redemption above $1,200.

Expedia® For TD

Points can alternatively be redeemed for flights, hotels, vacation packages and rental cars via ExpediaForTD.com. Redeeming with this method yields a flat value of $0.005 per point. The site will indicate the dollar value of the TD points you have on hand, and then you apply those points to your travel purchase when checking out.

Aside from the high value in earning and redeeming rewards via ExpediaForTD.com, the platform also provides a nice price guarantee feature: If you find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in, Expedia will refund the difference between what you paid and the lower rate you found.

2. Other redemption paths

TD Points can also be redeemed for the following, though the value you get per point tends to be lower than what you get for the above two travel redemption methods.

- Amazon’s Shop with Points † : Select your TD card as your method of payment at Amazon.ca checkout , then automatically apply points toward your purchase. 10K TD Points can be redeemed for $33 (value of $0.0033 per point) and can be redeemed for Amazon.ca purchases either in part or in full.

- TD’s Shop the Mall † : Redeem points for clothing, electronics and computers from retailers like Roots, Zara, and the Body Shop.

- TD’s Shop the Catalogue † : Redeem points for merchandise including clothing, games, furniture, and appliances.

- Gift cards † at retailers like Bed Bath & Beyond, Best Buy, Canadian Tire, and more.

- Cash statement credit † for your TD card account. This requires a minimum 10K points to redeem. The first 10,000-point minimum is worth $0.005 per point and then each additional 400 points is worth $1 (0.0025 per point).

- Education credit † via HigherEdPoints.com . Credits must be purchased in minimum 62,500 points/$250 credit increments, for a redemption value of $0.004 per point.

TD First Class Travel Visa Infinite key benefits

- Excellent welcome bonus of up to $700 in value, including up to 75,000 TD Rewards Points and no annual fee for the first year † and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- High earn rate on travel, groceries and restaurants, and recurring bills without loyalty to a particular store

- Comprehensive travel insurance

TD First Class Travel Visa Infinite travel insurance and other protections

You can check out our guide to credit card travel insurance to learn more about the different types of coverage listed above, and to review other Canadian travel credit cards that might have stronger travel insurance benefits.

TD First Class Travel Visa Infinite extra benefits

- $100 annual travel bonus

- Mobile device insurance

- Earn more at Starbucks when you link your card

- Save a minimum of 10% with Avis and Budget in Canada and the U.S. (5% savings elsewhere)

- Apple pay, Google Pay, or Samsung Pay to instantly use your credit card.

- Complimentary Visa Infinite Concierge 24/7 for any cardholder request

- Visa Infinite Luxury hotel collection, dining series, wine country, and entertainment access.

What people have to say about the TD First Class Visa Infinite

Redditor, alwaysdetermined points out that yes, the annual fee can be waived with TD's All Inclusive but notes "the All-Inclusive costs $29.95, but that account fee can be waived if you keep $5,000 in the account at all times."

Reddit user, SensitiveAward , has the card, says they travel multiple times a year and is please with the insurance coverage saying "TD [credit card] comes out cheaper" when comparing it to third-party travel insurance products.

However, some users say the Expedia For TD prices are higher than regular Expedia rates, so be sure to cross reference the two portals before booking (and clear your internet cache or browse in incognito to prevent tracking)

TD First Class Visa Infinite eligibility requirements, fees, and rates

- Minimum income: $60,000 individual and $100,000 household annual income

- Foreign transaction fee: 2.5%

- Annual fee: $139, $50 for each additional cardholder (fees can be waived with TD's All inclusive banking plan)

How does TD First Class Visa Infinite compare?

¹ Conditions Apply. Visit here for the Scotiabank Gold American Express® Card to learn more. *See Card Provider's website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

When comparing travel credit cards with similar annual fees, the TD First Class Travel® Visa Infinite* Card strengths and weaknesses are clear:

Its sign-up bonus eclipses the competition, which gives it an immediate punch of value. It’s also something of a no-brainer card for those who have TD’s All-Inclusive Banking Plan, as the annual fee rebate† effectively makes the card free to use year after year.

It’s less ideal for those who are unlikely to spend a significant amount at through Expedia® For TD, want to avoid the foreign transaction fees and want free airport lounge access.

TD First Class Travel Visa Infinite vs. Scotiabank Gold American Express® card

No foreign transaction fees, earns 6X Scene points for each $1 CAD on all eligible purchases at Sobeys and eligible grocers¹, 5X Scene+ points for every $1 CAD spent on other eligible groceries and 3X Scene+ points for every $1 CAD spent on gas, and has an all-encompassing travel insurance package.

Conditions Apply. Visit here for the Scotiabank Gold American Express® Card to learn more. *See Card Provider's website and Card Application for complete card details, terms and current offers. Reasonable efforts are made to maintain accuracy of information.

TD First Class Travel Visa Infinite vs. BMO Ascend™ World Elite®* Mastercard®*

Includes complimentary membership in Mastercard Travel Pass provided by DragonPass,* with four annual complimentary passes. That’s a ~$128 USD value that renews every year*. Plus the up to 60,000-point sign-up bonus* and first year annual fee waiver* is still competitive with the TD card’s sign-up bonus.

*Terms and conditions apply

Drawback: There are increased earn rates but you earn only 1 point for every $1 spent everywhere else where they do not apply.*

Is the TD First Class Travel Visa Infinite worth it?

Yes, for its welcome bonus alone it's a great card. You'll also get a first year annual fee rebate, high earn rate in everyday spending, 10% annual birthday bonus, a $100 annual travel credit, and comprehensive travel coverage.

Is TD First Class Travel good?

Yes, especially if you're a TD client. You can't lose with its awesome welcome bonus, high earn rate in everyday spending, special perks like its birthday bonus and $100 annual travel credit (nearly negating its annual fee), and full suite of insurance coverage.

Does TD First Class Travel have lounge access?

No, there is no airport lounge access with the TD FIrst Class Travel Visa Infinite. Check out the BMO Ascend or Scotiabank passport for cards with similar annual fees that include airport lounge access .

What does TD First Class Travel Cover?

It's the full suite of travel insurance as well as purchase protection and rental car. Check out all the details in the TD First Class Travel review insurance section.

†Terms and conditions apply.

Sponsored Content

The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

This offer is not available to residents of Quebec.

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca.

Scott Birke is a finance editor at Money.ca.

More great credit card content

Latest articles, 4 numbers to track to become a millionaire, how to hack your spending for cheaper trips, credit card hacks for international travel, government of canada makes national trade easier, $500 million settlement reached with loblaws, 82% of canadians support single-use plastic ban.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

TD First Class Travel ® Visa Infinite* Card 🇨🇦

- 2X points on all purchases

- Premium Insurance

- Visa Infinite Benefits

Earn up to $700 in value † , including up to 75,000 TD Rewards Points † and no Annual Fee for the first year . Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card † .

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening † .

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points † .

- Get an annual TD Travel Credit † of $100 when you book at Expedia® For TD.

- Get an Annual Fee Rebate for the first year † .

To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

Earn TD Reward Points on all the things you normally do, whether you use your card for groceries, dining, paying bills or booking travel. The rewards will add up quickly so you can enhance your travel experience or enjoy a wide variety of rewards.

- Earn 8 TD Rewards Points † for every $1 you spend when you book travel through Expedia® For TD †

- Earn 6 TD Rewards Points † for every $1 you spend on Groceries and Restaurants

- Earn 4 TD Rewards Points † for every $1 you spend on regularly recurring bill payments set up on your Account

- Earn 2 TD Rewards Points for every $1 you spend on other Purchases made using your Card † plus earn an annual Birthday Bonus † of up to 10,000 TD Rewards Points

Your Card also allows you to enjoy:

- An extensive suite of travel insurance coverages which helps you travel prepared

- No travel blackouts † , no seat restrictions † and no expiry † for your TD Rewards Points as long as your account is open and in good standing.

Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply. See more details .

Card Awards

Fees & conditions.

Per dollar of purchases

Travel Insurance

There may be a daily maximum amount depending on the type of fees paid

Other Insurance

With the TD First Class Travel® Visa Infinite* Card, you can earn up to 75,000 TD Rewards Points † and a rebate on the annual fee for the first year :

- 20,000 TD Rewards Points for the first purchase made with your Card †

- 55,000 TD Rewards Points if you spend $5,000 within 180 days of opening †

- A birthday bonus equal to 10% of the TD Rewards points you’ve earned in the past year, up to a maximum of 10,000 TD Rewards Points †

Get an Annual Fee Rebate for the first year †

With the TD First Class Travel® Visa Infinite* Card, you get:

- 8 TD Rewards Points † for every $1 you spend when you book travel through Expedia® For TD

- 6 TD Rewards Points † for every $1 you spend on Groceries and Restaurants

- 4 TD Rewards Points † for every $1 you spend on regularly recurring bill payments set up on your Account

- 2 TD Rewards Points † For every $1 you spend on other Purchases

This TD credit card is one of the best TD travel rewards cards.

- TD Best Credit Cards - August 2024

- Best Travel Credit Cards - August 2024

- Best Visa Credit Cards - August 2024

- Canada's Best Credit Card Offers - August 2024

- Expedia For TD: How To Redeem TD Rewards Points?

Alternative Cards

† Terms and conditions apply.

- Customer Service

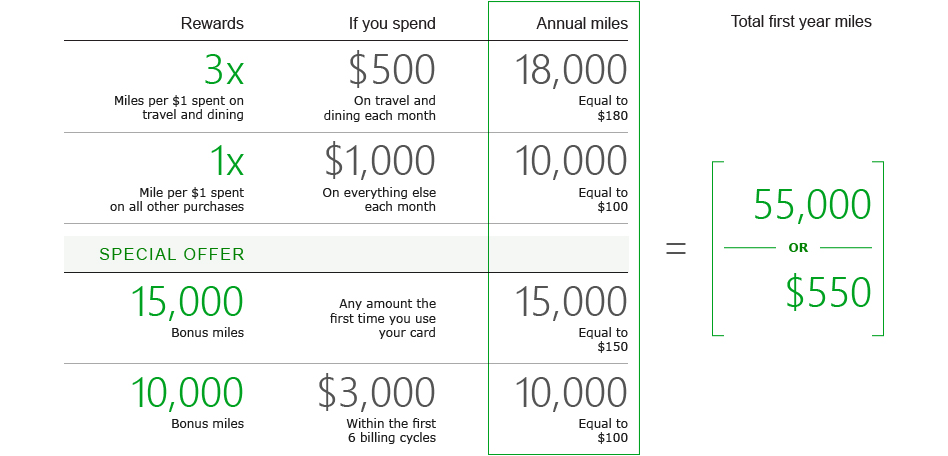

TD First Class SM Visa ® Signature Credit Card

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Mortgage Renewal

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does a Mortgage Work in Canada?

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- How to Save Money on Your Next Renewal

- First-Time Home Buyer Grants and Assistance Programs

- Types of Houses in Canada

- Types of Mortgages in Canada: Which Is Right for You?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.

Did you know? TD isn’t the only issuer that works with Aeroplan. American Express and CIBC also offer Aeroplan credit cards with their own earn rates and perks.

Aeroplan rewards

Each of the four Aeroplan credit cards offered by TD have slightly different earn rates and reward categories. Learn more about each card’s earn rates and spending categories below:

TD Aeroplan Visa Infinite Card

- 1.5x Aeroplan points on eligible gas, groceries and Air Canada purchases.

- 1x Aeroplan points on everything else.

- Double the points earned when you shop with partner brands and through the Aeroplan eStore.

- 50% more Aeroplan points when you shop at Starbucks (card must be linked to your Starbucks Rewards account).

TD Aeroplan Visa Platinum Card

- 1 Aeroplan point per $1.00 spent on eligible gas, groceries and Air Canada purchases.

- 1 Aeroplan point per $1.50 spent on everything else.

TD Aeroplan Visa Infinite Privilege Card

- 2x Aeroplan points on Air Canada purchases.

- 1.5x Aeroplan points on eligible gas, groceries, travel and dining purchases.

- 1.25x Aeroplan points on everything else.

TD Aeroplan Visa Business Card

- 1.5x Aeroplan points on eligible travel, dining and business purchases.

- 1x Aeroplan points on everything else.

TD Aeroplan card earn rates and categories accurate as of June 22, 2023.

Pros of TD Aeroplan

- Range of cards to choose from.

- Business card available.

- Most cards include travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD Aeroplan

- The redemption program focuses mainly on Air Canada.

- Lower earn rates than similar cards, including the TD First Class Travel card.

TD First Class Travel is another name for one of TD’s rewards cards: the TD First Class Travel Visa Infinite card. It’s the only card from TD with the name First Class Travel, but not the only card that earns TD Rewards Points. The TD Platinum Travel Visa, TD Travel Rewards Visa and TD Business Travel Visa also earn TD Rewards Points.

TD First Class Travel rewards

The TD First Class Travel Visa Infinite card earns between two and eight TD Rewards Points per CAD spent, depending on the purchase category.

- 8x TD Rewards Points on travel bookings made via the Expedia for TD platform.

- 6x TD Rewards Points on groceries and restaurants.

- 4x TD Rewards Points on recurring bill payments.

- 2x TD Rewards Points on everything else.

Pros of TD First Class Travel

- High reward earn rates compared to TD Aeroplan cards.

- Travel TD Rewards Points can be redeemed with multiple booking platforms.

- Includes travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD First Class Travel

- Only one First Class Travel card to choose from.

- Highest earn rate is only for Expedia purchases.

TD First Class Travel vs TD Aeroplan: Which is better?

TD Aeroplan beats out First Class Travel when it comes to points value. Based on NerdWallet analysis, the average value of 1 Aeroplan point is worth 2.23 cents. To compare, you can expect to get around 0.25-0.5 cents per TD Rewards Point, according to NerdWallet analysis. These values depend on the redemption method you choose.

That’s not to say TD Aeroplan cards are better than the TD First Class Travel Visa Infinite card. If you don’t fly with Air Canada, for example, Aeroplan points may not be as practical. Look at features like annual fees , reward categories, redemption options, interest rates and insurance perks when making your decision.

TD First Class Travel and TD Aeroplan cards

Td first class travel® visa infinite* card.

- Annual Fee $139 To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024. Waived first year

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 2x-8x Points Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†. Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†. Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†. Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

- Intro Offer Up to 75,000 Points Earn up to 75,000 TD Rewards Points†: Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†. Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†. Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†. Account must be approved by September 3, 2024.

- Earn up to $700 in value†, including up to 75,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening.

- To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

TD® Aeroplan® Visa Infinite* Card

- Annual Fee $139

- Rewards Rate 1x-1.5x Points Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Intro Offer Up to 40,000 Points Earn up to 40,000 Aeroplan points†: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†. Account must be approved by September 3, 2024.

- Earn up to $1,000 in value†, including up to 40,000 Aeroplan points† and additional travel benefits. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Earn big rewards on the little things: Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks® Rewards account. Conditions apply.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Infinite* Cardholder in good standing.

- Travel lightly through the airport and save on baggage fees†: Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lbs) when your travel originates on an Air Canada flight.

- To be eligible, a $60,000 annual personal income or $100,000 household annual income is required. You must also be a Canadian resident and be the age of majority in the province or territory where you live.

TD® Aeroplan® Visa Platinum* Card

- Annual Fee $89 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024. Waived first year

- Rewards Rate 0.67x-1x Points Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Intro Offer Up to 20,000 Points Earn up to 20,000 Aeroplan points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†. Conditions Apply. Account must be approved by September 3, 2024.

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Platinum* Cardholder.

- Flight/Trip Delay Insurance†: Up to $500 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Emergency Travel Assistance Services†: Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

- To be eligible, you must be a Canadian resident and be of the age of majority in your province/territory of residence.

TD® Aeroplan® Visa Infinite Privilege* Credit Card

- Annual Fee $599

- Rewards Rate 1.25x-2x Points Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®). Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases. Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Intro Offer Up to 75,000 Points Earn up to 75,000 Aeroplan points: Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 25,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†. Account must be approved by September 3, 2024.

- Earn up to $2,700 in value† including up to 75,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 25,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†.

- Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®).

- Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases.

- Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Share first free checked bags with up to 8 travel companions†, and get unlimited access to Maple Leaf Lounges† including complementary access for one guest.

- Plus, primary cardholders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- Get an annual round-trip companion pass from $99 (plus taxes, fees, charges and surcharges)†.

- Get access to Priority Airport Services† like Priority Boarding, Priority Baggage Handling, and Priority Airport Standby & Priority Airport Upgrades†.

- Travel Medical Insurance†: Up to $5 million of coverage for the first 31 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- To be eligible, $150,000 annual personal income or $200,000 household annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

TD® Aeroplan® Visa* Business Card

- Annual Fee $149 Waived first year

- Interest Rates 14.99% / 22.99% 14.99% on purchases, 22.99% on cash advances.

- Rewards Rate 1x-2x Points 2x on Air Canada purchases, including Air Canada Vacations. 1.5x on travel, dining and select business categories, such as shipping, internet, cable and phone services. 1x on everything else.

- Intro Offer Up to 60,000 Points Earn up to 60,000 Points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card. Plus, earn up to 45,000 Aeroplan points when you spend $2,500 in purchases each month for the first 12 months of Account opening. Plus, earn up to 5,000 Aeroplan points when you spend $250 on eligible mobile wallet Purchases within 90 days of Account opening. Account must be opened by September 3, 2024.

- Earn up to 60,000 Aeroplan pointsΓ. Conditions Apply. Account must be opened and approved by September 3, 2024.

- Earn 2 Aeroplan points for every dollar spent on eligible purchases made directly with Air Canada, including Air Canada Vacations.

- Earn 1.5 Aeroplan points for every dollar spent on eligible travel, dining and select business categories, such as shipping, internet, cable and phone services.

- Earn 1 Aeroplan point for every dollar spent on all other eligible purchases.

- Earn points twice when paying with a TD Aeroplan Visa Business Card and providing an Aeroplan number at over 150 Aeroplan partner brands and more than 170 online retailers via the Aeroplan eStore.

- Points can be redeemed for flights, hotels, merchandise, gift cards and more. They can also be used to pay down the card’s balance.

- Linked cards earn 50% more Aeroplan points and Stars at participating Starbucks stores.

- $149 annual fee — rebated in the first year.

- Free first checked bag for up to 9 people travelling on the same reservation on Air Canada flights.

- One free one-time guest pass to Maple Leaf Lounges for every $10,000 in net purchases. Maximum of 4 passes a year.

- Reach Aeroplan Elite Status more quickly by earning 1,000 Status Qualifying Miles and one Status Qualifying Segment for every $5,000 in net purchases.

- Access online reporting, review business expenses, managing existing credit limits and apply spend controls through the TD Card Management Tool.

- Visa SavingsEdge program: save up to 25% on eligible business purchases.

- Travel benefits: travel medical insurance (up to $2 million in coverage for the first 15 days for those under 65; coverage lasts for 4 days for those 65 and older); common carrier travel accident insurance (up to $500,000 for covered losses), trip cancellation insurance (up to $1,500 per insured person; maximum of $5,000), trip interruption insurance (up to $5,000 per insured person; maximum of $25,000), flight/trip delay insurance (up to $500 if a flight or trip is delayed for longer than 4 hours), delayed and lost baggage insurance (up to $1,000 of overall coverage per insured person), auto rental collision/loss damage insurance (covers the full cost of a car rental for up to 48 days), hotel/motel burglary insurance (up to $2,500), mobile device insurance (up to $1,000 in coverage).

- Toll-free emergency travel assistance services.

- Receive a rebate of up to $100 on NEXUS enrolment application/renewal fee costs once every 48 months.

- Save a minimum of 10% on the lowest available base rates in Canada and the U.S., and a minimum of 5% on the lowest base rates internationally on qualifying car rentals at participating Avis and Budget locations.

- Visa Zero Liability protection, Verified by Visa and instant alerts to prevent fraudulent card use.

- Purchase security and extended warranty protection.

- Minimum credit limit of $1,000.

- Interest rates: 14.99% on purchases, 22.99% on cash advances.

About the Author

Georgia Rose is a lead writer on the international team at NerdWallet. Her work has been featured in The Washington Post, The New York Times, The Independent and The Associated…

13 Best Aeroplan Credit Cards in Canada for 2024

The best Aeroplan credit cards in Canada earn points for Air Canada’s loyalty program on every purchase. Aeroplan points have an average value of 2.23 cents per point.

Aeroplan vs. Air Miles: Differences and Alternatives

Aeroplan is usually an ideal choice for those who want to use points for Air Canada flights, while Air Miles is a better choice for those who want flexible point redemption options.

15 Best Travel Credit Cards in Canada for August 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

12 Best TD Bank Credit Cards in Canada for 2024

The best TD Bank credit cards in Canada include several Visa Infinite options as well as co-branded travel credit cards that earn Aeroplan points.

Prince of Travel

Prince of Travel is a full-service travel brand with an emphasis on luxury travel.

Get in-depth information on hotel programs and learn more about Prince Collection’s premier brands and vendors.

Credit Cards

Points programs.

Get the latest news, deals, guides, and travel reviews straight to your inbox with a Prince of Travel newsletter subscription.

Join Our Newsletter

Subscribe to the prince of travel newsletter.

You'll receive priority information about the newest luxury properties worldwide, exclusive reservations and deals through Prince of Travel , and unique destinations across the globe.

By providing your email, you agree to the Prince of Travel Privacy Policy

Thank you for subscribing!

Please check your email to confirm your subscription!

Id ea eiusmod magna cupidatat proident commodo tempor sit incididunt. Fugiat aliquip officia exercitation ad culpa ipsum est.

Hotel Programs

Best credit cards.

TD First Class Travel® Visa Infinite* Card

Updated on: 2024-06-04

Application must be approved by September 3, 2024 to receive this offer

Signup bonus:.

20,000 TD Rewards Points upon first purchase† 55,000 TD Rewards Points upon spending $5,000 within 180 days of account opening† Total of up to 75,000 TD Rewards Points†

Annual fee:

$139, rebated for the first year†

Interest rates:

20.99% purchase 22.99% cash advance (20.99% in Quebec) 22.99% balance transfer (20.99% in Quebec)

Earning rate:

8 TD Rewards Points† per dollar spent on eligible travel booked through Expedia® for TD† 6 TD Rewards Points† per dollar spent on eligible groceries and restaurant purchases† 4 TD Rewards Points† per dollar spent on eligible recurring bill payments set up on your account† 2 TD Rewards Points† per dollar spent on all other eligible purchases†

The TD First Class Travel ® Visa Infinite * Card is one of the most popular credit cards that allows you to earn points in the bank's proprietary TD Rewards program. With regular high-volume welcome bonuses, a strong return on travel purchases booked through Expedia, and a competitive insurance package, the TD First Class Travel ® Visa Infinite * Card is a solid choice to incorporate into your TD credit card strategy.

Bonuses & Fees

- 20,000 TD Rewards Points upon first purchase †

- 55,000 TD Rewards Points upon spending $5,000 within 180 days of account opening †

Earning Rewards

- 8 TD Rewards Points † per dollar spent on travel booked through Expedia ® for TD †

- 6 TD Rewards Points † per dollar spent on groceries and restaurants †

- 4 TD Rewards Points † per dollar spent on recurring bills and purchases †

- 2 TD Rewards Points † per dollar spent on all other purchases †

Redeeming Rewards

The best way to redeem TD Rewards Points is by booking travel through Expedia ® for TD, an online travel portal operated in partnership with Expedia ® . You can book flights, hotels, car rentals, vacation packages, and anything else that you would normally be able to book via Expedia ® . You'd apply your TD Rewards Points to the purchase at a rate of 200 points = $1, or 0.5 cents per point. If you'd rather not book through Expedia ® for TD, you can also redeem TD Rewards Points directly against any travel purchase that you purchase with your TD First Class Travel ® Visa Infinite * Card. However, the rate isn't quite as competitive at 250 points = $1, or 0.4 cents per point. Redeeming for statement credits or gift cards is also possible, although the rate is even less appealing at 400 points = $1, or 0.25 cents per point. Generally speaking, you should always strive to redeem your TD Rewards Points for travel through Expedia ® for TD whenever possible, in order to maximize their value. TD Rewards Points never expire as long as you're a cardholder. † If you cancel or switch your card to a different product, you'll have 90 days' time to redeem your TD Rewards Points before they go away. However, you'll lose the ability to book through Expedia ® for TD for 0.5 cents per point, and you'll be limited to redeeming against any travel purchase for only 0.4 cents per point.

Perks & Benefits

TD First Class Travel ® Visa Infinite * cardholders are eligible to earn a $100 credit † on accommodations and vacation packages booked through Expedia ® for TD. † This benefit is available annually to cardholders, and notably does not include flights. However, it certainly helps to offset the $139 annual fee that the card commands, beginning in the second year. Cardholders can also get car rental discounts at Avis and Budget: 10% in Canada or the US, and 5% internationally. †

Insurance Coverage

As one of TD's flagship travel rewards credit cards, the TD First Class Travel ® Visa Infinite * Card offers a strong set of insurance provisions. The card comes with 21 days of travel medical insurance of up to $2,000,000 for travellers aged under 65, and four days of coverage for travellers aged 65+. † There's also trip cancellation and trip interruption insurance of up to $1,500 and $5,000 per person, up to a maximum of $5,000 and $25,000 per trip, respectively. † While flying, cardholders are covered for up to $500 in flight delay insurance and an aggregate amount of $1,000 for lost, stolen, or delayed baggage. † And when making purchases, the card offers extended warranty of up to one additional year, as well as purchase protection that insures you against damage or theft of an item for up to 90 days after your purchase. † Lastly, it also comes with Mobile Device Insurance. By paying for your smartphone, tablet, or smartwatch using your TD First Class Travel Visa Infinite Card, you’ll get coverage of up to $1,000 in the event your mobile device is lost, stolen, or accidentally damaged, for up to 24 months! †

† Terms and conditions apply.

† The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

Share this post

Copied to clipboard!

Prince of Travel is a non-traditional, full service travel concierge designed exclusively for companies and individuals who require exclusive travel arrangements. We handle the nuances of travel ensuring a seamless and extraordinary journey from start to finish.

Join the Prince Collection newsletter to get weekly updates delivered straight to your inbox.

Book your travel

Let Prince Collection’s Travel Concierge handle your exclusive travel arrangements. Get started by filling out some basic info about your trip.

Why Compare Car Insurance Quotes?

- Step 1. Find out your state's minimum coverage requirements

Step 2. Compare at least three different policies

Step 3. avoid falsifying information, step 4. ask for discounts, tools and resources, factors that affect car insurance quotes.

- Top Car Insurance Companies to Consider

Tips for Comparing Car Insurance Quotes

Compare car insurance quotes.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

- The best way to find a better policy is to shop for car insurance and compare your options.

- You'll want to compare both big national insurers and smaller local insurance providers.

- Look beyond the monthly premium and deductible to see what's actually covered.

51% of drivers do not trust their car insurance providers and car insurance costs continue to rise, up by 11.2% in 2023-2024. If your auto insurance renewal is approaching — or if you're buying car insurance for the first time — get ahead of the game by shopping for a better quote. Here's how.

Benefits of Comparing Car Insurance Quotes

The main benefit of comparing quotes is to save money on your insurance policy. Since insurance companies calculate rates differently, shopping around helps you find the most competitive rates on the market.

Another benefit is securing better coverage on your policy. You don't need to skip out on adequate coverage to fit your budget. Comparing quotes allows you to customize your policy based on your coverage needs and find a policy that offers the lowest rates.

Common Mistakes to Avoid

One common mistake to avoid when buying car insurance is to settle on the first policy you find. You may be tempted to buy insurance from a major player, like State Farm or GEICO, just because of its popularity. But doing some research may point you towards a local, less well-known provider that offers personalized coverage for drivers in your region and lower rates.

Another mistake is choosing the lowest price. Liability-only insurance is often the cheapest insurance policy offered by companies. It only pays for the other person's damages and injuries if you're at fault in an accident, not yours. So, choosing the lowest-priced policy without examining your coverages likely means you're not fully protected

Finally, another mistake to avoid is not shopping around regularly. Rates change all the time, even with the same insurer. You can ensure that you always have the best rates for your coverages by shopping at renewal, which is at least once a year for most policyholders.

How to shop for car insurance

If you're in the market for car insurance, here's a step-by-step guide to finding the best and cheapest car insurance for you.

Step-by-Step Guide

Step 1. find out your state's minimum coverage requirements.

Liability coverage is required by law. If you're involved in an accident, liability insurance covers damage you cause to the other vehicle, driver, and its passengers. If you finance or lease your car, your lender probably requires comprehensive and collision coverage.

Liability coverage requirements and minimums vary by state. The two main components of liability insurance are bodily injury and property damage, which most states require. Liability insurance also includes uninsured motorists and underinsured motorists .

The best way to make sure you haven't overlooked any red flags or essential questions is to compare policies by getting quotes from at least three different auto insurance companies. Be sure to check both national and local companies, too. You'd be surprised how many regional insurers have better customer satisfaction than national carriers.

Comparison shopping is the best practice for a few reasons. For starters, it prevents you from assuming that one company in particular is the cheapest. Also, one company might be more forthcoming than another when it comes to a particular feature of their policy. This will help you build a list of questions you should be asking all of your potential insurers.

When faced with rising premiums, you might be tempted to "fudge" your numbers to get a lower rate. You're not alone. Many drivers have either intentionally underestimated mileage, left a driver off their policy, provided a different ZIP code in a more desirable area than the one the car is actually stored in or claimed their car was for pleasure instead of commuting.

While you might enjoy lower premiums if you take this route, all of these lies will come to the surface if you file a claim. In this case, you could be on the hook for the entire cost of damages because your policy would be rendered inapplicable since the price you were paying was not for the truth of your situation. That's why it's best to avoid playing the odds and be truthful when shopping.

One way to get cheap car insurance is to ask for a discount. Most companies list available discounts on their website, but there may be some that aren't listed. Common discounts include:

- Deals for members of professional organizations (be sure to name yours)

- Multi-car discounts

- Special quotes for paying your six-month or annual premium in one payment

- Anti-theft installed systems

- Good driving record discounts

- On-time payment discounts that could save you in the long run

After you've completed these steps, you can relax, knowing you did your due diligence to ensure you're paying the best rate for your personal car insurance.

Remember — be thorough in your search, starting with national companies but also looking into local companies to compare rates. You'll be happy you did. On average, consumers who shop around can save as much as 47% in premium costs, or as much as $847 per year. Even if you only save a fraction of this, a $200 savings is money that can be well spent (or saved) elsewhere.

You can use an online insurance comparison tool — like Policygenius — to help comparison shop. You'll need your vehicle's VIN number, the year, make, and model of your car. This will include your daily commute (in miles), your ZIP code, where the car is stored (in a garage or on the street), and the number of accidents you've had in recent years. You'll also need to put in your age and gender since some states consider these factors.

Obviously, you'll want to find a plan that fits your budget — so premium payment is likely the first thing you'll consider. But you'll also want to take into account the deductible, i.e. the price you'll pay if you file a claim, along with coverage areas. Some plans cover damage from uninsured motorists, and others don't.

You'll want to find a plan that covers all of your state's minimum coverage requirements, plus any important requirements. Remember if you're financing or leasing, you will likely need comprehensive and collision coverage in addition to the state minimum liability coverage.

Though a lower premium is nice, you often get what you pay for. After you get quotes from each of the companies you speak to, ask them to send your quotes to you via email. If possible, print out every quote and compare the coverage line-by-line. This will give you a true idea of what the costs will be in the event of an accident.

Personal Factors

One personal factor that affects your car insurance quotes is your age and gender. The Insurance Information Institute (III) reports that females and drivers over 25 experience fewer accidents and moving violations than males and teen drivers. So, they tend to see lower rates on their insurance policies.

Your credit score is another personal factor that influences your car insurance rates. According to the III, drivers with good credit histories file fewer claims. So, insurers use insurance-based credit scores to determine your rates in states where applicable.

Vehicle-Related Factors

The specifics of your vehicle also play a part in how expensive your insurance premiums will be. Vehicles with higher replacement, like new or luxury cars, require more coverage, leading to increased premiums. The III also notes that insurers consider your vehicle's theft rate, engine size, and overall safety record when calculating your costs.

Policy Related Factors

Finally, policy-related factors such as coverages will influence your insurance bill. Several relevant policy features that alter your premiums include, but aren't limited to:

- Whether you purchase a full-coverage or a liability-only policy

- Coverage limits

- Optional coverages

- Deductible amounts

- The amount of discounts applied

- Payment terms (monthly, quarterly, annually)

It's important to read the fine print to ensure your policy meets your individual needs so you're only paying for what you need.

Top Car Insurance Companies to Consider

Overview of major providers .

Based on our review of the best car insurance companies , these are some providers insurance providers to consider:

- Best for customer satisfaction: Amica

- Best for affordability: GEICO

- Best for military personnel: USAA

- Best for teen drivers: State Farm

- Best for discounts: Farmers

- Best for teachers: Liberty Mutual

- Best for accident forgiveness: Progressive

Comparison of Key Features

Take a look at the table below for key features related to each auto insurance provider.

Bundling Policies

One of the most common ways to get the best car insurance rates is by buying two or more insurance products from the same insurance company via their multi-policy discount . Auto and home insurance is a common bundle. But auto insurance companies may let you pair your auto policy with renters, motorcycle, pet, and life insurance.

Increasing Deductibles