- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

WorldTrips travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Updated 9:26 a.m. UTC June 28, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Top travel insurance plans

Average cost, medical limit per person, why it’s the best.

If you’re looking for the best travel insurance for international travel , WorldTrips’ Atlas Journey Elevate plan gives you $250,000 in travel medical insurance with primary coverage. This plan is a good option if health insurance for international travel is a priority. It also has $1 million in emergency evacuation coverage.

Customer reviews

WorldTrips has a rating of 4.27 stars out of 5 on Squaremouth, based on 428 reviews of policies purchased through the travel insurance comparison site since 2008.

- $250,000 in primary medical coverage.

- $1 million per person in medical evacuation coverage.

- Primary damage or loss baggage coverage of $500 per item, up to $2,500.

- 5 optional upgrades, including pet care, adventure sports and rental car damage and theft.

- No non-medical evacuation coverage.

Why trust our travel insurance experts

Our team of travel insurance experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

About WorldTrips travel insurance

WorldTrips Atlas Journey travel insurance plans provide customizable travel insurance coverage at a competitive price. Depending on the type of trip you are planning, you can customize your travel insurance coverage by adding upgrades such as pet care and adventure travel.

In this WorldTrips insurance review, we break down the insurer’s three main insurance plans, share sample pricing for its top-rated travel insurance plan and explain some common policy exclusions.

WorldTrips travel insurance plans

WorldTrip’s Atlas Journey travel insurance plans include medical coverage and trip interruption coverage for both domestic and international trips. The three travel insurance plans — Elevate, Explore and Escape — allow you to select the plan with the appropriate amount of coverage to meet your travel needs.

Atlas Journey Escape

The WorldTrips Atlas Journey Escape plan was designed for travelers who are looking for basic coverage on their next vacation or business trip.

The plan includes all the basic travel insurance coverages such as trip cancellation, trip interruption, trip delay, medical coverage, medical evacuation and baggage coverage.

Of the three plans, the economy plan offers the lowest payout benefits. The travel medical insurance limit is only $50,000 per person in excess coverage. This coverage limit might be fine when traveling through the United States where your primary medical insurance would cover any emergency medical situations. However, if you are traveling internationally through countries that do not accept your domestic health insurance , you might want to upgrade your plan to include more medical coverage.

Atlas Journey Explore

The WorldTrips Atlas Journey Explore plan includes everything the economy plan does, but increases the coverage amount for every benefit. This plan gets 5 stars in our rating of the best travel insurance .

Atlas Journey Explore provides the same interruption benefits as the top-tier Elevate plan, but offers lower limits for trip cancellation , emergency medical evacuation , delays, missed connections and baggage insurance.

The biggest difference between the Explore and the more expensive Elevate plan is that the Explore plan offers up to $150,000 in primary emergency medical coverage while the Elevate plan offers up to $250,000.

Atlas Journey Elevate

The WorldTrips Atlas Journey Elevate plan is the crème de la crème of the WorldTrips trio of plans. It offers travelers the highest payout benefits of all the plans, which is especially important for those traveling overseas. This plan also gets 5 stars in our rating of the best travel insurance.

Compare WorldTrips travel insurance plans

What worldtrips travel insurance covers.

The core types of travel insurance packaged together in WorldTrips Atlas Journey policies include:

- Sickness or injury that renders you or your traveling companion unable to travel.

- Death of a family member, traveling companion or business partner.

- Severe weather that causes your common carrier to shut down for more than 12 hours.

- Terrorist incident or civil unrest in your destination.

- Emergency medical expenses: Travel medical insurance helps pay doctor and hospital bills and emergency evacuations if you get sick or injured on your trip.

- Travel delay: If your trip is delayed for five hours or more due to a reason listed in the policy, travel delay insurance can help cover the cost of accommodations, meals and local transportation while you are delayed.

- Baggage: Baggage insurance includes lost or stolen baggage, excessive baggage damage and baggage that is delayed more than 12 hours.

- Travel Assistance Services: Multilingual travel agents can provide worldwide travel, medical, emergency, and security assistance 24 hours a day, seven days a week.

What WorldTrips travel insurance doesn’t cover

Like all travel insurance plans, WorldTrips plans will not cover everything. While it is always a good idea to read the fine print before buying a policy, here are some exclusions to WorldTrips travel insurance plans.

- Traveling against the advice of a physician.

- Medical tourism.

- Intoxication.

- Pre-existing conditions, unless you qualify for a waiver of the pre-existing condition exclusion.

- Participation in an organized sports competition or as a sporting professional.

- Participation in bodily contact sports, extreme sports and certain adventure sports.

WorldTrips additional coverage options and benefits

You can customize and enhance WorldTrips travel insurance plans with the following add-ons, provided they are available with the plan you choose and in your state.

“Cancel-for-any-reason” (CFAR) coverage

A “cancel for any reason” upgrade allows you to cancel your trip for any reason not already covered by your trip cancellation benefit, as long as you do so at least 48 hours before your scheduled departure.

Explore and Elevate plan policyholders can choose to be reimbursed for 50% or 75% of their costs with CFAR. This optional coverage is not available with the Atlas Journey Escape plan.

“Interruption-for-any-reason” coverage

The trip “interruption for any reason” (IFAR) upgrade reimburses 50% of your trip cost as long as you are at least 48 hours into your trip when you decide to end your travels early. This optional coverage is only available on the WorldTrips Atlas Journey Elevate plan.

Adventure sports

This optional coverage extends your travel insurance to include safari activities, bungee jumping, hang gliding and other extreme activities. This add-on is available for the Explore and Elevate plans.

Rental car damage and theft

This upgrade adds collision damage and theft coverage for rental vehicles. The rental car coverage is an available add-on for all plans.

This upgrade adds trip cancellation or trip interruption coverage in the event of your dog or cat’s death or critical illness. It also adds vet care compensation if your dog or cat becomes ill while traveling with you. It’s available with the Explore and Elevate plans.

Compare the best travel insurance companies of 2024

Via Compare Coverage’s website

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024 . For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

WorldTrips insurance review FAQs

Yes, WorldTrips offers both annual and group medical insurance plans.

- Atlas Group medical insurance plans offer a 10% reduced rate for families and groups of five or more when traveling abroad.

- Atlas MultiTrip insurance is annual travel medical coverage for multiple trips abroad in a period of 364 days.

Yes, WorldTrips offers travel health insurance for international students. WorldTrips’s Atlas America travel health insurance is for non-U.S residents and citizens who travel internationally to the United States. Atlas America insurance reviews online are overwhelmingly positive, with 96% of reviewers recommending the policy.

WorldTrips considers a pre-existing condition to be an illness, disease or other condition during the lookback period (90 days in most states) immediately prior to your effective date of coverage for which you received or were recommended to receive a test, examination or medical treatment or received a medical prescription.

WorldTrips will waive the pre-existing conditions exclusion if you purchase your plan within 21 days of the date you made your first payment toward your trip and you are medically able to travel on the date of purchase.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

What does travel delay insurance cover?

Travel insurance Mandy Sleight

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

Travel insurance for UK trips

Travel insurance Amy Fontinelle

What is trip interruption insurance?

10 worst US airports for flight cancellations last week

What are your rights during an airline meltdown?

Travel insurance Erica Lamberg

Hurricanes and travel insurance

Generali Global Assistance travel insurance review 2024

Travel insurance Jennifer Simonson

Travel insurance for vacations to Italy

Travel insurance Timothy Moore

Tricky travel insurance questions answered by experts

Survey: 20% of Americans have had a life-changing experience while traveling

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Cheapest travel insurance of August 2024

Average flight costs: Travel, airfare and flight statistics 2024

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

WorldTrips Travel Insurance Review: Is it Worth The Cost?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

WorldTrips Travel Insurance

- Available to U.S. and non-U.S. residents, including international students.

- All travel protection plans include a pre-existing conditions waiver.

- Cancel For Any Reason add-ons are available on most plans.

- Rental car coverage isn’t automatically included with any plan.

- Baggage delay coverage takes 12 hours to kick in.

- Atlas Journey and Atlas On-The-Go plans aren’t available to non-U.S. residents.

Since 1998, WorldTrips has provided medical insurance and trip protection to travelers from the U.S. and around the world in addition to coverage for international students. The company also provides coverage for various tour groups, missionary work and student exchange programs. The insurance policies are underwritten by Tokio Marine HCC, a Houston-based insurance company.

Whether you’re a U.S. resident looking for comprehensive travel insurance plans or a student looking for a medical-only policy, WorldTrips insurance has coverage options.

What kind of plans does WorldTrips provide?

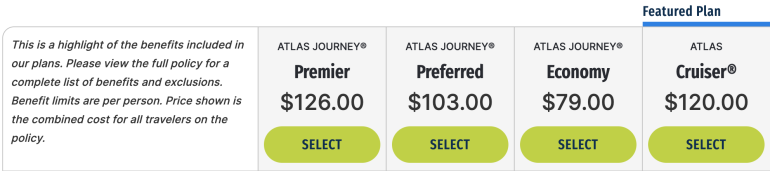

If you’re a U.S. resident, WorldTrips offers four single-trip comprehensive travel insurance plans: Atlas Cruiser, Atlas Journey Economy, Atlas Journey Preferred and Atlas Journey Premier. Here's a quick overview of the coverage offered by each plan.

Atlas Cruiser: This plan comes with 100% trip cancellation , 100% trip interruption , $25,000 medical expenses, $100,000 medical evacuation and $1,500 baggage loss coverage (up to $500 per item). This plan also offers optional Cancel For Any Reason coverage for up to 75% of the total trip cost (as long as you purchase it within 21 days of your initial trip payment and more than 48 hours before your trip begins).

Atlas Journey Economy: This budget plan covers 100% trip cancellation, 100% trip interruption, $10,000 medical expenses , $250,000 medical evacuation and $1,000 baggage loss (up to $250 per item).

Atlas Journey Preferred: This mid-range plan offers coverage for 100% trip cancellation, 150% trip interruption, $100,000 medical expenses, $1 million medical evacuation and $1,500 baggage loss (up to $500 per item). You can add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Atlas Journey Premier: The priciest plan also provides the most coverage, including 100% trip cancellation, 150% trip interruption, $150,000 medical expenses (primary coverage), $1 million medical evacuation and $2,000 baggage loss (up to $500 per item). You have the option to add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Non-U.S. residents and international students have access to medical-only policies. Annual plans aren’t available for U.S. residents.

» Learn more: The best travel insurance companies

WorldTrips travel insurance cost and coverage

WorldTrips offers several comprehensive single-trip plans that include basic trip protections and medical coverage. The cost varies based on coverage limits.

WorldTrips single-trip plan cost

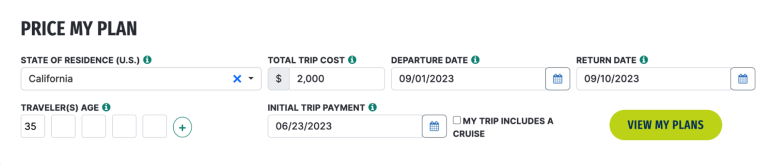

Here's a comparison of the cost of WorldTrips insurance plans for a 10-day trip that costs $2,000 for a 35-year-old traveler from California. In our example, the destination isn’t specified, and the trip doesn’t include a cruise.

The Atlas Journey Premier plan comes in at $126, the most expensive option. The Atlas Cruiser plan has a similar cost of $120. The Preferred and Economy plans, which cost $103 and $79, respectively, are a bit cheaper, but come with lower coverage limits.

» Learn more: What to know before buying travel insurance

Which WorldTrips travel insurance plan is for me?

The kind of coverage you’re seeking for your upcoming travels is going to affect your plan selection. Here are a few situations which might influence your decision:

If you’ve made nonrefundable deposits for your trip: If you’re going on a safari to Kenya or on a cruise to Antarctica and you’ve prepaid nonrefundable expenses, you probably want to go with plans that offer more coverage, such as Atlas Journey Preferred or Atlas Journey Premier.

If you need to add on Cancel for Any Reason coverage: For single-trip insurance plans, go with either Atlas Cruiser, Atlas Journey Preferred or Atlas Journey Premier because they offer this optional upgrade.

If travel insurance is mandatory and you hold a premium travel rewards credit card : If a tour operator requires you purchase travel insurance but you hold a credit card that already provides some trip protections, you can probably get away with the least expensive Atlas Journey Economy policy.

» Learn more: What does travel insurance cover?

How to get a quote from WorldTrips

To get an online quote, go to the WorldTrips home page and select whether you’re a U.S. resident, a non-U.S. resident or an international student. If you’re a U.S. resident, click on that box, then fill out the form to price your plan.

Make sure to provide your state of residence, total trip cost, departure and return dates, traveler’s age and initial trip payment date. If you’re going on a cruise, be sure to check the box. Once the form is complete, select “View my plans” and compare the plan types.

What isn’t covered by WorldTrips insurance?

As with any travel insurance policy, there are some exclusions to coverage. Here’s a sampling of things WorldTrips doesn’t cover:

Intentional self-inflicted injuries, including suicide.

War, invasion or acts of foreign enemies.

Speed or endurance competitions as well as athletic stunts.

Piloting or learning how to pilot an aircraft.

Being engaged in illegal activities.

Medical tourism.

Traveling against a physician’s advice.

Operating a motor vehicle without a license.

» Learn more: How much is travel insurance in 2023?

Is WorldTrips travel insurance worth it?

WorldTrips insurance offers multiple plans for U.S. travelers looking for trip insurance and medical coverage abroad as well as non-U.S. travelers and students looking for medical coverage in case of an unexpected injury or illness.

If you travel once or twice per year, WorldTrips offers several comprehensive single-trip policy options that are worth checking out. However, if you need an annual plan, you'll want to look elsewhere.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

WorldTrips Travel Insurance Review — Is It Worth It?

Senior Editor & Content Contributor

176 Published Articles 108 Edited Articles

Countries Visited: 197 U.S. States Visited: 50

Jessica Merritt

Editor & Content Contributor

104 Published Articles 543 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Stella Shon

News Managing Editor

116 Published Articles 791 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

Who can get worldtrips travel insurance, what does worldtrips travel insurance include, optional add-ons to atlas journey plans, comparison of worldtrips atlas journey travel insurance plans, how much does worldtrips travel insurance cost, how worldtrips travel insurance compares to other options, tips for ensuring a smooth claim process, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Planning trips is fun. Reading about travel insurance for them isn’t. But a little effort to plan for problems during your upcoming vacation can make a big difference.

WorldTrips provides multiple types of travel insurance, ranging from minimalist policies with just medical insurance to full-scale policies that cover anything that might go wrong during your next family vacation. The insurer also offers add-ons that most competitors lack, such as policies for students studying abroad, special provisions for hunting and fishing trips, veterinary emergencies, school activities that force you to delay your vacation, and even coverage for destination weddings when the bride or groom calls it off.

However, you may be surprised that rental car protections are only available as an add-on to WorldTrips plans, and you’ll need the most expensive plan if you want to add coverage for pre-existing medical conditions.

Here’s a look at the various travel insurance plans from WorldTrips and whether the costs are worth it.

Before understanding who can get a plan, it’s essential to understand the different types of travel insurance plans available from WorldTrips.

Atlas Travel plans are available for citizens and residents of numerous countries when traveling internationally. Conversely, Atlas Journey plans are available only to U.S. citizens and residents, covering domestic and international travel. Atlas Journey plans are geared primarily toward trip delay and cancellation benefits, while Atlas Travel plans are focused primarily on medical coverage. However, they share some crossover benefits.

WorldTrips also has travel insurance policies that aren’t focused on typical tourists. StudentSecure plans provide injury and illness coverage for those studying abroad. Atlas MultiTrip plans provide coverage for 364 days, covering trips up to 30 or 45 days each (depending on the plan you choose), and Atlas Group plans can provide up to a 10% discount if you’re traveling in a group of 5 or more people.

Additionally, WorldTrips Atlas Travel plans can provide medical coverage for those doing overseas volunteer or missionary work.

WorldTrips offers multiple types of travel insurance policies. Atlas Travel plans are available only for international trips (open to residents of many countries) and primarily focus on medical coverage. With these plans, you’ll choose your preferred deductible and maximum coverage limit, then provide your age and destination.

U.S.-based travelers have access to Atlas Journey plans. These cover domestic and international trips and are what you likely think of when considering travel insurance. We’ll analyze these in depth in the article and then cover the medical-focused Atlas Travel plans near the end.

WorldTrips Atlas Journey Travel Insurance Coverage Types and Benefits

To know what you’re looking for in a travel insurance policy, you should first understand what the types of coverage are:

- Trip Cancellation Insurance: Covers prepaid, non-refundable expenses when you cancel a trip for covered reasons like sickness, injury, or death of a family member.

- Trip Interruption: Reimburses prepaid, non-refundable expenses if you miss part of a trip or have to end a trip early due to covered reasons like weather, jury duty, or injury.

- Travel Delay: Applies to additional expenses incurred for delays of 5+ hours, covering accommodation, meals, and local transport costs.

- Travel Inconvenience: Applies when one of the following occurs: your return home is delayed and causes you to miss 2 or more days of work, your flight must land 50+ miles from the original destination, there’s a documented security breach causing delays at your departure terminal, you’re a victim of a verified physical assault, your credit/debit card is canceled for reasons beyond your control, or your travel documents are stolen and can’t be replaced locally.

- Emergency Accident and Sickness Medical Expense: Covers losses due to medical and dental emergencies. This is secondary coverage except on the Premier plan.

- Medical Evacuation and Repatriation of Remains: Covers medically necessary transportation and care en route when you’re ill or injured and don’t have access to appropriate care in the immediate area. You also can be covered for repatriation to your home or other U.S. city with appropriate care, requiring prior approval.

- Baggage Damage or Loss: Provides reimbursement for loss, damage, or theft of personal effects in excess of other insurance, such as homeowners’ or airline baggage policies.

- Baggage Delay: Provides reimbursement for covered expenses after 12+ hours of baggage delay at your destination. Covered expenses include necessary clothing, laundry, toiletries, and costs for retrieving your baggage. Coverage ends when your luggage is retrieved or you return home — whichever is first.

- Missed Connection: Can reimburse expenses related to missed cruises, tours, flights, or trip departures due to 3+ hours of delays. Covered delays include weather, carrier problems, strikes, quarantines, and more. Expenses cover costs to catch up with your trip or money lost from missing the trip.

- Airline Cancellation or Reissue Fees: Reimburses costs for changing or canceling tickets after interruptions or canceled flights. This coverage applies to costs after any refunds or vouchers you receive.

- Travel Assistance Services: Provides 24/7 assistance services like security advice, coordination of medical benefits, interpreters, legal referrals, and referrals for needs during emergencies. Note that you may have costs for services you use from these referrals.

It’s also important to note that each section has rules and restrictions about which costs are covered, when coverage applies, and other terms you must follow.

You’ll see options for additional coverage depending on the base plan you select:

- Cancel for Any Reason Coverage (CFAR): This add-on policy covers up to 75% of your losses if you cancel for reasons not covered in other sections of your policy, so long as you purchase within 21 days of your first deposit and cancel 48+ hours before the trip. This add-on isn’t available for Economy plans.

- Interruption for Any Reason: Provides reimbursement for 50% of non-refundable trip costs after a trip is interrupted for non-covered reasons. WorldTrips says, “No questions asked” on this coverage. This add-on is available for Premier plans only.

- Pre-existing Conditions: Requires purchasing a policy within 21 days of the initial deposit and covers pre-existing conditions that have a change in treatment or that make you unable to travel.

- Adventure Sports: Provides coverage for leisure, non-professional sports like bungee jumping, scuba diving, and mountain climbing up to 7,000 meters, as well as safari activities. This add-on is available for all plan levels.

- Rental Car Damage and Theft: Requires a $250 deductible; afterward, provides rental car coverage for collision, theft, and damage beyond your control. You must be authorized to drive at the destination and listed on the rental policy. This add-on is available for all plan levels.

- Pet Care: Provides reimbursement for a trip canceled due to the death or critical illness of your dog or cat within 7 days of trip departure. Provides up to $250 in coverage for boarding fees if your return home is delayed for a covered reason and up to $500 for emergency veterinary care for a pet traveling with you. This add-on is available with all plan types.

- Rental Accommodations Protection: Covers trip interruptions if you can’t access your vacation rental property for 12+ hours or if your property is unsuitable or not as described on arrival. It’s available on all plan levels.

- School Activities: Provides cancellation coverage for trips you must cancel due to school activities like exams or sporting events beyond standard season dates. This coverage also applies to study abroad, volunteer, or philanthropic programs. This add-on is available for all plan levels.

- Hunting and Fishing: Covers canceled and interrupted trips related to changes in government regulations or delays of 24+ hours in receiving your necessary equipment. This coverage also applies to theft, damage, and destruction of your essential equipment and trips where your guide or traveling companion becomes medically unfit to participate. This add-on is available for all plan levels.

- Destination Wedding: Provides reimbursement for lost funds when you plan to attend a wedding and then it’s canceled. Coverage also applies to canceled flights, flights forced to land 50+ miles from the intended airport, and flight delays of 12+ hours. This add-on isn’t available for Economy plans.

- Security/Terrorism: This covers cancellations due to terrorist events at your destination or trip interruption for riots/civil unrest lasting 12+ hours. It also can provide ransom payments or security assistance for kidnapping. However, it doesn’t cover countries like Mali, Afghanistan, Syria, or others excluded from the policy. It’s available on all plan levels.

- Primary Medical Coverage: This paid upgrade to Preferred plans makes the emergency medical and dental benefits primary coverage rather than secondary.

- Primary Baggage Coverage: This makes baggage coverage primary rather than secondary. This is available on all plan levels.

It’s also possible to upgrade your maximum coverage limits on certain benefits. These include baggage loss and upgrading benefits from secondary to primary coverage.

Few companies offer kidnapping ransom, destination wedding, or school activity coverage. If these are concerns for your upcoming trip, WorldTrips can make sense over competitors that lack these protections.

Take note that rental car protection isn’t included in any plans — not even the Premier plan. It’s available for an additional cost, but this reinforces the importance of using a good credit card that provides built-in rental car protections .

Pre-existing Conditions

When purchasing an Atlas Journey plan, this coverage is included if you purchase your plan within 21 days of your initial trip payment.

COVID-19 Coverage

Atlas and StudentSecure plans purchased on or after February 2, 2023, include coverage for medical expenses related to COVID-19.

There are several coverages that are the same across all 3 plans :

- Coverage for Pre-existing Medical Conditions — Included if conditions are met and policy is purchased within 21 days of initial deposit

- 24/7 Travel Assistance Services — Included

- Adventure Sports Medical Coverage — Available add-on service; average cost $44

- Pet Care — Available add-on service; average cost $10

- Rental Car Damage and Theft — Available add-on service; average cost $50

- Rental Accommodation Protection — Available add-on service; average cost $21

- School Activities Protection — Available add-on service; average cost $16

- Hunting and Fishing Protection — Available add-on service; average cost of $20

WorldTrips Travel Insurance Economy Plan

This is the most inexpensive plan but still covers the essentials. You can be reimbursed for canceled, interrupted, and delayed trips and get reimbursed for sicknesses, injuries, and even delayed bags. Numerous add-ons can improve this plan, though the cost will increase.

WorldTrips Travel Insurance Preferred Plan

This intermediate plan offers more coverage and higher cover limits than the Economy plan but costs more. This plan has additional add-on options, and it’s the lowest plan with an option for CFAR coverage.

WorldTrips Travel Insurance Premier Plan

The most expensive plan also offers the most robust coverage — in terms of types and values. It’s the only plan with an option to add coverage for pre-existing conditions, though many options remain add-ons and aren’t included in this plan (such as rental car coverage).

None of the Atlas Journey plans include rental car protections. Those are available as an add-on, however.

Atlas On-The-Go Insurance

WorldTrips provides another travel insurance plan called On-The-Go . It’s only available to U.S. residents and covers non-refundable trip costs, lost or damaged personal items (including luggage), and medical expenses (including COVID-19).

You can be covered for trip interruption, travel delays, missed connections, and emergency medical expenses. However, you won’t be covered for trip cancellation and cannot add coverage for pre-existing conditions or CFAR.

Let’s price some sample plans to see how they cost. This will give you a better idea of whether these plans fit your budget.

Atlas Journey Plans

These plans are available to U.S. residents and citizens and cover domestic and international trips.

Atlas Travel Plans

These plans are available to residents of numerous countries and only cover international trips.

Notice there is a high additional cost for elderly travelers . Also, your maximum coverage amount is lower for people aged 60 and above.

Since Atlas Travel plans primarily focus on medical coverage, you don’t need to provide your trip cost when getting a quote. These plans can make sense if you’re OK with minimal trip protections while ensuring you’re covered for possible injuries during a trip. You can choose from several options for a maximum coverage amount and deductible payment for your claims.

These plans are focused on medical coverage during international trips. If you aren’t worried about expenses for delays or cancellations, you could potentially save money by purchasing an Atlas Travel plan. These especially make sense for last-minute trips where your odds of cancellations are low.

As these plans have maximum coverage amounts and don’t cover trip cancellation, they’re cheaper. This can be a good option if your trip is unlikely to be canceled and you want protection for your stuff and your health during a vacation. As long as you’re a U.S. resident, plans are available for both international and domestic travel.

WorldTrips Travel Insurance vs. Competitors

Part of shopping for trip insurance is understanding what you get and how much it costs. The other part is understanding how this compares to competitors. What are companies like Generali Global Assistance and Nationwide charging for similar plans? Here’s a comparison of costs.

We priced a 1-week itinerary for 2 travelers (ages 40 and 39) going to Colombia in November 2023. The cost for the trip was estimated at $3,000, and the first trip deposit was made in the last 24 hours. Squaremouth provided these comparison costs.

The WorldTrips plan had the middle cost of the 3 .

All 3 plans included COVID-19 coverage; all 3 provided the same trip cancellation benefits and the same medical evacuation benefits . However, WorldTrips and Nationwide had lower maximums for emergency medical benefits than Generali, and WorldTrips also had the lowest maximum benefit for trip interruption .

WorldTrips has a competitive cost against similar plans from other providers. You’ll see similar coverage types and maximum payouts in some areas. However, you’ll see lower benefits for emergency medical and trip interruption than more expensive options. Consider these numbers and how important they are.

WorldTrips Travel Insurance vs. Credit Card Insurance

You may be surprised that your credit card could provide some of the same travel insurance . This could help you save money by not needing to buy a separate policy.

However, when the coverage goes into effect varies. Some credit cards require you to pay for the entire trip (including round-trip tickets, not one-way) with that card to trigger the protections. Others go into effect by paying just a portion of the trip with that card. It’s important to understand exactly what your card offers and when it’s available to determine if those protections are sufficient.

Here’s a look at how WorldTrips’ Atlas Journey Premier plan compares to coverage with The Platinum Card ® from American Express , Capital One Venture X Rewards Credit Card , Chase Sapphire Preferred ® Card , and Chase Sapphire Reserve ® .

WorldTrips’ Premier plan has lower trip delay, lower lost luggage, and lower accidental death and dismemberment benefit maximums than you may get with premium credit cards. However, WorldTrips’ top plan has better baggage delay protections and offers the best protections for emergency medical and emergency evacuation.

Even before your trip, you should think about “what if something goes wrong” and have a plan. That includes buying your plan within required deadlines (based on initial and final trip payments) and keeping receipts for every expense. Keep receipts for flights, hotels, rental cars, meals during trip delays, and even a toothbrush while waiting for delayed luggage. Keep it all.

You also should read the policy documents before and after buying a plan. These will help you know precisely what is and isn’t covered. For instance, destination wedding coverage can be handy if the wedding gets called off, but the policy’s fine print will tell you you’re not covered if you’re the bride or groom.

Keeping a paper trail and knowing what is (and isn’t) covered will ensure a smoother claim process because you’ll avoid submitting unnecessary claims and will avoid unnecessary delays during the evaluation process. It also helps you know what’s covered before you swipe your card for expenses during a delay.

If you need to submit a claim, WorldTrips has a “How the claims process works” page , and it includes instructions on what to do, what forms you need, and how the claims process varies based on whether your trip was inside or outside the U.S. It also provides information on how medical facilities can direct bill WorldTrips, which can save you the hassle of paying and then waiting for reimbursement.

No one likes to think about emergencies when planning an exciting holiday. However, planning for emergencies can reduce stress and costs should something go wrong. WorldTrips offers several types of travel insurance, covering all your bases or potential medical expenses. The sheer variety of options provides more potential coverage types than many competitors.

For Capital One products listed on this page, some of the benefits may be provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

For the baggage insurance plan benefit of the Amex Platinum card, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the car rental loss and damage insurance benefit of the Amex Platinum card, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the premium global assist hotline benefit of the Amex Platinum card, eligibility and benefit level varies by Card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, card members may be responsible for the costs charged by third-party service providers.

For the trip delay insurance benefit of the Amex Platinum card, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of the Amex Platinum card, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

For rates and fees of The Platinum Card ® from American Express, click here .

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Suggested companies

Seven corners.

WorldTrips Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.2.

Most relevant

I misspelled a name on our roster

I misspelled a name on our roster, but Gaby was very understanding and got it corrected nearly overhnight. She also helped me select the best coverage for our team.

Date of experience : August 12, 2024

Reply from WorldTrips

Hello Kenya. Thank you for taking the time to leave a review! We are happy to hear that you received the assistance you were looking for. If you have any other questions, feel free to reach out! We will be happy to assist you. Thank you for choosing WorldTrips!

I was lucky and did not need to make…

I was lucky and did not need to make any claims. So I hope that in case I do require to claim, i will have a pleasant and helpful experience

Date of experience : February 25, 2024

Hello and thank you for taking the time to leave a review! We are happy to hear that you had a great experience with us. If you have any questions, feel free to reach out to our customer service team or email us at [email protected]. We will be happy to assist you! Thank you for choosing WorldTrips.

You didn't do what you promised.

My son was almost hit by a car while riding a bicycle, but the car swerved and my son hit the car. The police and ambulance came and were going to take my son to the hospital. But after loading him in the ambulance, my son suddenly said he was fine and didn't need to go to the hospital. We had liability insurance and so we called you and you explained that we should go ahead and pay the damage on the vehicle, which was about $750. We sent you receipts, police reports, everything you asked for, but then you said you weren't going to pay. I travel all over the world and bring people with me all the time. I would appreciate you doing the right thing, the very thing I've paid you for, and follow through with what you said you were going to do, and reimburse us like you said you were going to. If not, how can you honorably continue to sell insurance. Please make it right. My number is 817-501-8941. Steve Headland

Date of experience : August 11, 2024

Everything went well, though would appreciate a reminder!

I enjoy the coverage provided by WorldTrips and often use it for travel insurance. But 4 stars as the reminders that typically come a few days before the policy expires (to provide the option of fuss-free extension) are not sent anymore though they have been very useful in the past.

Date of experience : August 03, 2024

Hello and thank you for taking the time to leave a review. We are happy to hear that you had a pleasant experience with us! Our reminder emails are currently only sent to policy holders that purchase 15 days of coverage or more as they are sent 15 days and 30 days prior to the expiration. If you happen to have any further questions or concerns, please feel free to email us at [email protected]. We will be happy to assist you! Thank you for choosing WorldTrips.

Amazing Service!

Our luggage arrived where it needed to go and everything was accounted for. Also, the website was very easy to navigate.

Date of experience : August 07, 2024

Hello Jason. Thank you for taking the time to leave a review! We are happy to hear that you had a great experience with us and that you like our website. Your feedback is greatly appreciated. We hope to join you on your next journey! Thank you for choosing WorldTrips.

Excellent service, prompt and clear communication

Easy to understand and navigate website, communication is brief , clear and spot on. Got exactly what I was looking for. Thank you 🙏

Date of experience : July 30, 2024

Hello Stoyan. We appreciate you taking the time to leave a review. It is great to hear that you had such a positive experience with us. Wishing you safe travels on your upcoming trip. Thank you for choosing WorldTrips!

World Trips - easy to work with and provides a great product

World Trips is one of the few companies that will provide travel insurance if you have already started your travels. I wanted to extend my travels and needed additional coverage.

Date of experience : July 18, 2024

Hello Diana. Thank you for taking the time to leave a review! We are happy to hear that you had such a great experience with us. Wishing you safe travels on your upcoming trip. Thank you for choosing WorldTrips!

The good thing about your services is…

The good thing about your services is that it is fairly straightforward and not time consuming to register on the website and buy a policy. However, originally I wanted to log in with the existing account that I had and I forgot the password, so I tried to recover it, but the emails from World trips that I was supposed to receive to restore my account did not reach my email address.

Date of experience : August 02, 2024

Hello Andrei. Thank you for leaving your feedback. Our team would love to look into this further. If you feel inclined, please email us at [email protected] with your name, policy number, and a reference to this email. Someone on our team will be happy to investigate. Thank you!

Good application

Good application, but I’m still confused is cruise ships are covered under the annual plan

Date of experience : August 05, 2024

Hi Scott. We apologize for the confusion. Our team would love to take this offline and see if we can answer any questions you might have about this. If you feel inclined, please email us at [email protected] with your name, policy number, and a reference to this email. We will be happy to assist you.

WorldTrips was great.

When we booked the trip and took out the insurance it was for 6 months, but something didn't go right on our end and we had to cancel. I cancelled the insurance with WorldTrips and was surprised how easy it was to do that, and within 2 days we had the money back for unused days. I would use WorldTrips again if the need comes up again.

Date of experience : May 23, 2024

Hello Deanna! Thank you for sharing your experience with us. We are sorry to hear that you needed to cancel your trip but we hope we can join you on your next journey. Thank you for choosing WorldTrips!

I felt unwell but I could not get help…

I felt unwell but I could not get help as the service provider here nor the contact person at my organization did not know what to do.

Date of experience : August 08, 2024

Hello Frank. We are sorry to hear that you did not have the best experience with us. If you feel inclined, please email us at [email protected] with your name, policy number, and any questions you may have. We will be happy to assist you.

The attention at the call center was…

The attention at the call center was great because they clarify my doubt about which plan covers what I need, so it was great.

Date of experience : July 25, 2024

Hello Italo. Thank you for taking the time to leave your feedback. We are happy to hear that you had a great experience with our team. If you have any further questions, feel free to reach out. We will be happy to assist you! Wishing you safe travels during your upcoming trip. Thank you for choosing WorldTrips!

We travel around of Australia with all…

We travel around of Australia with all the security in peace!

Date of experience : July 29, 2024

Hello Veronica. Thank you for taking the time to leave a review! We are happy to hear that you had a great experience with us and hope that you enjoyed your trip. We hope to join you on your next journey! Thank you for choosing WorldTrips.

It’s easy to use

It’s easy to use. I have used it for years when I travel and it’s so quick and easy and something then that I no longer have to think/ worry about if something would happen away from home.

Hello Erin. Thank you for taking the time to leave a review. We are happy to hear that you have such a great experience with us! Wishing you safe travels during your trip. Thank you for being a loyal WorldTrips customer!

Fast and easy transaction

Fast and easy transaction. Very reasonable rates.

Hello and thank you for leaving your feedback! We are happy to hear that you had a great experience with us. Wishing you safe travels on your upcoming trip! Thank you for choosing WorldTrips.

The last executive I contacted was…It was a lady.

The last executive I contacted was uncaring & indifferent with my situation, I asked her for a dermatologist and send me a long list of Family Drs. I still can’t find a provider. BAD experience to help me find a Dr, the first one said was eczema but people said is a severe poison ivy

Hello Cecilia. Thank you for taking the time to leave a review. We are sorry to hear that you were unable to find a provider. If you are still in need of assistance, please email us at [email protected] with your name, policy number, and any questions you might have. Our team will be happy to assist you!

Covered my claim

Bought a policy in in April 2022 to cover an international trip in June 2022. They covered my claim with little questions, and paid out. Remember to keep all receipts and any supporting paperwork to file it after returning to home country. The only complaint was the payout took 3 months so I had to carry a balance on my credit card during that period. Overall, a reliable company but hope they speed up their claims processing.

Date of experience : July 05, 2023

Hello. Thank you for taking the time to provide some feedback. We have been working on our claims processing and are trying our best to shorten our turnaround time. Thank you for choosing WorldTrips!

Easy to navigate the different options…

Easy to navigate the different options of coverage, only downside is the limitations when you are older. Would love to see health questions or even doctors certificates to be able to get better coverage. Don’t know about claims - luckily never had one!

Date of experience : July 08, 2024

Hello and thank you for taking the time to leave your feedback. We will pass this along to the team and see if we can implement any changes. Looking forward to joining you on your next journey! Thank you for choosing WorldTrips.

The staff were very nice and attentive…

The staff were very nice and attentive but not TOO attentive. It made for a very relaxing vacation. I highly recommend this cruise if you can get on it.

Date of experience : July 11, 2024

Hi Kevin. Thank you for taking the time to share your feedback! We are happy to hear that you would highly recommend us. We hope to join you on your next journey! Thank you for choosing WorldTrips.

Thankfully, in all the times we have purchased insurance through WorldTrips, we have not needed to actually use it. They came highly recommended by a friend a few years ago and have used them for all our vacations out of country. They are affordable and their website is easy to use.

Date of experience : June 17, 2024

Hi Christie. Thank you for taking the time to leave a review! We are happy to hear that you and your friend had great experiences with us. We hope you had a great trip and look forward to joining you on your next trip!

- 10 Welcoming Towns to Retire in Pennsylvania

As you close one chapter of your life and look to begin another, Pennsylvania emerges as a storybook setting for retirement. Known for its rich American history and diverse landscapes that stretch from the bustling streets of Philadelphia to the serene Pocono Mountains, the Keystone State offers a mosaic of towns each with its own character and charm. But what if you could find a place not just to live, but to thrive in your golden years?

Imagine a retirement where every day feels like a leisurely stroll through history, where the cost of living doesn’t keep you up at night, and where the community feels like family. This article will guide you through nine such towns in Pennsylvania. You'll learn about towns where historical reenactments bring the past to life, where local festivals celebrate everything from mushrooms to pretzels, and where the average house price makes financial comfort in retirement a tangible reality.

Carlisle, with its beautiful architecture and tree-lined streets that have witnessed the comings and goings of early American icons, provides an enriching backdrop for daily life. For history enthusiasts, the town boasts several significant sites including the U.S. Army Heritage & Education Center and Carlisle Barracks, one of the oldest U.S. Army installations, now home to the prestigious U.S. Army War College. Additionally, the town's proximity to the Appalachian Trail appeals to outdoor lovers, offering ample opportunities for hiking and enjoying nature. With a moderate population that ensures a cozy yet dynamic community spirit, Carlisle combines the tranquility of small-town living with a rich educational and cultural scene, thanks to institutions like Dickinson College and Penn State Dickinson School of Law.

Moreover, Carlisle's calendar is replete with engaging events such as the famous car shows at Carlisle Fairgrounds, including Corvettes at Carlisle and Carlisle Ford Nationals, which attract visitors from all over the nation and provide a lively community atmosphere. The median house price of $300,000 in Carlisle stands as an attractive feature, offering affordability alongside quality living, which is particularly appealing to retirees looking to maximize their quality of life on a fixed income. The town also fosters a strong sense of community through various local initiatives and cultural institutions like the Central Pennsylvania Youth Ballet, renowned for its international acclaim.

Established in 1785 by Ludwig Deer, Lewisburg combines a mysterious origin story with a longstanding connection to the Susquehanna River, a factor that spearheaded its early economic growth in logging and shipping. Today, retirees can explore a well-preserved downtown area that hosts numerous landmarks such as the Packwood House Museum and the Reading Railroad Freight Station, bringing history to life through their engaging exhibits. Additionally, the presence of annual events like the Lewisburg Arts Festival and the Heart of Lewisburg Ice Festival provides year-round cultural engagement and community participation opportunities, perfect for those seeking an active retirement.

Lewisburg is home to the Dale's Ridge Trail at Dale's Ridge Conservation Park, offering stunning panoramic views and well-maintained hiking paths. For those who prefer a more leisurely pace, the Buffalo Valley Rail Trail offers miles of scenic walking or biking along the Susquehanna River. Art lovers are drawn to the Samek Art Museum and various local galleries, enriching the cultural fabric of the town. Importantly, the median house price of $450,000 in Lewisburg provides an affordable entry point into a thriving community.

As the site of the pivotal 1863 Battle of Gettysburg , the town offers retirees the opportunity to immerse themselves daily in the rich tapestry of American history through the vast Gettysburg National Military Park and the Gettysburg Museum & Visitor Center. These sites, along with the Eisenhower National Historic Site and the Seminary Ridge Museum, provide not only educational opportunities but also a sense of participation in national heritage. In addition to its historical offerings, Gettysburg hosts engaging community activities such as ghost tours and military-themed dining at Hunt's Battlefield Fries & Cafe, which add a layer of local flavor and entertainment to daily life. With a median house price around $430,000, Gettysburg is also financially accessible for many retirees, making it an attractive option for those who cherish history and community spirit.

The town's community vibe is palpable in its bustling downtown area, particularly around Lincoln Square, which offers unique shopping and dining experiences like the 18th-century Dobbin House Tavern. The blend of historical intrigue and modern-day amenities makes Gettysburg not just a landmark of past conflicts, but a peaceful haven for retirees. The town’s population of 8,600 fosters a close-knit community atmosphere, ideal for those looking to find new friendships and engage in local activities.

Founded in 1756 by Moravian settlers, Lititz boasts a well-preserved historic district with over 100 buildings that chronicle its storied past. Notable sites include the Julius Sturgis Pretzel Bakery, America's first commercial pretzel bakery, where retirees can engage in interactive tours and taste freshly baked pretzels. The Lititz Moravian Church, another pivotal landmark, offers insights into the town's founding and its spiritual heritage, enhancing the educational and cultural richness of the community. For those interested in more recent history, the town is also home to the original manufacturer of the Victor Mouse Trap. With an inviting main street filled with antique shops, quaint cafes, and unique restaurants, Lititz offers a daily living experience that combines leisure with a sense of ongoing discovery. Moreover, house prices in Lititz sit at $450,000 on average.

Events and activities around town such as visits to the Lititz Springs Park, with its beautiful gardens and walking trails, provide peaceful outdoor pursuits. The town's commitment to preserving its heritage while offering contemporary comforts is evident in its culinary offerings, from the fresh salads at Tomato Pie Cafe to the rustic charm of the Bulls Head Public House. The local economy is bolstered by historic businesses like the Wilbur Chocolate Company, known for its Wilbur Buds since 1894, adding a sweet touch to the community vibe.

New Hope , known for its eclectic blend of quirky shops, delectable cuisine, and rich historical sites, offers an engaging lifestyle that appeals to a wide range of interests. Food enthusiasts can savor Italian delicacies at Italian Cucina or sample fine wines at the New Hope Winery, while art and theater lovers can enjoy captivating performances at the historic Bucks County Playhouse, an iconic venue since 1939. This blend of dining and entertainment, coupled with the town's friendly atmosphere, makes it a delightful place for retirees to explore new interests and enjoy their leisure years. The natural surroundings further enhance this appeal, with the Bowman’s Hill Wildflower Preserve and the trails along the Delaware Canal offering tranquil settings for outdoor activities. With an average house price around $800,000, New Hope is positioned as a premium yet worthwhile investment for those looking to retire in a lively and picturesque environment.

The 19th-century Locktender's House and the Parry Mansion, built in 1784, stand as testaments to the town’s foundational role in regional development, particularly in canal transport that once connected it to major trade routes. These historical sites not only offer educational opportunities but also link residents with the town’s storied past, fostering a sense of continuity and community pride. For retirees, this historical backdrop is complemented by modern amenities and a robust calendar of community events, ensuring a well-rounded lifestyle. The presence of venues like the Bucks County Playhouse, which continues to draw talent and audiences alike, keeps the cultural scene vibrant and engaging.

Kennett Square

Known as the "Mushroom Capital of the World," Kennett Square produces 60% of the nation’s mushrooms, a fact that is celebrated annually at the Kennett Square Mushroom Festival. This event not only highlights the town’s agricultural prowess but also brings together the community and visitors for a festive experience, showcasing local crafts, food, and entertainment. Beyond mushrooms, the town is home to Longwood Gardens, one of the premier botanical gardens in the United States. This sprawling 1,100-acre wonder features 13 meticulously curated interior gardens and an impressive collection of 859 unique plant species. The Festival of Fountains, running from May through October, adds to the allure with its stunning display of water choreography set to music, making Longwood a year-round attraction for nature lovers and horticultural enthusiasts alike.

The average house price in Kennett Square is around $550,000, offering retirees a reasonable cost of living in an area rich with natural beauty and community activities. The town’s charm is further enhanced by East Penn Railroad, Kennett Meetinghouse, and Anson B. Nixon Park, which provide ample opportunities for leisure and historical exploration. The park, with its extensive facilities including a soccer field, dog park, and picnic pavilions, is perfect for those looking to stay active and engage with the community. The presence of these amenities within a small-town setting ensures a peaceful yet fulfilling retirement lifestyle, where one can enjoy both the tranquility of nature and the vibrancy of community life.

Bellefonte is renowned for its well-preserved Victorian architecture and significant historical landmarks like the Plaza Theater and Garman Opera House. This town, nestled in the Allegheny Mountains, is not only a scenic delight but also boasts an illustrious history as the home to seven state governors. Today, it houses the headquarters of the American Philatelic Society, adding a unique cultural dimension to its local community. For those interested in exploring further, the Bellefonte Academy, one of the earliest in Pennsylvania, stands as a testament to the town’s commitment to educational excellence since 1805. With an average house price around $350,000, Bellefonte is an affordable option for retirees who value both historical richness and the tranquility of mountain life.

The Bellefonte Historical Railroad offers scenic train rides that provide both relaxation and education about the area’s history, while Talleyrand Park offers peaceful walks along Spring Creek. For nature enthusiasts, the nearby Bald Eagle State Park is a haven for outdoor activities like hiking, fishing, and boating on Foster Joseph Sayers Lake, ensuring retirees have ample opportunities to engage with nature. Additionally, the town’s cultural scene is vibrant with landmarks such as the Centre County Courthouse and the Bellefonte Art Museum for Centre County, which hosts regional art and cultural exhibits. The annual Bellefonte Victorian Christmas turns the town into a festive wonderland, enhancing its community spirit.

Honesdale is known as the “Birthplace of the American Railroad.” It holds a special place in U.S. history, with its pioneering role in the railway industry marked by the 1829 trial run of the “Stourbridge Lion,” the first locomotive in the U.S. to run on rails. This profound heritage is celebrated in town, with replicas and exhibits like the Stourbridge Lion replica at the site of the first commercial steam train run, connecting residents and visitors alike to a pivotal moment in industrial America. Additionally, Honesdale's roots in coal mining and its evolution into a dairy and farming center enrich its cultural tapestry, providing a glimpse into the town’s industrious past and its transformation over the centuries.