- Prepaid Cards >

- Travel Prepaid Cards

Compare our best prepaid travel cards

Simplify your spending abroad with a prepaid travel card, find a prepaid travel card, what is a prepaid travel card.

A prepaid travel card , also known as a 'travel money card', is a debit card that you preload with money and take on holiday. It's a good way to stick to your holiday budget and avoid carrying a lot of cash.

Prepaid travel cards can be used at cashpoints, in shops and restaurants , or anywhere that accepts Mastercard or Visa debit or credit cards.

However, a prepaid travel card is not the same as a credit card for two key reasons:

You can only spend the amount you have put on the card; the pre-loaded limit prevents you overspending and getting into debt

You can choose which currency to preload your travel money card with depending on where you're going, which often means you can secure a better exchange rate

Pick a card with fees that suit how you plan to use it, e.g. choose one with no withdrawal fees if you'll be withdrawing cash often while travelling.”

What are the different types of prepaid travel cards?

Multi-currency prepaid cards.

These can be loaded with several different currencies , making them ideal for both frequent travellers and those taking trips to multiple destinations. For example, you holiday in Europe but often visit the US on business, you could use a prepaid travel card to cover your everyday spending wherever you are by topping it up with say £600 then exchanging £200 into euros and £200 into US dollars. The different currencies will then be stored in separate “wallets” , allowing you to switch currencies when you like.

Sterling prepaid cards

These can be used at home and abroad , making them even more flexible than the best travel cards offering multiple currencies. You don’t need to worry about setting up a wallet for the currency you want to use; the card provider simply converts your pounds to the required currency each time you make a purchase . However, this can make holiday budgeting harder and may increase your costs, depending on the charging structure.

Euro prepaid cards

As well as multi-currency cards, you can take out prepaid cards designed to hold a specific currency . This can work out excellently if you're trying to lock in a good rate now by loading your euro prepaid card, but if you then use the card to buy things in a country that isn't in the eurozone. That's because if you spend in a country that does not use the euro, it converts to the local currency each time you make a purchase, which can work out more expensive.

Prepaid US dollar cards

These keep your balance in dollars . If you spend in countries that use a different currency, the card will exchange your dollars to the local currency, and you might well be charged a fee. The currency exchange takes place as soon as you load your card . If the pound strengthens afterwards, you won’t be getting the best value for money, but it if weakens you'll do well.

How to get a prepaid travel card

Compare cards.

Use our table below to find prepaid travel card that offers the features you need with the lowest fees

Check your eligibility

Make sure you fit the eligibility criteria for your chosen travel money card and can provide the required proof of ID

Apply for the card

Click 'view deal' below and fill out the application form on the provider's website with your personal details

What are the eligibility requirements?

Anyone can get a prepaid travel card. There's no need to have a bank account, and no credit checks are required . Some providers have a minimum age of 18, but many will let you have a prepaid card from the age of 13 with parental consent.

Sometimes parents like to use travel money cards to give their children a set amount of holiday money , and to help teach them about budgeting and financial responsibility.

Pros and Cons

What exchange rate do you get.

Exchange rates vary over time depending on what is happening in the wider economy. That means the exchange rate you get on a US dollar travel card today, for example, might not be the same as you get tomorrow or next week.

What prepaid cards offer is the ability to lock in today's rate to use later on. That could see you better off if the pound weakens, but might also mean you get a poor deal if the pound strengthens.

That offers is certainty - you'll know exactly how many dollars, euros, lira or whichever currency you load onto the card you have to spend on holiday.

Today’s best exchange rates

At what point is the currency exchanged with prepaid travel cards.

Some prepaid travel cards hold the balance in pounds sterling. These convert the required amount to the local currency every time you spend on them .

The exchange rate isn’t fixed, so you’ll only know how many pounds you have on the card - not what it will buy you while overseas.

But the cards in our comparison table convert your money when you add it onto the card. This means you know the exchange rate used and your card's exact balance before you go away.

Compare the rates before you choose a prepaid card. Although rates can change several times a day, some travel cards will be more competitive than others.

Using a card with competitive exchange rates will mean you get more local currency for your pound.

You also need to watch out for fees as well as withdrawal limits when choosing a card, as these can vary between providers.

What are the alternatives to prepaid travel cards?

Travel credit card.

A travel credit card works just like a regular credit card, with which you can make purchases by borrowing money. The main difference is that travel credit cards don't charge foreign transaction fees for spending abroad.

Travel money

For many people, cash is the most comfortable form of payment when travelling. It's hassle-free and universally accepted. But it’s riskier, as you'll lose out if it’s lost or stolen and you’ll need to budget carefully to ensure your foreign currency lasts the length of your trip.

Travel debit card

These days, there are plenty of specialist banks and providers that offer bank accounts that don't charge foreign transaction fees when used abroad. This offers you a chance to take advantage of the best exchange rates. And if it's your main current account, you won't have to worry about topping up your account before you go.

What other costs or fees are there with prepaid travel cards?

As well as the exchange rate, you might have to pay several other charges on your prepaid travel card.

These could include:

A fee to buy the card

A monthly or annual fee for keeping the account open

Cash withdrawal fees

Transaction fees when you pay for anything on the card

Inactivity fees

Loading fees when you add money onto the card

Some cards also charge fees for withdrawing cash or making purchases inside the UK .

But some of the cards in this comparison do not charge fees in countries that use currencies loaded on the card - just make sure the right one is selected before spending on them.

Check carefully for fees before you pick one.

Read our full guide on how much it costs to use a travel prepaid card and how to choose one .

"With multi-currency cards, check you've selected the right currency before you arrive."

How long does it take to get a prepaid travel card?

You can apply online and get a decision immediately. However, it can take up to two weeks before your card arrives in the post.

Can I use any prepaid card abroad?

Yes, you can use prepaid Visa or Mastercard cards in most destinations worldwide. Travel prepaid cards are usually cheaper to use overseas than a standard credit or debit card.

Can I withdraw cash abroad?

Yes, you can use a travel money card in a cash machine outside the UK. Some cards charge fees for this, so always check if you want to use your prepaid travel card to make cash withdrawals.

What currencies can my card hold?

All the travel money cards in our comparison can hold a balance in popular currencies such as euros or dollars, while some support more than 50 different currencies.

Can I make international payments?

Yes, some providers let you send or receive money from abroad by logging into your online account, which works in the same way as standard internet banking.

Who sets the exchange rate?

This depends on the company that processes the transactions. Typically, it’s down to Visa or Mastercard , as well as your card provider, which may take an additional cut.

Can I use my prepaid card in the UK?

You can use prepaid cards to withdraw cash or buy things in the UK or online. However, you may pay fees or even an exchange rate if your card is loaded with a foreign currency.

Explore our prepaid card guides

About the author

Didn't find what you were looking for?

Our most popular prepaid card deals

Other products that you might need for your trip

Customer Reviews

Hub of information!

Super accessible and easy to use

Very helpful

Best Prepaid Travel Money Cards

Matt Crabtree

Rebecca Goodman

Prepaid travel cards have various names, such as travel money cards or multi-currency prepaid cards, but they all work in the same way to make spending abroad easier.

Using your debit card or usual bank account on holiday can accrue fees, and spending more than you have may be tempting, like dipping into your overdraft or savings accounts.

With a prepaid card, you can stick to your budget and be aware of all the fees involved before spending.

In this article, I'll discuss everything you need to know about prepaid cards to use when you're abroad, and I've picked a list of the best prepaid travel cards on the market to help you decide.

What are multi-currency prepaid cards?

A prepaid card works much like a debit card in terms of how you use it to make purchases and withdraw cash from an ATM. The only difference is that a prepaid card isn't attached to a bank account; you must top it up to use it.

Anyone can sign up for a prepaid card and use it for travelling. There are no credit checks, so even if you’ve got a history of bad credit, you can still apply for a prepaid travel card.

A prepaid multi-currency card is like a gift card in the same way you top it up and use it. With multi-currency prepaid cards, you use them as an alternative to carrying cash or traveller's cheques when travelling . You top the card up in the currency of your choice and then use it as you need it.

You can top-up prepaid cards on the go, usually by an app, and you can use them in most places worldwide. You’ll have to check with your prepaid card provider to see what currencies you can use on the card and where you can use it.

The pros and cons

Like any financial product, there are benefits and drawbacks to using a prepaid card.

✔️ Budgeting: You can preload all of your spending money on the card, and as you can only spend what's there, it's much easier to stick with a budget and not overspend.

✔️ Safer than cash : If you lose your prepaid card, or if it's stolen, you can get a replacement card sent to you. A prepaid card isn’t attached to a bank account , so you don’t have to worry too much about anyone potentially accessing your everyday banking.

✔️ No foreign exchange fees: Most travel money cards are made for spending abroad, so there are usually no foreign exchange fees.

✔️ Accepted in most places: Most countries accept prepaid cards. Double-check with your prepaid card provider if your card is accepted before you fly out to your destination.

✔️ Different foreign currency: You can spend money in your chosen currency.

✔️ Top-up on the go: Most prepaid cards have an app that allows you to add money, exchange multiple currencies and view transaction history in one place.

✔️ Good credit not required: Anyone can apply and use a prepaid multi-currency card and there are no credit checks .

❌️ Fees to cash withdrawals: Some prepaid cards charge you for cash withdrawals.

❌️ Other fees: Fees will vary between prepaid card providers, but there may be administration fees, monthly charges or other additional fees.

❌️ Limits: Some travel prepaid cards limit how much money you can hold on your prepaid card, and some cards have a minimum amount to deposit to use the card.

Best prepaid travel cards

Here are the best prepaid travel money cards:

1. Wise: Digital and physical cards available

- Application fees: One-time fee of £7

- Conversion Fees: Fixed fee + 1.75% after free allowance

- Minimum loading amount: No limit

- Cash withdrawal fee: Fee-free cash withdrawals up to £200 monthly

With the Wise Travel Money Card, you can use it straight away as a digital card.

If you want a physical card, there is a £7 delivery fee, but you can use a digital card instantly with Google Pay or Apple Pay. You can create up to three free digital cards.

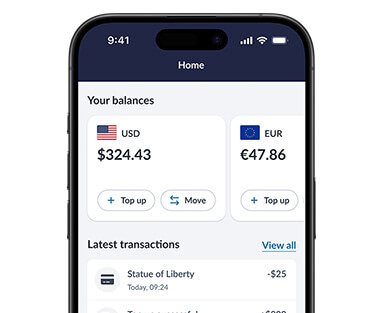

With the mid-market rate, you can top up your currency card from the Wise app . On the app, you can check your balance and transactions and receive spending notifications to see how much you spend to help you stay within your budget.

You can manage your Wise account from the mobile app or their website. You can exchange money for over 40 other currencies in real time. If you have leftover money from your holiday or your plans have changed, you can spend the money at home in the UK with a small conversion fee.

You can use your currency card to withdraw cash from over 3 million ATMs worldwide. You can use your currency card in more than 160 countries. The Wise prepaid travel money card is eco-friendly, biodegradable, reloadable, and has no subscription fee. There are no fees if you choose not to use the Wise travel card.

2. Asda Money Travel Money Card: Apply online or in store

- Application fees: None

- Conversion Fees: 5.75%

- Minimum loading amount: £50

- Cash withdrawal fee: Fee-free

You can apply for an Asda Money Travel Money Card online or in-store.

You can load up to 15 currencies and use your card contactless worldwide. You don't have to worry about cash withdrawal fees when you use this prepaid currency card; you can manage it on the go with the app. You can exchange 16 currencies with a fixed conversion fee.

You can top up via the app, online, or over the phone. You can top up while abroad, so you don't have to worry about running short of money. There are no fees when you spend in a currency preloaded to your card.

There is a £2 inactivity fee per month after 12 months. With this card, you can withdraw £500 a day, but the maximum it can hold is £5,000. This card has no link to your bank account for fraud protection.

Asda Travel Money Card is issued by PrePay Technologies Limited pursuant to a licence by Mastercard International. The Financial Conduct Authority authorises PrePay Technologies Limited under the Electronic Money Regulations 2011 .

3. Caxton Currency Card: Up to £12,000 on a card

- Conversion Fees: Live exchange rates

- Minimum loading amount: £10

- Cash withdrawal fee: Fee-free abroad, £1.50 for domestic ATM withdrawals and transactions

The daily cash withdrawal limit for the Caxton Currency Card is £300, and you can hold up to £12,000 on the prepaid card.

When you use this currency card abroad, you can make purchases fee-free with no worries. You can convert your money into 15 currencies with live exchange rates and hold multiple simultaneously.

You can use your Caxton prepaid card anywhere that accepts Mastercard; watch for the Mastercard Acceptance Mark. You can manage your finances from the mobile app as it allows you to check your card balance, top up, and block the card if you misplace it.

Caxton offers customer service that is live 24/7 to help with any of your issues or concerns. Caxton also runs an international trading online platform.

4. Easy FX Currency Card: Fee-free international cash withdrawals

- Conversion Fees: Exchange rate plus 1.8% for up to £1,000

- Cash withdrawal fee: International cash withdrawals are free

There are zero international fees when you use the EasyFX Personal Currency Card.

There is a £1.50 withdrawal fee for using a cash machine in the UK. You can benefit from highly competitive exchange rates and store multiple currencies on one account.

There are conversion fees with this currency card. However, the more money you convert, the lower the cost. You'll pay 1.8% on top of the exchange rate for conversion up to £1,000. The conversion fee lowers to 1.2% for up to £4,000.

As well as a currency card, you'll gain access to risk management tools provided by VFX Financial. You can manage your balances in real time on any device using the smart app or EasyFx website. If you don't use your card for 12 months, you'll be charged £2 monthly for inactivity.

5. Travelex Money Card: Use in millions of locations

- Application fees: One-time fee of £15

- Minimum loading amount: £50 in person and £100 online

- Cash withdrawal fee: None

The Travelex Travel Money Card allows you to use your card across millions of locations that accept Mastercard Prepaid. Look for the Mastercard International Incorporated logo when you're travelling, and you can use the Travelex Travel Money Card at those locations.

With the Travelex Money Card, you'll get free WiFi worldwide without worrying about roaming fees. There are no charges for withdrawing cash from an ATM overseas. You can exchange GBP into 15 other currencies with fixed exchange rates.

There is a monthly £2 inactivity fee. There is currently a giveaway running with Mastercard that's open until 30 September, where all you need to do is load £220 or more onto a Travelex Money Card. You'll enter into a prize draw to win a dream holiday.

6. Post Office Travel Money Card: No fee for spending abroad

- Cash withdrawal fee: Fees vary between locations

Carry up to 22 currencies with the Post Office Travel Money Card. Wherever you see the Mastercard Acceptance Mark , you can use this travel money card, including millions of shops, restaurants, and bars in over 200 countries.

There are cross-border fees of 3% when you use your currency in other countries than what the Post Office offers. There is also a load commission fee of 1.5%.

Use the Post Office accessible Travel app to top up, manage your prepaid card, transfer funds between currencies and more. You can connect your prepaid card to Apple Pay and Google Pay. If you return from your holiday with money left on your card in another currency, you can use the wallet-to-wallet feature and transfer it to a new currency you choose.

7. Sainsbury's Bank Prepaid Travel Money Card: Lower exchange rate for Nectar cardholders

You may get better exchange rates than a non-card holder if you're a Nectar cardholder and want to apply for Sainsbury's Prepaid Travel Money Card. If you hold a Nectar card, you can earn 500 bonus Nectar points when you load at least £250 onto your travel money card.

You can load money onto your card in 15 currencies at once. You can use your prepaid travel card to make purchases worldwide and withdraw cash without worrying about ATM fees.

You can check out all your transactions and load money onto the card with the Sainsbury's Bank travel money card app. There is no direct link to the prepaid card to your bank account, so you don't have to worry about security.

There is a 2% fee for loads and reloading into GBP purses. Additionally, if you don't use your card for 18 months, you may be charged a £2 inactivity fee.

8. FairFX Prepaid Card: Earn cashback in select retailers

- Application fees: Free

- Conversion Fees: 1.12%

- Cash withdrawal fee: £2 flat rate + 3.75% of the transaction amount

The FairFX Prepaid Card holds 20 major currencies, including GBP, Euros, US dollar, Japanese yen, Australian dollar, and more.

You can use this free multi-currency card in over 190 countries worldwide. You can top up on the go, either before you travel or whilst you're travelling.

Travel smarter with FairFX; when you become a customer, you can access offers and deals from partners to help your money take you further, for example, discounts on lounge access and more. You can earn 3.5% cashback in-store or online at select UK retailers.

If your car expires with a leftover balance, there will be a monthly £2 charge. Card renewal is free so that you can avoid expiration. There are no subscription fees or monthly fees.

Tips for looking after your money as you travel

Money is a massive element of travelling; it pays for your trips, food, and all the fun activities you get up to. A prepaid currency card can make your journey much more accessible.

We've compiled a list of further tips to help manage your finances a little more easily while you travel:

- Check the expiry date on the card: For any cards you take with you on your travels, ensure they're within the expiry date. Otherwise, you may be stuck without access to money. If your cards are close to expiring, consider contacting your provider and getting a new one sent out before you fly out.

- Travel insurance: Always travel with travel insurance to protect yourself and your belongings. Travel insurance can cover your medical costs if you become ill or have an accident.

- Check exchange rate: If you choose a prepaid card provider that uses live exchange rates, keep an eye on the exchange rates at specific types of the day.

- Top up your card online: If you're running low on holiday money, choose a prepaid travel card that allows you to top up online to add money to the card quickly.

- Check foreign exchange fee: Most prepaid travel cards offer minimum foreign exchange fees, but always check with the card provider for potential fees before you travel.

- Have card provider details at hand: If any issues occur, you should have the contact number or support team access to contact prepaid providers. If your card is stolen or you find fraudulent transactions on it, contact your provider, and it's worth alerting local police, too.

The verdict

A prepaid card is the ideal companion if you're someone who travels regularly and wants to be on control of tour cash.

They allow you to stay within budget, control your account from an app on your phone, and spend abroad without worrying too much about fees. With one of the prepaid currency cards from our best list, you can spend abroad securely and confidently.

Related Guides:

- 7 Cheapest Ways to Spend Money Abroad

- Best Avios Credit Cards

- Best Air Miles Credit Cards

- What Is Holiday Let Insurance?

Related posts:

- 7 Best International Banks for Expats: Pros & Cons in 2024

- Best Reward Current Accounts in 2024

- 6 Best Current Accounts UK With Cashback in 2024

- Tide Vs Starling Bank Full Review: Which is the #1 Choice?

- Revolut Vs Monzo – Which Is Best For You in 2024?

- Bank of England Base Rate Predictions for 2024

Is it Worth Getting a Prepaid Travel Card?

Using your debit card or usual bank account can accrue many travelling fees. With a prepaid card, you can stick to your budget with no credit options available and know all the fees involved before spending. You can spend without worrying about security, as your prepaid card has no direct link to your bank accounts. Prepaid cards are safer than cash and are accepted in most places. You can spend money in your chosen currency and top up on the go.

How Does a Prepaid Card Work?

You can top-up prepaid cards on the go, usually by an app, and you can use it in most places worldwide. It works similarly to a debit card, like how you use it to spend, but a prepaid card isn’t attached to a bank account, and anyone can use one.

What is the Best Travel Money Card?

The Wise Travel Money Card is at the top of our best travel money card list. There is no minimum loading fee; you make free monthly cash withdrawals of up to £200. While waiting for your card to be delivered, you can use your balance immediately as a digital card with Google Pay or Apple Pay. You can create up to three free digital cards. You can use your currency card to withdraw cash from over 3 million ATMs worldwide.

Related Articles

Mentioned Banks

Get Bank Deals & More

Sign up for our email updates on the best bank deals, money savings tips and more.

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

- Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

- Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

The savvy way to pay on holiday Travel Money Card

A safe-to-use, prepaid, reloadable, multi-currency card that’s not linked to your bank account

No charges when you spend abroad*

Make contactless, Apple Pay and Google Pay™ payments

Manage your account and top up or freeze your card easily with our Travel app

*No charges when you spend abroad using an available balance of a local currency supported by the card.

Why get a Travel Money Card?

Carry up to 22 currencies safely.

Take one secure, prepaid Mastercard® away with you that holds multiple currencies (see ‘common questions’ for which).

Accepted in over 36 million locations worldwide

Use it wherever you see the Mastercard Acceptance Mark – millions of shops, restaurants and bars in more than 200 countries.

Manage your card with our travel app

Top up, manage or freeze your card, transfer funds between currencies, view your PIN and more all in our free Travel app .

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

It’s simple to get started

No need to carry lots of cash abroad. Order a Travel Money Card today for smart, secure holiday spending.

Order your card

Order online, via the app or pick one up in branch and load it with any of the 22 currencies it holds.

Activate it

Cards ordered online and in-app should arrive within 2-3 working days. Activate it by following the instructions in your welcome letter.

It’s ready to use

Spend in 36 million locations worldwide, and top up and manage your card in the app or online.

What is Post Office Travel Money Card?

Discover how easy our Travel Money Card makes managing your spending aboard

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Order a Travel Money Card

Order your card online – or through the Post Office travel app – and we'll deliver it within 2-3 days. Just activate it and go.

Need it quick? Visit a branch

Pick up a Travel Money Card instantly at your local Post Office. Bring a valid passport, UK driving licence or valid EEA card as ID.

Need some help?

We’re here to help you make the most of your Travel Money Card – or put your mind at ease if it’s been lost or stolen

Lost or stolen card?

Please immediately call: 020 7937 0280

Available 24/7

To read our FAQs, manage your card or contact us about using it:

Visit our Travel Money Card support page

Common questions

How can i order my card.

There are three ways that you able to obtain a Travel Money Card, each very simple.

Please note, you must be a UK resident over the age of 18 to obtain a Travel Monday Card.

- Via our travel app: you can order and store up to three Travel Money Cards in our free travel app . Delivery will take 2-3 working days.

- Online: follow our application process to order your card online. Your card will take 2-3 working days to be delivered. Once it arrives you can link it to our Travel app to manage on the go.

- In branch: simply find a nearby Post Office branch and pop in to get your Travel Money Card there. Please remember to take a valid passport, UK driving licence or a valid EEA card in order to obtain your card, and you can take it away the same day.

Whichever way you choose to order your card, don't forget to activate it once it arrives. Full details of how to activate your card will be provided in your welcome letter, to which your card will be attached if it’s been sent in the post.

How do I use my card?

Travel Money Card is enabled with both chip & PIN and contactless, so you can make larger and lower-value value payments with it respectively. For convenience, you can also add it to Apple Pay and Google Wallet.

You can load it with between £50 and £5,000 (see more on load limits below). You can use it to pay wherever the Mastercard Acceptance Mark is displayed. And you can withdraw cash with it at over 2 million ATMs worldwide (charges and fees apply, see 'Are there top-up limits?' below).

Your Travel Money Card is completely separate from your bank account so it’s a safe and secure way to pay while you’re abroad.

How can I manage my card?

After you've activated your card, you can manage it using our travel app or via a web browser. You can check your recent transactions, view your PIN, transfer funds between different currency ‘wallets’, top up your card, freeze your card and more.

Our travel app brings together travel essentials including holiday money, travel insurance and more together in one place. As well as managing your Travel Money Card you can buy cover for your trip, access your policy documents on the move, book extras such as airport parking and hotels, and find your nearest ATM while overseas or Post Office branches here in the UK.

Which currencies can I use?

The Post Office Travel Money Card can be loaded with up to 22 currencies at any one time. You can top up funds on the card and transfer currencies between different ‘wallets’ for these currencies easily in our travel app or online.

Currencies available:

- EUR – euro

- USD – US dollar

- AUD – Australian dollar

- AED - UAE dirham

- CAD – Canadian dollar

- CHF – Swiss franc

- CNY – Chinese yuan

- CZK – Czech koruna

- DKK – Danish krone

- GBP – pound sterling

- HKD – Hong Kong dollar

- HUF – Hungarian forint

- JPY – Japanese yen

- NOK – Norwegian krone

- NZD – New Zealand dollar

- PLN – Polish zloty

- SAR – Saudi riyal

- SEK – Swedish Krona

- SGD – Singapore dollar

- THB – Thai baht

- TRY – Turkish lira

- ZAR – South African rand

What are the charges and fees?

Full details of our charges and fees can be found in our Travel Money Card terms and conditions .

The Post Office Travel Money Card is intended for use in the countries where the national currency is the same as the currencies on your card. If the currency falls outside of any of the 22 we offer on your card, you’ll be charged a cross-border fee. For example, using your card in Brazil will incur a cross-border fee because we do not offer the Brazilian real as a currency.

Cross border fees are set at 3% and are only applicable when you use your currency in a country other than the ones we offer.

For more information on cross border fees, please visit our cross border payment page.

There are no charges when using your card in retailers in the country of the currency on the card. This means that a €20 purchase in Spain would cost you €20 and will be deducted from your euro balance.

To avoid unnecessary charges to your card, wherever asked, you should always choose to pay for goods or withdraw cash in the currencies of your card. For example, if you are using the card in Spain you should always choose to pay in euro if offered a choice; choosing to pay in sterling (GBP) in this example would allow the merchant to exchange your transaction from euro to sterling. This would mean your transaction has gone through two exchange rate conversions, which will increase the total cost of your transaction.

For loads in Great British pounds, a load commission fee of 1.5% will apply (min £3, max £50). A monthly maintenance fee of £2 will be deducted from your balance 12 months after your card expires. Expiration dates can be found on your TMC; all cards are valid for up to 3 years.

A cash withdrawal fee will be charged when withdrawing cash from a UK Post Office branch or from any ATM globally that accepts Mastercard. Some ATM owners will charge their own fees for withdrawing cash, these are in addition to the fees that we charge.

We have listed all available currencies and their associated withdrawal limits and charges below:

EUR – euro Max daily cash withdrawal: 450 EUR Withdrawal charge: 2 EUR

USD – US dollar Max daily cash withdrawal: 500 USD Withdrawal charge: 2.5 USD

AED – UAE dirham Max daily cash withdrawal: 1,700 AED Withdrawal charge: 8.5 AED

AUD – Australian dollar Max daily cash withdrawal: 700 AUD Withdrawal charge: 3 AUD

CAD – Canadian dollar Max daily cash withdrawal: 600 CAD Withdrawal charge: 3 CAD

CHF – Swiss franc Max daily cash withdrawal: 500 CHF Withdrawal charge: 2.5 CHF

CNY – Chinese yuan Max daily cash withdrawal: 2,500 CNY Withdrawal charge: 15 CNY

CZK – Czech koruna Max daily cash withdrawal: 9,000 CZK Withdrawal charge: 50 CZK

DKK – Danish krone Max daily cash withdrawal: 2,500 DKK Withdrawal charge: 12.50 DKK

GBP – Great British pound Max daily cash withdrawal: 300 GBP Withdrawal charge: 1.5 GBP

HKD – Hong Kong dollar Max daily cash withdrawal: 3,000 HKD Withdrawal charge: 15 HKD

HUF – Hungarian forint Max daily cash withdrawal: 110,000 HUF Withdrawal charge: 600 HUF

JPY – Japanese yen Max daily cash withdrawal: 40,000 JPY Withdrawal charge: 200 JPY

NOK – Norwegian krone Max daily cash withdrawal: 3,250 NOK Withdrawal charge: 20 NOK

NZD – New Zealand dollar Max daily cash withdrawal: 750 NZD Withdrawal charge: 3.5 NZD

PLN – Polish zloty Max daily cash withdrawal: 1,700 PLN Withdrawal charge: 8.5 PLN

SAR – Saudi riyal Max daily cash withdrawal: 1,500 SAR Withdrawal charge: 7.50 SAR

SEK – Swedish Krona Max daily cash withdrawal: 3,500 SEK Withdrawal charge: 20 SEK

SGD – Singapore dollar Max daily cash withdrawal: 500 SGD Withdrawal charge: 3 SGD

THB – Thai baht Max daily cash withdrawal: 17,000 THB Withdrawal charge: 80 THB

TRY – Turkish lira Max daily cash withdrawal: 1,500 TRY Withdrawal charge: 7 TRY

ZAR – South African rand Max daily cash withdrawal: 6,500 ZAR Withdrawal charge: 30 ZAR

Are there top-up limits?

Yes, all currencies have top-up limits and balances. See full information below, which is applicable to all currencies available on the Travel Money Card.

- Top-up limit: minimum £50 – maximum £5,000

- Maximum balance: £10,000 at any time, with a maximum annual balance of £30,000

- Read more Travel Money Card FAQs

Other related services

From European hotspots to far-flung destinations, UK travellers are making ...

One of the joys of summer are the many music festivals playing across the ...

We all look forward to our holidays. Unfortunately, though, more and more ...

Travelling abroad? These tips will help you get sorted with your foreign ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Looking to enjoy the sunshine without breaking the bank? New research from Post ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Our annual survey of European ski resorts compares local prices for adults and ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

Eastern Europe leads the way for the best value city breaks this year. And ...

Going on holiday is an exciting time for families. To make sure it stays fun, ...

Find out more information by reading the Post Office Travel Money Card's terms and conditions .

Post Office Travel Money Card is an electronic money product issued by First Rate Exchange Services Ltd pursuant to license by Mastercard International. First Rate Exchange Services Ltd, a company registered in England and Wales with number 4287490 whose registered office is Great West House, Great West Road, Brentford, TW8 9DF, (Financial Services Register No. 900412). Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Post Office and the Post Office logo are registered trademarks of Post Office Limited.

Post Office Limited is registered in England and Wales. Registered number 2154540. Registered office: 100 Wood Street, London, EC2V 7ER.

These details can be checked on the Financial Services Register by visiting the Financial Conduct Authority website and searching by Firm Reference Number (FRN).

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

6 Best Travel Cards for the UK

Getting an international travel card before you travel to the UK can make it cheaper and more convenient when you spend in British Pound Sterling. You'll be able to easily top up your card in USD before you leave the US, to convert seamlessly to GBP for secure and flexible spending and withdrawals.

This guide walks through our picks of the best travel cards available for anyone from the US heading to the UK, like Wise or Revolut. We'll walk through a head to head comparison, and a detailed look at their features, benefits and drawbacks.

6 best travel money cards for the UK:

Let's kick off our roundup of the best travel cards for the UK with a head to head comparison on important features. Here's an overview of the providers we've picked to look at, for customers looking for ways to spend conveniently overseas when travelling from the US:

Each of the international travel cards we’ve picked out have their own features and fees, which may mean they suit different customer needs. Keep reading to learn more about the features, advantages and disadvantages of each - plus a look at how to order the travel card of your choice before you head off to the UK.

Wise travel card

Open a Wise account online or in the Wise app, to order a Wise travel card you can use for convenient spending and withdrawals in the UK. Wise accounts can hold 40+ currencies, so you can top up in USD easily from your bank or using your card. Whenever you travel, to the UK or beyond, you’ll have the option to convert to the currency you need in advance if it’s supported for holding a balance, or simply let the card do the conversion at the point of payment.

In either case you’ll get the mid-market exchange rate with low, transparent fees whenever you spend in GBP, plus some free ATM withdrawals every month - perfect if you’re looking for easy ways to arrange your travel cash.

Wise features

Wise travel card pros and cons.

- Hold and exchange 40+ currencies with the mid-market rate

- Spend seamlessly in GBP when you travel

- Some free ATM withdrawals every month, for those times only cash will do

- Ways to receive payments to your Wise account conveniently

- Manage your account and card from your phone

- 9 USD delivery fee for your first card

- ATM fees apply once you've exhausted your monthly free withdrawals

- Physical cards may take 14 - 21 days to arrive

How to apply for a Wise card

Here’s how to apply for a Wise account and order a Wise travel card in the US:

Open the Wise app or desktop site

Select Register and confirm you want to open a personal account

Register with your email, Facebook, Apple or Google ID

Upload your ID document to complete the verification step

Tap the Cards tab to order your card

Pay the one time 9 USD fee, confirm your mailing address, and your card will be on the way, and should arrive in 14 - 21 days

Revolut travel card

Choose a Revolut account, from the Standard plan which has no monthly fee, to higher tier options which have monthly charges but unlock extra features and benefits. All accounts come with a smart Revolut card you can use in the UK, with some no fee ATM withdrawals and currency conversion monthly, depending on the plan you pick. Use your Revolut account to hold and exchange 25+ currencies, and get extras like account options for under 18s, budgeting tools and more.

Revolut features

Revolut travel card pros and cons.

- Pick the Revolut account plan that suits your spending needs

- Hold and exchange 25+ currencies, and spend in 150 countries

- Accounts come with different card types, depending on which you select

- All accounts have some no fee currency exchange and some no fee ATM withdrawals monthly

- Some account tiers have travel perks like complimentary or discounted lounge access

- You need to upgrade to an account with a monthly fee to get all account features

- Delivery fees may apply for your travel card

- Fair usage limits apply once you exhaust your currency conversion and ATM no fee allowances

- Out of hours currency conversion has additional fees

How to apply for a Revolut card

Set up your Revolut account before you leave the US and order your travel card. Here’s how:

Download and open the Revolut app

Register by adding your personal and contact information

Follow the prompts to confirm your address and order your card

Pay any required delivery fee - costs depend on your account type

Chime travel card

Use your Chime account and card to spend in the UK with no foreign transaction fee. You’ll just need to load a balance in USD and then the money is converted to GBP instantly with the Visa rate whenever you spend or make a withdrawal. There’s a fee to make an ATM withdrawal out of network, which sits at 2.5 USD, but there are very few other costs to worry about. Plus you can get lots of extra services from Chime if you need them, such as ways to save.

Chime features

Chime travel card pros and cons.

- No Chime foreign transaction fees

- No ongoing charges for your account

- Lots of extra products and services if you need them

- Easy ways to manage your money online and in app

- Virtual cards available

- You'll need to inform Chime you're traveling to use your card abroad

- Low ATM limits

- Cards take 7 - 10 days to arrive by mail

How to apply for a Chime card

Here’s how to apply for a Chime account and order a travel card in the US:

Visit the Chime website or download the app

Click Get started and add your personal details

Add a balance

Your card will be delivered in the mail and you can use your virtual card instantly

Monzo travel card

Monzo cards can be ordered easily in the US and used for spending in the UK and globally. Monzo accounts are designed for holding USD only - but you can spend in GBP and pretty much any other currency easily, with no foreign transaction fee. Your funds are just converted using the network exchange rate whenever you pay or make a withdrawal.

Monzo doesn’t usually apply ATM fees, but it’s worth knowing that the operator of the specific ATM you pick may have their own costs you’ll need to check out.

Monzo features

Monzo travel card pros and cons.

- Good selection of services available

- No foreign transaction fee to pay

- No Monzo ATM fee to pay

- Manage your card from your phone conveniently

- Deposits are FDIC protected

- You can't hold a foreign currency balance

- ATM operators might apply their own fees

How to apply for a Monzo card

Here’s how to apply for a Monzo account and order a travel card in the US:

Visit the Monzo website or download the app

Click Get Sign up and add your personal details

Check and confirm your mailing address and your card will be delivered in the mail

Netspend travel card

Netspend has a selection of prepaid debit cards you can use for spending securely in the UK. While these cards don’t usually let you hold a balance in GBP, they’re popular with travelers as they’re not linked to your regular checking account. That increases security overseas - plus, Netspend offers virtual cards you can use to hide your physical card details from retailers if you want to.

The options with Netspend vary a lot depending on the card you pick. Usually you can top up digitally or in cash in USD and then spend overseas with a fixed foreign transaction fee applying every time you spend in a foreign currency. You’ll be able to view the terms and conditions of your specific card - including the fees - online, by entering the code you’ll find when your card is sent to you.

Netspend features

Netspend travel card pros and cons.

- Large selection of different card options depending on your needs

- Some cards have no overseas ATM fees

- Prepaid card which is secure to use overseas

- Manage your account in app

- Change from one card plan to another if you need to

- You may pay a monthly fee for your card

- Some cards have foreign transaction fees for all overseas use, which can be around 4%

- Selection of fees apply depending on the card you pick

How to apply for a Netspend card

Here’s how to apply for a Netspend account and order a travel card in the US:

Visit the Netspend website

Click Apply now

Complete the details, following the onscreen prompts

Get verified

Your card will arrive by mail - add a balance and activate it to get started

PayPal travel card

PayPal has a debit card you can link to your PayPal balance account, to spend in the UK as well as locally, in person and online. One advantage of PayPal is that there are lots of easy ways to add money in USD - but bear in mind that when you spend in GBP you’ll likely pay a foreign transaction fee of 2.5%. ATM fees apply when you make out of network withdrawals, too, which can push up the costs depending on how you use your card.

PayPal travel cards aren’t connected to your checking account which makes them a handy and secure way to spend, particularly if you already have a PayPal balance account.

PayPal features

Paypal travel card pros and cons.

- Globally accepted card

- Easy ways to top up your PayPal balance including cash and check

- Popular and reliable provider

- Use your card for spending online easily as well

- 2.5 USD fee for out of network ATM withdrawals

- 2.5% fee when you spend in a foreign currency

- Other charges may apply depending on how you fund and use your account

How to apply for a PayPal card

Here’s how to apply for a PayPal account and order a travel card in the US:

Visit the PayPal website or download the app

Click Get Sign up or log into your existing account

Add your personal details to create an account, or tap Request a card if you already have a PayPal account

Follow the prompts to order your card

What is a travel money card?

A travel money card is a card you can use for secure and convenient payments and withdrawals overseas.

You can use a travel money card to tap and pay in stores and restaurants, with a wallet like Apple Pay, or to make ATM withdrawals so you'll always have a bit of cash in your pocket when you travel.

Although there are lots of different travel money cards on the market, all of which are unique, one similarity you'll spot is that the features and fees have always been optimised for international use. That might mean you get a better exchange rate compared to using your normal card overseas, or that you run into fewer fees for common international transactions like ATM withdrawals.

Travel money cards also offer distinct benefits when it comes to security. Your travel money card isn't linked to your United States Dollar everyday account, so even if you were unlucky and had your card stolen, your primary bank account remains secure.

Travel money vs prepaid card vs travel credit card

It's helpful to know that you'll be able to pick from several different types of travel cards, depending on your priorities and preferences. Travel cards commonly include:

- Travel debit cards

- Travel prepaid cards

- Travel credit cards

They all have distinct benefits when you head off to the UK or elsewhere in the world, but they do work a bit differently.

Travel debit and prepaid cards are usually linked to an online account, and may come from specialist digital providers - like the Wise card. These cards are usually flexible and cheap to use. You'll be able to manage your account and card through an app or on the web.

Travel credit cards are different and may suit different customer needs. As with any other credit card, you may need to pay an annual fee or interest and penalties depending on how you manage your account - but you could also earn extra rewards when spending in a foreign currency, or travel benefits like free insurance for example. Generally using a travel credit card can be more expensive compared to a debit or prepaid card - but it does let you spread out the costs of your travel across several months if you'd like to and don't mind paying interest to do so.

What is a prepaid travel money card best for?

Let's take a look at the advantages of using a prepaid travel money card for travellers going to the UK. While each travel card is a little different, you'll usually find some or all of the following benefits:

- Hold and exchange foreign currencies - allowing you to lock in exchange rates and set a travel budget before you leave

- Convenient for spending in person and through mobile wallets like Apple Pay, as well as for cash withdrawals

- You may find you get a better exchange rate compared to your bank - and you'll usually be able to avoid any foreign transaction fee, too

- Travel cards are secure as they're not linked to your everyday USD account - and because you can make ATM withdrawals when you need to, you can also avoid carrying too much cash at once

Overall, travel cards offer flexible and low cost ways to avoid bank foreign transaction and international ATM fees, while accessing decent exchange rates.

How to choose the best travel card for the UK

We've picked out 6 great travel cards available in the US - but there are also more options available, which can make choosing a daunting task. Some things to consider when picking a travel card for the UK include:

- What exchange rates does the card use? Choosing one with the mid-market rate or as close as possible to it is usually a smart plan

- What fees are unavoidable? For example, ATM charges or top up fees for your preferred top up methods

- Does the card support a good range of currencies? Getting a card which allows you to hold and spend in GBP can give you the most flexibility, but it's also a good idea to pick a card with lots of currency options, so you can use it again in future, too

- Are there any other charges? Check in particular for foreign transaction fees, local ATM withdrawal fees, inactivity fees and account close fees

Ultimately the right card for you will depend on your specific needs and preferences.

What makes a good travel card for the UK

The best travel debit card for the UK really depends on your personal preferences and how you like to manage your money.

Overall, it pays to look for a card which lets you minimise fees and access favourable exchange rates - ideally the mid-market rate. While currency exchange rates do change all the time, the mid-market rate is a good benchmark to use as it’s the one available to banks when trading on wholesale markets. Getting this rate, with transparent conversion fees, makes it easier to compare costs and see exactly what you’re paying when you spend in GBP.

Other features and benefits to look out for include low ATM withdrawal fees, complimentary travel insurance, airport lounge access or emergency cash if your card is stolen. It’s also important to look into the security features of any travel card you might pick for the UK. Look for a card which uses 2 factor authentication when accessing the account app, which allows you to set instant transaction notifications, and which has easy ways to freeze, unfreeze and cancel your card with your phone.

For the UK in particular, choosing a card which offers contactless payments and which is compatible with mobile wallets like Apple Pay could be a good plan. Card payments are extremely popular in the UK - so having a card which lets you tap and pay easily can speed things up and make it more convenient during your trip.

Ways to pay in the UK

Cash and card payments - including contactless, mobile wallet, debit, credit and prepaid card payments - are the most popular ways to pay globally.

In the UK card payments are common in most situations. You’ll be able to make Chip and PIN or contactless payments or use your favourite mobile wallet like Apple Pay to tap and pay on the go. It’s still worth having a little cash on you just in case - and for the odd situations where cash is more convenient, such as when tipping or buying a small item in a market.

Which countries use GBP?

If you have GBP, you should be able to use it in a few countries. You may decide to keep your travel card topped up with a balance for this trip to the UK or for the next time you’re headed somewhere which uses GBP.

What should you be aware of when travelling to the UK

You’re sure to have a great time in the UK - but whenever you’re travelling abroad it's worth putting in a little advance thought to make sure everything is organised and your trip goes smoothly. Here are a few things to think about:

1. Double check the latest entry requirements and visas - rules can change abruptly, so even if you’re been to the UK before it’s worth looking up the most recent entry requirements so you don’t have any hassle on the border

2. Plan your currency exchange and payment methods - you can change USD to GBP before you travel to the UK if you’d like to, but as card payments are common, and ATMs widely available, you can actually leave it until you arrive to get everything sorted as long as you have a travel money card. Top up your travel money card in USD and either exchange to GBP in advance or at the point of payment, and make ATM withdrawals whenever you need cash. Bear in mind that currency exchange at the airport will be expensive - so hold on until you reach the UK to make an ATM withdrawal in GBP if you can.

3. Get clued up on any health or safety concerns - get travel insurance before you leave the US so you have peace of mind. It’s also worth reading up on any common scams or issues experienced by tourists. These tend to change over time, but may include things like rip off taxis or tour agents which don’t offer fair prices or adequate services.

Conclusion - Best travel cards for the UK

Ultimately the best travel card for your trip to the UK will depend on how you like to manage your money. Use this guide to get some insights into the most popular options out there, and to decide which may suit your specific needs.

How does a British Pound Sterling card work?

Getting a British Pound Sterling card can make managing your money easier when you travel to the UK.

Your British Pound Sterling card will be linked to a digital account you can manage from your phone, so you'll always be able to see your balance, get transaction notifications and manage your card no matter where you are. Just add money to your account in pounds, and - depending on your preferences and the specific card you pick - you can either convert your balance to British Pound Sterling instantly, or just let the card do the conversion when you spend or make a withdrawal.

If your card gives you the option to hold a British Pound Sterling balance, there's not normally any extra fee to spend the British Pound Sterling you have in your account when you're in the UK.

Can I withdraw British Pound Sterling currency with my card in the UK?

With some cards, you'll be able to add money to your card in United States Dollar, and then convert to British Pound Sterling instantly online or in your card's app.

Once you have a balance in British Pound Sterling you can spend with your card with no extra fees - just tap and pay as you would at home. You'll also be able to make cash withdrawals whenever you need to, with no extra conversion fee to pay. Your card - or the ATM operator - may charge a withdrawal fee, but this can still be a cheap, secure and convenient option for getting cash when you need it.

With other cards, you can't hold a balance in British Pound Sterling on your card - but you can leave your money in United States Dollar and let the card convert your money for you when you spend and withdraw.

Some fees may apply here - including currency conversion or foreign transaction charges - so do compare a few different cards before you sign up, to make sure you're picking the one which best suits your specific spending needs.

Bear in mind though, that not all cards support all currencies - and the range of currencies available with any given card can change from time to time. If your card doesn't let you hold a balance in British Pound Sterling you might find that fees apply when you spend in the UK, so it's well worth double checking your card's terms and conditions - and comparing the options available from other providers - before you travel, just in case.

Why should I get a British Pound Sterling card?

Getting a British Pound Sterling card means you can spend like a local when you're in the UK. You'll be able to check your British Pound Sterling balance at a glance, add and convert money on the move, and use your card for secure spending and withdrawals whenever you need to. Best of all, British Pound Sterling cards from popular providers often offer good exchange rates and low, transparent fees, which can mean your money goes further when you're on a trip abroad.

FAQ - best travel cards for the UK

When you use a travel money card you may find there’s an ATM withdrawal fee from your card issuer, and there may also be a cost applied by the ATM operator. Some of our travel cards - like the Wise and Revolut card options - have some no fee ATM withdrawals every month, which can help keep down costs.

Travel money cards may be debit, prepaid or credit cards. Which is best for you will depend on your personal preferences. Debit and prepaid cards are usually pretty cheap and secure to spend with, while credit cards may have higher fees but often come with extra perks like free travel insurance and extra reward points.

There’s no single best prepaid card for international use. Look out for one which supports a large range of currencies, with good exchange rates and low fees. This guide can help you compare some popular options, including Wise, Revolut and Monzo.

Yes, you can use your local debit card when you’re overseas. However, it’s common to find extra fees apply when spending in foreign currencies with a regular debit card. These can include foreign transaction fees and international ATM charges.

Usually having a selection of ways to pay - including a travel card, your credit or debit card, and some cash - is the best bet. That means that no matter what happens, you have an alternative payment method you can use conveniently.

Yes. Most travel debit cards have options to make ATM withdrawals. Check the fees that apply as card charges do vary a lot. Some cards have local and international fees on all withdrawals, while others like Wise and Revolut, let you make some no fee withdrawals monthly before a fee kicks in.

Both Visa and Mastercard are globally accepted. Look out for the logo on ATMs and payment terminals in the UK.

The cards you see on this page are ordered as follows:

For card providers that publish their exchange rates on their website, we used their USD / GBP rate to calculate how much British Pound Sterling you would receive when exchanging / spending $4,000 USD. The card provider offering the most GBP is displayed at the top, the next highest below that, and so on.

The rates were collected at 09:36:26 GMT on 25 May 2024.

Below this we display card providers for which we could not verify their exchange rates. These are displayed in alphabetical order.

Send international money transfer

More travel card guides.

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

Travel Cards: What are the best options in the UK? 2024

If you’re expecting to spend overseas - on holiday, when shopping online with international retailers, or even because you’re relocating to sunnier climes - you’ll want to find the cheapest and most convenient way to manage your money.

One option is to pick an international debit card - but are they really worth it? This guide covers all you need to know about:

How international debit cards can help cut bank fees and get a better exchange rate

What advantages there are to having an international debit card compared to a regular bank card

How international debit cards work

Which are the best travel and international debit cards available in the UK

Let’s dive right in.

Our Top 4 Travel Debit Cards in the UK:

Wise Travel Card

Post Office Travel Card

ASDA Travel Card

Sainsbury's Travel Card

Travel debit cards: the best options in the UK

How do travel cards work.

Travel debit cards allow you to spend and make withdrawals in a foreign currency easily - and often, for a lower fee compared to using a regular bank debit or credit card.

That means you can use your travel debit card when you travel internationally, to pay for your accommodation, food, shopping - and whatever else you plan to do. You can use your card to make cash withdrawals overseas to make sure you always have a ready supply of foreign currency for when cards aren’t accepted. And finally, you can use your travel card when you shop online with international retailers, to cut the costs of foreign transaction fees.

Types of travel card

You’ll find that there are 3 main types of travel cards that traditional banks offer : prepaid cards, debit cards, and credit cards. Each has its own advantages and disadvantages - make sure you research carefully to find the cheapest option for your spending. Here’s a rundown of some common travel card options for UK customers.

1. Prepaid travel card

Prepaid travel cards - also often known as travel money cards - are offered by a wide range of providers. You’ll top up your card in pounds before you travel, and then you can use your card to spend or make withdrawals when you’re away. Some cards also allow you to add funds online, so you can top up your card after you leave too.

Different prepaid travel cards have their own fee structures, with some charging for top ups, or having ongoing maintenance fees. Check out all the details, including the exchange rates available before you pick one.

2. International card with traditional banks

Most UK based banks which offer a linked debit card will allow you to spend and make withdrawals around the world. However, it’s extremely common to find that there are some extra fees to spend in a foreign currency - often including an exchange rate markup or foreign transaction fee of around 3%.

In the UK you can find the occasional bank or building society which offers a linked debit card with no foreign transaction fee - like the Virgin Money M Plus account, or the Cumberland Building Society Plus Account. However, these specialist accounts do often have other restrictive terms such as minimum balance requirements, or high transaction fees for other services.

You can also choose to spend internationally with your bank issued credit card - but this does risk higher overall fees once you take into account credit costs and any cash advance fees you run into, on top of foreign transaction charges.

3. Travel card with neobanks

You’ll often find that a travel card from a modern online provider - often called a neobank - is the cheapest and most convenient option. Accounts are usually simple to set up, and it’s easy to order your card online or in the provider app. Once you’re up and running you’ll often find you get a better exchange rate than the rate offered by your normal bank - or even the mid-market exchange rate with no markup at all.

Because neobanks are often specialists which operate online and don’t have the same overheads as traditional banks, you can often net a better deal, including no minimum balance requirements, ongoing charges or maintenance costs.

Best travel debit cards: a comparison

Shopping around is the best way to get the right travel card for your needs. There are several travel card providers in the UK which can offer a better deal compared to traditional banks, including online specialist services like Wise. Here’s a more detailed look at some of our top picks.

The Wise card allows you to make payments in more than 200 countries and in more than 150 currencies. Your card is linked to a handy Wise multi-currency account, which lets you hold, convert, send and spend in dozens of currencies, and manage your money on the go from your smartphone.

Pros of the Wise card

No minimum balance or ongoing charges

Hold and exchange 50+ currencies in your Wise account

Auto convert feature will make sure you always get the best possible deal on currency conversion

Manage your card in the Wise app, to freeze and unfreeze the card and get instant transaction notifications

Physical and virtual cards available

Cons of the Wise card

5 GBP fee for your first card

ATM fees apply if you make frequent withdrawals

Spending limits apply

No option to top up account in cash

Post office travel card

Apply for a Post Office travel card online, or by visiting your local Post Office branch with a government issued ID document. You’ll be able to hold 23 currencies in your account, and it’s free to spend any supported currency. Contactless and mobile payments are supported - but there are some fees you’ll need to watch out for, including ATM withdrawal charges.

Pros of the Post Office travel money card

Apply online or in person

Hold and exchange 23 currencies

No fee to spend currencies you hold in the account

Cons of the Post Office travel money card

3% foreign transaction fee if you spend in an unsupported currency

Cash withdrawal fees apply which vary by currency

Monthly maintenance fees apply from 12 months after your card applies

Read our full Post Office travel card review .

ASDA Money Travel Card

You can order an ASDA Money Travel Card online or by visiting a store which has an ASDA Money bureau. Your travel card can hold 16 currencies, and it’s free to spend in any of these currencies, including making ATM withdrawals. It’s worth noting that topping up your account in pounds comes with a fee, and there’s a steep charge for spending in a currency not supported by the card, so you’ll want to double check the currencies you require are all covered.

Pros of the ASDA travel card

24/7 global assistance

Hold up to 16 currencies

Contactless payments supported

No fee for ATM withdrawals

Cons of the ASDA travel card

2% fee to top up in pounds

High fees of 5.75% if you spend in a currency not supported by the card

Inactivity fees of 2 GBP/month apply after 12 months

Sainsbury Bank travel money card

It’s free to get the Sainsbury’s travel card, and it’s free and easy to make contactless payments in any of the 10 supported foreign currencies. You can also make ATM withdrawals in supported currencies without being charged a fee by Sainsbury’s. There are a few costs to watch out for though, including a GBP reload fee, and a high foreign transaction fee if you’re spending in any currency other than the 10 supported currencies.

Pros of the Sainsbury Bank travel money card

Hold up to 10 foreign currencies

Free to spend any currency you hold

Card will deduct funds from the correct balance when you spend in a supported currency, to avoid unnecessary fees

Cons of the Sainsbury Bank travel money card

Inactivity fees of 2 GBP/month apply after 18 months

Advantages of the travel debit cards

Getting an international debit card can be a good alternative to using traditional bank cards to spend money abroad. Advantages include:

Top up your account or card in advance to set a travel budget

Know the exchange rates in advance so there are no surprises

No need to tell your bank you’re travelling

Manage your money online or in an app for convenience

Overall costs are often far lower compared to using a bank

Are there any limitations on travel debit cards?

Travel debit cards aren’t right for everyone - here are a few drawbacks to consider:

Spending currencies not supported by the card can incur fees

You can’t always use your travel card for car rental as it’s not likely to have a credit facility

Some transactions - like paying at the pump for petrol - may result in a hold on funds within your account

Adding funds to your account may not be instant

How does a travel card work?

A travel debit card works similarly to a normal bank debit card in some ways:

Pay with your card directly with merchants - often with contactless functionality

Withdraw cash when you need it from ATMs

Check your balance online, in an app, or via an ATM easily to keep an eye on your money

Funds are deducted from your balance so there’s no worry about running up credit charges

However, travel debit cards have a few distinct advantages compared to regular bank cards:

Cards can often be ordered easily online or by phone

Top up your account whenever you like, to create a separate travel budget

Convert your pounds to foreign currencies in advance so you know the exchange rate before you spend

You’ll often get a better exchange rate compared to a bank, with lower transaction fees

There’s no need to tell the card issuer that you plan to travel

How can I use a travel debit card abroad?

Once you have your travel debit card, you’ll be able to start spending. You’ll need to double check that the merchant or ATM accepts the card network your card uses - Visa and Mastercard are most common, and are widely accepted internationally. You’ll also need to read through the card terms and conditions to make sure you’re aware of any fees that the card issuer applies when you spend or make withdrawals

One other important point when using an international travel card is to watch out for dynamic currency conversion (DCC). That’s when you’re asked by a merchant, or at an ATM terminal, if you’d rather pay in pounds or the local currency wherever you are. If you choose to pay in pounds you’ll usually be hit by high fees and a poor exchange rate - well worth avoiding if you want to make the most of your travel money. Always choose to pay in the local currency to get the best possible deal when spending or withdrawing with your travel card.

How to request a travel debit card

If you’re looking for a specialist travel debit card which lets you spend conveniently while cutting your costs, you may find the best available deal from an online provider such as Wise or Revolut . Signing up for an account is pretty painless, and can be done entirely online or through an app - and you’ll usually find the fees are lower compared to a traditional bank, too.

To show how easy it is, let’s take a look at how to sign up for a Wise card - we’ll cover Wise and a few other top UK travel debit card options in more detail, later:

Download the Wise app or head to the Wise desktop site

Sign up for a Wise account with just an email address, Google, Facebook or Apple ID

Get verified by uploading a photo of your ID documents

Order your card online or in the Wise app for a one time 5 GBP fee

Your physical card will arrive within a few days - or you can access your card details in the Wise app right away for mobile payments

What are the transaction fees which apply to a travel card?

Travel debit cards can offer a better deal when you spend in foreign currencies - but that doesn’t necessarily mean they’re entirely free. Here are a couple of the key costs to consider.

Exchange fee

Some travel debit cards will convert your money from pounds to the currency you need with an exchange rate that includes a fee. This may be described as a foreign transaction fee, or a currency conversion charge, for example. For traditional banks this can often be in the region of 3% of the transaction value, although modern online providers do often offer a better deal, and may even skip this fee entirely.

Withdrawal fee

If you plan on making cash withdrawals you’ll also need to check the costs applied by your own bank, and keep an eye on the ATM to make sure the ATM operator won’t also levy a fee. ATM withdrawal fees do vary pretty widely. Some banks offer low, or fee free withdrawals at selected ATMs, but out of network charges can be steep. Again, online travel debit cards may have a more flexible approach to withdrawal fees which can save you money.

Conclusion: is the travel debit card worth it?

Picking the right travel debit card can mean cutting the costs of spending in a foreign currency, with lower transaction fees and a better exchange rate. However, different travel debit cards have their own advantages and disadvantages, with varying fee structures and a range of supported currencies. Compare a few cards, including travel debit cards from online specialist providers like Wise , to find the right one for you.

An international debit card lets you spend and make cash withdrawals in a range of foreign currencies - often with lower fees than using your normal bank card.

Many online and specialist providers allow you to apply for a card easily through a desktop site, app or call centre.

Use your travel debit card just like you would your regular card, to spend and make cash withdrawals around the world.

Travel debit card fees do vary based on the provider, and can include a foreign transaction fee when spending in an unsupported currency, top up charges and inactivity fees. Compare a few providers to get the best available deal for your needs.

MASTERCARD BENEFIT INQUIRIES

Your benefits may vary by card type and by issuing financial institution. Refer to your issuing financial institution for complete benefit coverage terms and conditions or call Mastercard (0800-96-4767) for assistance. Certain terms, conditions and exclusions apply.

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

The UK’s best rated travel debit card

Save 85% compared to high street banks¹.

What our customers think

Our connected banks, we work with all the major uk high-street banks.

What is Currensea?

Pay safer and faster with Apple Pay

See how much you can save

Save in 180 currencies vs high street banks, prepaid travel cards and travel debit cards.

Find out more

Super convenient

Currensea works with your current bank account to make your holiday money go further.

No new bank account needed

Forget having to set-up and manage multiple accounts

Better than a pre-paid travel card

Currensea connects to your bank account, removing the hassle of pre-loading another card

Use your card globally

Spend abroad in 180 currencies without the normal bank fees!

Advanced Security

Currensea is the layer over your bank account, giving you increased security when you spend abroad..

All purchases are protected by Mastercard Chargeback Protection

Authorised by the Financial Conduct Authority

Secured with the latest bank security and encryption technology

All purchases protected by Mastercard Chargeback Protection

Pricing plans

Our plans are simple and transparent. we give you the best live exchange rate so you can spend in confidence, without the hidden fees. .