Retail Dogma

RETAILDOGMA

RETAIL EDUCATION & TALENT SOLUTIONS

Travel Retail

What is travel retail.

Travel retail is a term that describes retail outlets that sell products to end consumers in a travel environment.

Some of these shops are duty free, where customers are exempted from certain local taxes and duties, and in this case shops usually require proof of travel, such as a boarding pass, to complete the transaction.

Advertise Here

Travel retail is a major source of revenue for airports, and provides a great sales channel and branding opportunity for consumer brands, as there are billions of international travelers that pass through airports each year. That’s why it is one of the main distribution channels in the beauty industry.

In some countries, certain types of products are not sold freely inside the country but are available at duty-free shops, such as alcoholic beverages, which drives the sales of these products upon arrival at these airports.

The market size of this segment has been steadily growing over the last few years, and is expected to reach $156.3 billion dollars by 2030, with a CAGR of 10.7% between 2023 to 2030.

Types of Travel Retail

- Airport shops

- Border shops

- Cruise & ferry shops

- Some shops at international railway stations

- Shopping onboard an aircraft

- Certain downtown stores that require proof of travel

Product Categories

The most common product categories include:

- Perfume & Cosmetics

- Confectionery

- Food & Beverage

- Electronics

- Accessories (Bags, watches, eyewear,..etc)

THE PROFESSIONAL RETAIL ACADEMY (PRA) ™

One Membership = Access to All Courses

More resources.

- Brick & Mortar Store

- Department Store

MORE RESOURCES

CONNECT THE DOTS

Learn how to manage a retail business end-to-end.

We’ve put together a curriculum, specifically designed for retail owners or retail professionals who want to advance into senior management roles.

Learn how to connect the dots of the business and take the basic knowledge to the next level of application .

What Is Travel Retail? A Comprehensive Guide

What Is Travel Retail?

Have you ever wondered why duty-free shops are so common in airports and other travel hubs? Or why some products seem to be so much cheaper when you buy them at the airport? If so, you’re not alone. Travel retail is a multi-billion dollar industry, and it’s growing rapidly. But what exactly is travel retail, and how does it work?

In this article, we’ll take a closer look at travel retail. We’ll discuss what it is, how it works, and why it’s so important to the global economy. We’ll also explore some of the challenges facing the travel retail industry today.

So, what is travel retail? Simply put, travel retail is the sale of goods to travelers. This can happen in a variety of settings, including airports, train stations, cruise ships, and border crossings. Travel retail is a global industry, and it’s estimated to be worth over \$50 billion per year.

Travel retail is important for a number of reasons. First, it helps to generate revenue for airports and other travel hubs. Second, it provides travelers with a convenient way to buy goods that they might not be able to find at home. Third, it helps to promote tourism.

However, the travel retail industry is facing a number of challenges today. These include rising costs, increased competition, and changing consumer preferences. Despite these challenges, the travel retail industry is still growing, and it’s expected to continue to grow in the years to come.

“`html

What is Travel Retail?

Travel retail is the sale of goods to travelers in airports, seaports, train stations, and other points of departure and arrival. It is a global industry that generates billions of dollars in revenue each year.

Travel retail offers a unique shopping experience for travelers, who can find a wide variety of products that they may not be able to find at home. It also provides a convenient way for travelers to buy gifts for friends and family back home.

The travel retail industry is constantly evolving, as new technologies and trends emerge. In recent years, there has been a growing focus on sustainability and ethical sourcing. Travel retailers are also looking for new ways to engage with travelers and create memorable experiences.

History of Travel Retail

The history of travel retail can be traced back to the early days of commercial air travel. In the 1920s, airlines began selling duty-free goods to passengers on long-haul flights. This was done to offset the high cost of fuel and to make air travel more appealing to passengers.

Duty-free shopping quickly became a popular amenity for air travelers, and it soon spread to other modes of transportation, such as cruise ships and trains. In the 1960s, the first duty-free shops opened at airports. These shops offered a wider variety of products than the duty-free shops on airplanes, and they quickly became a popular destination for travelers.

In the 1970s, the travel retail industry began to grow rapidly. This was due to a number of factors, including the increase in air travel, the growth of the global economy, and the rise of tourism. By the end of the 1970s, the travel retail industry was a multi-billion dollar business.

The travel retail industry continued to grow in the 1980s and 1990s. This was due to the continued growth of air travel, the expansion of duty-free shopping into new markets, and the development of new technologies. By the end of the 1990s, the travel retail industry was a global phenomenon.

The travel retail industry has continued to grow in the 21st century. This is due to the continued growth of air travel, the expansion of duty-free shopping into new markets, and the development of new technologies. The travel retail industry is now a major part of the global economy.

Types of Travel Retail

There are a number of different types of travel retail outlets. These include:

- Airport duty-free shops: These shops are located in airports and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Border shops: These shops are located near international borders and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Train station shops: These shops are located in train stations and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Cruise ship shops: These shops are located on cruise ships and sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

- Other travel retail outlets: These shops are located in other places where travelers gather, such as hotels, casinos, and tourist attractions. They sell a wide variety of duty-free goods, including alcohol, tobacco, perfume, cosmetics, and souvenirs.

The different types of travel retail outlets offer a variety of shopping experiences for travelers. Airport duty-free shops are typically large and offer a wide variety of products. Border shops are typically smaller and offer a more limited selection of products. Train station shops are typically located in high-traffic areas and offer a variety of convenience items. Cruise ship shops are typically located near the ship’s casino and offer a wide variety of luxury items. Other travel retail outlets offer a variety of shopping experiences, depending on the location and the type of products that are sold.

Travel retail is a global industry that offers a unique shopping experience for travelers. It is a major part of the global economy and is constantly evolving to meet the needs of travelers.

Benefits of Travel Retail

Travel retail offers a number of benefits to both retailers and consumers. For retailers, travel retail provides an opportunity to reach a wider customer base and generate additional sales. In addition, travel retail can be a more profitable channel than traditional retail, as retailers are able to charge higher prices for products due to the lack of competition.

For consumers, travel retail offers a number of benefits as well. First, travel retail provides access to a wider range of products than is typically available in traditional retail stores. This is because travel retailers are able to source products from a variety of countries and regions, which can give consumers the opportunity to find products that they would not be able to find otherwise. Second, travel retail can offer lower prices than traditional retail stores, as retailers are able to pass on some of the savings they earn from duty-free shopping to their customers. Finally, travel retail can offer a more convenient shopping experience than traditional retail stores, as consumers can often find travel retail stores located in airports and other transportation hubs.

In addition to the benefits listed above, travel retail can also provide a number of other benefits to both retailers and consumers. For retailers, travel retail can help to increase brand awareness and loyalty, as well as generate positive word-of-mouth advertising. For consumers, travel retail can provide a more enjoyable shopping experience, as well as the opportunity to find unique and hard-to-find products.

Challenges of Travel Retail

While travel retail offers a number of benefits, there are also a number of challenges associated with this channel. One of the biggest challenges is the high cost of doing business in travel retail. This is due to the fact that travel retailers typically have to pay rent and other fees that are much higher than those charged by traditional retail stores. In addition, travel retailers often have to deal with high levels of theft and fraud, which can further increase their costs.

Another challenge of travel retail is the fact that it is a seasonal business. This is because travel retail sales are typically highest during peak travel times, such as the summer and winter holidays. During off-peak times, travel retailers can experience significant drops in sales. This can make it difficult for travel retailers to maintain a consistent level of profitability.

Finally, travel retail can be a challenging channel to manage due to the fact that it is often subject to a variety of regulations and restrictions. These regulations can vary from country to country, and can make it difficult for travel retailers to operate in a consistent and efficient manner.

Despite the challenges, travel retail can be a profitable and successful channel for retailers and consumers. By understanding the benefits and challenges of travel retail, retailers can make informed decisions about whether or not this channel is right for them.

Travel retail is a growing industry that offers a number of benefits to both retailers and consumers. By understanding the benefits and challenges of travel retail, retailers can make informed decisions about whether or not this channel is right for them.

What is travel retail?

Travel retail is the sale of duty-free and other goods to travelers in airports, seaports, train stations, and other points of departure and arrival. It is a global industry that generates billions of dollars in revenue each year.

Why is travel retail so popular?

There are a few reasons why travel retail is so popular. First, travelers often have extra money to spend when they are on vacation. Second, travel retail stores offer a wide variety of products that travelers may not be able to find at home. Third, travel retail stores often offer duty-free prices, which can save travelers a lot of money.

What are some of the challenges facing the travel retail industry?

The travel retail industry faces a number of challenges, including:

- The growth of e-commerce

- The rising cost of travel

- The increasing security measures at airports and other points of departure and arrival

What is the future of travel retail?

The future of travel retail is uncertain. However, there are a number of factors that suggest that the industry will continue to grow in the coming years. These factors include:

- The continued growth of international travel

- The increasing demand for luxury goods

- The development of new technologies that will make it easier for travelers to shop

How can I get involved in the travel retail industry?

There are a number of ways to get involved in the travel retail industry. You can:

- Work for a travel retail company

- Start your own travel retail business

- Become a travel retail consultant

- Attend travel retail trade shows

Additional resources

- [The International Duty Free Association](https://www.idfa.aero/)

- [The Travel Retail Business](https://www.travelretailbusiness.com/)

For consumers, travel retail offers a convenient and affordable way to purchase a wide range of products, from luxury goods to everyday essentials. In addition, travel retail can often be a more tax-efficient way to shop than at home. For businesses, travel retail provides a valuable opportunity to reach new customers and grow their sales. By understanding the needs of the traveling consumer, businesses can develop strategies to reach this lucrative market.

As the travel industry continues to grow, so too will the travel retail industry. By understanding the unique challenges and opportunities of this industry, businesses can position themselves to succeed in the years to come.

Author Profile

Latest entries

- January 19, 2024 Hiking How to Lace Hiking Boots for a Perfect Fit

- January 19, 2024 Camping How to Dispose of Camping Propane Tanks the Right Way

- January 19, 2024 Traveling Information Is Buffalo Still Under Travel Ban? (Updated for 2023)

- January 19, 2024 Cruise/Cruising Which Carnival Cruise Is Best for Families?

- + 1-888-961-4454 (TOLL-FREE)

- +1 (917) 444-1262 (US)

- [email protected]

COVID-19 has impacted all businesses across the globe.

our reports from the

CONSUMER GOODS CATEGORY

The novel coronavirus has affected all businesses across the globe

to access all our reports from the CONSUMER GOODS Category, featuring the impact of the pandemic

featuring the impact of the pandemic

Avail the Christmas season discount on the Travel Retail Market Report 20% OFF

(offer valid only till season lasts)

A Guide on Travel Retail: Definition, Growth Factors, and Future Prospects

Travel retail industry is one of the major subsidiary yet standalone industries of the travel and tourism sector. Since the last few years, barring the pandemic period, this industry has seen a substantial rise in terms of its growth number. Though one of the obvious reasons behind the growth in travel retail industry is the growth in number of travelers, there are certain growth factors which are characteristic to the travel retail industry itself.

In the 1700s, there was a shift from primary economic activities like agriculture, mining, etc. to secondary sector constituting manufacturing, construction, etc. This shift was primarily facilitated by the Industrial Revolution which was kickstarted in the Great Britain. Consequently, on similar lines, the ICT revolution enabled a shift from secondary to tertiary sector which predominantly constituted of service-oriented economic activities. One of the biggest industries that emerged out of the tertiary sector was the travel and tourism industry.

What is Travel Retail and Why is it on the Rise Since the Last Few Years?

In the last few decades, especially after the opening of majority of the global economies post-1991, travel and tourism industry has grown like anything else. Some economists even consider it to be a separate economic sector altogether. On account of this growth, several subsidiary and standalone industries have propped up and thrived under the travel and tourism sector. One such standalone industry is the global travel retail industry. Travel retail pertains to creating, planning, and providing travel services, while at the same time, engaging in sales activities to cater to the shoppers’ demands while they are in transit.

The growth in the travel retail market is mainly attributed to four main factors which are discussed below:

- Boom in the Travel Industry on the Whole

Except the aberration witnessed in the last two years due to the Covid-19 pandemic, there has been a steady growth in the number of people travelling across the globe. Though the reasons for travel might be different for each individual, the travel retail industry has been able to fulfill their varied demands efficiently. Hence, a growth in the travel industry has been mirrored by the travel retail industry. Also, since people have been exploring countries and places that were previously not so often visited, the travel retail industry has found new ways and avenues to offer their services.

- Travelers Tend to Shop More

Studies by various behavioral economists have shown that travelers, especially the ones going out for vacations, tend to shop more. This shift from a thrift behavior, according to these experts, is due to the leisurely atmosphere and stress-free state of mind. Also, since travelers have a lot of free time at their disposal, they can shop for longer periods of time. Another interesting theory as to why people spend more at transit channels, such as airports , is that the infrastructure inside airports is built on the concept of open-plan setups. As a result, luxury shopping and casual shopping spaces are intertwined in each other, thus blurring the lines between the two.

- Accurate Data Insights

The retailers engaging in travel retail and sales activities have an added advantage of accurate information about their customers. Their travel and departure times, the type of aircrafts they are travelling, their destination, etc. helps the retailer in getting a brief idea as to what the traveler might be looking for. This helps these retailers to plan their sale strategy accordingly, which helps in maximizing their profits. Also, providing customer service to the passengers or people in transit becomes much easier due to these vital data points.

- Better Showcasing of Products

Since travelers tend to shop more products and spend more on luxury items during their travel, they tend to appreciate certain products more than in normal circumstances. This provides the companies and travel retailers to showcase their products and test whether the products are sellable. Hence, various international brands of different sectors tend to launch and market their unique products through the travel retail industry.

Future of Travel Retail Industry

Though the Covid-19 pandemic and the subsequent lockdowns put a strain on the travel and the travel retail industries, market analysts are confident that both these industries will register huge growth rates in the post-pandemic world. Also, digitization of financial services has improved the quality of shopping experience at the transit channels and has helped in reducing the complexities associated with foreign currency exchange. Moreover, the introduction of smart technologies has further improved data collection, which has helped travel retailers to improve their business strategies in a much better way. All these factors point toward a great future of the global retail travel industry.

About the Author(s)

Princy A. J

Princy holds a bachelor’s degree in Civil Engineering from the prestigious Tamil Nadu Dr. M.G.R. University at Chennai, India. After a successful academic record, she pursued her passion for writing. A thorough professional and enthusiastic writer, she enjoys writing on various categories and advancements in the global industries. She plays an instrumental role in writing about current updates, news, blogs, and trends.

Related Post

A quick look at the top 4 cruise tourism destinations in the world for 2023, how popularly do capsule hotels takeover the position of conventional hotels in developed countries, how does adventure tourism turn a person’s world around, urban air mobility: the future of urban transportation.

How is Cybersecurity Becoming a Vital Measure to Combat Emerging Threats in the Banking Sector Globally?

Wood Pellet Biomass Boilers: An Eco-Friendly Heating Solution

5 Ways Vanilla Oil Can Transform Your Life

Discovering the Magic of Toasted Flour: Why & How to Use It

Request Sample Form

Subscribe to our newsletter and get our newest updates right on your inbox.

Blog Name Here

Obtain comprehensive insights on the Travel Retail Industry

Preview an Exclusive Sample of the Report of Travel Retail Market

The Company

- Why Research Dive?

- Research Methodology

- Syndicate Reports

- Customize Reports

- Consulting Services

- Design your research

- GDPR Policy

- Privacy Policy

- Return Policy

- Delivery Method

- Terms and Condition

30 Wall St. 8th Floor, New York, NY 10005 (P).

- + 1-800-910-6452 (USA/Canada) - Toll Free

- + 1-888-961-4454 (USA/Canada) - Toll - Free

- +1 (917) 444-1262 (US) - U.S

- [email protected]

Get Notification About Our New Studies

- © 2024 Research Dive. All Rights Reserved

What is a retail travel agency? This is how they operate

What is a retail travel agency for?

What types of retail travel agencies are there, what differentiates a retailer from a wholesaler, what a retail travel agency needs to do to keep customers happy.

If you are reading this article, the chances are you have an interest in the wonderful world of tourism. You will see in the following sections that there are ample opportunities to create or grow a travel agency. First of all, you need prior knowledge of the market, to conduct an analysis of the right tools to offer the services demanded by travelers, but especially you should be aware of the Special Regime for Travel Agencies that will define the operations performed and how they are invoiced depending on the nature of the service offered to customers.

Retail travel agencies are companies that provide their customers, people who want to travel, with services (such as these examples of tourism products) at their destination. These companies act as intermediaries between the tourist and the tourist packages organized by wholesale agencies. A retail agency does not offer its services to other agencies.

These companies are responsible for providing their clients with the trip of their dreams within their budget. They can offer tour packages created by a wholesale company or they can create their own by combining various services in the sector.

When we talk about retailers, we are referring to those travel agencies that offer services directly to the end user, the tourist. Therefore, they provide an intermediary service between a wholesaler and the customer . They have the task of preparing, organizing and selling the services to the tourist so that the trip they are going on is tailored to their liking.

There are different forms that a retail business can take in this area of the tourism industry. For example, a retail travel agency can have the following characteristics that differentiate it from other companies.

In other words, they offer trips previously created by wholesalers, to send people to places different from their hometowns and tailored to their needs.

Their role is to welcome visitors to the area where they are located.

Online Travel Agencies

Also known as OTAs. The European Graduate Center (CEUPE) explains that many retail companies do not have a physical presence and, as a result, offer services but do not usually act as advisors to their customers.

Brick-and-mortar agencies

This is the traditional form that is still in use. It allows for more direct service and for tourism professionals to get to know what the client is looking for and to advise according to their preferences.

Specialized

They offer travel services in a specific niche. These could be for learning languages abroad, adventure and extreme sports, honeymoons, business travel, senior travel, luxury travel, etc.

Basically, retailers choose travel packages that can be adapted to their target market and then recommend and sell these services and package tours to travelers. They are the intermediate company that has to respond to the needs and preferences of the end customer.

Wholesalers, on the other hand, are the ones responsible for creating these vacation packages . They are in contact with hotels, airlines and guides for various excursions. They are also in contact with retail companies that will offer these services to the end user.

Sometimes, retail travel agencies can partner with other agencies to form what are known as travel agency management groups. These groups are “entities” with greater competitive strength in terms of coordination and bargaining power with suppliers.

The role that these companies play, in itself, can bring a great deal of happiness to people: never forget that a good vacation or a trip to a dream destination can be a great source of joy!

But the service has to be right to fulfill this purpose. However, at the same time, if a company in this sector does not manage to get everything just right, it can ruin one of the highlights of the year for their customers. Here are some tips to ensure that the business runs smoothly and builds customer loyalty:

- Assess customers carefully . Who doesn’t spend months eagerly awaiting their trip of the year? For this reason, companies in this sector need to listen to their customers, find out their preferences and passions and, with this information in hand, advise them on the trip they are going to like the most, in line with their budget.

- Offer advice . A change of scenery is always a new cultural experience. A retail travel agency should also give guidelines to travelers so that they know what they can expect to find in the destination and also what practices will make their experience much more beautiful and enriching.

- Use technology to improve efficiency . Technology helps any experience to be faster and deliver better results. To stay in touch with wholesalers, there are services such as those offered by Hotelmize , which allow the use of big data applied to booking management that helps to find better services and save on costs.

Subscribe to our newsletter

Yay you are now subscribed to our newsletter.

Marc Truyols has a degree in Tourism from the University of the Balearic Islands. Marc has extensive experience in the leisure, travel and tourism industry. His skills in negotiation, hotel management, customer service, sales and hotel management make him a strong business development professional in the travel industry.

Mize is the leading hotel booking optimization solution in the world. With over 170 partners using our fintech products, Mize creates new extra profit for the hotel booking industry using its fully automated proprietary technology and has generated hundreds of millions of dollars in revenue across its suite of products for its partners. Mize was founded in 2016 with its headquarters in Tel Aviv and offices worldwide.

Related Posts

3 Reasons Why Tour Operators are Essential in the Industry

7 min. Today, tour operators are key to the success of the travel industry. Tourists rely on them to turn their dream vacations into a reality. And, as we know, one of the most common interactions between tour operators and travelers is the booking of a tour that allows them to explore different parts of […]

The 16 Types of Tour Operators That Keep Curated Travel Alive

29 min. Tour operators act as creators of unique and unforgettable travel experiences. They use their expertise and connections to arrange the best and most affordable transportation, accommodation, and activities. Today’s travelers are lucky to have them, and so is the industry as a whole. If you are in the travel business and you’re trying […]

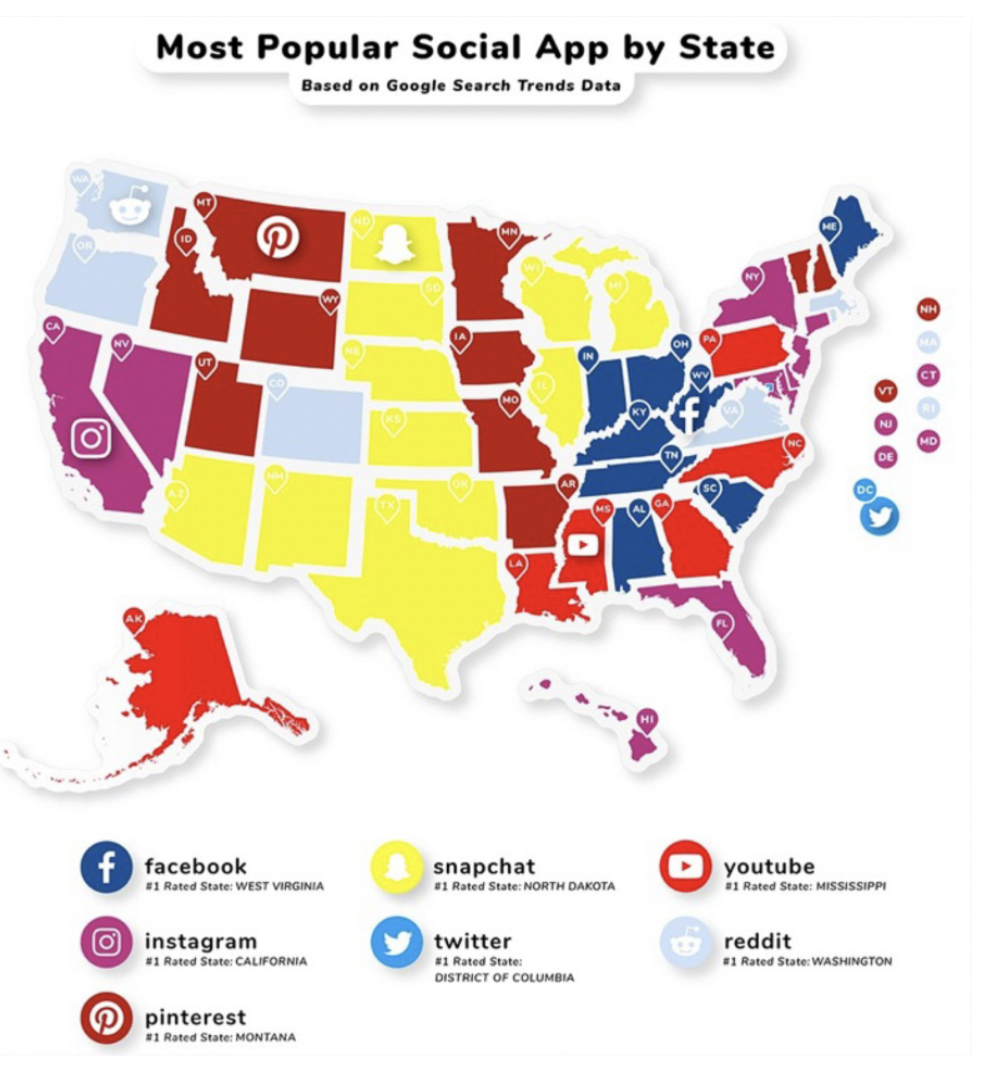

Top 5 Social Media Platforms for Travel Agencies and How to Make the Most of Them

10 min. Gone are the days when travelers sought to disconnect from technology. Today, 74% of people say they use social media while traveling. Sharing travel experiences through photos, videos and status updates is a clear sign that potential customers are out there, using social media not only for travel inspiration, but also for planning […]

Retail & Trade

Duty free and travel retail industry - statistics & facts

How has the travel retail and duty free industry held up after the pandemic, the duty free market and retail sales of airports, key insights.

Detailed statistics

Leading global travel retailers in 2022, based on turnover

Airports with the most international air passenger traffic worldwide 2023

Avolta: revenue worldwide 2013-2023

Editor’s Picks Current statistics on this topic

Travel retail: global forecast market size 2030

Shopping Behavior

Duty free shop customer conversion rate worldwide 2017-2022

UK: retail revenue of the Heathrow Airport Ltd. in 2022, by category

Further recommended statistics

- Premium Statistic Airports with the most international air passenger traffic worldwide 2023

- Premium Statistic Global air traffic - scheduled passengers 2004-2022

- Premium Statistic World: duty free and travel retail sales 2010-2022

- Premium Statistic Global travel retail sales 2022, by region

- Premium Statistic Duty free shop customer conversion rate worldwide 2017-2022

Leading airports for international air passenger traffic in 2023 (in million international passengers)

Global air traffic - scheduled passengers 2004-2022

Number of scheduled passengers boarded by the global airline industry from 2004 to 2022 (in millions)

World: duty free and travel retail sales 2010-2022

Duty free and travel retail sales worldwide in 2010 to 2022 (in billion U.S. dollars)

Global travel retail sales 2022, by region

Duty free and travel retail sales worldwide in 2022, by region (in billion U.S. dollars)

Customer conversion rate of duty free shops worldwide from 2017 to 2022

Leading travel retailers

- Premium Statistic Leading global travel retailers in 2022, based on turnover

- Basic Statistic Avolta: revenue worldwide 2013-2023

- Premium Statistic Lotte Duty Free: global revenue 2013-2022

- Premium Statistic Turnover of The Shilla Duty Free worldwide 2013-2022

- Premium Statistic China Duty Free Group's global turnover from 2013 to 2022

- Premium Statistic Lagardère Travel Retail: sales worldwide 2014-2022

- Premium Statistic Turnover of DFS worldwide 2013-2022

Leading travel retailers worldwide in 2022, based on turnover (in million euros)

Revenue of Avolta (Dufry) worldwide from 2013 to 2023 (in million Swiss francs)

Lotte Duty Free: global revenue 2013-2022

Turnover of Lotte Duty Free worldwide from 2013 to 2022 (in million euros)

Turnover of The Shilla Duty Free worldwide 2013-2022

Turnover of The Shilla Duty Free worldwide from 2013 to 2022 (in million euros)

China Duty Free Group's global turnover from 2013 to 2022

Turnover of China Duty Free Group worldwide from 2013 to 2022 (in million euros)

Lagardère Travel Retail: sales worldwide 2014-2022

Sales of Lagardère Travel Retail worldwide from 2014 to 2022 (in million euros)

Turnover of DFS worldwide 2013-2022

Turnover of DFS Group worldwide from 2013 to 2022 (in million euros)

Retail revenues of leading airports

- Premium Statistic Changi Airport: concession sales 2017/18 to 2022/23

- Premium Statistic Los Angeles World Airports: duty free operating revenue 2016-2022

- Premium Statistic Revenue of HK International Airport 2023, by segment

- Premium Statistic Offshore duty-free sales value in Hainan, China 2013-2023

- Premium Statistic Sydney Airport revenue 2023, by type

- Premium Statistic UK: retail revenue of the Heathrow Airport Ltd. in 2022, by category

- Premium Statistic Revenue of Schiphol Group in the Netherlands by business area 2022

Changi Airport: concession sales 2017/18 to 2022/23

Value of concession sales of Changi Airport from financial year 2017/18 to financial year 2022/23 (in million Singapore dollars)

Los Angeles World Airports: duty free operating revenue 2016-2022

Duty free revenue of Los Angeles World Airports from FY 2016 to FY 2022 (in million U.S. dollars)

Revenue of HK International Airport 2023, by segment

Revenue of Hong Kong International Airport in FY2023, by segment (in billion Hong Kong dollars)

Offshore duty-free sales value in Hainan, China 2013-2023

Annual offshore duty-free sales value in China's Hainan island from 2013 to 2023 (in billion yuan)

Sydney Airport revenue 2023, by type

Revenue of Sydney airport in Australia in 2023, by type (in million Australian dollars)

Retail revenue of the Heathrow Airport Limited in the United Kingdom (UK) from 2019 to 2022 (in million GBP), by category

Revenue of Schiphol Group in the Netherlands by business area 2022

Distribution of revenue of Schiphol Group in the Netherlands in 2022, by business area

Consumer behavior

- Premium Statistic Duty-free shoppers average spend by category worldwide 2022

- Premium Statistic Duty-free shoppers conversion rate by category worldwide 2022

- Premium Statistic Duty-free shoppers average spend worldwide by age 2022-Q1 2023

- Premium Statistic Share of wallet duty free purchases worldwide Q2 2023

- Premium Statistic Leading categories duty free shoppers traveling with children visit 2023

Duty-free shoppers average spend by category worldwide 2022

Average spend of duty free shoppers in different categories 2022, by region (in U.S. dollars)

Duty-free shoppers conversion rate by category worldwide 2022

Share of duty free shoppers browsing and making a purchase in different categories 2022, by region

Duty-free shoppers average spend worldwide by age 2022-Q1 2023

Average spend of duty free shoppers worldwide in 2022 and 1st quarter 2023, by generation (in U.S. dollars)

Share of wallet duty free purchases worldwide Q2 2023

Duty free purchases of shoppers worldwide as of the 2nd quarter 2023, as a share of total spend

Leading categories duty free shoppers traveling with children visit 2023

Leading duty free categories shoppers traveling with children visited at international airports as of 2023

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

How to Reach us

- Orlando: 407-679-7600

- Tampa Bay: 813-507-3600

- Miami: 954-651-8044

- Boca Raton: 561-289-8719

- Atlanta: 404-689-2118

CFO & Strategic Services

Business resources.

Timely and relevant articles written by Nperspective firm members that provide valuable financial insights.

Access on-demand webinars packed with tips and helpful advice to enhance your business.

From white papers to business templates. Access free financial tools to make life easier.

- Litigation Support

- CFO Insights

The Importance of Travel Retail

After working for a Japanese bank in New York for more than five years, I was sent to Miami to focus on the Travel Retail industry, more commonly known as duty free shops. The Travel Retail or Duty Free Retail industry sells goods to international travelers. Travel retail sales are exempt from taxes when the goods are immediately taken out of the country of purchase.

Vital revenues for the aviation, travel, tourism and maritime industries are generated by travel retail. At airports all over the world, travel retail is the largest contributor to non-aeronautical income. Shopping is a key element of the travel experience for many passengers, and the provision of duty-free retail goods is a service as well as an important revenue generator. More than 1 billion international travelers pass through airports each year, and that number is expected to grow 5% annually, according to industry projections.

Cornerstone of Airport Growth

Travel retail is the cornerstone of airport growth and development with modern airport terminal design recognizing the critical economic role it plays and ensuring new airports come with spacious and vibrant retail spaces.

The top three product categories in global travel retail are fragrances and cosmetics (30%), wines and spirits (17%) and accessories (15%). In 2018, travel retail revenues reached $82.42 billion and are expected to reach $125 billion by 2023.

Travel Retail Keeps Growing

- Increase in travelers – Annually more than 1 billion people travel internationally, approximately 15% of the global population, a figure expected to increase as emerging economies improve.

- The propensity to shop while traveling – travelers have more time to browse in airports designed as inviting shopping spaces.

- Travel retailers use data insights such as advance knowledge of where the customer is coming from and heading, to cater to specific needs. Staff and product displays are organized based on arrival passenger language and cultural sensitivities to ensure that the right products are clearly visible to targeted customers.

- Retailers have a tremendous opportunity to create visibility of their products, increase customer loyalty, recruitment and diversity.

- Aligning luxury with everyday products – travel retail is traditionally a market for luxury and high-end products. So travelers shop for everyday and luxury products in the same location and at significant discounts. High-end luxury product retailers use “minis” and “travel sets” to introduce their products at a discount.

Business Opportunities in Travel Retail

The sector affords SMEs the opportunity to present their products to international travelers at nominal advertising and marketing costs. Large manufacturers see the channel as a cost-effective route to market for new products requiring an international environment.

However, although the channel is lucrative, it is also full of challenges. Air travel requirements – security, passport control, gate closure, etc. – all take time away from browsing and shopping. Another big issue is space. Most travel retail stores, counters and pop-ups operate in a restrictive space, making it difficult to balance merchandizing and positive experience. Baggage allowances and product restrictions also affect the traveler’s propensity to buy.

Taking Advantage of Travel Retail

First is negotiation with airport operators. Travel retail operations are granted via concessions. Concession owners then negotiate with retailers on the appropriate margin based on expected sales volume. Retailers have to negotiate with the operator at each airport if they want to be in that airport and cater to those passengers. Operators look for the retailers that will generate the most sales that translate into more revenue and profit.

According to Moodie Davitt, the largest provider of business intelligence for the travel retail industry, the top five travel retail operators based on sales in 2017 were:

- Dufry – €7.166 billion/USD 8.098 billion (Switzerland)

- Lotte Duty Free – €4.842 billion/USD 5.471 billion (South Korea)

- Lagardere Travel Retail – €3.917 billion/USD 4.426 billion (France)

- DFS Group – €3.670 billion/USD 4.147 billion, Hong Kong based, owned by LVMH (France)

- The Shilla Duty Free – €3.412 billion/3.856 billion (South Korea), owned by Samsung Group

Duty Free Americas, the Miami International Airport concessionaire, ranks #11 with €1.499 billion/USD 1.694 billion in revenue in 2017 and is owned by a Miami-based group.

Additional Insights

EXIT PLANNNING – ARE YOU PREPARED?

Attracting Talent and Retaining Them!

The Current Economic Environment is New Territory for Many CFOs

Valuable business news and insights delivered right to your inbox, follow us on social media, talk to a financial expert.

Do you have a burning business or finance question? Ask one of our top CFOs now!

Orlando | Tampa | Miami | Boca Raton | Atlanta

© 2024, Nperspective CFO & Strategic Services

Privacy Policy | Terms & Conditions

Business Resources

Orlando | tampa | miami | boca raton.

© 2020, Nperspective CFO & Strategic Services

4 Key Trends Influencing Travel Retail

As the world begins opening up for travel, the market for travel retail is booming as brands double down their efforts to make up for lost sales during the pandemic.

It is no surprise that the industry expects to grow, and according to business consulting firm Allied Market Research , it will reach $123B by 2023. Travel retail suffered a significant impact due to the COVID-19 pandemic and the ongoing lockdowns in various world regions.

Consumers are undoubtedly anxious to make up for trips lost during the global COVID-19 pandemic, with leisure travel reduced to almost zero and business travel substituted by Zoom meetings. However, the travel retail market is still full of challenges.

Travel retail is a term that commonly refers to sales made in travel requirements. Duty-free and travel retail encompasses the sale of goods to international travelers.

Duty-free shops are exempt from paying certain local or national taxes and duties requiring travelers to take their purchases out of the country. Duty-free sales occur in highly regulated retail environments like airports, ports, ferries, cruise ships, and national customs authorities govern their operations.

Unlike traditional retail environments, airport timetables dictate customers’ shopping habits

Clarity Business Partners reported that in 2013, the average amount of time spent in an airport globally was 150 minutes; this dropped to 133 minutes in 2016 and has continued to decrease in recent years. The average time spent shopping in an airport is 29 minutes–not much time to draw someone in and browse the stores.

In addition to time constraints, there are ongoing issues around baggage allowances and product restrictions.

Often, customers can’t carry everything they might like to buy, forcing them to make difficult choices. These and other external challenges can make it hard to innovate in travel retail. But there are some innovative ways to overcome these travel constraints and present better buying experiences.

Duty-free and travel retail generates vital revenues for national aviation, travel, and tourism industries.

Airports, in particular, incredibly rely on commercial revenues to fund the development of their infrastructure and help them keep fees as low as possible. At airports across the world, retail is now the most significant contributor to non-aeronautical income.

Travel retailers can look forward to growing sales over the next few years

Global duty-free retail will grow 8.5% in 2021, with the number of international passengers increases as the world enters into the “new normal” following the pandemic, according to Technavio , a global market research firm.

However, retailers face challenges getting travels into the stores and enticing them to spend. Only 5-10% of travelers visit duty-free retail stores in the terminal.

Retailers in airports, ferry terminals, and train stations need ways to attract and engage passengers and deliver a unique and convenient shopping experience – no matter what currency their customers use or what language they speak.

Retailers have realized that travel retail provides them with tremendous opportunities to create visibility for their products, increases customer loyalty, and recruit new customers in different countries.

As consumers gear up for long-awaited travel adventures, here are four trends retailers can harness to improve their sales.

Use tech for passenger convenience

Airports, airlines, and ferry terminals are hubs for passenger data because of the multiple digital touchpoints that enable efficient check-in and boarding. Retailers who embrace the desire for digital can provide a seamless shopping experience that entices passengers in the store and engages them before during, and after their trip.

- Partnering with travel operators can unlock access to the travel information needed to create personalized offers and recommendations, starting when a passager books their ticket and checks in for their trip.

- Using data collected from the moment passenger books their ticket to when they check-in for their trip can provide insights into ways to customers with social media. Placing targeted ads and tailored offered is an effective way to create tailored offers that encourage in-store buying.

- Retailers can create loyalty programs with targeted offers that travelers can access easily on mobile devices, encouraging repeat customers and additional in-store buying.

Embrace travelers’ changing shopping habits

Millennials now travel more than any other generation, and it is essential to recognize their different shopping habits.

According to data measurement firm Nielsen , 44 percent of millennials are motivated to buy gifts at the airport, 30 percent shop to treat themselves, and 28 percent make impulse purchases.

The millennial travel shopper is unpredictable, and retailers need to understand their habits to deliver experiences that match their moods, interests, and personalities. Consider these tactics for connecting with the travel generation.

- Connect to travels using their chosen channels, from mobile apps and social media to digitized displays in stores.

- Personalized and location-based deals and recommendations tailed to their interest.

- Use flight info and airport timetables to tailor offers to the travel experience, including passengers’ destination at the time left before they embark.

Checkout should be as fast as check-in

Travelers of all ages value a quick and easy check-in, baggage, and boarding processes, and they will expect the same when paying for their purchases.

There is a need to support different languages and currencies and the regulatory requirements of various destinations, and this can bring complexity and delays to the travel retail checkout.

It is vital that checkout is smooth and efficient, or it could turn customers away. Pay attention to these tactics that can encourage a seamless shopping experience.

- Provide a range of checkout options, including mobile apps, online, self-service kiosks, or mobile POS.

- Travels should be able to check prices in pay in any currency or combination of currencies they choose.

- Use digital tools to support as many languages as possible both throughout the store and at checkout.

Leverage data to optimize inventory

Stocking a retail store with products that match travels tastes is a balancing act. There is limited time to capture customers’ interest, and retailers can’t afford to miss a sale by running out of stock.

The challenge is that there isn’t much room for excessive inventory in a busy terminal or on a ferry. It is for retailers to know what sells well to passengers in various locations to make intelligent decisions on inventory.

- To optimize inventory, use business intelligence tools to see where sales occur and understand shopping patterns. These tools can also provide insight into how passengers in different locations respond to promotions.

- The use of apps and loyalty programs combined with info gathered from customers’ online interactions can provide important insight into travelers’ tastes and interests.

- Integrate retail and supply chain systems for efficient orders and insights into supply and demand.

As travel retail grows, retailers can make their stores part of a seamless travel experience by engaging with passengers with digital and physical channels.

Stay relevant to customers’ needs and interests while providing convenient experiences wherever travelers want to go offers ambitious retailers a profitable opportunity to be a part of customers’ next great adventure.

Recent Articles

Q&A with Jackie Trebilcock, Managing Director of the New York Fashion Tech Lab

Meet The TRE: Nick Gray

Meet The TRE: Brian Librach

Hy-Vee Embraces Digital Transformation and Sustainability Initiatives

Retailer executives.

" * " indicates required fields

Solution Provider

Solution providers, retail executive.

Travel Retail Marketing

Travel retail is the sales channel targeting travellers in duty-free zones such as airports and cruise terminals. Both digital channels and the in-store experience come together in making the user experience more convenient and memorable during their travels. Travel retail marketing plays an important role in reaching potential customers at various stages of their travel journey.

Due to the unique nature of the travel retail sector, the marketing strategy formulated needs to cater to the behaviours and mindset of a traveller who may interact with multiple touchpoints across various devices and formats, both online and offline. It is extremely important to leverage the right channels and touchpoints to bring an engaging experience to your potential customers.

Through user journey mapping, our digital marketing team will gain a clearer understanding of our target audience as travellers. This is then used to create an integrated marketing strategy that leverages the channels with the highest efficacy for reach, awareness, and conversion, working with various partners such as duty-free retailers, trade media, and industry influencers to amplify the marketing efforts.

Our team’s services include campaign planning for product launches, building brand and product awareness, partnership marketing, influencer marketing, and media buying, to name a few.

Our Capabilities

The Macallan Global Travel Retail - New Product Launch Campaign

- Lack of O2O strategy

- Fragmented customer journey

- Missed opportunity for data collection for customer re-engagement and campaign performance analysis

- Using AR in-store to engage offline users, bringing them onto digital channels

- Data collection for remarketing

- Integrated marketing plan to reach users at different stages of their travel journey

- Improved the seamlessness of the customer journey and brand experience

- Reconnected with online users across multiple channels

- Measured success of campaign through gathered data on digital channels, setting a benchmark for future campaigns

The team at RFI have had extensive experience working with travel retail clients and have a deep understanding of the importance of the online-offline-online strategy required to engage the traveller audience segment. With full-stack digital marketing capabilities from strategy development to execution, campaign ideation to design and copy development, RFI can help your travel retail business achieve its brand and business objectives.

Get a call back

Ready for departure: How the travel retail sector can succeed in the post-Covid environment

By Gabriel Schillaci

Recommendations and case studies for airports and retailers

Like all aviation-related industries, the travel retail sector has been turned on its head by the Covid-19 pandemic. A change in the passenger mix at airports, as well as longer idle times due to Covid-related delays, are driving new trends and behaviors. Digital channels are becoming increasingly important, for example, and shoppers are buying more because shops are quieter. Travel retailers need to adapt to these changes, or risk being left behind. In this article we assess the transformation taking place in the sector and present a series of recommendations for airports and retailers on how they can not only adapt to the new challenges, but also thrive. We also offer two case studies outlining successful Roland Berger travel retail projects.

"Airports, retailers and the entire ecosystem must embrace the new market dynamics."

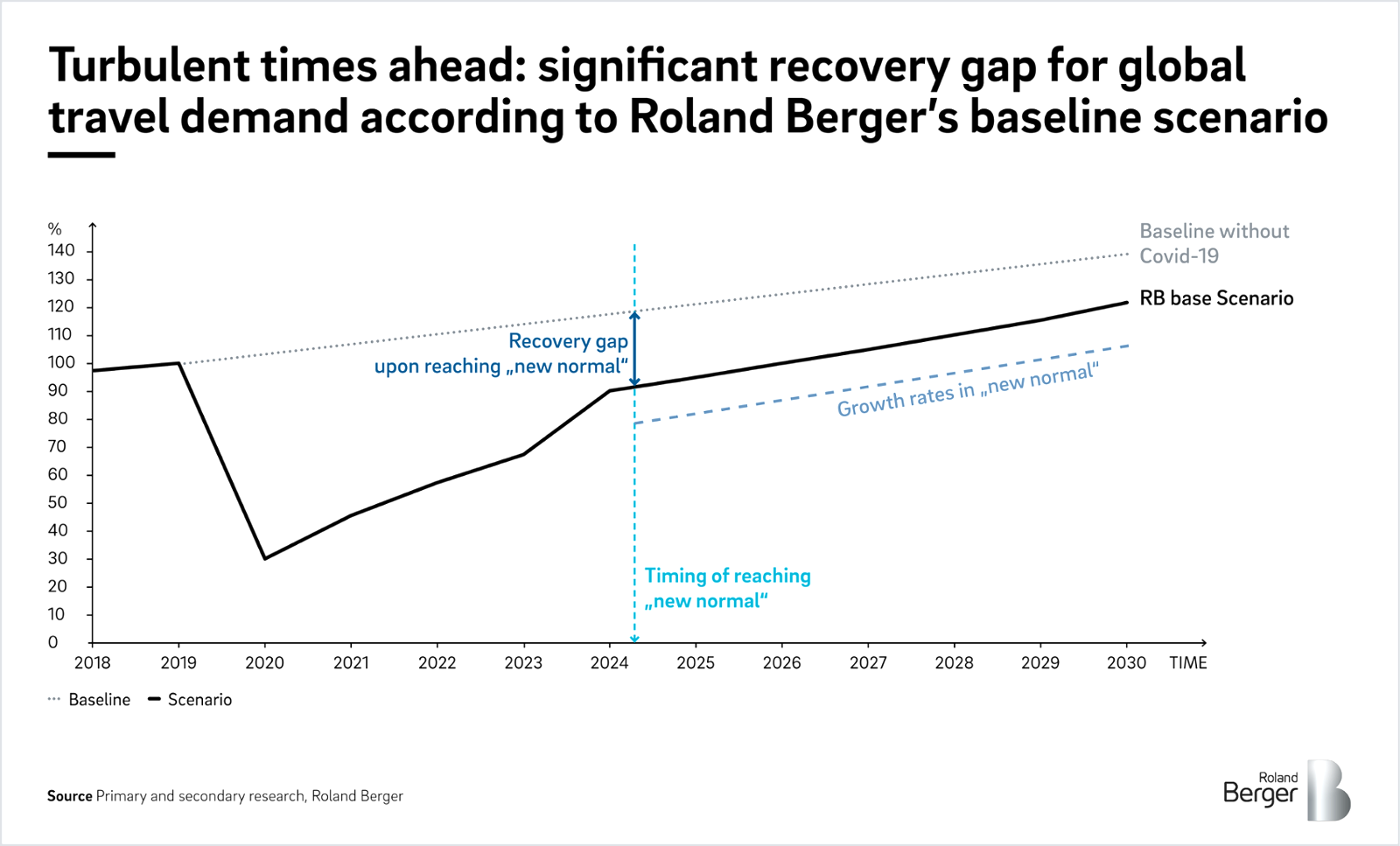

The Covid-19 pandemic has likely changed the air travel market for some time to come. Business travel has been decimated as workers switch to virtual mobility tools, one in five private travelers are choosing to fly domestically rather than internationally and passenger demand is set to remain well below pre-Covid forecasts for years to come, according to a recent Roland Berger study.

While airlines and airports have borne the brunt of the crisis, this reshuffled passenger mix has also had a profound impact on the travel retail sector. For example, fewer big-spending intercontinental passengers from Asia or Brazil mean fewer high-end sales, with retailers now having to adapt their offer to better suit the growing proportion of continental / domestic passengers, and especially low-cost passengers. On the other hand, less traffic and strong concerns over Covid-related delays at airports mean passengers are spending longer periods in airports, pushing up idle times available for shopping.

"Airports need to refocus their offer on their core passengers. They must adapt their product assortment and merchandizing to target the growing share of low-cost passengers."

New trends = new behaviors

This shift has accelerated several trends in travel retail, some that existed pre-Covid and some a result of the pandemic. First, the digital effect has become more pronounced. Retailers’ and brands’ omnichannel strategies are increasingly influencing clients, and e-commerce is driving up pricing transparency. Second, new forms of competition, such as social media use and music and video streaming are vying for passengers’ idle time. Third, the range of offers at some airports, which for years have been focused on either luxury or high-volume items, are becoming less attractive. Fourth, passengers now expect more than just traditional airport “shopping”, with demand growing for experience-based events, especially virtual ones. Finally, opportunities are growing to capture and exploit passenger data.

These trends and the reshuffled passenger mix are driving changes in buyer behavior. With less traffic in airports, passengers are buying more because the quieter environment makes it more appealing to spend time in airport shops. Increased idle times also mean they stay longer. In addition, better price transparency means that passengers can more easily compare duty free offers against online or Main Street prices, and dismiss offers that are not the bargain they purport to be.

Recommendations: How can travel retailers adapt?

The upshot is that travel retail players need to adapt to survive. In short, airports, retailers and the entire ecosystem must embrace the new market dynamics. To do this, we believe they need to focus on two key areas: revamping their traditional offer and reinventing their business models. Below we give our recommendations.

"Collaboration between airlines, airports and travel retailers is essential to realize the potential of new business models."

Revamp the offer

Refocus on core passengers: Travel retailers know that some passengers spend more than others. Their traditional offer has always included a premium element (designer stores, upmarket boutiques and restaurants, etc.) to cater to them. But this low volume/high value market has been badly hit by travel restrictions placed on some of its biggest spenders, such as Asian or Brazilian passengers. As a result, airports need to refocus their offer on their core passengers. They must adapt their product assortment and merchandizing to target the growing share of low-cost passengers, who while traveling low cost, do not necessarily have lower purchasing power at the airport.

Renew formats: To stay fresh, travel retailers need to frequently reinvent their formats. These might include pop-up stores, shop-in-shops, live performances and games. Integrating modularity into the design of commercial spaces helps with this.

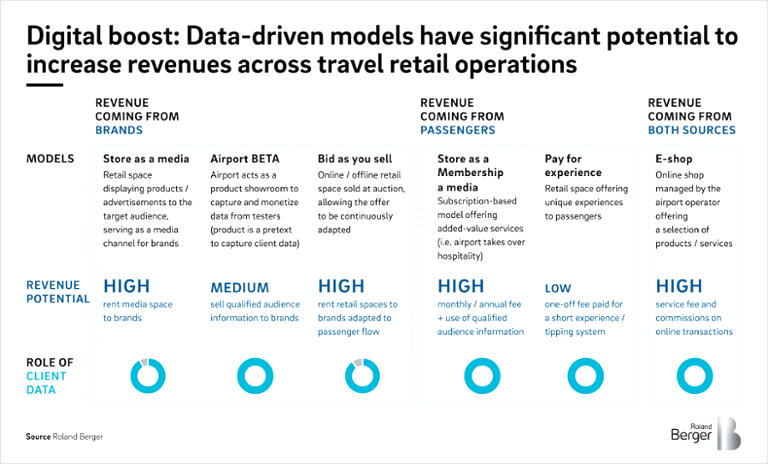

Modernize concepts: A purely transactional approach to travel retail is no longer enough. Players must develop concepts such as retail-as-a-media, where capturing data points on passengers is more valuable than making a sale. This involves showcasing, for example, electronics, with customers able to try out new products provided they register first.

Offer experiences: Memorable events can improve brand awareness, customer relations and sales. With their captive audiences, airports provide a perfect platform for surprising, entertaining events, such as concerts, virtual reality experiences and selfie-worthy backdrops.

Leverage data and AI: Good use of data can help turbocharge a retailer. For example, ultra-personalization can help to cement client relationships and performance can be improved by closely monitoring datapoints and adapting to changes accordingly.

"Our expert teams have considerable knowledge of travel retail, and have supported airports, travel retailers, brands and airlines through a host of strategic and operational challenges."

Reinvent business models

Leverage cooperation and value sharing: Collaboration between airlines, airports and travel retailers is essential to realize the potential of new business models. This could include developing loyalty cards for a retailer or airline, or a branded payment card for a retailer.

Case studies: Roland Berger success stories

Our expert teams have considerable knowledge of travel retail, and have supported airports, travel retailers, brands and airlines through a host of strategic and operational challenges. The following case studies highlight two recent success stories. Feel free to get in touch for more information.

Case study 1: Airport

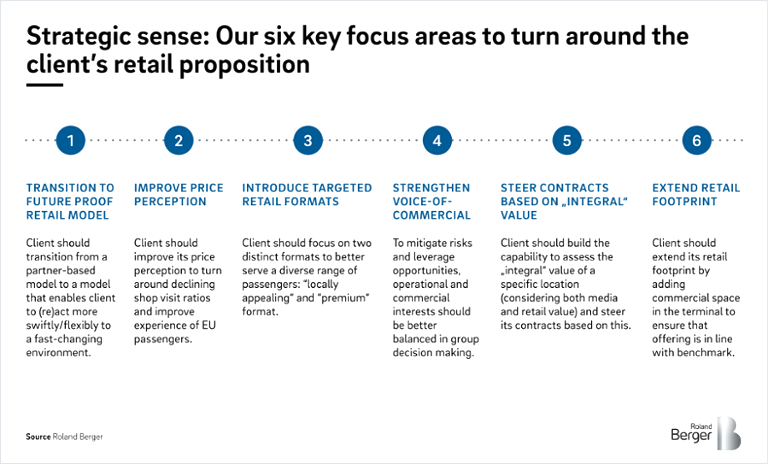

Project: A well-known European airport had a bottleneck in travel retail sales growth. Roland Berger was tasked with identifying the root cause and finding a transformation solution.

Approach: A comprehensive internal diagnosis identified declining sales per passenger as the root cause. Key factors behind this included passengers perceiving the retail offer to be expensive, an indifferent quality of assortment, insufficient consumer traction and a below-average commercial footprint.

Benchmarking against best practices at the airport’s leading competitors revealed it needed to step up to remain competitive. As such, we designed a commercial strategy with six key focus areas:

Case study 2: Duty-free retailer

Project: A leading Asian duty-free player wanted to win a concession in a major airport in Japan.

Approach: We conducted a thorough analysis of the retail RFP issued by the airport and compared it to the airport's specificities to determine the perfect requirements of its retail business. We identified three key needs, and proposed three corresponding KSFs:

Partial recovery: How three trends are changing long-distance travel

We calculated the impact of three trends on four key travel dimensions to determine the "recovery gap" between pre-crisis long-distance travel and the post-pandemic situation.

The future of long-distance mobility: How Covid jolted long-distance business travel

The outbreak of Covid-19 affected especially long-distance business traveling which is shown by a 66% globally decrease in air traffic last year.

The future of long-distance mobility: How Covid changed consumer appetites

The first part of our article series on long-haul mobility examines how private travel has forever changed, and why European demand might not return until 2025.

Transportation, Tourism & Logistics

Roland Berger supports the mobility and logistics industry in digitization along the entire value chain.

Smart Mobility

Smart Mobility contributes to a more sustainable and value-adding state of mobility. Find out more about new mobility scenarios for our society here.

- Publications

- Recommendations for successful travel retail

4 reasons why travel retail is booming

Why this expansion?

1. more people travel, 2. travelers are more prone to shop while en route.

- The open-plan setup: Airports are a democratic shopping spaces – much more so than malls and high streets. In airports the differentiation between luxury and casual brands becomes blurred. Travelers just need to enter the open-plan stores (as airport shops have no doors) to access brands and items they may not have visited in a more traditional setting.

- Free time to browse and buy: Long waits and demands to show up in advance provide passengers with a lot of time to spare in airports. As airports are constructed as shopping spaces, which encourage passengers to leisurely walk around and shop during their wait.

- Holiday atmosphere: After having passed check-ins and security controls, passengers traveling for leisure are left in the right condition to buy items – whether to indulge themselves, to start off or cap off their trip.

3. Retailers can use data insights to better cater for customers

4. products get even more visibility.

Retailers have realized that travel retail provides them with tremendous opportunities to create visibility for their products, increase customer loyalty and recruit new customers in different countries. Airports have become an area where brands test their possible success in new markets, basing on customers’ nationalities and flight destinations. Many brands also offer “travel retail exclusive”, special products which are only available to travelers to entice shoppers to buy appealing to their desire for exclusive items. Travel retail is, in many ways, different from traditional retail spaces. Brands have managed to capitalize on the differences to tap into a very lucrative market. As travel retail is expected to grow steadily in the next few years, brands count on some of their success in airports to trickle down to their traditional stores, and possibly help open new, profitable markets.

Don’t buy retail management software until you read this

What is the difference between a retail travel agent and a wholesale travel agent?

Faqs about the difference between a retail travel agent and a wholesale travel agent:, 1. what services can i expect from a retail travel agent, 2. what kind of customers do retail travel agents typically serve, 3. can a retail travel agent provide better deals compared to wholesale travel agents, 4. what benefits do wholesale travel agents offer, 5. can i contact a wholesale travel agent directly, 6. are there any disadvantages to using a retail travel agent, 7. how can i find a reliable retail travel agent, 8. do wholesale travel agents offer packages for specific destinations or types of travel, 9. can i negotiate prices with a retail travel agent, 10. do retail and wholesale travel agents have different access to deals and promotions, 11. can wholesale travel agents assist with complex travel itineraries, 12. are there any advantages to booking directly with travel suppliers instead of using a retail travel agent.

A retail travel agent and a wholesale travel agent are both professionals in the travel industry, but they serve different purposes and cater to different clienteles. Understanding the differences between these two types of agents is essential for travelers seeking assistance in planning their trips.

Retail travel agents, also known as leisure or traditional travel agents, provide travel-related services directly to individual customers. These agents are the ones you typically find in brick-and-mortar travel agencies or online platforms. They specialize in offering vacation packages, airline tickets, hotel reservations, and other travel-related services to individuals and families. Retail travel agents essentially act as intermediaries between travelers and travel service providers, helping their clients find the best deals and providing personalized advice based on their preferences. They offer a wide range of travel options and often have access to exclusive deals, ensuring that their clients have the best possible travel experience.

On the other hand, wholesale travel agents, also referred to as tour operators or travel wholesalers, primarily focus on providing travel services to travel agencies and other travel-related businesses. They negotiate and create travel packages, including accommodations, transportation, activities, and more, which they then market and sell to retail travel agents. Wholesale travel agents play a crucial role in the travel industry by curating and packaging various travel components, simplifying the process for retail agents and their clients. These packages often come at discounted rates, allowing retail travel agents to offer competitive prices to their customers. By partnering with multiple travel suppliers and consolidating services, wholesale travel agents can offer a wide range of options and more affordable travel experiences.

Retail travel agents can help you with various travel-related services, including booking flights, accommodations, car rentals, cruises, and vacation packages. They can also assist with visa applications, travel insurance, and provide valuable recommendations and advice based on your specific preferences and budget.

Retail travel agents cater to individual travelers and families who are seeking assistance in planning their vacations. They help clients choose destinations, find the best deals, and create customized itineraries to suit their unique needs and interests.

While wholesale travel agents often offer discounted rates to retail travel agents, retail agents have the advantage of providing personalized advice and customized itineraries tailored to the specific needs of individual travelers. By leveraging their knowledge and relationships with various travel suppliers, retail travel agents can often secure competitive deals for their clients.

Wholesale travel agents play a crucial role in the travel industry by consolidating various travel services into packages that can be sold to retail travel agents. This simplifies the booking process for retail agents, allowing them to offer a wide range of options at competitive prices to their clients. Wholesale travel agents also negotiate deals with suppliers, which can result in cost savings for retail travel agents and their customers.

Wholesale travel agents primarily work with retail travel agents and other travel-related businesses. As an individual traveler, it is more common to seek assistance from a retail travel agent who can access the packages and deals offered by wholesale agents. However, some wholesale travel agents may have services available for direct consumers as well.

One potential drawback of using a retail travel agent is the service fee they may charge for their assistance. While many agents do not charge fees for certain services, others may require a fee for more complex itineraries or specialized services. It is important to clarify any fees upfront to avoid surprises.

To find a trustworthy retail travel agent, consider asking for recommendations from friends or family who have used their services before. You can also read reviews or check for memberships with industry associations, such as the American Society of Travel Advisors (ASTA), to ensure professionalism and expertise.

Yes, wholesale travel agents often create packages for specific destinations or types of travel experiences. They may design packages for popular tourist destinations, adventure trips, luxury vacations, or niche travel markets. Retail travel agents can assist in finding and customizing these packages to suit individual preferences.

Retail travel agents have the expertise to negotiate prices with certain travel service providers, especially when it comes to group travel or tailored experiences. However, it is important to keep in mind that negotiations may not always be possible or successful, as prices are determined by various factors, including availability and market conditions.

Wholesale travel agents often have access to exclusive deals and promotions specifically designed for retail travel agents. Retail agents, in turn, offer these deals to their clients along with their expertise and personalized service. Both types of agents aim to provide the best possible travel experiences while offering competitive rates.

Wholesale travel agents primarily focus on creating and packaging travel components but may not provide the same level of assistance for complex itineraries as retail travel agents. Retail agents are better equipped to handle intricate plans and tailor-made experiences to ensure a seamless and personalized trip.

Booking directly with travel suppliers can be advantageous in certain situations, especially if you have a specific preference or loyalty to a particular supplier. However, using a retail travel agent offers the benefit of personalized service, expert advice, access to exclusive deals, and a streamlined experience when handling multiple travel components. Retail agents can save you time and effort by taking care of all the arrangements, ensuring a stress-free travel experience.

These frequently asked questions provide a deeper understanding of the key differences between retail and wholesale travel agents and how they can assist travelers in different ways. Whether you choose to work with a retail travel agent or take advantage of the packages offered by wholesale agents, the primary goal remains the same: to ensure you have a memorable and enjoyable travel experience without the stress of planning and organizing every aspect yourself.

About The Author

Adrian Ashley

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Agenda-setting intelligence, analysis and advice for the global fashion community.

News & Analysis

- Professional Exclusives

- The News in Brief

- Sustainability

- Direct-to-Consumer

- Global Markets

- Fashion Week

- Workplace & Talent

- Entrepreneurship

- Financial Markets

- Newsletters

- Case Studies

- Masterclasses

- Special Editions

- The State of Fashion

- Read Careers Advice

- BoF Professional

- BoF Careers

- BoF Insights

- Our Journalism

- Work With Us

- Read daily fashion news

- Download special reports

- Sign up for essential email briefings

- Follow topics of interest

- Receive event invitations

- Create job alerts

The Anatomy of Travel Retail

LONDON, United Kingdom — Travel retail typically plays second fiddle in brand communications, which emphasise flagship mono-brand stores. But, people travelling account for 40 percent of global spending on personal luxury goods, with 12 to 13 percent captured by the specialised and globally dispersed travel retail channel.

Airport malls account for almost 60 percent of the travel retail market, but the travel retail channel also includes ferries and cruises, border shops and downtown duty and tax-free shops.

These channels each have their own characteristics. Airport operators typically charge rent as a percentage of sales, which limits the potential upside for retailers as it reduces their operating leverage. Additionally, airport locations normally come with guaranteed minima attached. These can be expressed as absolute dollar amounts, in which case the retailer bears a traffic, consumer mix and execution risk. More frequently however, the dollar amounts are linked to traffic volume, in which case the retailer carries the consumer mix and execution risk only.

By contrast, the economics of downtown travel retail are similar to those of traditional luxury retail operations under fixed rental cost agreements. These stores typically have higher potential for operating leverage. Downtown and border shops compete directly with tax refund and display the same fundamental dynamics; fast growth with the continuing rise in traveller numbers, susceptibility to travel disruption and dependence on key brands. However, downtown tax free stores follow the business logic and constraints of the traditional high street, where tax refunds are available.

ADVERTISEMENT

Tax and duty free stores have a clear price advantage over the domestic market. They also face limited direct competition from other retailers, especially on core categories — airports with two or more operators for a single category are a minority. However, space growth is constrained by the need to win and retain concessions.

Diverse approaches to a complex channel

LVMH is the only luxury goods player with significant direct operations in travel retail, through its selective retail division. The division, comprising of duty free operator DFS and beauty products chain Sephora, booked sales of €9.5 billion (about $10.38 billion) and operating earnings of €882 million (almost $964 million) in 2014. Of this, DFS contributed an estimated 42 percent of sales and 38 percent of profits.

Salvatore Ferragamo is by far the most exposed brand to travel retail, with 138 duty free locations, more than twice as many as the number two, Hermès. It also operates nearly 27 percent of travel retail mono-brand points-of-sale (POS). Hermès and Bulgari follow with 60 and 51 travel retail locations respectively, each with about 19 percent of travel retail mono-brand POS. The list continues with Gucci , Swatch and Cartier.

The brand order is very different in terms of travel retail POS as a percentage of total POS: Shanghai Tang (30 percent), Givenchy (16 percent), Chloé (14 percent), Bottega Veneta (10 percent). But the picture could change as more and more travel retail POS are opened. In the past two years, Swatch has opened 26, Hermès and Givenchy have opened 13, Chloé 11, Bottega Veneta 10, Bulgari 10 and Cartier nine.

Hermès is the most exposed of the high-end brands, by a big margin, with 49 airport locations (Bottega Veneta 19, Chanel seven, Dior three).

Among the mega-brands, Louis Vuitton has the lowest exposure to travel retail, with only two airport locations (Gucci 31, Burberry 22, Prada nine). However, the brand operates 15 downtown locations, piggybacking on DFS Galleria (Gucci 15, Prada 15). This could give Louis Vuitton better marginal headroom for space growth, should it decide to expand more meaningfully into accessible categories — fashion jewellery, eyewear, fragrances and cosmetics, and silk scarves.

Will travel, will spend

The overall market is growing fast, by an aggregate 8.4 percent a year in the past 10 years. This is several percentage points faster than the broader personal luxury goods market and nearly three times as fast as GDP. If we include spirits, cigarettes and electronics, the travel retail market has doubled in value during the period, to about $63 billion.

Asia-Pacific is the largest and fastest growing region for travel retail ($24 billion, 13.8 percent compound growth between 2004 and 2014), with sales largely through airports, and downtown and border shops. Seven of the top eight downtown duty free locations are in Asia. Europe is the second-biggest region ($21 billion), but has the lowest growth (4.4 percent in 2004–14) and is focused on airports ($14.2 billion). The Americas region is worth about $11.5 ($6.3 billion in border shops, $4.6 billion in airports) and is growing by 7.1 percent a year. The Middle Easter and Africa market is about $6.7 billion, focused mainly on airports ($5 billion), with a compound annual growth rate of 12.4 percent for 2004–14.

As may be expected, the biggest country is Greater China (Mainland, Hong Kong, Macau, plus Taiwan), at about $10 billion, followed by South Korea ($8 billion). The third market is USA ($3.8 billion) followed by big western European countries (UK $3.7 billion, Germany $2.9 billion), the UAE ($2.7 billion) and Turkey ($2.2 billion).

However, the travel retail market is by nature sensitive both to foreign exchange rates and to exogenous shocks; terrorism, health scares, financial crises and so on. For example, the weakness of the yen and the euro have encouraged a sharp increase in spend in Japan and the Eurozone, primarily by Chinese consumers — and by Chinese professionals arbitraging price differences by buying in Europe to sell then in China through specialist websites. By the same token, Japanese consumers have withdrawn from international markets. Meanwhile, the stronger United States dollar is feeding hopes of a revival in international American spend worldwide. Currency fluctuations have also been partly responsible for a nominal slowdown in market growth in the last three years.

Conversely, regional diversity helps cushion the impact of external shocks. The buoyancy of Asian and Chinese demand has been further support. By the end of 2010, the travel retail market had fully recovered from the 2009 financial crisis and even exceeded the 2008 level — a strong performance in Asia-Pacific and the Middle East more than offset a slower recovery in Europe and Latin America.

The regional figures also underline the growing importance of emerging-market travellers. They are expected to be one of the main forces behind the forecasted doubling of air traffic in the next 15 years, including sharp increases in domestic air traffic in developing Asia and Latin America. This offers a potentially rich target for travel retail.

The result is a positive double-whammy outlook for travel retail, as emerging market nationalities are also the biggest spenders per passenger. Travel retail should therefore continue to grow faster than the personal luxury goods market.

Luca Solca is the head of luxury goods at BNP Exane Paribas.

- Luca's Letter

- Salvatore Ferragamo

- Bottega Veneta