The state of tourism and hospitality 2024

Tourism and hospitality are on a journey of disruption. Shifting source markets and destinations, growing demand for experiential and luxury travel, and innovative business strategies are all combining to dramatically alter the industry landscape. Given this momentous change, it’s important for stakeholders to consider and strategize on four major themes:

- The bulk of travel is close to home. Although international travel might draw headlines, stakeholders shouldn’t neglect the big opportunities in their backyards. Domestic travel still represents the bulk of travel spending, and intraregional tourism is on the rise.

- Consumers increasingly prioritize travel—when it’s on their own terms. Interest in travel is booming, but travelers are no longer content with a one-size-fits-all experience. Individual personalization might not always be practical, but savvy industry players can use segmentation and hypothesis-driven testing to improve their value propositions. Those that fail to articulate target customer segments and adapt their offerings accordingly risk getting left behind.

- The face of luxury travel is changing. Demand for luxury tourism and hospitality is expected to grow faster than any other travel segment today—particularly in Asia. It’s crucial to understand that luxury travelers don’t make up a monolith. Segmenting by age, nationality, and net worth can reveal varied and evolving preferences and behaviors.

- As tourism grows, destinations will need to prepare to mitigate overcrowding. Destinations need to be ready to handle the large tourist flows of tomorrow. Now is the time for stakeholders to plan, develop, and invest in mitigation strategies. Equipped with accurate assessments of carrying capacities and enhanced abilities to gather and analyze data, destinations can improve their transportation and infrastructure, build tourism-ready workforces, and preserve their natural and cultural heritages.

Now boarding: Faces, places, and trends shaping tourism in 2024

Global travel is back and buzzing. The amount of travel fell by 75 percent in 2020; however, travel is on its way to a full recovery by the end of 2024. More regional trips, an emerging population of new travelers, and a fresh set of destinations are powering steady spending in tourism.

There’s no doubt that people still love to travel and will continue to seek new experiences in new places. But where will travelers come from, and where will they go?

We share a snapshot of current traveler flows, along with estimates for growth through 2030.

The way we travel now

Which trends are shaping traveler sentiment now? What sorts of journeys do today’s travelers dream about? How much are they willing to spend on their trips? And what should industry stakeholders do to adapt to the traveler psychology of the moment?

To gauge what’s on the minds of present-day travelers, we surveyed more than 5,000 of them. The findings reveal disparate desires, generational divides, and a newly emerging set of traveler archetypes.

Updating perceptions about today’s luxury traveler

Demand for luxury tourism and hospitality is expected to grow faster than for any other segment. This growth is being powered in part by a large and expanding base of aspiring luxury travelers with net worths between $100,000 and $1 million, many of whom are younger and increasingly willing to spend larger shares of their wealth on upscale travel options. The increase is also a result of rising wealth levels in Asia.

We dug deeper into this ongoing evolution by surveying luxury travelers around the globe about their preferences, plans, and expectations. Some widely held notions about luxury travelers—such as how much money they have, how old they are, and where they come from—could be due for reexamination.

Destination readiness: Preparing for the tourist flows of tomorrow

As global tourism grows, it will be crucial for destinations to be ready. How can the tourism ecosystem prepare to host unprecedented volumes of visitors while managing the challenges that can accompany this success? A large flow of tourists, if not carefully channeled, can encumber infrastructure, harm natural and cultural attractions, and frustrate locals and visitors alike.

Now is the time for tourism stakeholders to combine their thinking and resources to look for better ways to handle the visitor flows of today while properly preparing themselves for the visitor flows of tomorrow. We offer a diagnostic that destinations can use to spot early-warning signs about tourism concentration, along with suggestions for funding mechanisms and strategies to help maximize the benefits of tourism while minimizing its negative impacts.

Six trends shaping new business models in tourism and hospitality

As destinations and source markets have transformed over the past decade, tourism and hospitality companies have evolved, too. Accommodation, home sharing, cruises, and theme parks are among the sectors in which new approaches could present new opportunities. Stakeholders gearing up for new challenges should look for business model innovations that will help sustain their hard-won growth—and profits.

Unbundling offerings, cross-selling distinctive experiences, and embracing data-powered strategies can all be winning moves. A series of insight-driven charts reveal significant trends and an outlook on the future.

RELATED ARTICLES

The future of tourism: Bridging the labor gap, enhancing customer experience

The promise of travel in the age of AI

From India to the world: Unleashing the potential of India’s tourists

- Regional Support Office for Asia and the Pacific (RSOAP)

- Member States in Asia and the Pacific

- SUSTAINABLE TOURISM OBSERVATORIES (INSTO)

According to the first UNWTO World Tourism Barometer of the year, international tourism ended 2023 at 88% of pre-pandemic levels , with an estimated 1.3 billion international arrivals . The unleashing of remaining pent-up demand, increased air connectivity, and a stronger recovery of Asian markets and destinations, are expected to underpin a full recovery by the end of 2024 (UNWTO Tourism Barometer January 2024 – Press Release) .

An estimated 1286 million international tourists (overnight visitors) were recorded around the world in 2023, an increase of 34% over 2022. International tourism recovered 88% of pre-pandemic levels, supported by strong pent-up demand (UNWTO Tourism Barometer January 2024-Excerpt) .

International tourism is expected to fully recover pre-pandemic levels in 2024, with initial estimates pointing to 2% growth above 2019 levels. This central forecast by UNWTO remains subject to the pace of recovery in Asia and to the evolution of existing economic and geopolitical downside risks (UNWTO Tourism Barometer January 2024 – Press Release) .

Asia and the Pacific reached 65% of pre-pandemic levels, with a gradual recovery since the start of 2023 following the reopening of several markets and destinations. However, performance among subregions were mixed, with South Asia recovering 87% of pre-pandemic levels and North-East Asia, 55% (UNWTO Tourism Barometer January 2024-Excerpt) .

There is still significant room for recovery across Asia. The recent reopening of several source markets and destinations is expected to boost recovery in the region and globally (UNWTO Tourism Barometer January 2024- Excerpt) .

Read more on the UNWTO Tourism Barometer (January 2024 excerpt) here .

About the UNWTO World Tourism Barometer

The UNWTO World Tourism Barometer is a publication of the World Tourism Organization (UNWTO) that monitors short-term tourism trends regularly to provide global tourism stakeholders with up-to-date analysis of international tourism. The information is updated several times a year and includes an analysis of the latest data on tourism destinations (inbound tourism) and source markets (outbound tourism). The Barometer also includes three times a year Confidence Index based on the UNWTO Panel of Tourism Experts survey, which provides an evaluation of recent performance and short-term prospects for international tourism.

Regional Support Office in Asia and the Pacific (RSOAP)

Rsoap a to z.

- Sustainable Tourism Observatories(INSTO)

UNWTO A to Z

- About UNWTO

- Affiliate Members

- Member States

- Tourism in the 2030 Agenda

- World Tourism Day

- Technical Cooperation

- ASIA AND THE PACIFIC

- MIDDLE EAST

- RESOURCES/SERVICES

- Sustainable Development of Tourism

- Ethics, Culture and Social Responsibility

- Market Intelligence

- Tourism Data Dashboard

- Publications

- UNWTO Academy

Partners links

© UNWTO Regional Support Office for Asia and the Pacific (RSOAP)

US Travel Header Utility Menu

- Future of Travel Mobility

- Travel Action Network

- Commission on Seamless & Secure Travel

- Travel Works

- Journey to Clean

Header Utility Social Links

- Follow us on FOLLOW US

- Follow us on Twitter

- Follow us on LinkedIn

- Follow us on Instagram

- Follow us on Facebook

User account menu

The latest travel data.

MONTHLY INSIGHTS March 04, 2024

U.S. Travel has temporarily paused our monthly data newsletter, however, the latest travel data is still available via the U.S. Travel Insights Dashboard . This dashboard is updated each month (member login required).

The U.S. Travel Insights Dashboard , developed in collaboration with Tourism Economics, is supported by more than 20 data sources. The dashboard is the most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry, tracking industry performance, travel volumes and predictive indicators of recovery including air and lodging forecasts, DMO website traffic, convention and group trends, travel spending and losses, traveler sentiment, among others to measure the health of the industry.

Key Highlights January 2024:

- Travel appetite started the year on a softer note, but overall growth continued. Air passenger growth remained positive, up 6% versus the prior year but lower than the double-digit growth seen through 2023. Foreign visits remained strong, up 24% YoY.

- Hotel room demand continued a trend of slight contraction falling 1% versus the prior year, while short-term rental demand grew 1%, a lower rate than 2023.

- A particular bright spot was that group room demand within the top 25 markets displayed solid growth of 9% relative to the prior year.

- The outlook for the economy remains fairly optimistic due to the strength of the labor market, looser financial conditions and healthy household and nonfinancial corporate balance sheets. This has filtered through to slightly higher consumer sentiment in February.

- Sentiment is also growing for upcoming leisure travel in 2024. The share of travelers reporting having travel plans within the next six months increased to 93% in January from 92% in December, according to Longwoods International’s monthly survey.

- Travel price inflation (TPI) fell slightly in January as a result of falling transportation prices. Sticky services inflation should see relief from decelerating wage growth. However, upside risks stem from rising healthcare costs, supply chain disruptions and slowing labor supply. Source: U.S. Travel Association and Tourism Economics

Member Price:

Non-Member Price: Become a member to access.

ADDITIONAL RESEARCH

Travel Price Index

Travel Forecast

Quarterly Consumer Insights

Additional monthly insights are available through the full U.S. Travel Monthly Data Report, exclusive to members. Please inquire with membership if you are interested in learning about becoming a member of U.S. Travel Association.

Report Description

Table of content, competitive landscape, methodology.

- Consumer Goods

- Travel & Luxury Travel

- Tourism Market Size, Share, Growth & Industry Trends [2032]

Tourism Market

Segments - by Travel Days (Within 7 Days, More Than 15 Days, and 7-15 Days), Travel Type (Business Spending and Leisure Spending), and Region (Asia Pacific, North America, Latin America, Europe, and Middle East & Africa) - Global Industry Analysis, Growth, Share, Size, Trends, and Forecast 2024–2032

Debadatta Patel

Fact-checked by:

Partha Paul

Tourism Market Outlook 2032

The global tourism market size was USD 12.4 Trillion in 2023 and is projected to reach USD 23.1 Trillion by 2032 , expanding at a CAGR of 5.4% during 2024–2032 . The market growth is attributed to the increasing standard of living and mobility. Increasing global mobility and disposable income are expected to boost the market. Tourism offers immense opportunities for economic growth and job creation as one of the world's largest economic sectors. It generates revenue, fosters cultural exchange, promotes peace, and helps preserve natural and cultural heritage.

Rising popularity of experiential tourism is projected to signify a shift in consumer preferences from traditional sightseeing to immersive experiences. Today's tourists seek authentic, personalized experiences that allow them to connect with local cultures, learn new skills, and gain a deeper understanding of their destinations. This trend is driving innovation in the tourism industry, with businesses developing unique offerings to cater to these evolving demands.

Impact of Artificial Intelligence (AI) in Tourism Market

Artificial Intelligence (AI) has a significant impact on tourism market. AI's role in enhancing customer service is particularly noteworthy, with chatbots and virtual assistants providing round-the-clock assistance, thereby improving response times and customer satisfaction. AI's ability to analyze vast amounts of data allows for the creation of highly personalized travel recommendations, enhancing customer engagement and fostering loyalty. AI-powered predictive analytics enable businesses to forecast demand accurately, optimize pricing strategies, and manage resources effectively on the operational side. Additionally, AI's role in automating routine tasks reduces operational costs and allows staff to focus on complex, value-adding activities.

Tourism Market Dynamics

Major drivers.

Surging globalization is expected to drive the market. Travel becomes easier and accessible as the world becomes interconnected. This trend is projected to boost the market, as it facilitates international travel and promotes cultural exchange. Rising government initiatives promoting tourism is projected to propel the market. Governments worldwide are estimated to invest in tourism infrastructure and marketing to attract international visitors. These initiatives are expected to boost the tourism market, as they enhance the accessibility and attractiveness of travel destinations.

Existing Restraints

Increasing environmental concerns are expected to pose a significant challenge to the market. The industry's impact on natural resources, pollution, and climate change is leading to growing scrutiny. This trend is projected to intensify, leading to stricter regulations and a decrease in tourist activities in certain regions. Growing security concerns are projected to act as a restraint on the market. Instances of terrorism, political instability, and natural disasters significantly deter tourists. This factor is likely to continue to influence the decisions of travelers, limiting the market.

Emerging Opportunities

Increasing adoption of digital technology is projected to present a significant opportunity for the market. An increasing number of travelers are expected to use digital platforms for booking and planning their trips as technology advances. This trend is projected to open new avenues for market players, as they offer innovative and convenient digital solutions for travelers. High demand for wellness and medical tourism is expected to present potential for the market. Consumers are projected to seek travel experiences that promote wellness as health and wellness become important to them. This demand is likely to create opportunities for market players, as they develop and offer wellness-focused travel products and services.

Scope of the Tourism Market Report

The market report includes an assessment of the market trends, segments, and regional markets. Overview and dynamics are included in the report.

Regional Outlook

In terms of region , the global tourism market is classified as Asia Pacific, North America, Latin America, Europe, and Middle East & Africa. Europe, specifically France held a major market share in 2023 due to its rich cultural heritage, world-renowned landmarks such as the Eiffel Tower and the Louvre, and its reputation as a global culinary capital. Additionally, France's well-developed infrastructure and strategic location in Europe, which allows for easy travel from neighboring countries, further bolstered its market share. The market in Asia Pacific, particularly China is projected to grow at a significant pace in the years to come owing to China's rich cultural history, diverse landscapes, and rapid urban development making it an increasingly attractive destination for international travelers. China's growing middle class is driving domestic tourism , contributing to its overall market share. The government of China’s initiatives to boost tourism, such as improving infrastructure and easing visa restrictions, are expected to enhance its appeal as a travel destination, thereby driving its market.

Tourism Market Segment Insights

Travel days segment analysis.

Based on travel days , the tourism market is divided into within 7 days, more than 15 days, and 7-15 days. The 7-15 days segment held the major share of the market in 2023 due to this duration offering an optimal balance between exploration and relaxation, enabling travelers to immerse themselves in the destination without feeling rushed. The rise of this segment is attributed to the increasing preference for comprehensive travel experiences that allow for a deeper understanding of the local culture and environment. The 7 days segment is expected to expand at a significant growth rate in the coming years owing to the growing demand for short, frequent getaways that provide a quick respite from daily routines. The convenience and affordability of these shorter trips and the increasing availability of weekend packages and city breaks, is expected to fuel the segment.

Travel Type Segment Analysis

On the basis of travel type , the global market is segregated into business spending and leisure spending. The business spending segment held largest market share in 2023 due to the necessity of face-to-face meetings and networking events in many industries. Despite the rise of digital communication tools, in-person interactions remain crucial in the business world, leading to a steady demand for business travel. The leisure spending segment is anticipated to grow at a substantial CAGR during the forecast period owing to the growing emphasis on work-life balance and the recognition of travel as a means of relaxation and rejuvenation. The increasing disposable income and the rising trend of experiential travel is projected to drive the segment in the coming years.

The tourism market has been segmented on the basis of

Travel Days

- Within 7 Days

- More Than 15 Days

Travel Type

- Business Spending

- Leisure Spending

- Asia Pacific

- North America

- Latin America

- Middle East & Africa

Key Players

- Austin Adventures, Inc.

- Butterfield & Robinson Inc.

- Cox & Kings Ltd.

- Discovery Nomads

- G Adventures

- Geographic Expeditions Inc.

- Intrepid Group, ltd.

- Mountain Travel Sobek

- Row Adventures

Key players competing in the global tourism market are Austin Adventures, Inc.; Butterfield & Robinson Inc.; Cox & Kings Ltd.; Discovery Nomads; G Adventures; Geographic Expeditions Inc.; Intrepid Group, ltd.; Mountain Travel Sobek; Row Adventures; and Tui Group. These companies use development strategies including mergers, acquisitions, partnerships, collaboration, and product launches to expand their consumer base worldwide.

In January 2021 , Geographic Expeditions Inc. , a key market player, initiated a three-country expedition across the Horn of Africa, encompassing less explored destinations such as Eritrea, Djibouti, and the self-proclaimed nation of Somaliland.

Purchase Premium Report

- Single User $4200

- Multi User $5500

- Corporate User $6600

- Online License $2999

- Excel Data Pack $2599

Customize This Report

- Ask for Research To Be Focused On Specific Regions or Segments

- Receive Data As Per Your Format and Definition

- Companies Profiled based on Your Requirements

- Breaking Down Competitive Landscape as per Your Requirements

- Any Level of Customization

Our Clients

We needed a highly accurate and precise report, which delivered promptly. The company compiled information from a wide array of reliable agencies and sourcess.It is extremely satisfactory to be working with you. Strategy Head of Major Tech Company

We were very pleased to contact as they tailored reports precisely as per our requirements. As we are dealing with the aerospace and defense industry, we need reports of high accuracy and substantial quality. Major Player in Defense Industry

Extremely delighted to have a well-crafted report on “Global Packaging Solutions Market Research Report” from your team. Thank you for providing me with all our requirements and for incorporating our suggestions. CMO of Leading Packaging Company from USA

I had a good experience working with as they were very open to all constructive changes in the report. I found that the report had its charm embedded with ample of data. Founder and Managing Partner of Major Korean Company

Our company has been working with for some years now and we are very happy with the quality of the reports provided by the company.I, on behalf of my organization, would like to thank you for offering professional reports. Global Consulting Firm

Quick Contact

+1 909 414 1393

Certified By

Related Reports

Some other reports from this category!

Camping Sleeping Bags Market Report | Global Forecast From 2023 To 2032

Cruise Liners Market Report | Global Forecast From 2023 To 2032

Duty-Free and Travel Retail Market Report | Global Forecast From 2023 To 2032

Duty Free & Travel Retail Market Report | Global Forecast From 2023 To 2032

Business Travel Market Report | Global Forecast From 2023 To 2032

Travel Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Adventure Tourism Market Report | Global Forecast From 2023 To 2032

Cooler Bags Market Report | Global Forecast From 2023 To 2032

Luggage & Bags Market Report | Global Forecast From 2023 To 2032

Leather Luggage Market Research Report 2032

- Free Sample

"People want to travel": 4 sector leaders say that tourism will change and grow

The global travel and tourism industry's post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. Image: Unsplash/Anete Lūsiņa

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Anthony Capuano

Shinya katanozaka, gilda perez-alvarado, stephen kaufer.

Listen to the article

- In 2020 alone, the travel and tourism industry lost $4.5 trillion in GDP and 62 million jobs - the road to recovery remains long.

- The World Economic Forum’s latest Travel & Tourism Development Index gives expert insights on how the sector will recover and grow.

- We asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

The global travel and tourism sector’s post-pandemic recovery is gaining pace as the world’s pent-up desire for travel rekindles. The difference in international tourist arrivals in January 2021 and a similar period in January 2022 was as much as the growth in all of 2021. However, with $4.5 trillion in GDP and 62 million jobs lost in 2020 alone, the road to recovery remains long.

A few factors will greatly determine how the sector performs. These include travel restrictions, vaccination rates and health security, changing market dynamics and consumer preferences, and the ability of businesses and destinations to adapt. At the same time, the sector will need to prepare for future shocks.

The TTDI benchmarks and measures “the set of factors and policies that enable the sustainable and resilient development of the T&T sector, which in turn contributes to the development of a country”. The TTDI is a direct evolution of the long-running Travel and Tourism Competitiveness Index (TTCI), with the change reflecting the index’s increased coverage of T&T development concepts, including sustainability and resilience impact on T&T growth and is designed to highlight the sector’s role in broader economic and social development as well as the need for T&T stakeholder collaboration to mitigate the impact of the pandemic, bolster the recovery and deal with future challenges and risks. Some of the most notable framework and methodology differences between the TTCI and TTDI include the additions of new pillars, including Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact. Please see the Technical notes and methodology. section to learn more about the index and the differences between the TTCI and TTDI.

The World Economic Forum's latest Travel & Tourism Development Index highlights many of these aspects, including the opportunity and need to rebuild the travel and tourism sector for the better by making it more inclusive, sustainable, and resilient. This will unleash its potential to drive future economic and social progress.

Within this context, we asked four business leaders in the sector to reflect on the state of its recovery, lessons learned from the pandemic, and the conditions that are critical for the future success of travel and tourism businesses and destinations.

Have you read?

Are you a 'bleisure' traveller, what is a ‘vaccine passport’ and will you need one the next time you travel, a travel boom is looming. but is the industry ready, how to follow davos 2022, “the way we live and work has changed because of the pandemic and the way we travel has changed as well”.

Tony Capuano, CEO, Marriott International

Despite the challenges created by the COVID-19 pandemic, the future looks bright for travel and tourism. Across the globe, people are already getting back on the road. Demand for travel is incredibly resilient and as vaccination rates have risen and restrictions eased, travel has rebounded quickly, often led by leisure.

The way many of us live and work has changed because of the pandemic and the way we travel has changed as well. New categories of travel have emerged. The rise of “bleisure” travel is one example – combining elements of business and leisure travel into a single trip. Newly flexible work arrangements, including the opportunity for many knowledge workers to work remotely, have created opportunities for extended travel, not limited by a Monday to Friday “9 to 5” workweek in the office.

To capitalize on this renewed and growing demand for new travel experiences, industry must join governments and policymakers to ensure that the right conditions are in place to welcome travellers as they prepare to get back on the road again, particularly those who cross international borders. Thus far, much of the recovery has been led by domestic and leisure travel. The incremental recovery of business and international travel, however, will be significant for the broader industry and the millions who make their livelihoods through travel and tourism.

Looking ahead to future challenges to the sector, be they public health conditions, international crises, or climate impacts, global coordination will be the essential component in tackling difficult circumstances head-on. International agreement on common – or at least compatible – standards and decision-making frameworks around global travel is key. Leveraging existing organizations and processes to achieve consensus as challenges emerge will help reduce risk and improve collaboration while keeping borders open.

“The travel and tourism sector will not be able to survive unless it adapts to the virtual market and sustainability conscience travellers”

Shinya Katanozaka, Representative Director, Chairman, ANA Holdings Inc.

At a time when people’s movements are still being restricted by the pandemic, there is a strong, renewed sense that people want to travel and that they want to go places for business and leisure.

In that respect, the biggest change has been in the very concept of “travel.”

A prime example is the rapid expansion of the market for “virtual travel.” This trend has been accelerated not only by advances in digital technologies, but also by the protracted pandemic. The travel and tourism sector will not be able to survive unless it adapts to this new market.

However, this is not as simple as a shift from “real” to “virtual.” Virtual experiences will flow back into a rediscovery of the value of real experiences. And beyond that, to a hunger for real experiences with clearer and more diverse purposes. The hope is that this meeting of virtual and actual will bring balance and synergy the industry.

The pandemic has also seen the emergence of the “sustainability-conscious” traveller, which means that the aviation industry and others are now facing the challenge of adding decarbonization to their value proposition. This trend will force a re-examination of what travel itself should look like and how sustainable practices can be incorporated and communicated. Addressing this challenge will also require stronger collaboration across the entire industry. We believe that this will play an important role in the industry’s revitalization as it recovers from the pandemic.

How is the World Economic Forum promoting sustainable and inclusive mobility systems?

The World Economic Forum’s Platform for Shaping the Future of Mobility works across four industries: aerospace and drones; automotive and new mobility; aviation travel and tourism; and supply chain and transport. It aims to ensure that the future of mobility is safe, clean, and inclusive.

- Through the Clean Skies for Tomorrow Coalition , more than 100 companies are working together to power global aviation with 10% sustainable aviation fuel by 2030.

- In collaboration with UNICEF, the Forum developed a charter with leading shipping, airlines and logistics to support COVAX in delivering more than 1 billion COVID-19 vaccines to vulnerable communities worldwide.

- The Road Freight Zero Project and P4G-Getting to Zero Coalition have led to outcomes demonstrating the rationale, costs and opportunities for accelerating the transition to zero emission freight.

- The Medicine from the Sky initiative is using drones to deliver vaccines and medicine to remote areas in India, completing over 300 successful trials.

- The Forum’s Target True Zero initiative is working to accelerate the deployment and scaling of zero emission aviation, leveraging electric and hydrogen flight technologies.

- In collaboration with the City of Los Angeles, Federal Aviation Administration, and NASA, the Forum developed the Principles of the Urban Sky to help adopt Urban Air Mobility in cities worldwide.

- The Forum led the development of the Space Sustainability Rating to incentivize and promote a more safe and sustainable approach to space mission management and debris mitigation in orbit.

- The Circular Cars Initiative is informing the automotive circularity policy agenda, following the endorsement from European Commission and Zero Emission Vehicle Transition Council countries, and is now invited to support China’s policy roadmap.

- The Moving India network is working with policymakers to advance electric vehicle manufacturing policies, ignite adoption of zero emission road freight vehicles, and finance the transition.

- The Urban Mobility Scorecards initiative – led by the Forum’s Global New Mobility Coalition – is bringing together mobility operators and cities to benchmark the transition to sustainable urban mobility systems.

Contact us for more information on how to get involved.

“The tourism industry must advocate for better protection of small businesses”

Gilda Perez-Alvarado, Global CEO, JLL Hotels & Hospitality

In the next few years, I think sustainability practices will become more prevalent as travellers become both more aware and interested in what countries, destinations and regions are doing in the sustainability space. Both core environmental pieces, such as water and air, and a general approach to sustainability are going to be important.

Additionally, I think conservation becomes more important in terms of how destinations and countries explain what they are doing, as the importance of climate change and natural resources are going to be critical and become top of mind for travellers.

The second part to this is we may see more interest in outdoor events going forward because it creates that sort of natural social distancing, if you will, or that natural safety piece. Doing outdoor activities such as outdoor dining, hiking and festivals may be a more appealing alternative to overcrowded events and spaces.

A lot of lessons were learned over the last few years, but one of the biggest ones was the importance of small business. As an industry, we must protect small business better. We need to have programmes outlined that successfully help small businesses get through challenging times.

Unfortunately, during the pandemic, many small businesses shut down and may never return. Small businesses are important to the travel and tourism sector because they bring uniqueness to destinations. People don’t travel to visit the same places they could visit at home; they prefer unique experiences that are only offered by specific businesses. If you were to remove all the small businesses from a destination, it would be a very different experience.

“Data shows that the majority of travellers want to explore destinations in a more immersive and experiential way”

Steve Kaufer, Co-Founder & CEO, Tripadvisor

We’re on the verge of a travel renaissance. The pandemic might have interrupted the global travel experience, but people are slowly coming out of the bubble. Businesses need to acknowledge the continued desire to feel safe when travelling. A Tripadvisor survey revealed that three-quarters (76%) of travellers will still make destination choices based on low COVID-19 infection rates.

As such, efforts to showcase how businesses care for travellers - be it by deep cleaning their properties or making items like hand sanitizer readily available - need to be ingrained within tourism operations moving forward.

But travel will also evolve in other ways, and as an industry, we need to be prepared to think digitally, and reimagine our use of physical space.

Hotels will become dynamic meeting places for teams to bond in our new hybrid work style. Lodgings near major corporate headquarters will benefit from an influx of bookings from employees convening for longer periods. They will also make way for the “bleisure” traveller who mixes business trips with leisure. Hotels in unique locales will become feasible workspaces. Employers should prepare for their workers to tag on a few extra days to get some rest and relaxation after on-location company gatherings.

Beyond the pandemic, travellers will also want to explore the world differently, see new places and do new things. Our data reveals that the majority want to explore destinations in a more immersive and experiential way, and to feel more connected to the history and culture. While seeing the top of the Empire State building has been a typical excursion for tourists in New York city, visitors will become more drawn to intimate activities like taking a cooking class in Brooklyn with a family of pizza makers who go back generations. This will undoubtedly be a significant area of growth in the travel and tourism industry.

Governments would be smart to plan as well, and to consider an international playbook that helps prepare us for the next public health crisis, inclusive of universal vaccine passports and policies that get us through borders faster.

Understanding these key trends - the ongoing need to feel safe and the growing desire to travel differently - and planning for the next crisis will be essential for governments, destinations, and tourism businesses to succeed in the efforts to keep the world travelling.

Download WP Travel

Please enter your email to download WP Travel and also get amazing WP Travel offers and Newsletters.

Currently the form is not available.

Global Tourism Statistics 2024:Facts and Forecasts

Home » Blog » Global Tourism Statistics 2024:Facts and Forecasts

After the massive hit of the COVID-19 pandemic, global tourism’s future and trends tend to move towards an upward shift. This paradigm shift has a gigantic impact on tourism and related activities. So, we will delve more into Global Tourism Statistics 2024:Facts and Forecasts today.

There was a subsequent rise in GDP after the COVID-19 pandemic period . Statista predicted in 2022 that the tourism industry will get back on track as tourists tend to be inbound and outbound from place to place.

Table of contents

Global tourism analysis, global tourism statistics 2019, global tourism statistics 2020, global tourism statistics 2021, global tourism statistics 2022, global tourism statistics 2023, global tourism statistics 2024 | predictive analysis, international tourist arrivals in 2024.

- Global Tourism Contributions to GDP 2024

Global Tourism Growth Rate 2024

Global tourism revenue growth rate 2024.

The tourism industry and activities started to flourish after the pandemic. The number started to rise again. Global Tourism Statistics predicted that the travel and tourism business will experience 18% growth in 2024.

This is the highest point after the pandemic period. Hotel bookings, travel, and tourism businesses are expected to reach new heights. Experts suggest it’s the best time to start your own travel agency business.

- International tourist arrivals worldwide were around 95,000 at the beginning of 2019.

- The growth rate of tourist arrivals was slower.

- Nearly $1.9 trillion was spent by tourists in 2019.

- Travel receipts were around $9.3 billion in 2019.

Global Tourism was about $8.9 trillion in 2019 . Tourists love to explore beautiful countries. And popular destinations. France tends to hold the Number 1 position in 2019 as more than 90 million tourists visit the country.

(Top 5 visited countries 2019)

Moreover, 2019 tourism was slightly disturbed by covid 19 from July. However, there were many popular destinations loved by tourists worldwide.

In 2019, the total spending on world tourism reached a peak of $1.86 trillion, showing a growth of 1.81% compared to the previous year.

This indicates that people tend to spend more on travel and tourism activities, contributing to the overall tourism industry’s economic enhancement.

The increase in spending suggests a continued interest and investment in tourism experiences on a global scale.

There was a massive decline in the travel and tourism industry in 2020. The tourism industry declined by more than 67% compared to the previous year . This makes one of the greatest downward shifts in the tourism industry ever recorded after subsequent time.

Pacific island Fiji tends to face an economic crisis because of a decline in tourist and tourism activities. Countries relying totally on tourism were more affected this year.

From January to May 2020. International tourist arrivals declined by more than 56% similarly in April it was recorded with a decline of 97%.

(Decline in international arrivals 2019 vs 2022)

The limited movement of people from place to place results in a massive loss for the aviation industry as well.

Air passenger was reduced by almost 60.2% compared to 2019 . This creates the worst conditions for the airline industry. Among many industries airline industry was one of the most impacted as there was a decline in tourist flow.

- GDP of tourism ( 2.9 of GDP) $624.7 billion was declined to $356.8 (1.7 of GDP) making it the greatest downfall of all time in tourism history.

- Total number of visitors in 2020 was comparatively low compared with the past 10 years of data.

- Tourism-dependent countries faced a major economic crisis.

Overall global tourism in 2020 didn’t grow that well the unpredictable circumstance has resulted in a massive decline in the GPD as well. There were approximately 1.5 billion tourist arrivals in 2019 and the number declined by more than 75% in 2020 the estimated tourist arrival in 2020 was around 381 million only. Compared with the 2019 tourist arrival the data fluctuation is very high.

The Tourism industry has gone through numerous uptrends and downtrends throughout the period. 2019 ended and 2020 was considered one of the most challenging years for the whole tourism industry. Regarding 2021 the tourism industry starts to rise at a minimal speed.

In 2021 tourism industry start to gain speed at a minimal rate according to the popular data analytical site Statista. Global tourism worldwide increased by 4% in 2021 compared to 2020.

Matter of fact the international tourist arrival was 79% down compared with the 2019 tourist inbound data.

Recovering from the mass decline of 2020 the tourism industry started to increase with several 64.4% in 2021. The travel and tourism increment number in 2020 was only 50.7%

(Decline in international tourist arrivals)

In 2021, the US had 22.1 million inbound arrivals, which is a 15% increase from 2020 and a 72% decrease from 2019.

- Overall increment in the tourism industry was recorded at more than 64.4 %

- Export revenues from international tourism dropped 59%.

- In 2021, the travel and tourism industry’s share of GDP increased from 1.54% in 2020 to 2.15% in 2021.

- Compared to 2019 the contribution of GDP was still down in 2021 ( 49.1% ) only.

- Recovering from the pandemic travel and tourism businesses tend to increase by more than 362 billion dollars.

Regarding 2021 tourism status it has shown a little increment in terms of number compared with the 2020 data. The industry recorded a substantial 64.4% growth , surpassing the incremental rate in 2020.

Export revenues dropped by 59%, while the industry’s share of GDP improved from 1.54% in 2020 to 2.15% in 2021 . Despite signs of recovery, the sector has not reached its growth level in 2020.

Comparing the tourism condition with the year 2021 the number and data start to shift toward an upward curve. Analyzing the data deeply in 2022 total international tourism receipt reached the threshold of $1 trillion which is massive compared to the 2022 number.

However, the total receipts were still not able to reach the number of pre-pandemic. In 2022 more than 900 million tourists travel internationally.

International tourist spending reached 64% of pre-pandemic levels. 2022 start to maintain sort of momentum to reach the peak point of travel and tourism activities.

( C ontribution over GDP from 2019 to 2022 )

- The total earned export revenue was still below the line ( 34 % ) below the pre-pandemic level.

- $7.7 trillion contribution to global GDP

- Significant growth in spending of international visitors ( about 20.4% increment )

- In 2022 travel and tourism generated more than 22 million new jobs . Significantly high in number compared to 2021 data.

The travel and tourism sector ultimately makes a contribution of 7.7 trillion dollars to global gross domestic product ( GDP ). The number is shifting in an upward trend compared with other previous years.

The 2022 travel and tourism activities maintained a pace of recovery mode. The industry maintained to level up from the previous year. As it intends to create more jobs and contribute more to the global economy and GDP.

All the dimensions of the tourism industry in 2022 starts to evolve and grow over time. Ultimately the revenue received from tourists hit a whopping $1 trillion and more than 900 million people travel globally.

The travel industry solely created millions of jobs and contributed to overall economic growth.

Popular website for travel and tourism data stated that more than 975 million tourists were traveling internationally in the year 2023. Compared with 2021 and 2022 this year seems to be beneficial for travel and tourism industries.

In the first quarter of 2023, there is a spike in the growth of tourist arrivals. International tourist arrival reached 80% of pre-pandemic level. This states that the year 2023 is a sort of recovery year for the tourism industry. After years the industry was able to reach this point.

The travel and tourism industry somehow was able to reach progress similar to the year 2019. Travel bookings were up r oughly 31% at the end of March 2023 compared to the same time in 2019.

The travel and tourism health progress up to 87% in the year 2023. The USA tends to be a prime actor as it was able to accumulate more than $190.39 billion U.S. dollars.

Followed by the supreme country China and Canada.

China accumulated around $154.02 billion U.S. dollars followed by Canada which is $16 billion U.S. dollars.

The total gap between Canada and the USA is around $174.39 billion U.S. dollars respectively. In terms of numbers, these countries seem to do well in the tourism industry.

(Top 5 Visited Countries 2023 )

Key Points:

- Over 975 million tourists traveled worldwide in 2023 ( Jan to Sep)

- The total projected contribution of travel and tourism was around $2.2 trillion U.S. dollars toward global GDP.

- The total international receipt projected in 2023 was around USD 1.4 trillion .

- Compared with other years in 2023, there were more than 171 nights spent compared to 2022.

- Rise in tourist traveling rate results into increment in increment in hotel occupancy rate up to 10% higher compared to the previous year.

Airline industries also tend to bounce back as revenues reach more than $803 billion , Comparatively it’s higher than 2022 as it reached around 9.7%.

Certain external factors do impact the travel business globally. The economic sanctions on Russia by different nations have resulted in delays in travel and tourism as well. Similarly, the zero COVID strategy promulgated by China has also affected the tourism industry overall.

The momentum of global tourism could potentially shift to an upward curve if all external factors don’t interrupt travel and tourism activities.

2024 is regarded as one of the important years for the travel and tourism sector. As the impact of COVID-19 started to overcome the travel and tourism business all across the world started to gain momentum throughout the time.

There are thorough predictions made for 2024 tourism. Multiple analyses tend to show potential opportunities for the tourism sector. From 2019 to 2023 the industry of tourism was scattered by COVID-19 after the interference of COVID-19 the cycle of 2024 tourism got into rollercoaster rides.

However, global tourism spending is predicted to reach $2 trillion in 2024 . After a long period, it’s predicted that international travel trips will exceed pre-pandemic levels in 2024, marking a 3% increase from 2019 .

The overall tourism market will get to a new level. The prediction is that the travel and tourism market will reach $927.30 billion in 2024 . Which is one of the big numbers compared to the previous year’s global tourism statistics.

After lot’s of ups and downs finally the travel and tourism industry is getting into momentum. It’s expected that tourist arrivals in 2024 will increase by 17.23% from the past year i.e. 2023. If the industry can meet the expectation there will be massive changes in the overall tourism business.

- The expected international tourists is about 1.53 billion which is significantly large compared to the previous year.

- the GDP contribution by tourism in 2024 will be 10.6%

- Year-to-year growth in 2024 will be increased by a large number as expectation of over 17.24 % is made.

- Ultimately the revenue will be around US 9.4 billion American dollars .

In 2024, the travel and tourism industry is on the rise after facing challenges. There’s a big anticipation of a 17.23% increase in tourist arrivals compared to 2023.

(International Tourist Arrival in 2024 )

If this expectation is met, it could bring significant positive changes to the overall tourism business.

The projected number of international tourists for 2024 is a substantial 1.53 billion, a noteworthy increase from the previous year.

The industry’s contribution to the global GDP in 2023 was 10.6%. Looking ahead, there’s an optimistic year-to-year growth forecast of over 17.24% in 2024.

In terms of revenue, the industry is expected to generate around US $9.4 billion . These promising figures indicate a strong recovery and growth for the travel and tourism sector in the coming year.

Global Tourism Contributions to GDP 2024

The travel and tourism industry is getting on track after facing challenges in recent years. For 2024, there is an optimistic growth outlook:

- Tourist arrivals are expected to increase by 17.23% from 2023 . If this matches the expectations, it could bring major positive impacts for the overall tourism business.

- International tourist projections sit at a substantial 1.53 billion for 2024, a significant jump from the previous year’s numbers.

- The industry contributed 10.6% to global GDP in 2023.

- For 2024, year-over-year growth forecasts are a promising 17.24%, indicating strong momentum.

- In terms of revenue generation, the travel sector could reach around USD 9.4 billion.

(2024 Global Tourism Contribution To GDP)

These numbers and projections point to a rapid recovery and expansion period for international and domestic travel over the coming year.

More people are expected to take vacations and business trips that could greatly benefit tour operators, hotels, airlines, and other travel entities after facing struggles not too long ago.

If the above expectations and forecasts are fulfilled, 2024 is shaping up to be a beneficial year for travel and tourism when looking at tourist arrivals, GDP contributions, growth percentages, and total revenue creation. There seems to be renewed optimism across the sector.

Overall ,the travel and tourism industry holds a positive growth approach in 2024 according to projections:

- Global tourism saw significant declines in 2020 and 2021 due to the COVID-19 pandemic. However, momentum picked back up in 2022.

- For 2023, the estimated growth rate in global tourism is between 30% to 35% as the industry rebounds.

- Looking ahead to 2024 , the global tourism growth rate is forecasted to be around 34.7%.

- This would represent a noticeable jump from the expected 30-35% growth in 2023 showing sustained positive momentum.

- If 2024 hits the projected 34.7% in tourism growth , it would take global travel significantly above 2019 volumes indicating a full industry comeback has been achieved.

- This global growth also implies strong performance in major tourism markets across different regions like Europe, Asia Pacific, the Americas, the Middle East, and Africa.

(Global Tourism Growth Rate 2024)

Ultimately, 2024 is setting up to be another very high growth year for travel globally with expectations of over one-third increase in tourism versus 2023 numbers.

So, we suggest that travel business owners be ready to create travel booking websites and generate revenue and growth substantially with huge scope.

All signals point to a sector that has recovered to pre-pandemic strength and managed to undo the large drops observed in 2020 and 2021.

International tourist arrivals are projected to reach 1.53 billion, representing a substantial recovery with an expected year-over-year growth of 17.24% from the 975 million arrivals in 2023.

After facing major challenges in 2020 and 2021, the tourism industry is all set for substantial revenue growth in 2024:

- Global tourism revenue saw a major decline of nearly 50% at the peak of the pandemic. This significantly impacted many travel businesses and destinations.

- A rebound is already underway in 2022 and is expected to continue accelerating through 2023 with an estimated 30-35% growth rate .

- Experts expect Global tourism revenues to surge by around 34.7% year-over-year in 2024

- Gaining a 34.7% revenue growth target would indicate tourism has fully recovered from the pandemic demand shock and is expanding rapidly again.

(Global Tourism Revenue Growth 2024)

If achieved, 2024 would likely represent the highest-ever revenues for the tourism industry globally surpassing pre-pandemic levels.

The projections for a nearly 35% boost in tourism revenues globally paint an extremely optimistic picture of what lies ahead for the sector in 2024 as demand swells.

This rapid growth trajectory beyond 2023 forecasts shows tourism maintaining great momentum as a key recovery success story among industries worldwide.

➤ Here is the complete list of tour operator software.

The overview for tourism in 2024 is highly positive across expected metrics. Forecasts predict that international tourist arrivals will hit 1.5 billion, representing a rapid 17.23% increase compared to estimates from 2023. This surge will elevate volumes well beyond pre-pandemic levels.

The tourism sector’s contribution to global GDP looks to have a significant rise in 2024, building on its 10.6% share in 2023. This growth reflects the sector’s full economic recovery. Most notably, tourism revenues could grow up to 34.7% year-over-year, reaching around $9.4 billion globally .

Yam Bahadur Chhetri is a content writer and vivid contributor to the WordPress community and a WordPress enthusiast with an experience of 7+ years in the relative field. He also loves to develop WordPress Themes, Plugins, and custom WordPress development for clients.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Get WP Travel Pro

Create Stunning , SEO friendly and Fully functional Travel website within minutes . No Coding Required !

Suitable for any

- Travel Agency

- Tour Booking Services

- Travel Bloggers

Drive more Sales and Revenues from today !

$ 99 99 USD per year

📢 Santa has sent the gift for Christmas and New Year sales on all WP Travel Pro plans. 🛍️ Use coupon code "XMAS_NEWYEAR2024" at checkout.

Related posts

How to Build a Website Like Airbnb in 2024? [Complete Guide]

Best Stock Photos Sites For Royalty-Free Travel Images(Updated)

Leading Tour Operator Software for Medium Businesses in The USA

Wp travel modules.

Need more features to save your time and to boost your travel business? WP Travel Pro comes with more powerful modules . While our core travel plugin provides almost all the features that a travel and trekking websites generally needs, our add-ons boost it’s capacity further to make it the best travel engine on WordPress. Whether you want to add new payment method to your site or brush up your trekking listings with beautiful maps show casing your trips, we have all your imagination covered. See all our add ons below to boost your travel website’s features further.

Weather Forecast

Import Export

Partial Payment

Connect with wp travel to join the travel conversation, documentation →.

Explore More

Customer Support →

We are here to help.

Facebook Group →

User Community Forum

Follow On Twitter →

Connect with us on Twitter

7 Top Travel Industry Trends (2024 & 2025)

You may also like:

- Transportation Industry Trends

- Growing Travel Startups

- New Technology Trends

This is our list of the top 7 travel trends happening right now (in 2024).

Along with expert predictions about trends that are likely to blow up in 2025.

1. Travelers go it alone

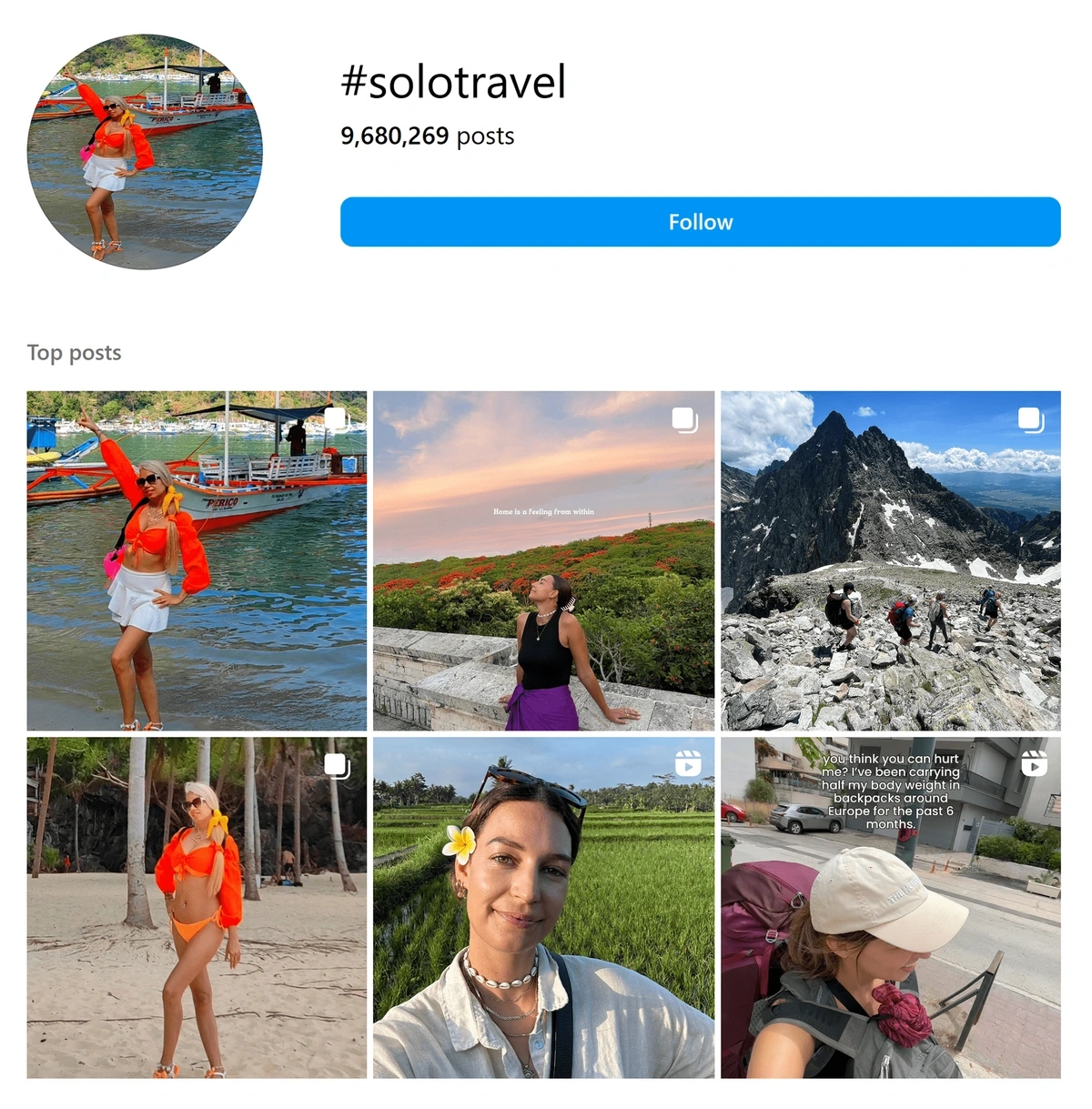

A survey by American Express found that 69% of travelers are planning a solo trip this year .

The same survey discovered that 76% of Gen Z and Millennials were open to solo travel.

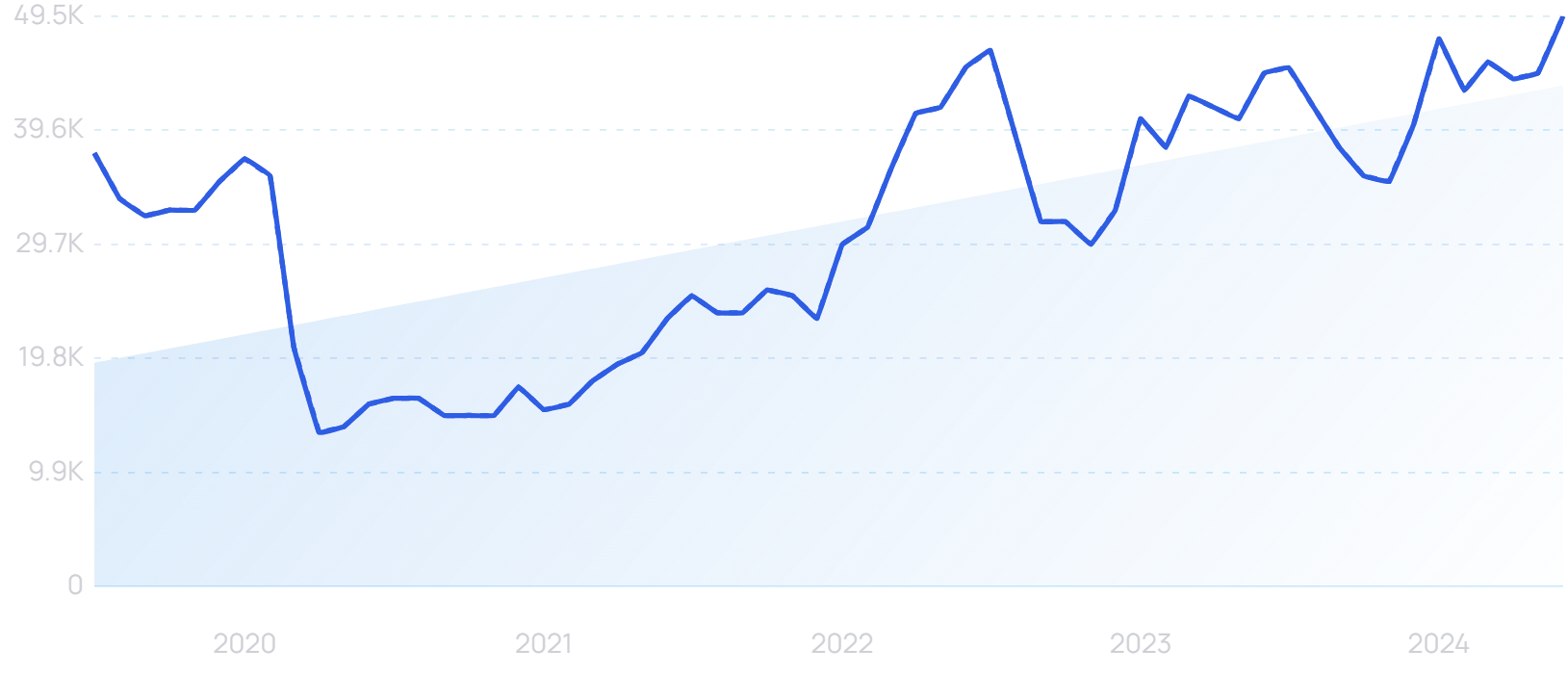

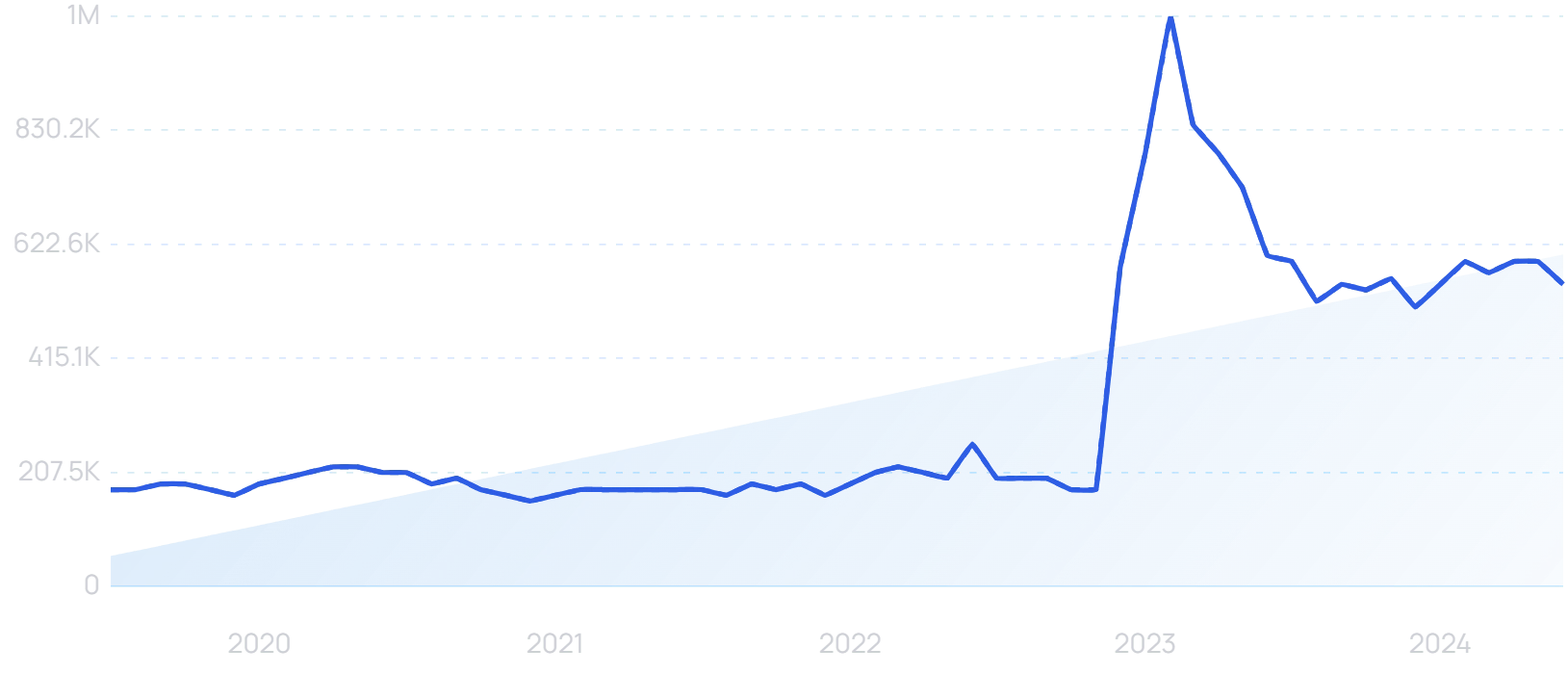

There are other signs that this trend is on the rise.

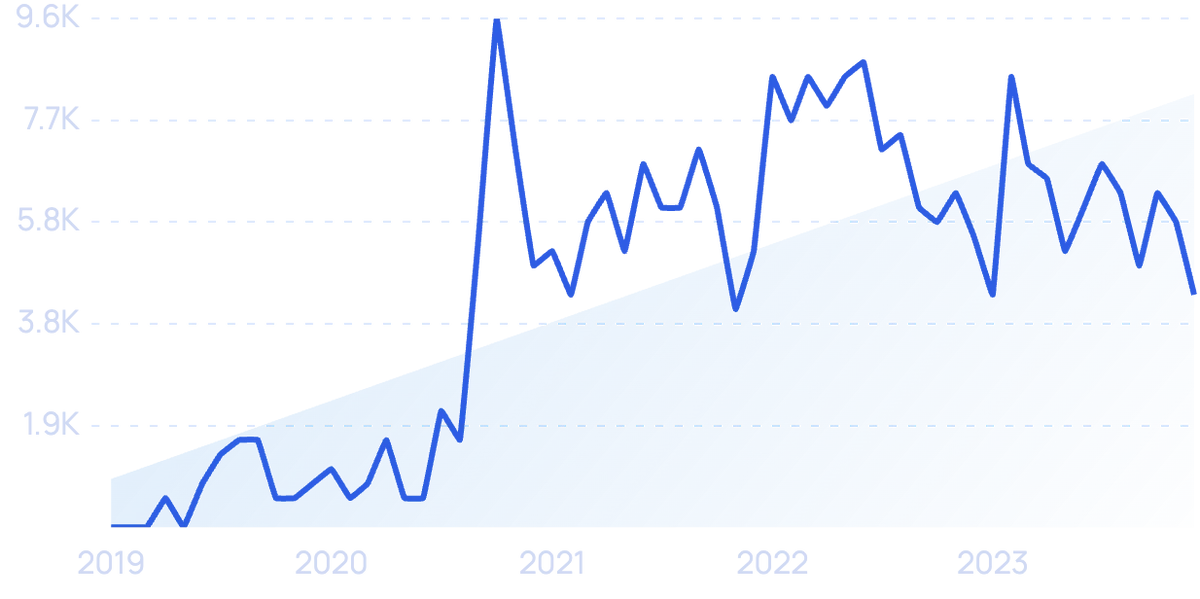

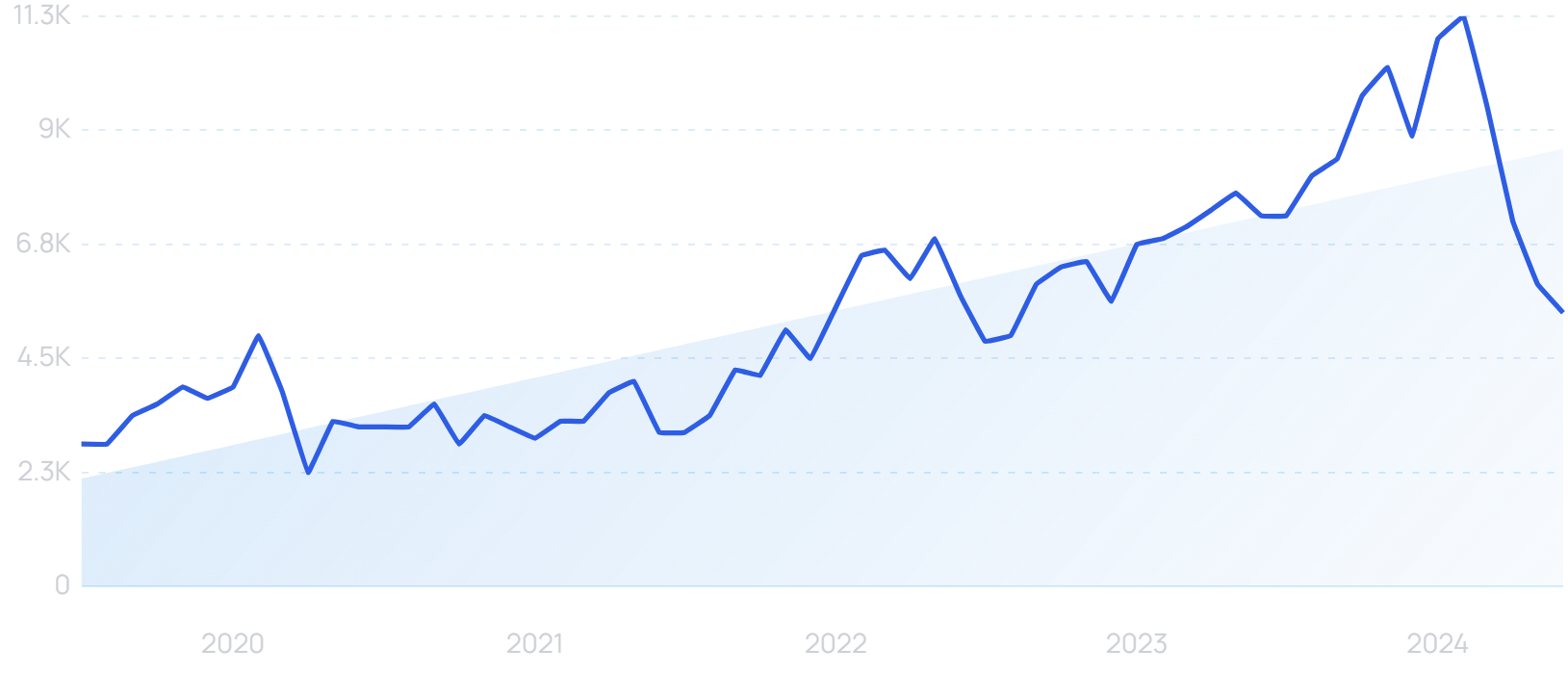

Google searches for "solo travel" have increased by 223% over the last 10 years .

Solo travelers are big on social media too. We're seeing a large increase in videos and images posted on social media that feature solo adventures.

The big question is: why are more people planning trips alone?

- Self-care: AMEX's recent Global Travel Trends Report found that 66% travelers planning to go solo did so to focus on treating themselves.

- Less hassle: No need to coordinate agendas or competing interests. Solo travelers can book the exact trip they desire without compromise.

- Quick refresh: Most solo trips are for smaller getaways. Which makes them ideal for a weekend or single-week trip. Travelers still prefer a partner for longer journeys.

- Meeting new people: Traveling alone makes it more likely to make new connections with locals or with other travelers.

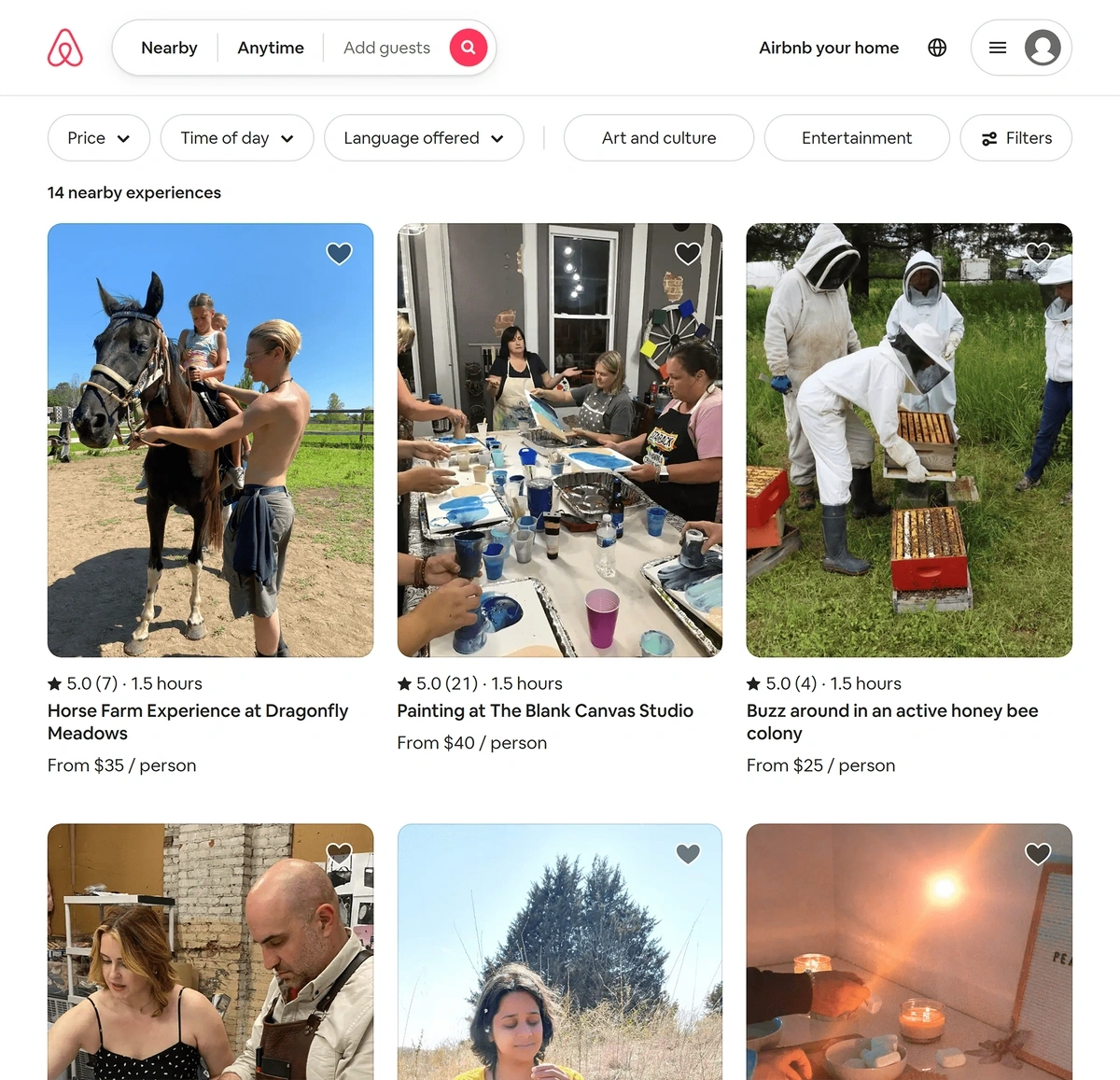

2. Travelers crave local experiences

The "experience economy" is huge in the travel industry.

However, fewer travelers are seeking traditional sightseeing expeditions.

Instead, “consumers [will] pursue authentic experiences , distancing themselves from mainstream tourism providers and venturing into pastimes that feel more meaningful”.

Data insights company AirSage marks this as an emerging trend because “people no longer want boring and conventional travel experiences as much as they used to. Instead, they would rather pay for vacations that are once-in-a-lifetime opportunities”.

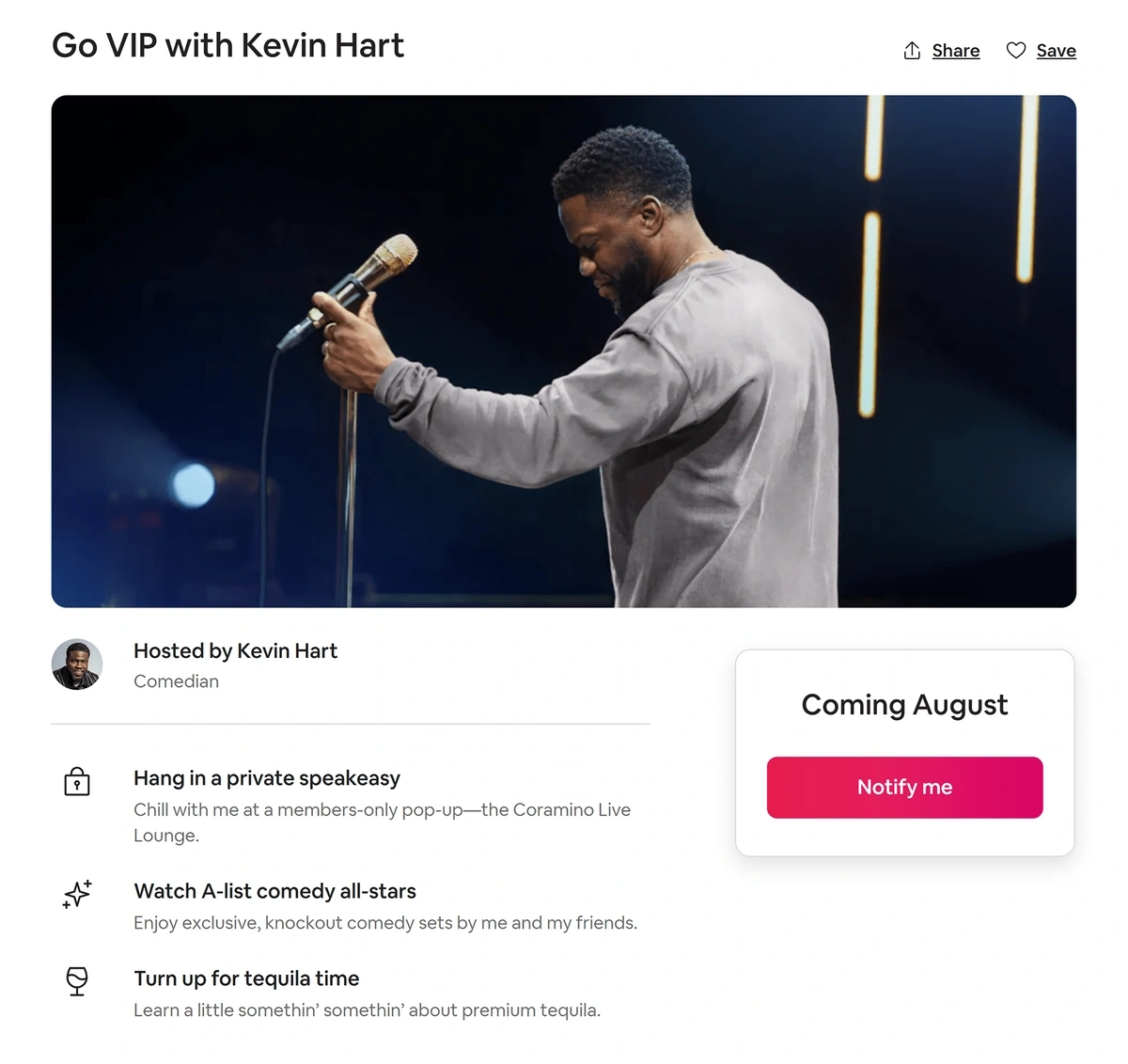

Airbnb is betting on this trend.

Their Experiences feature makes it easy for people to have unique experiences on their trip "hosted by locals".

Airbnb currently offers around 50,000 experiences .

The company also recently launched " Icons ", which is essentially a VIP version of Experiences.

For example, travelers can book a night to hang out with comedian Kevin Hart.

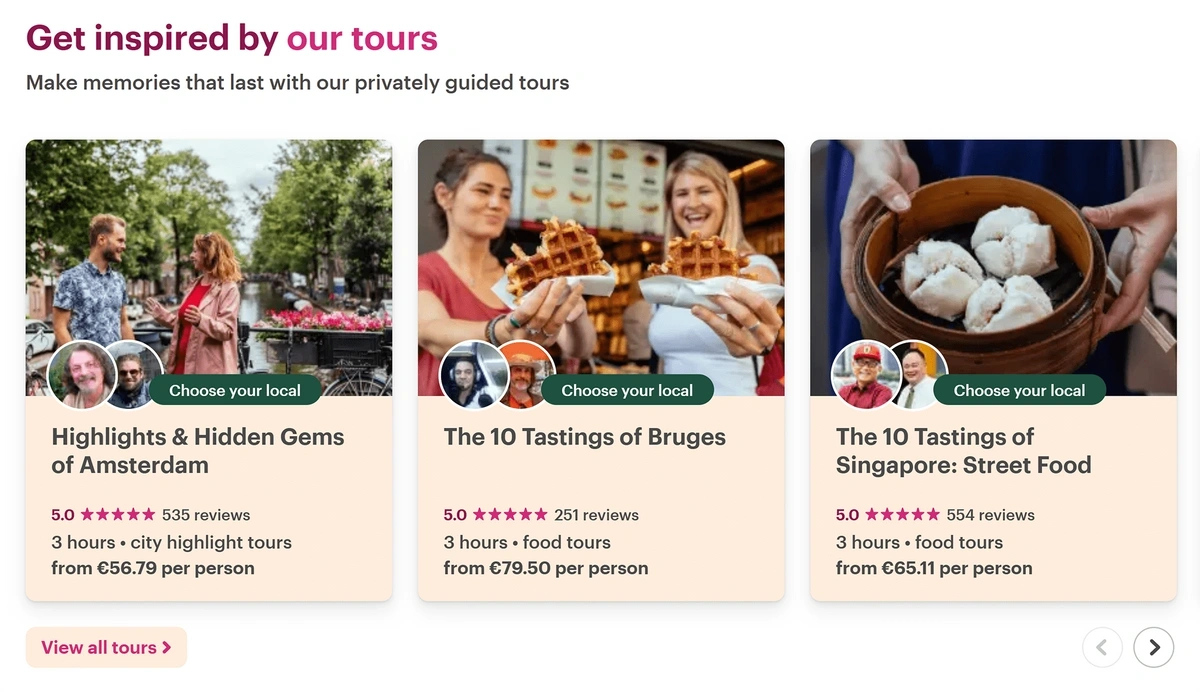

Other companies are banking their entire business model on this trend.

Withlocals offers “personalized traveling” — the opportunity for travelers to book private tours and activities with locals around the world.

Camping (and glamping) trips have also become a popular way for people to travel while experiencing the local culture.

Companies riding this trend include:

Outdoorsy has been called the “Airbnb of RV rentals”.

Under Canvas runs seven glamping camps in wilderness locations across the United States aimed at exploring the local landscape and inspiring human connections.

3. Travel tech adoption accelerates

Technology is presenting the travel industry with seemingly endless opportunities.

The pandemic served to increase the speed of tech adoption in the travel industry.

A McKinsey survey showed that “companies have accelerated the digitization of their customer and supply-chain interactions and of their internal operations by three to four years".

One example: room service robots.

Two Chinese hotel giants invested in ExcelLand, a manufacturer that already had 3,000 robots in operation.

BTG Homeinnes is looking at these robots as a way to control costs and safeguard guests.

Hotels, airlines, booking sites, and others are using chatbots like never before.

Travelers can chat with providers during every stage of their journey.

And, they won’t (always) feel like they’re talking to a robot. Advances in generative AI have made this type of communication hassle-free.

United Airlines has launched an “ Agent on Demand ” service that allows travelers at the airport to video chat with a customer service representative simply by scanning a QR code.

More and more airlines and airports are deploying facial recognition technology.

Corporations and government entities tout this technology as a boon for travel safety.

But many privacy advocates have put a halt to this emerging trend. They warn that this type of surveillance could easily turn dystopian.

With all of this new tech, companies are also continuing to capitalize on an older piece of technology — the smartphone.

Stats show that travelers who book tours and activities on their phone spend 50% more than those who book elsewhere.

4. Consumers blend business and leisure travel

The latest statistics say there are nearly 17 million digital nomads in America.

The concept of being location-independent, traveling and working remotely, has become even more popular since the start of the pandemic.

The hospitality industry is starting to cater specifically to digital nomads.

Aruba is opening its beaches up to travelers who’d like to work remotely, calling the marketing campaign “ One Happy Workation ”.

Visitors can stay for up to 90 days. And do not need any governmental documentation.

Barbados and the Cayman Islands will also let you work remotely from paradise for an extended period of time.

Booking.com reports that the "workation" trend is going strong.

More than 50% of travelers say they would extend their business trip to enjoy personal time at their destination.

Hotels are beginning to even cater to locals who needed a quiet place to work.

The Hamilton Hotel in Washington, DC, is just one example. It’s WFH-Work From Hamilton program offers rooms on a 6:00 am to 7:00 pm schedule.

5. The travel industry gets serious about sustainability

Recent data shows that more than half of US travelers believe there aren’t enough options when it comes to sustainable travel.

A poll conducted on behalf of Exodus Travels went even deeper into consumers’ attitudes .

- 91% of travelers see the importance of taking ethical trips

- 56% believe in buying souvenirs from local merchants

- 44% want to support local businesses at their destination

Sustainable travel involves minimizing impact on the local cultural environment.

And also taking an eco-friendly approach to the physical environment.

Nearly 70% of travelers say they are more likely to book accommodations if they know the property is planet-friendly.

Many in the travel industry have recently made commitments to preserving the environment.

For example, India-based ITC Hotels Group has LEED certified each of its hotels.

As of 2023, hotels in the state of California will no longer be allowed to provide single-use toiletries in plastic bottles to their guests.

Marriott International has made a pledge to remove these types of plastics from all their hotels, too. But the pandemic has put a temporary stop to that plan.

A recent report from Skift made this summary statement regarding sustainable travel in the future:

“[It’s a] less flashy way of viewing and traveling the world . . . with an emphasis on safety, sustainability, and profound experiences while getting from point A to B without wrecking the climate and local quality of life in the process”.

Sustainability isn't just about helping the environment.

Offering sustainable travel options has the potential to increase revenue as well.

A survey by Simon Kucher found that high net worth consumers are willing to pay up to 40% more for a travel option focused on sustainability.

Booking.com surveyed travelers and found that they'd be happy to pay a premium for accommodations that were certified sustainable.

The exact figure of how much consumers are willing to pay for sustainability varies from study to study.

But overall, we see that most travelers are happy to pay around 10-20% extra for vacations that have sustainability in mind.

6. Younger Travelers Seek Exotic Destinations

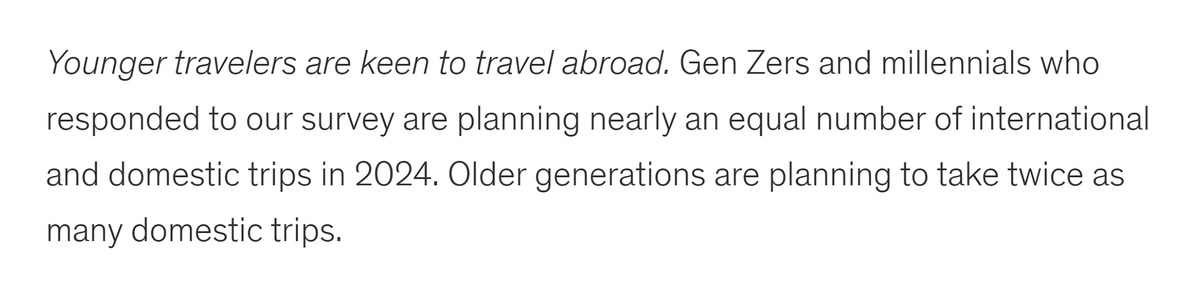

McKinsey recently discovered a generational divide among travel preferences.

Specifically, they found that Gen Z and Millenials were just as likely to book an international trip than a domestic one.

Members of Boomers and Generation X were 2x more likely to travel domestically.

Notably, older generations have different goals when it comes to travel.

Younger generations are primarily looking for fun, novel experiences.

While older folks are aiming to spend quality time with family.

In fact, older travelers specifically cite that having fun with loved ones is a bigger priority than seeing a new place .

Here are a few other reasons that younger generations are seeking destinations abroad more often:

- Lower barrier to entry (literally): More and more countries are offering visa on arrival or other programs to encourage international visitors. Older generations likely remember the hassle of needing to arrange visa and other travel arrangements well before booking a trip.

- Staying in touch: Smart phones and communication apps makes it easy for travelers to keep in touch with friends and family at home.

- Easy navigation: Travelers can use apps like Google Translate and Apple Maps to get around their destinations without hassle.

- Bragging rights: Showing off a video or picture from an exotic place is likely to get more engagement on social media compared to posts featuring local destinations.

7. AI Adoption Increases

Generative AI platforms (ChatGPT, Perplexity etc.) could see real world impacts on the travel industry in the very near future.

In fact, Skift recently asked 17 executives from the travel industry about their outlook on AI.

These executives largely saw tremendous promise in adopting AI and machine learning technology to their businesses.

Specifically, these executives saw a few areas that AI could be used to improve operations in the travel space:

- Personalization: Generative AI tools can be used to help plan personalized itineraries for guests. For example, a travel agent could prompt ChatGPT with: "My client is a 40 year old single mother with a 10-year old son. They want to travel somewhere abroad that has plenty of gluten free eating options". And the AI could provide a list of suggestions for that specific traveler.

- Advanced segmentation: AI has the potential to offer hyper specific targeting options. Some even think that AI could even generate campaigns for a specific customer.

- Customer service: Incorporating AI tools into workflows can help improve the customer experience for both the traveler and staff members. For example, AI can automatically answer common questions that come in. Which empowers workers to spend more time on challenging situations or edge cases.

Other uses cases for AI in travel include:

- Predictions: AI can analyze large amounts of data to help predict future demand at specific destinations.

- Booking agents: The process of booking a trip may change from manually buying airline tickets and hotel rooms online. Instead, AI agents may take care of all of the details on the traveler's behalf.

- Real-time translation: LLMs like ChatGPT-4o are capable of essentially real-time translation via audio.

That’s it for the top seven trends driving the travel and tourism industry forward into 2024 and beyond.

Through these trends, we can see a dynamic relationship between the travel industry and consumers.

It’s a push-and-pull that’s sure to continue in 2025 and companies that can adapt quickly to the changing wants and needs of travelers are the best suited for future success.

Find Thousands of Trending Topics With Our Platform

More From Forbes

How one company is changing luxury travel.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The luxury travel industry is experiencing a noticeable transformation to provide consistently comfortable stays while incorporating the newest technology and numerous high-touch amenities. Here is how one industry leader is adapting to today’s demands to provide memorable vacation home stays that an influx of travelers expect for work or leisure.

Luxury property on Wander.com

How the Luxury Travel Industry is Changing

High-quality accommodations are a cornerstone of luxury travel. Five-star hotels and resorts dominate the landscape where guests expect a consistent experience across a brand’s portfolio. While each location may have its unique traits, certain “creature comforts” like rainfall showerheads, fireplaces, or comfortable bedding are uniform.

The coronavirus pandemic is a catalyst for the industry’s rapid changes. Specifically, many travelers started staying at vacation homes for extra privacy and personal amenities. However, the lack of hotel-grade amenities at many properties detracts from the guest’s experience.

Experiencing the imminent need for better stays himself, John Andrew Entwistle founded Wander in May 2021 to provide luxury vacation home experiences without sacrificing the quality of luxury hotels.

Entwistle’s timing is impeccable. He had just stepped down from running his last company and was using this getaway to reflect on his future. Specifically, his Colorado rental cabin with uncomfortable beds, unreliable internet, and no dedicated workspace inspired him to mesh the quality of luxury hotels with the comfort of private vacation homes.

Best Travel Insurance Companies

Best covid travel insurance plans.

Currently, Wander embraces his dream by owning and operating more than 90 locations in desirable destinations across the United States, including Big Sur, Yosemite, Malibu, Vail, Telluride, the Atlantic Coast, and the New England countryside.

Each property includes the following core amenities:

- AI-assisted services

- Smart bed technology

- Modern workstations

- Wellness features (i.e., pools, saunas, and hot tubs)

- 24/7 concierge service

“With an industry-leading 93%+ guest satisfaction rate, we’re the first end-to-end travel platform for trips, experiences, and concierge service,” says Entwistle who is currently Wander’s CEO and previously a Forbes 30 under 30 and Thiel Fellow.

Entwistle continues, “In a world where expectations are high and disappointments are plenty, where so much of the infrastructure to experience the world is broken, Wander stands as a

beacon of what the future of luxury travel can be: consistent, beautiful, and

unforgettable.“

Luxury Travel Growth Trends

Luxury hospitality is the fastest-growing travel segment with 6% anticipated annual growth through 2025, reports McKinsey in its The State of Travel and Hospitality 2024 report.

McKinsey finds the rapid increase stems from several factors:

- Younger generations prefer experiences, thereby allocating more for travel than previous generations at a similar age.

- 66% of surveyed travelers are more interested in travel now than pre-pandemic.

- 35% of travelers have a net worth between $100,000 and $1 million. The advent of aspiring luxury travelers who splurge on select trip components—lodging, special meals, or flight upgrades—debunks the notion that luxury travel is only for millionaires.

- Luxury travel is no longer almost exclusively for travelers from the United States or Europe, as more international residents have increased purchasing power.

- An increasing number of modern travelers prefer branded luxury and loyalty programs to independent operators while seeking personalizable itineraries and experiences.

The burgeoning interest in the upscale travel segment is increasing competition among operators of luxury hotels and vacation homes, which are adapting to today’s travel needs.

Guests Want Standardization in Luxury Travel

As the industry pivots to a growing audience and more diverse traveler behaviors, McKinsey recommends digging deeply and segmenting by age, nationality, and net worth to serve the needs of their primary guest with a standardized experience.

Recognizing the industry-wide changes and learning from personal travel experiences, Wander has had over 17,000 guests experience its modern, white-glove amenities so far.

Unlike most vacation rental platforms, which simply list properties from a broad swath of individual hosts and agencies, with vastly different amenities and minimum property standards, Wander fully operates each home on its platform. This practice allows the company to provide a uniform experience across its portfolio.

Further, implementing the latest technology available is one of Wander CEO John Andrew Entwistle’s priorities to provide a personal touch from booking until checkout. Embracing technology is second nature as Entwistle was previously the co-founder of Coder.com before launching Wander.

Instead of just browsing listings by destination at the beginning of the booking process, aspiring guests receive AI-assisted property recommendations to find the ideal destination. Further, each listing includes virtual house tours, local attraction guides, and guest testimonials to get an in-depth grasp of the stay experience and panorama before arrival.

Economic Challenges Facing Luxury Travel Providers

While the increased demand for premium travel experiences is a net positive for travel hosts, financial obstacles lie beneath the surface that can impact the profitability of high-end short-term rental properties.

Specifically, in 2023, short-term rental owners experienced a double whammy of inflation and an overall decline in revenue per available room (RevPAR). Thankfully, the industry forecasts modest improvements in the average daily rate and revenue so hosts can continue offering services that affluent and high-income travelers expect.

Wander is leaning into the industry’s changes through the following strategies :

- Authentic experiences: Focus on differentiation and make customer experiences the core emphasis instead of offering a cookie-cutter solution for all guest backgrounds.

- Portfolio diversification: Be rigorously selective when choosing homes and locations. Inspiring destinations are one research factor, but choosing the right spot is crucial.

- Top 1% of vacation rentals: Data points indicate the top 1% of properties earn 35% of all short-term vacation rental revenue. Wander prides itself on only owning top-tier properties resulting in strongly positive guest reviews for a win-win situation.

- Ignore the hype: Many temporary distractions—especially advancing travel demand—make it harder to achieve the cardinal goal of building a stable and durable business.

Entwistle’s vision is to be a resilient smart vacation home platform for the foreseeable future while remaining receptive and adaptable to guests' needs for a top-notch experience. Guests can expect a level of consistency across Wander’s portfolio at their favorite destinations and new adventure spots to spend more time exploring instead of adjusting to a property’s shortcomings.

Recent studies indicate that 77% of travelers care more about the best-fitting travel experience than about the cost of the trip, according to the 2024 Global Travel Trends Report from American Express Travel .

For instance, Wander’s ambitions include establishing a global footprint while expanding its United States portfolio simultaneously. As the company grows, it plans to seamlessly integrate other travel booking options, such as flights and additional services, that the next generation of travelers is seeking. Premier guest stays remain its core focal point, though, assures Entwistle.

Final Thoughts

Leisure and business travelers flocked to luxury vacation rentals during the pandemic. While many enjoy the coziness and extra living space, the lack of hotel-grade amenities and cleanliness leaves something to be desired. Wander is addressing these shortcomings through vacation homes meeting the travel needs of the 21st century to work or rest.

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected