Protect Your Trip »

The 8 top alaska cruise lines of 2024.

Discover the best lines and itineraries for your type of travel style.

The Top Alaska Cruise Lines

Courtesy of Royal Caribbean International

A cruise vacation to Alaska is a profound adventure. The spectacular natural beauty, rugged wilderness, massive glaciers and endless opportunities for wildlife viewing make a trip to the 49th state a once-in-a-lifetime experience for many travelers. As an added bonus, cruise ships can reach remote parts of the state, including Glacier Bay National Park & Preserve: one of the most significant (and picturesque) marine and wildlife sanctuaries in the world.

With the ever-growing popularity of the destination and an extended cruising season (some lines now travel to Alaska between April and October), more ships are heading north to the shores of The Great Land. With these expanded itineraries, there's more than ever to think about when booking your Alaska cruise.

To assist in your decision-making process, U.S. News listed the top cruise lines to consider across five categories, including the best options for families , luxury-seekers and adventurers. U.S. News consulted data provided by Cruiseline.com and the results of our 2024 Best Cruise Lines rankings to help develop this list of the top cruise lines sailing to Alaska.

- Best Overall: Holland America Line; Princess Cruises

- Best for Families: Norwegian Cruise Line; Royal Caribbean International

Best for Couples: Celebrity Cruises

- Best Luxury: Regent Seven Seas Cruises; Silversea Cruises

Best Small-Ship Expedition Line: UnCruise Adventures

Find your perfect cruise

Best Overall: Holland America Line and Princess Cruises

Holland america line.

Courtesy of Holland America Line

Alaska cruise ships: Eurodam , Koningsdam , Nieuw Amsterdam , Noordam , Westerdam , Zaandam Departure cities (cruises and cruisetours): Anchorage , Fairbanks and Whittier, Alaska; Seattle; Vancouver, British Columbia Starting from: $379 per person for seven-night Alaska Inside Passage cruise on May 1, 2024, or Sept. 22, 2024. Round-trip from Vancouver.

Holland America Line has been cruising Alaska's pristine glacial waters for more than 75 years – longer than any other cruise line. On top of that, the line features more voyages to Glacier Bay National Park & Preserve than its competitors. Seven-night round-trip sailings depart from either Seattle or Vancouver, while cruisetours – Holland America Line 's sea- and land-based packages – leave from several cities and extend each trip to nine to 18 days.

If this will be your first visit to Alaska, consider booking the comprehensive 14-day Yukon + Denali cruisetour. This Alaska adventure includes a voyage aboard Koningsdam, plus a three-night stay at Holland America's exclusive lodge in Denali National Park, where you'll have the opportunity to see Alaska's big five: moose, caribou, grizzly bears, Dall sheep and wolves – and book bucket list activities like flightseeing over Denali. If it's a picture-perfect day, your pilot might even be able to land on the tallest mountain in North America, also known as "The Great One." Other excursions include meeting dog mushers from the Iditarod, landing on the Yanert Glacier, heli-hiking or embarking on a covered wagon adventure on the Alaska tundra. The Yukon Territory portion of this trip is exclusive to Holland America; while there, visit the mining town of Dawson City and learn about Northern Canada's Klondike Gold Rush of August 1896.

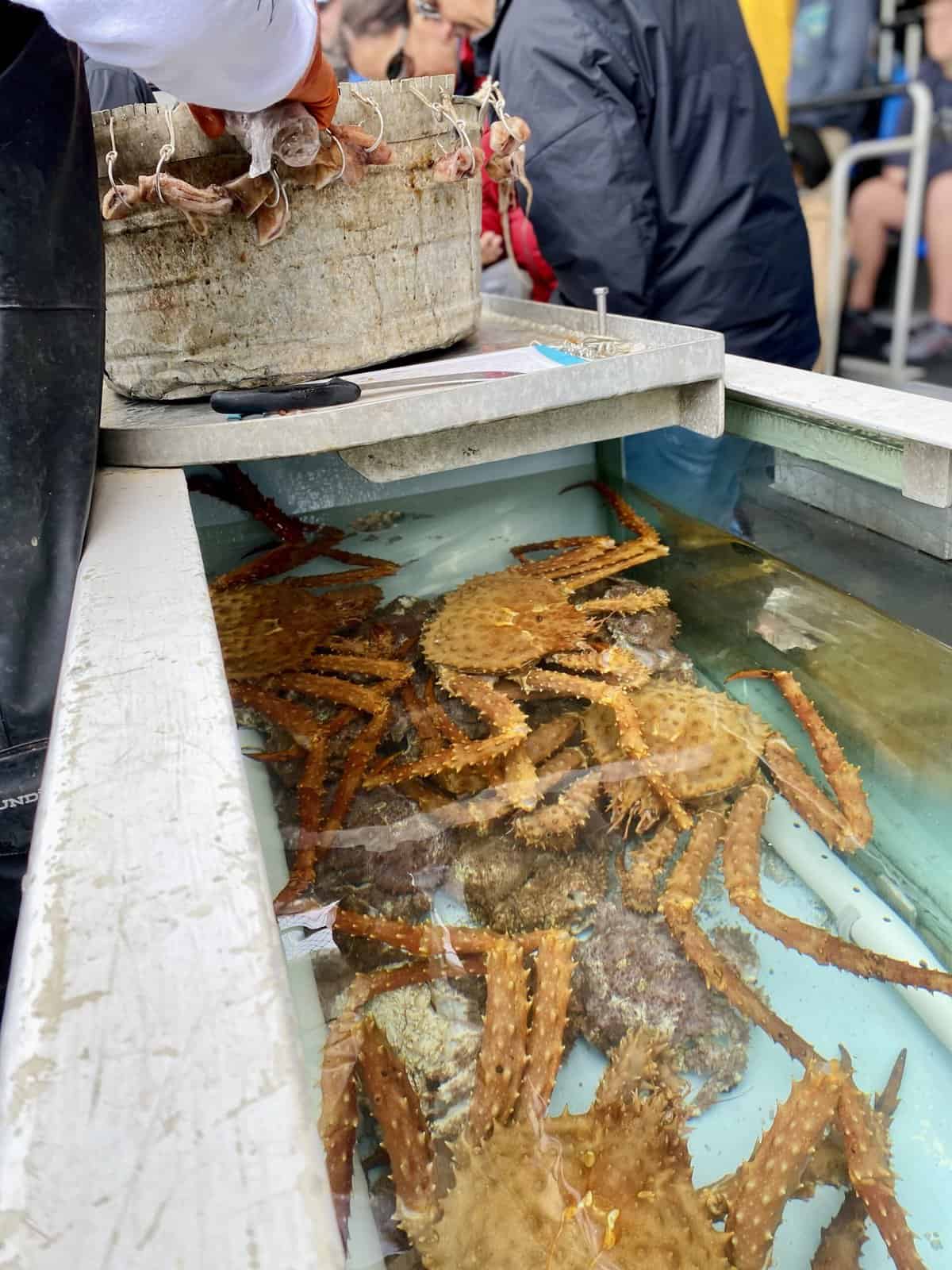

Another highlight of sailing Alaska with Holland America is the Alaska Up Close program, which immerses guests in an array of expert-led lectures and excursions on board and shore. When it comes to dining , Holland America is the only cruise line to achieve the Responsible Fisheries Management (RFM) certification, which means cruisers will enjoy certified sustainable wild Alaska seafood on board (think: Alaskan king crab legs and fresh salmon). You may also have access to culinary excursions in partnership with Food & Wine magazine, as well as special offerings like Alaska salmon bakes.

Cruisers should also consider one of the Holland America's new itineraries for 2024: the 28-night Alaska Arctic Circle Solstice voyage aboard Westerdam, round-trip from Seattle. This sailing, which departs on June 9, 2024, features highlights like crossing the Arctic Circle; celebrating the summer solstice in Nome, Alaska; and watching Kodiak bears – the largest bears in the world – on Kodiak Island.

Insider tip: Sample Holland America Line's famous Dutch pea soup while glacier viewing on the outside decks. The crew passes around mugs of the warm soup in this Holland America tradition that gives a nod to the line's heritage – and keeps guests warm on chilly summer days in Alaska.

Princess Cruises

Courtesy of Princess Cruises

Alaska cruise ships: Grand Princess , Sapphire Princess , Royal Princess , Ruby Princess , Majestic Princess , Discovery Princess , Crown Princess Departure cities (cruises and cruisetours): Seattle; Anchorage, Alaska; Vancouver, British Columbia; San Francisco ; Fairbanks, Alaska Starting from: $398 per person for seven-night cruise from Anchorage (Whittier, Alaska) to Vancouver on May 18, 2024

Princess Cruises has a long history in Alaska, boasting more than 50 years of sailing to the Great Land. Cruise itineraries last between seven and 14 nights, and many visit the Inside Passage. Princess Cruises also owns and operates five wilderness lodges for guests of its cruisetours, plus exclusive "Direct to the Wilderness" rail service to those properties. The line's wide selection of cruisetours includes independent adventures and off-the-beaten-path destinations, like Wrangell-St. Elias National Park & Preserve, the largest national park in the U.S. For travelers seeking the highest level of service and the most time on land, the Connoisseur cruisetour is a good option, including up to 10 nights ashore following the seven-day Voyage of the Glaciers cruise. The Connoisseur trip is hosted by a tour director and includes select sightseeing outings and most meals in the fare.

Princess' special programming, North to Alaska, offers guests unique insights into the history and culture of the region with visits from local Alaskans, photography sessions, demonstrations on lumberjacking and excursions like Cook My Catch, where guests will go fishing (with a guide), then bring their fish back for chefs to prepare for dinner at one of the designated Princess lodges.

There are two new Princess cruisetours to consider for 2024. The 15-night National Parks Tour includes a seven-day cruise, visits to five national parks, scenic rail travel and a total of eight evenings across four Princess wilderness lodges. Meanwhile, the Katmai National Park Tour is a nine-day adventure that takes guests to the famed Brooks Falls in Katmai National Park & Preserve to see bears feasting on wild salmon in Alaska's wilderness.

Insider tip: While visiting Denali National Park, be sure to check out the Princess Treehouse at the Mt. McKinley Princess Wilderness Lodge. Built by Pete Nelson of Animal Planet's "Treehouse Masters," the treehouse offers a different perspective of Denali and features "Sappy Hour" and other fun activities.

Best for Families: Norwegian Cruise Line and Royal Caribbean International

Norwegian cruise line.

Courtesy of Norwegian Cruise Line

Alaska cruise ships: Norwegian Encore , Norwegian Bliss , Norwegian Jewel , Norwegian Sun , Norwegian Spirit Departure cities (cruises and cruisetours): Seattle ; Vancouver, British Columbia; Seward, Alaska Starting from: $349 per person for seven-night sailing between Seward and Vancouver (itineraries visit Hubbard Glacier and Skagway, or Glacier Bay, Skagway and Juneau). Available on Norwegian Jewel in April, May and June 2024.

Norwegian Cruise Line has one of the longest seasons in Alaska, extending from April through October. The line operates two of its larger ships in Alaska: Norwegian Bliss and Norwegian Encore. These ships feature a plethora of onboard activities to keep kids and adults entertained, like racetracks, laser tag, mini-golf, complimentary kids and teen clubs, video arcades, themed parties, live performances and more. Families will also enjoy entertainment by Nickelodeon, character breakfasts, salmon bakes and sessions with a park ranger who comes on board to narrate the Glacier Bay passage. You'll find many spacious room options on board perfectly suited to larger families – especially in The Haven, the line's exclusive ship-within-a-ship concept. In addition, Norwegian Cruise Line offers select cruise deals where third and fourth guests sail free .

There are two new Alaska shore excursions for 2024: the Mendenhall Glacier Canoe Paddle & Trek and the Fly-In Norris Glacier Hike and Packraft. The first outing takes place in Juneau , where you'll paddle a 12-person canoe across Mendenhall Lake to reach the towering glacier. Prepare to be surrounded by the spectacular setting of Tongass National Park, a 400-foot waterfall and an Arctic tern nesting ground. The second excursion, also in Juneau, takes participants on a flight into the Alaska wilderness via floatplane; you'll then paddle across a pristine glacial lake and hike the surface of Norris Glacier. Unforgettable sights along the way include densely forested mountains; the mouth of the Taku Inlet, a waterway that offers access to Juneau Icefield; and plenty of wildlife, including sea lions and bald eagles.

Also new for 2024 is the option to take the Denali Talkeetna Explorer tour after your cruise. (This cruisetour previously only took place prior to the voyage.) The 13-day sea and land package, Denali Talkeetna Explorer – Northbound Cruisetour, is available on three dates in 2024 in combination with a Norwegian Jewel sailing. The package includes a seven-night cruise; a total of six nights in Fairbanks, Denali and Talkeetna; a stop at the Trans-Alaska Oil Pipeline; a riverboat cruise in Fairbanks; a visit to an Iditarod dog musher's kennel; a deluxe glass-domed Alaska Railroad journey between Fairbanks and Denali; and more. You'll also have free time to book optional shore excursions like whitewater rafting, park tours, helicopter flightseeing and other outdoor adventures.

Insider tip: If you're sailing on Norwegian Bliss or Norwegian Encore, be sure to grab a front-row seat in the Observation Lounge when sailing in Glacier Bay Park & Preserve. This expansive space on Deck 15 at the bow of the ship offers breathtaking panoramic views from the comfort of inside the ship.

Royal Caribbean International

Alaska cruise ships: Radiance of the Seas , Quantum of the Seas , Brilliance of the Seas , Ovation of the Seas Departure cities (cruises and cruisetours): Seward, Alaska; Vancouver, British Columbia; Seattle Starting from: $439 per person for seven-night cruise on Radiance of the Seas, Seward to Vancouver on May 24, 2024

Royal Caribbean International offers seven-night cruise-only Alaska options (some featuring the Inside Passage) and extended cruisetours (lasting nine to 13 days) with land portions before or after the voyage. Cruisetours may visit Denali National Park & Preserve, among other highlights. The line also offers select "kids sail free" itineraries, which will appeal to families.

If you want nonstop entertainment while on board, choose one of Royal Caribbean International 's two larger Quantum Class vessels: Quantum of the Seas or Ovation of the Seas. Both megaships accommodate approximately 4,900 passengers. If you prefer a smaller ship, consider booking one of the Radiance Class vessels, which hold a maximum of around 2,500 guests.

Quantum Class ships have multiple outdoor attractions that provide panoramic views of the scenery. For example, the surf simulator, FlowRider, affords views of magnificent snow-capped mountains and glaciers all around the ship. If you're adept at rock climbing, this is another chance for optimal scenic viewing – at 40 feet above the deck. Additional entertainment includes free-fall skydiving at RipCord by iFly, outdoor movie nights, live performances and musical entertainment, bumper cars, an escape room, a sports court and indoor pools for those cool Alaska summer days.

Insider tip: For more awe-inspiring vistas, take a ride on North Star. Exclusive to Royal Caribbean (on Quantum and Ovation of the Seas), the glass-enclosed capsule rises 300 feet above sea level while suspended over the ocean.

Read: The Most Affordable Alaska Cruises

Celebrity Cruises

Courtesy of Celebrity Cruises

Alaska cruise ships: Celebrity Summit , Celebrity Edge , Celebrity Solstice Departure cities (cruises and cruisetours): Seward, Alaska; Vancouver, British Columbia; Seattle Starting from: $397 per person for seven-night voyage on Celebrity Summit, Seward to Vancouver on May 17, 2024

Adventure-seeking couples will have many options to choose from during Celebrity Cruises ' 2024 Alaska season. The line's six- and seven-night cruise-only itineraries include up-close views of the Dawes Glacier in the Endicott Arm Fjord and the Hubbard Glacier, the world's longest tidewater glacier at 76 miles long. For an in-depth exploration of Alaska's interior, Celebrity's cruisetours extend the trip to a maximum of 13 nights and feature small-town destinations like Talkeetna, Alaska – the quirky village that inspired the 1990s television show "Northern Exposure." There are also themed tours centered on wildlife viewing and national parks, as well as culinary tours highlighting the flavors of Alaska.

Couples will also find plenty of adult-focused activities and entertainment on board, no matter which vessel they choose. Each ship offers a spa, multiple bars and lounges, and an excellent selection of complimentary and specialty restaurants. Celebrity's three Alaska-bound ships carry between 2,158 guests (Celebrity Summit) and 2,908 passengers (Celebrity Edge). Celebrity Edge, the newest of the ships, offers immersive entertainment and especially beautiful public spaces – like Grand Plaza, a three-story venue at the heart of the vessel.

For extra privacy during your couples' vacation, consider splurging on a suite or villa in The Retreat. This all-inclusive space features luxurious accommodations; a private lounge; a sundeck (unavailable on Celebrity Solstice); and a private restaurant, Luminae at The Retreat. The swanky culinary venue serves dishes curated by renowned French chef Daniel Boulud. In addition, you'll have a team of attendants, butlers and concierges to indulge every whim.

Insider tip: Book your Alaska cruise on Celebrity Edge. The outward-facing design of the ship and expansive outdoor spaces, including the Magic Carpet, offer guests excellent viewing opportunities of Alaska's vast landscapes, calving glaciers and wildlife, including humpback whales in the Inside Passage and around Juneau and Sitka.

Tips on Trips and Expert Picks Newsletter

Travel tips, vacation ideas and more to make your next vacation stellar.

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

Best Luxury: Regent Seven Seas Cruises and Silversea Cruises

Regent seven seas cruises.

Alaska cruise ships: Seven Seas Explorer Departure cities: Vancouver, British Columbia; Seward, Alaska Starting from: $4,699 per person (all-inclusive) for seven-night cruise, Vancouver to Seward on May 1, 2024

Regent's Seven Seas Explorer will spend the 2024 season in Alaska, with the first sailing embarking from Vancouver, British Columbia, on May 1, 2024. The line offers 20 seven-night voyages and two 14-night sailings between May and September. The 746-passenger ship provides an in-depth exploration of Alaska's wilderness, thanks to the vessel's smaller size and all-balcony suites. Regent Seven Seas Cruises ' all-inclusive fares include free unlimited shore excursions (though select tours come with a fee); complimentary fine wines and spirits; dining at specialty restaurants; 24-hour room service; unlimited Wi-Fi access; prepaid gratuities; free valet laundry service; and more. Depending on the suite category, guests may also receive a pre- and post-cruise hotel stay with their voyage.

Complimentary shore excursions are available in a number of Alaska ports. In Ketchikan, sign up for the Tongass Rainforest Expedition, the Great Alaska Lumberjack Show or the Alaskan Lodge Adventure & Seafest. (Note: Some excursions in Ketchikan, such as the Alaska Fishing & Wilderness Dining option, come with an additional fee.) In Juneau, guests can take the complimentary hiking adventure through the Mendenhall Glacier National Recreation Area, home to black bears, mountain goats and other wildlife. Cruisers can also dine on wild Alaska salmon grilled over a fire at the Gold Creek Salmon Bake.

Insider tip: Take advantage of the complimentary shore excursions during your cruise. These are tours you'd normally have to pay for on a ship that's not all-inclusive – and that can add up quickly.

Silversea Cruises

Courtesy of Silversea Cruises

Alaska cruise ships: Silver Nova , Silver Muse , Silver Shadow Departure cities: Seward, Alaska; Vancouver, British Columbia Starting from: $3,450 per person for seven-night cruise, Vancouver to Seward on Silver Muse on Aug. 1, 2024

Debuted in August 2023, Silversea's latest addition, Silver Nova, is the newest luxury vessel sailing Alaska for the 2024 season. Silver Nova features an asymmetrical design and advanced technologies that make it Silversea Cruises ' most environmentally friendly vessel yet. With just 728 guests, spacious suites (some affording 270-degree views) and outdoor spaces showcasing The Great Land's pristine wilderness, Silver Nova is an excellent luxury option for an Alaska adventure. Silversea offers seven-night itineraries on its three Alaska ships, plus longer voyages on Silver Muse and Silver Shadow.

Silversea's all-inclusive fares include pre- and post-cruise hotel stays; complimentary nonalcoholic and alcoholic beverages; in-room minibars; gourmet dining; all gratuities; at least one excursion per port; butler service in every suite; and other upscale amenities. Complimentary Alaska excursions include a scenic railway tour aboard the White Pass and Yukon Railway in Skagway, the Sea Otter & Wildlife Quest in Sitka Sound and more. You can also visit the Iditarod dogs' summer camp in Juneau. For an additional cost, Silversea offers more exclusive experiences, like a helicopter ride to Mendenhall Glacier followed by a dogsledding adventure with a team of Alaskan huskies in Juneau, or a remote fly-fishing trip in Sitka.

Insider tip: Spend some time on Deck 10; you'll enjoy unobstructed views of the spectacular scenery from the comfort of the heated pool, thanks to the asymmetrical design of the pool deck.

UnCruise Adventures

Alaska cruise ships: Wilderness Discoverer, Wilderness Legacy, Safari Endeavor, Safari Explorer, Safari Quest Departure cities: Ketchikan, Juneau, Whittier, Dutch Harbor and Sitka, Alaska; Seattle Starting from: $3,600 per person for seven-night cruise, Juneau to Ketchikan (or reverse itinerary) on Wilderness Discoverer; various dates between April and September 2024

UnCruise's expedition-style small ships call on ports and remote areas in Alaska that larger ships can't access, taking guests to locales that the line coins, "UnAlaska." The five ships operating in The Great Land accommodate between 22 passengers (Safari Quest) and 86 guests (Wilderness Legacy), and there are seven-, 12- and 14-night itineraries to choose from. You can also book optional land tours, including a Denali & Talkeetna Wilderness Rail Adventure. Expedition teams take guests on kayaking, skiffing, paddleboarding, bushwhacking, waterfall walks and hiking excursions close to the glaciers and visit secluded areas and waterway passages known for optimal wildlife viewing.

Cruise fares include group transfers to and from the ship; all meals; premium wine, beer and liquor; all nonalcoholic beverages; daily activities; wellness amenities; onboard heritage and expedition guides; and access to guest experts. You'll need to disconnect from your devices in remote areas, as there is no Wi-Fi access on UnCruise vessels.

For a once-in-a-lifetime trip, book the 14-night Alaska's Fjords & Glaciers Bay Adventure Cruise on Wilderness Discoverer, a 76-passenger ship. This voyage includes birding in the South Marble Islands, where you'll see puffins, cormorants, oystercatchers and other bird species. You can also search for brown bears in Corner Bay, bushwhack in old-growth forests, visit the town of Haines to sample local brews and spirits, and more.

UnCruise has introduced a few new cruises for 2024 with a renewed focus on The Great Land. One of these is the Kids in Nature, Wild Woolly & Wow with Glacier Bay cruise. The seven-night, family-focused voyage departs round-trip from Juneau aboard Wilderness Legacy and is available on three dates between June and July. One highlight of the voyage is exploring off-the-grid in Glacier Bay National Park & Preserve's "Outback."

A second new option is the seven-night Prince William Sound Explorer with Cordova cruise. This adventure visits dozens of glaciers; the small fishing village of Cordova; the Harriman and College glacial fjords; the islands of Knight and Montague; and multiple places where you can see orcas, humpback whales, sea otters, seals, sea lions, puffins and other wildlife. The itinerary is offered round-trip from Whittier, Alaska, on Safari Explorer throughout the summer.

Insider tip: Depending on your itinerary, you may be able to hop in a skiff directly off the ship to watch bears along the shore hunt for salmon just 100 feet away. This is an Alaska experience you can only have when sailing on a small ship.

Read: The Top Cruises on Small Ships

Why Trust U.S. News Travel

Gwen Pratesi has been an avid cruiser since her early 20s. She has sailed on nearly every type of cruise ship built, including the newest megaships, traditional masted sailing ships, river ships in Europe and a small luxury expedition vessel in Antarctica. She has cruised to Alaska and visited The Great Land in the summer, fall and winter, and journeyed to remote areas by bush plane above the Arctic Circle. Pratesi covers the travel and culinary industries for major publications, including U.S. News & World Report.

You might also be interested in:

- Alaska Cruise Packing List

- The Top Things to Do in Alaska

- The Top Northern Lights Alaska Cruises

- The Top Antarctica Cruises

- The Best Cruise Insurance Plans

Vacation Ideas for Every Traveler

Tags: Travel , Cruises

World's Best Places To Visit

- # 1 South Island, New Zealand

- # 4 Bora Bora

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

You May Also Like

The best fanny packs and belt bags.

Marisa Méndez July 3, 2024

The 4 Best Temecula Wine Tours

John Rodwan and Nicola Wood July 2, 2024

The Best Puerto Rico Tours

John Rodwan July 2, 2024

Amazon Prime Day Luggage Deals

Amanda Norcross July 2, 2024

Top Things to Do in Montana

Ben Luthi and Kelsey J. Lawrence July 2, 2024

Best Monterey Whale Watching Tours

John Rodwan and Ann Henson July 1, 2024

Sun Princess Review

Holly Johnson June 25, 2024

The 7 Best Key West Snorkeling Tours

Gwen Pratesi June 21, 2024

The Best San Diego Whale Watching

John Rodwan June 21, 2024

6 Top Boston Harbor Cruises

Brittany Chrusciel and Marisa Méndez June 21, 2024

Alaska Cruise Tips – 21 Things I Wish I Knew Before My First Alaskan Cruise

My husband and I recently returned from a wonderful cruise to Alaska. We took the trip (without our three kids) to celebrate our 10th anniversary. We thoroughly enjoyed our first cruise – especially since it was to Alaska with lots to see and history to discover. Having never cruised before, we read a lot of Alaska cruise tips for months before we traveled.

You see, we had been saving since our wedding for a big trip like this. ( Alaska was one of our 15 savings accounts and a great way to save for a special event like this. ) We researched a lot online before we booked our cruise, and researched even more Alaska cruise tips before we actually left. We felt pretty well prepared but there were still some things that we had to learn on the ship. There were actually several times we looked at each other and commented how we wished we had known that. This is how this list of Alaska cruise tips began.

I’m sharing this list of Alaska cruise tips to help others who are getting ready for their Alaskan cruise! Some of these tips may apply to all cruises and some are specific to Alaskan cruises. Either way, I hope it helps someone else get ready to cruise.

This post may contain affiliate links. As an Amazon Associate, I earn from qualifying purchases. You can read more in my disclosure policy.

Here are my most important Alaska cruise tips. Otherwise entitled, 21 things I wish I knew before my first Alaskan cruise.

1. The ship will seem overwhelming at first but you will figure it out.

When we first walked onto our ship (the Norwegian Bliss), Andy and I were both overwhelmed. We expected more information than we received. We got a map of the ship at check in and the staff welcomed us aboard, but that was it. It took us a couple days of wandering around but we learned the ins and outs of the ship faster than we anticipated. Just plan to be overwhelmed at first and give yourself time to figure it out.

2. Inside staterooms are a good deal.

We booked a guaranteed inside stateroom (with the possibility of an upgrade) to get the best deal. Not only did we save money, but we found our room was very comfortable and well designed for two people. There was space for our suitcases under our very comfortable bed, as well as a closet with shelves and a decent sized bathroom. It did not feel cramped at all. The other upside to an inside stateroom is that you don’t have windows. Since the sun sets so late and rises so early (around 4 am in the summer in Alaska), our inside stateroom was always nice and dark to sleep. We were very thankful for that.

3. Your cruise card is everything and links to your tv.

When you board the ship, you will be printed a credit card sized cruise card for your trip. Your card is how you access and pay for everything on the cruise. Do not lose it! You need it to check into all the restaurants (even the free ones), to open your room (obviously), to turn on your room lights, and to pay for anything you purchase on the ship. Your card will allow you to use any free or purchased credits you have for your cruise. After that, it is linked to your credit card so you don’t have to carry a wallet around the ship. On our Norwegian cruise, the rooms had a Smart TV where we could see a running summary of charges, activities and credits.

4. You don’t need a lanyard for your cruise card.

I saw the advice to buy a cruise lanyard (like this one ) for your card so many times when researching for our cruise. We decided not to buy one and I’m glad we didn’t. Honestly? Less than 15 percent of people on our cruise used a lanyard. You do need to have your card with you at all times but it is very easy to put the card in your pocket. It is also much less noticeable. If you are a girl and don’t have pockets in your outfit, just give your card to your spouse or carry the card with your book. I would not recommend buying a lanyard unless you really want to wear a necklace with your card the entire trip. I would possibly recommend it for grandparents who are cruising. Otherwise, I think you will be fine.

5. You don’t need a power strip or water bottle.

These were two more items I saw regularly recommended for purchase. We did not purchase a power strip and managed just fine with the 3 outlets in our room. None of the outlets were in the bathroom but they were by a large mirror in our room. We had two phones (which we used for pictures), two Fitbits and a Kindle to charge, plus my hair straightener. I never wished for more outlets. If you do think you will nee more outlets, make sure you purchase a cruise-approved outlet since it can not be a surge protected one.

A water bottle was mentioned as an important purchase and I did purchase one. However, I did not really use my water bottle on the cruise. You can take your glasses out of any dining room on the ship and it was easy to stop by the buffet for a drink anytime we needed one. Even when we were off the ship, I did not take nor did I need my water bottle. If you have strenuous hiking excursions planned, perhaps you want a water bottle. Otherwise, save the space and money from skipping this purchase too.

6. Pack Dramamine – just in case.

Walmart has a generic box of motion sickness pills for less than $2. It is worth the money to pick up a box, just in case! We definitely noticed the motion of the ship, even though we had a relatively calm trip. There was one night the waves got higher than usual and I ended up taking one pill before bed. It is a cheap $2 insurance policy and a useful thing to pack, but you are not out much if you don’t need it.

7. Check your cell phone coverage before you go.

It is important to know what your cell plan covers before you leave. Most cell phone plans include Alaska so you can use your phone as normal when in port and on land. When you are cruising, be sure to set your phone to airplane mode so you do not occur roaming charges. My husband debated on the internet package but we saved our money and touched base with the kids when we were on land, every day or two. It was nice to disconnect for awhile.

8. Print brochures ahead of time.

Wanting to make the most of our time in port, I researched every port city before we left. I printed any important directions or brochures before we left and put them in our cruise binder. Many cities have brochures available online and I printed those off. Skagway and Ketchikan had walking tours that I printed off. My husband printed maps of the cities so we knew how to get around once we docked. We also noted where all the visitor center locations were so we could pick up print copies of the brochures. In a couple cases, they were out of the walking tour brochures and other things we wanted. It was very useful to have our print copies from the moment we got off the ship.

9. Be prepared for 30 to 90 degrees on your cruise, sun and rain.

Alaska is very unpredictable. We actually had beautiful weather on our mid-June cruise, which we are told is unusual. We had one rainy day in Juneau and a couple foggy hours at sea. Otherwise, we had sunshine and beautiful days to see Alaska. To be prepared, I packed 4 different coats – a tee-shirt type light jacket, a fall weather jacket, my heavy winter down coat and a wool shawl wrap. I wore every coat I packed.

We discovered that the coldest times were at sea with the wind coming off the water. When we were on land, I went without a jacket sometimes. My husband wore shorts a couple days. I wore jeans or leggings. It is difficult to know exactly what to wear so pack an assortment of clothes, plus various jackets, and you will be fine. We also packed our umbrellas and needed them in Juneau!

10. Elevators will get crowded. Be ready to take the stairs.

With thousands of people on a cruise ship, there are many times the elevators will be crowded. Plan on taking the stairs and you won’t have to wait for elevators. It also helps you burn off calories from the delicious food you will be eating!

11. You will walk a lot – on and off the ship.

I am a walker but I was surprised by how much we walked on our cruise. Our highest walking day was 30,000 steps in Skagway – and that was after we sat on a train for 3 hours in the morning! Even when we were on the ship all day, I easily hit 10,000 steps without ever stepping foot in the exercise room.

12. The dress attire on Alaskan cruises is pretty casual.

We read much on this topic before we boarded our cruise. Knowing that we needed various coats for Alaska, we didn’t really want to waste room on formal clothes. I wore nice slacks and a dressy top one evening, and Andy changed into dress slacks and a polo that night too. That was as dressy as we got and we never felt out of place. We saw only a handful of people dress in formal attire at night. Most were dressed in jeans and leggings and nice tops. Alaska cruise attire on the Norwegian really was cruise casual.

13. Sign up early for shows and ship activities.

We were assigned a boarding time of 11 am for our cruise. Somehow, we were some of the first on the ship and the very first ones at the sign up desk for activities. Before you get on board, make sure you know what activities you plan on doing. We knew we needed to sign up for Andy to ride the go karts on our ship. Because we were the first ones there, we had our pick of times.

We had signed up online to see Jersey Boys but because we waited until just a couple weeks before our cruise, the only spots left were at at 10:30 pm show. We signed up, but then learned we could line up as stand by for the 7:30 show and easily got in. It was an excellent show and worth the wait! Still. Lesson learned. Sign up for whatever you can online as soon as you book your tickets. Then, make your first stop once you board, to sign up for any other activities or dining experiences you want.

14. Get up early for the best seats and views.

One of the most popular spots on the Norwegian Bliss was an Observation Gallery at the front of the ship. It had floor to ceiling windows for amazing views. There were also comfortable lounge chairs to relax and watch the scenery float by. As you can imagine, this spot was very popular!

On one at sea day, we were up early after breakfast and managed to snag two lounge chairs, where we spent the morning relaxing and reading. It was amazing! You certainly don’t want to hog seats or save them empty for hours (as some people did) but if you are up early, you will have the most choices of best seats to enjoy the beautiful Alaskan views.

If all the areas seem crowded, keep exploring the ship! Some spots will get more crowded than others. Keep looking around. Our third day, we discovered a bar that was completely deserted in the morning. We were able to enjoy the peace and quiet and even spotted several whales that morning! We moved seats almost every day as we preferred the quieter areas. It is completely possible. Just keep exploring the ship and you can always find some good seats!

15. The time change will throw you for a loop.

When you cruise to Alaska, you will have to change time zones. Not only will you change from your time zone, but parts of Alaska are another time zone over from the United States. Traveling from Indiana (Eastern time), we had a 3 or 4 time hour difference for the cruise. It wasn’t terrible but it did throw us for a bit of a loop. Since it was just my husband and myself traveling, we decided to embrace it and keep an earlier cruise schedule. We were always up by 6 or 7 (Alaska time) and went to bed by 10:30. Granted, that was still late in Indiana but not nearly as late as some people kept. Whatever schedule you decide to keep, just be aware that the time change will take a bit of adjusting to during your cruise.

16. Eat early for best views and service.

Since we were used to Eastern time, we kept that schedule and were usually the first to lunch and dinner. It meant we had the choice of seats and almost always early enough to be seated by a window. If you want great views as you dine, consider eating early. We had good views and good service without having to deal with crowds.

Also, we decided the buffet was a great option for breakfast while we preferred to eat at the sit down restaurants for lunch and dinner. Breakfast was never crowded at the buffet and they had good food options. I loved their cinnamon raisin French toast while my husband liked the Belgian waffles. We both enjoyed the bacon! Lunch and dinner were crowded at the buffet and it was more relaxing to sit at our own table and have food brought to us. If you do eat the buffet, be sure to find an empty table first and then go get your food. It’s much easier than wandering around with full plates.

17. There is plenty to eat without paying for extra dining.

Every cruise ship will be different but the Norwegian cruise line had 5 restaurants included in our dining plan. After that, we could pay extra to eat at another 15 (or more) restaurants. Frugal travelers that we are, we decided to forgo the extra dining and save money. There were plenty of food choices at the included restaurants! The menu at the main restaurants changed daily with some items staying the same.

We did have some free credits that we had received so we tried one of the restaurants (Q – Texas Barbeque) the last night. It wasn’t that great. Nothing special that made us wish we had paid more money for specialty dining. In fact, it just made us more glad that we had saved on our money in this area.

18. Be prepared to share port cities with 2-4 other cruises.

We knew there would be other ships in all our ports but didn’t realize the impact until we docked. The ships arrival and departure times are staggered but you will see other cruise ships along your route. We noticed it most in Skagway which is a town of 800 people year round. On our cruise day? There were 12,000 people in town. Amazingly, it never felt overwhelming but it is something else I wish I had known.

19. Skagway has the most and best excursion options.

Hands down, Skagway was our favorite stop! We spent 14 hours in Skagway and made the most of them all. We started our day with a 3 hour train ride on the White Pass and Yukon railroad. It was our most expensive excursion but I am so glad we did it. It was fascinating to learn Gold Rush history as we traveled the same route so many of those people did.

After a very enjoyable train trip, we spent the rest of the day wandering around Skagway. The National Parks Service has a great (free!) museum with lots of information about the Gold Rush. We also took a free walking tour with one of their rangers. We enjoyed lunch at Skagway Brewing Company, which was worth the wait. Their Spruce Tip beer was a unique blend!

Later on, we did a short hike to Yukutania Point (beautiful water views) and a much longer than expected hike to see the old Gold Rush cemetery (I would skip this one if I had to do it again). This was also our favorite town for shops, although sadly, by the time we went back to buy something at the Christmas shop, it was closed. We learned so much about the Gold Rush during out stop in Skagway and it only made us want to learn more. Make the most of your time in Skagway. You’ll be glad you did!

20. If you have a port in Ketchikan, book an excursion.

Ketchikan was our shortest port day, and it was our least favorite. It had a very touristy feel that we didn’t really care for. We did not book an excursion in Ketchikan (to save money). If we did it again, we would book an excursion in Ketchikan to give us something to enjoy. We did enjoy walking around the town but easily saw all there was to see in under 5 hours. We were back on the ship early – in time for lunch.

21. You can cruise on a budget and have a marvelous time!

While an Alaskan cruise is not cheap, it does not have to be incredibly expensive either. We were able to cruise for a week to Alaska (flights, hotel, airport parking, cruise tickets, food, excursions and everything) for right at $5000 for 2 people.

My best two tips for saving money on your Alaskan cruise?

First, book your cruise through Rakuten.

Rakuten is a free online program that earns you cash back. When we went to book our cruise, I noticed that Norwegian’s prices on their website were exactly the same as at Priceline. I started at Rakuten and booked through Priceline – and earned $177 cash back, simple as that, just for taking 5 minutes to research and one extra click. Plus, Priceline gave us a free $200 in cruise credit which Norwegian wasn’t offering. Both were great perks! You can sign up for Rakuten here. (I use it for all my online shopping and baking hundreds of dollars back every year. More about how I use Rakuten to make money shopping online here. ) This tip may not work for all the cruises but it is definitely worth comparing prices to see if it works for you too!

Second, if you are flying to get to your cruise, consider signing up for an airline credit card.

I am a firm believer in not carrying debt and only use credit cards if I can pay them off each month. That said, United (one of the most popular Seattle airlines if you are cruising to Alaska) has a great credit card program! They offer a $0 fee for the first year (and it is easy to cancel the credit card after your flight, if you so choose). Plus, it gives you free baggage fees – which at $30+ per bag, per flight – saved us $120. In addition to that, it gave us two free United club passes where we were able to pass an enjoyable 2 hours in the Seattle airport, enjoying complimentary snacks, beer and wine as we waited for our flight home. That was another $100 plus value. Our credit card also gave us a free upgrade on our flight out up to business class – another $100 value without paying any extra.

But the best perk of the United credit card? When we spent $2000 in the first 3 months of opening our account, we earned a bonus 40,000 miles to our United account! We simply booked our flights on the credit card and the remaining cruise balance and quickly met that amount for our free miles. These miles don’t expire and translate to at least one free flight – depending on where you are flying. With perks and savings like this, it made signing up for the United credit card a no brainer and a great source of savings. I highly recommend looking into the United credit card (or a similar airline credit card).

You can sign up for the United credit card (with the bonus 40,000 mile offer) here.

To learn more about saving money on your cruise, check out exactly how we did it with this post – 10 Simple Ways to Save Money on a Cruise.

I hope these tips help you enjoy your Alaskan cruise! If you have any questions, feel free to ask in the comments and I will do my best to help!

Have you ever been on a cruise – to Alaska or elsewhere? If so, what tips would you add to this list?

Hello and welcome! Check out how we're thriving when our income has been cut in half , take a look at some of my custom, Biblical books (with free printables) or learn how to build a stockpile that works for your family . You can sign up for blog updates with my email newsletter here . Thanks for stopping by!

Similar Posts

11 Tricks to Get Dinner on the Table Quickly

Leaving our First Home for a New One – An Official Update

When Your Income is Cut in Half

The Surprising Arrival of Caleb Joshua

Setting Goals for 2021 & Looking Back at 2020

Setting Goals for a New Year

I was just wondering where I could get free map print out of the ports we will be in. Thanks

Just check out those port areas and yes, you can probably print out those port maps online!

I would love to know which excursions are worth the penny. Iḿ going with my family and everything adds up to a small fortune. Thank you for the great tips.

You’re welcome, Gloria! For us, the train ride was definitely worth the money. When traveling with a family, I think you prioritize and maybe alternate a paid excursion with a free one (like hiking to the Mendenhall Glacier), because you are right. Things definitely can add up quickly! I hope you have an amazing time in Alaska!

I loved your tips and they are pretty spot on. I agree with everything except the inside state room. Having a patio to watch whales, orcas, and glaciers calving is worth the extra price. Makes me want to go back on our trip! So fun. I liked your post😀

I’ve heard from others who loved their patio view too! Maybe if we go back, we will try it to compare! 🙂 Alaska really is an amazing place to cruise to, and I’m glad you agreed with the tips. Like you, I’m ready to go back too! 🙂

Thank you for the great post. We have a trip planned late June of this year.

I recommend downloading a couple of free audiobooks from the library to a cellphone so you don’t need to take your eyes off the scenery. I also think it’s a good idea to use an earpiece that is single sided meaning there’s only one ear being used. The ones I use mix the sound for both sides-I guess you’d call it stereo instead of mono and I purchase from amazon. I prefer this type so I feel more aware of what’s going on around me-I don’t mean for crime or anything like that but to feel more connected to the world. 🙂

Another thing I do before I travel is to take a look at my little stash of “travelers helpers” medications like say stool softener, Imodium, Benadryl, Aleve, temporary dental glue (in case a cap comes off) to make sure they’re fresh. Honestly the only one I’ve really used besides Aleve is the Benadryl and that was simply to rush it to the dining car when I was on Amtrak and heard an announcement requesting it for someone there on the train. I know they have these things on cruise ships because they’ve got doctors but I like having my own at my fingertips. Peace of mind…

I am so glad I found this post. I have been wondering about your trip!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Alaskan Cruises

10 Best Alaska Cruises to Take This Summer, According to Experts

We spoke to cruise experts to find the best Alaska itineraries to book this year.

:max_bytes(150000):strip_icc():format(webp)/Lauren-Dana-Ellman-1cd58a16cf194beaad4749c08ba31269.jpeg)

Taylor McIntyre/Travel + Leisure

With its majestic wildlife, otherworldly glacial scenery, and endless outdoor adventure, a trip to Alaska is one for the books — and the best way to experience it, in our opinion, is by cruise. An Alaska sailing offers travelers the chance to get up close and personal to some of the destination’s most stunning natural wonders (think: Glacier Bay, Hubbard Glacier, the Tracy Arm Fjord, and so much more). Fortunately, when it comes to the best Alaska cruises, options abound, from small-ship luxury sailings and expedition voyages to mega-ships that feel like a floating resort and theme park all in one. Ultimately, explains Travel + Leisure A-List travel advisor Eric Goldring , “The question of which are the ‘best’ cruise lines for Alaska really depends on the guest’s desires as there is a balance between how in-depth they wish to delve into Alaska’s nature and Indigenous culture, what type of onboard experience they desire, and, of course, whether the cruise is family-focused.” To determine which Alaska cruise is best for you, Goldring recommends using a travel advisor “who has actually been to Alaska more than once and on different ships” so that you have “access to important first-hand knowledge.”

According to T+L A-List travel advisor Ashton Palmer , the Alaska cruise season is short (typically from May to September) and availability is limited, which is why travelers should plan their sailings six to eight months ahead of time. While the travel advisor notes that “most trips average a week in length,” he also recommends cruisers allow time to “visit the northern part of the state, including Denali National Park, the Kenai Peninsula, Anchorage, and Fairbanks,” either before or after the cruise. Several cruise lines also offer land extensions (sometimes called “cruisetours”) to make the experience as seamless as possible.

While the Alaska cruise season takes place in the warmer months, be sure to pack a few sweaters — and consider dressing in layers. When I cruised Alaska in summer 2022, the weather was (mostly) warm and sunny; however, when we sailed through Glacier Bay, it was chilly, and I was especially glad to have brought a scarf, hat, and light jacket to help brace the chill. Rob Clabbers , another T+L A-List travel advisor , agrees. What’s more, he says, “Weather can change quickly in Alaska, so one moment you may need a sweater, and the next you’re better off in shorts.”

Meet the Expert

Eric Goldring is a T+L A-List travel advisor specializing in expedition, small-ship, and medium-ship cruises.

Ashton Palmer is a Seattle-based T+L A-List travel advisor who specializes in expedition cruises.

Rob Clabbers is a T+L A-List travel advisor specializing in cruises, and he’s the founder of Q Cruise + Travel.

Dawn Gabree is a travel advisor who specializes in Alaska cruises at Travels by Danielle.

Mary Curry is another T+L A-List advisor who specializes in small-ship cruises to Polar regions and the Galapagos.

Now that we’ve covered the basics of all things Alaska cruising, keep reading to discover the best Alaska cruises for every type of traveler, featuring expert insight and award-winning picks.

Norwegian Cruise Line

Courtesy of Norwegian Cruisees

Dawn Gabree, a travel advisor at Travels by Danielle who specializes in Alaska cruising, deems Norwegian Cruise Line (NCL) "excellent for multigenerational families" thanks to the abundance of onboard activities. "Their larger vessels used in the Alaska market ( Encore and Bliss ) feature must-do activities like go-karting, laser tag, and water slides." On the contrary, "Their smaller vessels ( Jewel and Sun ) provide a more intimate atmosphere over the large ships." Regardless of which ship you choose, expect an array of entertainment options, including Broadway-caliber shows, which Gabree describes as "excellent." What's more, she says, "We saw their production of 'Six' on an Alaskan sailing, and it was phenomenal." The travel pro also loves the World's Best Award-winning mega-ship ocean line for its Freestyle Dining program (read: no assigned seating or fixed reservation times) and plentiful dining options to appease even the pickiest of eaters. Lastly, says Gabree, "A huge selling point for NCL is always their Free at Sea promotion, which includes perks like specialty dining, an unlimited open bar, Wi-Fi, and more. "It's a great value, in my honest opinion."

Itinerary: The 7-day Alaska: Dawes Glacier, Juneau, and Ketchikan itinerary sails from Seattle on select dates between April and October. Ports of call include Sitka, Juneau, Ice Strait, and Ketchikan in Alaska, as well as Victoria in Canada. Scenic cruising through the Endicott Arm and Dawes Glacier is also included.

Holland America Line

Tim Rue/Bloomberg via Getty Images

Holland America Line (HAL) — which recently snapped up a 2023 World’s Best Award in the large-ship ocean cruise line category — has been cruising Alaska for over 75 years. HAL prides itself on having more permits for Glacier Bay National Park visits than any other cruise line. The cruise line also offers beloved live music programming, which I got to experience firsthand on a summer 2023 Alaska sailing. Most ships boast a “Music Walk,” a section home to venues like B.B. King's Blues Club, Billboard Onboard (a dueling piano bar), Lincoln Center Stage, and Rolling Stone Rock Room. After our shore excursions, we’d hop back on board the ship for drinks, dinner, and a nightcap at the dueling piano bar to jam out to hits from Billy Joel and Elton John. All of the above make HAL a popular pick among middle-aged and mature couples traveling without kids; however, onboard our summer sailing, I did notice quite a few small children traveling with their parents and grandparents.

The onboard culinary offerings are especially noteworthy. While pulling into port one day, I remember digging into a hearty lunch of fish and chips featuring fresh-caught Alaskan halibut. (HAL is the first cruise line to serve fresh, certified-sustainable Alaskan seafood.) As of September, acclaimed chef Masaharu Morimoto is the Fresh Fish Ambassador as part of the line’s Global Fresh Fish Program . Cruisers can try his flavorful seafood dishes during their sailing.

Itinerary: As a first-time Alaska cruiser, I thoroughly enjoyed the Alaska Explorer itinerary , which cruises round-trip from Seattle between June and September. Enjoy scenic cruising along the Puget Sound and Stephen’s Passage before calling on Juneau, followed by more scenic cruising in Glacier Bay. From there, it’s off to Icy Strait Point, Sitka, Ketchikan, Skagway, and Victoria.

Related: The Ultimate Alaska Cruise Packing List

Royal Caribbean International

Courtesy of Royal Caribbean

Royal Caribbean International — or Royal Caribbean for short — offers great fun for families of all ages looking to experience Alaska. As such, it’s no wonder why the mega-ship ocean line is loved by T+L readers and travel advisors alike. What’s more, says Gabree, “Their larger ships (Quantum Class) have equally impressive amenities like skydiving simulators (RipCord by iFLY), the FlowRider surf simulator, and SeaPlex (an indoor recreation center with bumper cars),” says Gabree. The pro is also quick to highlight the North Star observation capsule, which is available on Ovation of the Seas , which cruises Alaska. The attraction whisks passengers over 300 feet above sea level, offering picture-perfect 360-degree views. Put simply, she says, “This is a one-of-a-kind experience when sailing scenic destinations like Alaska.”

The fun continues the minute cruisers disembark in each port, with excursions ranging from dogsledding to private helicopter tours. Back on board, Gabree recommends The Chef’s Table for a truly memorable meal — and I, too, can attest to this. While on board a Caribbean sailing with the cruise line, I had the chance to indulge in this chef- and sommelier-led multi-course food and wine pairing adventure. Four years later, I still find myself dreaming of the delicious circular-shaped dessert known as “The World” — the perfect combo of peanut butter ganache, chocolate mousse, and salted caramel gelato).

Itinerary: Set sail on the aforementioned Ovation of the Seas and embark on a journey through Alaska with Royal Caribbean’s 7-night Alaska Experience itinerary . Cruising round-trip from Seattle, the ship stops in Juneau, Skagway, and Sitka before heading onto Canada, where it calls on Victoria and Vancouver.

Princess Cruises

Taylor McIntyre/Travel + Leisure

Princess Cruises is among T+L readers’ top five favorite mega-ship ocean lines , and its Alaska sailings are not to be missed. Unlike other mega-ship lines, says Gabree, Princess is not at all flashy. That said, she recommends it for “more mature cruisers or those looking for a quieter atmosphere.” So, while you won’t find go-karts or race tracks aboard Princess ships, you can expect incredible educational programming. Don’t miss Puppies on the Piazza, which offers passengers the chance to interact with sled dogs brought on board by local mushers in Skagway. The line also partners with the Glacier Bay National Park rangers and the Discovery Channel to offer unique onboard exhibits and interactive activities like the Jr. Ranger Program. Similarly, says Gabree, “The naturalists that come aboard are extremely knowledgeable.” Last but not least, the service is top-notch. According to the pro, the staff is best described as “attentive and very pleasant.”

Itinerary: Book the 14-day Voyage of the Glaciers Grand Adventure , which sets sail on select dates between May and September. Passengers will cruise round-trip from Vancouver and visit Juneau, Skagway, Anchorage, and Ketchikan. Bonus: Scenic cruising through Glacier Bay National Park, College Fjord, and Hubbard Glacier is also built into the itinerary.

Related: All 16 Princess Cruises Ships, From Newest to Oldest

Seabourn Cruise Line

Courtesy of Seabourn

This World’s Best Award-winning cruise line combines the best of expedition-style and luxury cruising, making it a popular pick amongst well-heeled, adventure-seeking travelers. Highlights include bespoke service, all-suite oceanfront accommodations (most with private balconies), world-class dining (the cruise line has a partnership with Michelin-starred chef Thomas Keller), and, last but not least, a swanky country club-esque atmosphere. According to Goldring, both Seabourn Quest and Seabourn Odyssey offer similar Alaska itineraries in 2024; however, it will be the latter’s final sailing since it was sold.

Alaska sailings feature a team of academics, scientists, and naturalists, all of whom are on hand to provide expert insight and lead excursions (think: kayaking and Zodiac tours, hiking, bear viewing, and so on). Also, according to Goldring, Seabourn ships “travel no further north than Juneau” and offer a “more intensive and nature-focused experience.” On a similar note, says Clabbers, thanks to the vessels’ small size, cruisers can “spend more time sailing through places like Misty Fjords, where most ships can’t go.” Back onboard, says Clabbers, “enjoy Champagne and caviar when you like, or relax in your suite, the spa, or elsewhere.”

Itinerary: The 7-day Alaska Fjords and Canadian Inside Passage cruise sails from Juneau to Vancouver, calling on Tracy Arm or Endicott Arm, Wrangell, Rudyerd Bay (Misty Fjords), and, finally, Prince Rupert in British Columbia. Scenic cruising through Stephens Passage, Decision Passage, Stikine Strait, and the Behm Canal are also included in the itinerary.

Celebrity Cruises

jewhyte/Getty Images

Those who prefer a “younger atmosphere on a modern, larger ship with lots of bars and restaurants and entertainment” should consider cruising Alaska aboard the Celebrity Edge, explains Clabbers. (While Edge is the newest Celebrity ship to cruise Alaska, Celebrity Solstice and Celebrity Summit also sail here . ) Per the pro, the seven-night sailings on Edge “include key destinations like Ketchikan and Skagway,” along with a quick visit to Victoria in British Columbia and scenic cruising through the beautiful Endicott Arm Fjord. Additionally, the World’s Best Award-winning line offers round-trip sailings from both Vancouver and Seattle — as well as one-way itineraries between Vancouver and Seward, the latter of which offer more time to explore (read: fewer sea days).

Regardless of the ship, passengers can expect a wide range of entertainment offerings, an abundance of bars, restaurants, and lounges, and a handful of accommodation options. Speaking of the latter, wellness-seeking duos can reserve an AquaClass stateroom, which includes perks like complimentary dining at the exclusive Blu restaurant, their very own spa concierge, and unlimited access to the adults-only Sea Thermal Suite. Alternatively, for a worth-it splurge, opt for a suite in The Retreat, which includes a dedicated team of concierges and butlers, access to a private lounge and/or sundeck (note that the latter is not available on Celebrity Solstice ), premium drinks, Wi-Fi, and access to the private Luminae at The Retreat restaurant, helmed by chef Daniel Boulud.

Itinerary : The aforementioned 7-night Alaska Dawes Glacier itinerary on Celebrity Edge cruises round-trip from Seattle and visits Ketchikan, Endicott Arm Fjord (scenic cruising), Juneau, Skagway, the Inside Passage (scenic cruising), and Victoria.

Related: What to Know About All 16 Ships in the Celebrity Cruises Fleet

Viking Ocean Cruises

Courtesy of Viking Cruises

Viking Ocean Cruises recently nabbed a 2023 World’s Best Award in the midsize-ship ocean cruise lines category, coming in at first place for the second year in a row. The line’s identical ocean ships offer a sleek Scandinavian design, which only enhances the tranquil atmosphere on board. The luxury adults-only line is also all-inclusive, covering meals, activities, most beverages, Wi-Fi, port taxes and fees, spa access, and one complimentary excursion in every port of call. Cruisers can bask in the mountain and glacier views from the comfort of their private balcony — and, if they’re lucky, they may even spot a whale or two. Finally, in addition to classic ports like Juneau and Ketchikan, Viking Ocean Cruises’ Alaska itinerary also calls on Valdez, which is chock-full of natural beauty and outdoor adventure.

Itinerary : The 10-night Alaska and the Inside Passage itinerary , which sails between Vancouver and Seward, “is a great choice for curious travelers who have a bit more time and want to learn more about Alaska,” says Clabbers.

Courtesy of Silversea

Those craving a luxury Alaska cruise need not look further than Silversea, says Goldring. Additionally, “While primarily for adults ranging from contemplative to active, Silversea is also a good option for families with more mature children who are more engaged with the journey than onboard child-focused activities.” Silversea guests enjoy all-suite staterooms with butler service and an all-around tony atmosphere. The line’s Door-to-Door All-Inclusive fares cover private airport transfers, economy flights, business-class upgrades or air credits, and shore excursions.

This luxury cruise line offers classic and expedition-style cruising, the latter of which takes aboard the 274-passenger Silver Wind . (Classic cruises, on the other hand, take place on board Silver Muse , Silver Nova , Silver Shadow , Silver Whisper , or Silver Moon ). Nova and Moon offer the Sea and Land Taste program (S.A.L.T), offering culinary connoisseurs the incredible opportunity to experience the local food scene and culture both on and off the ship. Last but not least, keep in mind that Silversea sails between Vancouver and Seward (with the exception of one September 2024 itinerary, which sails from Nome to Vancouver).

Itinerary : The 7-day Vancouver to Seward sailing on board Silver Nova features Inside Passage scenic cruising and stops in Ketchikan, Juneau, Skagway, and Sitka. Before disembarking in Seward, enjoy scenic cruising around Hubbard Glacier.

Related: This Is the Cheapest Time to Cruise to Alaska

UnCruise Adventures

Courtesy of UnCruise

“If you are looking for a more casual and laid-back experience, Seattle-based UnCruise Adventures offers down-to-earth trips with enthusiastic naturalist guides, simple accommodations, and hearty local cuisine,” says Palmer. Mary Curry , another T+L A-List travel advisor, echoes these sentiments, explaining that “small ships are the absolute best way to see Alaska if your goal is to immerse yourself in nature and wildlife.” While the cabins are no-frills, Curry stresses that the main focus of the cruise is “getting off the ship and exploring everything Alaska's Inside Passage has to offer.” With that said, when it comes to activities, options abound. Per the pro, travelers can “choose between a menu of included excursions such as kayaking, paddleboarding, hiking, zodiac cruises, whale watching, and more.” All in all, UnCruise really does offer something for everyone.

Itinerary : For a truly unique Alaska itinerary, consider the Aleutian Islands Adventure with Kodiak, Katmai, and Kenai Wilderness . Cruisers embark in Whittier before making their way to Kenai Fjords National Park, Kodiak Island and Foul Bay, Katmai National Park, Ugashik National Wildlife Refuge, Aniakchak National Monument and Preserve, the Shumagin and Unga Islands, False Pass, and Unalaska (where they’ll dock overnight in Dutch Harbor before disembarking the next day).

Lindblad Expeditions-National Geographic

Courtesy of Nation Geographic

For a true expedition-style experience, Lindblad Expeditions is your best bet. The cruise line offers itineraries in partnership with National Geographic, which have come highly recommended by almost every travel advisor we spoke to. Just take it from Curry, who tells T+L, “If you want to learn about Alaska from a team of exceptional experts, there's no better choice than a Lindblad Expeditions-National Geographic itinerary. “Every night before dinner,” she says, “We would hear about what we had seen on our excursions that day from the perspective of the experts — naturalists, geologists, marine mammal researchers, and even a diver who would share magical and colorful images from underwater of the area we had explored via Zodiac during the day.” According to the pro, the vessels are “some of the nicest and most modern small ships in the area,” some of which have private balconies along with “little extras” like water bottle filling stations, a mudroom to store gear, and multiple disembarkation platforms to get travelers on and off the ship quickly. Meanwhile, Goldring notes the line’s National Geographic Global Explorers family program, “which focus[es] on interactive and hands-on education with a true naturalist during outings.” As a result, cruisers can expect “a far more enriching experience [than those] offered by most other lines.”

Itinerary : The weeklong Exploring Alaska’s Coastal Wilderness itinerary is “perfect for couples and multi-generational families interested in an engaging and authentic experience exploring the fjords, islands, and small coastal communities,” says Palmer. The itinerary sails between Juneau and Sitka throughout May and September. Along the way, cruisers will visit Tracy Arm-Fords Terror Wilderness, the tiny fishing town of Petersburg, Glacier Bay National Park, and more.

Related : 21 Cruise Tips That Will Help Make Your Trip Even Better, According to Experts

Related Articles

- Cruise Reviews

Alaska Trip Report: Cruising the Inside Passage

Doug Parker

- May 21, 2024

Between the writing assignments on this sailing and producing Cruise News Today onboard, I quickly realized that doing a daily trip report for this seven-night Alaska cruise on Holland America would be impossible without working around the clock.

So, instead, I took a lot of mental notes. Now, back home and with a little breathing room, I can gather my thoughts and share details about my sailing on the MS Koningsdam.

Speaking of working while at sea, the Starlink high-speed internet service was quite impressive. The speeds were great for basic use, such as email, reading news websites, or posting to social media. They were also sufficient for online heavy lifting (uploading, streaming, or downloading work media files). I had the four-device package for my work computer, iPad, and iPhone, and the signal/speeds met my needs.

As the last trip report mentioned, the northern lights were like nothing I’d ever seen. Sitting on my balcony and taking it all in was surreal; it gave me chills (and not just because it was a windy 43 degrees).

What is the Inside Passage?

The Inside Passage is a scenic route that stretches from the Pacific Northwest to Southeast Alaska, offering cruisers views through a network of fjords, islands, and coastal towns.

Many Alaska cruises include the Inside Passage in their itineraries, offering stops in popular ports like Juneau, Ketchikan, and Skagway. These sailings often depart from Seattle or Vancouver.

Ships may take alternate routes to the Gulf of Alaska, which typically include crossing the open ocean to visit ports like Anchorage and Seward, or even longer voyages to the Aleutian Islands or Arctic Circle. That rough is a bit rougher, as I learned the hard way back in 2019.

A balcony cabin in Alaska

This brings me to this next point: If a balcony cabin fits your budget, do it! Sure, the ship has views outside your stateroom, but having your little slice of privacy on your voyage is priceless. This is true in general, but particularly when sailing in Alaska.

Alaska offers stunning natural landscapes, including some of the best glaciers in Alaska , fjords, and lots of wildlife (we saw bears, dolphins, sea otters, bald eagles, and mountain goats), all of which can be viewed from the comfort of your balcony cabin.

Just pack a hoodie or jacket because Alaska does get cold on the open water, no matter when you’re sailing.

I forgot to mention one thing in yesterday’s trip report when talking about the room: the motion-activated floor lighting in the cabin. Countless times throughout the week, it saved me from kicking the bedpost in the middle of the night. I know it’s something small, but sometimes things like that make a big difference.

Alaska Sea Day Brunch

We woke up this morning and went to the Alaska Sea Day brunch, where we sat with a family of three. We could have waited for a table for two, but because we hit brunch at peak time, that would have meant a 45-minute wait, and we were starving. Plus, back-to-back cruisers have told us that the brunch is a not-to-miss experience. They were right!

This was my first time sitting with people who weren’t at my party since the cruise industry restarted, and I realized I missed sitting and talking with people outside of my circle. One of the great things about cruising is the opportunity to meet people you might not otherwise.

The family we sat with was from Kentucky. They are normally Royal Caribbean and Carnival guests, but they wanted to try something different, so they opted for Holland America.

I went with goat cheese and assorted fresh berries, a fried halibut sandwich, and a wild berry crisp. It was all spot on, and I thought the menu was thoughtfully planned for our itinerary. It offered enough selection so that if you didn’t like seafood, there were breakfast options like yogurt and parfaits.

The brunch menu had a nice selection of options, including fresh halibut and reindeer sausage. (And yes, one of the ingredients is, in fact, reindeer. I wonder how many kids are traumatized when they find that out?)

The meal took about an hour, but we could have left earlier. Since we were sitting with another family, getting feedback and seeing what everyone else thought of the sailing was good.

My thoughts? Fresh seafood and Alaska go hand-in-hand. Holland America’s recently launched Fresh Seafood program is the real deal. I’ve been on many cruises and can say that this has been top-notch as a lover of fresh seafood. I’d go so far as to say it’s maybe the best I’ve ever had on a ship.

Quiet days at sea

It was nice to hear the entertainment host (cruise director) speak only briefly during the day to echo that sentiment. It might seem small, but something must be said about being on vacation and not having to hear about the latest bingo game or slot pull. This cruise line appears to understand that if their guests want to know what is happening, they will open the Navigator app or look at the daily program in the stateroom.

Speaking of the Navigator app, it does come in handy but there is room for improvement. One miss with the app is a planner and times for what is happening around the ship. If venue hours of operation are a thing with the Navigator app, it wasn’t working on our sailing.

Because it was a cloudy sea day as we made our way to our first port of Juneau, I spent most of the day working in the Crow’s Nest. What I love about this space is its 270-degree unrestricted views, and on an Alaska cruise, you want that.

For instance, at one point, the watch officer announced that a whale pod was on the ship’s port side, directly off the bridge and in the distance.

Since our stateroom was on the starboard side, I wouldn’t have been able to see them from the balcony. Because I spent so much time in the Crow’s Nest, I could walk 50 feet and see the whales off in the distance, as promised.

Plus, since I had the Quench Beverage package (soda, water, and coffee), having a coffee shop on the starboard side and a bar on the port side was convenient. I probably drank more coffee than I should have on this cruise.

Dinner at the Pinnacle Grill

On the first sea day, we ate dinner at Pinnacle Grill. The steakhouse on deck two on the Koningsdam is popular, so reservations are highly recommended. Depending on the voyage’s itinerary, it’s also open for lunch and sometimes brunch on select days. On our sailing, they had a special Mother’s Day Brunch.

We only did the dinner at Pinnacle Grill on this voyage, and it was a delicious experience. You get one appetizer, an entree with sides, and a dessert. I started with the jumbo shrimp as the appetizer, the Porterhouse (medium rare), and the not-so-classic Baked Alaska for dessert.

One of my friends wasn’t hungry, so I had him order the clothesline candied bacon for his appetizer, which took center stage for the entire meal. It came out hanging on a rack on hooks with little tongs to grab them. This is bacon overload, which is also why I take the stairs on cruise ships.

Between the conversation, food, and wine selections, it was a value for $46.

Nighttime Entertainment on Holland America

The nighttime entertainment is in one area called Music Walk, where the Rolling Stone Lounge (rock music), Billboard Onboard (piano), and the B.B. King Blues Club are located. All were lively throughout the night. The house band at B.B. King’s is the real deal and always had the crowd on the dance floor. I couldn’t tell you which would’ve won a popularity contest; they would have all tied for first place.

We also hit the Rolling Stone Lounge, where the talent pulls out all the stops. They did an Aerosmith cover of “Dream On” that had everyone in the place rocking out. By the way, big props to the guy who mixed the live sound; it’s not easy to mix levels in a room that is not shaped like your typical concert venue.

I’m a huge music fan, so seeing everything performed throughout the week in all the venues was refreshing. You weren’t limited to hearing Journey or the Eagles’ covers all week—everything from the 80s and 90s to the country and more.

I have to say that I was very impressed with my first time back in Southeast Alaska with Holland America in a decade.

In my next report, we’ll look all the ports we visited and what we did in them. We visited three ports and spent a full day in Glacier Bay National Park , before moving onto more food and onboard programming.

Recent Posts

Uber takes to the water with boats in european cruise port, travel agent leaves carnival cruise passengers without refunds after port cancellation, 3 cruise ships earn perfect cleanliness scores from the cdc, disney updates boarding times for florida-based cruise ships, share this post, related posts.

Wildfires in Alaska Force Cancellation of Denali Cruise Tours

Passenger Jumps Off Cruise Ship in Asia, Still Missing

Bringing you 15 years of cruise industry experience. Cruise Radio prioritizes well-balanced cruise news coverage and accurate reporting, paired with ship reviews and tips.

Quick links

Cruise Radio, LLC © Copyright 2009-2024 | Website Designed By Insider Perks, Inc

The 9 best Alaska cruises for every type of traveler in 2024

Even with a season that only runs from April through October, Alaska draws roughly 40 big cruise ships and dozens of smaller cruise vessels each year, making it one of the most popular cruise destinations in the world after the Caribbean and Europe. The best Alaska cruises range from off-the-beaten-path voyages on vessels carrying fewer than 100 passengers to weeklong jaunts through the Inside Passage aboard megaships that hold thousands.

It can be hard to figure out which cruise ship will deliver your idea of a "bucket list" experience in The Last Frontier. A lot comes down to your travel style, preferences and budget.

Some travelers demand luxury Alaska cruises , while others don't mind going less fancy if it means close encounters with bears and other creatures in the wilderness. Some look for romance, while others want to introduce the kids or grandkids to glaciers and eagles, gold panning and sled dogs.

For cruise news, reviews and tips, sign up for TPG's cruise newsletter .

The good news is there's a ship in Alaska for you no matter your taste or style. Here's a beginner's guide to the best Alaska cruises to help you narrow down your choices.

Best for megaresort fans: Ovation of the Seas

Royal Caribbean is known for its floating megaresorts, which carry thousands and are big on amenities, glitz and a certain amount of glamor — think flashy casinos, high-tech shows and lavish spas. Dining and drinking venues number in the dozens, while amusement park features thrill the kids and adrenaline-seekers.

The line always stations one or two Quantum-class ships in Alaska for the season. On the 4,180-passenger Ovation of the Seas, you can order a drink from a robotic bartender, try simulated skydiving or surfing experiences, and take a ride in a glass capsule that travels high above your ship on a mechanical arm — a weird and wonderful way to see the Alaska scenery. Adults can linger in the glass-walled Solarium, relaxing in the indoor pools and whirlpools, while their kids zoom around the SeaPlex in bumper cars.

Ovation of the Seas sails round-trip from Seattle on seven-night cruises, but the exact itinerary varies by week. The ship cruises Endicott Arm for scenic views of Dawes Glacier and typically visits three Alaska ports and Victoria.

Related: A beginners guide to picking a cruise line

Best for land and sea adventures: Koningsdam

Holland America Line has offered Alaska cruises for 75 years and is clearly a market leader. The line tops the list in terms of cruises, as well as cruise tours, which combine time sailing with overnight stays on land. The company operates its own lodges, rail cars and motorcoaches for exploration of Alaska's interior and beyond.

Related: The coolest things to do on an Alaska cruise

The line will send six ships to Alaska in 2024, with tour offerings to Denali, Fairbanks and Anchorage. However, it's the 2,650-passenger Koningsdam that offers some of the most interesting cruise tour itineraries out there.