ATO Reasonable Travel Allowances

‘Reasonable’ allowances received in accordance with ATO’s reasonable travel allowances schedules are not required to be declared as income, and can be excluded from the expense substantiation requirements.

Per diem rate schedules of amounts considered reasonable are set out in Tax Determinations published by the Tax Office annually.

Tax Ruling TR 2004/6 describes the substantiation exception for expenses which are in line with the prescribed reasonable allowance amounts.

2021, 2022, 2023 and 2024 rates and for prior years are set out below.

The annual determinations set out updated ATO reasonable allowances for each financial year for:

- overtime meal expenses – for food and drink when working overtime

- domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work

- overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

On this page:

2017- 18-Addendum

More information

Substantiation rules

Substantiation in practice

Alternative: Business travel expense claims

Distinguishing Travelling, Living Away and Accounting for Fringe Benefits

See also: Super for long-distance drivers – ATO

Allowances for 2023-24

The full document in PDF format: 2023-24 Determination TD TD 2023/3 (pdf).

The 2023-24 reasonable amount for overtime meal expenses is $35.65.

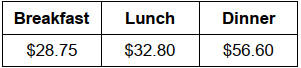

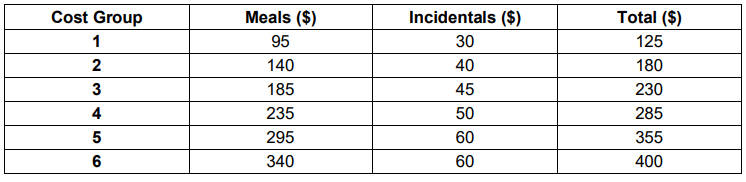

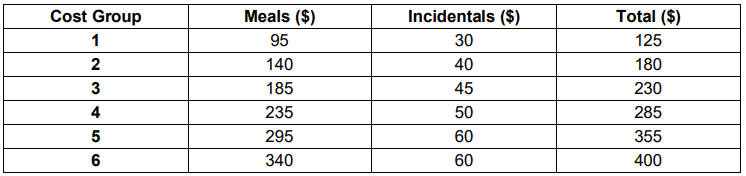

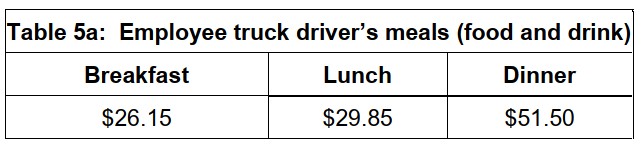

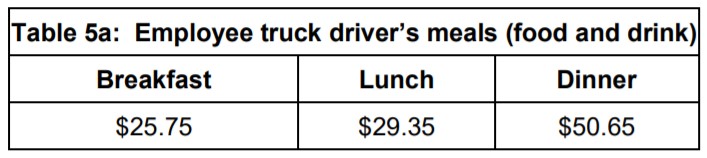

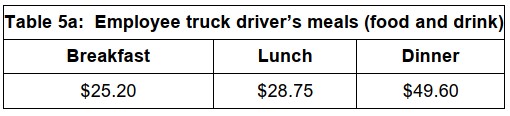

Reasonable amounts given for meals for employee truck drivers (domestic travel) are as follows:

- breakfast $28.75

- lunch $32.80

- dinner $56.60

For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document:

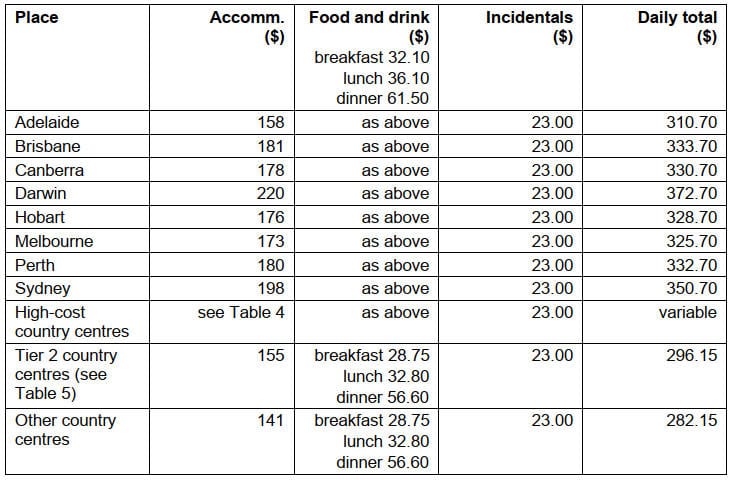

2023-24 Domestic Travel

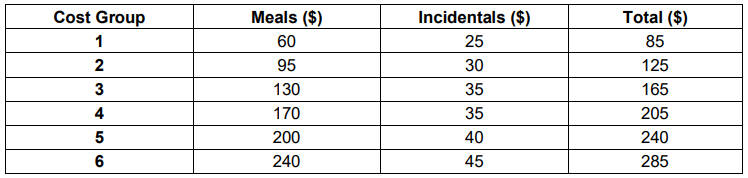

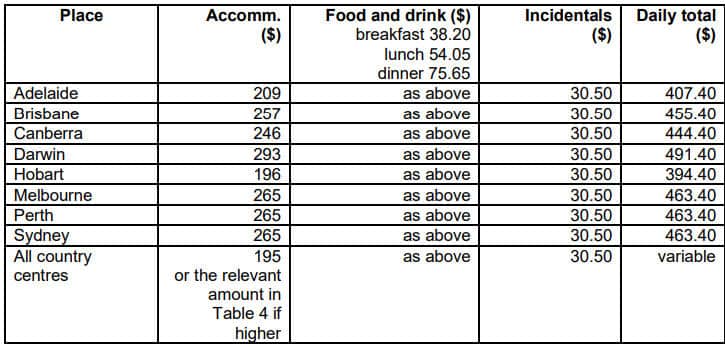

Table 1:Salary $138,790 or less

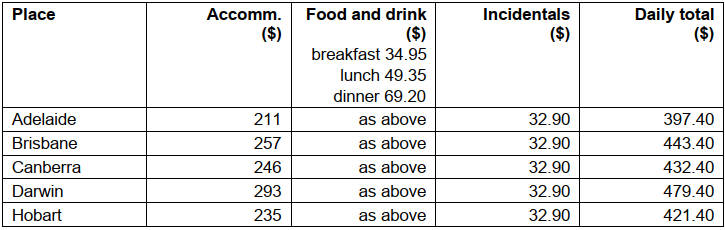

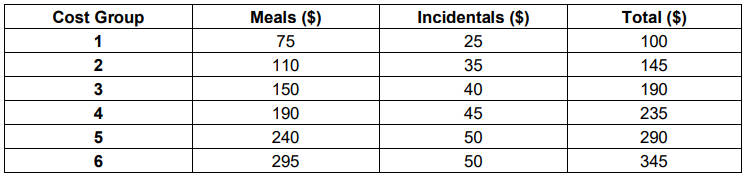

Table 2: Salary $138,791 to $247,020

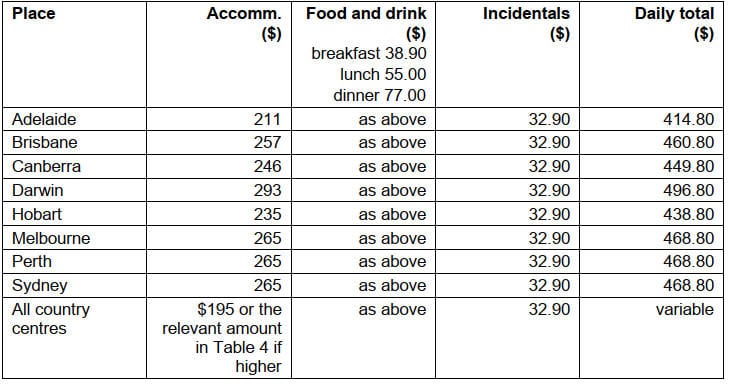

Table 3: Salary $247,021 or more

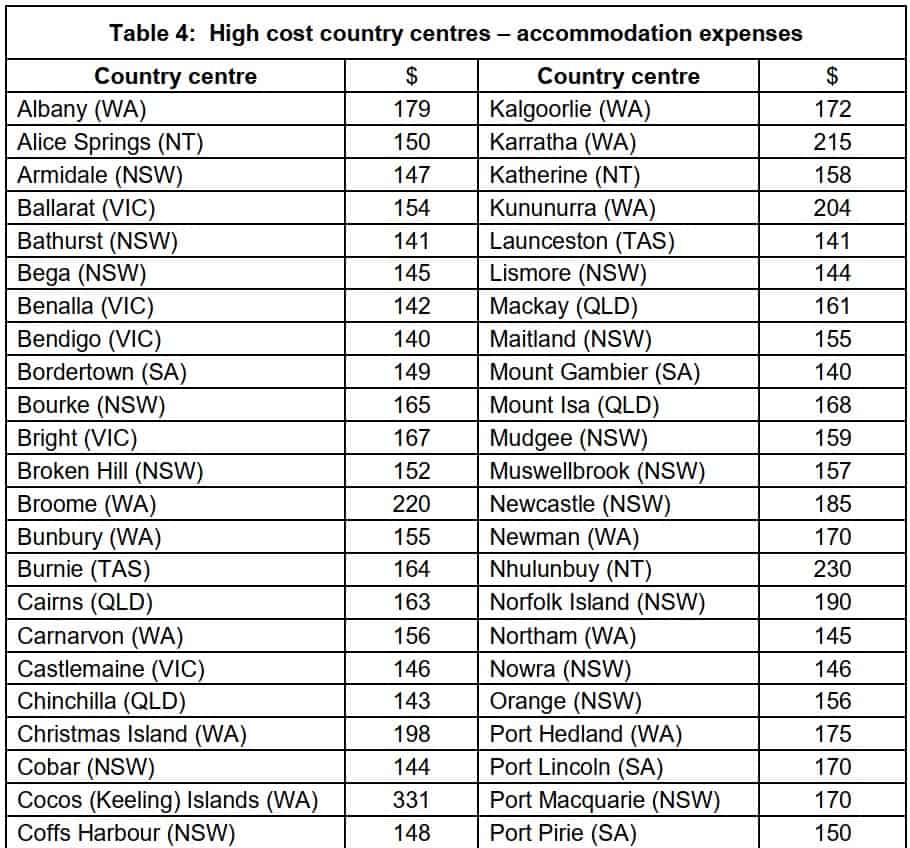

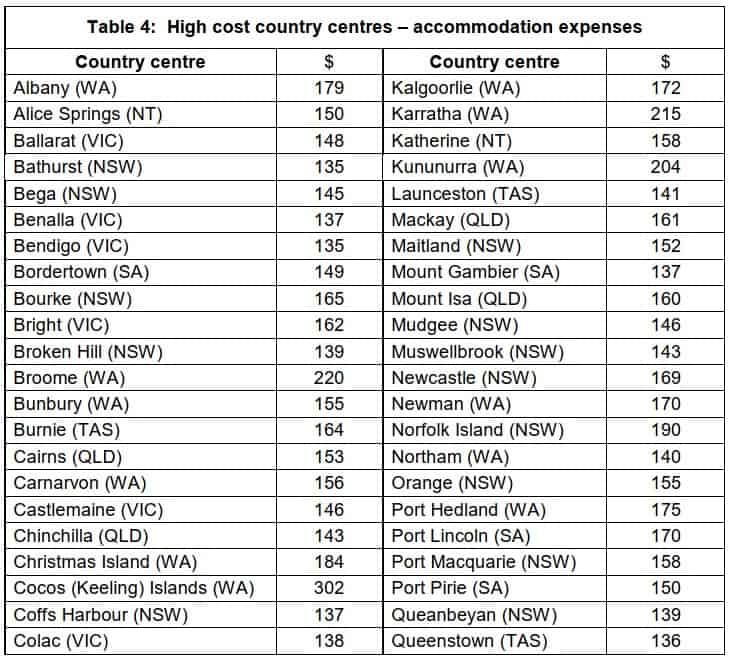

Table 4: High cost country centres accommodation expenses

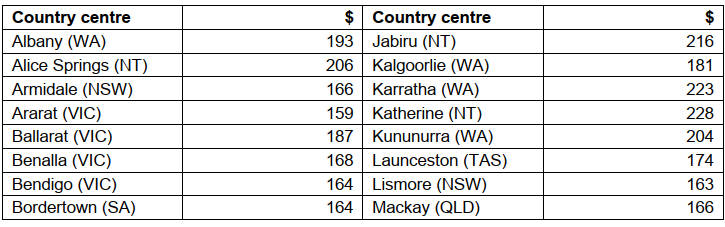

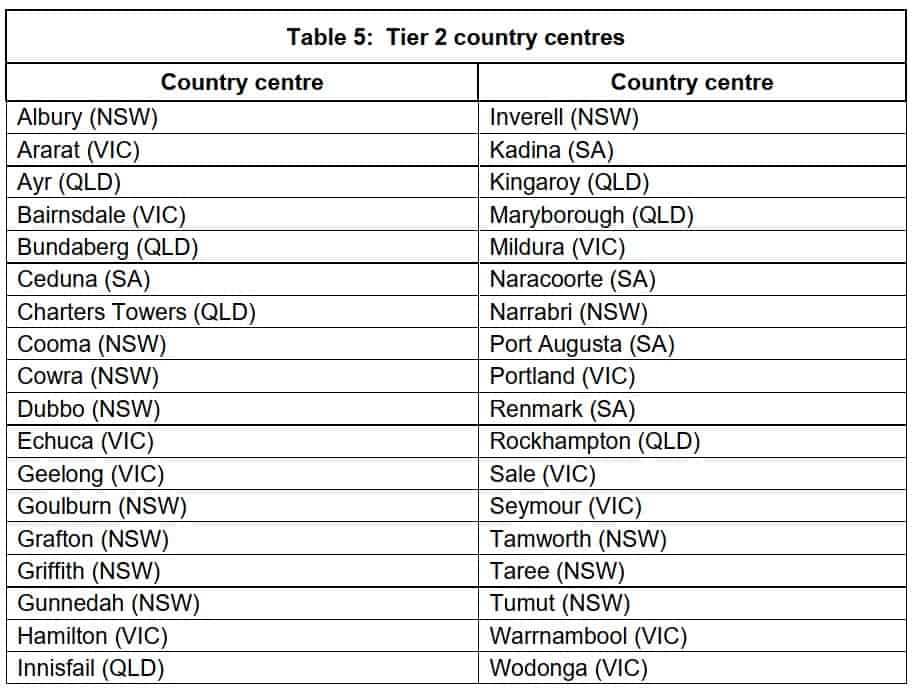

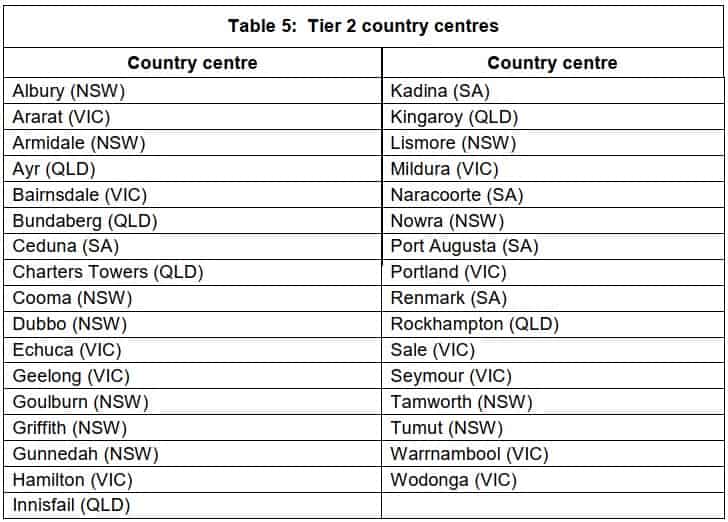

Table 5: Tier 2 country centres

Table 5a: Employee truck driver’s meals (food and drink)

2023-24 Overseas Travel

Table 6: Salary $138,790 or less

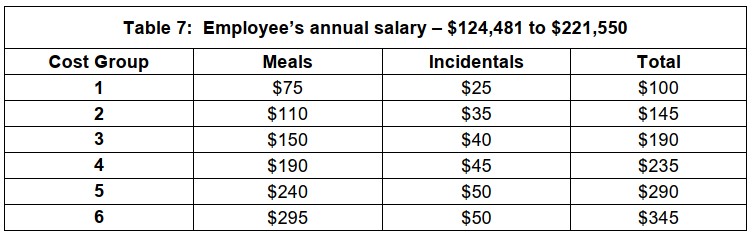

Table 7: Salary $138,791 to $247,020

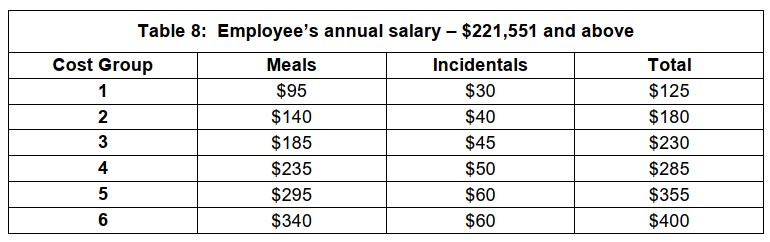

Table 8: Salary $247,021 or more

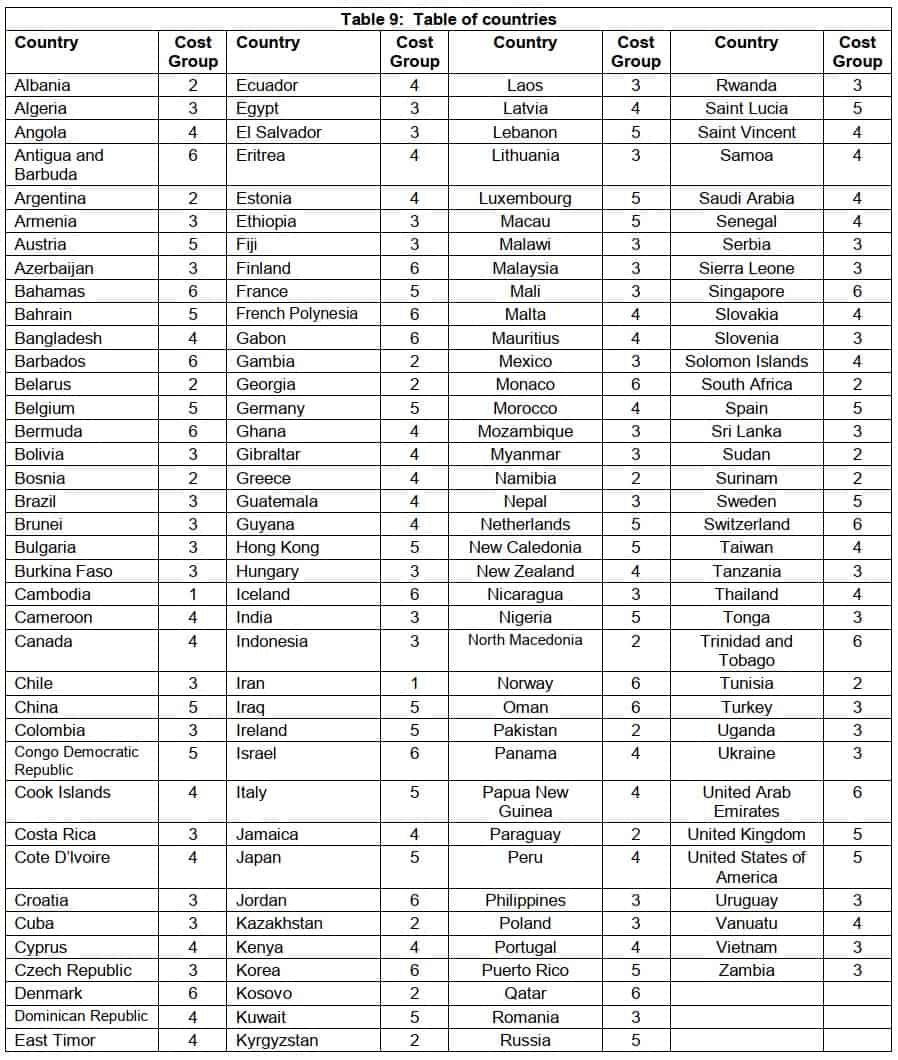

Table 9: Table of countries

Table 1:Reasonable amounts for domestic travel expenses – employee’s annual salary $138,790 or less

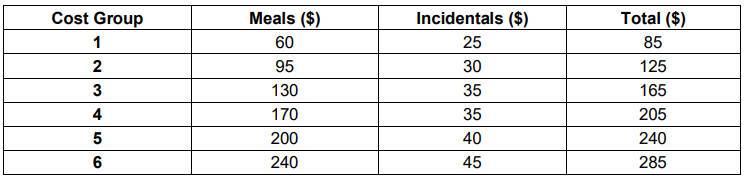

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $138,791 to $247,020

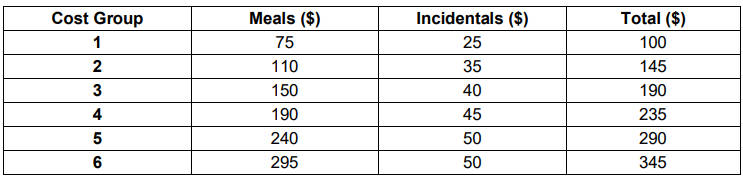

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $247,021 or more

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,790 or less

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $138,791 to $247,020

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $247,021 or more

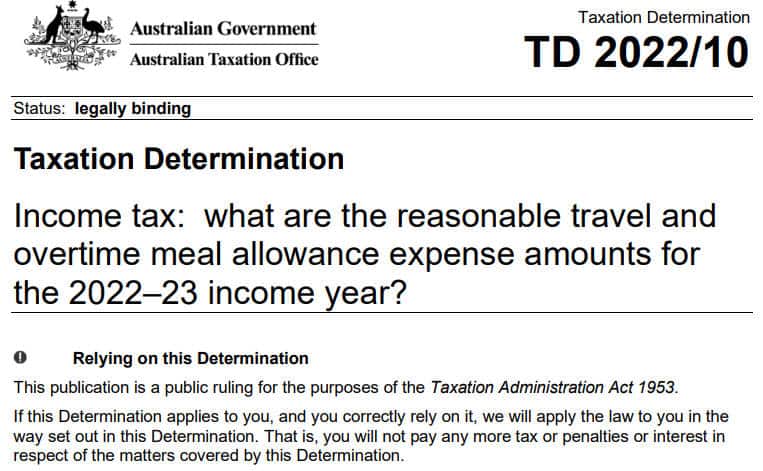

Allowances for 2022-23

The full document in PDF format: 2022-23 Determination TD 2022/10 (pdf).

The 2022-23 reasonable amount for overtime meal expenses is $33.25.

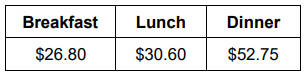

Reasonable amounts given for meals for employee truck drivers are as follows:

- breakfast $26.80

- lunch $30.60

- dinner $52.75

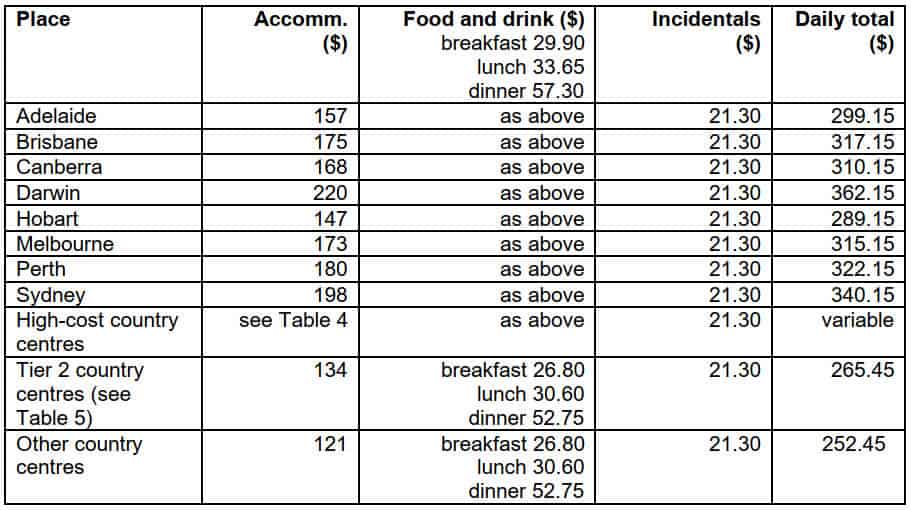

2022-23 Domestic Travel

Table 1: Salary $133,450 and below

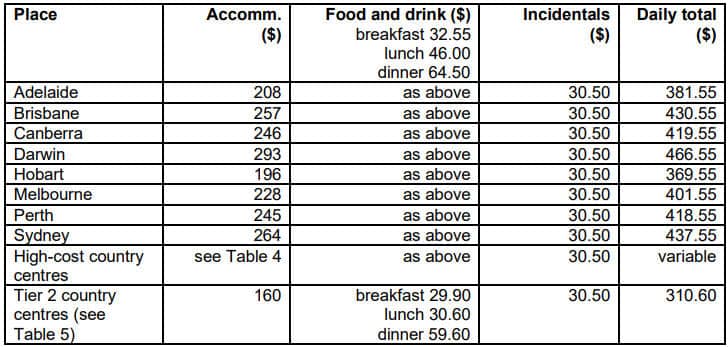

Table 2: Salary $133,451 to $237,520

Table 3: Salary $237,521 and above

2022-23 Overseas Travel

Table 6: Salary $133,450 and below

Table 7: Salary – $133,451 to $237,520

Table 8: Salary – $237,521 and above

Table 1: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,450 and below

Table 2: Reasonable amounts for domestic travel expenses – employee’s annual salary $133,451 to $237,520

Table 3: Reasonable amounts for domestic travel expenses – employee’s annual salary $237,521 and above

Table 4: Reasonable amounts for domestic travel expenses – high-cost country centres accommodation expenses

Table 5a: Reasonable amounts for domestic travel expenses – employee truck driver’s meals (food and drink)

Table 6: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,450 and below

Table 7: Reasonable amounts for overseas travel expenses – employee’s annual salary $133,451 to $237,520

Table 8: Reasonable amounts for overseas travel expenses – employee’s annual salary $237,521 and above

Allowances for 2021-22

The full document in PDF format: 2021-22 Determination TD 2021/6 (pdf).

The document displayed with links to each sections is set out below.

For the 2021-22 income year the reasonable amount for overtime meal expenses is $32.50

2021-22 Domestic Travel

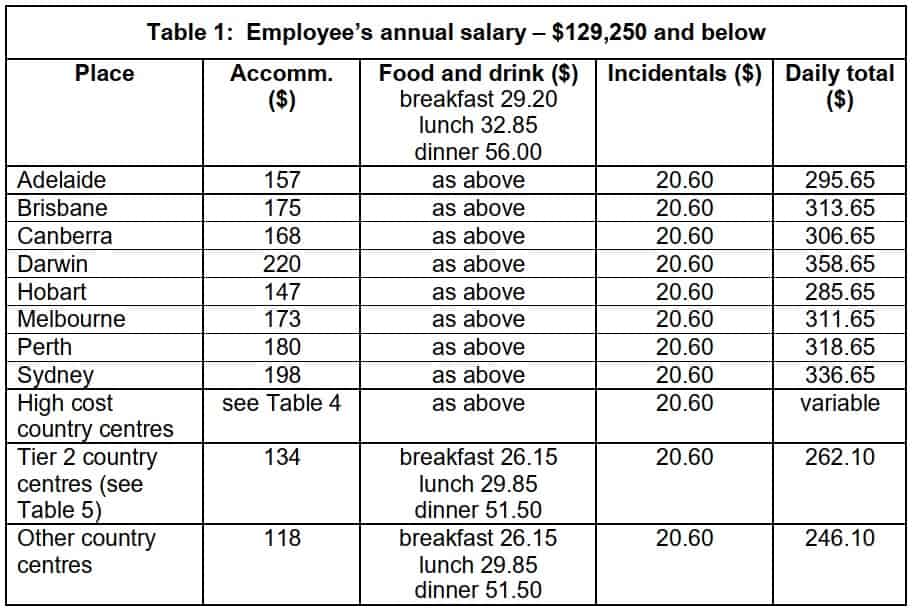

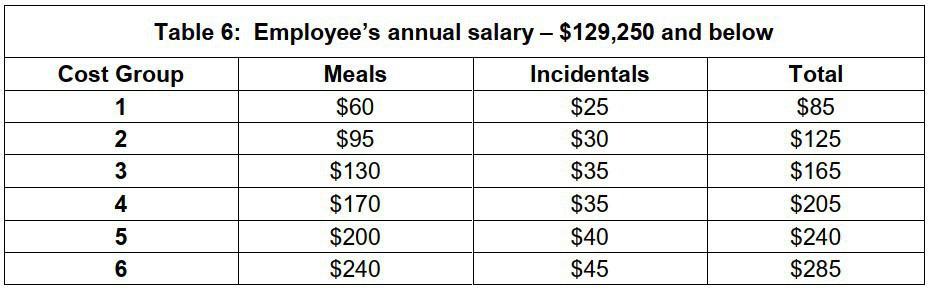

Table 1: Salary $129,250 and below

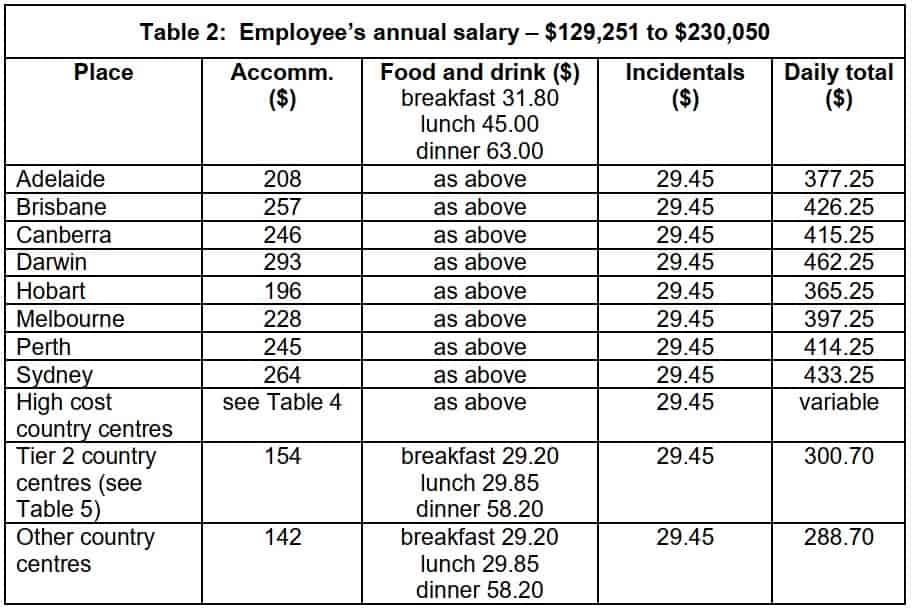

Table 2: Salary $129,251 to $230,050

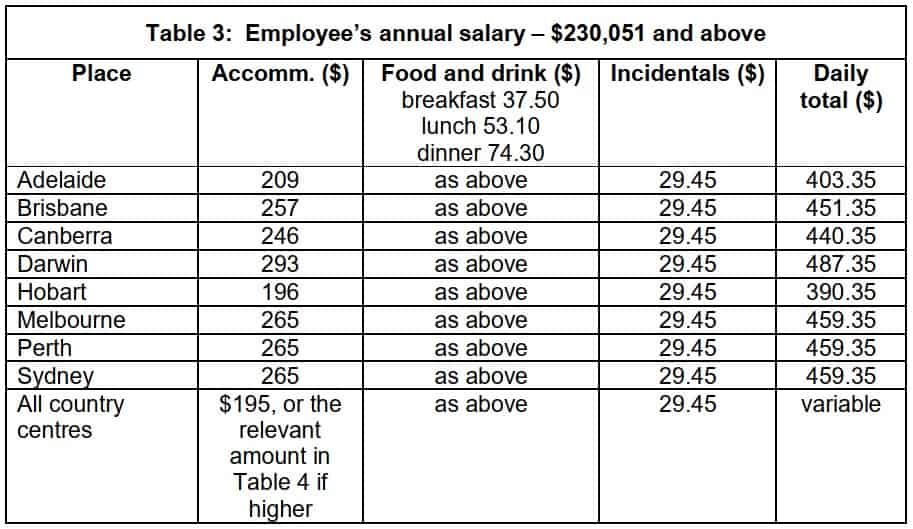

Table 3: Salary $230,051 and above

2021-22 Overseas Travel

Table 6: Salary $129,250 and below

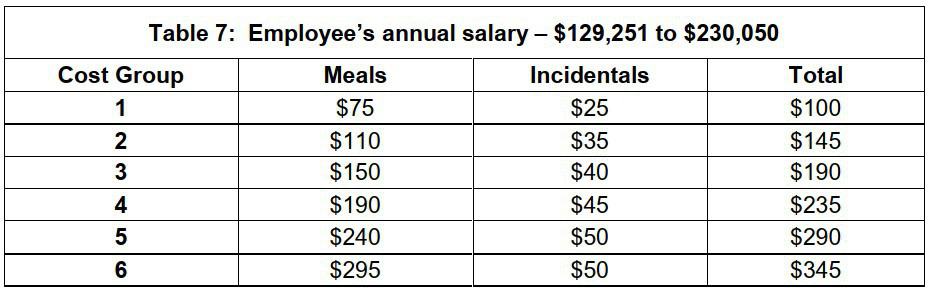

Table 7: Salary – $129,251 to $230,050

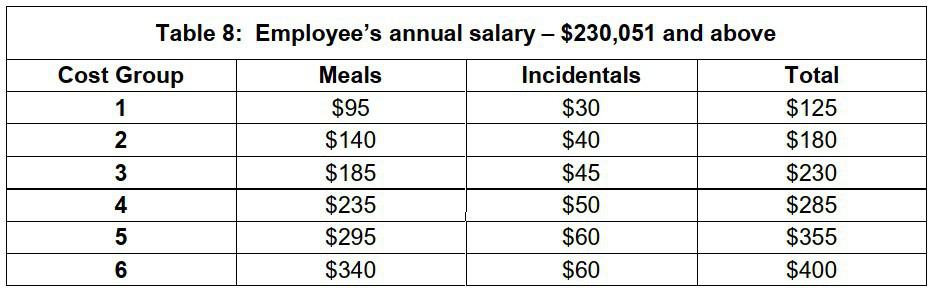

Table 8: Salary – $230,051 and above

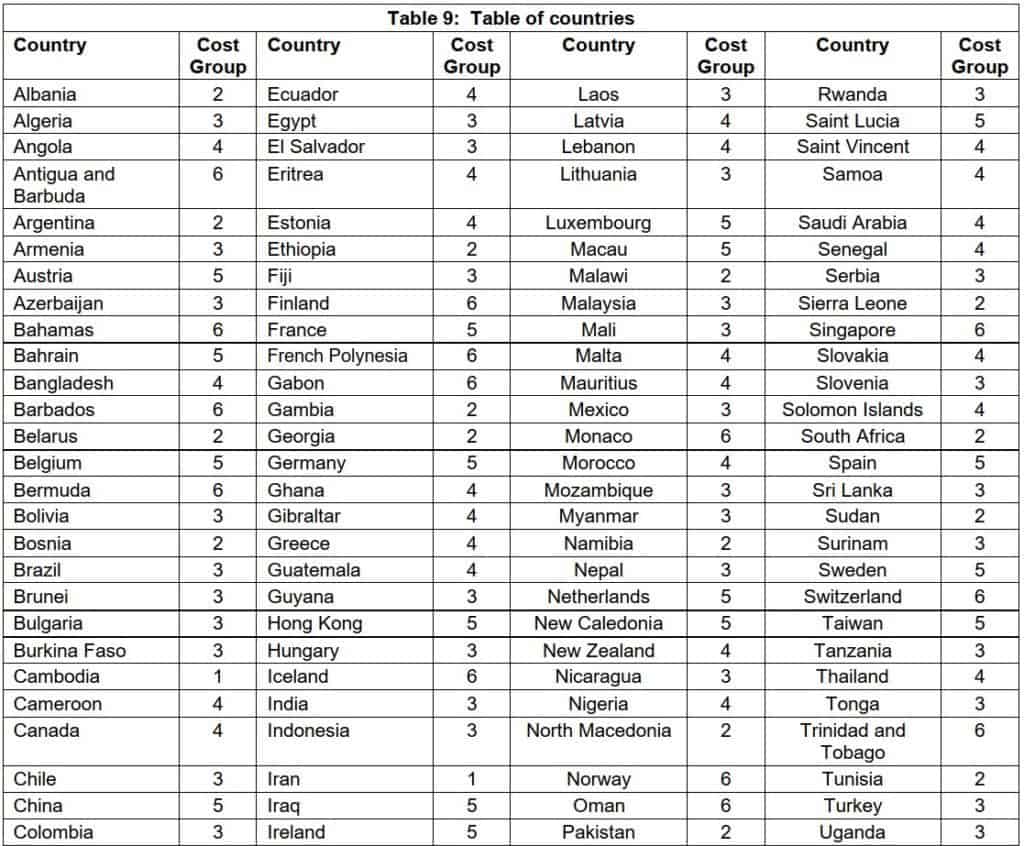

2021-22 Domestic Table 1: Employee’s annual salary – $129,250 and below

2021-22 Domestic Table 2: Employee’s annual salary – $129,251 to $230,050

2021-22 Domestic Table 3: Employee’s annual salary – $230,051 and above

2021-22 Domestic Table 4: High cost country centres – accommodation expenses

2021-22 Domestic Table 5: Tier 2 country centres

2021-22 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2021-22 Overseas Table 6: Employee’s annual salary – $129,250 and below

2021-22 Overseas Table 7: Employee’s annual salary – $129,251 to $230,050

2021-22 Overseas Table 8: Employee’s annual salary – $230,051 and above

2021-22 Overseas Table 9: Table of countries

Allowances for 2020-21

Download full document in PDF format: 2020-21 Determination TD 2020/5 (pdf).

The document displayed with links to each section is set out below.

For the 2020-21 income year the reasonable amount for overtime meal expenses is $31.95 .

2020-21 Domestic Travel

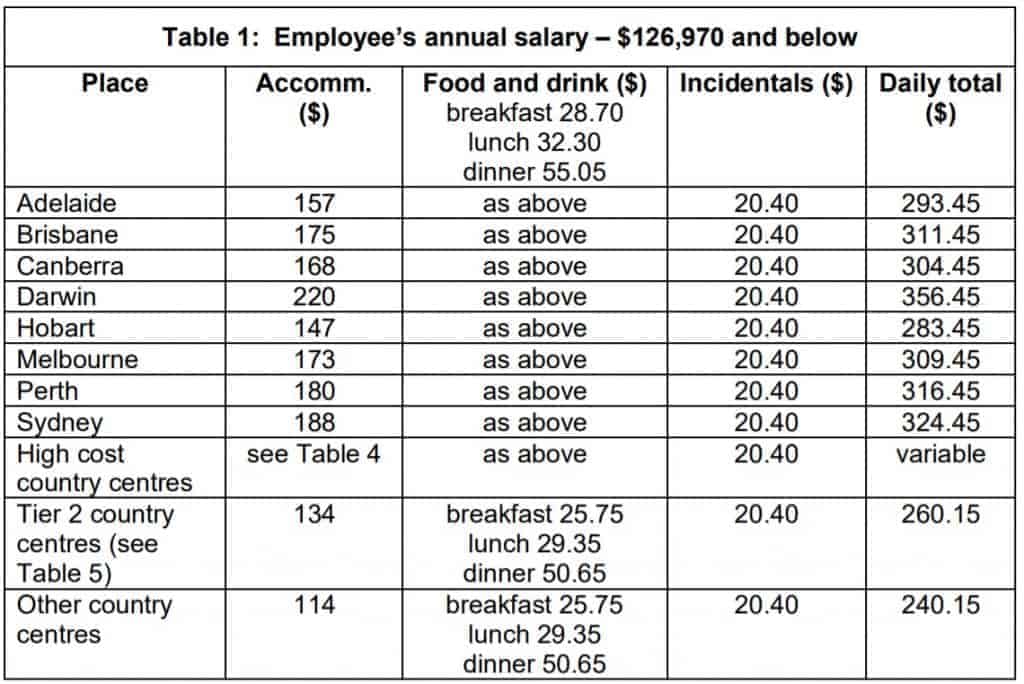

Table 1: Salary $126,970 and below

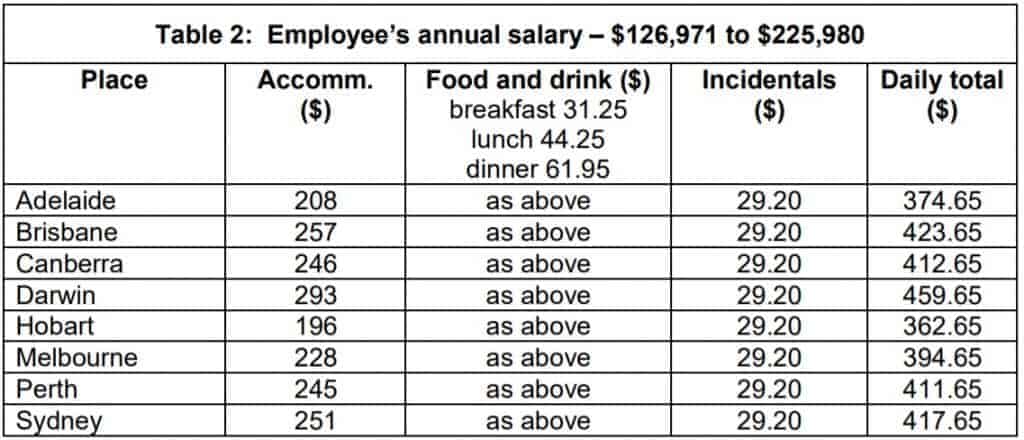

Table 2: Salary $126,971 to $225,980

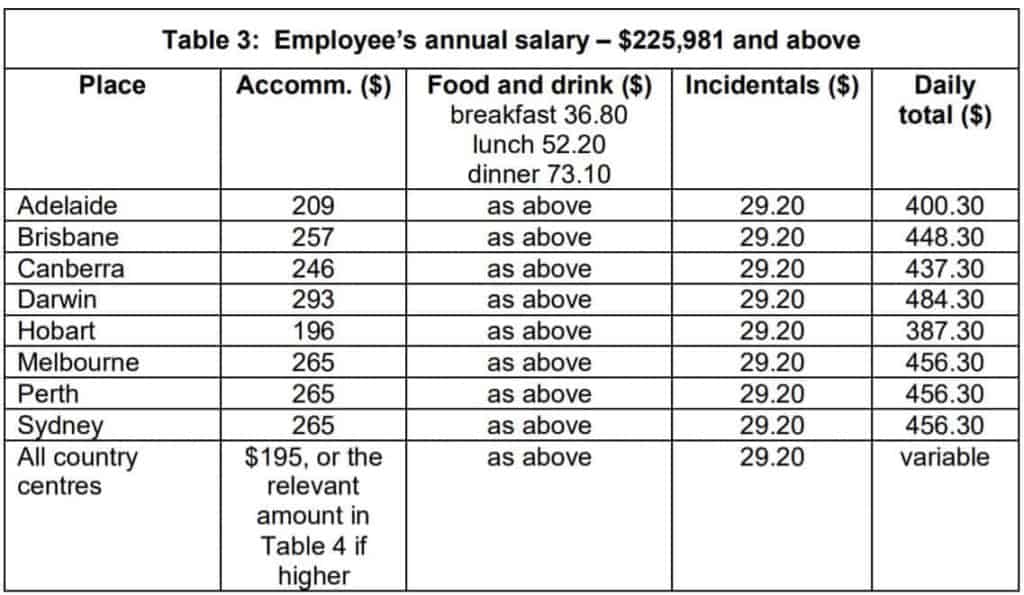

Table 3: Salary $225,981 and above

2020-21 Overseas Travel

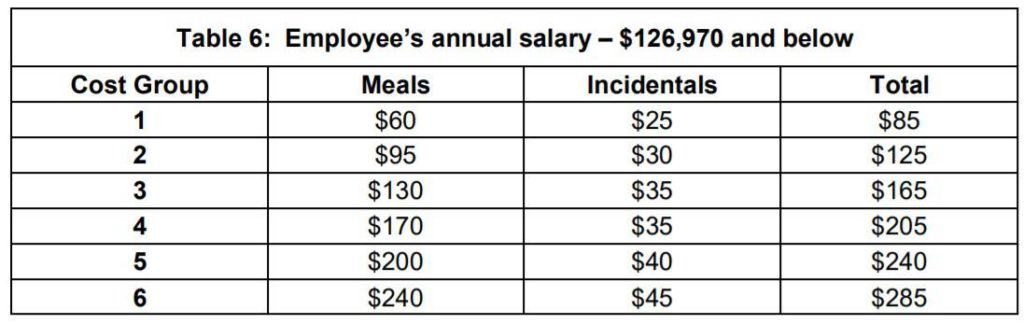

Table 6: Salary $126,970 and below

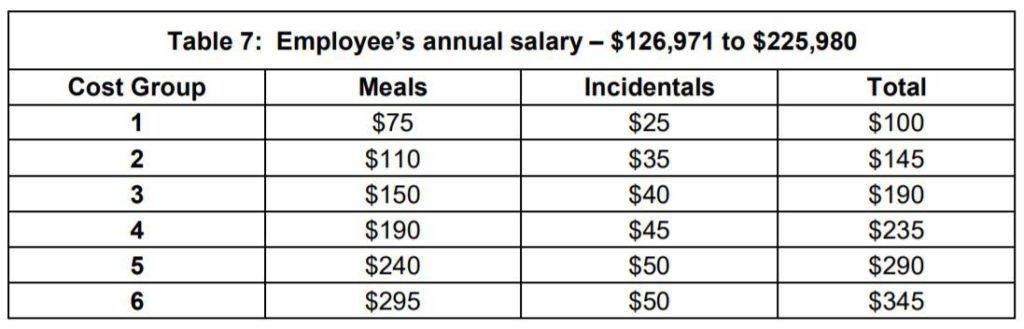

Table 7: Salary – $126,971 to $225,980

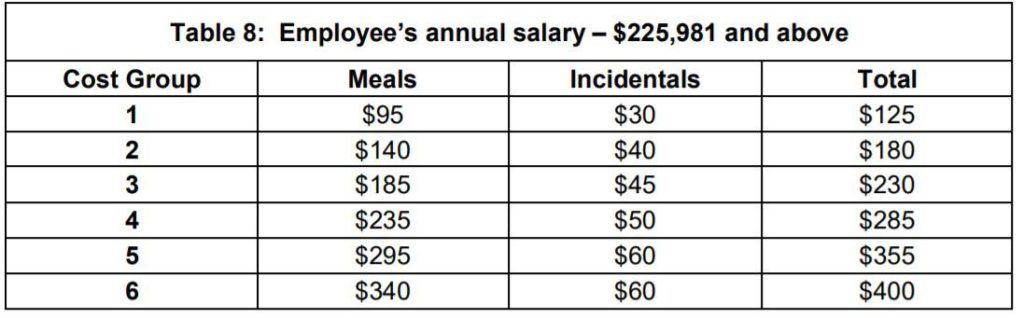

Table 8: Salary – $225,981 and above

2020-21 Domestic Travel 2020-21 Domestic Table 1: Employee’s annual salary – $126,970 and below

2020-21 Domestic Table 2: Employee’s annual salary – $126,971 to $225,980

2020-21 Domestic Table 3: Employee’s annual salary – $225,981 and above

2020-21 Domestic Table 4: High cost country centres – accommodation expenses

2020-21 Domestic Table 5: Tier 2 country centres

2020-21 Domestic Table 5a: Employee truck driver’s meals (food and drink)

2020-21 Overseas Travel 2020-21 Overseas Table 6: Employee’s annual salary – $126,970 and below

2020-21 Overseas Table 7: Employee’s annual salary – $126,971 to $225,980

2020-21 Overseas Table 8: Employee’s annual salary – $225,981 and above

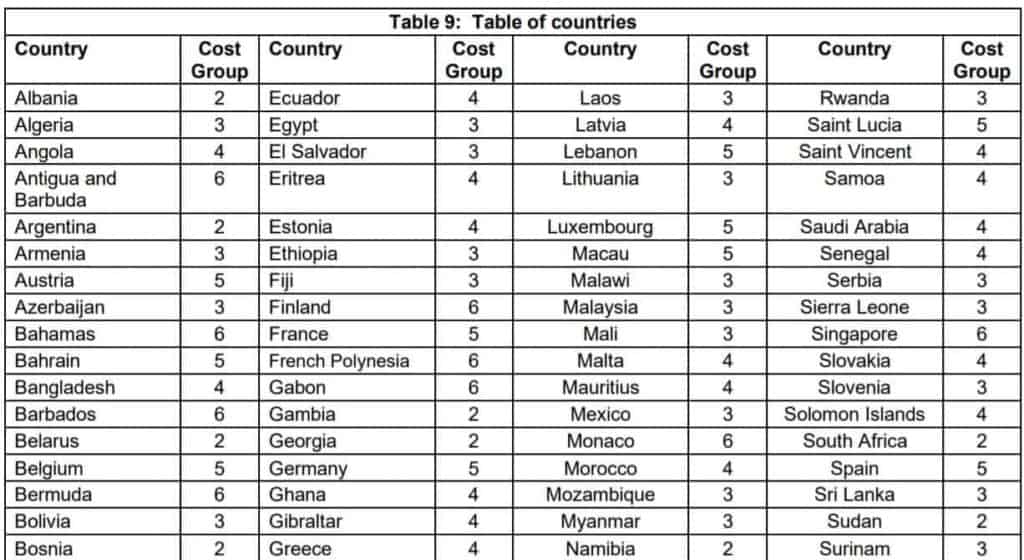

2020-21 Overseas Table 9: Table of countries

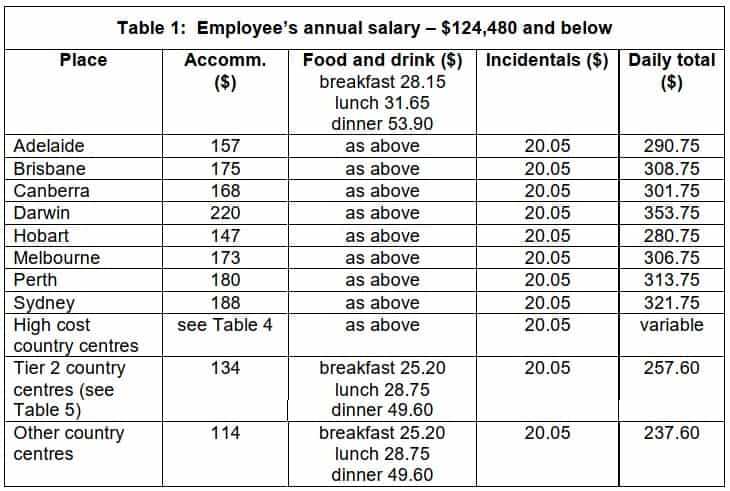

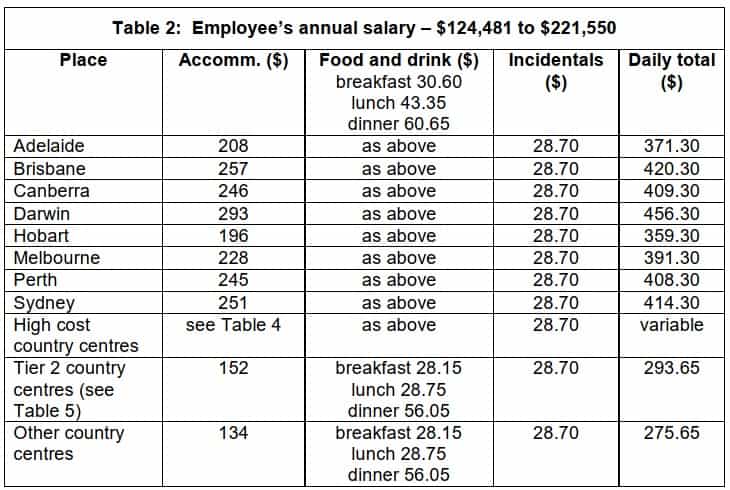

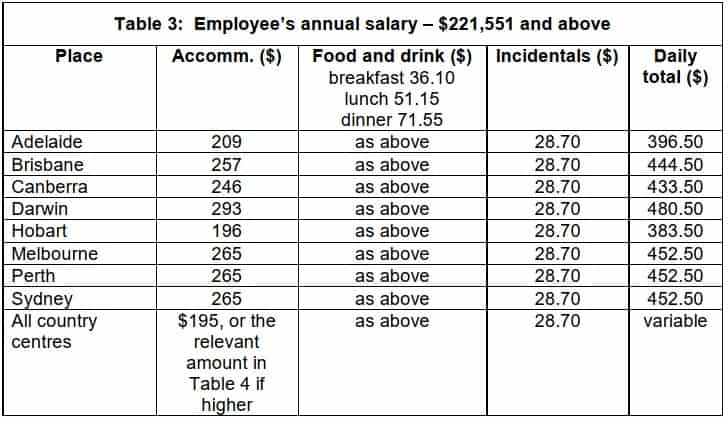

Allowances for 2019-20

The determination in sections:

Domestic Travel

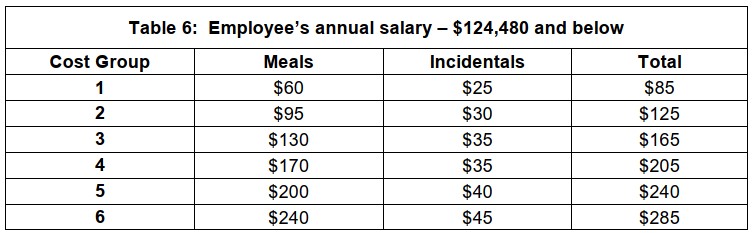

Table 1: Employee’s annual salary – $124,480 and below

Table 2: Employee’s annual salary – $124,481 to $221,550

Table 3: Employee’s annual salary – $221,551 and above

Table 4: High cost country centres – accommodation expenses

Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel

Table 6: Employee’s annual salary – $124,480 and below

Table 7: Employee’s annual salary – $124,481 to $221,550

Table 8: Employee’s annual salary – $221,551 and above

For the 2019-20 income year the reasonable amount for overtime meal expenses is $31.25.

The reasonable travel and overtime meal allowance expense amounts commencing 1 July 2019 for the 2019-20 income year are contained in Tax Determination TD 2019/11 (issued 3 July 2019).

Download the PDF or view online here .

Domestic Travel Table 1: Employee’s annual salary – $124,480 and below

Domestic Travel Table 2: Employee’s annual salary – $124,481 to $221,550

Domestic Travel Table 3: Employee’s annual salary – $221,551 and above

Domestic Travel Table 4: High cost country centres – accommodation expenses

Domestic Travel Table 5: Tier 2 country centres

Domestic Travel Table 5a: Employee truck driver’s meals (food and drink)

Overseas Travel Table 6: Employee’s annual salary – $124,480 and below

Overseas Travel Table 7: Employee’s annual salary – $124,481 to $221,550

Overseas Travel Table 8: Employee’s annual salary – $221,551 and above

Overseas Travel Table 9: Table of countries

Substantiation and Compliance

Taxation Ruling TR 2004/6 explains the the way in which the expenses can be claimed within the substantiation rules, including the requirement to obtain written evidence and exemptions to that requirement.

Allowances which are ‘reasonable’ , i.e. comply with the Reasonable Allowance determination amounts and with TR 2004/6 are not required to be declared as income and are excluded from the expense substantiation requirements.

These substantiation rules only apply to employees. Non-employees must fully substantiate their travel expense claims. Expenses for non-working accompanying spouses are excluded.

Key points :

To be claimable as a tax deduction, and to be excluded from the expense substantiation requirements, travel and overtime meal allowances must:

- be for work-related purposes; and

- be supported by payments connected to the relevant expense

- for travel allowance expenses, the employee must sleep away from home

- if the amount claimed is more than the ‘reasonable’ amount set out in the Tax Determination, then the whole claim must be substantiated

- employees can be required to verify the facts relied upon to claim a tax deduction and/or the exclusion from the substantiation requirements

- an allowance conforming to the guidelines doesn’t need to be declared as income or claimed in the employee’s tax return, unless it has been itemised on the statement of earnings. Amounts of genuine reasonable allowances provided to employees(excludng overseas accommodation) are not required to be subjected to tax withholdings or itemised on an employee’s statement of earnings.

- claims which don’t match the amount of the allowance need to be declared.

The Tax Office has issued guidance on their position.

[11 August 2021] Taxation Ruling TR 2021/4 reviews the tax treatment of accommodation and food and drink expenses, and provides 14 examples which distinguish non-deductible living expenses from deductible travelling on work expenses. FBT implications for the ‘otherwise deductible’ rule and travel and LAFHA allowances are also considered.

[11 August 2021] Practical Compliance Guideline PCG 2021/3 (which finalises draft PCG 2021/D1 ) provides the ATO’s compliance approach to determining if allowances or benefits provided to an employee are travelling on work, or living at a location.

For FBT purposes an employee is deemed to be travelling on work if they are away for no more than 21 consecutive days, and fewer than 90 days in the same work location in a FBT year.

See also: Travel between home and work and LAFHA Living Away From Home

The issue of annual determination TD 2017/19 for the 2017-18 year marked a tightening of the Tax Office’s interpretation of the necessary conditions for the relief of allowances from the substantiation rules, which would otherwise require full documentary evidence (e.g. receipts) and travel records. (900-50(1))

For a full discussion of the issues, this article from Bantacs is recommended: Reasonable Allowance Concessions Effectively Abolished By The ATO .

Prior to 2017-18

In summary: Prior to 2017-18 the Tax Office rulings stated the general position that provided a travel allowance was ‘reasonable’ (i.e. followed the ATO-determined amounts) then substantiation with written evidence was not required. “In appropriate cases”, however employees may have been required to show how their claim was calculated and that the expense was actually incurred.

What changed

The relevant wording was changed in the 2017-18 determination to now require that more specific additional evidence be available if requested. This additional evidence is not prescribed in the tax rules, but represents a higher administrative standard being applied by the Tax Office.

The required evidence includes being able to show:

- you spent the money on work duties (e.g. away from home overnight for work)

- how the claim was worked out (e.g. diary record)

- you spent the money yourself (e.g. credit card statement, banking records)

- you were not reimbursed (e.g. letter from employer)

Other requirements highlighted by the Bantacs article include:

- a representative sample of receipts may be required to show that a reasonable allowance (or part of it) has actually been spent (TD 2017/19 para 20)

- hostels or caravan parks are not considered eligible for the accommodation component of a reasonable allowance because they are not the right kind of “commercial establishment”, examples of which are hotels, motels and serviced apartments (para 14)

- reasonable amounts for meals can only be for meals within the specific hours of travel (not days), and can only be for breakfast, lunch or dinner (para 15), and therefore could exclude, for example, meals taken during a period of night work.

Tip : The reasonable amount for incidentals still applies in full to each day of travel covered by the allowance, without the need to apportion for any part day travel on the first and last day. (para 16).

Alternative: business travel expense claims

With the burden of proof on ‘reasonable allowance’ claims potentially quite high, an alternative is to opt for a travel expense claim made out under the general substantiation rules for employees, or under the general rules for deductibility for businesses.

The kind of business travel expenses referred to here could include:

Airfares Accommodation Meals Car hire Incidentals (e.g. taxi fares)

The Tax Office has an article describing how to meet the requirements for claiming travel expenses as a tax deduction. See: Claiming a tax deduction for business travel expenses

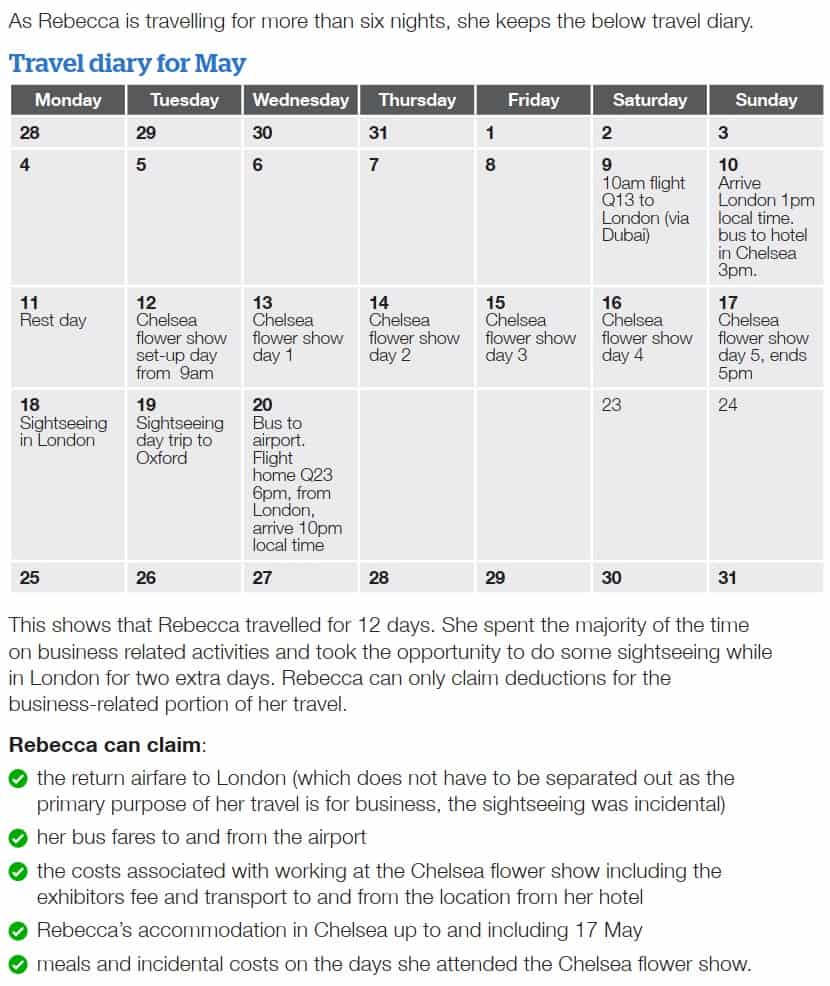

Travel diary

A travel diary is required by sole traders and partners for overnight expenses and recommended for everyone else (including companies and trusts).

It is important to exclude any private portion of travelling expense which is non-deductible, or if paid on behalf of an employee gives rise to an FBT liability.

For example the expenses of a non-business associate (e.g. spouse), the cost of private activities such as sight-seeing, and accommodation and associated expenses for the non-business portion of a trip.

Airfares to and from a business travel destination would not need to be apportioned if the private element of the trip such as sightseeing was only incidental to the main purpose and time spent.

This is an example of a travel diary for Rebecca who owns a business as a sole trader landscape gardener. (courtesy of ATO Tax Time Fact Sheet )

Allowances for 2018-19

For the 2018-19 income year the reasonable amount for overtime meal allowance expenses is $30.60 .

The meal-by-meal amounts for employee long distance truck drivers are $24.70, $28.15 and $48.60 per day for breakfast, lunch and dinner respectively.

This determination includes ATO reasonable allowances for

(a) overtime meal expenses – for food and drink when working overtime (b) domestic travel expenses – for accommodation, food and drink, and incidentals when travelling away from home overnight for work (particular reasonable amounts are given for employee truck drivers, office holders covered by the Remuneration Tribunal and Federal Members of Parliament) (c) overseas travel expenses – for food and drink, and incidentals when travelling overseas for work

Allowances for 2017-18

An addendum was issued modifying paragraphs 23 to 30 of determination TD 2017/19 setting out the new reasonable amounts, and consolidated into TD 2017/19 as linked above. For reference purposes, the first-released version of TD 2017/19 issued 3 July 2017 is linked here .

2017-18 Addendum: ATO reinstates the meal-by-meal approach for truck drivers’ travel expense claims

On 27 October 2017 the ATO announced the reinstatement of the meal-by-meal approach for truck drivers who claim domestic travel expenses for meals. The following new reasonable amounts have now been included in an updated version of the current ruling (see on page 7):

For the 2017-18 income year the reasonable amount for overtime meal allowance expenses is $30.05 .

This determination contains ATO reasonable allowances for:

- overtime meals

- domestic travel

- employee truck drivers

- overseas travel

- $24.25 for breakfast

- $27.65 for lunch

- $47.70 for dinner

The amount for each meal is separate and can’t be combined into a single daily amount or moved from one meal to another.

See: ATO media release

Allowances for 2016-17

For the 2016-17 income year the reasonable amount for overtime meal allowance expenses is $29.40 .

Allowances for 2015-16

Download the PDF or view online here . For the 2015-16 income year the reasonable amount for overtime meal allowance expenses is $ 28.80 .

Allowances for 2014-15

Allowances for 2013-14

The reasonable travel and overtime meal allowance expense amounts for the 2013-14 income year are contained in Tax Determination TD 2013/16 . For the 2013-14 income year the reasonable amount for overtime meal allowance expenses is $ 27.70 .

Allowances for 2012-13

The reasonable travel and overtime meal allowance expense amounts for the 2012-13 income year are contained in Tax Determination TD 2012/17 . For the 2012-13 income year the reasonable amount for overtime meal allowance expenses is $27.10

Allowances for 2011-12

The reasonable travel and overtime meal allowance expense amounts for the 2011-12 income year are contained in Tax Determination TD 2011/017 . For the 2011-12 income year the reasonable amount for overtime meal allowance expenses is $26.45

This page was last modified 2023-06-28

- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Record keeping exceptions for travel allowance expenses

You may not need to keep receipts or a travel diary for travel allowance expense claims within the reasonable amounts.

Last updated 25 April 2023

Eligibility for the record keeping exception

Generally, to claim a deduction you need to keep detailed records of your travel allowance expenses as evidence for your claims.

However, you may not need to keep detailed records if you receive a travel allowance and your expenses meet certain conditions.

The eligibility conditions depend on the type of travel:

Domestic travel

Overseas travel, overseas travel for airline crew.

You will be able to rely on the record keeping exception if:

- you receive a travel allowance from your employer

- you must incur the expenses and they must be deductible – merely receiving a travel allowance from your employer does not automatically entitle you to claim a deduction

- your travel allowance expenses are within the reasonable amounts .

If you meet these conditions you don't need to keep written evidence of your accommodation, food and drink and incidental expenses, or a travel diary. But you still need records showing that you incurred the expenses on work-related travel . If your deduction for travel allowance expenses exceeds the reasonable amounts, you will need to keep:

- written evidence for your whole claim

- a travel diary if you travel for 6 or more nights in a row.

Example: expenses incurred less than the reasonable amount

Jasha lives in Darwin and travels overnight for work to Adelaide. He receives a travel allowance of $150 to cover his accommodation. His employer includes the allowance on his income statement.

In Adelaide, Jasha stays at a motel that costs him $90 for the night. For a person in Jasha’s circumstances, the reasonable amount for accommodation in Adelaide is $157.

At the end of the income year, Jasha must include the allowance of $150 in his tax return as income. He can also claim a deduction of $90, the amount he incurred on his accommodation.

Jasha can rely on the travel allowance record keeping exception because:

- he incurs deductible travel allowance expenses, that is, accommodation

- he receives a travel allowance from his employer to cover his accommodation expenses

- his deduction ($90) is less than the reasonable amount ($157).

Example: expenses incurred more than reasonable amount

Quin lives in Adelaide and travels to Perth for work for 3 nights. She receives a travel allowance of $180 per night to cover her accommodation costs.

Quin's employer reports the total allowance ($180 × 3 = $540) on her income statement at the end of the income year.

The reasonable amount for accommodation is $180 for a person in Quin’s circumstances.

Quin spends a total of $750 ($250 per night × 3 nights) on her accommodation in Perth.

At the end of the income year, Quin must declare her allowance of $540 as income in her tax return.

Quin can claim a deduction for the amount she incurred ($750) if she keeps written evidence of the whole amount she spends.

If Quin wants to keep more limited records, she can claim a deduction for up to the reasonable amount ($540) for her accommodation.

The exception from keeping written evidence and a travel diary for overseas travel works in the same way as the exception for domestic travel except:

- you must keep written evidence for all your accommodation expenses

- you must keep a travel diary if you are away from your home for 6 or more nights in a row.

If you are an airline crew member on an overseas flight, you can claim a deduction for your travel allowance expenses without keeping a travel diary, if:

- your travel allowance covers your travel as a crew member on an aircraft

- your travel is principally outside Australia

- your deduction for expenses covered by your travel allowance doesn't exceed the allowance you receive.

This exception only applies to keeping a travel diary.

To rely on the exception from keeping written evidence for your food and drink and incidental expenses:

- you must incur deductible travel allowance expenses

- you must receive a travel allowance from your employer

- your deduction for travel allowance expenses must be within the reasonable amounts .

You must keep written evidence for all your accommodation expenses.

Exception for overseas travel by airline crew – claim within reasonable amounts

Exception for overseas travel by airline crew – claim exceeds reasonable amounts

Example: travel records and written evidence for international airline crew

Orla works for an airline as a captain and flies long-haul international routes to the United States of America. She receives a travel allowance for meals when she stays overnight.

The amount of Orla's allowance is:

- $25 for breakfast

- $56 for lunch

- $67 for dinner.

Orla’s regular itinerary is as follows:

- Days 1 and 2: flies from Sydney to Los Angeles on an overnight flight and spends an additional night in Los Angeles to rest

- Days 3 and 4: flies from Los Angeles to New York and stays 2 nights there to rest

- Days 5 and 6: flies from New York to Los Angeles and spends 2 nights there to rest

- Day 7: flies back to Sydney.

All up, Orla is away from home for 6 nights.

While in Los Angeles, Orla spends:

- $22 on breakfast

- $18 on lunch

- $46 on dinner.

While in New York, Orla spends:

- $23 on breakfast

- $25 on lunch

- $40 on dinner.

Even though Orla is away from her home for 6 nights in a row, she doesn't need to keep a travel diary because the amounts she spends on meals is less than the travel allowance her employer pays her.

Her meal expenses are also less than the reasonable amounts for the United States of America, so Orla does not need to keep written evidence for her meal expenses. She can rely on the overseas travel allowance record keeping exception.

However, Orla can only claim the amount she incurs on meals as a deduction, and she still needs to show how she works out the amount of her claim.

Reasonable amounts

To be eligible for the record keeping exceptions, your deduction for travel allowance expenses must be within the 'reasonable amounts'.

We specify the reasonable amounts in TD 2022/10 Income tax: what are the reasonable travel and overtime meal allowance expense amounts for the 2022–23 income year?

For travel allowance expenses we provide daily rates for:

- accommodation

- food and drink – as an amount for each breakfast, lunch and dinner

- other deductible expenses incidental to the travel.

The reasonable amounts vary depending on:

- your annual salary

- the location you travel to for work.

There are also reasonable amounts specifically for employee truck drivers.

You can't automatically claim the reasonable amounts as a deduction. You can only claim a deduction for the deductible travel allowance expenses that you actually incur.

Accommodation

The reasonable amount for accommodation is a daily rate and only applies to commercial establishments that offer short stays, such as motels, hotels and serviced apartments.

The reasonable amount doesn't apply to other types of accommodation, such as caravan parks or hostels.

There is no record keeping exception for accommodation expenses you incur while travelling overseas for work purposes. If you travel overseas for work you need to keep written evidence for all your accommodation expenses.

Food and drink

For domestic travel, there is a reasonable amount for breakfast, lunch and dinner. You can't combine the amounts for each meal. That is, you must consider each meal separately to work out whether your claim is reasonable.

For overseas travel, the reasonable amount for food and drink (meals) is set as a daily rate. This means the costs you incur for food and drink during each day you are travelling for work only needs to be less than the reasonable daily amount.

The reasonable amount only applies to the period you are travelling for work purposes.

Example: meal-by-meal approach to reasonable amounts

Lei travels interstate for work purposes. His trip begins at 11:00 am on Wednesday and ends at 4:00 pm the next day (Thursday).

Lei receives a travel allowance from his employer to cover his meals for this trip. During the period Lei is travelling for work, it is reasonable to expect that Lei will incur expenses for lunch and dinner on Wednesday and breakfast and lunch on Thursday.

To work out whether he can rely on the travel allowance record keeping exception, Lei has to consider whether the expenses for each meal are less than the reasonable amount.

If the expenses Lei incurs are less than the reasonable amount for each meal, Lei can claim a deduction and rely on the exception for those meals.

If Lei incurs more than the reasonable amount for dinner on Wednesday night but less than the reasonable amount for lunch on the same day, he can't combine the reasonable amount for lunch and dinner when considering the reasonable amount. He must limit his deduction for dinner to the reasonable amount, or claim the full amount on all meals and keep written evidence for them.

Incidental expenses

The reasonable amount for incidental expenses applies to each day you are away. It is not apportioned for part-day travel on the first and last day of the trip.

Example: incidental expenses and the reasonable amounts

Sheena travels from her regular place of work in Sydney to Canberra to meet with clients. She leaves Sydney at 5:00 pm on Monday, stays in Canberra for 2 nights and returns to Sydney at 4:30 pm on Wednesday.

Sheena receives a $10 travel allowance for each day she is away to cover her incidental expenses.

If Sheena incurs deductible incidental expenses while she is travelling for work, she will have to consider if the amount she incurs on each of the 3 days she is travelling for work was less than the reasonable amount.

Although Sheena is only travelling for part of the day on Monday and Wednesday, she can rely on the travel allowance record keeping exception if her incidental expenses for each day is less than the reasonable amount.

The fact that Sheena receives an allowance to cover her incidental expenses does not mean she can automatically claim the reasonable amount as a deduction. She can only claim the amount she actually spends on incidental expenses.

Travel allowance less than or more than reasonable amounts

It doesn't matter if the travel allowance you receive from your employer is the same as, less than or more than the reasonable amounts. It is the amount you claim as a deduction that must be reasonable, rather than the amount of the allowance you receive.

If you incur deductible travel allowance expenses and the allowance you receive is a travel allowance, you can claim a deduction up to the reasonable amounts without keeping written evidence or a travel diary, even if:

- your travel allowance is less than the reasonable amounts

- your travel allowance is more than the reasonable amounts.

Example: allowance more than reasonable amount and expenses less than reasonable amount

Kylie travels for a week to work in Darwin. She receives a travel allowance of $250 for each night she is away to cover her accommodation costs. Her employer reports the allowance on her income statement.

For a person in Kylie’s circumstances, the reasonable amount for accommodation in Darwin is $220. Kylie spends $190 a night on accommodation while she is in Darwin for work.

As the accommodation expense is less than the reasonable amount, Kylie can rely on the travel allowance record keeping exception.

At the end of the income year, Kylie must declare her allowance of $250 as income in her tax return. She can also claim a deduction for the amount she spent ($190 per night) without keeping written evidence.

Although Kylie can rely on the travel allowance record keeping exception, if her claim is reviewed she will need to be able to show:

- when she travelled overnight for work

- that she spent the money on accommodation.

Records to keep if the exception applies

Even if the record keeping exception applies to you, we may still check your tax return and ask you to show:

- how you spent the money in the course of performing your work duties – for example, in travelling away from home overnight on a work trip

- how you worked out your deduction – for example, a diary showing the times you were away and how many meals you ate and where

- you spent the money yourself and were not reimbursed – for example, credit card statements or other banking records.

- you correctly declared your allowance as income in your tax return.

Example: relying on exception for domestic travel

Zoran works in Melbourne. His employer requires him to travel to the office in Sydney for a week to meet with a number of clients. Zoran leaves early on Monday morning and returns home on Friday evening.

For the 5 days he is in Sydney, Zoran's employer pays him a travel allowance of $1,030. He receives the allowance to cover:

- accommodation of $170 per night × 4 nights = $680

- food and drink of $70 per day × 5 days = $350

Based on his records, Zoran calculates that he spent $700 on his hotel accommodation and $400 on food and drinks over the 5 days. Zoran determines that the amount he incurred each night on accommodation and the amount he incurred on each meal were less than the reasonable amount set by the ATO.

As Zoran is away from home for less than 6 nights in a row, he doesn't have to keep travel records. He isn't required to keep receipts for his accommodation, food and drink expenses for the trip to Sydney because he meets the requirements for relying on the travel allowance record keeping exception for domestic travel.

However, Zoran keeps:

- records that show he was travelling for work

- his credit card statements to show he spent the amount he is claiming as a deduction

- a record to show he declared the $1,030 allowance in his tax return.

Zoran must keep receipts for any incidental expenses he has when in Sydney. As he didn't receive an allowance for incidental expenses, he can't rely on a travel allowance record keeping exception for incidental expenses.

- Call Us 03 9557 3138

- Email Us [email protected]

Reasonable travel and overtime meal allowance amounts for 2022–2023

The ATO released Taxation Determination TD 2022/10 , applying from 1 July 2022, setting out the amounts it will treat as reasonable for 2022–2023 in relation to employee claims for:

- overtime meal expenses – the reasonable amount is $33.25

- domestic travel expenses

- meal expenses for employee truck drivers in receipt of a travel allowance and required to sleep (take their major rest break) away from home

- overseas travel expenses.

- February 2024

- January 2024

- December 2023

- November 2023

- September 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- August 2022

- February 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- August 2020

- February 2020

- January 2020

- December 2019

- October 2019

- January 2019

- February 2018

Recent Post

- Understanding Key Superannuation Thresholds for the 2024/25 Financial Year

- FBT cents per kilometre rates & LAFHA for 2024-25

- FBT: Adequate alternative records – instruments registered

- 2024-25 private health insurance income threshold and rebate

- Medicare Levy Low-income Threshold for 2023/24 Financial Year

I am looking for…

Travel allowance or LAFHA? And how is each taxed?

Thanks to Tax & Super Australia for the article.

Being asked by the boss to travel for work purposes can be demanding on staff — financially, physically and also emotionally. Out of this has developed more than one way to compensate employees; these being a travel allowance and the living away from home allowance (LAFHA).

When both were developed, the difference between the two were often decided by an ATO-initiated rule-of-thumb in that travel of less than 21 days was deemed to be the former, while more than 21 days was considered to have a more LAFHA flavour. The 21-day “threshold” however no longer applies.

For travel allowances, typically employees are:

- paid standard travel allowance for accommodation and food

- working at the one location

- visiting home on weekends

- staying in accommodation provided by the supplier (which may be available for use by other customers when the employee is not there).

The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee.

However it has also been found that some employees may be on a travel allowance for six weeks or more.

It is often asked whether these transactions should be looked at under the FBT rules (for LAFHA ) or the income tax rules (for travel allowances ). The tax treatment (and therefore the financial outcomes) of both can be different.

Deciding factors

The FBT framework would generally provide for a more concessional tax outcome where certain prescribed requirements for a LAFHA is met in comparison with the income tax effect of a travel allowance.

The reality is that you could have someone who is away from home but is still considered to be only travelling. Alternatively you could have someone that is away from home for two weeks only, but in those two weeks was actually living away from home.

When an employee is required to travel on business and overnight their food, drink and accommodation expenses become deductible expenses and are FBT free for the employer. The difference between LAFH rules and travelling on business is quite simply the employee on LAFH has to temporarily change their usual place of residence and therefore their food, drink and accommodation expenses become private and non-deductible. And that is why the employer needs the FBT concession for such employees. It is a question of fact as to whether or not the employee has temporarily changed their usual place of residence as opposed to travelling around on business.

So it is a test of substance whether someone is just travelling or is actually living away from home. It would have to be substantiated to be proven in fact as a LAFHA. Similarly, if away from home and treated as a travel allowance, the ATO will generally not challenge such treatment if substantiated as travel. Taxation ruling TR 2017/D6 deals with these factors.

Travel allowance or living away from home?

The following general principles may be of guidance:

- When a person is living away from home, there will be a change in job location and a temporary residence will be taken up near the new work location. Often, but not always, the employee’s spouse and family will accompany the employee to the new location.

- When a person is merely travelling, there will be no change in job location and there will be no establishment of a temporary residence – rather, the person will merely be accommodated while travelling. Usually the employee’s spouse and family will not accompany the employee.

- However the issue of whether the family accompanies the employee is not determinative. The critical factor seems to be where the job is located. If it is temporarily located away from the employee’s usual place of residence, the employee will usually be living away from his or her usual place of residence. Where the job location does not change, but the employee must travel to undertake duties, he or she will be regarded as travelling.

- While the length of period away from home is not determinative, the ATO will generally accept that shorter periods away will generally be deemed to be travelling. In addition, the Tax Commissioner has stated that employees attending short-term staff training courses will generally be treated as travelling in the course of their employment.

- There is no minimum or maximum period of absence to qualify as living away from home, although the application of the FBT rules may be less concessional if someone lives away from their usual place of residence for more than 12 months. The period that a person is living away from home will end when the person returns to his or her usual place of residence, or changes his or her usual place of residence to the new location.

Related resources

analyst report

Get Started

Your privacy is assured.

404 Not found

- gvfinancial22

- Jul 30, 2022

Daily Travel Allowances 2023

The ATO has released updated figures for daily travel allowances, which apply for the current financial year ending 30 June 2023.

Travel allowances can be paid by an employer (e.g. a practice trust) to an employee (the medical or dental practitioner) to cover costs of accommodation and/or meals while travelling for business involving at least one night away from home. Both domestic and international travel is covered.

The advantages of being paid a travel allowance are as follows:

There is no need to substantiate spending on items covered by the allowance. This means it is not necessary to keep receipts, making record-keeping simpler. The allowance amount might also exceed actual expenditure. For example, high income earners can be paid a travel allowance for Melbourne or Sydney of $463.40 per day ($265 accommodation plus $198.40 for meals and incidentals).

The allowance is deductible to the employer and does not appear on the employee’s PAYG Payment Summary or tax return.

The ATO ruling, TD 2022/10, contains tables specifying allowance limits for various domestic and international locations. Here is a link to the full text of the ruling:

https://www.ato.gov.au/law/view/view.htmdocid=%22TXD%2FTD202210%2FNAT%2FATO%2F00001%22

Should you have any questions regarding the payment of travel allowances, please contact our office.

Recent Posts

Free Tax Audit Insurance? We've got you covered.

How can a $62k car cost less than a $44k car?

Payroll Tax Update

Comentarios

- Need urgent help? Phone numbers

Online services

You can access a range of DVA services online.

- Make and track your claims

- Access your digital Veteran Card

- View your accepted conditions

Providers and ESOs

DVA Online Services modernises transactions for service providers such as transport bookings and invoicing.

Receive urgent help

These services are confidential and available 24 hours a day.

If life is in danger, call 000 .

Free counselling, treatment programs and suicide prevention training.

1800 011 046

Helps ADF personnel and their families access mental health services.

1800 628 036

Crisis support and suicide prevention help.

1800RESPECT

Help for people impacted by sexual assault, domestic or family violence and abuse.

1800 737 732

Annual increases to travel allowances

Please be aware that travel allowances for transport, meals and accommodation under DVA’s Travel for Treatment Program will increase on 1 July 2023 in line with the Consumer Price Index.

How is the increase applied?

The increase applies to travel by private vehicle as well as accommodation and meal allowances for all eligible veterans, war widows and widowers (entitled persons) travelling for treatment purposes or disability and income support claims.

The increase also applies to the Australian Participants in British Nuclear Tests and British Commonwealth Occupation Force (Treatment) Act 2006 and the Treatment Benefits (Special Access) Act 2019 .

What is the Transport for Treatment Program?

The intention of the program is to assist with travelling expenses to the closest practical provider for an entitled person and their medically required attendant, not necessarily to reimburse the entire cost incurred. For further information on closest practical provider requirements and attendant travel, please visit the DVA website.

The Travel for Treatment Program is available to holders of:

- Veteran Gold Cards and Veteran White Cards (for specific conditions) eligible under the Veterans’ Entitlements Act 1986 (VEA) who are entitled to assistance towards travelling expenses when travelling to receive treatment for an accepted service-related condition or for treatment of a specific condition covered under Non-liability Health Care (NLHC).

- Veteran Gold Cards under the Australian Participants in British Nuclear Tests and British Commonwealth Occupation Force (Treatment) Act 2006 and the T reatment Benefits (Special Access) Act 2019 who are entitled to assistance towards travelling expenses when attending approved treatment.

Where can I find more information?

For any queries about travel for treatment allowances, contact DVA on 1800 VETERAN (1800 838 372). Further information is also available on DVA’s website.

What are the new travel allowances?

* A meal allowance is not paid on a day where an accommodation allowance is paid, as a meal component is already built into the accommodation allowance.

† This column refers to the number of times an allowance is paid when an entitled person travels with a medically required attendant. For instance, if an entitled person shares a room with an attendant, only the allowance for one room is paid (x1). If they each have a single room, the allowance for both rooms is paid (x2).

Parliamentarian travel allowance rates - current

- Linkedin - external site

- Twitter - external site

- Facebook - external site

Rates effective on and from 27 August 2023.

Capital cities

Use the Capital City Zone Map to search capital city boundaries and identify if a location is within a capital city zone or outside of it.

Regional centres

1 This means locations:

- outside a 30 kilometre radius of Parliament House

- outside a 10 km radius from the GPO in Sydney, Melbourne, Brisbane, Perth or Adelaide or five km from the major airport servicing the city

- outside a five km radius from the GPO in Darwin and Hobart or five km from the major airport servicing the city

- for which a country centre rate has not been specified.

Commercial and non-commercial rates

Commercial rate : In order to be paid the commercial rate, a receipt for the accommodation must be produced or a certification made that a receipt can be produced and will be produced on request.

Non-commercial rate : Excluding Canberra, a rate of one-third of the commercial rate is payable where accommodation is provided in private, non-commercial accommodation, such as the home of a family member or friend.

Related content

Office holder travel allowance rates - current, principles-based framework, travel within australia.

Acknowledgement of Country

The Independent Parliamentary Expenses Authority acknowledges the traditional owners and custodians of country throughout Australia and acknowledges their continuing connection to Land, Waters and Community.

We pay our respects to the people, the cultures and the Elders past, present and emerging.

IMAGES

VIDEO

COMMENTS

The reasonable amount for incidentals applies in full to each day of travel covered by the allowance, without the need to apportion for any part -day travel on the first and last day. 18. The reasonable amounts for domestic travel expenses, according to salary levels and destinations, for the 2023-24 income year, are shown in Tables 1 to 5 of ...

Travel allowance is a payment made to an employee to cover accommodation, food, drink or incidental expenses they incur when they travel away from their home overnight in the course of their duties. Allowances folded into your employee's salary or wages are taxed as salary and wages and tax has to be withheld, unless an exception applies. You ...

• overseas travel expenses - for food and drink , and incidentals when travelling overseas for work. 2. The approach outlined in this Determination can only be used where you receive an allowance to cover the particular expenses you are claiming - for example, you received an accommodation allowance and are cl aiming accommodation expenses.

A travel allowance expense is a deductible travel expense: you incur when you're travelling away from your home overnight to perform your employment duties. that you receive an allowance to cover. for accommodation, meals (food or drink), or incidentals. You incur a travel allowance expense when you either: actually pay an amount for an expense.

lunch $32.80. dinner $56.60. For full details including domestic and overseas allowances in accordance with salary levels, refer to the full determination document: 2023-24 Domestic Travel. Table 1:Salary $138,790 or less. Table 2: Salary $138,791 to $247,020. Table 3: Salary $247,021 or more.

To be a travel allowance, the allowance must be a payment to cover travel allowance expenses. This means a travel allowance must cover: accommodation; meals (food or drink) incidental expenses. A travel allowance doesn't have to cover all those expenses. The allowance may still be a travel allowance if it is only paid to cover 1-2 of these ...

Expenses you can claim. Your business can claim a deduction for travel expenses related to your business, whether the travel is taken within a day, overnight, or for many nights. Expenses you can claim include: airfares. train, tram, bus, taxi, or ride-sourcing fares. car hire fees and the costs you incur (such as fuel, tolls and car parking ...

In August 2021, the Australian Taxation Office (ATO) finalised Taxation Ruling TR 2021/4 and PCG 2021/3, which provide guidance on the income tax deductibility of accommodation, food and drink expenses incurred in connection with travel.To the extent that an employer provides these types of benefits to employees, these rulings will be relevant in determining the extent that these expenses may ...

A travel allowance is a predetermined amount of money provided by an employer to an employee to cover the expenses associated with traveling for work-related purposes. The ATO considers a travel allowance to be tax-free if it meets the following conditions: The travel is required as part of the employee's job duties, The travel involves an ...

website (https://www.ato.gov.au). Preliminary Part 1 Section 7 Remuneration Tribunal (Official Travel) Determination 2023 3 ... Offices—Remuneration and Allowances) Determination (No. 1) 2023 (or any determination that supersedes that determination) applies; ... (for domestic and international travel) if the duration of the flight exceeds 5 ...

Jasha can rely on the travel allowance record keeping exception because: he incurs deductible travel allowance expenses, that is, accommodation. he receives a travel allowance from his employer to cover his accommodation expenses. his deduction ($90) is less than the reasonable amount ($157). Example: expenses incurred more than reasonable amount.

On 11 August 2021, the Australian Taxation Office (ATO) finalised TR 2021/4 (public ruling addressing deductibility of travel accommodation/meals and the determination of travel on work vs living at a location) and PCG 2021/3 (practical compliance guideline to determine if employee benefits/allowances relate to travel on work vs living at a location).

Find out the ATO Rates for 23/24 for Meals and Travel. The information below sets out the reasonable amounts for the substantiation exception for the 2023-24 income year in relation to claims made by employees for overtime meal expenses, domestic travel expenses, and overseas travel expenses.

The ATO released Taxation Determination TD 2022/10, applying from 1 July 2022, setting out the amounts it will treat as reasonable for 2022-2023 in relation to employee claims for: overtime meal expenses - the reasonable amount is $33.25; domestic travel expenses; meal expenses for employee truck drivers in receipt of a travel allowance and required to sleep (take their major rest break ...

Travel Allowance Staff - Annual Salary $138,791 to $247,020 High Cost Country Areas *Areas stated by the ATO Rates Cairns B'Fast Lunch Dinner Incidentals Mount Isa $34.95 $49.35 $69.20 $32.90 Daily Total: $186.40 Thursday Island Weipa Horn Island Other Country Centres *Areas not stated by the ATO rates are classified as "Other" Country Centres

The ATO publishes guidelines each year on what it considers to be reasonable amounts for a travelling employee. However it has also been found that some employees may be on a travel allowance for six weeks or more. It is often asked whether these transactions should be looked at under the FBT rules (for LAFHA) or the income tax rules (for ...

In brief. On 17 February 2021, the Australian Taxation Office (ATO) released the following new guidance in relation to whether an employee is "travelling on work" or otherwise, and the income tax and fringe benefits tax (FBT) treatment of associated travel expenses: Draft Taxation Ruling TR 2021/D1: Income tax and fringe benefit tax ...

2021, 2022, 2023 and 2024 rates and for prior years are set out below. The annual verdicts set out updated ATO reasonable allowances for each financial year for: extra meal expenses - for food and drink when running extra; domestic travel expenses - for accommodation, food and drink, and incidentals when travelling away from home stay for work

The Australian Taxation Office has issued new rates for reasonable travel expenses for the 2021/22 financial year. Tax Determination TD2021/6 sets out the rates for employee taxpayers who travel within Australia or overseas for work-related purposes and receive travel allowances. Substantiation requirements do not apply if accommodation, food ...

The ATO has released updated figures for daily travel allowances, which apply for the current financial year ending 30 June 2023.Travel allowances can be paid by an employer (e.g. a practice trust) to an employee (the medical or dental practitioner) to cover costs of accommodation and/or meals while travelling for business involving at least one night away from home.

Employee travel allowance rates 2022-23. 8 December 2021. Current national employee travel allowance rates including commercial and non-commercial rates.

New travel allowances from 1 July 2023; Type of allowance Measure New allowance from 1 July 2023 Travel with a medically required attendant † Private vehicle: Per kilometre: 41.8 cents: x1: Public, community or air transport: Actual fare: Actual fare: x2: Taxi transport: Actual fare: Actual fare: x1: Commercial accommodation non-capital city ...

Yulara (NT) $757. $253. Unspecified locations. $350. $117. 1 This means locations: outside a 30 kilometre radius of Parliament House. outside a 10 km radius from the GPO in Sydney, Melbourne, Brisbane, Perth or Adelaide or five km from the major airport servicing the city.