- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

5 Tips for Buying Schengen Visa Travel Insurance

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

1. Decide which type of insurance you’d like

2. get multiple quotes, 3. use this as an opportunity to maximize credit card bonus points, 4. double-check the policy before purchasing, 5. consider using a credit card that provides trip insurance instead of buying a new policy, if you’re looking to buy travel insurance for a schengen visa.

Travel insurance can be a very important accompaniment to your trip, especially when you’re traveling throughout multiple countries. Europe is a prime example of this, where the border-free Schengen zone allows you to traverse multiple countries without passing passport control. Finding Schengen visa travel insurance isn’t always simple, however, and you’ll want to ensure that you have coverage regardless of your location.

There are plenty of things to think about before buying travel insurance when traveling throughout Europe, including: the coverage you’re looking for, how you’ll be paying and whether your credit card already offers insurance.

Let’s take a look at Schengen travel insurance and five easy tips for making sure you’re good to go — no matter where you travel within the region.

Although there aren’t generally any Schengen visa travel insurance requirements, there are multiple types of travel insurance coverage available depending on your needs. Consider carefully the type of coverage you’re looking for. Common types includes:

Travel medical insurance .

Trip interruption insurance .

Cancel for any reason insurance .

Trip cancellation insurance .

Lost luggage insurance .

Rental car insurance .

Accidental death insurance .

Emergency evacuation insurance.

Note that the U.K. left the Schengen zone a few years ago, so you’ll want to double-check whether coverage in the U.K. is valid for your travel insurance policy.

» Learn more: Is travel insurance worth it?

It’s always in your best interest to get multiple quotes before purchasing insurance. The amount you’ll pay will be heavily dependent on the type of coverage you receive, its length and any deductibles that you may have.

Cancel For Any Reason insurance, or CFAR, allows you to recoup most or all of your nonrefundable costs — no matter why you’ve chosen not to travel.

There are plenty of different websites that’ll allow you to compare different insurance plans such as TravelInsurance.com or SquareMouth.com (a NerdWallet partner), which will gather together multiple quotes in one easy search.

There are several details you’ll need to have on hand when looking for quotes. These include:

The total cost of your trip.

Your destination.

Your dates of travel.

The number of travelers.

The age of travelers.

Where you live.

When you booked your trip.

Once you’ve got all your information gathered together, it’s simple to find a policy that fits your need for travel insurance in the Schengen zone on one of the comparison websites.

» Learn more: What is travel insurance?

If you’re planning a vacation to Europe, hopefully you’ve already acquired a travel credit card or two. However, cards that focus on travel rewards won’t necessarily optimize insurance purchases.

» Learn more: How to choose a credit card for Europe travel

In this case, you’ll want to double down on rewards with a card that’ll maximize everyday spend. These cards will give you bonus points on all purchases, no matter their category. Great options for this include:

Capital One Venture Rewards Credit Card : Earn 2x Capital One Miles per dollar spent on all purchases.

Citi Double Cash® Card : Earn 2% cash back in the form of Citi ThankYou points on all purchases: 1% when you make your purchase and another 1% when you pay your bill. Plus, through the end of 2024, cardholders can get 5% cash back on hotel, car rentals and attractions booked through the Citi Travel portal .

Chase Freedom Unlimited® : Typically earn 1.5% cash back on all non-bonus category purchases.

The Blue Business® Plus Credit Card from American Express : Earn 2 American Express Membership Rewards on the first $50,000 in purchases each year. Terms apply.

Pair your Chase Freedom Unlimited® card with a Chase Sapphire Preferred® Card card or Chase Sapphire Reserve® card to unlock the full suite of Chase Ultimate Rewards® transfer partners. This strategy is sometimes referred to as the Chase Trifecta .

While you likely won’t be earning a ton of points for your travel insurance purchase (unless your costs are exorbitantly high), maximizing your earnings is always a good idea. Don’t leave money on the table.

» Learn more: The best travel insurance companies

Not all travel insurance policies are created equal. This is probably no great revelation, but it’s definitely something of which you’ll want to be aware.

This is especially pertinent when it comes to the current travel climate in the COVID-19 era. While you may purchase a health insurance plan that covers most medical costs, it may specifically exclude those incurred by COVID-19. And even if it does reimburse you for any hospital costs, it may not pay for a forced quarantine in the event of illness.

These are things you’ll want to check for when buying travel insurance for any trip. Be sure to read the terms and conditions of your policy carefully, and if there’s very specific coverage you’re looking for (such as that offering protection in the event you catch COVID-19), you can often use search filters to narrow down your options.

» Learn more: Is there travel insurance that covers COVID quarantine?

One great feature of travel credit cards is the complimentary trip insurance they often provide. In order for your trip to be eligible for coverage, you’ll need to use the card to pay for your trip. In exchange, however, you can receive some pretty powerful benefits without needing to pay out of pocket.

The Chase Sapphire Preferred® Card card, for example, provides primary rental car insurance. This means that when you decline the insurance offered at the counter, your entire rental will be covered against collision up to the actual value of the rental car.

What’s most powerful about this feature is that, as primary, it comes before your own personal insurance — possibly saving you expensive premium jumps and claims on your policy.

Other cards that include powerful travel insurance protection such as interruption, cancellation or baggage coverage include The Platinum Card® from American Express and the Chase Sapphire Reserve® card. Terms apply.

» Learn more: The cheapest flights to Europe on points

It makes sense to purchase travel insurance in many circumstances, especially with the uncertainty in today’s travel world. Take advantage of these five tips to make sure you’re properly prepared for your trip — whether you’re heading to France, Finland or any of the over two dozen Schengen countries.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Visa Traveler

Exploring the world one country at a time

Travel Insurance for Schengen Visa: A Comprehensive Guide

Updated: September 8, 2023

One of the key requirements of Schengen visa is the travel medical insurance. The travel insurance for Schengen visa must meet certain coverage and must be valid throughout the Schengen region for the entire duration of your stay.

With a myriad of travel insurance options in the market, picking out the right policy for your Schengen visa is difficult. In this article, you will everything about Schengen visa travel insurance and how to choose a policy for your visa.

Table of Contents

BONUS: FREE eBOOK

Enter your name and email to download the FREE eBOOK: The Secret to VISA-FREE Travel

Opt in to receive my monthly visa updates

You can unsubscribe anytime. For more details, review our Privacy Policy.

Your FREE eBook is on it’s way to your inbox! Check your email.

What is Schengen Travel Medical Insurance?

Schengen travel insurance is a type of insurance policy for travelers visiting the Schengen area. This type of travel insurance plan is designed specifically to comply with Schengen visa criteria of minimum coverage and validity requirements. Schengen travel insurance is also a mandatory requirement for obtaining a Schengen visa.

Who Requires Schengen Travel Health Insurance?

Visitors from visa-required countries planning to visit any Schengen country must require Schengen travel insurance.

If you are a traveler from a country that requires a visa to enter the Schengen zone, you must have a valid travel insurance policy. You must buy travel insurance not only for your Schengen visa application but also for any or all trips that you take to the Schengen area.

Is Travel Insurance Mandatory for Schengen Visa?

Yes, obtaining travel insurance is mandatory for Schengen visa . The European Commission’s 810/2009 Regulation mandates submitting valid travel medical insurance for Schengen visa applications.

Proof of travel medical insurance is not only mandatory for the first trip, but also for all subsequent trips for multiple-entry Schengen visas.

At the time of application, you would only need to provide proof of insurance for the first entry.

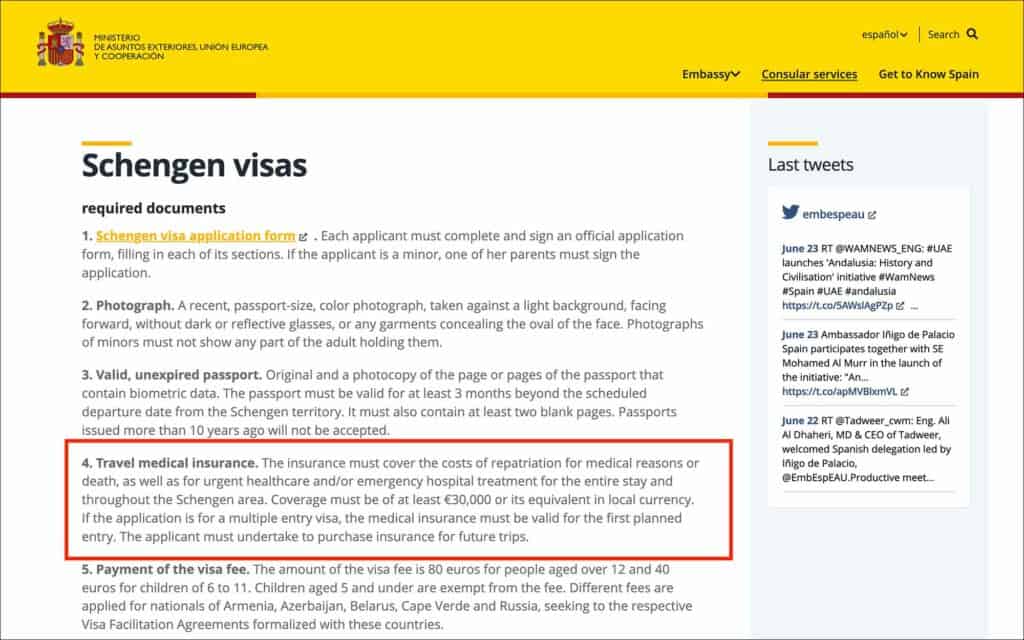

What are the Schengen Visa Insurance Requirements?

As per the Article 15 of REGULATION (EC) No 810/2009 , your Schengen visa travel insurance must meet the following three criteria:

- Must cover medical expenses up to a minimum of €30,000

- Must be valid for the entire duration of your stay

- Must be valid in all 27 Schengen countries

The policy must cover all medical expenses arising from emergency medical attention, treatment, hospitalization, emergency medical evacuation, repatriation due to medical reasons and death.

Let’s look at each of those requirements in detail.

1. Minimum Coverage

Your Schengen visa travel insurance must meet the minimum coverage requirement of €30,000. When purchasing Schengen visa travel insurance in USD, make sure the policy covers at least $50,000.

This minimum coverage is applicable for any medical expenses, emergency evacuation, and repatriation of remains.

This coverage is necessary to financially protect you in case of accidents, unforeseen illnesses, or other emergency situations that may arise during your travels in the Schengen area.

2. Validity Duration

Your travel insurance for the Schengen visa must remain valid for the entire duration of your stay in the Schengen area.

This travel insurance policy should cover you from the day you arrive in the Schengen area until the day you leave.

In terms of a multiple-entry visa, the Schengen visa insurance must be valid for the entire duration of your first entry only.

Here is an example:

You are applying for a multiple-entry visa and your trip is from Jan 01 to Jan 14. Your Schengen visa insurance must be valid from Jan 01 to Jan 14.

If you take another trip on the same visa, say from May 01 to May 14, then you must purchase another Schengen travel insurance at the time of your second trip.

For your visa application, you would only need to provide insurance for Jan 01 to Jan 14.

3. Validity in the Schengen Zone

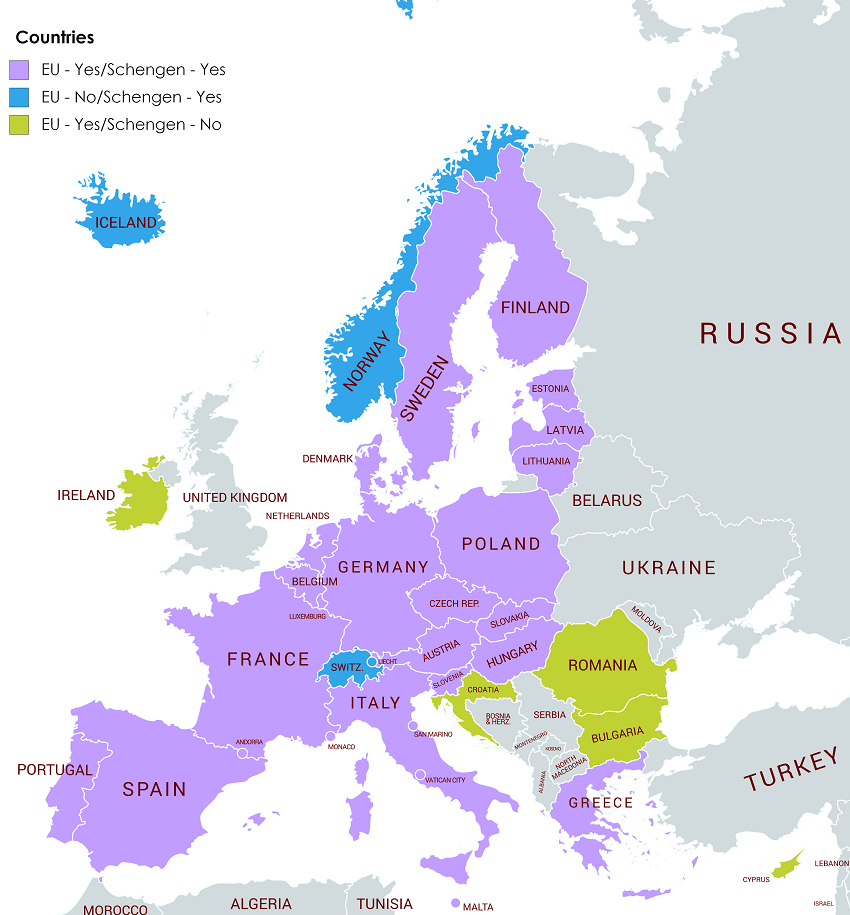

Lastly, your Schengen visa travel insurance must be valid in all 27 Schengen countries. This is to make sure that you have coverage regardless of which Schengen country you visit during your trip.

Most Schengen travel insurance aggregators such as VisitorsCoverage provide insurances that are valid in the entire Schengen zone.

In fact, any insurance valid globally is acceptable for the Schengen visa. Provided, the the insurance covers at least €30,000 in all medical costs and emergencies.

What Does Schengen Visa Insurance Plan Cover?

In general, any Schengen visa insurance plan covers medical expenses, COVID-19 protection, and trip coverage.

These coverage options are designed not only to provide comprehensive protection but also to meet the Schengen visa insurance requirements.

1. Medical Coverage

Medical coverage is the most important aspect of Schengen travel insurance. It provides coverage for emergency medical expenses, accidents, and unexpected illnesses.

The coverage also includes hospitalization, emergency hospital treatment, doctor visits, prescription drugs, and other necessary medical treatments that are considered emergency and necessary.

The policy must cover at least €30,000 for the visa. But depending on your needs and activities in the Schengen area, you can opt for policies with higher coverage.

2. COVID-19 Protection

COVID protection is not mandatory for Schengen visa. But most Schengen visa travel insurance policies offer coverage for medical treatment and quarantine expenses related to COVID. COVID tests and quarantine must be prescribed by a doctor to be eligible for the coverage.

That being said, you must review the policy details to make sure that COVID protection is included. Even though it’s not mandatory, it can provide peace of mind during your trip.

3. Trip Coverage

Trip coverage is also not mandatory for Schengen visa. But most travel insurance plans provide protection against flight cancellations, delays, and lost luggage during your travels. Trip coverage will help lessen any expenses arising from trip interruptions and baggage delays.

Review the policy details to make sure comprehensive trip coverage is included. This way, you can ensure that your trip goes smoothly, even when faced with unexpected setbacks.

What Does Schengen Visa Insurance Plan Not Cover?

Though Schengen travel insurance plans provide coverage for a wide range of scenarios, there will usually be some exclusions. One common exclusion is the coverage for pre-existing medical conditions.

It’s crucial to understand the limitations and exclusions of your Schengen visa insurance policy. Let’s look into the exclusion of pre-existing medical conditions in detail.

Pre-existing Medical Conditions

Pre-existing medical conditions are generally not covered by Schengen visa insurance plans. If you have a medical condition that was present prior to the purchase of your Schengen insurance policy, any medical expenses related to that condition during the trip will not be covered.

Review the terms and conditions of your travel insurance policy to determine if any exclusions apply to pre-existing medical conditions.

Is COVID-19 Coverage Mandatory for Schengen Visa Travel Insurance?

No, COVID-19 coverage is not mandatory for Schengen visa travel insurance. But most Schengen travel insurance companies include COVID coverage in their policy.

Even though it’s not required, having COVID protection in your travel insurance can provide financial security during your Schengen trip.

It is always better to be prepared and have coverage than face challenges during the trip.

How Much Does Schengen Visa Medical Insurance Cost?

The cost of Schengen visa medical insurance varies depending on several factors, such as age, duration of your trip, total coverage amount, and the insurance company.

Schengen travel insurance from IMG Global, through VisitorsCoverage for up to 39 years of age will cost about a dollar a day. For a one-week trip, it would be about $7 USD. The cost goes up with age.

IMG Global is a US-based insurance company offering Schengen visa insurance. If you opt for a Europe-based insurance company such as Europ Assistance, the prices are even higher. A one-week insurance policy can cost about €18.

To find the most affordable insurance policy for the Schengen visa, compare different insurance providers and policies using an insurance aggregator such as VisitorsCoverage .

How to Choose the Right Travel Insurance for Schengen Visa?

With a myriad of options available in the market, choosing travel insurance for your Schengen visa can be a daunting task. To make this process easier, consider factors such as the reputation of the insurance company, coverage limits, and customer reviews.

Let’s look at each of these factors in detail.

1. Reputation of the Company

When selecting a travel insurance provider, it’s important to evaluate their reputation in the market. A reputable insurance company will have a track record of providing reliable and quality coverage, as well as excellent customer service.

You can assess the reputation of an insurance company by looking at its reviews and ratings on sites such as Trustpilot. VisitorsCoverage , for example, has a 4.7 rating on Trustpilot.

If you choose an insurance company with a strong reputation, you will have confidence in the coverage and support they provide throughout your trip.

2. Coverage Limits and Exclusions

Another important aspect to consider is the coverage limit. The policy must be Schengen visa compliant, meaning the policy must meet the minimum coverage requirement of €30,000.

Additionally, it’s important to review if there are any exclusions such as pre-existing medical conditions or other limitations.

By reviewing the coverage limits and exclusions, you can pick out a policy that is Schengen visa compliant and provide enough protection during your trip.

3. Customer Reviews and Ratings

Reviews and ratings can be invaluable resources when evaluating any product or service in the market. Travel insurance is no different. The reviews and ratings provide insight into the insurance provider’s customer service, claims process, and embassy acceptability.

By considering the experiences of other travelers you can assess the quality and reliability of the travel insurance.

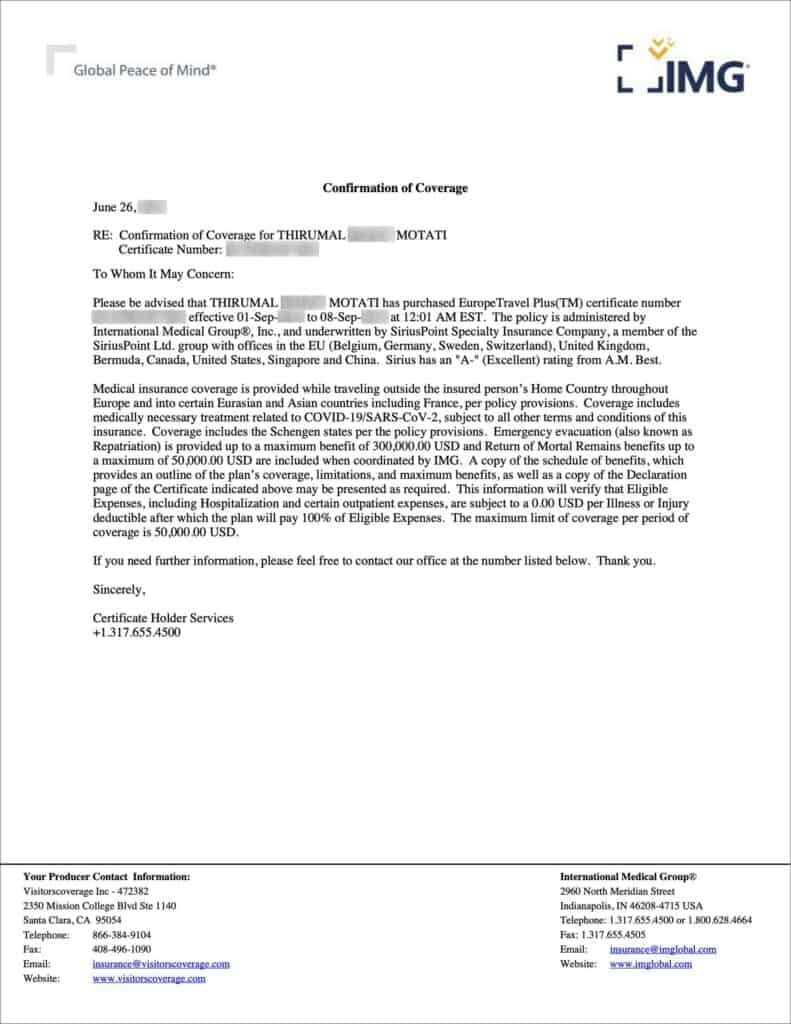

4. Schengen Insurance Certificate

Lastly, the insurance company must be able to issue a Schengen insurance certificate, also called a visa letter. Submitting a visa letter along with the policy is a mandatory requirement for the Schengen visa.

This certificate confirms that your insurance policy meets the Schengen visa criteria. The certificate should include:

- Your name (as the policyholder)

- Policy number

- Total coverage amount, which should be no less than €30,000 (or $50,000)

- Dates of validity (must cover the entire duration of your stay in the Schengen area)

- Contact details for the insurance company, in case of emergencies

Where to Purchase Travel Insurance for Schengen Visa?

Travel insurance for Schengen visas can be purchased from online insurance providers, local insurance companies and travel agencies.

Local insurance companies and travel agencies can offer personalized advice. With online platforms, you can compare prices and coverage options from multiple insurers.

Regardless of where you purchase your insurance, it’s important to make sure the insurance policy meets Schengen visa insurance requirements and provides the necessary coverage for your trip.

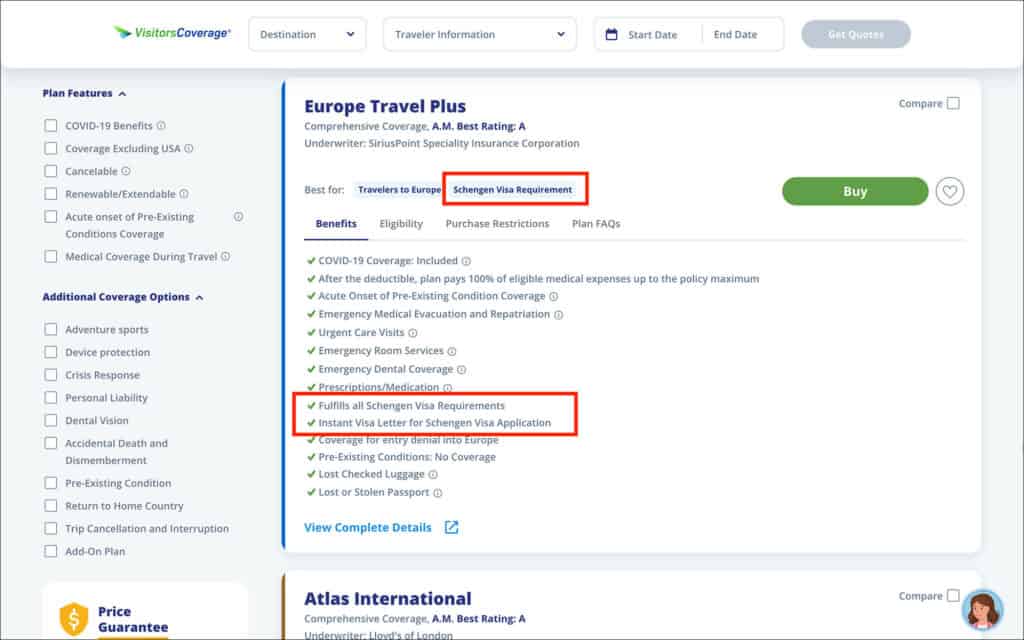

My recommendation is to buy Schengen visa insurance from VisitorsCoverage. Their Europe Travel Plus policy is specifically designed for the Schengen visa, meeting the minimum coverage requirements and downloadable visa letter. Here is a comparison for a 33-year-old, 7 days trip to the Schengen area.

How to Purchase Travel Insurance for Schengen Visa

To purchase your travel insurance for Schengen visa, go to the VisitorsCoverage’s Europe Travel Plus plan. Enter the following details.

- Destination Country

- Citizenship

- Residence/Home country

- Coverage Start Date

- Coverage End Date

- Arrival Date

- Date of Birth

- Email Address

Click on Continue. In the deductible and policy maximum, select $0 for the deductible and $50K for the policy maximum. Then click on Continue.

In the next steps, enter your details as per your passport. Complete the payment and purchase the policy. Once your purchase is complete, you can download your visa letter.

How To Find Cheap Schengen Travel Insurance?

Finding cheap Schengen travel insurance requires research and comparison of policies and companies. I have done this already for you. VisitorsCoverage was the cheapest in my research. If you are older than 50, then you might want to check other insurance companies to see if you can find a cheaper option.

Frequently Asked Questions (FAQS)

Do us citizens need schengen insurance.

No. US citizens do not require Schengen insurance when traveling to the Schengen area. This is because Schengen insurance is mandatory for those that require a visa for the Schengen area. And, US citizens do not require a visa for the Schengen area.

Is Schengen travel insurance refundable?

Yes. Most Schengen visa insurance companies offer reimbursement or free cancellation in the event of visa refusal. That being said, review the terms and conditions of the insurance policy before purchasing to make sure the policy is cancellable in case of visa refusal.

Can I purchase travel insurance after obtaining a Schengen visa?

No. You must purchase travel insurance before obtaining the visa. This is because travel insurance is one of the mandatory requirements for obtaining the Schengen visa. Without purchasing travel insurance, you won’t even be able to apply for the Schengen visa.

Are pre-existing medical conditions covered by travel insurance?

Pre-existing medical conditions are usually not covered by Schengen visa insurance plans. This means that any medical expenses arising due to pre-existing conditions will not be covered during your trip. Before purchasing, review the terms and conditions of the policy to determine the exclusions.

Can I extend my travel insurance coverage if my stay in the Schengen area is prolonged?

It may be possible to extend travel insurance coverage if your stay in the Schengen area is prolonged. But it depends on the insurance company and the policy type. Review the terms and conditions and also contact the insurance provider to inquire about extensions.

Obtaining the right travel insurance is a crucial step in your Schengen visa application process. The travel insurance for Schengen visa must provide at least €30,000 coverage and must be valid throughout the Schengen region for the entire duration of your trip.

While purchasing your Schengen visa insurance, consider factors such as the provider’s reputation, coverage limits and customer reviews. Compare different travel insurance providers and policies to pick out the right insurance for your Schengen visa.

WRITTEN BY THIRUMAL MOTATI

Thirumal Motati is an expert in tourist visa matters. He has been traveling the world on tourist visas for more than a decade. With his expertise, he has obtained several tourist visas, including the most strenuous ones such as the US, UK, Canada, and Schengen, some of which were granted multiple times. He has also set foot inside US consulates on numerous occasions. Mr. Motati has uncovered the secrets to successful visa applications. His guidance has enabled countless individuals to obtain their visas and fulfill their travel dreams. His statements have been mentioned in publications like Yahoo, BBC, The Hindu, and Travel Zoo.

PLAN YOUR TRAVEL WITH VISA TRAVELER

I highly recommend using these websites to plan your trip. I use these websites myself to apply for my visas, book my flights and hotels and purchase my travel insurance.

01. Apply for your visa

Get a verifiable flight itinerary for your visa application from DummyTicket247 . DummyTicket247 is a flight search engine to search and book flight itineraries for visas instantly. These flight itineraries are guaranteed to be valid for 2 weeks and work for all visa applications.

02. Book your fight

Find the cheapest flight tickets using Skyscanner . Skyscanner includes all budget airlines and you are guaranteed to find the cheapest flight to your destination.

03. Book your hotel

Book your hotel from Booking.com . Booking.com has pretty much every hotel, hostel and guesthouse from every destination.

04. Get your onward ticket

If traveling on a one-way ticket, use BestOnwardTicket to get proof of onward ticket for just $12, valid for 48 hours.

05. Purchase your insurance

Purchase travel medical insurance for your trip from HeyMondo . HeyMondo offers a 5% discount to Visa Traveler readers (use the link above), and covers all medical and travel emergencies during your trip.

Need more? Check out my travel resources page for the best websites to plan your trip.

LEGAL DISCLAIMER We are not affiliated with immigration, embassies or governments of any country. The content in this article is for educational and general informational purposes only, and shall not be understood or construed as, visa, immigration or legal advice. Your use of information provided in this article is solely at your own risk and you expressly agree not to rely upon any information contained in this article as a substitute for professional visa or immigration advice. Under no circumstance shall be held liable or responsible for any errors or omissions in this article or for any damage you may suffer in respect to any actions taken or not taken based on any or all of the information in this article. Please refer to our full disclaimer for further information.

AFFILIATE DISCLOSURE This post may contain affiliate links, which means we may receive a commission, at no extra cost to you, if you make a purchase through a link. Please refer to our full disclosure for further information.

RELATED POSTS

- Cookie Policy

- Copyright Notice

- Privacy Policy

- Terms of Use

- Flight Itinerary

- Hotel Reservation

- Travel Insurance

- Onward Ticket

- Testimonials

Search this site

Schengen Travel Insurance

Traveling to a schengen area.

- Double-check the expiration date on your passport, paying particular attention to the validity of childrens passports, which are only valid for five years.

- Make sure your passport is valid for at least six months beyond your intended return date

- Always carry your passport with you when traveling to other countries within the Schengen Area. While there may not be any border checks at the time of your travel, officials have the authority to reinstate border controls at any time, without prior notice.

Schengen Travel Insurance of which AXA is a leading provider, covers you in all 27 Countries within the Schengen Territory that have abolished internal border controls for their citizens. The countries are:

Do I need travel insurance while traveling to Schengen Countries?

What do I receive with my Schengen travel insurance?

What countries are covered under my axa travel plan, how can axa help with your trip to europe, how to get a travel protection quote.

Receive a free quote within minutes Or call us at 855-327-1441 to speak with our licensed Travel Insurance Advisors. Monday-Saturday, 8AM-7PM Central Time

Does AXA Travel Insurance provide coverage for Schengen Visa?

AXA Gold and Platinum plans offer the necessary medical and assistance coverage in all 27 countries in the Schengen Territory. However, the Gold and Platinum plans only provide coverage up to 60 – 90days.

What should I do if I have a medical issue while in the Schengen Area?

Please contact the local authority as soon as possible. Then contact us on the phone number given with the special conditions you receive after taking out your policy. Our helpful staff will then do all we can to resolve your issue and get you treatment or travel home, in line with the conditions of your policy. If you require assistance while traveling, call us at +1312-935-1719

The embassy states that I must get an insurance certificate with Covid protection. Is this possible?

Need help choosing a plan.

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

licensed agents available

Travel Insurance for Schengen Visa – Essential Coverage, Requirements & Tips

When visiting the Schengen Area in Europe, travellers should be ready for any unexpected medical expenses resulting from accidents or injuries.

EU laws require all Schengen visa applicants to acquire travel insurance to ensure financial protection against unexpected medical costs while travelling in the Schengen zone.

Schengen Visa Insurance Requirements

According to Regulation (EC) No 810/2009 of the European Parliament , medical insurance for a Schengen visa must fulfil the following requirements:

- A minimum coverage of medical costs: at least 30,000 EUR (equivalent to 28,000 USD as of August 2024).

- It should be valid in member states of the Schengen Area.

- It should cover the entire length of your stay in the Schengen area.

- It should cover any expenses arising from repatriation for medical reasons, urgent health attention, emergency hospital treatment, or death.

Even though travel health insurance is worth having for all travellers to Europe, not everyone is required to have it. A travel insurance policy is mandatory only for travellers applying for a Schengen visa . This group of travellers is always required to have the needed coverage for the entire period of their stay in Europe, regardless if they go there for business, tourism, studying, holidays, or other reasons.

Foreign travellers visiting Europe who enjoy visa-free travel to the Schengen zone can get their preferred European travel insurance policy if they want to, and while it is highly recommended – they are not required to.

Travel Insurance Is a Must When Applying for a Schengen Visa

Extract from “Regulation (EC) No 810/2009 of the European Parliament and of the Council of 13 July 2009”, which entered into force on April 5, 2010:

“… Applicants for a uniform visa for one or two entries shall prove that they own adequate and valid travel medical insurance to cover any expenses which might arise in connection with repatriation for medical reasons, urgent medical attention, and/or emergency hospital treatment or death, during their stay(s) on the territory of the Member States. The insurance shall be valid throughout the Schengen Area Member States territory and cover the entire period of the person’s intended stay or transit. The minimum coverage shall be EUR 30,000” (…)

Which Nationals Are Required to Purchase Medical Insurance for a Schengen Visa?

Selecting & buying the right schengen visa insurance plan.

Ensure that the insurance company and policy you select are licensed and approved by Schengen Embassies and Consulates. Additionally, confirm that it meets all the specified requirements. Failure to do so could result in the denial of your visa application.

Get Free Quotes for Schengen Travel Insurance Plans from the Most Reputable European Providers

Europ Assistance Schengen

- Assistance in the event of illness or injury: Up to € 30,000

- No deductible

- Coverage area: Covers trips in the Schengen area

- Cost: starting from €3 per day

- Coverage: medical expenses abroad up to EUR 30,000

- Cost: Starting from EUR 4.5 per day, for a 7-day trip

- Deductible: from EUR 30 to EUR 50

Mutuaide Basic

- Coverage: Medical expenses abroad up to EUR 3 0,000

- Coverage Area: Worldwide

- Cost: Starting from EUR 3.00 per day for a 10-day trip

- Deductible: €0

- Validity: 1 Trip

- Sports (search and rescue costs)

Allianz Serenity

- Coverage for medical expenses up to EUR 30,000

- Cost: Starting from EUR 7 per day, for a 7-day trip

- Deductible: from EUR 30 to EUR 100

- Luggage insurance

Europ Assistance Schengen Plus

- Assistance in the event of illness or injury: Up to €60,000

- Coverage area: Covers trips in the Schengen area plus Bulgaria, Cyprus, Ireland and Romania

- Cost: starting from €5 per day

- Return/relocation and lodging expenses of a companion

Compare Schengen insurance to find the best and most affordable Schengen travel insurance plan!

Does the medical insurance policy need to cover all schengen area countries.

Yes, a Schengen travel health insurance policy should cover all Schengen member states:

- Czech Republic

- Liechtenstein

- Netherlands

- Switzerland

How Much Does Schengen Insurance Cost?

Schengen travel insurance can be very affordable, with prices for a one-week policy as low as €10. However, the cost of Schengen medical insurance ultimately depends on several factors—your age, how much coverage you want, the trip duration, and the specific insurance company.

What Does Schengen Insurance Policy Usually Cover?

A good travel insurance policy for the EU/Schengen area should cover the following costs:

- Medical emergency (accident or sickness) while in the Schengen Area

- Emergency evacuation

- Repatriation of remains

- Return of a minor

- Accidental death, injury or disablement benefit

- Overseas funeral expenses

- Dental emergencies

- Usually, the insurers cover pregnancy-related expenses, if the travel occurs during the first trimester. After that, insurance coverage varies from insurer to insurer.

What Are the COVID-19 Coverage Requirements for Schengen Insurance?

What is presumably excluded or optional in a common european travel insurance policy.

Every travel insurance company is different; however, there are ones that offer to cover additional costs if necessary. If not, additional insurance must be purchased to cover explicit costs like:

- Preexisting conditions (e.g. Asthma, diabetes)

- Sports with an element of risk (e.g. skiing, scuba diving)

- Travel to high-risk countries (e.g. Due to war, natural disasters or acts of terrorism)

- Acute onset of pre-existing conditions – It means a sudden and unexpected occurrence of pre-existing medical conditions without any prior warning from a health care professional. If you have pre-existing conditions, get this coverage to protect you against any emergency that arises due to pre-existing conditions despite taking care.

How To Find Cheap Travel Insurance for the Schengen Area?

Finding the right cheap travel visa insurance for Europe calls for individual and more in-depth research. This means having to search online for the appropriate medical insurance policy. It is recommended that you compare products and companies before you decide which company has the cheapest and the best travel insurance for Europe.

Do not be confused about the price, as not all low-cost travel insurance policies contain low-quality services, and not all expensive insurance plans offer high-quality service. That is why the safest way to choose amongst boundless offers of medical insurance companies properly is by choosing not the cheapest travel insurance but the policy which covers all the areas as required by the Schengen visa application requirements.

What Is Travel Medical Insurance?

Travel health insurance covers medical expenses in case of an injury or unexpected sickness that arises during your trip. Whether you need health insurance when travelling to a foreign country depends on the desired destination and your ability to cover any health care needs during your stay.

However, travel insurance is a must for most people, especially the elderly, who have predetermined medical conditions and are bound to constant therapy or, most importantly, if the traveller’s destination is an underdeveloped region.

Besides medical expenses, travel insurance will cover different losses suffered during the trip, including one’s own country and internationally. Unexpected happenings like lost luggage, cancellation of your flight at the last moment, travel agency or accommodation bankruptcy will ruin your trip. Therefore, a travel insurance policy is designed to provide cancellation insurance by means of a full or partial refund.

Whether you are travelling once or several times during a short period of time, the insurance policy will match and cover the exact number of days spent in the international territory, in this case, the Schengen territory, with the price ranging accordingly.

What Are the Common Restrictions and Limitations?

- As previously mentioned, travel insurance companies don’t cover preexisting conditions internationally. If you have a condition before your departure to Europe, you’ve consulted a doctor and are already on treatment, and you’ve decided to travel out of the country, in this case, you are not prone to any medical cost alleviations via your insurer. However, if one is proclaimed fit to travel having the condition under control, most commonly, travel insurance is ought to cover an unexpected emergency related to the condition when travelling in an international domain, an acute onset of the preexisting condition.

- Sports – Participation in high-risk activities such as extreme sports, e.g., scuba diving, skydiving, etc., can be excluded.

- War – Policies may exclude coverage for injuries caused by war when travelling to an endangered war zone.

- Duration – Many policies specify a time limit for coverage (e.g., 60 days), and the costs differ accordingly.

- Suicide in an international or domestic domain is excluded from any insurance policy for self-inflicted injuries.

- In the case of any substance abuse, drugs or alcohol, domestic or international, the medical expenses won’t be covered by your insurance policy.

More Travel Insurance Guides

France Visa Insurance , Spain Visa Insurance , Germany Visa Insurance , Italy Visa Insurance , Switzerland Visa Insurance , Travel Insurance by Europ Assistance , Schengen Travel Insurance UK , Greece Visa Insurance , Portugal Visa Insurance , Netherlands Visa Insurance , Schengen visa insurance from Singapore

Is Travel Health Insurance Mandatory for Visa-Free Third-Country Nationals Entering the Schengen Area?

Travel medical insurance is not mandatory for visa-free third-country nationals. Nonetheless, getting one is highly recommended if you travel to the Schengen countries.

Can I Obtain a Schengen Visa Without Travel Insurance?

Every person applying for a Schengen visa to visit Europe must hold a valid Schengen travel insurance policy regardless of the reason for travel (tourism, leisure, business, studies or other).

Does a Family Member of an EU/EEA National Need Travel Insurance?

Under certain conditions specified in Directive 2004/38/EC of the European Parliament, immediate family members of EU/EEA nationals might not require travel insurance when applying for a Schengen visa. These conditions generally include:

- Accompanying or Joining: The family member must either accompany the EU/EEA national on the trip or be planning to join them in the Schengen Area.

- Financial Dependency: The family member might need to be financially dependent on the EU/EEA national.

- Specific Relationships: Exemptions typically apply to immediate family members such as spouses, registered partners, children under 21 (or older if dependent), or dependent parents.

Should We Choose Travel Insurance With a 0 Eur Deductible?

It is not a strict requirement to get a Schengen travel visa insurance with 0 EUR deductible; however, we strongly suggest that you get one without a deductible to be 100% sure that your Schengen visa application will not be rejected because of the travel insurance policy.

Are Diplomatic Passport Holders Exempt From the Requirement of Travel Insurance?

Yes, holders of diplomatic passports are exempt from the mandatory travel medical insurance requirement. They are not required to provide proof of insurance when travelling to the Schengen Area.

Is Travel Medical Insurance Mandatory for Seafarers Traveling to the Schengen Area?

No, travel medical insurance is not mandatory for seafarers travelling to the Schengen Area. Seafarers are exempt from the requirement of Schengen travel insurance based on their professional situation. Their existing medical insurance coverage, obtained due to their work activities, is considered adequate and fulfils the insurance requirement for their stay in the Schengen Area.

What if I’m Applying for a Schengen Multiple-Entry Visa?

According to Regulation (EU) 2019/1155 of the European Parliament and of the Council of 20 June 2019 amending Regulation (EC) No 810/2009 , if you are applying for a Schengen multiple-entry visa, you must demonstrate that you have sufficient and valid travel medical insurance that covers the duration of your initial planned visit.

However, it’s important to note that you should maintain valid insurance whenever you plan to travel to the Schengen area in the future.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Dog Insurance

- Senior Dog Insurance

- Exotic Pet Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- Cat vaccinations cost

- Dog vaccinations cost

- Dog dental cleaning cost

- Dog cataract surgery cost

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- Chase Ultimate Rewards Guide

- Capital One Rewards Guide

- Amex Membership Rewards Guide

- All Credit Card Guides

- Raisin (SaveBetter) Interest Rates

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- How much will $1,000 earn in a HYSA?

- How much will $10,000 make in a HYSA?

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Is Savings Account Interest Taxable?

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- How much will $10,000 make in a MMA?

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- How much will a $10,000 CD earn?

- How much will a $50,000 CD earn?

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- How To Get A Loan

- Loan Interest Calculator

- How To Prequalify for a Personal Loan

- What is a Payday Loan?

- How To Get a Loan With No Credit History

- Financial Hardship Loans

- Low-Income Personal Loans

- No Credit Check Loans

- Why Can't I Get a Loan?

- Cash Advance Apps

- All Insurance Guides

On This Page

- Key takeaways

Our top picks for Schengen travel insurance

What is schengen travel insurance, schengen visa travel insurance requirements, what does schengen travel insurance cover, how much does schengen travel insurance cost, schengen visa requirements, tips for buying schengen travel insurance, schengen travel information & requirements, faqs - schengen travel insurance, related topics.

Schengen Travel Insurance: Coverage for your Schengen Visa Application

- A Schengen travel visa is required for U.S. Citizens if they plan to stay in the Schengen Zone for more than 90 days .

- The Schengen visa application requirements include having travel insurance that covers a minimum of €30,000 in medical expenses and covers the cost of repatriating you to the United States in the event of a medical emergency.

- As of 31 March 2024, Romania and Bulgaria have joined the Schengen zone.

- In most cases, private U.S. health insurance or Medicare won’t cover medical expenses incurred overseas, so even if you don’t opt for a Schengen visa, it’s still a good idea to purchase travel insurance when visiting Europe’s Schengen area.

- Travel insurance for Schengen visits can cost around $1 per day for basic coverage.

- To find the right travel insurance for your trip to the Schengen Zone, we recommend using our online comparison tool . This will give you a clear overview of what’s available so you can easily compare your options.

Our top picks for the best schengen travel insurance

- Tin Leg: Best Overall Coverage

- Generali Global Assistance: Best Coverage on a Budget

- Travel Insured International: Best for Non-Medical Evacuation Coverage

- AXA Assistance USA: Best Premium Comprehensive Coverage

Best Overall Coverage

Why We Like It

Editor's take

Tin Leg is known for offering high-quality travel insurance coverage at a competitive, reasonable price.

All Tin Leg policies have an A- rating or better for their financial strength from AM Best. We like the Tin Leg Gold plan because it offers great medical and evacuation coverage limits at an affordable price.

This plan comes automatically with trip cancellation and interruption coverage for coronavirus and other covered instances, as well as up to $500,000 in emergency medical expense protection and up to $500,000 in coverage for emergency medical evacuation, just in case something were to happen while on your Italy trip.

You may also qualify for travel delay protection, baggage insurance, and insurance that protects against missed connections on your way to the Schengen area.

Read our full review

- Excellent primary coverage for medical expenses

- High limit for emergency evacuation coverage

- Optional cancel for any reason (CFAR) coverage available

- Comes with coverage for hurricanes and inclement weather

- Coverage for pre-existing conditions is available if purchased within 14 days of the trip deposit

- Baggage delay coverage requires a 24-hour waiting period

- Low coverage limits for baggage and personal effects

Best Coverage on a Budget

Generali global assistance.

Generali Global Assistance offers high coverage limits for medical expenses, emergency dental expenses, emergency medical evacuation coverage, and more for your trip to the Schengen zone.

This travel insurance provider has an A rating from AM Best and offers three tiers of travel insurance coverage to suit your needs:

- Standard plan

- Preferred plan

- Premium plan

If you’re looking for basic coverage at an affordable price point, the Standard plan may be just what you need. This plan offers coverage for up to 100% of the insured trip cost for cancellation and up to 125% of the insured trip cost for interruption. It also offers $1,000 per person in baggage coverage, up to $50,000 in medical coverage, and $250,000 in medical evacuation coverage.

- Lowest cost of all Generali Global Assistance plans

- 24/7 emergency travel assistance included

- Telemedicine included

- Lower coverage than other Generali plans

- Pre-existing conditions are not covered by the Standard plan

- No coverage for accidental death and dismemberment during on-land travel

Best for Non-Medical Evacuation Coverage

Travel insured international.

Travel Insured International offers two plans, Worldwide Trip Protector Edge and Worldwide Trip Protector. Of these two, we recommend the Worldwide Trip Protector plan for your trip to the Schengen area due to its superior coverage.

Worldwide Trip Protector covers 100% of the insured trip cost due to cancellation, 150% of the insured trip cost due to interruption, and $1,500 for trip delays and $500 for baggage delays after only 3 hours. It also includes $100,000 of secondary medical coverage and $1 million of evacuation coverage. it also offers $150,000 worth of non-medical evacuation coverage, providing transportation during a natural disaster or civil or political unrest.

- Travel delay coverage kicks in after just six hours

- Generous $150,000 non-medical evacuation coverage

- CFAR and IFAR coverage not included

- Baggage delay coverage only kicks in after 12 hours

- No rental car coverage

Best Premium Comprehensive Coverage

Axa assistance usa.

AXA Assistance USA is a highly-rated travel insurance company that offers comprehensive travel insurance plans with a ton of benefits for your trip to the Schengen area. This means the coverage you purchase from them includes medical evacuation protection as well as baggage insurance, trip cancellation insurance, trip interruption coverage, travel delay coverage, and more. The company also offers three tiers of coverage you can choose from based on your needs and your budget.

We recommend the Platinum plan from AXA Assistance USA due to its superior medical evacuation coverage and robust limits in other categories. This plan comes with up to $1 million in protection for emergency medical evacuation and repatriation of remains, up to $250,000 in coverage for emergency medical expenses, $300 per day (maximum of $1,250) in trip delay coverage, $3,000 in insurance for baggage and personal effects, and more. Optional cancel for any reason (CFAR) coverage is also available as an add-on with this plan.

- High coverage limits in every category. Extremely comprehensive

- Includes identity theft coverage & non-medical evacuation coverage

- CFAR coverage reimburses 75% of prepaid travel expenses

- Coverage cannot be extended unlike other plans

- Medical limit is lower than other cheaper plans, but still sufficient

Schengen travel insurance is simply a travel insurance plan that offers coverage while you’re traveling in Europe’s Schengen area, which now excludes the UK . This type of insurance is required for certain Schengen travel visas.

Typically, travel insurance plans offer coverage for certain destinations or areas of travel, and can sometimes exclude other destinations as part of the plan. Therefore, Schengen travel insurance refers to plans that offer coverage for travels within the Schengen area.

When do I need Schengen travel insurance?

It’s a good idea to have travel insurance any time you travel to this region, whether it be places such as France , Spain or Germany since most traditional health plans won’t work abroad, but you definitely need health insurance for a Schengen visa as noted by travel.state.gov ) if you plan to apply for a longer stay.

Having valid Schengen travel insurance is a basic requirement for applying for a Schengen visa. In other words, you cannot get a visa for the Schengen area unless you buy travel insurance for the length of your stay.

That said, we recommend buying travel insurance any time you travel to this region, regardless of if you plan to apply for a Schengen visa.

Travel medical insurance for a Schengen visa has the following requirements :

- It must be valid in all Schengen Zone countries and remain in effect until the end of your trip.

- It must cover at least €30,000 in medical expenses.

- Your insurance policy must cover repatriation due to medical emergencies. Repatriation is the technical term for returning to your own country.

Every insurance policy is a little different, but travel insurance usually covers these expenses:

Medical expenses: If you want a Schengen visa, your policy must include medical insurance . This type of insurance covers expenses arising from certain illnesses and injuries. Read your policy carefully, as Schengen travel health insurance typically excludes pre-existing conditions. Regardless of whether you require a Schengen visa or not, having medical insurance is a must for anyone traveling outside of the US . Medical insurance is generally broken down into two categories; emergency medical coverage, and emergency medical evacuation coverage.

Schengen medical insurance covers you for things such as hospitalization, emergency room treatment, X-rays, emergency dental care, and more. Emergency medical evacuation coverage will cover you for any transportation you require to receive medical care. This can include an ambulance to the nearest hospital or a pricey evacuation via a helicopter or plane.

- Lost/damaged luggage: Many Schengen visa travel insurance plans cover lost and damaged luggage. Your policy may even reimburse you for the cost of purchasing essential items while you wait for your delayed bag to arrive.

- Cancellations: Comprehensive travel insurance usually covers trip cancellations, giving you extra peace of mind in the event you have to cancel your plans due to severe weather, illness, serious medical problems, natural disasters or legal obligations. According to the Department of Financial Services , Schengen visa insurance won’t cover cancellations due to COVID-19 in most cases unless you have COVID-19 travel insurance . This is because it’s no longer an unforeseen complication.

- Delays: Some types of travel insurance cover losses arising from trip delays. This coverage kicks in if you experience a delay while traveling via one of these common carriers: airline, passenger railroad, ferry or long-distance bus service. Your policy may cover meals, hotel accommodations, toiletries and other related expenses.

What doesn’t Schengen travel insurance cover?

Travel insurance coverage depends heavily on the plan you choose. The more comprehensive your plan, the more things you will have covered.

That said, there are some common things not covered under travel insurance that extend to Schengen visa travel insurance.

Schengen visa travel insurance may not cover:

- Some scenarios relating to pregnancy – such as childbirth ( see pregnancy travel insurance )

- Some pre-existing conditions – depending on the plan and waiver criteria

- Some COVID-19 scenarios – such as self-imposed quarantine

- Anything mentioned in the “Exclusions” section of your specific plan – always read the fine print.

It’s important to review all the specific inclusions and exclusions of the plan you choose as there can be loopholes and exceptions to each of these scenarios.

For example, pre-existing conditions , which are health problems that existed before you purchased your policy, typically aren’t covered. However, there is often a limit to how far back this applies and certain criteria for waiving the exclusion.

Schengen travel insurance can cost as low as around $1 per day for the most basic coverage.

For more comprehensive travel insurance, you can expect to pay around $4 per day.

That said, the exact cost of travel insurance depends on several factors, including:

- The duration of your trip

- The cost of your trip

- The coverage limits you select

- The destination of your trip

For example, medical insurance usually costs less for younger people than it does for older people, so a 65-year-old can expect to pay more than a 23-year-old.

Let’s walk through a real-world example comparing coverage types. We got travel insurance quotes for the following trip information:

- Age: 35 years old

- Destination: Schengen area

- Trip Length: 14 days

- Trip cost: $3,000

- Date: September, 2024

The requirements for Schengen visa travel insurance are quite simple, so you can get a relatively inexpensive plan . In this first table, we got price quotes for basic Schengen travel insurance.

Example Where Plan Doesn’t Reimburse the Full Trip Cost

While you are at it, you may want to opt for more comprehensive benefits. For the example below, we chose plans that will reimburse the full cost of your trip.

Example Where Plan Does Reimburse the Full Trip Cost

When you purchase travel insurance, it’s up to you whether you want to stick with the required minimums or give yourself a little extra peace of mind. That can have a big impact on the cost of your policy. For example, it costs a lot more to purchase €100,000 in medical insurance than it does to purchase the minimum €30,000 in medical insurance.

Where can I purchase Schengen travel insurance?

Where you ultimately purchase Schengen visa travel insurance is up to you.

If you are going as part of a larger tour or study program, you may be able to purchase Schengen visa travel insurance through your tour operator. That said, you may be able to find a better deal buying Schengen travel insurance online. Most major travel insurance providers offer plans that match the Schengen visa requirements.

You can also have a look at an online comparison tool . To see Schengen visa travel insurance plans you can enter your trip details in the tool below. Once you reach the quote pages, there is a filter to select “Schengen Visa” under the preset filter options. This will highlight all the plans that match the Schengen visa requirements from multiple travel insurance companies at once.

Before you travel, you may need to obtain a Schengen visa. Here’s what you need to know about the visa requirements.

Who needs a Schengen visa?

Any American citizen who intends to stay in the Schengen Area for more than 90 days must obtain a visa before traveling. This includes both business travelers and leisure travelers.

How does a Schengen visa work?

A Type D Schengen visa, also known as a national long-stay visa, allows you to stay in the Schengen Area for more than 90 days in a 180-day period. It also allows you to travel from one Schengen country to another Schengen country.

If you need to travel to the Schengen Area several times, you may be able to obtain a 3-year, multiple-entry Schengen visa or a 5-year, multiple-entry Schengen visa.

It’s important to note that if you plan to get a Schengen visa, you must have valid Schengen travel insurance for the entirety of your stay within the Schengen area. Multi-trip insurance insurance can be especially beneficial in such cases.

Schengen visa requirements for children

Age criteria for Schengen Visa:

- Children aged 6 and over will often require their own Schengen Visa. This specific age can vary from country to country, so it is important to check the specific age requirements of the Schengen country you plan to visit.

Application Process:

- Minors need to pass through the same Visa application process as adults. This process generally contains the following stages:

- Applicants must complete a Schengen visa application form.

- You must gather the appropriate supporting documents (see below).

- Schedule an appointment with the respective embassy or consulate.

- Pay the Visa fee.

Required Documentation:

- A child’s Schengen Visa application requires the following documents:

- A valid passport with at least two blank pages.

- A completed Schengen Visa application form. Parents or legal guardians must ensure they sign this form for young children.

- A recent passport-sized photo.

Parental Consent:

- When a minor is traveling without one or both parents, it is important to provide a notarized letter of consent from the absent parent(s) or legal guardian(s). This letter contains information such as the child’s name, the names of the traveling and non-traveling parents or guardians, the travel dates, and a brief explanation of the trip’s purpose.

How do I apply for a Schengen visa?

To apply for a Schengen visa, follow these steps:

Type of Schengen visa.

Determine what type of Schengen visa you need.

Submit your Schengen visa application.

If you plan to visit one country, submit it to the consulate or embassy for the country you’ll be visiting. If you plan to visit multiple Schengen countries, submit it to the consulate or embassy for the first country on your itinerary.

Purchase travel insurance.

Make sure your policy meets the minimum requirements.

Submit documents.

Submit your passport, proof of financial insurance and proof that you’ve met all Schengen visa requirements to the embassy.

Travel insurance is a worthwhile expense, but not all plans offer the same level of protection, so it’s important to shop around.

Follow these tips to find a policy that meets your needs.

Decide what type of travel insurance you’d like

Remember, your U.S. health insurance won’t cover medical expenses incurred overseas, so you’ll need to purchase a Schengen insurance plan that includes medical coverage.

You should also consider the following types of travel insurance.

- Medevac: Medical evacuation insurance , commonly called medevac coverage, covers the cost of transporting you to a medical facility if you get into an accident or develop a serious illness while you’re traveling.

- Rental car insurance: If you decide to rent a car while traveling in the Schengen, rental car insurance covers you in the event of an accident. Many policies also cover theft and vandalism.

- Cancel-for-any-reason insurance: CFAR insurance allows you to recoup some of your expenses if you have to cancel a trip for a reason that’s not covered by your standard insurance policy. For example, if you encounter financial difficulties, you may have to cancel your trip to save money.

Compare plans

Several companies offer insurance plans designed to meet the minimum requirements for a Schengen visa. Before you purchase coverage, use the LA Times comparison tool to find the best plan for the best price.

Check the limitations of your policy

Most insurance policies have limitations. Before you apply for a Schengen visa, review your policy to make sure it meets the minimum requirements. During your review, make sure you have coverage for common travel scenarios.

See if your credit card already provides trip insurance

Some travel credit cards offer rental car insurance, trip interruption insurance and other types of insurance coverage. Before you travel, check your credit card terms to find out if you have any of these benefits available to you. If you have certain types of coverage through your credit card company, you won’t have to purchase them.

Tips for visiting the Schengen area

Where is the schengen area.

Named after a small village in Luxembourg, the Schengen Area is the largest free travel area in the world, according to the European Council . As of 2024, there are 27 Schengen countries, most of which belong to the European Union. Switzerland, Norway, Iceland and Liechtenstein are in the Schengen Area, but they aren’t in the EU. As part of the Schengen Borders Code, these countries don’t perform border checks unless there’s a specific threat.

Do I need a passport to visit the Schengen?

Yes. All U.S. citizens must obtain a passport before traveling to the Schengen Area. You’re allowed to enter the Schengen countries as long as your passport doesn’t expire until at least 90 days following your planned departure date. For example, if you plan to leave the Schengen countries on September 1, your passport should be valid until at least December 1. However, if you’re looking for places to travel without a passport , you might consider exploring countries and destinations that don’t require

Do I need to be vaccinated to enter the Schengen?

You don’t have to get vaccinated before traveling to the Schengen countries. However, scientists at the Centers for Disease Control and Prevention recommend getting routine vaccines before you travel outside the United States. For example, the CDC says you should have vaccinations for chickenpox, influenza, diphtheria-tetanus-pertussis, polio, shingles and measles-mumps-rubella before traveling to France.

This is some important travel information you should know before visiting the Schengen.

Schengen insurance protects you when you’re traveling in the Schengen Zone, a group of 27 European countries. If you have a covered loss, the insurance company reimburses you for certain expenses. If you need a visa for travel to the Schengen Zone, one of the requirements is having travel insurance that will cover you in this part of the world. This is often referred to as Schengen insurance or Schengen travel insurance

What type of insurance is required for a Schengen visa?

At minimum, your travel insurance must cover at least €30,000 in medical expenses. It must also cover your repatriation costs. If you purchase a comprehensive policy, it may also cover losses arising from trip delays, trip cancellations, lost baggage or damaged baggage.

Do I need travel insurance to visit the Schengen?

You’ll need travel insurance if you plan to stay in the Schengen Zone for more than 90 days. Although you don’t need a short-stay visa for trips lasting 1 to 90 days, you do need a visa for longer trips. See more at travel.state.gov .

Does Schengen insurance cover countries that are not part of the Schengen Area?

No. Your Schengen visa insurance only covers the 23 EU and four non-EU countries in the Schengen Zone.

Per travel.state.gov ,{:rel=’nofollow’ target=’_blank’} the following countries are members of the Schengen Zone: Austria, Belgium, Czech, Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden, Switzerland

About the Author

Leigh Morgan is a seasoned personal finance contributor with over 15 years of experience writing on a diverse range of professional legal and financial topics. She specializes in subjects like navigating the complexities of insurance, savings, zero-based budgeting and emergency fund development.

In the last five years, she’s authored over 300 articles for credit unions, digital banks, and financial professionals. Morgan is also the author of “77 Tips for Preventing Elder Financial Abuse,” a book focused on helping caregivers protect the elderly from financial scams.

In addition to her writing skills, she brings real-world financial acumen thanks to her previous experience managing rental properties as part of a $34 million real estate portfolio.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Travel Insurance for Seniors

Best Medical Evacuation Insurance Plans 2024

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Pregnancy Travel Insurance: Tips for Traveling while Pregnant

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions August 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Guide to Chase Sapphire Travel Insurance Benefits 2024

2024 Complete Guide to American Express Travel Insurance

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Plans for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans August 2024

Best Travel Insurance for Trips to the Bahamas

Europe Travel Insurance: Your Essential Coverage Guide

Trip Cancellation Insurance: Plans & Coverage Explained

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review August 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Best Travel Insurance for a Japan Vacation in 2024

Faye Travel Insurance Review August 2024

Travel Insurance for Brazil: Plans & Coverage 2024

Best Travel Insurance for Bali, Indonesia (2024)

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review August 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for August 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review August 2024

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

Medjet Travel Insurance Review 2024: What You Need To Know