The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

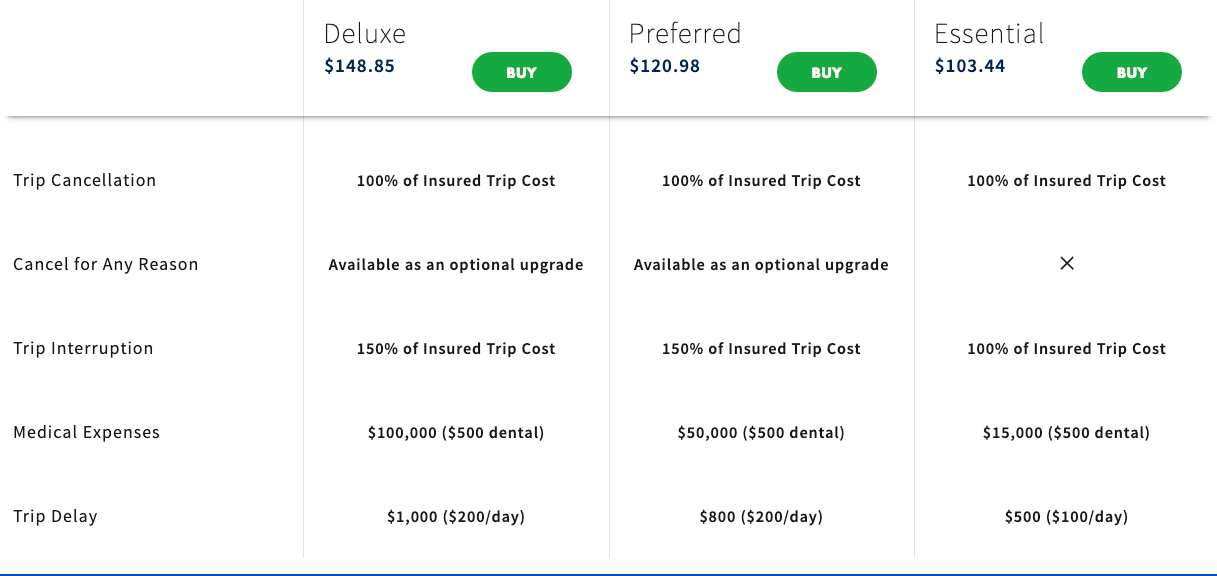

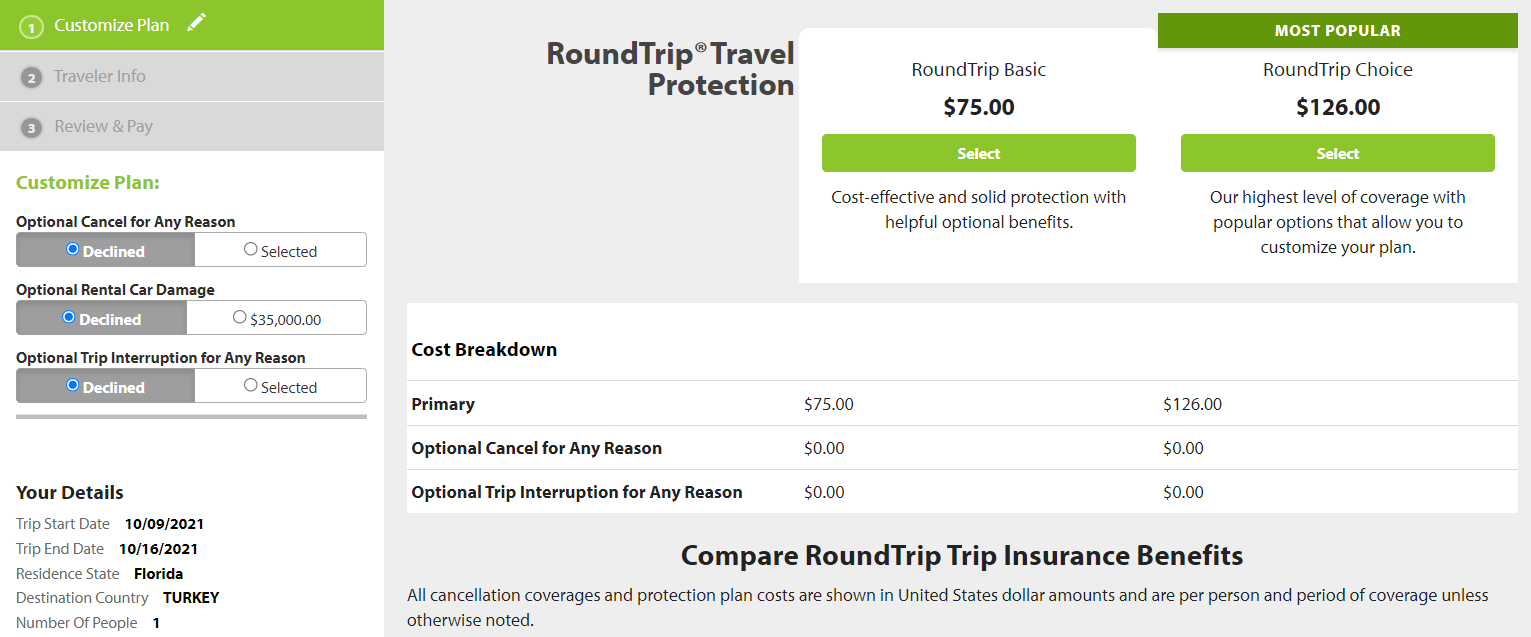

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

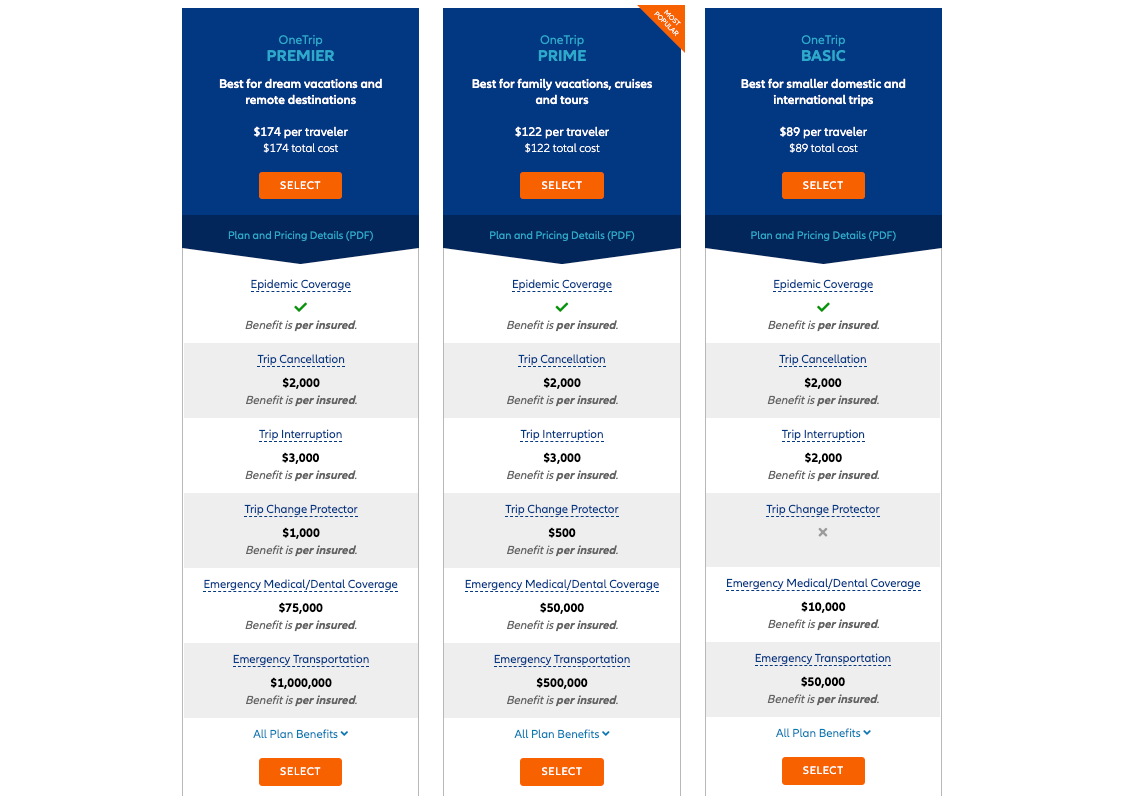

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

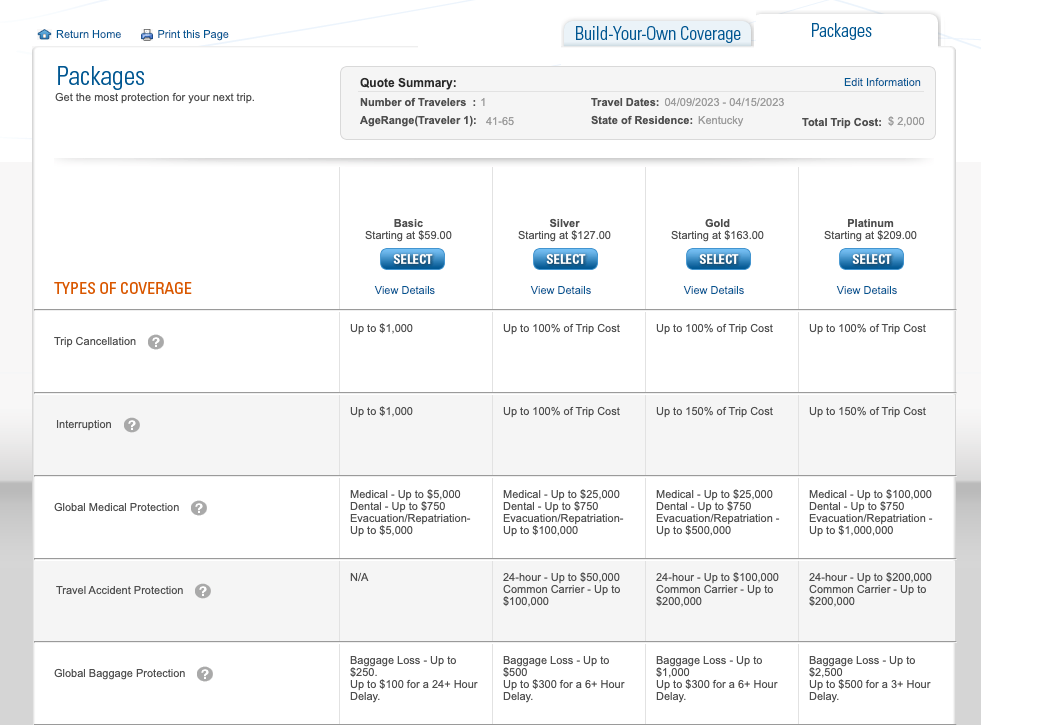

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

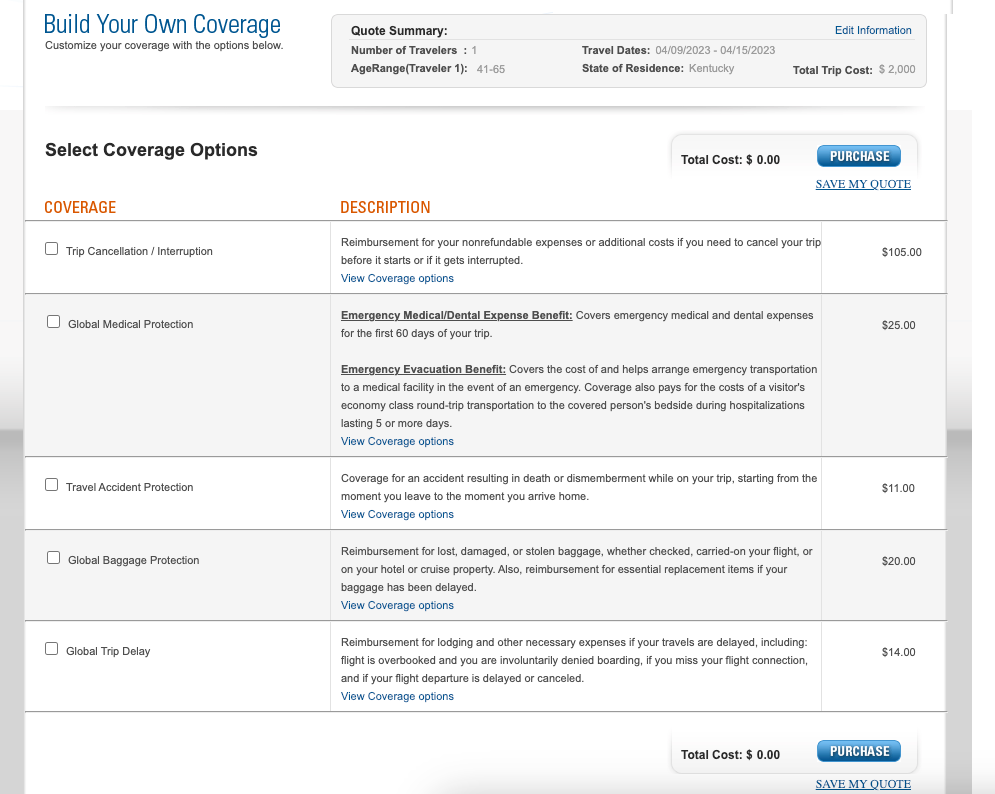

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

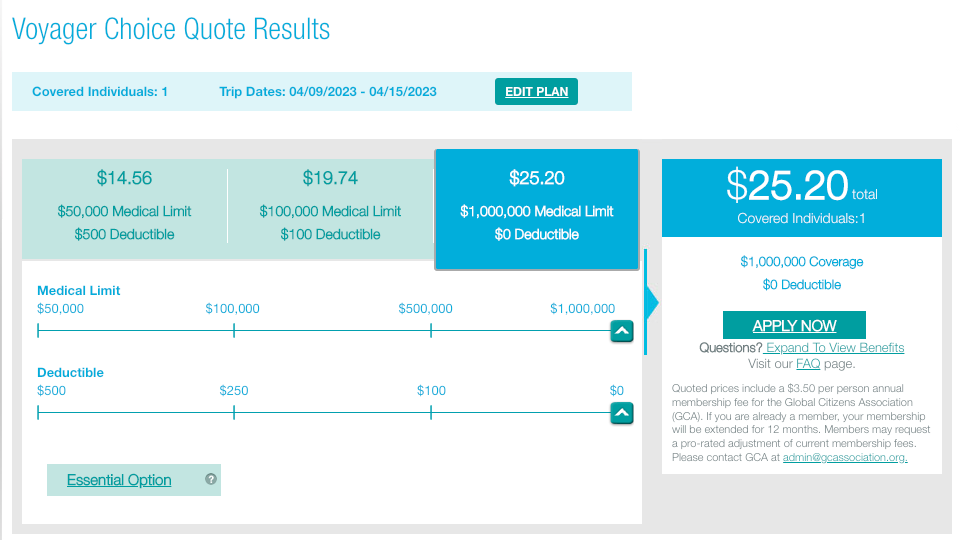

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

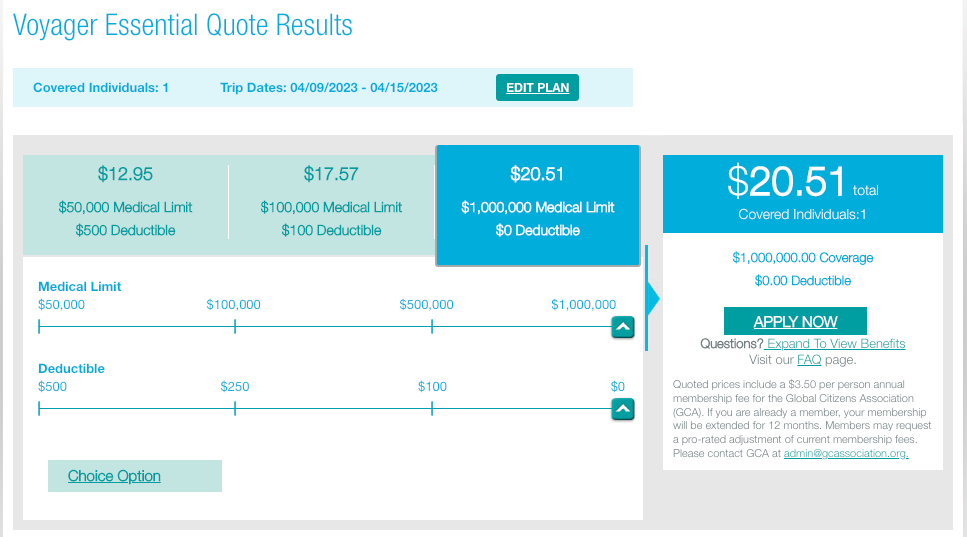

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

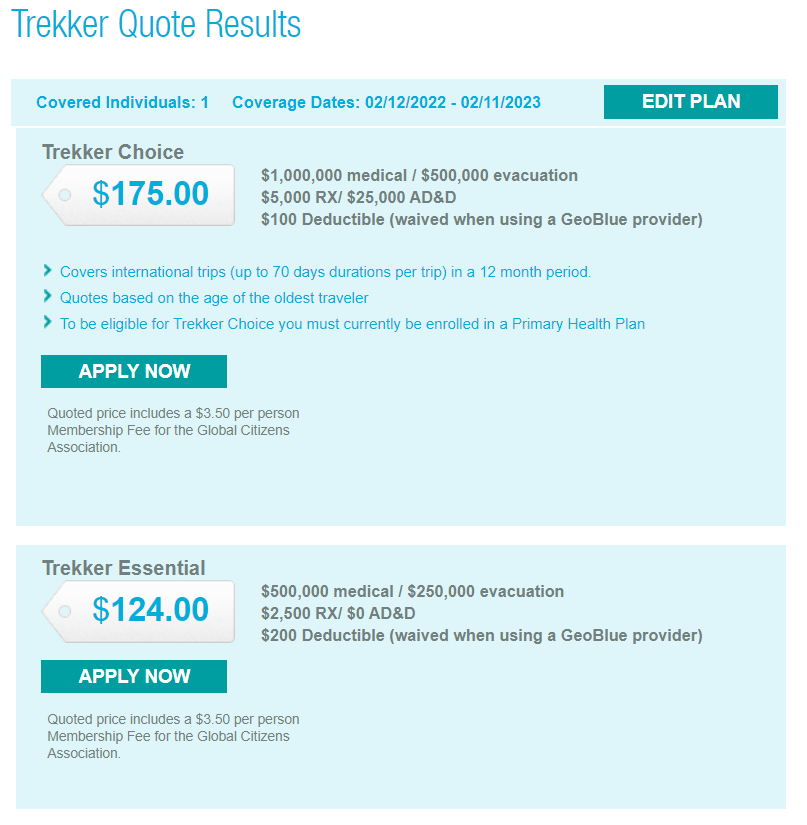

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

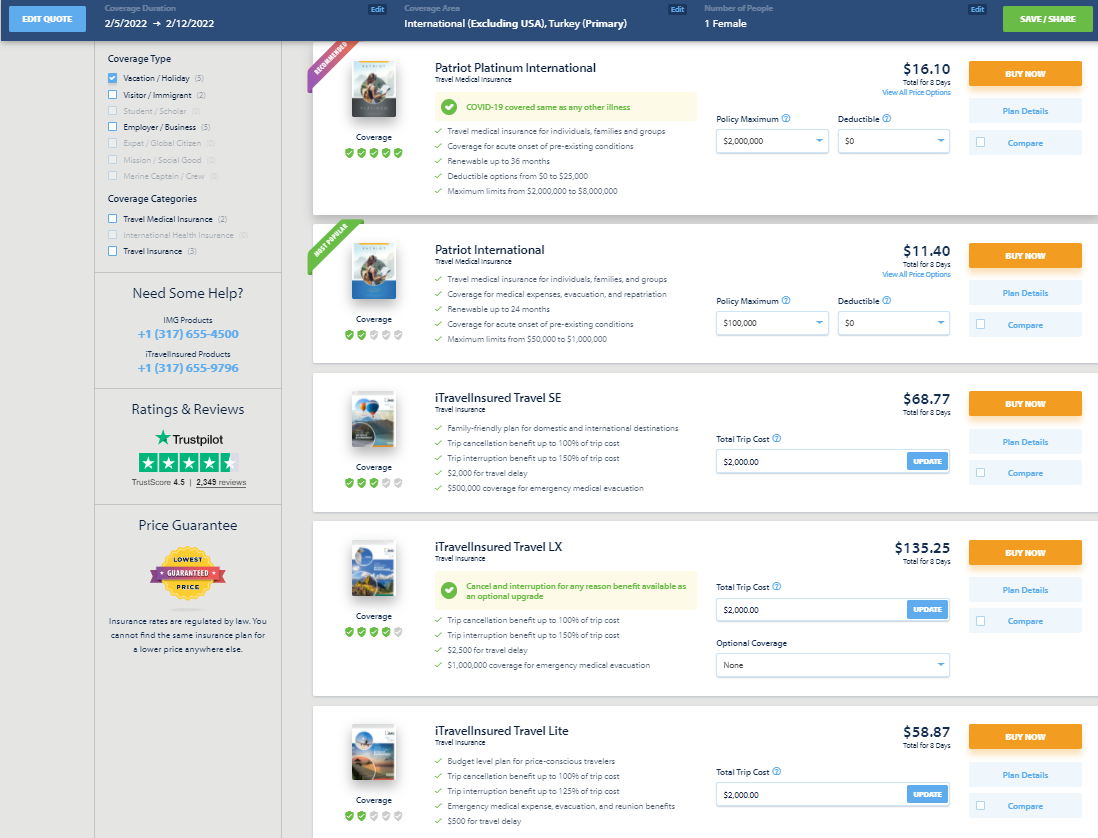

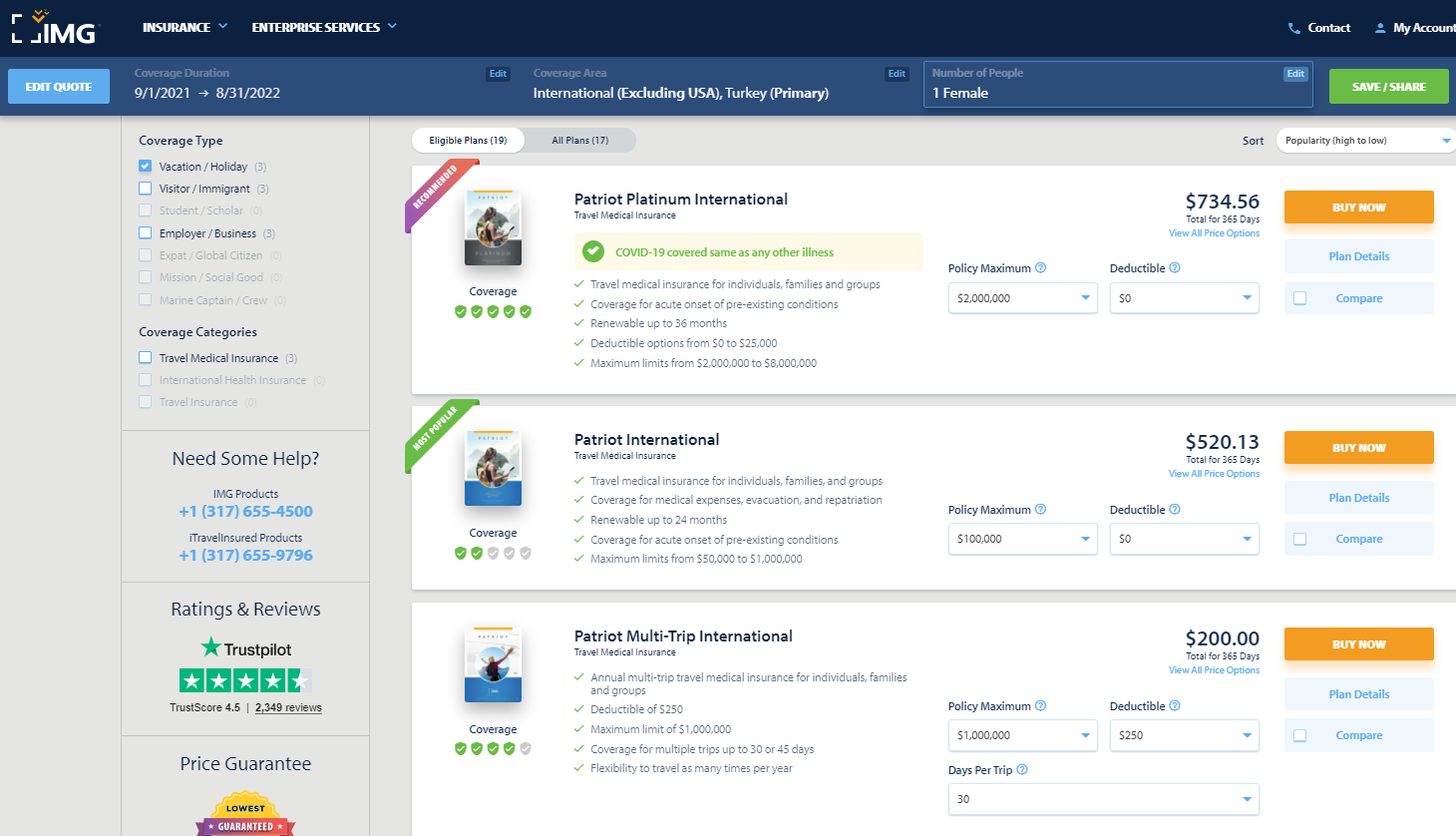

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

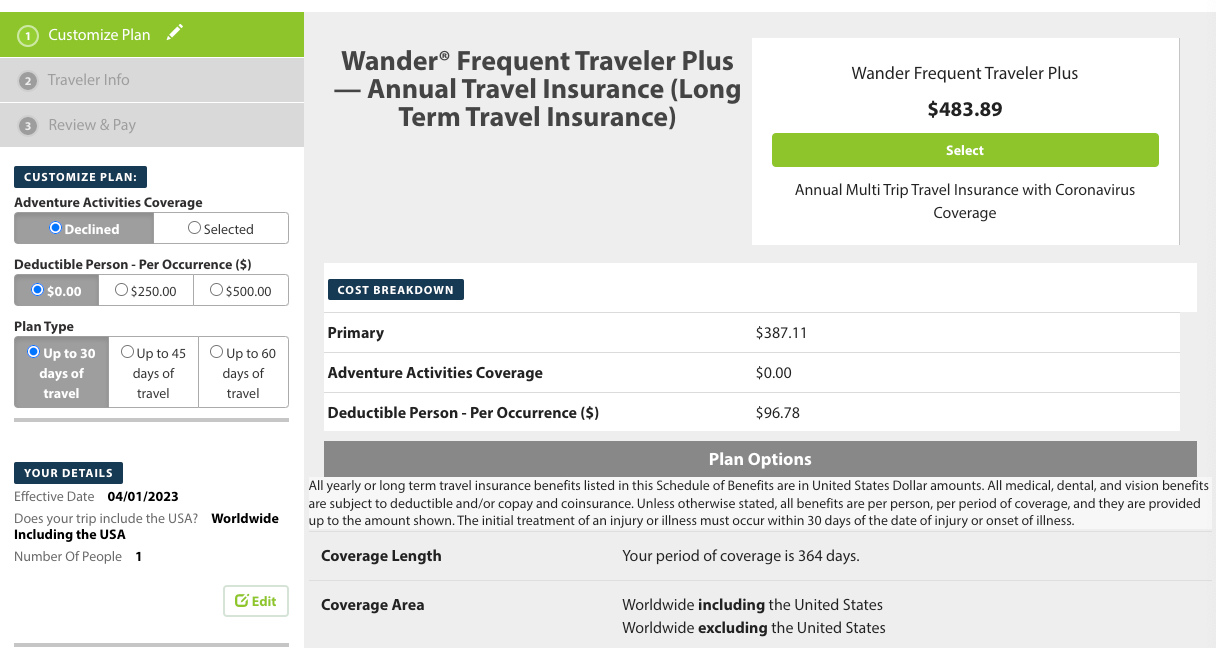

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

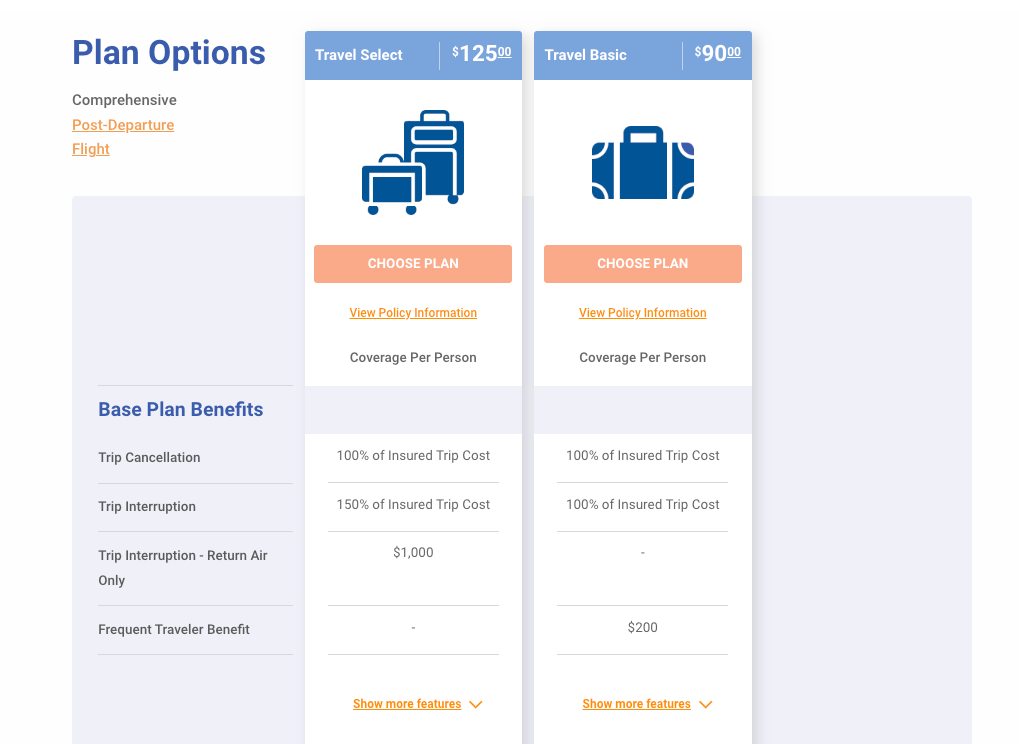

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

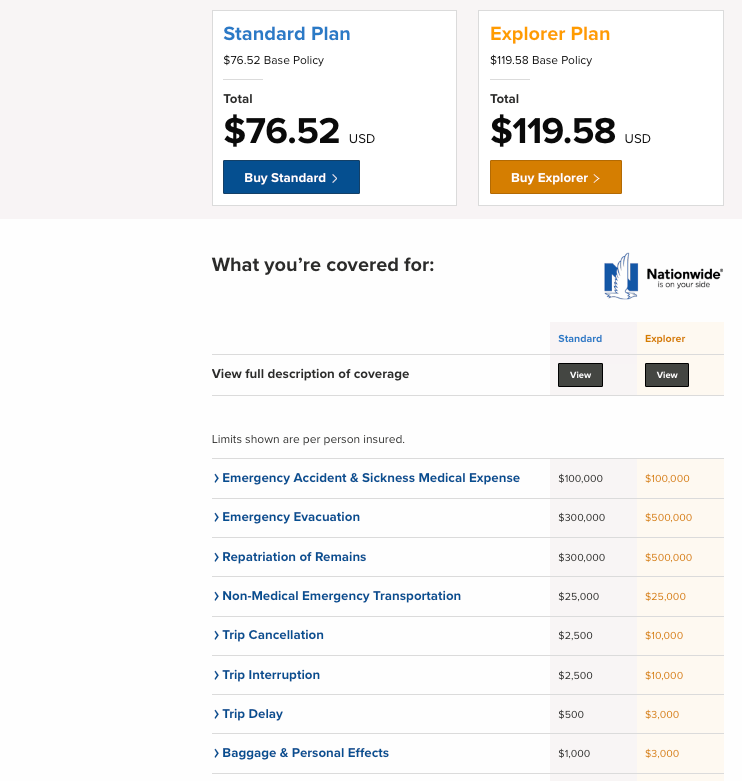

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

Debeka Krankenversicherung

Civil servant-based insurer which successfully branched out, what are the benefits of debeka krankenversicherung.

Debeka Krankenversicherung

Strong in the area of private health insurance for civil servants.

Debeka is one of Germany's largest private health insurers . Debeka can return all surpluses to its members as a mutual insurance association. Debeka Krankenversicherungsverein is part of the Debeka Group, which attaches great importance to its independence from other economic and financial organizations.

- Very strong insurer for civil servants

- Stable premiums

- Premium refunds in the event of no benefits

- One of the largest health insurers in Germany

Debeka Krankenversicherung regards economic, social and ecological sustainability as an essential principle of its corporate strategy. Debeka Krankenversicherung focuses on long-term insurance benefits and the consideration of ethical and social concerns - as in capital investment.

Comprehensive private health insurance Debeka aims to distinguish itself through stable premiums and high premium refunds in private health insurance. Debeka's strength lies in the area of private health insurance for civil servants and doctors.

Debeka's also offers various comprehensive health insurance plans for employees and self-employed outpatient treatment, inpatient treatment, dental treatment, dentures and orthodontics, and travel abroad. Employees and the self-employed can choose between six different health insurance plans.

Supplementary insurance Debeka Krankenversicherung offers various supplementary insurance policies, ranging from hospital tariffs to outpatient benefits, daily hospital and daily sickness benefits, supplementary dental tariffs and foreign travel insurance. Debeka also offers supplemental insurance for alternative practitioner treatments, glasses and contact lenses, preventive check-ups, and non-prescription medicines. A special offer from Debeka Krankenversicherung is a supplementary insurance tariff for people over 55 with statutory health insurance, which covers dental prostheses and visual aids, among other things.

Address and contact

Telephone head office: (02 61) 4 98 - 46 64 Customer telephone: (08 00) 8 88 00 82 20 For calls from abroad: +49 (0)2 61 4 98 - 99 01

Fax: (02 61) 4 98 - 55 55 Email: [email protected] Website: https://www.debeka.de/produkte/versichern/krankenversicherung/index.html Facebook: https://www.facebook.com/Debeka/

Balance sheet key figures 2022

Type of company: Versicherungsverein auf Gegenseitigkeit Insured persons (comprehensive and supplementary): 4.246.785 Gross premiums earned (in thousands of euros): 7.872.545 € Investments (in thousands of euros): 54.015.784 € Current interest: 3 % Acquisition costs: 4 % Administrative expenses: 1 %

How is ‘trip insurance’ different from ‘trip protection’? A Danvers couple found out the hard way.

Milda walkley and leo peters canceled their mediterranean trip well in advance, but viking cruises imposed a $3,800 cancellation penalty because they mistakenly filed with viking’s insurer, not viking directly..

Milda Walkley and Leo Peters, both in their mid 80s, got married last year and took a celebratory eight-day cruise on the Danube River .

“It was lovely,” said Milda, a retired nurse who was long divorced when she met Leo, a retired engineering executive and recent widower.

The couple was so pleased that they quickly booked another trip on Viking Cruises — 10 days on the Mediterranean — for this October.

They purchased travel insurance for both trips because, as Milda put it, “it seemed prudent for anyone in their golden years.”

Travel insurance may be prudent, but it is also expensive — about 10 percent of the trip cost for Milda and Leo’s Mediterranean trip. And it can be maddeningly confusing when making a claim, as the couple found out after a medical issue forced them to cancel.

Advertisement

Milda and Leo made their claim well in advance of the trip’s departure date to qualify them for a full cash refund. But Viking imposed a $3,800 cancellation penalty nevertheless because Milda mistakenly canceled with Viking’s insurer, not Viking, and that put the cancellation a few days past the full-refund date.

Really? A $3,800 hit for a good-faith bookkeeping mistake by a repeat customer in her 80s?

When he finally got a Viking manager on the phone to make his case for waiving the penalty, Leo got nowhere.

“The Viking manager was adamant there was nothing they could do,” Leo said. “It was: ‘tough luck.’ And then silence.”

Viking’s attitude changed after I got involved. And it wasn’t only Viking. Trip Mate, Viking’s insurer , told me it should have done more to help Milda and Leo.

The couple admittedly did not read the umpteen pages of fine print on their insurance policy and didn’t actually understand the full extent of its coverage. And apparently no one from Viking or Trip Mate offered a guiding hand, which wound up costing the couple a lot of unnecessary time and aggravation.

In the end, Milda and Leo got a full refund, which is exactly what Viking and Trip Mate owed them under the terms of their confusing insurance policy. Plus, Viking wound up giving the couple $500 in travel vouchers as a sort of makeup gift.

Here’s what happened:

Milda and Leo, who live in Danvers, paid $1,900 for what Viking calls its “Trip Protection Plan” on a trip that cost $19,000 (using round numbers). They basically checked a box requesting insurance when running down a list of trip options such as what kind of room they wanted, Milda said.

On its website, Viking touts its Trip Protection Plan as a “cancel for any reason” policy. It says the plan, while offered by Viking, is administered by Trip Mate and covers “unforeseeable circumstances that may arise before or during your trip.”

I suspect few travelers understand there’s actually two different components in Viking’s Trip Protection Plan (and other plans): trip protection and trip insurance. If you are considering travel insurance it behooves you to know how each works.

Trip protection protects the money you prepay for your trip (most travel companies require full upfront payment, not just a fractional deposit). It’s standard practice in the travel industry that when you cancel your trip close to the date of departure you forfeit some or all of your upfront payment in so-called cancellation penalties — the closer you are to the date, the more money you forfeit.

For Milda and Leo’s trip, Viking had established a sliding scale of cancellation penalties. It would impose no penalty on anyone canceling four months or more in advance of departure and a 100 percent penalty on anyone canceling less than 30 days of departure. In between those two extremes, Viking would impose a penalty ranging from 20 percent of the prepaid amount to 80 percent, depending on how close the cancellation came to the departure date.

But would-be travelers can insure against such cancellation penalties by purchasing Viking’s Trip Protection. Let’s say your cancellation date triggers a 20 percent cancellation penalty on a $19,000 trip, as in the example of Milda and Leo. That’s a $3,800 loss in cash. But anyone who purchased Viking’s Trip Protection would be covered for that loss — but in future travel credits with Viking (a.k.a., “travel vouchers,”) not cash. That means you can “cancel for any reason,” as Viking touts on its website, but you get travel credits to cover a cancellation penalty, which are a lot less valuable than cash.

Trip insurance, by contrast, typically covers losses you may incur while traveling, like emergency medical or dental expenses or lost, damaged, or stolen baggage or personal items.

The Trip Protection Plan offered by Viking bundles the two types of protection together for one price and makes Viking responsible for trip protection and Trip Mate for trip insurance. What’s confusing is that Trip Mate’s trip insurance also provides a measure of trip protection, though it differs from Viking’s in that it provides cash refunds, not vouchers, and restricts coverage to only certain “covered events,” such as illness or injury that prevents travel (backed by a doctor’s letter).

The bottom line is that Milda and Leo were eligible for a full cash refund, even without Viking giving them a break for misunderstanding how to cancel. Viking should have refunded 80 percent (based on the date of cancellation) and Trip Mate 20 percent (based on Milda’s medical issue being a covered event). But no one took the time to explain that to them and the fine print posted online is mostly difficult to understand legalese. The couple first learned of the extent of their coverage from me. And it wasn’t easy for me to figure it out.

It was May when Milda’s doctor told her to cancel because of a cardiac issue. Believing she had “cancel for any reason” insurance, Milda searched the Viking website for instructions on how to cancel, but did not find them. So, she went directly to Trip Mate, which she considered an interchangeable and equal partner with Viking on her insurance.

A Trip Mate customer service representative gave her instructions on filing a claim online, which Milda did, including uploading medical records.

But the Trip Mate representative missed an opportunity to spare Milda and Leo a big headache. The rep should have realized the couple on that date was entitled to a no-penalty refund from Viking based on early cancellation. The rep should have said: Don’t file a claim with us — file with Viking, and here’s how to do it.

But no such discussion took place. Instead, Milda awaited her refund, thinking she had properly filed her claim.

“I thought by canceling with Trip Mate I was canceling with Viking,” Milda told me.

But 18 days after filing with Trip Mate Milda received a letter from the insurer saying it had discovered Milda’s trip hadn’t actually been canceled with Viking, and that filing a claim with Trip Mate wasn’t the same as canceling with Viking.

A day after getting the letter, Milda contacted Viking. But it was now too late for a no-penalty refund, she was told. Between the time of her filing with Trip Mate and the time she contacted Viking the number of days before her trip departure date had dropped from 132 to 114, meaning she was past the no-penalty period by six days, a $3,800 goof.

At that point, Viking could have said “close enough” and given her a full refund, which is what Leo argued to the Viking manager. But it also could have — and should have — explained that she would wind up with a full cash refund anyway, because Trip Mate’s policy would kick in to cover Viking’s 20 percent cancellation penalty.

But no such discussion occurred. And Milda and Leo were left thinking they were losing thousands of dollars.

After I got involved, Viking imposed its $3,800 cancellation penalty, but Trip Mate agreed it would cover that amount, much to the relief of Milda and Leo.

If you are considering travel insurance, ask questions. Am I getting trip protection or trip insurance or both? What happens if I cancel my trip before departure? Do I get cash or travel credits? Does the reason I cancel matter? What’s my coverage while I’m on my trip? Who are the responsible parties? How do I cancel and how do I file a claim?

Lots of questions to ask. Make sure you know what you’re getting.

Got a problem? Send your consumer issue to [email protected] . Follow him @spmurphyboston .

Advertisement

Supported by

W.H.O. Declares Global Emergency Over New Mpox Outbreak

The epidemic is concentrated in the Democratic Republic of Congo, but the virus has now appeared in a dozen other African countries.

- Share full article

By Apoorva Mandavilli

The rapid spread of mpox, formerly called monkeypox, in African countries constitutes a global health emergency, the World Health Organization declared on Wednesday.

This is the second time in three years that the W.H.O. has designated an mpox epidemic as a global emergency. It previously did so in July 2022. That outbreak went on to affect nearly 100,000 people , primarily gay and bisexual men, in 116 countries, and killed about 200 people.

The threat this time is deadlier. Since the beginning of this year, the Democratic Republic of Congo alone has reported 15,600 mpox cases and 537 deaths. Those most at risk include women and children under 15.

“The detection and rapid spread of a new clade of mpox in eastern D.R.C., its detection in neighboring countries that had not previously reported mpox, and the potential for further spread within Africa and beyond is very worrying,” said Dr. Tedros Adhanom Ghebreyesus, the W.H.O.’s director general.

The outbreak has spread through 13 countries in Africa, including a few that had never reported mpox cases before. On Tuesday, the Africa Centers for Disease Control and Prevention declared a “public health emergency of continental security,” the first time the organization has taken that step since the African Union granted it the power to do so last year.

“It’s in the interests of the countries, of the continent and of the world to get our arms around this and stop transmission as soon as we can,” said Dr. Nicole Lurie, the executive director for preparedness and response at the Coalition for Epidemic Preparedness Innovations, a nonprofit that finances vaccine development.

Facing the threat of global spread, the Centers for Disease Control and Prevention has urged clinicians and the public in the United States to be alert for the virus.

The W.H.O.’s designation of a “public health emergency of international concern” is intended to prompt member countries to begin preparing for the virus’s appearance and to share vaccines, treatments and other key resources with poorer nations.

“We need concerted international action to stem this recent, novel outbreak,” said Gregg Gonsalves, an epidemiologist at Yale University who served on the W.H.O.’s mpox committee in 2022.

The outbreak that year stayed mostly within tight sexual networks, among gay and bisexual men. A combination of behavioral changes and vaccination tamped down the spread.

In the United States, for example, the toll dropped to about 1,700 cases last year from more than 30,000 in 2022.

The version of mpox that has been circulating in Congo has always been more virulent, and currently has a death rate of about 3 percent, compared with 0.2 percent in the 2022 outbreak. The infection can produce fever, respiratory symptoms, muscle aches and swollen lymph nodes, as well as a rash on the hands, feet, chest, mouth or genitals.

Until recently, it spread mainly through consumption of contaminated meat or close contact with infected animals and people. Most of the deaths have been in children, who in this region of Africa are already beset by malnutrition and infectious diseases like cholera, measles and polio.

Should the outbreak spread globally, children in developed countries are likely to be less vulnerable to severe illness, experts have said.

Last year, for the first time, scientists discovered sexual transmission of this version of mpox, with cases split about equally among young men and women. According to genetic analyses , sometime around September, the virus gained mutations that enabled it to spread more readily among people. It has done so partly through heterosexual prostitution .

This viral type has not surfaced outside Africa. Over all, there have been more than 17,500 presumed and confirmed mpox cases in 13 countries, according to Africa C.D.C . Most of the cases and deaths have occurred in Congo.

Given the rapid spread, the declaration of a global health emergency was justified, said Anne Rimoin, an epidemiologist at the University of California, Los Angeles, who served on the 2022 mpox panel.

“I think we learned a great deal about the speed with which this virus can spread,” she said.

Amid rising numbers, Congo has approved two mpox vaccines , a Japanese product called LC16 and Jynneos, the vaccine made by Bavarian Nordic that was used in 2022 in the United States and Europe. But Congo has yet to institute an immunization plan.

On Aug. 9, the W.H.O. invited vaccine manufacturers to apply for an emergency use listing , a prerequisite for international groups such as Gavi, a global vaccine alliance, to purchase and distribute the shots in low-income nations.

Bavarian Nordic has donated 15,000 doses of Jynneos to be distributed in African countries. But that is a tiny fraction of the 10 million doses needed to control the outbreak, according to Africa C.D.C.

“The challenge is that these vaccines are not sufficient,” even if countries try to protect only the people at highest risk, said Dr. Dimie Ogoina, a Nigerian scientist and chair of the W.H.O.’s mpox emergency committee.

LC16 was used in Japanese children in the 1970s. Clinical trials funded by the Coalition for Epidemic Preparedness Innovations are now evaluating whether Jynneos can protect children and people who have already been exposed to the virus , Dr. Lurie said.

The organization is also supporting the development of a new mRNA vaccine made by BioNTech that would protect against mpox and related viruses, such as smallpox.

“This outbreak has been smoldering for quite a long time, and we continually have missed opportunities to shut it down,” Dr. Lurie said. “I’m really glad that everybody is now paying attention and focusing their efforts on this.”

Apoorva Mandavilli is a reporter focused on science and global health. She was a part of the team that won the 2021 Pulitzer Prize for Public Service for coverage of the pandemic. More about Apoorva Mandavilli

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

The 5 Best Annual Travel Insurance Plans of 2024

Allianz Travel Insurance »

AIG Travel Guard »

Seven Corners »

GeoBlue »

Trawick International »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Annual Travel Insurance Plans.

Table of Contents

- Allianz Travel Insurance

- AIG Travel Guard

Buying travel insurance can be a smart move for most trips, but those who travel more than a few times a year should consider an annual travel insurance policy. Whether you regularly travel for business and/or take several vacations a year, annual travel insurance plans can help you get the coverage you need without having to price out and purchase protection every time you leave home.

If you find yourself in a situation where an annual plan makes sense, know that not all travel insurance companies offer this kind of coverage. You'll also want to consider the available annual travel insurance plans to see which options make sense for your travel style and the level of coverage you want.

Frequently Asked Questions

Annual travel insurance plans all work in their own way, but the majority let travelers pay one annual premium for coverage that lasts for up to 364 days. These plans often limit the length of individual trips that are covered within the coverage year. Per-trip and annual limits on coverage can also apply.

In some cases, annual travel insurance plans require a deductible or coinsurance for certain types of coverage. If you're considering an annual travel insurance plan because you take multiple trips each year, make sure you read over the policy details and understand all coverage limits and trip limits that apply.

The cost of annual travel insurance typically varies based on factors like the age of the travelers applying, included benefits and coverage limits. You will want to shop around to compare plans across multiple providers using a platform like TravelInsurance.com or Squaremouth before you settle on a travel insurance policy.

To provide an example of the cost of annual travel insurance, U.S. News applied for a quote for two 40-year-old travelers seeking coverage for eight trips over a 12-month period. The Squaremouth travel insurance portal quoted policies with costs that range from $206 for the GeoBlue Trekker Essential plan to $610 for the Safe Travels Annual Deluxe plan by Trawick International.

Annual travel insurance can be worth it if you take multiple trips each year and want to make sure you always have coverage in place. After all, the alternative to having a multitrip policy is buying a new travel insurance plan for every vacation you take. That's not always feasible for frequent travelers who are always jetting off somewhere new – often at the last minute.

Just keep in mind that annual travel insurance plans tend to come with lower coverage limits than plans for single trips, and that you'll pay a premium for coverage that comes with comprehensive benefits and high limits for medical expenses and emergency evacuation.

- Allianz Travel Insurance: Best Overall

- AIG Travel Guard: Best for Basic Coverage

- Seven Corners: Best for Medical

- GeoBlue: Best for Expats

- Trawick International: Best for the Cost

Tailor your annual travel insurance plan to your needs

Most plans include coverage for trip cancellation and interruption, travel delays, medical expenses, and more

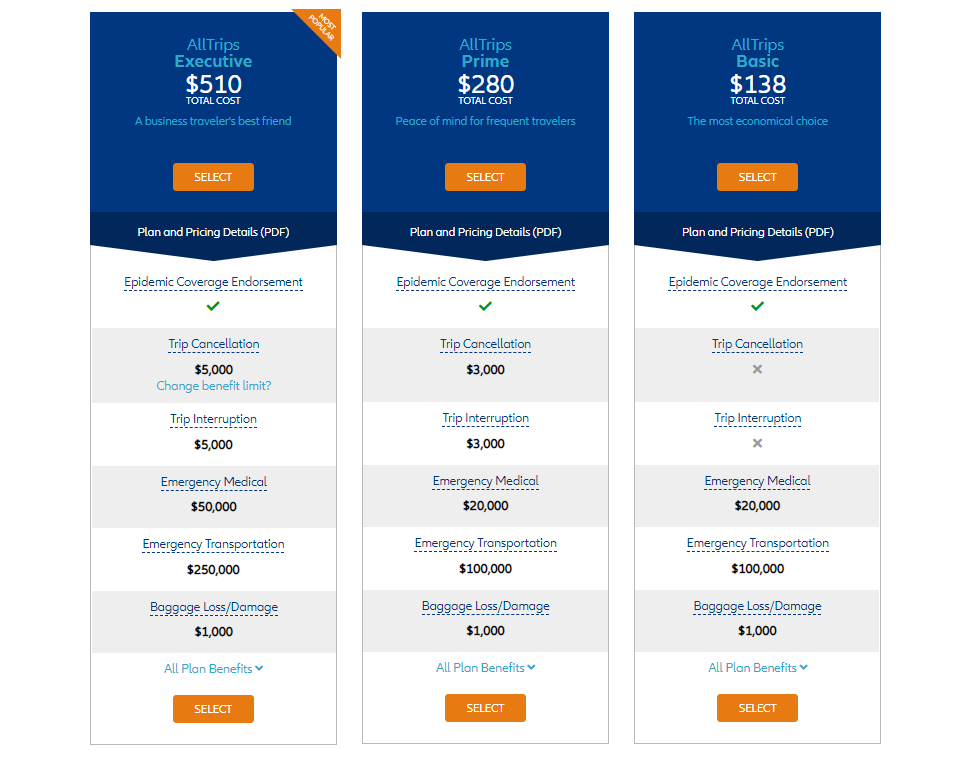

Lowest-tier plans (AllTrips Basic and AllTrips Prime) come with no or relatively low coverage limits for trip cancellation

Most annual plans (except for AllTrips Premier) do not cover trips longer than 45 days

- Trip cancellation coverage worth up to between $2,000 and $15,000

- Trip interruption coverage worth up to between $2,000 and $15,000

- Emergency medical coverage worth up to $50,000

- Up to $500,000 in emergency medical transportation coverage

- Up to $2,000 in coverage for lost or damaged baggage

- Up to $2,000 in coverage for baggage delays

- Travel delay coverage worth up to $1,500 ($300 daily limit)

- Rental car coverage worth up to $45,000

- Up to $50,000 in travel accident coverage

- 24-hour hotline assistance and concierge service

SEE FULL REVIEW »

Annual Travel Insurance Plan offers year-round travel insurance protection

Relatively high limits for medical expenses ($50,000) and emergency evacuation ($500,000)

No trip cancellation coverage and relatively low limit ($2,500) for trip interruption coverage

No coverage for preexisting medical conditions

- Up to $2,500 in coverage for trip interruption

- Up to $1,500 in coverage for trip delays of five-plus hours ($150 per day limit)

- Missed connection coverage worth up to $500

- Up to $2,500 in baggage insurance

- Baggage delay coverage worth up to $1,000 for delays of at least 12 hours.

- Up to $50,000 for emergency medical expenses ($500 for emergency dental sublimit)

- Up to $500,000 for emergency evacuation and repatriation of remains

- Up to $50,000 in accidental death and dismemberment (AD&D) insurance

- Up to $100,000 in protection for security evacuation

Provides coverage worth up to $250,000 for emergency medical expenses

Tailor other included benefit levels to your needs

Coverage only applies to trips up to 40 days

Deductible up to $100 applies for emergency medical coverage and baggage and personal effects

- Trip cancellation coverage worth up to between $2,500 and $10,000

- Trip interruption coverage worth up to 150% of the trip cancellation limit

- Up to $2,000 in trip delay coverage ($200 daily limit)

- Up to $1,000 in protection for missed connections

- Up to $250,000 in coverage for emergency medical expenses ($50,000 in New Hampshire)

- $750 dental sublimit within emergency medical coverage

- Up to $500,000 in coverage for emergency medical evacuation and repatriation of remains

- Up to $2,000 in coverage for baggage and personal effects

- Baggage delay coverage worth up to $1,000 ($100 daily limit)

- 24/7 travel assistance services

Get annual coverage for medical expenses and routine medical care

High limits for medical expenses and emergency medical evacuation

GeoBlue plans don't offer comprehensive travel protection

Deductibles and copays apply

- Ambulatory and therapeutic services

- Inpatient hospital services

- Emergency medical services

- Rehabilitation and therapy

- Preventive and primary care

Choose among three tiers of annual travel protection

Option for basic protection with affordable premiums

No coverage for preexisting conditions

Maximum trip duration of 30 days per trip

- Trip cancellation coverage up to $2,500 maximum per year

- Trip interruption coverage up to $2,500 maximum per year

- $200 per trip for trip delays (up to $100 per day for delays of 12 hours or longer)

- Up to $500 in coverage per trip for baggage and personal effects

- Baggage delay coverage up to $100 per trip

- Up to $10,000 for emergency medical expenses per trip

- Up to $50,000 in emergency medical evacuation coverage per trip

- Up to $10,000 in AD&D coverage

- 24-hour travel assistance services

Why Trust U.S. News Travel

Holly Johnson is a travel expert who has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world. On a personal level, her family uses an annual travel insurance policy from Allianz. Johnson works alongside her husband, Greg – who has been licensed to sell travel insurance in 50 states – within their family media business and travel agency .

You might also be interested in:

The 5 Best Family Travel Insurance Plans

Holly Johnson

Explore the options to protect your family wherever you roam.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

The 6 Best Vacation Rental Travel Insurance Plans

Protect your trip and give yourself peace of mind with the top options.

Is Travel Insurance Worth It? Yes, in These 3 Scenarios

These are the scenarios when travel insurance makes most sense.

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Review

- Best Car Buying Apps

- Best Sites To Sell a Car

- CarMax Review

- Carvana Review (July 2024)

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best Accounting Software

- Best Receipt Scanner Apps

- Best Free Accounting Software

- Best Online Bookkeeping Services

- Best Mileage Tracker Apps

- Best Business Expense Tracker Apps

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best SEO Services

- Best Mass Texting Services

- Best Email Marketing Software

- Best SEO Software

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Free Time Tracking Apps

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software

- Free Project Management Software

- Best Personal Loans

- Best Fast Personal Loans

- Best Debt Consolidation Loans

- Best Personal Loans for Fair Credit

- HOME EQUITY

- Best Home Equity Loan Rates

- Best Home Equity Loans

- Best Checking Accounts

- Best Online Checking Accounts

- Best Online Banks

- Bank Account Bonuses

- Best High-Yield Savings Accounts

- Best Savings Accounts

- Average Savings Account Interest Rate

- Money Market Accounts

- Best CD Rates

- Best 3-Month CD Rates

- Best 6-Month CD Rates

- Best 1-Year CD Rates

- Best 5-Year CD Rates

- Best Hearing Aids

- Best OTC Hearing Aids

- Most Affordable Hearing Aids

- Eargo Hearing Aids Review

- Best Medical Alert Systems

- Best Medical Alert Watches

- Best Medical Alert Necklaces

- Are Medical Alert Systems Covered by Insurance?

- Best Online Therapy

- Best Online Therapy Platforms That Take Insurance

- Best Online Psychiatrist Platforms

- BetterHelp Review

- Best Mattress

- Best Mattress for Side Sleepers

- Best Mattress for Back Pain

- Best Adjustable Beds

- Best Home Warranty Companies

- Best Home Appliance Insurance

- American Home Shield Review

- Liberty Home Guard Review

- Best Moving Companies

- Best Interstate Moving Companies

- Best Long-Distance Moving Companies

- Cheap Moving Companies

- Best Window Brands

- Cheap Window Replacement

- Window Replacement Cost

- Best Gutter Guards

- Gutter Installation Costs

- Best Solar Companies

- Best Solar Panels

- How Much Do Solar Panels Cost?

- Solar Calculator

- Texas Electricity Companies

- Texas Electricity Rates

- Best Car Insurance Companies

- Cheapest Car Insurance Companies

- Compare Car Insurance Quotes

- Best Car Insurance for New Drivers

- Best Pet Insurance

- Cheapest Pet Insurance

- Pet Insurance Cost

- Pet Insurance in Texas

- Pet Wellness Plans

- Is Pet Insurance Worth It?

- Best Life Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Term vs. Whole Life Insurance

- Best Travel Insurance Companies

- Best Homeowners Insurance Companies

- Best Renters Insurance Companies

- Best Motorcycle Insurance

- Cheapest Homeowners Insurance

- Cheapest Renters Insurance

- Travel Medical Insurance

MarketWatch Guides is a reviews and recommendations team, independent of the MarketWatch newsroom. We might earn a commission from links in this content. Learn More

The Best Senior Travel Insurance Companies of 2024

Alex Carver is a writer and researcher based in Charlotte, N.C. A contributor to major news websites such as Automoblog and USA Today, she’s written content in sectors such as insurance, warranties, shipping, real estate and more.

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

Here’s a breakdown of how we reviewed and rated the best travel insurance companies

Top 9 Best Senior Travel Insurance Companies of 2024

Here are our picks for the top travel insurance companies for U.S. seniors. All companies we’ve ranked as our top picks offer pre-existing conditions coverage or a waiver.

- Faye: Our top pick for seniors

- Travelex : Best for budget travelers

- Nationwide Travel Insurance : Best for baggage coverage

- Generali Global Assistance : Best for trip interruption coverage

- Seven Corners Travel Insurance : Best for visitors to the USA

- HTH Travel Insurance : Best for group travel

- WorldTrips Travel Insurance: Most affordable comprehensive coverage

- Allianz: Best for concierge services

- International Medical Group : Best for medical coverage

Compare Travel Insurance Companies for Seniors

It’s important to balance coverage with cost when searching for a senior travel insurance policy to ensure you get the best deal possible. See the table below for the average cost of a travel insurance plan based on quotes we gathered from our top company picks. We’ve also included our recommended plans for seniors and Better Business Bureau (BBB) ratings across each provider.

* Average costs are based on quotes our team gathered from each provider using four different traveler profiles, ranging from 70 to 81 years old.

The Best Senior Travel Insurance in Detail

Why We Picked Faye for Senior Travelers

We chose Faye as our top pick for senior travelers. While it offers only one plan, the company includes $250,000 worth of primary medical coverage on all its policies and has a pre-existing conditions waiver to help seniors cover chronic medical conditions. To qualify for this pre-existing coverage waiver, you must purchase your policy within 14 days of your initial trip deposit and be medically able to travel at the time of plan purchase. Faye’s policies also provide $500,000 in emergency medical evacuation coverage, which older travelers may require if they have a complex health condition or are in a remote area.

Pros and Cons

Coverage and cost.

Faye offers the following add-on options:

- CFAR coverage

- Rental car damage or theft

- Adventure and extreme sports protection

- Vacation rental damage protection

We gathered quotes directly from Faye to better understand the cost of a travel insurance policy for seniors. Based on the quotes we gathered, the average cost of senior travel insurance is $337.

Why We Picked Travelex for Senior Travelers

Travelex is worth considering for senior travelers because of its primary medical coverage. If you become hospitalized outside of the U.S. , Medicare won’t pay for most injuries and illnesses. A travel insurance plan that offers secondary coverage may leave you with a major medical bill after a serious accident. Travelex’s Travel Select plan allows seniors to upgrade their primary medical coverage with additional medical and emergency evacuation coverage, providing peace of mind while abroad.

- Trip cancellation: 100% of non-refundable costs

- Trip interruption: 100%–150% of non-refundable costs

- Baggage: $100–$200 for delays and $500–$1,000 for losses

- Medical expenses: $15,000–$50,000

- Medical evacuation: $100,000–$500,000

You can choose from the following add-on coverage with Travelex:

- Cancel for any reason (CFAR) coverage (up to 75% of trip costs)

- Accidental death and dismemberment (AD&D) and medical benefit upgrades

- Car rental collision

We gathered quotes directly from Travelex to learn more about the average cost of a travel insurance policy for seniors through the company. Based on these quotes, Travelex’s average cost is $585.

Nationwide Travel Insurance

Why We Picked Nationwide for Senior Travelers

Nationwide’s Cruise Luxury plan features several inclusions that benefit senior travelers at an affordable price. Trip interruption coverage includes up to 200% of your trip cost, and you can qualify for a pre-existing conditions waiver up to 21 days after your initial deposit. While medical limits are lower than most competitors, Nationwide’s general and cruise-specific coverages present a viable option for older travelers.

- Trip interruption: 125%–200% of non-refundable costs

- Baggage: $100–$600 for delays and $500–$2,000 for losses

- Medical expenses: $75,000–$150,000

- Medical evacuation: $250,000–$1 million

Nationwide offers the following add-ons, but available coverage may vary by plan.

- AD&D coverage (available on all plans)

- Rental car coverage options (Essential and Prime plans)

- CFAR coverage (Prime Plan, Cruise Choice and Luxury plans)

We gathered quotes directly from Nationwide to better gauge what a travel insurance policy costs for seniors. Based on the quotes collected by our research team, a senior travel insurance plan with Nationwide costs $407 on average.

Generali Global Assistance

Why We Picked Generali Global Assistance for Senior Travelers

We named Generali Global Assistance our pick for emergency assistance, as the provider offers a team of bilingual representatives on standby to assist in an emergency. Generali’s policies include around-the-clock travel assistance, and its Premium plan offers generous medical coverage of up to $250,000. In addition, Generali’s medical coverage does not have a lower cap for dental coverage, a benefit if you experience a dental abscess or another major dental emergency on vacation.

- Trip interruption: 125% – 175% of non-refundable costs

- Baggage: $200–$500 for delays and $1,000–$2,000 for losses

- Medical expenses: $50,000–$250,000

Generali offers fewer add-on options than other insurance providers we reviewed, including:

- Rental car accident insurance (offers up to $25,000 with the Standard and Preferred plans)

- CFAR insurance (available with the Premium plan only)

Note that the Premium plan includes rental car coverage as standard so the add-on is not available to those customers.

We gathered quotes directly from Generali to learn about the cost of a travel insurance policy for seniors. Based on these quotes, seniors can expect to pay $298 for a Generali plan.

Seven Corners Travel Insurance

Why We Picked Seven Corners for Senior Travelers

As an older traveler, you may focus on comprehensive medical care and evacuation protections when buying travel insurance. Seven Corners offers a broad selection of medical insurance policies, with travelers 65 to 79 years old provided up to $100,000 in medical coverage. Travelers 80 years and older can receive $10,000 in coverage, which is an age many other providers exclude from enrollment entirely. Seven Corners also offers medical evacuation coverage up to $1 million, which can benefit those traveling to a remote area.

- Baggage: $500 for delays and $500–$2,500 for losses

- Medical expenses: $100,000–$500,000

With Seven Corners, you can choose from the following add-ons:

- CFAR insurance

- Event ticket registration fee protection

- Interrupted for any reason (IFAR) coverage

- Rental car collision waiver ($35,000 maximum)

- Sports and golf equipment rental coverage

Our research team collected quotes from Seven Corners using various senior traveler profiles. We found that a senior traveler can expect to pay $388 on average.

HTH Travel Insurance

Why We Picked HTH for Senior Travelers

If you’re a senior traveling with a group, you might consider buying coverage through a travel insurance provider offering benefits when you purchase two or more policies at once. HTH Travel Insurance policies have a 10% discount for groups of travelers over the age of 65 and include medical limits of up to $1 million. Nationwide underwrites policies in most areas, and you may qualify for up to 200% of trip interruption coverage and primary medical benefits.

- Trip interruption: 100% of non-refundable costs (up to $1,000)

- Baggage: $500 for losses and delays

- Medical expenses: $50,000–$1 million

- Medical evacuation: $500,000

You can add the following coverage to your group insurance plan:

- CFAR insurance (must purchase within 10 days of your first trip deposit)

- Rental car damage (not available in Oregon, New York or Texas)

Based on quotes our research team gathered from HTH Worldwide, senior travelers can expect to pay $437 on average .

WorldTrips Travel Insurance

Why WorldTrips is Great for Senior Travelers

Our team rated WorldTrips with 4.6 out of 5 stars because it offers three general plans with up to $250,000 in emergency medical coverage. Its policies are competitively priced with an average cost of $206 per senior traveler, which can make it a more appealing choice for those on a budget. WorldTrips is also notable for its range of add-on options, being one of the only travel insurance companies we reviewed to offer multiple tiers of CFAR reimbursement options.

- Trip interruption: 125%–150% of non-refundable costs

- Baggage: $200–$600 for delays and $2,500 for losses

WorldTrips offers the following add-on options, which vary in availability by plan choice:

- CFAR coverage (50% or 75% reimbursement rates available)

- IFAR coverage

- Adventure sports medical coverage waiver

- Medical evacuation (doubles the standard coverage limit)

- Rental car damage and theft

Our team collected quotes for a variety of senior trips directly from WorldTrips to learn more about what seniors pay for travel insurance on average. In our review, we found the average senior traveler will pay a total of $276 for a travel insurance policy from WorldTrips.

Allianz Global Assistance

Our team rated Allianz Travel Insurance 4.1 out of 5 stars and named it the best travel insurance company for concierge service. The Allianz OneTrip Prime and OneTrip Premier both include access to 24/7 concierge assistance around the world. This service provides personalized information about your destination and individual assistance communicating with emergency and medical professionals. In non-emergency situations, Allianz’s concierge service can help you make the most of your time abroad by booking reservations, tee times and other local add-ons.

- Baggage: $200–$600 for delays and $500–$2,000 for losses

- Medical expenses: $10,000–$75,000

- Medical evacuation: $50,000–$1 million

Allianz currently offers the following add-on options, with choices varying by plan:

- Rental car protection

- CFAR upgrade (reimburses up to 80% of trip expenses)

After collecting a range of quotes from Allianz, we concluded the average senior traveler will pay about $551 for insurance. This is higher than the national average our team calculated, especially in light of Allianz’s lower medical coverage limits.

International Medical Group

Why IMG Is Great for Senior Travelers

If you’re looking for more extensive medical coverage, you can find a number of policies available through International Medical Group (IMG). The company has inclusive international policies, with more than five choices and up to $8 million in medical coverage on single-trip plans. It also offers GlobeHopper Senior plans tailored specifically to senior travelers by not enforcing a maximum age restriction. IMG makes it easier for seniors to customize coverage than other companies we’ve researched, allowing you to skip baggage and delay-related coverage if you solely want medical insurance.

- Trip interruption: 125% of non-refundable costs

- Baggage: $150–$500 for delays and $750–$2,500 for losses

- Medical expenses: $100,000–$8 million

Rental car damage and theft coverage, which some companies offer as add-ons, is included with many of IMG’s plans. You can add the following optional coverages:

- Pet kennel (up to $100 per day with a max of $300 per pet)

- Pre-existing condition review

IMG’s medical insurance policies include some exclusions limiting when you can use your coverage. But you can purchase a waiver that extends coverage to medical issues resulting from adventure sports and terrorism.

Based on quotes we gathered from IMG using four different senior traveler profiles, a 70-year-old couple taking a 7-day, $4,000 trip to Mexico will pay around $428 .

How We Ranked the Best Senior Travel Insurance Companies

After reviewing dozens of travel insurance providers, we ranked the best options for senior travelers by cost, coverage and value. The following are the major factors that influenced how we ranked each company:

- Medical expense limits: Companies with higher medical expense limits ranked higher on our list, specifically providers offering medical benefits higher than $250,000.

- Primary medical coverage: Medicare does not cover most medical bills incurred abroad. Companies offering primary medical coverage scored higher than those that only offer secondary coverage.

- Emergency medical evacuation: Not every travel insurance company offers medical evacuation coverage. We ranked companies with at least $100,000 in coverage higher than those with a lower benefit amount or not offering coverage at all.

- Premium costs: Travel insurance is more expensive for seniors because insurance companies consider older adults more likely to run into a medical issue and file an insurance claim. To compare premium costs , we gathered quotes for a U.S. couple taking a trip to the United Kingdom and ranked companies based on average affordability.

- Travel assistance: We ranked companies offering 24/7 travel assistance higher than those with more limited customer service hours.

How Much Does Senior Travel Insurance Cost?

The average cost of travel insurance for seniors is $417. However, seniors can likely expect to pay anywhere from $159 to $745 for a policy. Our team analyzed average travel insurance policy costs for senior travelers by gathering quotes from multiple providers using four different traveler profiles. Based on these quotes, we found the average cost of travel insurance for seniors was about 9% to 18% of their trip’s total value.

See the table below for a breakdown of average policy costs across the traveler profiles we used to gather quotes during our research process.

The table below shows the average cost of senior travel insurance by provider, averaging each of their plan costs for all 4 traveler types highlighted above, from cheapest to most expensive.

Keep in mind your actual travel insurance policy cost as a senior will depend on factors such as your age, total trip cost, level of coverage and more. We recommend gathering quotes from at least three different travel insurance companies before settling on a plan.

How To Pick The Best Senior Travel Insurance

When shopping for senior travel insurance, consider the following tips to pick the right policy for your coverage needs.

Check for Pre-Existing Conditions Waivers

Most travel insurance companies exclude pre-existing conditions from medical coverage. If you’ve had changes in your health before purchasing a policy — such as a new diagnosis or new medication — a company may consider it a pre-existing condition.

Senior travelers with chronic medical conditions or a new diagnosis can see if their travel insurance provider offers a waiver for pre-existing conditions. This waiver can prevent a travel insurance company from denying medical-related reimbursements if you have a pre-existing condition, as it keeps the provider from examining your recent medical records when reviewing a claim.

Angela Borden, a product marketing specialist at Seven Corners, encourages travelers to check on medical coverage if they have pre-existing conditions.

“Contact your insurance provider to be sure you fully understand the pre-existing conditions coverage for the plan you choose,” she said, “being prepared and having the information before you need it in an emergency can make a huge difference.”

Opt for Primary Medical Coverage

If you get your health insurance through Medicare, you may consider travel insurance providers that offer primary (rather than secondary) medical coverage. Medicare does not pay for medical care provided outside the U.S., which can make travel insurance for seniors valuable. Providers like Travelex and Faye are good options for seniors who think they may need international medical care policies with primary coverage.

According to our survey of 1,000 people who have purchased a travel insurance policy in the past, over 60% recommend that a friend buy a comprehensive travel insurance policy that includes medical coverage, cancellations, baggage, etc., over a cheaper policy with less coverage.

Choose a Plan With at Least $100,000 in Medical Coverage

Travel medical insurance can protect you if you need emergency medical care while on a trip. If you’re a senior with a Medicare policy that covers your domestic healthcare needs, your policy likely will not cover medical bills you incur in another country. If you need healthcare services due to a sudden illness or injury, a travel insurance plan with medical coverage can likely protect you financially in an emergency.

We recommend senior travelers obtain at least $100,000 in medical coverage based on our review of travel insurance companies and research into emergency medical expenses. If you experience a serious medical emergency that requires hospitalization, your healthcare bills might add up quickly. Consider your financial situation, the length of your travels and other factors when deciding on the amount of coverage you’re comfortable purchasing.

Get at Least $250,000 in Medical Evacuation and Repatriation Coverage

When traveling to a location without an accessible or strong healthcare infrastructure, the need for medical evacuation increases if you have a severe accident. If you need transport in an ambulance, helicopter or another specialized medical vehicle, medical evacuation coverage can help cover transport-related bills. Repatriation benefits — often included alongside medical evacuation coverage — cover the cost of transporting your remains back to your home country in the event of death abroad.

We recommend getting emergency evacuation coverage of at least $250,000, ideally $500,000. According to Medjet , medical transport costs can range from $30,000 to over $180,000, so you’ll likely want limits that can provide you with peace of mind if you need transport during a medical crisis.

Frequent International Travelers: Consider Annual Travel Insurance

Seniors who plan to travel to multiple destinations over the course of a year might consider an annual travel insurance policy. Annual, multi-destination travel insurance covers multiple trips over a set period — typically 12 months. If you plan on traveling frequently while returning to your home base between trips, this coverage may offer a cost-effective way to protect your travels versus buying multiple single-trip policies for all your adventures.