Why a timeshare brand just bought Travel + Leisure magazine

One of the world's most iconic travel brands has been bought by a timeshare company.

Wyndham Destinations , which operates hundreds of timeshare resorts, acquired Travel + Leisure magazine from media company Meredith Corp. for $100 million, The Wall Street Journal reported last night. Collectively, the company — which will change its name to Travel + Leisure Co. early this year — will now have resort, lifestyle and travel club brands. Meredith will continue to publish the magazine under a 30-year licensing agreement.

For more TPG news delivered each morning to your inbox, sign up for our daily newsletter .

" ... We have laid the foundation to expand our footprint beyond our core vacation ownership business, and today we add one of the most trusted and influential brands in travel through the acquisition of Travel + Leisure," Michael D. Brown, president and CEO of Wyndham Destinations, said in a statement .

"As new stewards of the Travel + Leisure brand, we are committed to ensuring that the integrity and independence of its trusted, authoritative journalism remains uncompromised," Brown added, saying that Jacqui Gifford will remain at the helm of the magazine as editor-in-chief. "For 50 years, Travel + Leisure has offered travel inspiration to tens of millions across the world ... and we look forward to supporting Meredith as it continues that mission."

Acquisitions in media aren't exactly uncommon. During the years I worked at Travel + Leisure, ownership changed hands twice. Time Inc. bought the brand from American Express Publishing in 2013, and Meredith Corp. acquired Time in 2018.

And the pandemic has been an incredible hardship for both the travel and media industries. Skift reported that Meredith Corp. posted a $289 million loss in the third quarter of 2020. But even with vacation club revenue down 44% year-over-year during the same quarter, Wyndham Destinations still reported a $40 million profit across its operations.

There's also a precedent for hospitality brands using magazines to reach new audiences, and leveraging a trusted media name. In 2017, suitcase brand Away launched its own print and digital travel magazine, Here. That same year, Airbnb collaborated with Hearst Corporation on a namesake publication. And Skift pointed out that RCI, a timeshare exchange brand owned by Wyndham Destinations, already has an eponymous magazine, formerly known as Endless Vacation.

For this newly formed company, the Journal said the goal is to "grow ... membership travel-club businesses, offer new travel services and expand licensing agreements."

Related: How to use Wyndham Rewards points to book timeshares

But by aligning itself with a renowned travel magazine, getting access to all its platforms (including an Instagram account with 5.6 million followers, compared to Wyndham Destinations' current 4,087) and rebranding, Wyndham Destinations will also be better positioned to appeal to a new, younger and more affluent demographic of travelers. Skift underscored the company's persistent efforts to reach younger travelers and refashion the perception of timeshares .

"This strategic alliance brings a new, innovative approach to media brand development," Meredith chairman and chief executive Tom Harty said in a statement. "This is a great demonstration of the value that strong brands deliver when expanded beyond the media space," Harty added, suggesting there might be more "value-enhancing programs" in the media conglomerate's future.

- Best of 2024

- How to Spot a Trustworthy Website

- Dating Apps

- Shopping Discount Fashion

- Discount Clothing

- Discount Designer Clothing

- Affordable Wedding Dresses

- Affordable Activewear for Women

- Plus-Size Swimwear

- COVID-19 Resources

- Consumer Tips

- Write a Review

- For Business

- Request a Review

- Backed by the National Science Foundation

- Travel + Leisure

Unsolicited

Is this your business?

Claim your listing for free to respond to reviews, update your profile and manage your listing.

Travel + Leisure has a rating of 3.44 stars from 16 reviews, indicating that most customers are generally satisfied with their purchases. Travel + Leisure ranks 17th among Travel Other sites.

“Best company”

All you need for vacation in one site, and that incluid the sisters companies rci and wyndham destinations

“Editing your comments w/ your permission”

Most people don't read small print or think about it. When you sign up you agree to let TL edit your name and comments you make. Think about that for a little… so who's writing the review me or TL? I won't sign up for this. And like other reviewers said, u can do own research - or just check out my travels for real pics and reviews that don't get edited/changed.

Reviews (16)

- Follow Justin T.

About the business

Explore Travel + Leisure? ۪s travel guides for the best hotels, restaurants, and things to do around the world from expert editors for your next destination.

- Visit Website

- United States

- Edit business info

How do I know I can trust these reviews about Travel + Leisure?

- Sitejabber’s sole mission is to increase online transparency for buyers and businesses

- Sitejabber has helped over 200M buyers make better purchasing decisions online

- Suspicious reviews are flagged by our algorithms, moderators, and community members

- Suggested Resorts

Current Available Points

- Buzzworthy News Owner Testimonials Pride of Ownership Tour the Club Using My Ownership VIP by Wyndham Presidential Reserve

- Search Resorts Featured Destinations Travel Inspiration Resort News Vacation Planner Explore Destinations

- New Owner Quick Start Dig into Club Life Education Webinars Resources

- Non-Owner Travel Deals Owner Exclusives Club Wyndham Travel Travel Up by Travel + Leisure Owner Travel Deals Partner Offers VIP Exclusives

- Make A Payment Ask and Answer Glossary Contact Us

- Sign In Register

- Skip to Main Content

- Buzzworthy News

- Owner Testimonials

- Pride of Ownership

- Tour the Club

- Using My Ownership

- VIP by Wyndham

- Presidential Reserve

- Search Resorts

- Travel Inspiration

- Resort News

- Vacation Planner

- Explore Destinations

- Dig into Club Life

- Education Webinars

- Non-Owner Travel Deals

- Club Wyndham Travel Travel Up by Travel + Leisure

- Owner Travel Deals

- Partner Offers

- VIP Exclusives

- Make A Payment

- Ask and Answer

- Current Available Points >

Dear Owners,

On Feb. 17, 2021, our parent company was renamed Travel + Leisure Co. and made its debut as the world’s leading membership and leisure travel company, with a portfolio of nearly 20 resort, travel club, and lifestyle travel brands. A link to a press release with more details is available here .

As we shared in January when we announced the acquisition of the iconic Travel + Leisure brand, Travel + Leisure Co. will be supported by three branded business lines. Wyndham Destinations has become the umbrella brand for our vacation ownership clubs business line.

This transition to Travel + Leisure Co. as the parent company over Wyndham Destinations will not directly affect Club Wyndham or its products or club offerings. You will continue to enjoy your beautiful timeshare properties and exceptional benefits. This news does not impact any current contracts, and we do not anticipate any changes to our services. You may continue to leverage the award-winning Wyndham Rewards program, just as you always have.

We are excited about our future, and are proud to be a part of a thriving travel business that is committed to ongoing innovation, growth, and strategies that benefit our customers and stakeholders. As always, thank you for your continued loyalty and support. We look forward to helping you fulfill your vacation dreams.

Geoff Richards Chief Operating Officer, Wyndham Destinations

- Pride of Ownership Using My Ownership Owner Testimonials How To Use a Club Wyndham Timeshare Buying a Club Wyndham Timeshare Buzzworthy News

- Explore Resorts Featured Destinations Resort News Traveler's Pledge

- New Owner Quick Start Resources

- Owner Exclusives Partner Offers Wyndham Vacation Packages Wyndham Sweeps

- Publications

- Wyndham Cares

- Terms of Use

- Privacy Notice

- Cookie Settings

- Do Not Sell Or Share My Personal Information - Consumers

- Do Not Sell Or Share My Personal Information - Former Employees (California)

- Top results

- Pride of ownership

- Owner testimonials

- TravelShare

- VIP by WorldMark

- Search resorts

- Explore destinations

- Guides & inspiration

- Go-now getaways

- Navigate your website

- New owner quick start

- Resort deals

- WorldMark by Wyndham Travel

- TravelShare exclusives

- Extra savings

- My dashboard

- My reservations

- Credits summary

- Dues & loans

- RCI & exchanges

- Switch ownership

- Sign In Register

- Skip to Main Content

Introducing Travel + Leisure Co.

Dear Owners,

On Feb. 17, 2021, our parent company was renamed Travel + Leisure Co. and made its debut as the world's leading membership and leisure travel company, with a portfolio of nearly 20 resort, travel club, and lifestyle travel brands. A link to a press release with more details is available here .

As we shared in January when we announced the acquisition of the iconic Travel + Leisure brand, Travel + Leisure Co. will be supported by three branded business lines. Wyndham Destinations has become the umbrella brand for our vacation ownership clubs business line.

This transition to Travel + Leisure Co. as the parent company over Wyndham Destinations will not directly affect WorldMark by Wyndham or its products or club offerings. You will continue to enjoy your beautiful timeshare properties and exceptional benefits. This news does not impact any current contracts, and we do not anticipate any changes to our services. You may continue to leverage the award-winning Wyndham Rewards program, just as you always have.

We are excited about our future, and are proud to be a part of a thriving travel business that is committed to ongoing innovation, growth, and strategies that benefit our customers and stakeholders. As always, thank you for your continued loyalty and support. We look forward to helping you fulfill your vacation dreams.

Worldmark news

- Explore resorts

- Traveler's pledge

- Wyndham cares

- Publications and newsletters

- Privacy notice

- Privacy settings

- Mobile help

- Terms of Use

- Cookie Settings

- Do Not Sell Or Share My Personal Information - Consumers

- Do Not Sell Or Share My Personal Information - Former Employees (California)

Travel + Leisure

Services offered.

Virtual Consultations

Location & Hours

Suggest an edit

6277 Sea Harbor Dr

Orlando, FL 32821

International Drive / I-Drive

You Might Also Consider

Star Pmc Travel Agency

We provide the star service experience!! Let us handle the stress of travel planning and help you get the best destination. We handle the planning and provide you with options for you to choose the trip you need. We want to make it… read more

in Travel Agents

Southern Waves Property Management LLC

At Southern Waves we take great delight in becoming part of your greatest memories, this is why we would like to be the connection between our lovely homes in Sunny Central Florida and the vacation of your dreams! The best part of… read more

in Vacation Rentals

Margaritaville at Sea

Jeni M. said "After reading a plethora of reviews online, I was pleasantly surprised to find that the 2 day cruise was better than other cruise lines in some ways. I must first explain that I went on the cruise with the worst expectations given…" read more

in Boat Tours, Boat Charters, Travel Services

About the Business

We Put the World on Vacation. Travel + Leisure Co. is the world's leading membership and leisure travel company, with a portfolio of nearly 20 resort, travel club, and lifestyle travel brands including Wyndham Destinations, RCI and Travel + Leisure Group. …

Ask the Community

Ask a question

Yelp users haven’t asked any questions yet about Travel + Leisure .

Recommended Reviews

- 1 star rating Not good

- 2 star rating Could’ve been better

- 3 star rating OK

- 4 star rating Good

- 5 star rating Great

Select your rating

Overall rating

Never buy any kind of ownership into Wyndham Resorts. They take your money and do not give you what they promised. I should have known better! There are better companies out there with better properties, customer service, and locations.

Business owner information

Club Wyndham

Business Manager

Sep 20, 2023

Hi Justine, we’re upset to hear that you have not had an excellent experience. We would love to hear from you directly at 855-670-0758 to learn more about ways we could improve.

I made a reservation for budget car rental and was told that I was charged a deposit and the balance on Sept 28 I was sent a reminder and a confirmation Upon arrival at Orlando airport I had to wait for one hour and a half in line. The budget rental car associate spent 10 min pulling up the reservation and swiped my card to pay again he then said my reservation got booted out now I'd have to pay an extra $250.

If I could give this a zero if I would do so. We learned the hard way that you cannot trust the salespeople. We were promised that certain things were the case; that there would be no increase in monthly fees; that there was an excellent travel store help us locate a place to stay; that there were Wyndham resorts in Europe and in various locations in cities throughout the United States. It was all false. In fact, their travel store was a joke--we did much better in 15 minutes than the hour it took to speak to them; when I attempted to reach them via numbers furnished by the company the numbers didn't work; the wait time for answer when finally I located the correct number was ridiculous. And I was transferred 3 times just to speak to someone about my contract. (On multiple occasions) The only thing I suggest is don't buy a time share. Ever. It's the one debt that is inheritable. You can't resell them for a reasonable price. And this company is terrible from a customer service standpoint. And, sorry to be redundant, they lied to us without consequence in selling us the timeshare. Buyer Beware!

Jun 22, 2023

We’re disappointed to learn of your experience, Steven. Thank you for sharing your feedback and we will be sure to pass it along to our leadership team. If you have any further concerns please reach out to us at 855-670-0758.

To Manager......I'm still waiting for the link to be contacted. The link provided a year ago is invalid & I have yet to get this issue resolved when I call. I'd like to be contacted.

Jan 25, 2021

Hi Shaunda, we take this extremely seriously and would like to discuss with you directly. Can you please fill out this form so that we can reach out to you? https://clubwyndham.wyndhamdestinations.com/us/en/help/wyndham-cares

SCAM!!!! This package is a complete scam. The representative lied about this being a line of credit, they never sent me information, put in a fake address so when I called I was never able to verify my account but yet I was still getting billed monthly. I looked Into some of the resorts and NOTHING looked like it did on pictures. Complete waste of money and time!!! Run away from these people.

I would give this company a negative 100 if possible. These people lie thru their teeth to make a sale. They continue to badger you with more info, more numbers, then they throw 10 additional reps at you til you are so confused, you don't know which end is up. Good luck trying to actually reach a real human AFTER the purchase. I spent 1 1/2 hours on hold. Again, nothing but lies, and no follow thru on what they say they are going to do.

I told this company my max was $250 per month period, they made one thing $250 per month, but maintenance and the bills for everything else it came to $600 per month. Not very happy with this company, everything they told us was half-truths. Sneaky salespeople and its across the board, We have several upgrades and those too did not come to fruition as described. I suggest you do your research and find someone else to invest in.

I had stayed at a hotel owned by Wyndham, so I decided to sign up for their rewards program in November 2017. When I did, I was offered a "special deal" of four days & three nights for $179 at one of their resorts if I would sit through a two-hour sales pitch. I scheduled a trip to Wisconsin Dells, WI, in March 2018. Because of work, I had to change the reservation to April 17, 2018. On April 13, 2018, I received word that a dear friend of mine had died in North Carolina. The funeral would be the day I was supposed to return from Wisconsin. I immediately called Wyndham to reschedule. The customer service representative had a horrible headset. Everything sounded garbled and all I could hear was her breathing. I told her about it several times, but it never could get straightened out. I THOUGHT we rescheduled for May 1, 2018, at a hotel in Wisconsin Dells. Initially, I was told I would have to pay a $50 penalty fee because I was changing the reservation within the five-day window. When I told her I was rescheduling because of a death, she said she waived it (or at least I thought she did). Today is Sunday, April 29, 2018. Right before leaving on the 400+ mile drive, I searched for the reservation confirmation to print it out. When I couldn't find it, I called Reception at Wyndham Vacation Resorts in Wisconsin Dells. I was told that, according to the notes, the reservation for April 17th had been cancelled. No reservation had been made for May 1st.

I would do a lot of research before ever buying with Wyndham. A lot of lies and misleading statements. If you are not a million point owner or top tier, even if your priority or gold as we are called you get the lesser of the picks of resorts and if your do get your resort your not given the preferred rooms. Also every time you check in to their resort you have to go to a counter after check in to get your parking pass and listen to the try to schedule you for a review of what's new"aka sales pitch". It's very annoying that it happens every time, even when we left a resort in one town and drove to a town 3 hours away they tried to sell us. Your points get you very little actually, you can join RCI direct and save a ton of money and get better choices in locations. The "maintenance" fees they charge every month forever always increase and you end up spending more for the first 10 years of your ownership than you probably would spend in 15 years of normal vacations. I would really look hard at reviews online if I had the opportunity to before buying. Hard to find a good one.

Bought a reservation over the phone. Was told I had to do was cancel within seven days if I changed my mind. I called the same day I made the reservation and they told me they couldn't cancel over the phone. Very misleading. Customer Service is nonexistent. I'm sending my cancellation by certified mail with proof of delivery. If that doesn't work I have to involve my credit card company. Stay away from Windham destinations. I will tell everyone I know about my bad experience. Service is nonexistent. I'm sending my cancellation by certified mail with proof of delivery. If that doesn't work I have to involve my credit card company. Stay away from Wyndham destinations. I will tell everyone I know about my bad experience.

This company deserves 0 starts. Please protect your family and friends from this company . They are a complete scam and a resort filled with liars and cheats . My wife and I signed up for discovery program and no one told us that in order to take best advantage of your package you have to book 10-12 months in advance , after hearing that we requested a cancellation and a refund . This all happened within 2 days of signing up and now it's been 4 months and we still don't have any update on our refund or cancellation . The company has a policy that contracts can be cancelled in 10 days and we cancelled in 2 days . Whenever we can we are told that it's under review . How much can you review that the customer has not used the service and wants to cancel . 4 months and still waiting ...

7 other reviews that are not currently recommended

Lets Getaway Travel

Explore Your Cruise Vacation with ICON of the Seas. It’s the best family vacation in the world. Introducing the new Icon of the Seas — a first-of-its-kind Royal Caribbean® adventure where you’ll have the time of your life, multiple… read more

EmpowerHer Escapes

Welcome to EmpowerHer Escapes: Blissful Retreats, where unforgettable adventures meet self-care indulgence. We specialize in curating exclusive girl trips that seamlessly blend the excitement of travel with the rejuvenation of… read more

People Also Viewed

Timeshares By Owner

Hilton Grand Vacations

Wynpoints Resort Rentals

Casiola Orlando

Buena Vista Vacation Management

Florida Sunshine Vacation Rentals

Gold Crown Resort

Rent Sunny Florida

Friendly Motel

Florida Dream Homes

Best of Orlando

Things to do in Orlando

Other Resorts Nearby

Find more Resorts near Travel + Leisure

Related Articles

Yelp’s Top 100 US Hotels

Service Offerings in Orlando

Browse nearby.

Things to Do

Vacation Rentals

Hotels Disneyland Near Me

Pool Hotel Near Me

Resorts Near Me

Vacation Rentals Near Me

Related Cost Guides

Town Car Service

- The TUGBBS forums are completely free and open to the public and exist as the absolute best place for owners to get help and advice about their timeshares for more than 30 years! Join Tens of Thousands of other Owners just like you here to get any and all Timeshare questions answered 24 hours a day!

- TUG started 30 years ago in October 1993 as a group of regular Timeshare owners just like you! Read about our 30th anniversary: Happy 30th Birthday TUG!

- TUG has a YouTube Channel to produce weekly short informative videos on popular Timeshare topics! Free memberships for every 50 subscribers! Visit TUG on Youtube!

- TUG has now saved timeshare owners more than $21,000,000 dollars just by finding us in time to rescind a new Timeshare purchase! A truly incredible milestone! Read more here: TUG saves owners more than $21 Million dollars

- Sign up to get the TUG Newsletter for free! 60,000+ subscribing owners! A weekly recap of the best Timeshare resort reviews and the most popular topics discussed by owners!

- Our official "end my sales presentation early" T-shirts are available again! Also come with the option for a free membership extension with purchase to offset the cost! All T-shirt options here!

- Step by Step Guide: How to Sell your Timeshare!

- Last Minute Discounted Timeshare Rentals

- Free Timeshare Giveaways

- Timeshare Resort Systems

- Club Wyndham Plus

Does anyone have TravelUp

- Thread starter Don40

- Start date Nov 7, 2021

Tug Review Crew: Rookie

- Nov 7, 2021

Went to a presentation yesterday and the salesperson was pushing TravelUp as a great way to save on travel. They claim with the Wyndham purchase of travel and leisure the TravelUp membership will allow savings on cruise, safaris of up to 70% percent off. Has anyone used this feature. salesperson said buy more points to get enrolled, 13k for 64k CWA contract and then TravelUp is added. I could not find anything on TravelUp. Does anyone have TravelUp, and if so are the discounts worth it.

Don40 said: if so are the discounts worth it Click to expand...

HitchHiker71

Please search this forum for more guidance on the TravelUp program. There are a few threads on it already will provide some answers to your inquiry. Many thanks! Sent from my iPhone using Tapatalk

TUG Review Crew: Veteran

I know this site is not full of retail buyers but it is surprising that no one here has bought 49,000 or more retail wyndham points in the last 5.5 months (introduced May 20, 2021) . Of course the biggest discounts would be from platinum or founders members who also bought retail since they have offered this benefit but even a standard member would be able to discuss their up to 20% discounts so it could be compared to what might be possible for the up to 40% (platinum) and up to 50% (founders) discounts.

HitchHiker71 said: Please search this forum for more guidance on the TravelUp program. There are a few threads on it already will provide some answers to your inquiry. Many thanks! Sent from my iPhone using Tapatalk Click to expand...

- Feb 1, 2022

Don40 said: Went to a presentation yesterday and the salesperson was pushing TravelUp as a great way to save on travel. They claim with the Wyndham purchase of travel and leisure the TravelUp membership will allow savings on cruise, safaris of up to 70% percent off. Has anyone used this feature. salesperson said buy more points to get enrolled, 13k for 64k CWA contract and then TravelUp is added. I could not find anything on TravelUp. Does anyone have TravelUp, and if so are the discounts worth it. Click to expand...

ILSherry said: Never buy CWA - very high maintenance and large increases in maintenance fee. Wyndham puts all of the old resorts in there - they require more upkeep. TravelUp is a 3rd party travel agency. We talked to them directly. They told us that you cannot use points/reward points to purchase travel. They are cash. Also, unless you do a lot of traveling, Owners at lower levels will not benefit much. You need to be Platinum, Founder of Presidential to get the larger discounts. Click to expand...

I assume without knowing that Wyndham indirectly gives you cash per Point. So they pay cash and deduct "X" Points from your Account.. Worldmark has something like this for Travelshare Members. For Worldmark you only get 4 cents per Credit. So it is a bad use of Credits. Also you get the best price on the day you make the Purchase. If the cost goes town too bad. Also the approximate cross value of Wyndham vs Worldmrk is 16 Wyndham Points for 1 Worldmrk Credit. So it is probably even a worse deal for Wyndham Members.

TUG Review Crew: Expert

I have seen numerous posts about Travel Up in the Facebook groups too and I am yet to see a single response from someone that has Travel Up and got some great discount using it. Personally I would assume its all the usual smoke and mirrors and not remotely worth the cost to get it.

HitchHiker71 said: The median would be [...] using basic mathematics. Click to expand...

bnoble said: This is a bit of a quibble, but you've provided the mid-point, not the median. I suspect that the distribution is not symmetric around the mid-point, and the median is in fact probably lower. Does that matter? probably not. But the pedant in me has not let that sort of thing go. Click to expand...

Deleted

chapjim said: Median is the mid-point. Half above, half below. Click to expand...

- Feb 2, 2022

bnoble said: The median is the point at which half of the “population” (in this case, contracts) are above and below. The mid point is the middle of the range. They are not the same thing. Again I know I’m being pedantic about this, but it’s an occupational hazard as a professional pedant. Click to expand...

chapjim said: The population in this case is a list of resorts and corresponding maintenance fees, sorted by maintenance fee. Take that list, find the item halfway down the list. That is the median. It is also the mid-point. Can't be anything else. Click to expand...

bnoble said: Full disclosure: I'm a professor of electrical engineering and computer science at a reputable university, so I teach statistics as part of my living in the guise of performance measurement and evaluation. I get very good teaching ratings, so I'm probably good at it. Maybe the students just like me; it is not because I am an easy A. You define the median correctly, but the median is not necessarily the mid-point of the range. I'll give you two hypothetical examples to illustrate the difference. In the first example, imagine there are a total of 9 contracts in the Wyndham universe. One is the highest: $13/K. One is the lowest: $4.5/K. The others are roughly evenly distributed, so the sorted list is $4.5, $6, $7, $8, $8.75, $10, $11, $12, $13. In this population the median is $8.75, because there are four contracts that cost less ($4.5, $6, $7, $8) and four contracts that cost more ($10, $11, $12, $13). $8.75 also happens to be the midpoint of the range [($13-$4.5)/2]+$4.5. In this example, the median and the midpoint are identical. In the second example, imagine there are a total of 9 contracts in the Wyndham universe. One is the highest: $13/K. One is the lowest: $4.5/K. The others are not evenly distributed, but instead occupy the bottom half of the range: $4.5, $5, $5.5, $6, $6.5, $7, $7.5, $8, $13. Now, the median is $6.5, because there are four contracts that cost less ($4.5, $5, $5.5, $6) and four that cost more ($7, 7.5, $8, $13). But the midpoint of the range is still $8.75, because the range is still $4.5 to $13. In this example, the median and the midpoint differ. I believe that the universe of Wyndham deeds looks more like our second example than our first example, and the MF history seems to back this up based on how I am reading it. So, while CWA's $/K cost is below the midpoint of the Wyndham $/K range, I suspect it is above the median of Wyndham deeds ordered by $/K. Click to expand...

chapjim said: So, you define mid-point as the average of the top and bottom values. Got it. I have no difficulty believing you are not an easy A! Click to expand...

Ty1on said: But he's right. midpoint isn't median. If you add the highest observation to the lowest observation and divide by two, that is the midpoint. The median is the point at which there are an equal number of observations above and below it. View attachment 46219 Similarly, in geometry, the midpoint is the point exactly halfway between the upper and lower extremities of a line. Click to expand...

Retracted, as I think I misinterpreted the response

I'd like a lesson on Average versus Weighted Average Price. Thanks. I'll give an A if it is explainable to a non-TUG/non-Timeshare idiot that I deal with.

Cyrus24 said: I'd like a lesson on Average versus Weighted Average Price. Thanks. I'll give an A if it is explainable to a non-TUG/non-Timeshare idiot that I deal with. Click to expand...

capital city

I think the point is CWA does not have the outrageous mf's that many on here say it does. Is it the best contract to own? No, not unless you need arp at several dozen resorts without actually owning contracts at these resorts. I own CWA and royal vista, royal vista is higher but CWA also gives me access at 13 months, guess which contract Ill dump first? I can get Limetree in St thomas, Daytona 500, mardi gras, etc. all at 13 months for the middle, median, midpoint (who gives a shit) mf cost

T-Dot-Traveller

- Feb 3, 2022

bnoble said: The median is the point at which half of the “population” (in this case, contracts) are above and below. The mid point is the middle of the range. They are not the same thing.Again I know I’m being pedantic about this, but it’s an occupational hazard as a professional pedant. Click to expand...

- This site uses cookies to help personalise content, tailor your experience and to keep you logged in if you register. By continuing to use this site, you are consenting to our use of cookies. Accept Learn more…

Travel + Leisure Magazine Acquired by Wyndham Destinations for $100 Million

Cameron Sperance, Skift

January 6th, 2021 at 3:26 AM EST

A timeshare company like Wyndham Destinations and a media brand like Travel + Leisure joined at the hip? It may not be as crazy as it sounds, especially if you're wanting a younger client base to join the vacation club sector.

Cameron Sperance

This pandemic world has really changed everything: The new year brings the unlikeliest of travel marriages between a timeshare company and one of the industry’s leading media brands.

Wyndham Destinations , the vacation rental and timeshare company spun off parent Wyndham Hotels in 2018, is acquiring Travel + Leisure for $100 million in cash, the company announced Wednesday morning. The timeshare and travel club company will change its name to Travel + Leisure Co. sometime in the first quarter of this year. Meredith Corp. — the media brand’s parent company — will continue to operate the media side of the company under a 30-year licensing agreement.

The acquisition is the latest in Wyndham Destinations’ ongoing push to expand the reach of its timeshare and vacation clubs into new markets and appeal to younger travelers .

“Over the past 18 months, we have laid the foundation to expand our footprint beyond our core vacation ownership business and, today, we add one of the most trusted and influential brands in travel through the acquisition of Travel + Leisure,” Wyndham Destinations CEO Michael Brown said in a statement.

The $100 million price tag shows a significant financial gain for the Travel + Leisure brand, which American Express Publishing sold in 2013 to Time Inc. in a bundle with other lifestyle publications like Food & Wine. But the sale price was so low that Time Inc. actually made a $20 million gain on its acquisition after settling a management agreement with American Express.

Meredith Corp. acquired Time in early 2018 in a $2.8 billion deal.

Wyndham Destinations paid $35 million in cash at closing with trailing payments expected to wrap no later than June 2024.

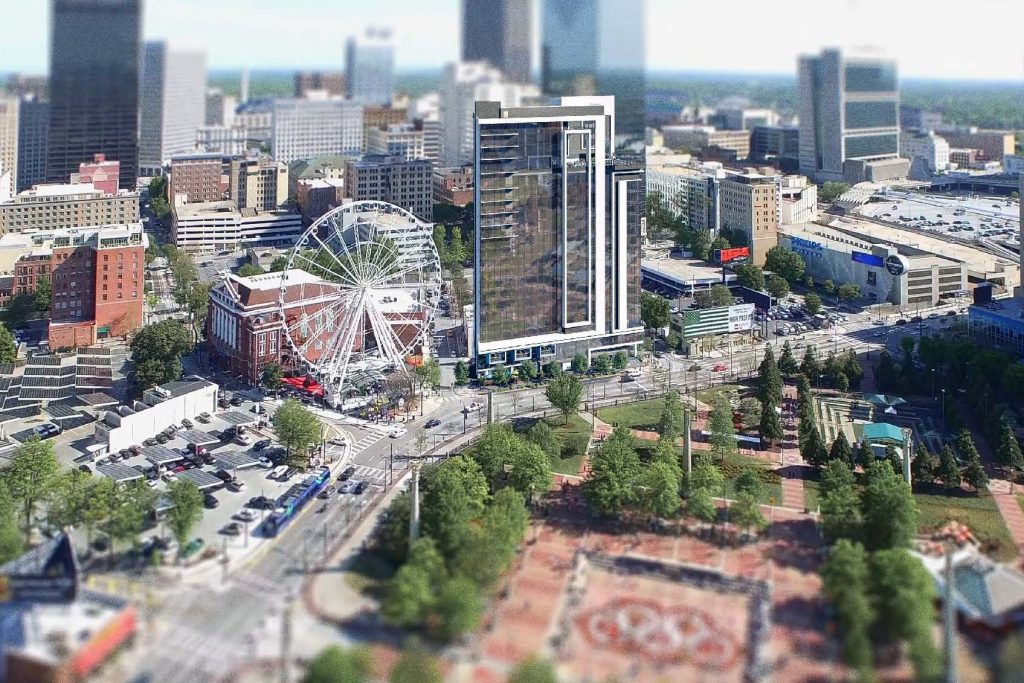

Rendering of a Wyndham Destinations resort slated for Atlanta. (Credit: Wyndham Destinations)

While the hotel industry faced its worst year on record in 2020 due to the coronavirus pandemic, industry analysts were optimistic on the timeshare sector due to its ability to offer owners and members more control over their space. Wyndham Destinations even managed to post a $40 million profit by the third quarter of last year.

Meredith Corp. reported a $289 million loss for the same quarter.

The Wyndham Destinations acquisition of Travel + Leisure appears to maintain distinct identities for both companies’ existing brands.

All Wyndham Destinations brands, including Margaritaville Vacation Club and Club Wyndham, are expected to remain through the acquisition and continue to be a part of the Wyndham Rewards loyalty program. Wyndham Destinations will become the new umbrella brand for the broader company’s vacation club resorts.

Travel + Leisure will maintain its current slate of brands and products — including the namesake magazine and “A-List” travel advisor network. The new Travel + Leisure Co. will license out the brand name to Meredith Corp. to operate the media channels.

Travel + Leisure’s Editor-in-Chief Jacqui Gifford and Giulio Capua, the brand’s publisher, will maintain their roles with the company.

Wyndham Destinations also agreed to a five-year marketing commitment across Meredith Corp.’s portfolio of media brands beyond Travel + Leisure.

“This strategic alliance brings a new, innovative approach to media brand development, and we’re excited to leverage Wyndham Destinations’ and Meredith’s respective strengths to enhance and realize Travel + Leisure’s full potential,” said Meredith Corp. CEO Tom Harty in a statement.

The deal is not expected to impact employee counts at either company. The new Travel + Leisure Co. will end up with nearly 20 brands and 230 vacation club resorts around the world. Travel + Leisure’s travel clubs, with a combined 60,000 members, are also included in the acquisition.

“The Wyndham Destinations alliance is a win-win strategy, and indicative of our interest in collaborating with industry leaders to optimize the potential of our many other powerful Meredith media brands,” John Zieser, Meredith Corp.’s chief development officer, said in a statement.

Hospitality companies leveraging a media brand to drive business is a union not entirely new to the hospitality industry. Playboy magazine’s parent company, Playboy Enterprises, operated branded nightclubs and resorts in the past.

There is even precedent within Wyndham Destinations for some degree of media marriage. Its RCI brand’s magazine, previously known as Endless Vacation magazine, had one of the travel sector’s largest circulations thanks to its distribution to two million members, according to journalism platform Muck Rack.

But the Travel + Leisure acquisition is the latest in a Wyndham Destinations development streak aimed at evolving the reputation of timeshares and vacation clubs. Brown hinted in an interview with Skift last July the pandemic would lead to growth opportunities for the company.

The company increasingly develops vacation clubs aimed at shorter stays in urban markets like Atlanta and Nashville as a way to appeal to potential younger members. Millennials in 2019 accounted for 20 percent of sales at Wyndham Destinations, the company’s fastest-growing sales demographic.

“There is still a broad misperception out there that timeshare is same unit, same week, same location, same time of the year,” Brown told Skift last year. “That’s the perception, and — broadly — timeshare now is all about flexibility. The urban city center downtown destination is the prime leading indicator that trend has changed.”

While millennials weren’t specifically mentioned as a motive to acquire the media brand, Brown did highlight Travel + Leisure’s 20 million “loyal followers” across social media platforms.

“This iconic brand, along with their authoritative content and wide audience, will help accelerate and amplify the growth of new capital-light travel businesses and services, as we take the next step in expanding our reach within the global leisure travel industry,” he said Wednesday.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus recovery , mergers and acquisitions , travel + leisure , wyndham destinations

Photo credit: Wyndham Destinations acquired the Travel + Leisure brand for $100 million, the company announced Wednesday. Tom Lowry

Wyndham Rewards

- # 1 in Best Hotel Rewards Programs

The Wyndham Rewards program caters to leisure and business travelers who visit popular destinations in the United States , Europe , Mexico , the Caribbean and Asia. As a Wyndham Rewards member, you'll earn points when you stay in any of Wyndham Hotels & Resorts ' more than 8,000 properties across several distinctive brands, including Days Inn by Wyndham, Dolce Hotels and Resorts by Wyndham, La Quinta by Wyndham, Ramada by Wyndham and Wyndham Grand. Wyndham Hotels & Resorts' alliance with numerous air carriers – such as American Airlines and United Airlines – also allows you to earn miles or points with those rewards programs on Wyndham hotel stays. You can earn points on car rentals, too, thanks to Wyndham's partnerships with Avis and Budget. Wyndham Rewards also has a partnership with Caesars Entertainment 's Caesars Rewards, allowing all members to link accounts and earn and redeem points at Caesars properties; meanwhile, elite members can match status. Additionally, you can earn rewards points on hotel and everyday purchases if you have one of three Wyndham Rewards Earner Visa credit cards . Earned points can be used for hotel stays, vacation rentals, flights, tours and activities, gift cards and retail purchases.

Pros & Cons

More than 8,000 participating properties worldwide

Qualifying nights can roll over into the following year, making higher status easier to obtain

Free stays at all-inclusive properties cover meals, drinks and amenities for up to two guests

Can take six to eight weeks for partner rewards to be processed

Brand has limited number of high-end properties

Membership perks are minimal until Diamond status

Wyndham Rewards is ranked No. 1 in the Best Hotel Rewards Programs. U.S. News evaluated 15 loyalty programs associated with major hotel brands across several indicators of excellence. Read more about how we rank rewards .

Wyndham Rewards is ranked as:

- Property Diversity » 4.4

- Geographic Coverage » 4.8

- Ease of Earning Free Night » 5.0

- Additional Benefits » 5.0

- No. of Hotels » More than 8,000

The Wyndham Rewards program awards points that can be redeemed for free hotel stays, airline tickets, retail purchases, tours and activities, car rentals and gift cards. You can earn points every time you stay at a participating Wyndham Hotels & Resorts property. You'll also have the option to collect points through the company's partners and on everyday purchases made with your Wyndham Rewards credit card.

Points Can Expire

Can Earn Points On:

Hotel Stays

Credit Card

Can Use Points On:

Booking Hotels

Room Upgrades

Membership Levels

The Wyndham Rewards program is divided into four levels: Blue, Gold, Platinum and Diamond.

Travelers can achieve these levels with qualifying nights booked directly with Wyndham. Once you qualify for a status level, you will hold that status for the remainder of that year and for the following calendar year. If you do not meet the requisite number of nights in year two, your membership status will expire on Jan. 1 of the third year after you obtained that status.

Status shortcuts: By signing up for the Wyndham Rewards Earner Card , you'll receive complimentary Gold status for no annual fee. The Earner Plus card ($75 annual fee) offers complimentary Platinum status, and the Earner Business card ($95 annual fee) grants automatic Diamond status.

The Fine Print

- Wyndham Rewards points expire after four years of account inactivity.

- Blackout dates may apply to rewards reservations at select properties.

- The number of miles you can earn or redeem per trip through partner airline programs varies by membership level.

- Free stays count toward qualifying nights for earning status but do not accumulate points.

- You can purchase up to 60,000 points in 1,000-point increments each year.

You Might Also Like

Delta SkyMiles

The Delta SkyMiles program is convenient for frequent flyers based in United …

Marriott Bonvoy

The Marriott Bonvoy program accommodates both business and leisure travelers …

Sonesta Travel Pass

Sonesta Travel Pass caters to travelers looking for a rewards program that …

Best Hotel Rewards Programs

- #1 Wyndham Rewards

- #2 Choice Privileges

- #3 Marriott Bonvoy

- #4 World of Hyatt

- #5 IHG One Rewards

If you make a purchase from our site, we may earn a commission. This does not affect the quality or independence of our editorial content.

Travel + Leisure Readers' 500 Favorite Hotels and Resorts in the World

These properties scored the highest in Travel + Leisure's most recent World's Best Awards survey.

Sometimes a hotel is so special that it becomes a destination in its own right. If you’re on the hunt for a property worth planning a trip around, look no further than the T+L 500, our annual list of the hotels and resorts our readers love the most.

Drawn from the results of the World’s Best Awards survey (voted on by our readers), these 500 top scorers deliver the bucket-list locations, outstanding design, and exceptional service our readers want to return to time and time again.

The honorees are grouped into eight geographic regions: Africa and the Middle East; Asia; Australia, New Zealand, and the South Pacific; Canada; the Caribbean; Europe; Mexico, Central America, and South America; and the United States.

Below, we highlight 10 properties that embody all of the spectacular charm and amenities one might look for when planning their next dream vacation. You can read the full T+L 500 list in Travel + Leisure 's May 2024 issue, on newsstands today, or digitally on Apple News+.

Etéreo, Auberge Resorts Collection

The name Etéreo , Spanish for “ethereal,” accurately describes this rejuvenating resort on Mexico's Riviera Maya. Known for its elevated restaurants, excellent Sana spa, gorgeous views of the Caribbean Sea, and nearby cenotes , it’s no surprise this property is a family favorite, appealing to multiple generations.

Montage Los Cabos

Located on Santa Maria Bay in Los Cabos, Mexico, Montage Los Cabos has 122 guestrooms, suites, and casas, as well as 52 residences. Here, you’ll find fresh Baja-inspired cuisine — and, if your timing is right, the annual grey and humpback whale migration.

Kokomo Private Island Fiji

A quick 45-minute flight from Nadi International Airport gets you to Kokomo , a private island resort in Fiji. Unspoiled and wildly luxurious, this secluded escape has some of the best diving and snorkeling around the world’s fourth largest reef.

Four Seasons Hotel Istanbul at the Bosphorus

With a European address that overlooks Asia, this Four Seasons Hotel holds a unique position along the Bosphorus Strait. After a busy day of shopping in one of Istanbul’s trendiest neighborhoods, the heated outdoor pool is the perfect place to wind down and relax the senses.

Six Senses Douro Valley

The restored 19th-century manor in Lamego, Portugal has 71 guest rooms with panoramic views of the Douro river, private balconies, and wooden bridges leading to tranquil, secret gardens.

Grace Hotel, Auberge Resorts Collection

This top 10 best resort in Europe, according to our 2023 World’s Best Awards, lies in the heart of Santorini’s Imerovigli village. Whether you’re in the infinity pool or in the comfort of your private villa, it’s impossible to miss the bright orange sunset that sets its light over the Aegean Sea.

The Ritz-Carlton Maui, Kapalua

Deeply rooted in Hawaiian history, The Ritz-Carlton Maui , which underwent a $100-million renovation last year, centers its design around the location’s culture and maintains the nearby Honokahua Preservation Site (a recognized wahi pana , or sacred site, where about 2,000 Hawaiians were buried between 610 C.E. and 1800 C.E.).

Nayara Tented Camp

If you’ve ever been to La Fortuna, Costa Rica, you know it's one of the most magical natural places in the world. At Nayara Tented Camp , not only can you revel in the surrounding biodiversity with highly trained naturalist guides, but after a busy day of sightseeing, you can return to your spacious tent with a private pool fed by the volcano’s mineral hot springs.

The Little Nell

Aspen’s only ski-in, ski-out hotel has 92 rooms, a new luxury spa, two restaurants, three bars, extraordinary mountain views and, you guessed it — all things après-ski.

White Barn Inn, Auberge Resorts Collection

Drive 90 minutes north of Boston to Kennebunkport, Maine, to find the effortlessly cozy and elevated White Barn Inn . Roomy waterfront cottages await with a fireplace, a large living area, and direct access to the heated infinity pool.

For more Travel & Leisure news, make sure to sign up for our newsletter!

Read the original article on Travel & Leisure .

Press Releases

Travel + Leisure Co. and Allegiant Announce Multi-Year Marketing Agreement

ORLANDO, Fla.--(BUSINESS WIRE)-- Travel + Leisure Co. (NYSE:TNL) and Allegiant (NASDAQ: ALGT) announced a multi-year marketing agreement, allowing both companies to grow their customer engagement through cross-company promotion.

The two travel companies will share promotional offerings to each other’s customers, providing offers to a broad spectrum of travelers. Allegiant, with more than 15 million Allways Rewards members, and Travel + Leisure Co., with more than 800,000 vacation ownership members and 3.5 million vacation exchange members, will each benefit from a highly engaged base of travelers.

“With more than 100 Club Wyndham and WorldMark vacation ownership resorts within 50 miles of an airport served by Allegiant, we have a highly complementary customer base who shares the desire for affordable family vacations,” said Scott Cavanaugh, vice president of strategic partnerships for Travel + Leisure Co. “This marketing agreement will allow us to accelerate growth by offering unique travel packages desired by our customers.”

Allegiant’s leisure-focused business model builds its schedule around vacation seasons, making air travel to world-class destinations convenient and affordable. The Las Vegas-based airline operates more than 550 routes in 125 cities across the United States, connecting vacationers to the people and places that they love most. The airline also owns Sunseeker Resort Charlotte Harbor, a hotel in Southwest Florida that features 785 rooms and premier amenities including world-class restaurants, a spa and a championship golf course.

The airline’s national award-winning loyalty program, Allways Rewards, is popular among customers for its simplicity in accruing and redeeming points on everything from airfare to hotel stays.

“At Allegiant, we believe that leisure travel is more than just reaching a destination. It’s about creating exceptional moments and lasting memories for our customers,” said Scott DeAngelo, Allegiant’s chief marketing officer. “Travel + Leisure shares the same vision, which makes them a perfect partner for us. We’re excited to work with them to enhance travelers’ vacation experiences.”

About Travel + Leisure Co.

As the world’s leading membership and leisure travel company, Travel + Leisure Co. (NYSE:TNL) transformed the way families vacation with the introduction of the most dynamic points-based vacation ownership program at Club Wyndham , and the first vacation exchange network, RCI . The company delivers more than six million vacations each year at 245+ timeshare resorts worldwide, through tailored travel and membership products, and via Travel + Leisure GO - the signature subscription travel club inspired by the pages of Travel + Leisure magazine. With hospitality and responsible tourism at the heart of all we do, our 19,500+ dedicated associates bring out the best in people and places around the globe. We put the world on vacation. Learn more at travelandleisureco.com .

Allegiant – Together We Fly™

Las Vegas-based Allegiant (NASDAQ: ALGT) is an integrated travel company with an airline at its heart, focused on connecting customers with the people, places and experiences that matter most. Since 1999, Allegiant Air has linked travelers in small-to-medium cities to world-class vacation destinations with all-nonstop flights and industry-low average fares. Today, Allegiant serves communities across the nation, with base airfares less than half the cost of the average domestic roundtrip ticket. For more information, visit us at Allegiant.com . Media information, including photos, is available at http://gofly.us/iiFa303wrtF

View source version on businesswire.com: https://www.businesswire.com/news/home/20240423951983/en/

Steven Goldsmith Travel + Leisure Co. Public Relations (407) 626-3830 [email protected]

Allegiant Phone: 702-800-2020 Email: [email protected]

Source: Travel + Leisure Co.

Released April 23, 2024

Press Contacts

Contact our media contacts regarding any press related questions or needs.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest news

- Stock market

- Premium news

- Biden economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal loans

- Student loans

- Car insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Q1 2024 wyndham hotels & resorts inc earnings call, participants.

Geoffrey A. Ballotti; President, CEO & Director; Wyndham Hotels & Resorts, Inc.

Matt Capuzzi; SVP of IR; Wyndham Hotels & Resorts, Inc.

Michele Allen; CFO & Head of Strategy; Wyndham Hotels & Resorts, Inc.

Alex Brignall; Partner of Transport & Leisure Research; Redburn (Europe) Limited, Research Division

Brandt Antoine Montour; Research Analyst; Barclays Bank PLC, Research Division

Charles Patrick Scholes; MD of Lodging, Gaming and Leisure Equity Research & Analyst; Truist Securities, Inc., Research Division

Dan Wasiolek; Senior Equity Analyst; Morningstar Inc., Research Division

Dany Asad; VP & Research Analyst; BofA Securities, Research Division

David Brian Katz; MD and Senior Equity Analyst of Gaming, Lodging & Leisure; Jefferies LLC, Research Division

Isaac Arthur Sellhausen; Research Analyst; Oppenheimer & Co. Inc., Research Division

Joseph Richard Greff; MD; JPMorgan Chase & Co, Research Division

Meredith Jane Prichard Jensen; Senior Analyst of Consumer; HSBC, Research Division

Michael Joseph Bellisario; Director and Senior Research Analyst; Robert W. Baird & Co. Incorporated, Research Division

Stephen White Grambling; Equity Analyst; Morgan Stanley, Research Division

Steven Donald Pizzella; Research Analyst; Deutsche Bank AG, Research Division

Presentation

Welcome to the Wyndham Hotels & Resorts First Quarter 2024 Earnings Conference Call. (Operator Instructions) I would now like to turn the call over to Mr. Matt Capuzzi, Senior Vice President of Investor Relations. Please go ahead, sir.

Matt Capuzzi

Thank you, operator. Good morning, and thank you for joining us. With me today are Geoff Ballotti, our CEO; and Michele Allen, our CFO and Head of Strategy. Before we get started, I want to remind you that our remarks today will contain forward-looking statements. These statements are subject to risk factors that may cause our actual results to differ materially from those expressed or implied. These risk factors are discussed in detail in our most recent annual report on Form 10-K filed with the Securities and Exchange Commission and any subsequent reports filed with the SEC. We'll also be referring to a number of non-GAAP measures. Corresponding GAAP measures and a reconciliation of non-GAAP measures to GAAP metrics are provided in our earnings release, which is available on our investor relations website at investor.wyndhamhotels.com. We are providing certain measures discussing future impact on a non-GAAP basis only because without unreasonable efforts, we are unable to provide the comparable GAAP metric. In addition, last evening, we posted an investor presentation containing supplemental information on our investor relations website. We may continue to provide supplemental information on our website and on our social media channels in the future. Accordingly, we encourage our investors to monitor our website and our social media channels in addition to our press releases, filings submitted with the SEC and any public conference calls or webcasts. With that, I will turn the call over to Geoff.

Geoffrey A. Ballotti

Thanks, Matt, and thanks, everyone, for joining us this morning. Despite a challenging RevPAR environment here in the United States, we're pleased to report another strong quarter of progress on our executions, openings, retention and net room growth around the world. In addition, late last week, our Board increased our share repurchase authorization by $400 million, demonstrating its confidence in our ability to generate significant cash flow and its commitment to continued shareholder returns in the year ahead. We opened over 13,000 rooms globally, 27% more rooms than we opened last year, our largest first quarter of room openings since going public nearly 6 years ago. We increased our franchisee retention rate by 30 basis points versus the same time last year to 95.6%. We delivered a record 3.7% increase in net room growth and most importantly, for the 15th consecutive quarter, we grew our development pipeline by 8% to a record 243,000 rooms. Here in the United States, we again saw both sequential and year-on-year improvement driven by 3.3% system growth in the more revenue-intense midscale and above segments. We added 50 hotels domestically, including 11 hotel conversions under the newly created WaterWalk Extended Stay by Wyndham brand, located in key markets such as Charlotte, Raleigh, Tucson and Jacksonville, WaterWalk by Wyndham adds higher fee PAR hotels to our system while expanding our portfolio into the upscale extended stay segment, complementing our new construction ECHO Suites and midscale Hawthorn Suites Extended Stay brands. Internationally, we increased net rooms by 1% sequentially and by 8% versus prior year. Our Latin America team drove over 2% of sequential net room growth and 6% of net room growth versus prior year, adding significant conversions from competitive brands like the 600-room Wyndham São Paulo Convention Center Hotel and the financial capital of Brazil along with the new Tryp by Wyndham Asunción steps from the renowned shopping centers of Paraguay's capital city. Our EMEA team, which added 49% more rooms to its development pipeline than they did in the first quarter of 2023, once again grew net room sequentially and by 12% versus prior year, adding aspirational hotels like the Ramada Sapanca Thermal Resort in Turkey and the new trademark by Wyndham H2 Hotel in Downtown Vienna, Austria. Last month, I had the opportunity to visit with our teams in Singapore and Shanghai and joined the signing ceremonies for 27 of the over 60 hotel contracts awarded to owners this quarter across Asia Pacific. Our Southeast Asia and Pacific Rim region, which increased rooms by 2% sequentially and by 16% versus last year, entered several new markets, including Pattaya, a growing leisure destination in Thailand. In January, we opened the Wyndham John Tien, an upscale new construction hotel in the first of another 8 hotels we expect to open in the Pattaya market over the next 5 years. And our direct franchising team in China, which grew net rooms 1% sequentially and by 13% versus prior year, also had another strong quarter of openings and executions, awarding 38 new contracts to owners, over 3x what they awarded last year in the first quarter and opening new construction and conversion hotels across the country, like the Wyndham Dalian Jinpu, an upper upscale 5-star hotel in the City Center of Henan Province. Globally, our teams awarded 171 contracts for approximately 24,000 room additions. Domestic contracts signed in the first quarter were 50% higher than last year for our midscale and above segments and international Q1 signings increased by 80% year-over-year. This acceleration of our development activity grew our pipeline to a record 243,000 rooms and nearly 2,000 hotels. Midscale and above brands in the pipeline increased 4% to a record 168,000 rooms and now represent nearly 70% of our pipeline. Our domestic pipeline for midscale and above brands increased by 4%, and the pipeline for our highest international RevPAR regions of EMEA and Latin America increased by 21%. In the toughest quarterly comp we will face all year, domestic RevPAR finished down 5% compared with 2023. Domestic occupancy finished at 90% of 2019 levels, down 440 basis points from Q1 of 2023, while pricing power remained strong with ADRs 14% higher than pre-COVID levels yet still trailing inflation, which has increased 23% over the same period. RevPAR improved 240 basis points from February into March and accelerated into April. Month-to-date through the 20th of April, domestic RevPAR ran 4% ahead of year, benefiting from both the Easter shift to Q1 and weekend demand around the solar eclipse on April 8. And May revenue on the books is pacing 7% higher than it was at the same time last year. International RevPAR increased 14% to prior year in constant currency, driven by strength in Latin America, where RevPAR increased by 41%, and across EMEA, where RevPAR increased by over 10% and in China, which continues to face deflationary pressures, RevPAR also increased by over 10% year-over-year, driven by both ADR and occupancy, outpacing STR China RevPAR growth by 700 basis points. Ancillary revenues increased 8% during the first quarter, driven by success from our Blue Thread licensing agreement with Travel + Leisure group along with several new product offerings like our paid $95 Wyndham Rewards earner Business Card, which has garnered a claim as Forbes Best Business card for Road Warriors, thanks to its automatic diamond status, and its ability to earn a best-in-class 8 points for every $1 spent on hotel stays and gas purchases. And last week, we launched Wyndham Business to streamline the direct booking process for business of all types and all sizes along with travel planners who are contracting hotel nights for our nation's 15 million infrastructure workers across the United States of America, offering these planners a comprehensive suite of free tools that guarantee their companies a minimum 10% room discount, easy direct billing and instant group bookings with tailored Wyndham Rewards business to ensure a smooth travel planning process with personalized support from dedicated sales professionals. We anticipate that Wyndham business will not only drive additional bookings to our select service hotels, it will also drive additional membership to Wyndham Rewards USA TODAY's #1 loyalty program for 6 years running, along with additional cardholders to our suite of co-branded credit card products, providing us a new channel for ancillary fee growth. We're currently offering 4 distinct credit card products tied to Wyndham Rewards in the U.S. and we see significant opportunities to expand these products globally as Wyndham Rewards continues to grow in importance both domestically and internationally, up over 40% since 2019 and up 7% year-over-year to 108 million members strong. Finally, we'd like to thank our franchisees and team members for their unwavering commitment and support over the past months throughout Choice's failed takeover attempt of our company. Through it all, it was no surprise to see Wyndham Hotels and Resorts selected by Newsweek as one of the 2024 most trustworthy companies in America and is a 4-time honoree as one of the 2024 World's most ethical companies by Ethisphere. On behalf of our Board, we also want to thank our shareholders for their overwhelming support. We're confident in our growth strategy and in our ability to create substantial value both in the short term and in the long term. And with that, I'll now turn the call over to Michele. Michele?

Michele Allen

Thanks, Geoff, and good morning, everyone. I'll begin my remarks today with a detailed review of our first quarter results. I'll then review our cash flows and balance sheet, followed by our outlook. Before we begin, let me remind everyone that the comparability of our quarterly results is impacted by the timing of our marketing fund spend as discussed back on our February call. In the first quarter this year, marketing fund expenses exceeded revenues by $14 million, as expected, compared to expenses exceeding revenues by $4 million in the first quarter of last year. To enhance transparency and provide a better understanding of the results of our ongoing operations, I will be highlighting our results on a comparable basis, which neutralizes the marketing fund impact. In the first quarter, we generated $304 million of fee-related and other revenues and $141 million of adjusted EBITDA. Fee-related and other revenues declined $4 million year-over-year, reflecting a 4% decline in royalties and franchise fees and a 3% decline in marketing revenues. These declines were partially offset by an 8% increase in ancillary fee streams. The decline in royalties and franchise fees primarily reflects lower RevPAR in the U.S. and the lapping of our highest quarter of other franchisees, both of which were partially offset by a larger global system and international RevPAR growth. Ancillary revenues reflect higher license fees and credit card revenues as well as the effects of strategic marketing partnerships driven by initiatives that harness the power of our Wyndham Rewards loyalty program. Adjusted EBITDA grew 3% on a comparable basis, and our adjusted EBITDA margin improved 250 basis points to 83%. First quarter adjusted diluted EPS was $0.78, up 1% on a comparable basis, reflecting adjusted EBITDA growth as well as benefits from our share repurchase activity, which were partially offset by higher interest expense. During the first quarter, we executed $275 million of new forward starting interest rate swaps on our Term Loan B facility, which will begin in fourth quarter 2024 and expire in fourth quarter 2027 at just under 3.4%. As a result, nearly all of our Term Loan B is now swapped through the end of 2027 at a blended fixed rate of 3.3%, more than 200 basis points lower than current SOFR levels. Free cash flow before development advances and transaction costs was $102 million, up 5% year-over-year, primarily reflecting adjusted EBITDA growth. Development advance spend increased $18 million year-over-year, reflecting our ongoing efforts to capitalize on opportunities in the competitive landscape, particularly in attracting higher fee PAR properties to our system across the globe. We returned $89 million to our shareholders in the first quarter through $57 million of share repurchases and $32 million of common stock dividends. We ended the quarter with over $580 million in total liquidity, and our net leverage ratio of 3.4x was in the lower half of our target range. We are planning to finish the year at a net leverage ratio of at least 3.5x, which provides over $400 million of capital available for share repurchases this year, or 7% of our outstanding shares at recent price levels. Additionally, depending upon the availability and actionability of M&A opportunities, we could increase our leverage to 4x, which will provide us with over $750 million of available capital, which would equate to 13% of our outstanding shares. And with the Board's recent approval of an additional $400 million in share repurchase authorization, we now have nearly $800 million available under the program. Turning now to outlook. We're increasing our adjusted diluted EPS projection by $0.07 to a range of $4.18 to $4.30 to account for our first quarter share repurchase activity. This outlook is based on a lower diluted share count of 81.6 million shares and, as usual, excludes any future potential share repurchase activity. Our outlook for RevPAR remains unchanged. You'll recall from our February call that we expected a challenging comp in the first quarter with gradual improvement moving throughout the remainder of 2024. Last year, in the second quarter, we began to see a shift in travel patterns as COVID restrictions were lifted. Cruise and inexpensive air travel to destinations like Mexico and the Caribbean opened back up, while domestic leisure and drive-to hotels experienced demand declines, especially along the coast. We saw domestic RevPAR gradually deteriorate in 2023, starting modestly at down 1% in the second quarter and then deepening to down 4% by year-end. We are now beginning to lap these effects. Geoff already touched on some of the improving trends that we began seeing in March, April and May. When combining these recent trends with our expectation of incremental infrastructure capture, as we move into the second half of the year and strong positive growth internationally, we continue to expect full-year global RevPAR growth of 2% to 3% this year. There are also no changes to our expectations for the marketing funds. For Q2, we expect the funds to overspend by $5 million to $10 million bringing the first half overspend to approximately $20 million, which we then expect will reverse in the back half of this year. Combined with the $7 million we recorded during 2023, we now expect costs relating to Choice's failed takeover attempt to approximate $50 million in total, down from the previous $75 million estimate. The vast majority of this amount will be paid out in the second quarter and remember that these costs are excluded from our 2024 outlook. In closing, our first quarter results reflect strong execution on our growth strategy despite softer industry-wide RevPAR in the U.S. We continue to accelerate net room growth and pipeline growth. We generated significant ancillary fee growth and improved operating margins, driving incremental earnings growth. And we continue to generate significant cash, while maintaining a strong balance sheet with ample leverage capacity to further enhance shareholder returns over the remainder of the year. With that, Geoff and I would be happy to take your questions. Operator?

Question and Answer Session

(Operator Instructions) We'll go first this morning to Joe Greff of JPMorgan.

Joseph Richard Greff

Geoff, Michele, I know you talk to your developers and developer community frequently. I would love to hear from you about some of your recent conversations that you had with them, particularly after March 11, the date that Choice decided to stop the pursuit of buying you. Are you seeing or are they communicating to you an acceleration or a pivot with respect to development so whatever pause you may have seen, has that reversed? And is there anything within these conversations that may be more brand-specific or conversion-specific that you would call out? And just my last follow-up question with respect to this topic is, is it fair to think that start to really pick up and accelerate now and maybe you're kind of closer to the 4%, the higher end of your net rooms growth target for the year versus the midpoint? And that's all for me.

Yes. Thanks, Joe. Absolutely. We are seeing a lot less uncertainty out there in the development community. We are talking to our franchisees, obviously, daily. Our teams had great successes, I think, was your question last quarter on the first question off. In terms of could last quarter have been better, we had a great fourth quarter, a record full year of openings. And we've had, again, our largest first quarter of openings since going public 6 years ago. But certainly, to your question with the deal noise dissipating, owners who are uncertain on committing to deals with us, those who did not want to wind up in the Choice system have agreed to sign. And I think there's no better example of that than the dozen WaterWalk conversions that we did this month. So yes, I mean, the conversations, the trend, the pause, if there was one out there, has reversed, and we're certainly seeing a lot more activity on both the conversion and the new construction signing front. Our teams had a really good quarter, not only on the conversion side, our conversion room openings from a signing standpoint were up over 20% I believe in the quarter, but new construction executions were also up. They were up double digits, up over 20%, I think, versus the first quarter and even back before COVID. And so -- yes, we're really positive with the tenor of conversations that are going up there with our franchise development teams and any uncertainty that was out there in terms of doing business with us has certainly gone away.

And then with respect to maybe the higher end of net rooms growth is more reasonable than sort of the midpoint?

Sure, look, I mean, we're really feeling good right now about -- we've taken our 2% to 4% up to 3% to 4% as you've seen, and we've just finished the first quarter with a 3.7% net room growth and believe we're firing on all cylinders. The other piece of that, of course, is retention, and we're making just great progress. I mean, we've always said that moving our retention up a point moves our net room growth up a point, and our retention continues to improve both domestically and internationally. We've moved, over the last few years since going public, from 93% to over 95%, and we had this quarter, domestically, a retention improvement of -- I believe it was 20 basis points year-over-year. And internationally, our retention improved 30 basis points. So that 2% to 4% net room growth target that's been increased to 3% to 4% with the first quarter at 3.7%, our highest quarter ever, gives us confidence to continue to move that number higher.

We go next now to David Katz of Jefferies.

David Brian Katz

Pursuant to the subject of NUG, I wanted to go just a little bit further. One of the things we've been seeing and I think the deal that you included in your announcement exemplifies it where we're seeing some affiliate type deals. Can we just talk more about the NUG environment generally? Should we be seeing more of those kinds of deals? And give us a little bit of understanding about the revenue intensity of those kinds of deals because it seems to be more than just yourselves more of an industry trend.

Sure. I mean, I think if you look at our pipeline, what you continue to see, David, is it be weighted more to upscale and higher RevPAR brands like WaterWalk, which I'll talk about in a second. I mean, if you look at our openings this quarter, we'll always be leading in the economy segment, but when it comes to the midscale and above segments, our opens in the first quarter, midscale, upper midscale, upscale, they were up 30%. Our executions in terms of what our teams are selling was more in that revenue intense segment. It was up 70% year-over-year in terms of executions. And you're seeing that reflected certainly as we've laid out in our IP, in our pipeline, our midscale and above pipeline in the more revenue-intense segments, which not only have a higher fee PAR attached to them, but they also have a higher royalty fee, ability to drive that royalty fee higher has gone up. In terms of WaterWalk, that's a conversion straight franchise agreement with -- that we're very, very excited about. It's a relationship with a really strong upscale brand in the more revenue intense segments with a great pedigree. It's led by the very motivated granddaughter of the late Jack DeBore, who I think many on this call know he was the founder of Residence Inn and Summerfield and Candlewood Suites and just run by a very experienced group of developers. Jim Anhut 20-year IHG veteran, Jim Mrha, 35-year Marriott and MGM veteran and Jim Strawn, who is the President of WoodSpring. These guys have built a dozen really great upscale hotels in some great markets that we talked about in the script. I mean, if you look at the cover of Matt's IP, which you put out last night, you see a picture of one of those revenue-intense hotels, which the WaterWalk by Wyndham Boise, which just received 9 out of 10 star reviews on most of the online review sites. So this is a great upscale complement to our economy and midscale extended stay product. It's both new conversion and -- new construction and conversion opportunities for us and for our teams out there talking to owners of older upscale Gen 1 extended stay brands that are facing PIP requirements. It does not have a pipeline today, but we expect to build one. Our extended stay supply is underserved and demand is building. So our franchise sales teams will look to grow this brand aggressively. And it adds an upscale, extended stay brand for us to sell that we haven't had to sell previously. And a final point of your question, are there more deals like that out there for us to do, absolutely.

So as the follow-up, right, just, Michele, going back to part of your commentary about the potential of reaching 4x leverage. We're always, obviously, listening with a high degree of scrutiny. Does that mean that there are maybe some things in the offing that we should just keep in mind and prepare ourselves for the remainder of this year? Or was that just setting some boundaries?