Assurance Voyage en ligne - Allianz Travel

Sourds & malentendants

Assistance médicale, déclarer un sinistre, nos produits, assurance vacances (option annulation), assurance multi voyages, 🕒 délai de souscription du contrat.

Un espace 100% digital pour gérer vos contrats

Pourquoi choisir allianz travel, anticiper les frais médicaux à l’étranger grâce à la souscription à une assurance voyage.

Qu'est ce qu'une assurance voyage ?

Pourquoi ai-je besoin d'une assurance voyage ?

Quand et comment souscrire à un contrat d’assurance voyage ?

Les contrats et assurances vacances présentent-ils les mêmes garanties que les assurances proposées avec ma carte bancaire ?

Qu'est ce que comprend la garantie annulation ?

En quoi consiste la garantie Assistance et rapatriement médical ?

Qu'est ce que l'avance et prise en charge des frais médicaux ?

Qu'est ce que le service Téléconsultation voyageur

Qu'est ce que l'interruption de séjour ?

Qu'est ce que la couverture bagages / effets personnels ?

Qu'est ce que la garantie Vol Manqué ?

Qu'est ce que la garantie Retard de Transport ?

Qu'est ce que la garantie de rachat de franchise de votre véhicule de location ?

Qu'est ce que la garantie Responsabilité Civile à l'étranger ?

Destinations

Nos conseils pour un voyage en toute tranquillité

Accident à l'étranger : comment s'organise votre rapatriement ?

Obtenir son visa pour l'Australie

Les risques sanitaires en Thaïlande

Mon devis en ligne

Nous vous accompagnons.

Client login

Trusted Travel Insurance. Nearly 30 Years of Expertise.

Medical, Trip Cancellation and Interruption, and Baggage Protection Insurance: Tour+Med covers travelling Canadians of all ages.

Get 24/7 support anywhere around the world, plus access to our network of medical experts.

Latest News

The Early Bird Discount is Here!

Only 30 DAYS of stability for pre-existing conditions!

We're hiring!

Get the best travel insurance for your trip, get a quote.

More information

Make a claim

Read about our travel insurance products, contact emergency assistance, traveling with peace of mind..

Tour+Med has been providing travel insurance to Canadians of all ages for almost 30 years.

We are a trusted name among Snowbirds, but our competitive premiums, comprehensive coverage, and personalized approach meet the needs of all types of Canadian travellers.

Take advantage of our global network of medical experts.

Travel confidently!

Why choose Tour + Med

Travel insurance specialists.

Our experts take the time it takes to provide advice and answer your questions.

Personalized coverage

We customize your coverage so it suits your needs.

We are here for you, every step of the way

We are by your side at all times; from your purchase to your claim, including assistance.

Simple and clear

We simplify processes and documents to help you understand the insurance you are buying.

Testimonials

Thanks for all your help in the past months. Special thanks to (employee from Claims Services), who always was respectful, caring, knowledgeable and responsive. We have passed on your company name to everyone we talk to regarding emergency medical & travel insurance.

We have had Tour-Med for the last 7-8 years.

And …yes… we did had an expensive claim:

- service was EXCEPTIONAL

- response and attention to detail was IMPECCABLE

- claims payments were PROMPTLY made…NO HASSLES…they paid and delivered EXACTLY what they promised.

- have NOT had a premium increase due to the 2 claims as far as we can tell.

- after discharge from hospital, they followed up with us to find out if anything was still standing and how we were doing.

They are not the cheapest nor most expensive but we FULLY endorse their policies.

We sent our documents for cancellation of our trip and received the refund in less than 10 days. Extraordinary service. I will deal with Tourmed again.

I unfortunately had a motor bike accident in Utah in July, 2023. I was severely injured and spent a week in the hospital. I received EXCELLENT care and was 'medevact' to my home in BC on a private jet with two medical attendants..I can only imagine the cost for all this as all the bills were paid for by Tour+Med. Any bills I did receive I simply forwarded to them for payment. No questions asked! I UNEQUIVOCALLY recommend Tour+Med!! Choosing Tour+Med as my insurer saved my life and my retirement pension!! With gratitude, R.R.

We received a letter last week informing us that my husband's invoice from the hospital in Florida had been paid. This email is to say THANK YOU for the excellent service. We received professional service from the beginning. Every time we had a call, the first thing that was asked is how we were doing, and it feels good to see that human service still exists. We won't go away for long periods anymore due to (our age and) what happened this year, but rest assured, we will recommend you to our friends and family.

I received your letter dated July 4, advising me that TourMed had paid my hospital bill after my incident in Arizona in April. I can’t tell you how relieved I am to know that was covered! I thank you so much!

To give you a little background of the incident… there were 12 of us exploring the desert beauty in the area South of Florence, when we were all attacked by a huge swarm of Africanized honey bees (more commonly known as ‘killer bees’). We were all stung, but I seemed to be the worst. In my hospital stay, they told me they had removed over 500 stingers from my body, primarily my back, chest, face and scalp. The bees were in my nose, ears, and mouth. I was intubated and airlifted to the trauma centre where I was treated for 5 days. I am still not 100%, but a little better everyday. We have all been wary of scorpions and rattlesnakes in the desert, but not these bees!

I am very lucky to have survived this incident, and I truly believe the quick response from the medical team that treated me played a huge part in my survival. I am so very grateful to all involved in my ongoing recovery from this horrific ordeal.

Read our blog article about this medical emergency.

Thank you for your prompt handling of my request. It's very nice to see something go through so smoothly!

I had a medical problem arise while on holidays in Texas and required an emergency hospital visit. The LS-Travel Company far exceeded my expectations. Everyone that my husband or I spoke with at LS-Travel was amazing and I deeply appreciate how efficient my claim was handled. I would highly recommend this company for your travel insurance needs and am truly grateful to all the helpful kindness that your team provided. Thank you from the bottom of my heart.

My wife was hospitalized and needed to be repatriated to Canada in an air-ambulance. You were there at all times during this ordeal and showed great sollicitude.

You show empathy and do exceptional work. We greatly appreciate your professionalism.

I want to thank you for dealing with my medical claim so quickly and efficiently. The online claims process was simple and easy to understand. It took very little time. Impressive! I will recommend your company to my friends.

Already a client?

Visit the client portal to view your policy documents, print your tax receipts, change your dates, inform us of your new address, and much more!

Travel Advice & Blog

Things to do in maine: complete guide for a successful trip, 6 must-see places for rvers in canada, high blood pressure and travel insurance: everything you need to know to travel well-covered with hypertension, head office and customer service.

247, boulevard Thibeau Trois-Rivières (Québec) G8T 6X9

Telephone, toll free:

1 877-344-8398

819-377-3587

Emergency medical assistance

A bilingual team available 24 / 7 anywhere around the world!

E.U. and Canada:

1 844 820-6588

1 888 820-6588

1 819 377-2241

Subscribe to our newsletter

Be one of the first to know when something is up! Subscribe now.

Tour+Med is insured by

© 2024 Tour+Med. All rights reserved.

Assistance médicale d'urgence en voyage

Une équipe bilingue disponible 24 / 7 de partout dans le monde!

E.U. et Canada :

001 888 820-6588

Frais virés :

001 819 377-2241

A bilingual team available 24 / 7, anywhere around the world!

Holiday September 2 nd

Please note that our offices will be closed on Monday, September 2 nd for Labour Day .

For a last-minute purchase, check out our online quoting tool .

To extend your policy, connect to the Client Portal .

If you are on a trip and require Emergency Medical Assistance , click the link below. This service remains available 24/7.

Offices closed at noon on Wednesday, June 5 th .

Our offices will exceptionally close at noon on Wednesday, June 5, 2024 for an internal team activity.

Special Long Weekend Schedule :

Please note that our offices will be closed from Friday March 29 th to Sunday 31 st .

We will be open on Monday April 1 st .

Statutory Holiday May 20th:

Please note that our offices will be closed on Monday, May 20 th for Victoria Day .

soNomad Assurance Voyage - Welcome to the Nomad Junkies community!

We have the best rates on Travel Insurance in Canada with COVID-19 protection included at no extra cost. Save up to 25% with our exclusive products! Put Us To The Test!

soNomad Travel Insurance - Welcome To All Members Of Our Facebook Community!

We have the best rates for travel insurance on the market in Canada with Covid-19 coverage included at no extra cost. Put us to the test!

soNomad Travel Insurance - Welcome To The Clients Of Richard's Motel! (LISA)

Sonomad travel insurance - welcome to the clients of diversico, sonomad travel insurance - welcome to our vtc facebook community, sonomad travel insurance - welcome to the clients of rivard insurance of assured partners, sonomad travel insurance - welcome to the clients of richard's motel, sonomad travel insurance - thanks for subscribing.

We have the best rates on Travel Insurance in Canada with COVID-19 protection included at no extra cost. Save up to 25% with our exclusive products. Put Us To The Test!

soNomad Travel Insurance - Welcome to Canam Golf's Clients!

Sonomad travel insurance - welcome to all our facebook community members, sonomad travel insurance welcomes you, sonomad travel insurance, sonomad travel insurance - welcome to the fly trippers community, sonomad travel insurance - welcome to the hellosafe community, sonomad travel insurance - welcome to the retirees club of p&wc community, no-nonsense travel insurance..

Say goodbye to hassles and high commissions.

At soNomad, we are proud to support Leucan by participating in the Leucan Expedition to Morocco.

Our employee Maude is also taking part in this adventure to show her solidarity and commitment. Like her fellow participants, she is eagerly preparing for her ascent of Mount Toubkal and the dune Erg Chebbi. As part of this initiative and to help support their valuable mission, we are committed to raising funds that will be entirely donated to Leucan. Join us in this process, by making a donation to Leucan. Together, we can make a difference!

DOWNLOAD Your FREE e-Books

We're reinventing travel insurance so you can save up to 25%!

We put an end to this with our low-cost approach.

Get covered, whether you're visiting Canada or planning a trip abroad.

Medical Insurance

Emergency medical coverage for Canadians traveling outside their provinces.

Trip Insurance

Trip cancellation and interruption insurance plan designed to protect against risks and financial losses due to unexpected events.

Visitors Insurance

Visitors to Canada travel Insurance protects you from costly medical bills and provides peace of mind while visiting Canada.

Why soNomad?

Two clicks away from safe travels..

We use state-of-the-art technology to simplify all steps of the process of buying travel insurance

Travel without being taken for a ride.

Hidden commissions can run as high as 45% for a travel insurance premium. We put an end to this non-sense.

Soooooooooooo ooooooooooo much cheaper.

We take a minimum fee per each transaction versus the traditional brokers that take high commission, so our products are the most affordable on the market. On average, our clients save up to 25%.

Get going in 3 simple steps

If you would prefer to speak to one of our agents, please fill out the form below and we’ll get back to you as soon as possible.

By sending this request, you agree to be contacted for the purposes of receiving exclusive travel insurance offers from soNomad.

Good to know

soNomad reinvents travel insurance with a unique low-cost approach to help travelers save on their insurance. soNomad takes a minimum fee per transaction compared to traditional brokers who can take commissions up to 45%. We put an end to this nonsense with full transparency by revealing our fees to you.

Travel insurance provides financial protection in case of incurred medical expenses that may arise during a trip outside of your province or country of residence. Without proper travel insurance, you may find yourself responsible for the payment of the medical bills incurred in an emergency, while consulting a doctor, or if you are hospitalized. Even if you are covered by your provincial health insurance, the cost of medical expenses incurred outside of your province remains very limited.

Our travel insurance plans provide coverage for COVID-19 and all the variants at no extra cost. We have several plans to choose from based on your age, preexisting medical conditions and trip length at the most competitive price.

In the event of a medical emergency during your stay, you must contact emergency assistance listed on your travel insurance card before seeking care. A traveler who does not contact emergency assistance prior to receiving treatment may have his coverage reduced or limited. In the event that you cannot contact emergency assistance prior to receiving treatments, you can ask someone to call for you, or call as soon as it is possible.

Yes, our exclusive product plans provide coverage for pre-existing medical conditions , as long as you meet the eligibility and stability requirements. Our easy to use state of the art medical declaration tool was developed to simplify the underwriting process and guarantee coverage for your preexisting medical conditions.

Your provincial health insurance plan covers a very limited portion of your medical costs while you are abroad. Each public insurance plan reimburses hospital services following a sudden illness or an accident according to pre-determined amounts. These amounts do not take into consideration the reality of the expenses of health care in the country visited.

Ready To Save On Your Travel Insurance!

We’re ready to help right now! Get a quote and travel with confidence

- 12 August 2024 | Press release Record rainfall: Making your claim process easier

- 30 July 2024 | Press release Funding collective mobility is a societal issue

- 17 July 2024 | Press release Two new appointments to CAA-Quebec’s senior management team

Découvrez le magazine des membres CAA‑Québec

Le Canada a enfin sa charte. Découvrez les grandes lignes.

Vérifiez le prix réaliste dans votre région

Restez toujours au courant

Frequently asked questions - Travel insurance

The coverage offered by the RAMQ (Régie de l’assurance maladie du Québec) when you travel outside Quebec is far from complete. In addition, the RAMQ doesn’t provide 24/7 assistance services if something goes wrong.

Travelling outside Canada: The RAMQ will reimburse only a very small part of medical expenses incurred abroad: $50 for a doctor’s visit and $100 per day of hospitalization. Many other things aren’t covered at all, like prescription drugs, ambulance transport or repatriation, so you can quickly run up a very large bill.

Travelling in Canada: The RAMQ will reimburse professional services only up to the going rate in Quebec, even if the insured person paid more. If the service costs more than in Quebec, you will have to pay the difference. What’s more, in the rest of Canada, like abroad, prescription drugs, emergency dental care, ambulance transport and repatriation costs aren’t covered.

The insurer usually pays the expenses directly. However, certain hospitals may require immediate payment.

We recommend that you contact travel medical assistance services as soon as you can. They will be able to recommend a physician, clinic or hospital, confirm your coverage and avoid you having to make a deposit.

Although the addition of a deductible is optional, it is a good way to reduce your insurance premium. You can choose from among different deductible amounts. The chosen amount is the maximum you will have to pay for your medical expenses in the event you experience a problem abroad. The insurer will pay the remaining amount, if any.

Whether or not you opt for coverage with a deductible, you should always contact the insurer’s assistance service to have treatments approved.

A pre-existing condition is a health condition already existing at the time the contract is purchased or at the time of departure. Examples might include a case of the flu that you saw a doctor about, a change to the dosage of one of your existing medications, high blood pressure, surgery or a condition for which you are awaiting medical results.

Your policy may cover a pre-existing condition, but it depends on the nature of the condition, its severity and its stability. We will consider your pre-existing condition as low- or high-risk based on your age. As a result, your premium may be slightly higher than for a person in perfect health.

The information that you give your advisor about your health is important. It must be clear and accurate, so that the advisor can serve you properly.

Yes, but be aware that insurance companies and carriers may not have the same rules.

While Canadian authorities allow pregnant women to fly until 36 weeks of gestation, the conditions are different for most travel insurance.

CAA-Quebec Travel Insurance covers pregnancy and related complications if the pregnancy has not been declared high-risk and if the pregnant woman is travelling before the final nine weeks preceding her due date.

However, children born while traveling are not covered, regardless of when they were born.

Airlines may ask pregnant women for a written confirmation of how many weeks pregnant they are, so it’s important that they see their doctor and make sure they get all the information they need before travelling.

Yes! The Annual Plan package option from CAA-Quebec Travel Insurance is perfect for people who plan to make several trips a year. You choose the maximum duration of your coverage based on the total length of your trips. Several trip-length options are available to you.

Choosing this option saves you time, since you'll be covered for all your trips during the year under a single policy. Plus, you won’t need to notify your insurer before each trip, unless an extension is required or there is a change in your health.

It also saves you money: the insurance generally pays for itself after just two trips.

Travel insurance premiums are calculated by taking into account several criteria, including the length of the trip, the person’s age, the coverage chosen, and the state of their health (above a certain age).

We've developed a unique and effective calculation tool, so our counsellors can always offer the best option for you, along with a personalized premium at the lowest possible rate.

And that's not all! A number of discounts are available to you, and you can combine them. CAA-Quebec members are automatically awarded a discount of 10% on their premium. Members who purchase an explore travel product, and groups of 10 or more insured persons earn an additional discount of 10% . Our family premium is another way for you to save.

There are various reasons why you might need to extend your trip: you might be having too much fun to come home just yet, or an unforeseen event beyond your control might prevent you from coming back when you planned. In the first case, all you need to do is notify us before the return date specified in your contract. If no claims have been filed, we will extend your contract and charge the extra amount to your credit card, so you can enjoy your vacation for longer!

In the case of an unforeseen event, such as a delay of up to 24 hours due to the carrier, or hospitalization that goes beyond the planned return date, your coverage can automatically be extended free of charge. Refer to your policy for more details.

Contact the insurer's assistance services. See full details on the Claims and assistance page.

Whether or not they are at fault, Quebecers injured in a road accident while they are outside Quebec are entitled to the same compensation under the public plan.

For more information > see this link from SAAQ

A pre-existing medical condition is a health condition that already exists at the time insurance is purchased or at the time of departure. It’s also known as a “pre-existing condition.”

It may include, for example, a case of the flu that you’ve seen a doctor about, a change in the dosage of one of your existing medications, high blood pressure, surgery, a condition for which you’re awaiting medical results, etc.

You must inform your insurer of your health status, e.g., on the medical questionnaire if one is required. A false statement or incorrect information may result in your policy being cancelled and rendered null and void.

Travel insurance distributed by CAA-Quebec allows you to add an option to your policy to cover a pre-existing medical condition. No additional questions about your health will be asked. Your condition simply needs to be stable for seven days prior to departure in order to be covered.

Yes, the travel insurance distributed by CAA-Quebec covers COVID-19.

However, exclusions and limitations apply when a Canadian government travel advisory for COVID-19 is in effect.

If you purchase only emergency medical or trip interruption coverage, exclusions and limitations apply if the advisory is in effect prior to your departure. For example, the maximum benefit payable for medical care related to COVID-19 could be reduced if your COVID-19 vaccination is not up to date.

If you purchase insurance that includes trip cancellation coverage, the exclusions and limitations apply if the advisory is in effect before you purchase your insurance. For example, if you book a trip despite a government advisory, you will not get a refund if you have to cancel your trip due to COVID-19.

Check the latest advisories on the Canadian government website before you travel.

The insurer reserves up to 12 weeks to analyze and process travel claims for insurance distributed by CAA-Quebec. You can check the status of your claim online at any time.

Claims may be limited or denied if you did not contact the insurer before obtaining a consultation or treatment. Claims related to pre-existing conditions may be ineligible, whether or not a condition was disclosed at the time the insurance was purchased.

You may terminate your policy within 10 days of purchase if you haven’t started your trip and no claim is pending. Your premium will then be refunded. However, insurance that includes trip cancellation coverage purchased within 11 days of the trip cannot be terminated or refunded.

Other refund options are available. Please see the Refunds section of your policy for full details.

If you return from your trip early, you can get a refund for any unused days. You must provide proof that you have returned to your home province. It must indicate the place and date of your return.

Taking medication doesn’t necessarily mean your insurance coverage will be limited. As a general rule, if the medical conditions for which you’re taking the medications are stable during the three or six months prior to your departure, you shouldn’t have any problems. You should be able to buy travel insurance and even get coverage for the conditions. The stability period required in order for a condition to be covered varies between products.

The most important thing is that you know what medications you’re taking and why. You must be able to provide your insurer with accurate information when purchasing travel insurance. False statements or incorrect information can render your insurance policy null and void.

If you’re unsure about the functions of your medications, talk to your pharmacist. Ask for a specific list of your medications and the medical conditions they’re related to.

No. Significant limitations and even exclusions apply if the insurer finds there has been abuse of alcohol, drugs, or medication. For example, if you have an accident while under the influence of alcohol or drugs, you may not get any compensation.

You can purchase CAA-Quebec Travel Insurance at any time prior to your trip. However, the sooner you insure, the more risks and unforeseen events you cover that could arise between now and your departure.

In fact, you may even pay a lower premium if you take out your insurance in advance, since the premium increases with age. Therefore, it is a smart choice to purchase your insurance before your birthday.

Furthermore, some coverages cannot be purchased at any given time, such as “all-risk” cancellation insurance. It must be taken out within 48 hours of purchase or first payment. This insurance covers cancellation of your trip for any reason whatsoever. Reasons for cancellation are not limited to the risks listed in the policy.

Do you have questions about travel insurance?

1-855-440-4402

Your request has been sent and will be handled by a CAA-Quebec team member within a maximum of 48 business hours.

If this is an emergency, you can contact us at any time by calling 1-800-222-4357.

In order to provide you with products and services that fulfill your expectations, we need to collect certain personal information.

In full transparency, the following explains how we use your personal information. We guarantee that we will handle such information with care, in compliance with our privacy policy and with the law

How your information is used

By engaging in business with us, you consent to the collection and use of your personal information, as well as that of the individuals you represent, by CAA-Quebec, its affiliates and partners.

Your personal information is collected and used for:

- providing you with products and services;

- confirming your identity;

- soliciting you for surveys;

- improving the customer experience along with our products;

- managing risk, safety and regulatory compliance; and

- allowing you to enjoy all the benefits and privileges that are reserved for members when you first become one.

Your information may also be used to:

- provide you with personalized benefits, offers, promotions, and advice, and to ensure that you enjoy them;

- present you with targeted advertising on third-party sites; and

- send you invitations to take part in events or contests.

Your personal information may be communicated to a person associated with your account or to a CAA-Quebec supplier or partner, such as when CAA-Quebec acts as a sales intermediary (for insurance or travel), and to technology solution providers, including providers outside of Quebec.

Your rights regarding your information

You can access and correct your personal information. You also have the option of withdrawing your consent for specific uses through your Member Account, either by following the steps outlined in our Privacy Policy or by sending a request at any time by calling 1-800-686-9243.

For further details, please refer to our Privacy Policy at caaquebec.com/privacy .

Please note that quotes, changes to existing policies, and purchases cannot be made via this form or by email.

Ask for a quote or to purchase travel insurance .

To make changes to an existing policy, call 1-855-440-4402 .

You must complete all fields except those marked “optional.”

CAA‑Québec Assurances refers to Cabinet en assurance de personnes CAA‑Québec, firm in insurance of persons. The travel insurance products offered to CAA‑Quebec members and to the clients of its affiliates in Quebec under the name Assurance voyage CAA‑Québec are underwritten by Echelon Insurance doing business under the name Orion Travel Insurance and distributed by Cabinet en assurance de personnes CAA‑Québec. They are also offered by Voyages CAA‑Québec as part of its travel agency activities.

Find the Best Travel Insurance & Avoid Costly Surprises

- 22 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Explore Travel Insurance Types and Quotes

Standard single trip policies.

Our top plan type that covers cancellations, medical emergencies, delays, and luggage, protecting you from purchase to return.

Annual / Multi Trip Policies

A cost-effective choice for frequent travelers, these plans include medical, delay, and luggage benefits, with optional add-ons for trip cancellation or interruption.

Cruise Insurance Policies

Offers comprehensive protection for land and sea trips, with high medical coverage and weather safeguards.

Adventure & Sports Policies

Adrenaline-seeker? No problem. These plans cover lost or delayed sports equipment, cancellations, and medical emergencies.

Quote, Compare, and Go

Finding the best coverage for your trip is easy. Get personalized quotes from top providers in minutes.

Tell us some basic details about your trip to start your quote and we’ll handle the rest.

See how plans from the best travel insurance companies compete side-by-side.

Choose the perfect policy at the lowest price and travel with peace of mind.

Join More Than 3 Million Protected Travelers

Let’s face it, traveling these days can be expensive. That’s why we make it quick and easy to compare affordable travel insurance policies from the nation’s most trusted providers. Since your trip deserves the best coverage, we make sure that every plan on our site is carefully vetted and backed by real customer reviews.

- America’s largest travel insurance marketplace

- Intuitive & user-friendly comparison engine

- Lowest prices, guaranteed

- Multi award-winning customer service team

- 150,000+ customer reviews

Save With Squaremouth

No bias. No hidden fees. All the support. That’s why for 20 years, our customers keep coming back.

What Travel Insurance Benefits Do I Need?

Check out the comprehensive benefits our providers offer and find the perfect policy to meet your travel needs.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great price

"I looked for alternative travel insurance besides Allianz. I'm glad I searched because I got just what I needed and a very good price!"

Kent from MA 06/20/2024

Easy to Use

"Squaremouth makes shopping for travel insurance easy by allowing a side-by-side comparison of policies and offering endlessly customizable filters."

Stephanie from MI 06/12/2024

10 star customer service

"Beyond best in class service levels. The expertise and information shared was amazing."

Susan from GA 06/03/2024

Great selection, Easy choosing

"It's always good to see all choices when decisions about insurance are concerned. I always go to Squaremouth when I need travel insurance."

Spencer from NV 06/03/2024

"Website was easy to navigate. Numerous options for insurance. Excellent filter opportunities."

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

Most Popular Types of Travel Insurance

When it comes to travel insurance, there’s no such thing as a “one-size-fits-all" policy. Discover the different types of travel insurance coverage you should consider for your upcoming trip.

10 Ways to Get Great Coverage For Less

When it comes to travel insurance, more expensive does not necessarily mean better. We uncover 10 proven tactics you can use during your search to lower premiums without sacrificing protection.

Our Travel Insurance Experts are Available

Have questions? We have answers.

What Does Travel Insurance Cover?

Travel insurance is designed to cover out-of-pocket expenses relating to an unforeseen disruption to your trip. The majority of policies sold through Squaremouth are comprehensive and offer coverage for trip cancellations, medical emergencies, significant delays, and mishandled or lost luggage.

How Much Does Travel Insurance Cost?

Comprehensive travel insurance usually costs between 5% to 10% of your insured trip expenses. Factors like your trip cost, age, trip length, and coverage needs can impact pricing . You can lower your premium by comparing plans and choosing policies that don’t include cancellation coverage.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: The situations and expenses that are covered by a travel insurance policy.

- Coverage Limits: The maximum dollar amount that will be reimbursed within each benefit.

- Exclusions: Specific activities, expenses, and scenarios that are not covered in the event of a claim.

- Premium: The cost of the policy for your specific trip.

- Provider Reputation: Based on past customer reviews regarding interactions with assistance services and the claims experience.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance plans cover cancellations for reasons like sudden illness, injury, death of a family member, natural disasters, or unexpected work obligations. Policies with Trip Cancellation benefits usually offer 100% reimbursement for prepaid, non-refundable trip costs.

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Choosing the right travel insurance company can take time. We recommend comparing plans from at least 3-5 providers before buying.

Is Travel Insurance Mandatory for International Travel?

Travel insurance is not typically required when traveling overseas. The majority of travel insurance customers purchase their plans voluntarily for peace of mind and financial protection. With that said, some destinations or organized tours may require proof of international health insurance that lasts for the duration of your trip.

Does Travel Insurance Cover Canceled Flights?

Yes, the majority of travel insurance plans provide reimbursement if your flight is canceled and your travel plans are significantly delayed. You may be eligible for coverage through your policy’s Travel Delay or Trip Cancellation benefit depending on how soon you’re able to be rebooked.

Is Travel Insurance Necessary for International Travel?

Travel insurance acts as a financial safety net as you explore the world. Since most U.S. healthcare plans don’t extend coverage overseas, travel insurance can act as an international health insurance plan that protects you from unexpected medical expenses you may face during a trip. While rare, certain destinations or tour operators may require proof of travel insurance that lasts for the duration of your trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

It depends. Many travel insurance plans exclude coverage for pre-existing conditions, but some offer wavers, if you purchase within 14-21 days of your initial trip deposit. Check your policy details carefully to understand the specifics.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers you for one specific trip and is the most popular choice. Annual Travel Insurance on the other hand, covers multiple trips within a year. If you travel frequently, an annual plan can be more cost-effective and convenient than buying individual policies for each trip.

How Do I File A Travel Insurance Claim?

Each provider will have their own unique claims process. However, most will include the following steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Follow up: Stay in touch with the insurer for updates on your claim status.

View our Claims Center for more information on filing a travel insurance claim.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Get a Quote

Last-minute cancellations. Travel delays. Rental car accidents. When the unexpected happens, you can rely on Allianz Travel Insurance to help make things right.

Whether you're planning a road trip, camping getaway or vacation rental, a OneTrip plan can help you journey there — and back — with confidence.

Get affordable protection for all your trips — family vacations and weekend getaways alike — for a full 365 days.

Enjoy peace of mind on your next road trip. Get robust rental car coverage for a fraction of what you'll typically pay at the rental counter.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

Why Do I Need Travel Insurance?

Because your trip is too important to leave to chance. For a small fraction of your trip costs, you can count on travel insurance to save the day when things go awry.

- If you have to cancel your trip for a covered reason, travel insurance can reimburse you for your prepaid, non-refundable trip costs. Without insurance, you could lose the money you paid for your vacation rental, car rental, hotel, flights and more.

- If you experience a covered medical emergency , travel insurance can help ensure you get high-quality care and reimburse you for covered medical costs. Without insurance, you may have to pay out of pocket.

- If your rental car gets damaged, lost or stolen , travel insurance can pay for the loss. Without insurance, you could get hit with a huge bill.

- If you face an unexpected crisis, travel insurance connects you to 24-Hour Hotline Assistance for expert help and advice. Without insurance, you’re on your own.

- If your travel plans are affected by COVID-19, many of our travel protection plans now include the Epidemic Coverage Endorsement, which adds covered reasons to select benefits for certain losses related to COVID-19 and any future epidemic. Benefits vary by plan and by state of residence, and are not available in all jurisdictions. Learn more in our COVID-19 FAQ .

WHICH PLAN IS RIGHT FOR ME?

OneTrip Travel Insurance Plans

If you're the type who plans one big getaway a year, a OneTrip plan can offer benefits to help you breathe easier -- like trip cancellation, luggage protection, emergency medical benefits, and more. And all plans come with 24-Hour Assistance in case you need expert travel help along the way.

Annual Travel Insurance Plans

Frequent traveler? An AllTrips annual travel insurance plan may be a great fit. You can get the protection you need for all the trips you take in a full year -- domestic or international, leisure or business -- all under one convenient plan.

Rental Car Insurance Plans

If you're hitting the road in a rental car, OneTrip Rental Car Protector can provide primary protection for covered collision, loss, and damage, along with 24- hour emergency assistance. It's an affordable alternative to using your personal insurance, or overpriced options at the rental counter.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

What our customers say

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

7 Best Cheap Travel Insurance Companies in July 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Finding the cheapest travel insurance is often a priority for travelers hoping to protect themselves and their finances while away from home.

But is it better to err on the side of affordable travel insurance or opt for a more comprehensive plan? That depends on your needs .

On average, a comprehensive plan that covers some combination of trip cancellation and interruption costs, medical coverage and baggage protection (and perhaps a number of other things) will cost you 5%-10% of what you paid for the trip, according to NerdWallet partner Squaremouth, a travel insurance marketplace.

That means a comprehensive policy for a trip that costs you $3,000 could run you anywhere between $150 and $300. Factors like the cost and length of your trip, the age of the travelers and how much protection you want can significantly influence what you pay for your plan.

Ultimately, Squaremouth recommends “the least expensive policy that offers the coverage [travelers] need.”

» Learn more: The best travel insurance companies right now

Factors we considered when picking cheap travel insurance plans

We considered a few factors as we looked for the most affordable travel insurance plans.

Price: If your goal is to find cheaper travel insurance, you want the price to be affordable.

Breadth of coverage: The best budget travel insurance is typically going to be a plan that offers a wide range of protections at an affordable cost, ensuring you’re protected with at least some coverage for a wide range of scenarios.

Uniqueness or customizability : While many travel insurance plans have similar protections, some stand out for particular coverage that can be helpful to certain travelers, like those needing to Cancel For Any Reason , those going on a cruise, or travelers with preexisting health conditions. We didn’t spring for the priciest plans with broad, deep coverage; instead, we picked those that meet a sort of budget "sweet spot" when it comes to cost efficiency.

» Learn more: Is travel insurance worth getting?

An overview of the best cheap travel insurance plans

We looked at travel insurance quotes for a hypothetical 10-day trip to Italy in October 2023. The traveler is a 40-year-old man living in North Carolina who spent $2,000 on the trip, including airfare.

Reliable but cheap travel insurance providers

1. axa assistance usa (silver plan: $70).

Why we picked it:

The $500 missed connection benefit is great for cruise and tour participants. It covers additional transportation, accommodations and meal costs when you miss a cruise or tour departure.

Full trip cancellation and interruption coverage, along with up to $25,000 for out-of-pocket medical costs and baggage coverage.

Among the lowest prices we found.

If you’re willing to spend a bit more than AXA's $70 Silver plan, a Gold plan only costs $19 more and gets you deeper coverage amounts and up to $35,000 in collision rental car insurance.

2. Berkshire Hathaway Travel Protection (ExactCare Value plan: $56)

Cheapest plan we found while still offering a wide array of protections.

Includes a preexisting medical condition waiver.

Add-on rental car collision coverage optional for $10 per day. You can pick how many days you want the additional coverage — it’s not all or nothing.

At $56, this plan comes in at less than 3% of the $2,000 trip cost.

3. IMG (iTravelInsured Lite plan: $77)

Treats COVID-19 like any other illness, which is to say, if your claim accepts flu, strep throat or appendicitis as an acceptable, covered condition, the coronavirus is, too.

Covers costs related to trip interruption up to 125%

Higher than normal limits on dental expenses, at $1,000. If your teeth are your Achilles heel (or your biggest fear), this plan might be for you.

The iTravelInsured Lite plan doesn’t offer some of the bells and whistles that other plans do, like rental car coverage , Cancel For Any Reason coverage or waivers for pre-existing conditions. But you’ll have relatively solid across-the-board trip protections.

4. John Hancock (Silver plan: $93 for a mid-tier plan)

Mid-level plan (as opposed to a basic plan) at an affordable price for travelers who want more coverage without paying too much.

Includes an optional Cancel For Any Reason add-on for travelers wanting flexibility. It is a bit pricey, at half the cost of the insurance ($46.50 extra for a $93 plan).

Reimburses up to $1,000 for lost baggage , far more than many basic plans.

Add-on rental car coverage for $9 per day.

At $88, John Hancock’s basic (Bronze) plan isn’t particularly affordable. But for just $4 extra, you can tap into the benefits of a mid-tier plan at still less than 5% of the total trip cost.

5. Nationwide (Essential plan: $76)

Includes a preexisting conditions waiver.

Add-on rental car coverage for $90.

Covers trip interruption at 125% of the trip cost while providing comprehensive emergency medical and baggage coverage.

6. Seven Corners (Basic plan: $75)

On top of standard trip protections, it includes a relatively affordable Cancel For Any Reason option for $31.50 extra.

If you plan to rent expensive sporting equipment, you might consider paying $10 extra to cover lost, damaged, stolen or destroyed gear.

COVID-19 coverage reimburses you for costs incurred if you have to quarantine .

Rental car coverage comes in at an affordable $7 per day.

Seven Corners’ Basic plan stands out because it offers a little bit of everything, appealing to athletic travelers, those who need affordable trip protections, those who want the flexibility to cancel for any reason and those still concerned about getting quarantined due to COVID-19.

7. Travelex Insurance Services (Basic plan: $71)

Straightforward: What you see is what you get. This plan’s coverage has fewer rules and caveats than many.

While not sporting the highest coverage amounts, it offers a solid range of protections to ensure you get at least something back when your travel is disrupted or you have a medical emergency.

Offers add-on rental car coverage for $10 per day.

At $71, the Travelex Basic plan’s cost is just over 3% of the $2,000 trip’s cost.

If you want to get travel insurance at the cheapest possible rate, here’s a trick. Put $0 as your trip cost, Stan Stanberg, co-founder of comparison site Travelinsurance.com said in an email.

“When excluding trip cancellation and trip interruption coverage the cost of a travel insurance plan goes down significantly,” Stanberg said.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical, trip delay , missed connection, baggage and other protections.

You’ll often find comprehensive travel insurance plans cost 5%-10% of your total trip cost, according to Squaremouth. This will often get you full trip cancellation and trip protection, baggage protection, emergency medical coverage and often other benefits.

Typically, the more you pay, the broader and deeper the coverage.

For many plans, you can purchase travel insurance up until you depart. However, to get access to the most protections possible, booking two days to two weeks after making your initial deposit is the best rule of thumb.

That means you won’t get reimbursed if you need to cancel your trip or if it gets interrupted. But you may still have access to the plan’s medical,

, missed connection, baggage and other protections.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Assurance voyage multirisque

- Assurance voyage avec garanties médicales

- Garanties non médicales et en cas d’annulation de voyage

- Assurance voyage tous risques pour voyages multiples

- Assurance voyage annuelle avec garanties médicales pour voyages multiples

- Visiteurs au Canada et Étudiants non résidents

- Obtenir un traitement médical

- Comment soumettre une réclamation

- Accéder au portail de réclamations

- Règlement des différends

- Documentation requise

- Comprendre l'assurance voyage

- Comment choisir un forfait d’assurance?

- Avant de partir

- Pendant votre voyage

- Conseils de voyage

Couverture météorologique

Lorsque vous préparez un voyage, qu’il s’agisse de vacances bien méritées ou d’un voyage d’affaires, la dernière chose dont vous voulez vous préoccuper, ce sont les perturbations inattendues causées par les conditions météorologiques.

Compte tenu de l’impact mondial des changements climatiques, les conditions météorologiques imprévisibles deviennent un problème de plus en plus important pour les voyageurs internationaux. Heureusement, l’assurance voyage peut offrir une protection cruciale avant, pendant et après ces scénarios naturels imprévus.

Allianz Global Assistance propose plusieurs polices d’assurance voyage qui prévoient spécifiquement des prestations en cas de perturbations liées aux conditions météorologiques. Comprendre le fonctionnement de ces polices et les garanties qu’elles comprennent peut vous aider à faire en sorte que vos projets de voyage se déroulent sans tracas, même lorsque le mauvais temps les menace.

Types de perturbations météorologiques couvertes

- Annulation d’un voyage en raison des conditions météorologiques . L’une des préoccupations les plus courantes des voyageurs est de devoir annuler un voyage en raison de conditions météorologiques défavorables. Allianz Global Assistance peut fournir une couverture pour l’annulation d’un voyage lorsque des conditions météorologiques défavorables rendent le voyage impossible. Il peut s’agir de situations où des vols sont annulés ou des avis de voyage sont émis en raison d’ouragans, de blizzards ou d’autres phénomènes météorologiques extrêmes. Si vous devez annuler votre voyage et que vous avez déjà engagé des frais non remboursables, votre police d’assurance Allianz peut vous aider à les récupérer, souvent jusqu’à concurrence du coût du voyage assuré.

- Retard de voyage dû aux conditions météorologiques . Les retards dus aux conditions météorologiques peuvent même perturber les voyages les mieux préparés. Allianz Global Assistance inclut des prestations de voyage pour les retards causés par des conditions météorologiques difficiles, telles que les tempêtes de neige ou les inondations. Si vous subissez un retard important, qui peut se traduire par de l’attente à l’aéroport ou dans d’autres centres de transport, votre police d’assurance peut couvrir des frais supplémentaires tels que les repas et l’hébergement. Ainsi, les perturbations météorologiques inattendues ne vous feront pas débourser pour les coûts essentiels pendant ce retard.

- Interruption de voyage en raison de graves intempéries ou de catastrophes naturelles . Les catastrophes naturelles, notamment les ouragans, les tremblements de terre et les feux de forêt, peuvent interrompre vos projets de voyage une fois parti. Allianz Global Assistance inclut des prestations pour interruption de voyage causée par de telles catastrophes. Si vous devez écourter votre voyage et rentrer en raison d’une catastrophe naturelle affectant votre destination, votre police d’assurance peut vous aider à couvrir les frais supplémentaires liés à un retour anticipé, ainsi qu’à rembourser la partie non utilisée de votre voyage.

- Couverture en cas de mauvais temps affectant votre destination . Parfois, le mauvais temps à votre destination peut affecter vos projets de voyage de différentes façons. Les polices d’Allianz Global Assistance prévoient souvent des indemnités en cas de fermeture temporaire de votre hébergement ou d’autres importants services de voyage en raison de mauvaises conditions météorologiques. Si votre destination de voyage est touchée par un événement météorologique qui a un impact sur vos projets, vous pouvez déposer une demande de règlement afin de récupérer une partie des coûts liés à la perturbation.

Types de polices d’assurance voyage avec garanties non médicales proposés par Allianz Global Assistance

Allianz Global Assistance propose plusieurs types d’assurance voyage qui peuvent couvrir les perturbations liées aux conditions météorologiques. Voici quelques options intéressantes à examiner :

- Garanties non médicales : Prestations pour l’annulation de voyage, l’interruption de voyage, le retard de voyage, la perte ou l’endommagement des bagages et l’assurance accident de voyage.

- Forfait avec garanties non médicales (après le départ) : Identique à la formule standard sans soins médicaux, mais prenant effet après le départ et comprenant une assurance interruption de voyage, une assurance retard de voyage, une assurance perte de bagages et une assurance accident de voyage.

- Assurance Annulation et interruption de voyage : Remboursement des frais de voyage non remboursables en cas d’annulation ou d’interruption du voyage pour des raisons couvertes.

- Assurance Interruption de voyage : Couverture des frais si votre voyage est interrompu après avoir commencé pour une raison couverte.

Pour obtenir plus de renseignements ou pour consulter les détails de ces polices , rendez-vous en ligne.

Éléments à prendre en compte lors du choix d’une couverture

Lorsque vous choisissez une assurance voyage auprès d’Allianz Global Assistance, tenez compte des éléments suivants :

- Coût du voyage assuré : Assurez-vous que le plan que vous choisissez couvre le coût total de votre voyage, y compris le billet d’avion, l’hébergement et les autres dépenses. Cela vous permettra de maximiser votre remboursement si vous devez annuler ou interrompre votre voyage pour une raison couverte.

- Limites et exclusions de la police d’assurance : Examinez les détails de la police pour comprendre les limites de la police d’assurance et les éventuelles exclusions liées aux événements météorologiques. Savoir ce qui est couvert et ce qui ne l’est pas peut vous éviter des surprises en cas de demande de règlement.

- Conditions préexistantes : Certaines polices peuvent comporter des exclusions liées à des conditions préexistantes ou à des événements météorologiques spécifiques. Vérifiez les détails pour vous assurer que votre couverture répond à vos besoins.

L’assurance voyage d’Allianz Global Assistance peut fournir une protection complète contre les perturbations liées aux conditions météorologiques, garantissant vos projets de voyage, même en cas de conditions météorologiques imprévisibles.

En choisissant la police qui correspond à vos besoins, vous pouvez avoir l’esprit tranquille en sachant que vous êtes couvert en cas d’annulation, de retard, d’interruption de voyage et d’évacuation d’urgence. Comprendre les spécificités de votre police d’assurance et ce qu’elle couvre ou non vous aidera à prendre des décisions éclairées et à voyager en toute confiance, quelles que soient les conditions météorologiques.

- 5 raisons pour lesquelles votre réclamation pourrait être rejetée

- 7 façons dont l’assurance annulation et interruption de voyage vous fait économiser de l'argent

- Guide touristique de Paris

Rejoignez notre communauté de voyageurs!

Merci de vous inscrire à notre infolettre.

Veuillez nous excuser, nous ne pouvons pas accéder à votre requête. Merci de réessayer.

Warning - The E-Mail Address configured for this form is either unverified or invalid. Please verify the E-Mail Address and try again later.

A verification E-Mail was sent to the following E-Mail addresses:

Kindly check the corresponding inbox for a verification E-Mail and verify it.

Warning - Please add an email field in the form to proceed without any errors

Warning - The page URL seems to be incorrect. Kindly check the URL and try again.

Erreur entrée invalide

Erreur Champs obligatoire

Warning! Your mobileNumber field is not set up with the right component. Please use Textfield component with phone number validation, in order to avoid any errors when transporting data to Adobe Campaign

Entrez le texte ci-dessous 60 secondes restantes Difficulté à lire le texte ? Reload text

Ce message ne peut être envoyé pour le moment. Veuillez réessayer plus tard.

Votre saisie ne correspond pas au texte indiqué. Merci de réessayer.

Warning - This form has 100 fields, which is over the maximum allowed field count: 75. Form submissions will fail if this page is published.

Warning - The technical field name is duplicated in more than one location. This will cause information loss when delivering the form submission. Please remove the duplicated field or rename its field name.

Warning! Please upload a file with the correct file type to proceed.

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , Tin Leg , Faye , and Faye2 .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Travel Insurance Based on In-Depth Reviews

- 200+ Hours of research

- 60+ Sources used

- 15 Companies vetted

- 3 Research Criteria

- 6 Top Picks

- Look for customizable coverage

- How we analyzed the best Travel Insurance Companies

- Our Top Picks: Travel Insurance Reviews

- Travel Insurance and the Novel Coronavirus

In light of the current Covid-19 pandemic—and the accompanying social distancing and travel restriction measures implemented across the world—record numbers of flights, vacations, cruises, and other travel plans have been thrown into disarray. While the response from individual airlines and hotel chains has been to relax their cancellation policies, travel insurance companies are a different story . The travel insurance policy types that would apply to most of those canceled plans are trip cancellation or trip interruption, both of which are usually named-peril plans. This means that they'll honor the coverage on the insurance policy, but ONLY IF the reason for cancellation is listed in the plan. And neither the fear of contracting coronavirus or the fact that there is a very real worldwide pandemic, are listed reasons.

There is one notable, albeit more expensive option, if you purchase (or purchased) a Cancel For Any Reason (CFAR) add-on policy, then you can do exactly that: change your travel plans entirely and practice social distancing at home. To qualify, you must have purchased the CFAR within the insurer's specified timeframe after making your first payment, and you must insure the totality of your trip costs. You should also know that even a CFAR only goes so far—you won't be fully reimbursed, even though you're insuring 100 percent of your costs—most travel insurance policies give you the option of a 50 or 75 percent reimbursement.

Given the situation, before booking any travel and purchasing travel insurance, we recommend that you follow the current Center for Disease Control ( CDC) recommendations . Ask yourself:

1. Are coronavirus cases surging or spreading at your destination?

2. Do you live with someone who at high risk of infection from the coronavirus?

3. Likewise, are you yourself at high risk of becoming gravely ill from coronavirus?

4. And finally, does your destination have any travel restrictions or requirements?

This fourth question is key since it can significantly derail your plans—many state, local, and territorial governments have implemented restrictions of varying degrees, from mandatory testing or quarantines to outright travel bans. The European Union, for instance, just extended its travel ban for U.S. citizens, while Ireland and Hawaii allow travel but require a two-week, in-country quarantine. In short, we recommend you take the time to verify if this is the case in your chosen destination, either on state or local public health websites if traveling within the continental U.S., or through the U.S. Department of State's Country Information page .

- TravelInsurance.com review

Best for Travel Insurance Options

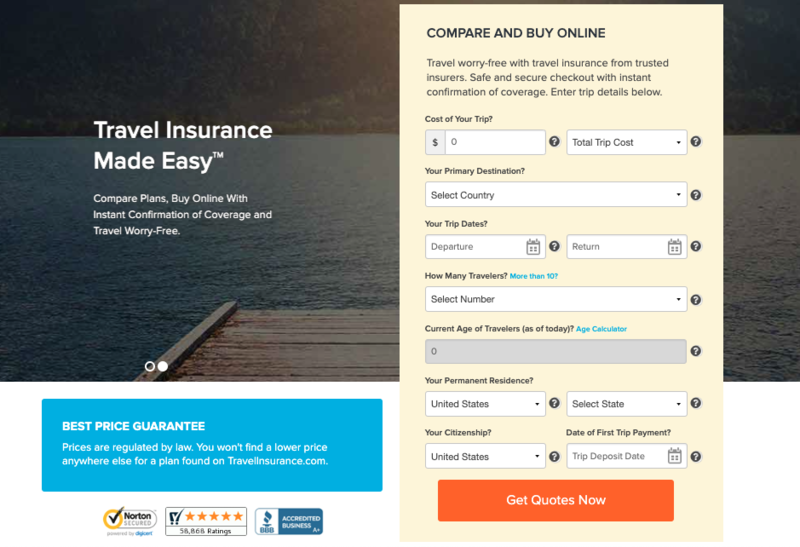

For consumers who want comparison shopping convenience, TravelInsurance.com is a great choice since it allows you to compare many policies at the same time.

Screenshot ravelinsurance.com, December 2019.

Customers are asked to fill in a simple web form that asks for the dates, destination, and total cost of an upcoming trip. The website instantly generates a list of available policies (26 of them for a hypothetical trip we described), their coverages, their costs, and their issuers’ financial strength ratings. The information is laid out on a single page in an easy-to-read format. Prospective travelers can do side-by-side comparisons of a smaller number of policies.

TravelInsurance.com is not an insurer itself, but it partners with many of the insurers we recommend. Before purchasing any one travel insurance policy, it's a good idea to research the company issuing it to gather even more information about it.

- Generali Global Assistance review

BEST FOR TRIP CANCELLATIONS AND INTERNATIONAL SUPPORT

Generali provides great value for your buck. Generali’s 24/7, year round “Telemedicine" service connects you with a network of American doctors for non-emergency medical consultations, advice, and prescriptions. The Premium plan offers a million dollars in medevac coverage, and nice extras, like $500 for sports equipment delays and $1,000 for missed connections. This policy is perfectly suited for the well-to-do traveler with a lot of money invested in a trip.

Generali scored high with us because, as travel insurers go, they offer some of the most comprehensive coverages, highest payout maximums, and many additional policy features other providers don't. All standard trip interruption and cancelation reasons are provided for, and then some. Additionally, the company has generous provisions for baggage and trip delays. Generali really shines when it comes to its traveler assistance services. Along with all the usual customer assistance features, the company also makes provision for such things as specialty food delivery, an emergency cash advance of $500, and travel companion meet and greet services. Pound for pound, one of the most extensive offerings out there.

The company will cover up to a whopping $250,000 max for medical care, and up to $1 million for emergency medical transportation. There are three plan levels that, aside from a few items, only differ in maximum payouts for certain coverages.

Generali also stands out in the trip interruption/cancellation category. They will reimburse up to 175% the cost of the trip due to trip interruption, and also provide a generous $1,000 travel delay reimbursement. If you purchase the premium plan, the coverage kicks in after a mere 6-hour delay.

Generali boasts many more customer assistance services than standard among travel insurance providers. These include identity theft resolution services, personalized retail shopping assistance services, procurement of hard-to-find items, limousine pick up of friends and business partners, pre-trip assistance, specialty food delivery, and booking golf tee times just to name a few. Generali's 24-hour emergency hotline can be accessed from anywhere in the world and includes medical, travel, and concierge assistance services.

The company's services are accessible anywhere in the world and they maintain a BBB accreditation of A+. Generali Global Assistance operates as a subsidiary of Europe Assistance Holding S.A. and their travel insurance business evolved from CSA Travel Protection.

- World Nomads review

Best for the Young and the Restless

World Nomads offers a choice of two plans. The primary difference between the two, aprt from cost, of course, are the benefit limits associated with each. Both plans offer the same types of coverage, including trip cancellation, trip interruption, emergency medical, evacuation, repatriation, and personal property losses. We used a hypothetical $3,000 trip to France tWorld Nomads' policies to competitive plans.

World Nomad's Standard Plan has a benefit limit of $2500. It wouldn't cover the entire cost of our hypothetical trip to France, but it would certainly lessen the economic blow of cancellation or interruption. World Nomad's Explorer Plan has a benefit limit $10,000 for cancellation and interruption. It would fully reimburse the cost of our hypothetical trip. I's important to understand that you can't collect any more than your trip cost with trip cancellation or interruption coverage, no matter how high the benefit limit of your policy. Our hypothetical traveler would want to compare the premium difference between the two plans. If it were more than $500, then World Nomad's Explorer plan would probably not make good financial sense.

Both of World Nomad's plans reimburse travelers for up to $100,000 in travel medical expenses. The Standard Plan covers up to $300,000 in medical evacuation costs while the Explorer Plan ups that figure to $500,000. The Standar plan offers up to $1000 reimbursement for baggage loss or theft, while the Explorer plan protects you for up $3000 for those losses. The more expensive of World Nomad's plans might make sense if you carry a lot of expensive gear when you travel, but again, travelers must weigh the cost of increased coverage against the benefits.

Unlike many travel insurance providers, World Nomads covers a large number of sports in its Standard Plan (kite surfing, ice hockey, and that most dangerous of sports… air guitar ) and more extreme sports under the Explorer Plan (bull riding, cave diving up to 165 feet/ 50 meters, and mixed martial arts), making it a great choice for the adrenaline junkies. The full list of covered activities is well worth a read if only for entertainment purposes. Now that we know what ski joring is, we're raring to try it ourselves!

Screen shot of worldnomads.com, July 18, 2019.

Great Guides and Community

What truly differentiates World Nomads from a crowded field is the sense of community it cultivates with its customers. The website contains free travel guides to numerous worldwide destinations, as well as free downloadable educational material on travel writing, filmmaking and other topics.

There are also sections dedicated to fascinating true travel stories to inspire your next trip, and entertaining and bizarre testimonials from World Nomads insurance customers. We’ll warn you, some of these tales are not for the faint of heart.

In keeping with the community theme, World Nomads presents an option at checkout to donate a few dollars to one of three charities, including a program dedicated to sight-restoring surgery in Kenya. According to the website, 85% of World Nomads customers elect to donate.

World Nomad's Disclaimer

All of the information provided about travel insurance is a brief summary only. It does not include all terms, conditions, limitations, exclusions and termination provisions of the travel insurance plans described. Coverage may not be available for residents of all countries, states or provinces. Please carefully read your policy wording for a full description of coverage.

- Medjet review

Best for the Vip Traveller

Strictly speaking, Medjet doesn’t provide travel insurance in the classic sense. For instance, there are no coverage options for trip cancellation, loss or delay of baggage, or many other standard travel medical insurance features. For those, you’ll have to purchase a standard travel insurance policy from another provider.

Medjet offers industry-leading global medical evacuation services to both private and corporate clients. With a network of hundreds of air ambulances and medical escorts located around the world, if you are hospitalized, Medjet provides transport to the home-country hospital of your choice aboard aircraft outfitted with state-of-the-art emergency medical equipment. Travel insurance typically requires you be treated and recover in the “nearest acceptable facility”, Medjet allows you get to a hospital at home.

Medjet operates on a membership model, with a number of programs calibrated to fit the needs of different types of travellers. Short term memberships for trips as short as 8 days are available, as are programs for students and professors and longer-term expatriates.

While there is no medical transport cost limit as long as your membership is current, Medjet does cap evacuations to two per member per year, or one for a member family. Though if you’re in need of more than two evacuations per year, you may want to reconsider your life choices.

Screen shot of medjetassist.com, July 18, 2019

Customers up to 75 years old can be covered under any of Medjet’s policies. Beyond that is a senior-specific Diamond membership which covers customers between the ages of 75 and 84.

In addition to medical evacuation, MedjetHorizon--the premium-tier option--provides professional crisis response assistance for victims of terrorism, natural disasters, kidnapping, hijacking, political threats, blackmail, and other events. If you are at risk for such hair-raising predicaments, standard travel insurance simply won’t suffice. These options are intended for VIP travellers such as high level corporate executives or high profile individuals--think C-suite execs and movie stars— but it’s also ideal for anyone who travels alone.

- AXA Travel Insurance review

Best for the Travelers on a Larger Budget

While a quick glance at AXA’s rather generic website might suggest that there’s nothing special about the company, the true value of its policies becomes apparent when you look at what’s covered. The Platinum plan for our $3,000 trip costs a quoted $125 and includes a remarkable suite of coverages. With medical expenses capped at $250,000 and medevac and repatriation capped at a cool million, the plan truly lives up to its precious metal namesake.

Screen shot of axatravelinsurance.com, July 18, 2019.