- OTP has been introduced for making e-com transactions through INR Prepaid Cards. The OTP will be received on customer registered mobile number.

- The daily transaction limit on SBFTC are displayed on the first page after the Customer Login into the Prepaid portal

- Gift Card Issuance Charges waived till 31.03.2018

- EZ-PAY/IMPREST/SMART PAYOUT/XPRESS MONEY CARDS are enabled for cash withdrawls from NON SBI ATMs Charges Rs.20/- for each cash withdrawls and

- Rs 9/- for Balance enquiry

- *Gift Card issuance charges are waived since beginning of launching the product, currently waived till 31-03-2016, waiver is proposed to be continued till 31.12.2017.

- & **Nil load/reload charges are applicable through CINB/INB.

State Bank Foreign Travel Card

The Smartest way of Carrying Money Abroad.

State Bank Foreign Travel Card is a card in foreign currency that makes your foreign trip secure and convenient. It is a Chip based EMV compliant Card which stores encrypted and confidential information. It offers you a convenient and secure way to carry cash anywhere in the world (valid worldwide except in India, Nepal and Bhutan).. With State Bank Foreign Travel Card (SBFTC), you can shop, dine or visit places abroad without any worries of carrying or losing cash. It relieves you of the Annual fees, joining fees, credit limits, etc., usually associated with International Debit / Credit Cards. All you have to do is produce your 'State Bank Foreign Travel Card' and you will find making payments overseas easy. SBFTC is available as both Single Currency and Multicurrency Card. Single Currency Card Single Currency Card is available in eight foreign currencies viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (JPY), Saudi Riyal (SAR) and Singapore Dollar (SGD). Multicurrency Card Multicurrency SBFTC is available in 9 foreign currencies, viz. US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Japanese Yen (JPY), Canadian Dollar (CAD), Australian Dollar (AUD), Saudi Riyal (SAR), Singapore Dollar (SGD) and UAE Dirham (AED).

- Cardholder has option to load all available currencies on a single card.

- Documentation

- FTC Selling Branch Address

Competitive exchange rates.

Reloadable any number of times..

Operatable by 4 digit PIN at ATMs and by PIN/Signature at Merchant Establishments.

SMS / E-Mail

Balance information after each transaction through SMS/e-mail.

Maximum amount of issue

As prescribed by the RBI/FEMA from time to time for the purpose of the visit abroad.

Balance Enquiry

Free balance enquiry at State Bank Group ATMs and VISA ATMs(at a charge).

Free balance enquiry and view / download details of transactions through https://prepaid.sbi/

Add-on-Cards

Add-on-cards not exceeding two in number to be used by the card holder in case of loss/misplacement/defacement of the card.

SMS/e-mail alerts for each transaction

*Disclaimer:The service is dependent on the infrastructure,connectivity and services provided by the service provider. State Bank of India will not be liable for any delay,inability or loss of information in the transmission of alerts.

A 24 x 7 call centre ( +91 18001234) to provide information and hot-list (block) the card in case of loss / misplacement.

Please Login to CitiManager: home.cards.citidirect.com

Department of Defense Travel Card Benefits

Progress informed from the past, and inspired by the future, cardholder guide.

Official travel for the Department of Defense just became easier with the Citi Department of Defense Travel Card. When you are preparing to use your new card, please read What To Do When I First Receive My New Card . For more information regarding your new card, please read the Department of Defense Cardholder Guide .

Department of Defense Travel Insurance

As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card.

- Travel Accident Insurance Guide

- Lost Luggage Insurance Guide

MasterCard Guide to Benefits

Visa Guide to Benefits

In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits .

Travel Tips

For more information on your Citi Department of Defense Travel Card, please read What to do Before, During and After travel .

Online Tools

Citi's global online tool, CitiManager ® , enables you to manage business expenses from anywhere around the globe from your computer or mobile device; you can view statements online, confirm account balances, sign up for email and SMS alerts, and much more. If you have not already signed up for the CitiManager ® tool, please log on to www.citimanager.com/login and click on the 'Self registration for Cardholders' link. From there, follow the prompts to establish your account.

For more information on the CitiManager ® tool, view our CitiManager ® Cardholder Quick Reference Guide .

- Profesionet e lira

- Biznese shumë të vogla

- Tregjet Globale

- Hapësira e Klientit

Credit Cards

Visa Credit Card

Visa Platinum

Standard Bank Business Credit Card Review 2024

The Standard Bank Business Credit Card is a versatile financial tool aimed at simplifying expense management and offering valuable rewards […]

The Standard Bank Business Credit Card is a versatile financial tool aimed at simplifying expense management and offering valuable rewards for business transactions. With competitive fees, interest-free periods, and extensive global acceptance, this card is a strong contender in the business credit card market.

Key Features

- Monthly Fee: R45.00

- Interest-Free Days: Up to 55 days

- Minimum Monthly Repayment: 5%

- UCount Rewards for Business: Earn points on eligible transactions (terms and conditions apply)

1. Global Acceptance

- Visa and MasterCard Options: Choose between Visa or MasterCard, both widely accepted worldwide.

- ATM Access: Use the card at over 900,000 ATMs globally.

2. Interest-Free Credit

- Up to 55 Days: Enjoy up to 55 days of interest-free credit if the balance is settled in full by the due date. This feature aids in better cash flow management.

3. Security Features

- Corporate Liability Waiver: Automatic protection against fraud and misuse.

- Fraud Prevention: Standard Bank will never request OTP (One-Time Password) via email or phone. Always verify requests directly with the bank.

4. Travel Benefits

- Discounts: Receive up to 20% off Emirates flight tickets.

- Travel Insurance: Automatic cover of up to R2 million for travel bookings made with the card.

5. Rewards Program

- UCount Rewards for Business: For an additional R30 per month, earn rewards points on purchases. Points can be redeemed for various products and services.

Costs and Fees

The 2024 fee structure for the Standard Bank Business Credit Card includes:

Monthly Fees

- Business Credit Card: R45.00

- Corporate Card: R43.58

- Travel Lodge and Aviation Cards: R523.00 annually

Initiation Fees

- Business Credit Card: R309.00

- Corporate Card: R309.00

Transaction Fees

- Standard Bank ATM Withdrawal: R2.40 per R100

- Other Bank ATM Withdrawal: R2.40 per R100

- International ATM Withdrawal: 2.75% of the transaction amount + R3 per R100 (minimum R70)

Cash Deposits

- ATM Deposit: R4.80 + R1.20 per R100

- Branch Deposit: R8.50 + R2.20 per R100 (minimum R60)

Statement Fees

- AutoPlus Statements: Free

- Branch Statements: R32.00

Card Replacement

- Standard Replacement: R145.00

- Emergency Replacement: R450.00

Pros and Cons

- Wide Acceptance: Accepted globally at millions of merchants and ATMs.

- Interest-Free Period: Up to 55 days interest-free credit.

- Rewards Program: Optional UCount Rewards program allows for earning points on business expenditures.

- Travel Perks: Discounts on Emirates flights and automatic travel insurance coverage.

- Rewards Program Fee: Membership to UCount Rewards for Business incurs an additional fee, unlike some competitors who offer similar programs for free.

- High International Conversion Fee: The 2.75% international transaction fee is higher than the typical 2% charged by other banks.

Requirements

To qualify for the Standard Bank Business Credit Card, applicants must meet the following criteria:

- Registered Business: The business must be registered in South Africa.

- Valid ID: A South African ID book or smart card is required.

- Age Requirement: The company representative must be at least 18 years old.

- Proof of Address: The business must provide proof of address dated within the last three months.

- Business Duration: The company should have been operational for at least 24 months.

The Standard Bank Business Credit Card offers a robust set of features designed to support businesses in managing expenses effectively. With its global acceptance, interest-free credit period, and valuable travel benefits, it presents a strong option for businesses seeking financial flexibility and rewards.

However, prospective users should consider the additional costs associated with the UCount Rewards program and the higher international transaction fees. For businesses that can leverage the rewards and manage their international transactions efficiently, the Standard Bank Business Credit Card could be a valuable addition to their financial toolkit.

For more information or to apply, visit Standard Bank’s Business Credit Card page .

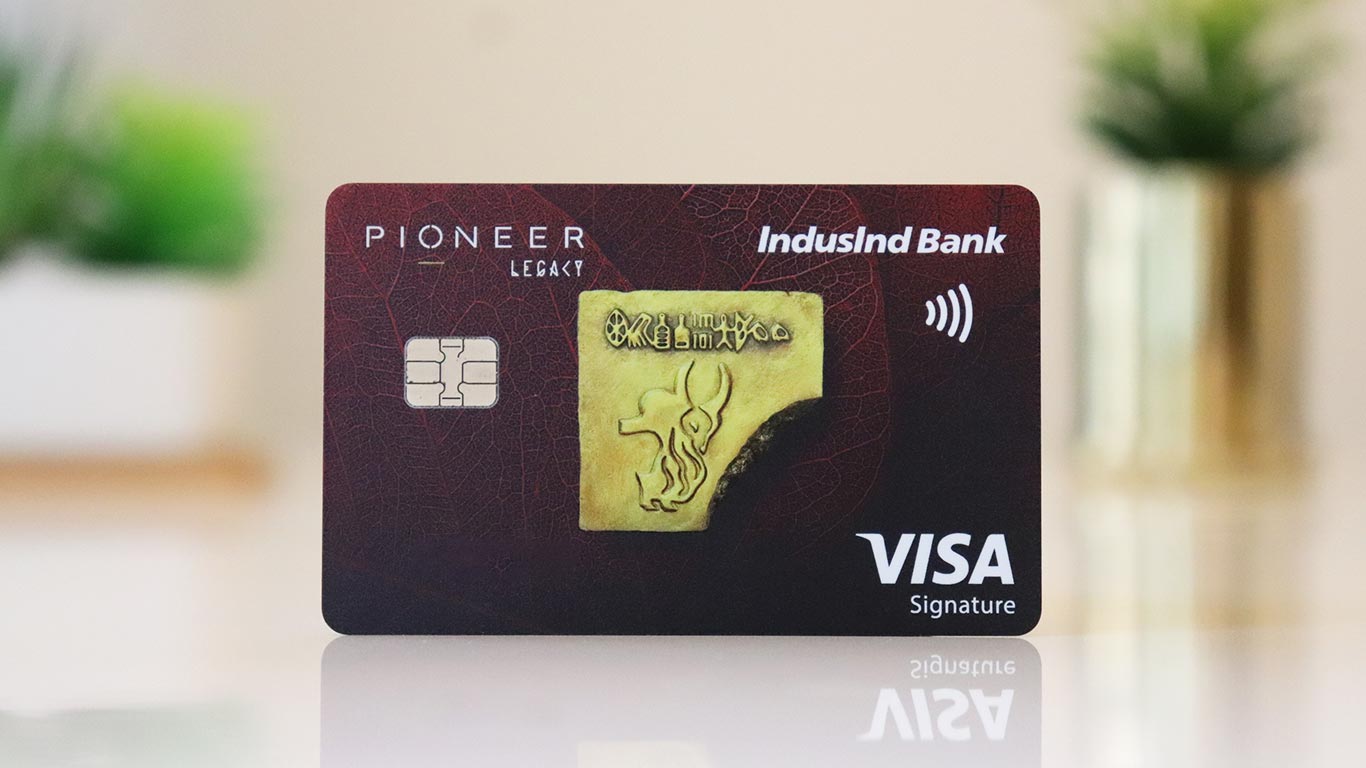

IndusInd Bank Pioneer Legacy Credit Card Review

IndusInd Bank offers two credit cards to its affluent customers as part of their Pioneer banking program: the Pioneer Heritage Metal Credit Card (Super Premium) and the Pioneer Legacy Credit Card (Premium).

Here, we’ll take a closer look at the IndusInd Bank Pioneer Legacy Credit Card that offers decent rewards and benefits.

Table of Contents

Joining Fees

Rewards , milestone benefit, airport lounge access , other benefits, hands-on experience.

Even though it is only a Premium Credit Card, it is intended only for High Net-Worth Individuals (HNI’s) with an IndusInd Pioneer Banking account.

The target segment for this card is relatively small, as most HNI’s would prefer a super-premium credit card instead.

While the card used to be offered as a Lifetime Free Card for Pioneer customers, it seems they’ve slightly modified the pricing recently by asking for a minimal spend requirement for the joining fee waiver.

But as you might know, IndusInd Bank usually has multiple pricing plans, so LTF might still be available.

The design is undoubtedly beautiful, much like most other IndusInd Bank credit and debit cards offered under the Pioneer banking program.

While the Visa variant is attractive, the Pioneer Legacy Mastercard variant is even more beautiful.

- 1 Reward Point = 1 INR (for cash credit)

- Select Categories: Utility, Insurance, Government Services, Education, Rent.

As you can see, weekend spends makes the card useful for many. And the option to redeem points for statement credit at 1:1 is quite good to have.

IndusInd Legacy was not having the category restriction (low rewards) for sometime but then it was added as well eventually.

Milestone benefit gives a nice 1% gain on 6L spend, thereby increasing the total reward rate to 2% (weekday spends) or 3% (weekend spends), depending on when the spends are made.

This makes it something similar to IndusInd Pinnacle Credit card which used to offer 2.5% reward rate in the past, before devaluation.

I wonder why domestic limit is too low for a premium credit card, international access limits are fair enough though.

That said, one good thing with IndusInd Premium Credit Cards is that they’re acceptable in most lounges, especially in the popular 080 Lounge in BLR – Terminal 1 , as I have seen couple of people using IndusInd Pioneer credit & debit cards for the access.

- 4 Games & 4 lessons per month

- Spend Requirement: 25,000 INR (in previous statement cycle)

IndusInd Pioneer Legacy Credit Card comes with pretty good Golf benefit, 2X more when compared to Pinnacle Credit Card.

The expected spend requirement to avail the Golf benefit is also fair enough, as IndusInd Golf booking system is one of the best in the industry.

- Bookmyshow Offer: Buy1 Get1 offer, Upto Rs.200 per ticket, upto 3 tickets per month

- 1% fuel surcharge waiver (txn range: 500-10,000 INR)

- No Cash Withdrawal Charges

- Low foreign Currency Markup of 1.8%

- Concierge benefits

While IndusInd Bookmyshow benefit used to work wonderfully well in the past, it’s not the case lately as the quota is getting used up pretty quick.

I applied for the IndusInd Pioneer Legacy Credit Card for a family member a few years ago as it was anyway a lifetime free card with a beautiful design.

However, it took a month to receive the card due to the physical application process. But I heard that IndusInd Bank recently moved to 100% digital application process, so one can expect the card in about a week or two.

But I continue to hope that IndusInd and other banks implement a super-fast & simple application process for their Premium Banking customers, similar to the one offered by Standard Chartered Bank for their SC Priority customers.

With Standard Chartered, all it takes is an OTP to be shared with the RM to log-in the application. IDFC Bank also offers a similar system, with instant approval.

- Cardexpert Rating: 4/5

The IndusInd Bank Pioneer Legacy Credit Card is a reasonably rewarding card for those with a Pioneer banking relationship who are looking for a credit card with moderate spends.

It can also serve as a backup card for super-premium cardholders as it comes with a good reward rate, directly as cashback instead of travel rewards.

However, it’s not worth opening a Pioneer Banking Account solely for this credit card. There are many other best credit cards in India to choose from.

Are you using IndusInd Bank Pioneer Legacy Credit Card? Feel free to share your thoughts in the comments below.

Sign up for Weekly Newsletter

Get curated emails every week, so you don't miss any rewards.

Related Posts

6 thoughts on “ IndusInd Bank Pioneer Legacy Credit Card Review ”

Pioneer legacy is what Legend used to be. Double pts on weekends, annual bonus on 6L spend, redeem as statement credit 1:1, little bit of lounges, 0.7 on select categories, practically LTF, all this before they downgraded it.

Right, and can as well compare it to the good old days of IndusInd Iconia Amex .

Doesn’t merit a 4/5 stars considering the benefits and privileges.

Can say 3.5 for some and 4.5 for some. Hence averaged.

They are coming up with Pioneer Private credit card too which will be above Pioneer Heritage, Pioneer legacy and Indulge

For a premium CC with such high net worth requirements with so few benefits as such, not a card deserving more than 3/5 in my view. IndusInd cards do not come with that many instant discount offers either these days, though the pioneer CC/DC have some good offers on Big Basket that is pretty regular. . Still a card that doesn’t quite earn its stripes I say.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Don't subscribe All new comments Replies to my comments Notify me of followup comments via e-mail. You can also subscribe without commenting.

About Contact

Terms of Use

Terms of Use Privacy Policy Advertising Policy

Subscribe to Emails

Love Credit Card Rewards? Then you would love the email newsletters too!

The best travel credit cards of 2021

Update: Some offers mentioned below are no longer available. View the current offers here .

At TPG, we are firm believers that travel can be absolutely transformative. It provides an opportunity to learn about different people and cultures and leaves you with unforgettable memories.

As travel starts to rebound, now is the ideal time to open a travel credit card to take advantage of all the perks and benefits. From elevated sign-up bonuses to automatic hotel elite status for your next big trip, it's best to get ahead of the game! And you can build up your points balances with online shopping for an amazing redemption in the future .

This list encompasses a broad range of exceptional travel credit cards (including a few that are likely to bring home awards from this year's TPG awards), all considered the best in their own categories. Read on to find a card that fits your spending style and travel goals.

New to The Points Guy? Sign up for our TPG daily newsletter for tips and tricks to make the most of your travel rewards.

Without further ado, here are my top picks:

The Points Guy's best travel credit cards

- The Platinum Card® from American Express : Best for welcome offer

- Capital One Venture Rewards Credit Card : Best for earning miles

- Chase Sapphire Preferred Card: Best travel credit card for beginners

- The Business Platinum Card® from American Express: Best for business travel

- American Express® Gold Card: Best for worldwide dining at restaurants

- Chase Sapphire Reserve : Best for travel credits

- Hilton Honors American Express Aspire Card : Best for hotel perks

- Delta SkyMiles® Platinum American Express Card: Best for airline rewards

Marriott Bonvoy Boundless Credit Card: Best midrange hotel card

- Alaska Airlines Visa Signature® credit card: Best for Alaska Airlines miles

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard® : Best for American Airlines flyers

- Capital One VentureOne Rewards Credit Card : Best for no annual fee

Here are some comparisons of the best travel credit card offers and bonuses available right now.

Comparing our best travel credit cards

*Bonus value is an estimated value calculated by TPG and not the card issuer.

The information for the Hilton Aspire and Citi AAdvantage Platinum Select cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuers.

The best travel credit cards

Let's take a look at the details of each of these travel credit cards and offers, including their bonus values and some of the ways I've been able to put the credit card benefits to use.

The Platinum Card from American Express: Best for welcome offer

Why it's the best travel card for welcome offer: The Amex Platinum's welcome offer is currently worth $1,500 according to TPG valuations , but that's only the beginning. Right now, new cardholders also get 10x at U.S. supermarkets and U.S. gas stations (on up to $15,000 in combined purchases) for the first six months of account opening.

Current welcome offer: Earn 75,000 Membership Rewards points after you spend $5,000 on purchases in your first six months of card membership (valued by TPG at $1,500). However, be sure to check the CardMatch tool to see if you're targeted for a higher 100,000-point welcome offer (offer subject to change at any time).

Rewards rate: Earn 5x points on airfare purchased directly with the airlines or through Amex Travel (on up to $500,000 on these purchases per calendar year) and 5x points on prepaid hotels booked with American Express Travel; 10x points on eligible purchases on your new card at U.S. gas stations and U.S. supermarkets, on up to $15,000 in combined purchases, during your first six months of card membership; 1x on everything else.

Travel benefits: The Amex Platinum is the king of luxury travel benefits. You'll get up to $200 in annual airline fee credits , up to $200 in annual Uber Cash for U.S. services, up to $100 in credit at Saks Fifth Avenue and up to $100 credit for your Global Entry or TSA PreCheck application fee once every four years. Plus, you'll get unparalleled lounge access , automatic Gold status with Hilton and Marriott and extra perks with Avis Preferred, Hertz Gold Plus Rewards and National Car Rental Emerald Club Executive. Enrollment required for select benefits.

Annual fee: $550 (see rates and fees)

Why it's worth it: It's not just the 75,000-point welcome offer that lands this card on our list of the most valuable travel cards. Besides the up to $500 in credits each year and various lounge access options, the Amex Platinum is a stellar premium travel card that can provide amazing redemptions . Among the Membership Rewards program's travel partners is Singapore Airlines KrisFlyer , which is the only way to book the ultra-premium Singapore Suites using miles. However, keep in mind that premium-class service is pretty watered down right now thanks to the coronavirus pandemic, so it might be best to save up for later premium-cabin award flights.

Other card highlights include an amazing 5x points per dollar spent on airfare purchased directly with the airline or through Amex Travel (equal to a 10% return on these purchases) and the ability to add three authorized users for a total of $175 (see rates and fees). Amex has also added several perks to the card in light of the coronavirus pandemic. This helps make the card's benefits easier to use if your spending habits and redemption choices have changed in recent months.

Further reading : American Express Platinum review

Apply here: Platinum Card from American Express

Capital One Venture Rewards Credit Card: Best for earning miles

Why this is the best stand-alone travel credit card: With the Capital One Venture, you're earning 2x on every purchase. That makes it easy to rack up rewards without having to juggle different bonus categories or spending caps. And with flexible redemption options and a manageable annual fee, this card is an excellent choice if you're looking to keep just one credit card in your wallet for all spending.

Current sign-up bonus: Earn 100,000 bonus miles after spending $20,000 on the card within the first 12 months of account opening. Or, still earn 50,000 miles after you spend $3,000 in purchases within the first three months.

Rewards rate: Earn 2 miles per dollar spent on every purchase.

Travel benefits: You get an application fee credit for Global Entry or TSA PreCheck of up to $100 every four years, a nice perk for a mid-tier card that only costs $95 a year.

Annual fee: $95

Why it's worth it: The Capital One Venture Card allows you to redeem miles for a fixed value or transfer the miles you earn to several airline and hotel transfer partners , including Avianca, Etihad and Singapore Airlines. The new and improved transfer ratio (1:1) applies to many partners, although other programs will still transfer at 2:1.5 or even 2:1. This means that you're effectively getting at least 1-2 points or miles with a partner airline for every dollar you spend on this card.

And for those who know they don't want to redeem for travel at this time, Capital One recently added fixed-value redemption options for this card that can be utilized through June 30, 2021 — takeout, restaurant delivery and select streaming services. Finally, it's the one card The Points Guy himself, Brian Kelly, can't live without .

Further reading : Capital One Venture Card review

Apply here: Capital One Venture Rewards Credit Card

Chase Sapphire Preferred Card: Best for when you're starting out

Why this is the best starter travel credit card: We've long suggested the Chase Sapphire Preferred as an excellent option for those who are new to earning travel rewards because it lets you earn valuable, transferable Chase Ultimate Rewards points with strong bonus categories and a reasonable annual fee.

Current sign-up bonus: Earn 80,000 bonus points after you spend $4,000 in the first three months from account opening. Plus, earn up to $50 in statement credits towards grocery store purchases in the first year of account opening. TPG values this bonus at $1,650.

Rewards rate: Earn 2x on a generous definition of dining and travel purchases. Earn bonus points for a limited time only — 5x on Lyft through March 2022 and 2x on groceries (on up to $1,000 in spending per month) through April 2021. Earn 1x on everything else.

Travel benefits: When you redeem your points for travel through the Chase Ultimate Rewards portal , you get a 25% bonus that makes your points worth 1.25 cents each. The CSP also comes with an entire suite of travel protections, including trip delay insurance , trip cancellation coverage , baggage delay and primary rental car insurance .

Why it's worth it: You'll earn a solid return (4% back based on TPG valuations ) on dining and travel on top of your generous sign-up bonus and you have access to some of the best travel protections offered by any travel rewards credit card.

If you are a frequent Lyft customer, you'll also enjoy the 5x on Lyft rides . Fans of DoorDash food delivery service can take advantage of at least a 12-month DashPass membership , offering free delivery on $12 or more orders. Although you won't get the same travel credits or lounge access as you do with the Chase Sapphire Reserve, this is the perfect starter travel credit card for anyone who can't justify a higher annual fee. Chase has also added new non-travel redemption options, giving you more flexibility for your points.

Further reading : Chase Sapphire Preferred review

Apply here: Chase Sapphire Preferred Card

The Business Platinum Card from American Express: Best for business travel

Why it's the best travel card for business travel: You're earning a solid return (10%) across select business travel spending, plus receiving a stellar lineup of benefits that can help take your business travels to the next level.

Current welcome bonus: Earn 125,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Platinum Card within the first 3 months of card membership.

Rewards rate: 5x points per dollar on flights and prepaid hotels booked with American Express Travel; 1.5x points per dollar spent on purchases over $5,000 (up to 1 million points per calendar year); 1x points per dollar spent on other eligible purchases.

Travel benefits: The Amex Business Platinum comes with a lot of the same benefits as the personal version, including up to $200 in annual airline fee credits , up to $100 in credit for your Global Entry or TSA PreCheck application fee once every four years, unparalleled lounge access and automatic Gold status with Hilton and Marriott . Enrollment required for select benefits. You'll also get a 35% airline bonus when you use Pay with Points for all or part of a flight with your selected qualifying airline (up to 500,000 bonus points per calendar year) when you book on amextravel.com.

Annual fee: $595 (see rates and fees)

Why it's worth it: The Amex Business Platinum is unmatched when it comes to travel and business perks. In addition to the long list of travel-specific benefits, cardholders also get up to $200 in statement credits each calendar year for any U.S. Dell technology purchases (enrollment required). If you travel for business frequently, this card could help you upgrade your experience while in the air and on the ground. And the current welcome bonus is just the icing on the cake.

This card is a Membership Rewards card, which means the points you earn can be used with Amex's many transfer partners to help you get the most out of your hard-earned rewards.

Further reading : Amex Business Platinum card review

Apply here: The Business Platinum Card from American Express

American Express Gold Card: Best for worldwide dining

Why it's the best travel card for dining: The Amex Gold earns 4x on dining at restaurants around the globe, with no foreign transaction fees (see rates and fees), meaning you'll get an 8% return on purchases (based on TPG's valuations ). While a few other cards temporarily offer higher return rates on dining, this is the best option for long-term spending.

Current welcome offer: Earn 60,000 Membership Rewards points after you spend $4,000 on purchases in the first six months of account opening (valued by TPG at $1,200). However, check the CardMatch tool to see if you're targeted for a higher 75,000-point welcome offer (offer subject to change at any time).

Rewards rate: Earn 4x at restaurants worldwide and at U.S. supermarkets (on the first $25,000 spent each calendar year, then 1x); 3x on flights booked directly with airlines or on amextravel.com; 1x on everything else.

Benefits: You'll get up to $120 in dining credits each year when you pay with the Amex Gold card at participating dining partners, including Grubhub, Seamless, The Cheesecake Factory, Ruth's Chris Steak House, Boxed and participating Shake Shack locations. You'll also enjoy up to $120 in Uber Cash each calendar year (up to $10 monthly credit) when you add your Gold card to your Uber account, redeemable for Uber rides in the U.S. or on Uber Eats orders. Enrollment required for select benefits.

Annual fee: $250 (see rates and fees)

Why it's worth it: The Amex Gold is a top performer in two categories — dining and groceries. You're getting a great return on those purchases, plus additional perks such as the dining credit.

The card doesn't do too bad in the travel sector, either, with 3x on flights booked direct or via amextravel.com. The fact that you're raking in high-value points across several common spending categories is a major advantage.

The annual fee is $250 (see rates and fees), but that fee is easily offset if you're using all the card's benefits. In fact, the Amex Gold is my most-used card right now, with its 4x at restaurants worldwide and U.S. supermarkets on top of the dining credit. While Membership Rewards aren't a great value for cash back, I'm saving up my points haul for flights later this year.

Further reading : American Express Gold review

Apply here: American Express Gold Card

Chase Sapphire Reserve: Best for travel credits

Why it's the best credit card for travel credits: The Chase Sapphire Reserve comes with an annual $300 travel credit. But rather than limiting that credit to airline incidental fees as competing cards do, you can use it to offset several travel expenses such as airfare, hotels, rental cars, transit and more. Plus, that $300 annual credit has been expanded through Dec. 31, 2021, with any balances being automatically applied to purchases at grocery stores and gas stations. You're also getting an up-to-$100 Global Entry or TSA PreCheck application fee credit once every four years.

Current sign-up bonus: Earn 60,000 Ultimate Rewards points after you spend $4,000 on purchases in the first three months of account opening ( valued by TPG at $1,200).

Rewards rate: Earn 3x points per dollar spent on travel (excluding the $300 travel credit) and dining at restaurants, 10x on Lyft through March 2022 and 3x on groceries through April 30, 2021. Earn 1x on everything else.

Travel benefits: In addition to the aforementioned travel benefits, cardholders get a combined up to $120 in food delivery credits with DoorDash through Dec. 31, 2021. When you're traveling, you'll get Priority Pass lounge access and some of the most extensive protections available on any credit card (including trip cancellation/interruption insurance , primary rental car coverage, trip delay insurance , emergency medical and more). The 50% redemption bonus when you use your points to pay for travel through the Chase portal is also a nice perk.

Annual fee: $550

Why it's worth it: The Chase Sapphire Reserve offers a stellar selection of perks on top of solid earning rates. And if you have this card, the Ultimate Rewards points you earn on other Chase credit cards can be transferred over and redeemed at the 1.5-cent rate. You could get even more value by transferring your rewards to Chase's 10 airline and three hotel partners , including Hyatt and United .

You also get an impressive 3x points on travel (after the $300 travel credit is exhausted) and dining purchases , which equates to a 6% return, based on TPG valuations. And through April 30, 2021, you'll get 3x on grocery spending as well. Plus, for cardholders who can use the new benefits , Lyft Pink, DashPass and the DoorDash credits are great additions. This credit card is a prime example of benefits more than making up for a steep annual fee.

Further reading : Chase Sapphire Reserve review

Apply here: Chase Sapphire Reserve

Hilton Honors American Express Aspire: Best for premium hotel perks

Why it's the best premium hotel travel credit card: Hilton is one of the top hotel brands in the world, and the Hilton Honors Aspire Amex offers a packed lineup of great benefits for hotel customers.

Current welcome offer: Earn 150,000 bonus points after using your new card to make $4,000 in eligible purchases within the first three months of card membership.

Related: How ExpertFlyer helped me score a first-class experience of a lifetime

Rewards rate: Earn 14x on eligible Hilton purchases; 7x on U.S. restaurants, eligible airfare and eligible car rentals; and 3x on all other eligible purchases.

Travel benefits: With this card, you get some great perks: complimentary Hilton Diamond status , up to two free weekend reward nights (one each year and one after you spend $60,000 on eligible purchases in the calendar year), up to $250 in Hilton resort statement credits, up to $250 in annual airline fee credits, up to $100 in Hilton on-property credit at certain hotels and a Priority Pass membership . Enrollment required for select benefits.

Annual fee: $450 (see rates and fees)

Why it's worth it: Hilton's premium card, the Hilton Honors American Express Aspire, offers a terrific haul of points and an array of perks. In addition to some stellar benefits, it provides an excellent 14x bonus category on spending at eligible Hilton properties — equivalent to an 8.4% return based on TPG's point valuations — among solid returns in other spending categories.

Further reading : Hilton Honors American Express Aspire Credit Card review

Delta SkyMiles Platinum American Express Card: Best for airline rewards

Why it's the best travel credit card for airline rewards: When it comes to cobranded airline cards , it doesn't get much better than Delta's lineup of cards . The Delta SkyMiles Platinum Amex is a great card for travelers hoping to hit Medallion elite status with the airline while racking up miles across a wide range of purchases.

Current welcome offer: Earn 90,000 bonus miles after you spend $3,000 on purchases in the first three months of account opening.

Rewards rate: Earn 3x on eligible Delta purchases and hotel stays; 2x on restaurants and U.S. supermarkets; and 1x on other eligible purchases.

Travel benefits : The Delta SkyMiles Platinum Card offers a Global Entry/TSA PreCheck application fee credit (up to $100), an annual companion certificate for a domestic main cabin round-trip ticket each year, elite-like perks such as a free checked bag and priority boarding on Delta flights, and a way to hit Medallion status faster: Earn 10,000 Medallion Qualification Miles after $25,000 in eligible purchases and another 10,000 MQMs after spending $50,000 in a calendar year. You can also get a Medallion Qualification Dollar waiver — but only if you spend $25,000 in a calendar year. Enrollment required for select benefits.

Why it's worth it: The Delta SkyMiles Platinum Amex offers enhanced bonus categories (including increased 3x earning on Delta) and a host of travel benefits. The card's annual fee is $250 (see rates and fees), so make sure you will get at least that much in value from the card each year. This card is best suited for regular travelers who are loyal to Delta and want a little help earning Medallion status with the airline.

Further reading : Delta SkyMiles Platinum Amex Card review

Apply here: Delta SkyMiles Platinum American Express Card

Why it's the best mid-tier hotel travel credit card: There are more than 7,000 Marriott properties around the world — plus, this card offers some substantial perks for casual travelers.

Current sign-up bonus: Earn 100,000 bonus points after you spend $3,000 on purchases in the first three months from account opening.

Rewards rate: Earn 6x at participating Marriott Bonvoy hotels and 2x on all other eligible purchases.

Travel benefits: You'll earn 15 elite-night credits every year, good enough for Marriott Bonvoy Silver Elite status . By spending $35,000 or more on your card each account anniversary year, you'll qualify for Marriott Bonvoy Gold Elite status. Plus, you'll receive a free award night good for stays costing up to 35,000 points every year after your account anniversary.

Why it's worth it: The Marriott Bonvoy Boundless is offering a fantastic sign-up bonus offer worth $800 according to TPG valuations. The free night award certificate alone can help you outsize the annual fee each year.

Further reading : Marriott Bonvoy Boundless credit card review

Apply here: Marriott Bonvoy Boundless Credit Card

Alaska Airlines Visa Signature credit card: Best for Alaska Airlines miles

Why it's the best travel credit card for Alaska Airlines miles: Alaska Airlines miles are among the most valuable airline miles you can earn today, in part because of Alaska's mix of airline partners and distance-based award chart.

Current bonus: Get a $100 statement credit, 40,000 bonus miles and Alaska's Famous Companion Fare (from $121 — $99 fare, plus taxes and fees from $22) after you spend $2,000 or more on purchases in the first 90 days your account is open.

Rewards rate: Earn 3x miles on eligible Alaska Airlines purchases; 1x miles on everything else.

Travel benefits: Get a free checked bag on Alaska flights for you and up to six guests on your reservation; receive an annual Companion Fare on your account anniversary; enjoy 50% off Alaska Lounge day passes and 20% back on all inflight purchases.

Annual fee: $75

Why it's worth it : Whether you live on the West Coast or not, the Alaska Airlines Visa Signature is a good cobranded airline card to consider adding to your wallet. The Seattle-based airline is mostly limited to North American routes (with some international destinations through partners), but that will change now that the airline has joined Oneworld. American Airlines and Alaska Airlines are also renewing (and strengthening) their partnership . Both developments will help Alaska Airlines add new ways for customers to use the Mileage Plan program as the airline establishes a global footprint.

Further reading : Maximizing the Alaska Airlines Visa Companion Fare

Citi / AAdvantage Platinum Select World Elite Mastercard: Best for American Airlines flyers

Why it's the best travel credit card for American Airlines flyers: If you fly American Airlines often, it can be handy to have a cobranded credit card from the airline. The Citi / AAdvantage Platinum Select offers a nice mix of benefits and earning opportunities for a manageable $99 annual fee, making it great for AA flyers who aren't looking for lounge access or an abundance of luxury perks.

Current bonus: Earn 50,000 bonus miles after you spend $2,500 in the first three months of account opening.

Rewards rate: Earn 2x miles on eligible American Airlines purchases, restaurants and gas stations.

Travel benefits: You'll get preferred boarding, a free checked bag on domestic itineraries for you and up to four travel companions, a 25% discount on eligible inflight purchases and a $125 American Airlines flight discount when you spend more than $20,000 in a calendar year and renew your card.

Annual fee: $99 (waived for the first year)

Why it's worth it : For a low annual fee, American Airlines customers can enjoy elite-like benefits without breaking the bank or needing to hit an elite status tier. You'll earn 2x (a 2.8% return) on three different bonus categories and a few nice benefits to help make the flight experience more enjoyable. Plus, the card is currently offering a welcome bonus that TPG values at $700. If you know how to maximize your AAdvantage redemptions , that bonus could potentially be worth even more.

Related : What credit score do you need to get the Citi / AAdvantage Platinum Select World Elite Mastercard?

Capital One VentureOne Card: Best for no annual fee

Why it's the best travel card for no annual fee : The no-annual-fee Capital One VentureOne Rewards Credit Card has the same decent redemption options as its older brother card, the Capital One Venture Rewards Credit Card — but with a lower rewards rate and fewer perks. The miles earned on the card can also be transferred to airline and hotel partners and some other benefits not usually seen with a no-annual-fee card.

Current bonus : 20,000 bonus miles after spending $500 within the first three months from account opening.

Rewards rate : You'll get a flat 1.25 miles per dollar on all purchases, which equates to a solid 1.75% return.

Travel benefits : Some of the perks include travel accident insurance — get up to $250,000 in coverage for common carrier accidental death or dismemberment when you pay for your entire travel fare with your card. There's also lost luggage reimbursement for up to $3,000 per trip if your bags are lost or stolen. You'll get an extended warranty, too — double the manufacturer's warranty or up to one extra year for warranties of three years or less, with a maximum of $10,000 per claim and $50,000 per cardholder. On top of all that, the VentureOne card is one of the only no-annual-fee options that don't charge foreign transaction fees. Benefit only available to accounts approved for the Visa Signature card. Terms apply.

Why it's worth it : The VentureOne card is a strong card to have in your arsenal and great if you are budgeting due to its no annual fee. After all, there aren't many no-annual-fee cards with the ability to transfer points and miles directly to travel partners, so it's a big bonus that this card offers that. The VentureOne also beats other no-annual-fee cards for perks such as purchase protection and no foreign transaction fees. Its earning scheme is practically identical to the $95-a-year card, but with a slightly lower return on everyday spending — so if you think you'll spend $7,600 on everyday purchases per year — this card is for you.

Related: Capital One Venture vs. Capital One VentureOne

Research methodology for the best travel credit cards

I reviewed numerous travel credit card offers and spent countless hours studying the pros and cons of each offer. I assigned value to these credit cards based on the following criteria:

- Sign-up bonus/welcome offer value — The first thing I look at for each card is the value of each sign-up bonus. Although you shouldn't choose a credit card based solely on that metric, you can use bonus values as a tiebreaker of sorts between similar cards or as a way to prioritize which card to get first.

- Earning rate — Bonus value is important, but so is the long-term value each card offers. I looked at the rewards rates to see which cards would reward cardholders for the long term.

- Travel credits — The best travel credit cards often offer an assortment of travel credits for cardholders. Some cards, including the Chase Sapphire Reserve, offer broadly defined travel credits. Others, such as the Amex Platinum, provide shopping and airline fee credits. Several offer a Global Entry/TSA PreCheck application fee credit.

- Travel benefits — In addition to travel credits, top travel credit cards often come with benefits like complimentary elite status or lounge access. I took these into consideration as well.

- Rewards program — Not all credit card rewards programs are created equal. Each program has its own valuation, which you can study here. The value of each currency is vitally important when rating travel credit cards and their promotional offers.

- Foreign transaction fees — This is a huge factor when choosing a credit card. If you plan to use your travel rewards credit card abroad or on websites hosted abroad, you want to ensure you don't have a foreign transaction fee biting into your earnings.

- Travel insurance coverage — Last, I look at what travel protections each card offers. These benefits are often overlooked but can save travelers hundreds or even thousands of dollars when things go awry during trips.

How do I use a travel credit card?

Travel credit cards offer rewards on different purchases that can help you book flights, hotels and more for little to no out-of-pocket expenses. Some cards also provide valuable perks and benefits that upgrade the overall travel experience — from Global Entry application fee credits to lounge access to complimentary elite status . If you have the right card (or cards) in your wallet, the sky is the limit on where your travels can take you — literally.

Are you new to the travel rewards card game? Check out our beginner's guide to all things points and miles . You'll learn about top loyalty programs, how to maximize your credit card strategy to reach your travel goals and so much more.

Related: The complete history of credit cards, from antiquity to today

Different types of travel credit cards

The reason to hold any travel rewards credit cards is to earn rewards, but there are different types of travel credits:

Transferable-rewards credit cards

These cards earn rewards that can be redeemed through a card's rewards program directly or by transferring them to a travel partner . Many of our best travel credit cards fall under this category because they are the most valuable type of points you can earn. Transferable rewards give you the flexibility to redeem your rewards in a way that will be most beneficial to you. Examples of top transferable rewards cards are the Chase Sapphire Reserve and Amex Platinum.

Some popular transfer rewards programs

- Guide to Amex Membership Rewards

- Guide to Capital One miles

- Guide to Chase Ultimate Rewards

- Guide to Citi ThankYou Rewards

Related: A guide to earning transferable points and why they're so valuable

Airline credit cards

Airline cobranded cards earn a specific type of airline miles. These cards also generally come with perks specific to that airline. For example, an airline card may offer free checked bags , a certain number of elite-qualifying miles to help you reach status, priority boarding privileges, inflight discounts and more.

Related reading: Best airline credit cards

Hotel credit cards

Hotel cobranded cards work like airline cards. You'll earn rewards that are redeemable for a particular hotel program, such as Hilton or Marriott. Hotel cards come with their own benefits, such as complimentary elite status or free award-night stays. One of my favorite things about hotel cards is that you can stack your earnings on hotel stays with the hotel's program.

For example, if you have the Marriott Bonvoy Boundless card, you'll earn 6x at participating Marriott properties on top of the 10x base points you get as a member of the Bonvoy program. That means you're really earning 16x on Marriott stays when you use your hotel card to pay for your booking.

If you have Bonvoy elite status , you'll also earn a bonus on those base points. You could earn up to 23.5x on eligible hotel stays, depending on what level of status you have.

Related: Best hotel credit cards

Fixed-value credit cards

Fixed-value cards earn points or miles that are always redeemed for the same value. For example, the Bank of America® Premium Rewards® credit card earns points worth 1 cent each. These cards are great for beginners who haven't quite gotten the hang of maximizing transferable points or casual travelers who don't want to worry about transfer partners or dynamic pricing.

As more hotels and airlines move to a dynamic pricing model where award pricing shifts dramatically, fixed-value rewards programs are becoming more popular.

Related reading: Comparing the best fixed-value point credit cards

Pros and cons of travel credit cards

Travel credit cards are a great way to earn rewards that allow you to travel the world for less money — or practically for free — simply by using a credit card to buy the same items you'd otherwise buy with cash or a debit card. With certain travel credit cards, you can also get perks to use while traveling — everything from airport lounge access and hotel elite status to free airline companion certificates and discounts or credits on your travel purchases. Those who are well-versed in award charts and redemption options for travel rewards cards can often get more value from points than from cash back.

However, there are a few drawbacks to travel rewards cards. Because travel credit cards are focused on earning and redeeming for travel expenses, your redemption options are slightly limited when it comes to maximizing value. For example, you can redeem your Amex Membership Rewards points as a statement credit — through Amazon, for gift cards and more — but you're generally only getting the best value when you transfer your points to partners.

But when it comes to transfer partners, the value you're getting can also change drastically depending on the partner and redemption you book. More airlines and hotels are switching to dynamic pricing models, which means the value you get from your points and miles can vary drastically.

Still, the advantages of travel rewards cards almost always outweigh the drawbacks for frequent travelers. You can't beat the potential redemptions, travel benefits and sign-up bonuses that top travel credit cards offer. Plus, many of these cards provide temporary perks that extend their value beyond just travel, at least in the short term.

How to compare travel credit cards

With so many travel credit cards on the market, it's essential to ask yourself which credit card benefits best meet your travel goals. Are you hoping to use your sign-up bonus for a specific redemption? Are you looking for a card that gives you luxury travel perks? Are you hoping to hit elite status with a specific hotel brand or airline? Are you a casual traveler or a frequent flyer? Which spending categories will be most beneficial to you?

For example, if you want a card to help you hit elite status with Delta while giving you elite-like perks, you should strongly consider getting a Delta credit card, such as the Delta SkyMiles® Reserve American Express Card. Multiple Amex Delta cobranded cards give you perks such as earning Medallion Qualification Miles when you hit certain spending thresholds and offer free checked bags and priority boarding.

Related: Delta now makes it even easier to earn elite status — but is it worth it?

On the other hand, if you only fly occasionally and aren't exclusively loyal to one airline, you might be better off with a flexible travel credit card, like the Chase Sapphire Preferred. While it doesn't offer perks on any one airline, it earns points that can be transferred to various airlines (and hotels). And if you're typically a road warrior who flies every week, you'll want to think about a premium travel credit card that offers lots of travel perks, such as the Amex Platinum, with airport lounge access and hotel elite status. Other aspects to consider are below.

Rewards rates

You should consider each card's reward rates — how many points or miles you receive per dollar spent. General travel cards offer flat-rate rewards, while cobranded cards will likely offer a base rate than a higher percentage in certain categories like hotels and airline tickets. Remember to look at the categories to which those reward rates apply and find a card that matches your spending patterns.

Most travel credit cards have an annual fee — the higher the fee, the better the perks and some premium cards can charge upward of $550. Consider the value of the rewards and perks you'll get to make sure they'll make up for the fee. If you only travel a few times a year, a high-end card like the Amex Platinum probably isn't worth it.

Elite status

Some travel cards offer automatic elite status with various brands when you sign up and can also accelerate the journey to elite airline status by converting points to air miles. If you are loyal to a particular hotel brand, status with that brand will be valuable. You'll be entitled to room upgrades, resort credits, early check-in, late checkout and more. If you're not loyal, it won't. The same goes for elite status with an airline — you'll get lounge access, upgrades, increased baggage allowance, etc. When comparing the perks of various cards like elite status, be realistic about which ones you will and won't use.

Foreign transaction fees

Since one of the points of a travel credit card is that it is advantageous for people who travel a lot, a decent one should not charge a foreign transaction fee. If it does, obviously the lower the better. Certain issuers like Discover and Capital One don't charge foreign transaction fees on any of their cards. Others charge them on some cards but not all.

Things to consider before applying:

- 7 things to understand about credit before applying for cards

- 6 things to do to improve your credit score

- Debunking credit card myths: Does applying for a card permanently affect my credit score?

As always, head to TPG's cards hub to see the best credit cards currently available.

Frequently asked questions about travel credit cards

How much is a point or mile worth on a travel credit card.

Every point or mile from an airline, hotel or bank is worth a different amount, so you can't assume that a 50,000-point bonus on one card is equivalent to a 50,000-point bonus on another. That's why The Points Guy maintains a guide to point and mile valuations , which explains how much each type of point and mile is worth. You can use those valuations to determine how much a sign-up bonus or bonus category is worth.

For instance, Amex Membership Rewards are worth 2 cents each based on TPG's valuations, which means the 75,000-point bonus on the Amex Platinum is worth $1,500. That's because 75,000 x .02 = $1,500. And since that card earns five points per dollar on airfare, you can also determine that each dollar you spend on airfare will get you 10 cents back in points because 5 points x 2 cents = 10 cents.

Is an annual fee worth it?

Many of the top travel rewards credit cards come with hefty annual fees. But cardholders who maximize the perks and rewards structures on these cards will almost always come out net-positive by the end of the year.

For example, although the Amex Platinum comes with a $550 annual fee (see rates and fees), you're getting up to $500 in annual credits, unrivaled lounge access, a TSA PreCheck/Global Entry application fee credit, elite status with Hilton and Marriott and more in return. If you're using your credits every year and regularly visiting lounges, that annual fee is already paying for itself even before factoring in any rewards you earn with the card.

Related: Battle of the premium travel rewards cards: Which is the best?

Even cards that don't offer a lot in travel credits are often worth the annual fee for cardholders. Take the Chase Sapphire Preferred Card, for example. There are no travel credits to offset the cost of the annual fee, but you only have to spend $2,375 on dining and travel each year to make the annual fee worth it ($2,375 x 2 points per dollar = 4,750 points; 4,750 points x 2 cents per point = $95). If you know you'll use the benefits and perks offered by a card while also earning rewards through bonus spending, annual fees are easily worth it.

Related: 5 reasons why the Chase Sapphire Preferred should be your first card

Should I get a cash-back or travel credit card?

Ideally, you should have both types of cards in your wallet. Travel credit cards are great when you want to redeem points and miles for travel purchases, but you aren't getting a great redemption value when you redeem for almost anything else. On the other hand, cash-back cards can be used to offset the cost of expenses your points and miles won't cover.

Related: The best cash-back credit cards for 2021

Let's say you are taking a trip to London in the fall. With the points earned through your Amex Platinum, you transfer points to partners for your award flights and hotel stays. However, those aren't the only expenses that go into a trip. Points and miles won't cover expenses like ground transportation, eating out or tourist attractions while you're there. But you can use cash-back rewards to offset those costs.

For example, if you use a card like the Capital One Savor Cash Rewards Credit Card for your dining and entertainment spending, you can use the cash back you've saved up previously as a statement credit to cover those purchases even while earning 4% back.

The information for the Capital One Savor Cash Rewards Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

If you wonder which type of card would be best as your first travel credit card , consider what type of rewards you will find more valuable. Cardholders who only plan to travel every once in a while may get more value out of a cash-back card that they can use to offset the cost of other expenses. However, if you hope to use the rewards from your card to book award flights and hotels, a travel credit card is the way to go.

Are there different considerations for choosing a card for international travel?

Not all travel credit cards are best for spending outside of the U.S. Some tack on fees for purchases that are not made within the U.S. or on a U.S. site. Others may not be widely accepted overseas. Plus, some cards offer more benefits that help you on your international adventures.

Here are a few of the things to look out for when choosing a card for international travel:

- Foreign transaction fees — Some cards charge a fee (typically 3% to 5% of each transaction) when you use your card outside of the U.S. (including sites that are considered international and not U.S.-based). That fee will wipe out any rewards you may earn, so make sure to have a card that charges no foreign transaction fees .

- TSA PreCheck/Global Entry — TSA PreCheck and Global Entry can make security lines go faster and reentry into the U.S. smoother. Luckily, plenty of top travel credit cards come with a TSA PreCheck/Global Entry application fee credit typically worth $100 every four years.

- Insurance benefits — Now more than ever, travel insurance is an important consideration when opening a new credit card. No one wants to think about the worst-case scenario happening on vacation, but it's better to be prepared with a card that offers some form of travel protection.

- Earning abroad — Some cards limit your bonus categories to U.S. merchants. If you plan to use a credit card abroad, make sure it will earn rewards on purchases no matter where you are.

What credit score is needed for a travel credit card?

The best travel credit cards typically require a good to excellent credit score. If you have no credit history, rather than a negative one, you may have to spend some time building your credit score with "beginner" cards before applying for a travel credit card. If your credit scores are in the 670 to 739 range, your credit is considered good, while scores above that will put you in the very good to excellent range.

Other factors are also considered when card issuers review your application, including income and monthly expenditure. Individual cards may also give a ballpark credit score you will need and you can also use our CardMatch tool which will recommend the best cards for you.

Bottom line

Travel credit cards are great at helping you meet your vacation goals. They can save you thousands of dollars on airfare and hotel costs. Whether you're a beginner who wants a card to offset the cost of your first big international trip or a road warrior looking to upgrade your travel experiences, there is a travel credit card out there for you.

It all comes down to choosing a card that will help you maximize your spending. Adding one of these cards to your wallet now could help you save up rewards for a fantastic redemption in the future.

For rates and fees of the Amex Platinum Card, please click here. For rates and fees of the Amex Business Platinum Card please click here. For rates and fees of the Hilton Aspire Card, please click here. For rates and fees of the Delta Platinum Amex, please click here. For rates and fees of the Amex Gold Card, please click here.

Additional reporting by Hayley Coyle and Stella Shon.

Updated on 4/8/2021

Bank Branch and ATM Locator

Ifsc, micr, swift, branch search.

Search Bank branch, Bank ATM, IFSC code, MICR code, Swift code

Hint: Type Bank Name, Branch Name, ATM, IFSC Code, MICR Code, Swift Code, Address, City Name or State name

- Open Joint Stock Company Otp Bank

SWIFT Code: OTPVRUMM: Open Joint Stock Company Otp Bank, 105062 Moscow, Russia

The SWIFT code of Open Joint Stock Company Otp Bank, 105062 Moscow, Russia is OTPVRUMM. This branch is located in 105062 Moscow, Russia. The SWIFT code OTPVRUMM is used to perform wire transfer electronically between Open Joint Stock Company Otp Bank 105062 Moscow, Russia and other participating branches in the world.

Report Incorrect

Nearby Open Joint Stock Company Otp Bank, Russia Swift Codes

Swift codes of banks in russia.

- International Science And (1)

- Primorye Bank (1)

- International Bank For (1)

- Uraltransbank (1)

- Transcapitalbank (1)

- Asia-invest Bank (1)

- Solidarnost Commercial Bank (1)

- Alfabank (1)

- Bank Of Tokyo-mitsubishi Ufj (1)

- The Royal Bank Of Scotland Zao (1)

- Uralsib Bank Oao (1)

- Yuzhny Region Bank (1)

- Chelyabinvestbank (1)

- Financial House Clearing Center (1)

- International Industrial Bank (1)

- Otkritie Commercial Bank (1)

- Sdm-bank (1)

- The Bank For Foreign Trade Of (1)

- Rosprombank (1)

- Bank Of Moscow (1)

Facebook fans

IMAGES

COMMENTS

You can do it through the Internet banking OTP Smart or call the 24-hour support service by phone +380 44 490 05 26, it is also desirable to notify the bank about your plans to stay abroad (this will allow the bank to enhance the security of your payment card in the country of your destination). You can do this by filling out a .

Create your free OTP Bank Tickets Travel Card and get cashback to 2% on each purchase! When making get 250 bonus points. Buy online with free delivery in Kyiv, Kharkov and Odessa. Individual clients; ... Card account tariffs «OTP Tickets Travel Card Loyal» (15/07/2024)

Mastercard OTP. You pay quickly, to any merchant who displays the Mastercard logo. The debit card gives you the opportunity to make online payments so you spend less time with your debts and more with your friends or family. Zero card usage fee for merchants. No administration fee in the first year.

Отримайте кешбек 2% при покупці на сайті tickets.ua, 1% за безготівковий розрахунок на інших сервісах з картою Tickets Travel Card від OTP Bank! Додатково використовуйте промокоди на 50% знижки при оплаті послуг таксі в системі Uber

Оформлюй безкоштовно картку OTP Bank Tickets Travel Card і отримуй кешбек до 2% з кожної покупки! При оформленні забирай 250 бонусних балів. Замовляй онлайн з безкоштовною доставкою по Києву, Харкову та Одесі

Internet & Mobile Banking: OTPdirekt & SmartBank. We notify you when you receive money in your bank account or make payments. or a shopping card? Pay with your Mastercard debit card in lei, anywhere, in stores or online and you can win on a monthly basis 1 travel gift card of 10.000 Lei or 1 of the 20 Altex vouchers of 500 Lei.

OTP Tickets Travel Card - a card for travelers from OTP Bank is among the top three credit cards issued in UAH. Analysts of the site Prostobank.ua, who studied the proposals of the 16 largest Ukrainian banks, made the rating of the best offers.Prostobank.ua, who studied the proposals of the 16 largest Ukrainian banks, made the rating of the best

Features. Mastercard Platinum debit card is available in LEI and EUR only for customers with the Privilege Banking package; You have access to your free account, 24 hours/day, 7 days/week, via OTPdirekt service; You receive SMS alerts for each card transaction, you can activate this service from OTPdirekt; Possibility to request up to 3 ...

With State Bank Foreign Travel Card (SBFTC), you can shop, dine or visit places abroad without any worries of carrying or losing cash. It relieves you of the Annual fees, joining fees, credit limits, etc., usually associated with International Debit / Credit Cards. ... OTP for carrying out financial transactions are sent to the Cardholders ...

Please Login to CitiManager: home.cards.citidirect.comhome.cards.citidirect.com

Citi customer service provides 24/7 assistance to cardholders at 1-800-200-7056 and 1-757-852-9076 (toll-free). These numbers are designated for DoD customers only. Remember, your APC is your first point of contact for travel card-related questions or issues. Call Citi Customer Service, or log on to CitiManager, to quickly obtain balance and ...

For more information regarding your new card, please read the Department of Defense Cardholder Guide. Department of Defense Travel Insurance. As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card. Travel Accident Insurance Guide

OTP Bank Group is the largest commercial bank of Hungary and one of the largest independent financial service providers in Central and Eastern Europe, with banking services for private individuals and corporate clients.The OTP Group comprises subsidiaries in the field of insurance, real estate, factoring, leasing and asset management, investment and pension funds.

Pay with OTP Tickets Travel and make your trip's reality. Payment cards with favorable terms from OTP Bank. Cashback up to 3%, the grace period 55 days, 0% Commission, bonuses for purchases, and when you open the account. Order your credit or debit card online with shipping.

Credit Cards. Visa Credit Card. Visa Platinum. Card Services (Debit & Credit) 3D Secure. PIN over SMS. SMS Banking. ATM services. ATM Cash IN.

Fraud Prevention: Standard Bank will never request OTP (One-Time Password) via email or phone. Always verify requests directly with the bank. 4. Travel Benefits. Discounts: Receive up to 20% off Emirates flight tickets. Travel Insurance: Automatic cover of up to R2 million for travel bookings made with the card. 5. Rewards Program

You automatically benefit from travel insurance abroad for the duration of the card validity, up to € 30.000, as provided for, under the insurance policy; ... If you wish to use the card issued by OTP Bank Romania at OTP Group ATMs abroad, you will be charged a cash withdrawal fee of only 3.5 LEI/1 EURO per transaction.

The IndusInd Bank Pioneer Legacy Credit Card is a reasonably rewarding card for those with a Pioneer banking relationship who are looking for a credit card with moderate spends. It can also serve as a backup card for super-premium cardholders as it comes with a good reward rate, directly as cashback instead of travel rewards.

One-time loadable card with min limit of ₹500 and max limit of ₹10,000; Used for purchases at any merchant outlet or Ecom site for shopping, food, travel tickets, bill payments, movies, events, fashion etc

up to 200 000. credit limit, UAH. Detail. OTP Tickets Travel Card - is a card for those who at least once a year travel across Ukraine or abroad. - this trusty payment aggregate and discount for fuel. SHOW ALL CARDS. +38 044 490 05 00. Round the clock, cost of calls according to the tariffs of your operator. Call online.

Why it's the best travel card for no annual fee: The no-annual-fee Capital One VentureOne Rewards Credit Card has the same decent redemption options as its older brother card, the Capital One Venture Rewards Credit Card — but with a lower rewards rate and fewer perks. The miles earned on the card can also be transferred to airline and hotel ...

A SWIFT code is a set of 8 or 11 digits that uniquely identify a bank branch. You'll need to use one when sending money internationally. If you want to send money to JOINT STOCK COMPANY 'OTP BANK', registered at 16A LENINGRADSKOE SHOSSE 16A in MOSCOW, RUSSIAN FEDERATION you will need the OTPVRUMMXXX SWIFT code.

If you have any questions, please, contact us: (044) 490 05 26, (044) 290 92 36, around the clock, the cost of calls according to the tariffs of your telecommunications operator; Facebook, Telegram та Viber. Please let us know if you are going abroad to avoid unnecessary hassles during your trip. To do this, we will make the necessary ...

Finance your dreams and take advantage of every moment, wherever you are, with the OTP Mastercard Platinum credit card. You have access to a credit limit of up to 100.000 lei to enjoy the life you want. You get a generous limit of up to 100.000 lei, which you can use anywhere, anytime. Do you go shopping?

The SWIFT code of Open Joint Stock Company Otp Bank, 105062 Moscow, Russia is OTPVRUMM. This branch is located in 105062 Moscow, Russia. The SWIFT code OTPVRUMM is used to perform wire transfer electronically between Open Joint Stock Company Otp Bank 105062 Moscow, Russia and other participating branches in the world. Report Incorrect

Airport services such as Fast Line on departure and arrival, discounts in Duty Free stores, free antigen/PCR testing at Ukrainian airports, as well as business lounges for comfortable waiting at flights at global airports - these and many other benefits can be obtained by OTP Bank customers - Mastercard premium card holders.