- Trending Stocks

- Yes Bank INE528G01035, YESBANK, 532648

- Vodafone Idea INE669E01016, IDEA, 532822

- Kotak Mahindra INE237A01028, KOTAKBANK, 500247

- IDFC First Bank INE092T01019, IDFCFIRSTB, 539437

- Bajaj Finance INE296A01024, BAJFINANCE, 500034

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- INSTANT LOANS UPTO ₹ 5 Lakhs

- Remove Ads Get Premium Content Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Fixed Deposit Interest Calculator

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- Pharma Industry Conclave Unlocking opportunities in Metal and Mining

- Pitchcraft REA

- Advanced Technical Charts

- International

- Go pro @₹99

- Elections 2024

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Travel Services

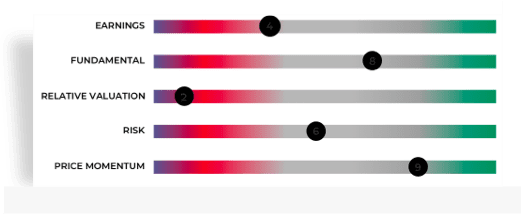

Samco Stock Rating

Easy Trip Planners Ltd.

As on 26 Apr, 2024 | 04:02

* BSE Market Depth (26 Apr 2024)

As on 26 Apr, 2024 | 04:01

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

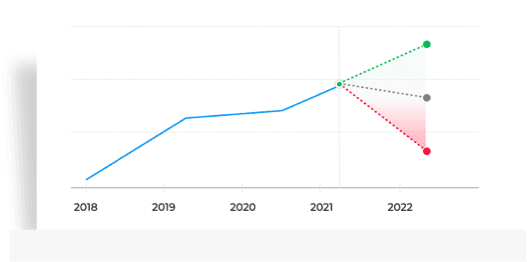

Forecast

Stock with medium financial performance with average price momentum and val

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

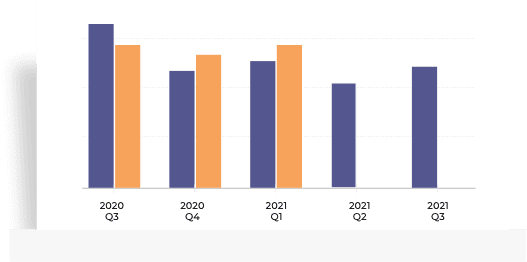

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 12.96% away from 52 week high

- Market Cap - Below industry Median

- Promoters holding remains unchanged at 64.30% in Mar 2024 qtr

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Decreasing ROE

Companies that are decreasing efficiency in utilisation of shareholders funds, rising profits, falling margins, companies that have grown their net profits but decreased net profit margins over the past 12 months, dii buying fii buying, list of companies in which diis and fiis have increased their holdings in last quarter.

- ROE<ROE 1 yr Back

- ROE<ROE 3 yr Avg

- Market Capitalization >250

- NetProfit>NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

- MarketCap>250

- FIIHolding >FIIHolding1QtrBack AND

- DIIHolding >DIIHolding1QtrBack AND

- MarketCap >250

Companies in which FIIs have increased holding QoQ

10x profit growth explosion, companies whose net profit have grown 10 times in 5 years, 5x premium to book value, companies trading at more than 5 times their book values.

- FIIHolding>FIIHolding1QtrBack AND

- MarketCap>500

- Market Capitalization >500 AND

- Profit growth 5Years >59 AND

- Profit growth >0

- Price to book value > 5 AND

- Book value >0 AND

- Market Capitalization >500

Profit Margin Leaders

Companies with npms consistently in excess of 25%, sales pioneers, 3 yr sales cagr of 25% or higher.

- NPM latest quarter >25 AND

- NPM last year >25 AND

- NPM5yrAvg>25

- Sales3yrCAGR>25 AND

- SalesGrowth>25 AND

Rising Book Value

Book value of these companies rising over last 3 years, price to book value above industry, companies with price to book value above industry.

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

- Price to book value >Industry PBV AND

Premium to Peers

Companies trading at premium pe valuation as compared to their industry peers, profit pioneers, companies that are consistently generating 25% or higher profit growth for last 3 years.

- Price to Earning >Industry PE AND

- NetProfit3yrCAGR>25 AND

- NetProfitGrowth>25 AND

Price and Volume

Why easemytrip ceo nishant pitti wants to own an airline and make movies too.

Bulk deals: Promoters sell stake in BGR Energy Systems, Minerva Ventures buy stake in Easy Trip Planners Feb 26 2024 07:39 PM

Radisson to open 2nd hotel in Ayodhya in tie-up with EaseMyTrip, Jeewani Group Feb 20 2024 07:16 PM

HFT Scan: Algo traders zoom in on Easy Trip Planners, Dish TV India Feb 13 2024 06:32 AM

Easy Trip Standalone December 2023 Net Sales at Rs 128.98 crore, down 1.05% Y-o-Y Feb 12 2024 10:36 AM

Community Sentiments

What's your call on Easy Trip today?

Read 2 investor views

Thank you for your vote

You are already voted!

_shubhamshelke96k_

Going to fly high bcz of king Adani buy now View more

Posted by : _shubhamshelke96k_

Repost this message

Going to fly high bcz of king Adani buy now

Siva_Trader_11

Buy this stock as much you can...it will reach 55 target soon...So dont sell the stock even single mistake View more

Posted by : Siva_Trader_11

Buy this stock as much you can...it will reach 55 target soon...So dont sell the stock even single mistake

Easy Trip Planners rises on collaborating with Adani Digital Labs View more

Posted by : nabdhj

Easy Trip Planners rises on collaborating with Adani Digital Labs

- Broker Research

ICICIdirect.com

- Company analysis giving insights of fundamentals, earnings, relative valuations, risk, price momentum and inside trading.

- Thomson Reuters proprietary rating of stock on scale of 1 to 10

- Industry ranking and detailed sector analysis of recent happening in sector

- Analyst rating like Buy/Sell/Hold with Earnings estimates with 1 year price target

WILSON HOLDINGS PRIVATE LIMITED

Nishant pitti.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

HRTI PRIVATE LIMITED

Minerva ventures fund.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

Rikant pittie, nishant pitti.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Rikant Pittie & PACs Disposal

Nishant pitti & pacs disposal, prashant pitti acquisition, nishant pitti disposal, prashant pitti & pacs acquisition.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

Easy Trip Planners Limited

Easy trip planners - announcement under regulation 30 (lodr)-press release / media release.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds holding remains unchanged at 0.06% in Mar 2024 qtr

- Number of MF schemes remains unchanged at 8 in Mar 2024 qtr

- FII/FPI have increased holdings from 2.18% to 2.78% in Mar 2024 qtr.

About the Company

Company overview, registered office.

223, FIE Patparganj Industrial Area, ,East Delhi,,

011-43131313

http://www.easemytrip.com

Selenium Tower B, Plot No. 31-32,,Gachibowli, Financial District, Nanakramguda,Seri

Hyderabad 500032

040-67161500, 67162222, 33211000

040-23420814, 23001153

http://www.kfintech.com

Designation

Chairman & CEO

Executive Director

Independent Director

Included In

INE07O001026

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

Access your Detailed Credit Report - absolutely free

- Sector: Services

- Industry: Online Service/Marke...

Easy Trip Planners Share Price

- 47.00 0.61 ( 1.30 %)

- Volume: 2,09,51,807

- 46.95 0.51 ( 1.09 %)

- Volume: 21,44,642

- Last Updated On: 26 Apr, 2024, 04:02 PM IST

- Last Updated On: 26 Apr, 2024, 03:56 PM IST

Easy Trip Planners Shar...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు

Easy Trip Planners share price insights

Company has spent less than 1% of its operating revenues towards interest expenses and 11.68% towards employee cost in the year ending 31 Mar, 2023. (Source: Consolidated Financials)

Stock gave a 3 year return of 291.56% as compared to Nifty Midcap 100 which gave a return of 104.06%. (as of last trading session)

Easy Trip Planners Ltd. share price moved up by 1.30% from its previous close of Rs 46.40. Easy Trip Planners Ltd. stock last traded price is 47.00

Insights Easy Trip Planners

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 55.46

- EPS - TTM (₹) 0.85

- Dividend Yield (%) 0.00

- VWAP (₹) 46.92

- PB Ratio (x) 22.46

- MCap (₹ Cr.) 8,323.27

- Face Value (₹) 1.00

- BV/Share (₹) 2.09

- Sectoral MCap Rank 15

- 52W H/L (₹) 54.00 / 37.00

- MCap/Sales 16.86

- PE Ratio (x) 54.86

- VWAP (₹) 46.84

- PB Ratio (x) 22.22

- 52W H/L (₹) 54.00 / 37.01

Easy Trip Planners Share Price Returns

Et stock screeners top score companies.

Check whether Easy Trip Planners belongs to analysts' top-rated companies list?

Easy Trip Planners News & Analysis

Announcement under Regulation 30 (LODR)-Press Release / Media Release

Easy Trip Planners Share Analysis

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

Easy Trip Planners Share Recommendations

Recent recos.

Mean Recos by 2 Analysts

That's all for Easy Trip Planners recommendations. Check out other stock recos.

Analyst Trends

Easy trip planners share price forecast, get multiple analysts’ prediction on easy trip planners.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

Peer Comparison

Easy trip planners stock performance, ratio performance.

Stock Returns vs Nifty Midcap 100

Choose from Peers

Choose from Stocks

- There’s no suggested peer for this stock.

Peers Insights Easy Trip Planners

Easy trip planners shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Corporate actions, easy trip planners board meeting/agm, easy trip planners dividends, about easy trip planners.

Easy Trip Planners Ltd., incorporated in the year 2008, is a Small Cap company (having a market cap of Rs 8,319.73 Crore) operating in Services sector. Easy Trip Planners Ltd. key Products/Revenue Segments include Commission (Air Passage), Income From Advertisement, Other Services and Other Operating Revenue for the year ending 31-Mar-2023. For the quarter ended 31-12-2023, the company has reported a Consolidated Total Income of Rs 165.31 Crore, up 14.35 % from last quarter Total Income of Rs 144.57 Crore and up 18.19 % from last year same quarter Total Income of Rs 139.87 Crore. Company has reported net profit after tax of Rs 45.68 Crore in latest quarter. The company’s top management includes Mr.Nishant Pitti, Mr.Prashant Pitti, Mr.Rikant Pittie, Mr.Satya Prakash, Justice(Retd)Usha Mehra, Mr.Vinod Kumar Tripathi, Mr.Ashish Kumar Bansal, Ms.Nutan Gupta, Mr.Priyanka Tiwari. Company has S R Batliboi & Co. LLP as its auditors. As on 31-03-2024, the company has a total of 177.20 Crore shares outstanding. Show More

Nishant Pitti

Prashant Pitti

Rikant Pittie

Satya Prakash

Vinod Kumar Tripathi

Ashish Kumar Bansal

Nutan Gupta

Priyanka Tiwari

- S R Batliboi & Co. LLP S R Batliboi & Associates LLP

Online Service/Marketplace

Key Indices Listed on

Nifty 500, S&P BSE 500, S&P BSE 250 SmallCap Index, + 9 more

223, FIE Patparganj Industrial Area,East Delhi,Delhi, Delhi - 110092

http://www.easemytrip.com

More Details

- Chairman's Speech

- Company History

- Directors Report

- Background information

- Company Management

- Listing Information

- Finished Products

FAQs about Easy Trip Planners share

- 1. What's the Easy Trip Planners share price today? Easy Trip Planners share price was Rs 47.00 as on 26 Apr, 2024, 04:02 PM IST. Easy Trip Planners share price was up by 1.30% based on previous share price of Rs. 46.95. In last 1 Month, Easy Trip Planners share price moved up by 6.70%.

- Stock's PE is 55.46

- Price to Book Ratio of 22.46

- 3. Which are the key peers to Easy Trip Planners? Top 10 Peers for Easy Trip Planners are Just Dial Ltd., Infibeam Avenues Ltd., Nazara Technologies Ltd., CarTrade Tech Ltd., Yatra Online Ltd., Matrimony.com Ltd., IndiaMART InterMESH Ltd., One97 Communications Ltd., FSN E-Commerce Ventures Ltd. and PB Fintech Ltd.

- Promoter holding have gone down from 71.3 (30 Jun 2023) to 64.3 (31 Mar 2024)

- Domestic Institutional Investors holding have gone down from 2.48 (30 Jun 2023) to 2.44 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 2.54 (30 Jun 2023) to 2.78 (31 Mar 2024)

- Other investor holding has gone up from 23.67 (30 Jun 2023) to 30.48 (31 Mar 2024)

- 5. What has been highest price of Easy Trip Planners share in last 52 weeks? In last 52 weeks Easy Trip Planners share had a high price of Rs 54.00 and low price of Rs 37.00

- 6. What's the market capitalization of Easy Trip Planners? Easy Trip Planners share has a market capitalization of Rs 8,323.27 Cr. Within Services sector, it's market cap rank is 15.

Trending in Markets

- HCL Tech Q4 Results

- Dynamic bond funds

- Gold prices today

- F&O stocks to buy today

- Vedanta Share Price

- Sensex Today

- Tech Mahindra Q4 Results

- ACC Q4 Results

- Vedanta Q4 Results

- Q4 results today

Easy Trip Planners Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- Option Chain

- Daily Reports

- Press Releases

26-Apr-2024 15:30

03-May-2024 | 83.1125

26-Apr-2024 17:00

Lac Crs 400.58 | Tn $ 4.81

26-Apr-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Announcements

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns, unitholding patterns, voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %), deals today --> block deals.

- For Block Deals - Morning Block Deal Window (first session): This window shall operate between 08:45 AM to 09:00 AM.

- Afternoon Block Deal Window (second session): This window shall operate between 02:05 PM to 2:20 PM.

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest news

- Stock market

- Premium news

- Biden economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal loans

- Student loans

- Car insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Easy trip planners limited (easemytrip.ns).

- Previous Close 46.40

- Day's Range 46.00 - 47.35

- 52 Week Range 37.00 - 54.00

- Volume 20,934,608

- Avg. Volume 27,881,996

- Market Cap (intraday) 83.286B

- Beta (5Y Monthly) 0.27

- PE Ratio (TTM) 54.65

- EPS (TTM) 0.86

- Earnings Date Feb 9, 2024

- Forward Dividend & Yield 0.10 (0.21%)

- Ex-Dividend Date Dec 19, 2023

- 1y Target Est --

Easy Trip Planners Limited Overview Travel Services / Consumer Cyclical

Easy Trip Planners Limited, together with its subsidiaries, operates as an online travel agency in India, the Philippines, Singapore, Thailand, the United Arab Emirates, the United Kingdom, New Zealand, and the United States. The company provides a range of travel-related products and services, including airline tickets, hotels, and holiday and travel packages; rail tickets, bus tickets, air charter services, and taxi rentals, as well as value added services, such as travel insurance, visa processing, and tickets for activities and attractions. It also engages in the tour operations and other reservation activities. The company distributes its products and services through business to business to customer channels, as well as online. The company was incorporated in 2008 and is based in New Delhi, India.

Full Time Employees

Fiscal year ends.

Travel Services

Related News

A Fed meeting, jobs report, and more Big Tech earnings: What to know this week

This Magnificent Dividend Stock Sees a Supercharged Growth Opportunity Ahead

Why I Continue Buying Shares of This Healthy and Secure 6.7%-Yielding Dividend Stock

3 Growth Stocks to Buy and Hold Forever

Large Pension Bets Big on AMD, Walmart, Peloton Stock. It Sold GM.

Dow Jones Futures: Nvidia Leads 7 New Buys As Market Roars; Fed, Apple, Super Micro Loom

Paramount Global CEO Bob Bakish expected to leave the company

Should You Buy the 3 Highest-Paying Dividend Stocks in the S&P 500?

3 Stocks to Invest $30,000 in Right Now

Forget Nvidia, These Unstoppable Stocks Are Better Buys

AI Boom’s Secret Winners? The Companies Expected to Power It

Catalyst Watch: This Beaten-Down, High-Yield Dividend Stock Is Working on a Long-Term Solution to Its Biggest Issue

Performance overview: easemytrip.ns.

Trailing total returns as of 4/26/2024, which may include dividends or other distributions. Benchmark is S&P BSE SENSEX .

1-Year Return

3-year return, 5-year return, compare to: easemytrip.ns.

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Statistics: EASEMYTRIP.NS

Valuation measures.

Enterprise Value

Trailing P/E

Forward P/E

PEG Ratio (5yr expected)

Price/Sales (ttm)

Price/Book (mrq)

Enterprise Value/Revenue

Enterprise Value/EBITDA

Financial Highlights

Profitability and income statement.

Profit Margin

Return on Assets (ttm)

Return on Equity (ttm)

Revenue (ttm)

Net Income Avi to Common (ttm)

Diluted EPS (ttm)

Balance Sheet and Cash Flow

Total Cash (mrq)

Total Debt/Equity (mrq)

Levered Free Cash Flow (ttm)

People Also Watch

- Super Investors

- Account

- Consolidated Standalone

- Share Holding

- Balance Sheet

- Corp. Action

Easy Trip Planners share price

NSE: EASEMYTRIP BSE: 543272 SECTOR: Travel Services 321k 1k 322

Price Summary

₹ 47.35

₹ 46

₹ 54

₹ 37

Ownership Below Par

Valuation expensive, efficiency excellent, financials very stable, company essentials.

₹ 8328.59 Cr.

₹ 8356.54 Cr.

₹ 3.75

₹ 37.46 Cr.

₹ 65.41 Cr.

₹ 0.94

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 12 Indices.

NIFTYMIDSMALL400

NIFTYSMALLCAP250

NY500MUL50:25:25

NIFTYTOTALMCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- The company has shown a good profit growth of 61.8220337463151 % for the Past 3 years.

- The company has shown a good revenue growth of 45.0015532868995 % for the Past 3 years.

- Company has been maintaining healthy ROE of 48.7523748414983 % over the past 3 years.

- Company has been maintaining healthy ROCE of 62.9349509192411 % over the past 3 years.

- Company has a healthy Interest coverage ratio of 42.5390608549168 .

- The Company has been maintaining an effective average operating margins of 21.787623694466 % in the last 5 years.

- The company has an efficient Cash Conversion Cycle of 58.689716750067 days.

- Company has a healthy liquidity position with current ratio of 2.21423447300998 .

- The company has a high promoter holding of 64.3 %.

Limitations

- Company has contingent liabilities of 147.079 Cr.

- Company has negative cash flow from operations of -93.476 .

- The company is trading at a high PE of 49.99 .

- The company is trading at a high EV/EBITDA of 36.3527 .

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split, investors details promoter investors, annual reports.

- Annual Report 2021 15 Sep 2021

Ratings & Research Reports

- Research Monarch Networth Capital 29 Sep 2022

- Research Edelweiss 9 Mar 2022

- Research Edelweiss 29 Sep 2022

- Research Edelweiss 28 Jun 2022

- Research Edelweiss 24 Nov 2021

Company Presentations

- Concall Q4FY22 7 Jun 2022

- Concall Q4FY21 23 Jul 2021

- Concall Q3FY24 15 Feb 2024

- Concall Q3FY22 25 Feb 2022

- Concall Q2FY23 14 Dec 2022

- Concall Q2FY22 17 Nov 2021

- Concall Q1FY23 20 Sep 2022

- Concall Q1FY22 31 Aug 2021

- Presentation Q4FY22 27 May 2022

- Presentation Q4FY21 30 Apr 2021

- Presentation Q4FY21 17 Jun 2021

- Presentation Q3FY24 12 Feb 2024

- Presentation Q1FY23 29 Sep 2022

Company News

Easy trip planners stock price analysis and quick research report. is easy trip planners an attractive stock to invest in.

Stock investing requires careful analysis of financial data to find out the company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement. This can be time-consuming and cumbersome. An easier way to find out about a company's performance is to look at its financial ratios, which can help to make sense of the overwhelming amount of information that can be found in a company's financial statements.

Here are the few indispensable tools that should be a part of every investor’s research process.

PE ratio : - Price to Earnings' ratio, which indicates for every rupee of earnings how much an investor is willing to pay for a share. A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Easy Trip Planners has a PE ratio of 49.9946814168705 which is high and comparatively overvalued .

Share Price : - The current share price of Easy Trip Planners is Rs 47 . One can use valuation calculators of ticker to know if Easy Trip Planners share price is undervalued or overvalued.

Return on Assets (ROA) : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. Easy Trip Planners has ROA of 25.8327981631199 % which is a good sign for future performance. (higher values are always desirable)

Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. Easy Trip Planners has a Current ratio of 2.21423447300998 .

Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders investments in the company. In other words, the return on equity ratio shows how much profit each rupee of common stockholders’ equity generates. Easy Trip Planners has a ROE of 46.8629209609928 % .(higher is better)

Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance. Easy Trip Planners has a D/E ratio of 0.1691 which means that the company has low proportion of debt in its capital.

Inventory turnover ratio : - Inventory Turnover ratio is an activity ratio and is a tool to evaluate the liquidity of a company's inventory. It measures how many times a company has sold and replaced its inventory during a certain period of time. Easy Trip Planners has an Inventory turnover ratio of 0 which shows that the management is inefficient in relation to its Inventory and working capital management.

Sales growth : - Easy Trip Planners has reported revenue growth of 84.5868762346474 % which is fair in relation to its growth and performance.

Operating Margin : - This will tell you about the operational efficiency of the company. The operating margin of Easy Trip Planners for the current financial year is 43.2830265058896 %.

Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock. The current year dividend for Easy Trip Planners is Rs 0 and the yield is 0 %.

Brief about Easy Trip Planners

Easy trip planners ltd. financials: check share price, balance sheet, annual report, and quarterly results for company analysis.

Easy Trip Planners Ltd. is a leading online travel agency that offers a wide range of travel services, including flight and hotel bookings, holiday packages, rail tickets, and bus tickets. The company leverages technology to provide convenient and efficient travel solutions to its customers. With a strong focus on customer satisfaction and technological innovation, Easy Trip Planners has established itself as a prominent player in the travel industry.

Easy Trip Planners Ltd. Share Price Analysis

Easy Trip Planners Ltd.'s share price reflects the market's perception of the company's performance and future prospects. Ticker's pre-built screening tools provide an in-depth analysis of the share price, enabling investors to make informed decisions based on the company's market valuation and price movements.

Easy Trip Planners Ltd. Balance Sheet

The balance sheet of Easy Trip Planners Ltd. provides a snapshot of the company's financial position, including its assets, liabilities, and shareholders' equity. Investors can access the company's annual reports on our website to gain insights into its financial health and stability. Ticker's premium features offer tools such as DCF Analysis, BVPS Analysis, Earnings multiple approaches, and DuPont analysis to evaluate the fair value of the company based on its balance sheet.

Easy Trip Planners Ltd. Annual Report

Easy Trip Planners Ltd.'s annual reports offer a comprehensive overview of its performance and operations throughout the year. Investors can download these reports from our website to delve into the company's strategic initiatives, financial results, and future outlook. Analyzing the annual reports can provide valuable insights for long-term stock investors.

Easy Trip Planners Ltd. Dividend Analysis

Dividends are an essential aspect of a company's financial performance and can be indicators of its stability and growth. Investors can evaluate Easy Trip Planners Ltd.'s dividend history and policies to assess its commitment to rewarding shareholders. Ticker provides research reports and credit ratings to assist investors in their dividend analysis.

Easy Trip Planners Ltd. Quarterly Results

Understanding Easy Trip Planners Ltd.'s quarterly results is crucial for investors to track the company's performance and growth trajectory. Utilizing our premium tools, investors can perform a fair value calculation based on the company's quarterly results, enabling them to make informed investment decisions.

Easy Trip Planners Ltd. Stock Price Chart

Ticker offers stock price charts that provide a visual representation of Easy Trip Planners Ltd.'s stock performance over time. By analyzing historical price movements, investors can identify trends and patterns, aiding in their investment strategies and decisions.

Easy Trip Planners Ltd. News

Staying abreast of recent developments and news related to Easy Trip Planners Ltd. is essential for investors. Ticker provides access to the latest news and market updates, empowering investors with valuable information for stock analysis and decision-making.

Easy Trip Planners Ltd. Concall Transcripts

Concall transcripts offer valuable insights into management discussions, strategies, and future plans of Easy Trip Planners Ltd. Investors can access these transcripts on our website to gain a deeper understanding of the company's direction and performance.

Easy Trip Planners Ltd. Investor Presentations

Easy Trip Planners Ltd.'s investor presentations provide a detailed overview of the company's business model, financial performance, and growth strategies. Our website offers downloadable access to these presentations, allowing investors to analyze the company's prospects and investment potential.

Easy Trip Planners Ltd. Promoters and Shareholders

Understanding the key stakeholders, including promoters and major shareholders, is vital for investors analyzing Easy Trip Planners Ltd. Ticker provides insights into the company's ownership structure, enabling investors to assess the level of insider confidence and institutional support.

Ratio Delete Confirmation

- EASY TRIP PLANNERS LTD.

- SECTOR : DIVERSIFIED CONSUMER SERVICES

- INDUSTRY : TRAVEL SUPPORT SERVICES

Easy Trip Planners Ltd. NSE: EASEMYTRIP | BSE: 543272

Expensive Rocket

Easy Trip Planners Ltd. Live Share Price Today, Share Analysis and Chart

47.00 0.60 ( 1.29 %)

27.03% Gain from 52W Low

23.1M NSE+BSE Volume

NSE 26 Apr, 2024 3:31 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

Easy Trip Planners Ltd. Live Price Chart

Earnings conference calls, investor presentations and annual reports, earnings calls, annual reports, investor presentation, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-earni…, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-analy…, easy trip planners ltd. results earnings call for q3fy24, easy trip planners results earnings call for q2fy24, easy trip planners results earnings call for q1fy24, easy trip planners results earnings call for q4fy23, easy trip planners ltd - 543272 - announcement under regulation 30 (lodr)-inves…, easy trip planners ltd. faq, how is the easy trip planners ltd. today, the easy trip planners ltd. today is trading in the green, up by 1.29% at 47.00., how has easy trip planners ltd. performed historically, the easy trip planners ltd. is currently trading up 1.29% on an intraday basis. in the past week the stock rose 7.31%. the stock has been down -0.21% in the past quarter and rose 1.95% in the past year. you can view this in the overview section..

- Share Market News

- e-ATM Order

- FindYourMojo

- Relax For Tax

- Budget 2024

- Live Webinar

- One Click Mutual Fund

- Retirement Solutions

- Execution Algos

- One Click F&O

- Apply IPO through UPI

- Life Insurance

- Health Insurance

- Group Health Insurance

- Bike Insurance

- SME Insurance

- Car insurance

- Home Insurance

- Sovereign Gold Bonds

- New Bonds on Offer

- Government Securities

- Exchange Traded Bonds

- ICICI Bank FD

- Top Performing NPS Schemes

- NPS Calculator

- NPS Important FAQ and Disclosures

- Self learning

- Customer Service

- Corporate Services

- Open Account

- Masters of the Street

- Features and Products

- Will Drafting

- Goal Planner

- Retirement Planning

- Brokerage Fees and Charges

- Business Partner

- Business Partner Opportunity

- Business Partner Earning Calculator

- Business Partner App

- Partner Universe

- Insurance – POSP

- Global Invest

- Easy Trip Planners Ltd

EASEMYTRIP SHARE PRICE TODAY

Apr 26, 2024 04:02 PM

SECTOR : E-Commerce/App based Aggregator | BSE :543272 | NSE : EASEMYTRIP

0.60 (1.29 %)

Company details

- Research Report

- Quick Results Snapshot

- SWOT Analysis

- Our Research View

- Information

- Easy Trip Planners Ltd: 47.00 0.60 (1.29 %)

Open Free Trading Account Online with ICICIDIRECT

Easy Trip Planners or EaseMyTrip.com (EMT) is the fastest growing and only profitable company in the online travel portal in India. The company offers a comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotels and holiday packages, rail tickets and bus tickets.

- Airline tickets accounted for 94.0% of revenues (pre-covid levels) while hotels and other services contributed 5.4% and 0.6% of revenues, respectively

Easy Trip Planners reported weak results for Q4FY22

- Adjusted revenues declined 1.7% YoY to ₹98.5 crore, in wake of omicron induced restrictions while gross booking revenues (GBR) was up 29% YoY to ₹1171 crore.

- EBITDA margins also declined 1147bps YoY to 30% due to higher employee and marketing costs.

- As a result PAT was lower by 23.4% YoY to ₹23.4 crore.

Click here for full recommendation

Research view on more stocks

Travel Support Services company Easy Trip Planners announced Q3FY24 & 9MFY24 results:

Financial Performance: - Q3FY24 revenue increased to Rs 1,607.9 million, up 18.1% YoY. - EBITDA for Q3FY24 stood at Rs 653.7 million, marking a rise of 10.9% from the previous year. - Profit After Tax (PAT) for Q3FY24 grew by 9.5% YoY to Rs 456.6 million. - Gross Booking Revenue (GBR) for Q3FY24 was at Rs 20,260.7 million. - For 9MFY24, the Revenue from Operations was Rs 4,265.3 million, exhibiting growth of 28.4% YoY. - EBITDA for 9MFY24 reached Rs 1,705.2 million, a growth of 17.9% YoY. - PAT for 9MFY24 increased by 15.3% YoY to Rs 1,188.6 million.

Operational Highlights: - Total number of air bookings in Q3FY24 was 22.6 lakhs, which is a decline of 29.7% compared to last year. - Hotel night bookings for Q3FY24 was at 91,915, showing a 4.1% decrease YoY. - Q3FY24 bookings in the 'Others' segment witnessed an 82.5% increase to 2.7 lakhs. - In 9MFY24, air ticket sales were 83.7 lakhs, marking a 1.0% increase. - Hotel nights bookings in 9MFY24 saw a significant increase of 53.5% to 3.8 lakhs. - The Trains, Buses, and Others segment grew by 72.0% to 7.7 lakhs in 9MFY24.

Strategic Initiatives and Partnerships: - EaseMyTrip acquired approximately 13% stake in ECO Hotels and Resorts. - Signed an MOU with the Government of Uttarakhand for tourism promotion. - Introduced EasyDarshan for curated pilgrimage packages and launched "Explore Bharat" for showcasing India's heritage. - Launched an exclusive subscription program aimed at High Net-Worth Individuals (HNIs).

Awards & Recognitions: - EaseMyTrip recognized as the Online Travel Marketplace of the Year (B2C) at ET Travel World Awards.

Announcing the results, Nishant Pitti, Co-founder and CEO of Easy Trip Planners, commented: "We're pleased to announce that our Q3FY24 PAT reached Rs 456.6 million, a 9.5% YoY increase, demonstrating our commitment to profitability. Similarly, our 9MFY24 PAT grew by 15.0% YoY to Rs 1,188.6 million. GBR for Q3FY24 and 9MFY24 stood at Rs 20,260.7 million and Rs 64,226.0 million, respectively.

In Q3FY24, we diversified our portfolio by acquiring a 13% stake in ECO Hotels and Resorts and signed an MOU with the Government of Uttarakhand. We also introduced EasyDarshan, offering hassle-free pilgrimage packages, and launched "Explore Bharat" to showcase India's rich heritage to international travellers.

Furthermore, our exclusive subscription program, the EaseMyTrip Platinum, Gold, and Silver Cards, provides luxury travel experiences to HNIs. These initiatives underscore the company's continuous expansion of services, catering to niche customer segments. Additionally, I am pleased to share that ET Travel World Awards has recognized EaseMyTrip as the Online Travel Marketplace of the Year (B2C).

Looking ahead, we're intensifying efforts to grow our air ticketing business and enhance our presence in non-air segments such as hotels, holidays, and transportation on a global scale. Also, we are expanding our retail footprints domestically and exploring both organic and inorganic growth opportunities. These initiatives are aligned with our ongoing commitment to driving continued growth, providing comprehensive travel solutions, and ensuring a seamless experience for our customers."

View Other Company Results

EaseMyTrip Shares SWOT Analysis

- SHAREHOLDING

Strengths (6)

- Strong Momentum: Price above short, medium and long term moving averages

- Company with Low Debt

- Increasing Revenue every quarter for the past 3 quarters

Weakness (3)

- Poor cash generated from core business - Declining Cash Flow from Operations for last 2 years

- Low Piotroski Score : Companies with weak financials

- Book Value Per Share deteriorating for last 2 years

Opportunity (1)

- RSI indicating price strength

Threats (3)

- Red Flags: Firms linked to ongoing regulatory investigations/legal cases

- High PE (PE > 40)

- Increasing Trend in Non-Core Income

Discover More

Resistance and support.

- Promoter 64.3%

- Public 30.46%

- Other Institutions 2.39%

- Mutual Funds 0.06%

OUR RESEARCH VIEW

- PROFIT AND LOSS STATEMENT

- BALANCE SHEET

- QUARTERLY RESULT

EaseMyTrip Stocks Comparison

Equity Capital: 369.99 Cr FV: 1.00

- ANNOUNCEMENT

- CORPORATE ACTION

Apr 25, 2024 l BSE Announcement

Apr 25, 2024 l NSE Announcement

Apr 23, 2024 l NSE Announcement

EaseMyTrip Information

- ABOUT COMPANY

- COMPANY INFO

- LISTING INFO

Easy Trip Planners Limited was formally incorporated Private Limited Company in the name of Easy Trip Planners Private Limited on June 04, 2008 in India. The Company converted into a Public Company effective from April 12, 2019 and consequently, the name of Company changed from `Easy trip Planners Private Limited` to `Easy trip Planners Limited`.

The Company is the second-largest online travel agencies in India. It offers a comprehensive range of travel-related products and services for end-to-end travel solutions, including airline tickets, hotels and holiday packages, rail tickets, bus tickets and taxis, in addition to ancillary value-added services such as travel insurance, visa processing and tickets for activities and attractions. The Company commenced its operations in 2008 by focusing on the B2B2C (business to business to customer) distribution channel and providing travel agents access to their website to book domestic travel airline tickets to cater to offline travel market in India. Subsequently, by leveraging their B2B2C channel, they commenced operations in B2C (business to customer) distribution channel in 2011 by focusing on the growing Indian middle class population`s travel requirements. Consequently, due to their presence in B2B2C and B2C channels, they were able to commence operations in the B2E (business to enterprise) distribution channel in 2013 with the aim of providing end-to-end travel solutions to corporate.

Their presence in 3 distinct distribution channels provided them with a diversified customer base and wide distribution network. The Company have a wide distribution network with three distinct distribution channels, namely B2C, B2E and B2B2C channels, which enables to cross-sell its products and services between such distribution channels. The Company`s distribution channels are supported by a hybrid platform, which is a combination of their websites, mobile applications and network of travel agents across India as well as call centre, particularly for holiday packages. They have developed streamlined software across their distribution channels, which provide them with multiple points of contact for marketing additional travel products and services to existing customers. In B2B2C segment, the Company has one of the largest agent network in the online travel agencies (OTA) space, majorly in the tier II and tier III cities.

It is enabling to enhance presence in these regions where demand is growing due to development in airport infrastructure, increase in connecting flights and new routes addition to reduce congestion in metro airports. In B2E segment, the Company has 12,505 corporate customers in network to further grow by leveraging travel agent network and integrating travel software with corporate customers IT systems. The Company`s products and services are organized primarily in business segments like airline tickets, which comprises standalone sale of airline tickets, as well as airline tickets sold as part of the holiday packages; hotels and holiday packages, which comprises standalone sales of hotel rooms as well as travel packages (which may include hotel rooms, cruises, travel insurance and visa processing); and other services, which comprises rail tickets, bus tickets, taxi rentals and ancillary value-added services such as travel insurance, visa processing and tickets for activities and attractions.

The products and services are offered online through their user-friendly websites (www.easemytrip.com and www.easemytrip.in), Android and iOS based mobile applications (EaseMyTrip). The Company offers the ability to search, compare and book reservations at more than 73,400 hotels in India and over 10,23,000 hotels outside India. The Company has one of the most sophisticated technology infrastructures with high level of automation and self-service capabilities across customer life cycle. It helps in managing product and services better, improve operational efficiency and drive customer satisfaction. The robust data analytics capabilities facilitate in providing customer-relevant information. The Company has a dedicated in-house technology team focused on developing a secure, advanced and scalable technology infrastructure and software, enabling them to continuously strengthen scalable technology infrastructure, support customer-focused initiatives, introduce innovative services and solutions, improve reliability and product and service delivery, which have helped to maintain high levels of customer satisfaction and grow the market presence.

The technology infrastructure is designed around customer satisfaction to serve them better with more personalized approach. In core air travel business, the Company provided customers with more than 400 international and domestic airlines customers, more than 10,96,400 hotels in India and international jurisdictions, almost all the railway stations in India as well as bus tickets and taxi rentals for major cities in India, It had the largest network of 59,274 registered travel agents in almost all major cities of India. Further, the Company finalized a partnership deal with an International Airlines to help boost International Air segment. In addition to this, a deal was entered with Just Dial whereby all flight tickets on their portal will be exclusively powered by EaseMyTrip. The Company`s leading market position and operational history have led to recognition of the `EaseMyTrip` brand in India, enabling them to target new customers and provide better leverage while contracting with airlines and hotel suppliers.

The strength of their brand increased significantly, which reflected in significant increase of visits to their websites. The Company strengthened their relationships with various airlines operators, such as IndiGo, Go Airlines (India) Ltd., and SpiceJet, as well as with various hotel chains, including, The Byke Hospitality Ltd., Seashells Beach Suites, Stone Woods Resorts and Spa, VITS Hotels, Kamat Hotels (India) Ltd. and VIVA Hotel. As part of their cross-marketing efforts, they have entered into arrangement with various banks and payment gateways, including One Mobikwik Systems Pvt. Ltd. and ePayLater, to offer promotion and discounts on the purchase of tickets on their websites and mobile applications platforms, in addition to providing cash-back option. Further, the Company had entered into alliances with various brands, including Ferns N Petals Pvt. Ltd., Coolwinks Technologies Pvt. Ltd. and Firefox Bikes Pvt. Ltd. for cross-marketing their products and services. The Company is focused in expanding product portfolio into higher-margin hotel and holiday packages segment. Being the hotel industry highly fragmented in nature, its share of online bookings in overall bookings remained low, indicating ample headroom for growth. With hotel suppliers listing their hotel inventories online, customers were expected to increasingly prefer online hotel bookings on account of convenience of digital transactions. In March 2021, the Company incorporated a subsidiary in the United Kingdom, EaseMyTrip UK Ltd. In addition, they also acquired EaseMyTrip SG Pte Ltd. and EaseMyTrip Middle East DMCC in Singapore and United Arab Emirates, respectively. During the year 2021-22, the Company incorporated EaseMyTrip Foundation (A non-profit organization) and YoloBus Private Limited, as wholly owned subsidiary companies in India. Further, it acquired Spree Hotels and Real Estate Private Limited which became its wholly owned subsidiary and acquired Technology and Assets of Yolo Travel Tech Private Limited. Thereafter, the Company incorporated wholly owned subsidiary companies outside India namely, EaseMyTrip Philippines Inc; EaseMyTrip USA Inc and EaseMyTrip Thai Co. Ltd.

As of March 31, 2023, EaseMyTrip has served over 14 million customers, granting them access to a network of more than 400 international and domestic airlines. It had the largest network of travel agents with 51000 registered travel agents across almost all major cities in India. During the year 2022-23, Company acquired subsidiary companies in India, Nutana Aviation Capital IFSC Private Limited with 75% to expand presence across air charter services market in India and internationally; further, the Company incorporated outside India, EaseMyTrip NZ Ltd. It acquired a 55% stake in CheQin - the real-time hotel reservations marketplace; acquired a majority stake of 55% in CheQin, a pioneering real-time marketplace for hotel reservations.

Easy Trip Planners share price as on 28 Apr 2024 is Rs. 47. Over the past 6 months, the Easy Trip Planners share price has increased by 22.88% and in the last one year, it has increased by 4.33%. The 52-week low for Easy Trip Planners share price was Rs. 37 and 52-week high was Rs. 54.

223 FIE East Delhi, Patparganj Industrial Area, New Delhi, Delhi, 110092

KFin Techologies Ltd

EaseMyTrip Shares Faq’s

How can i buy easy trip planners ltd share.

You can buy Easy Trip Planners Ltd shares through a brokerage firm. ICICIdirect is a registered broker through which you can place orders to buy Easy Trip Planners Ltd Share.

What is the share price of Easy Trip Planners Ltd?

Company share prices and volatile and keep changing according to the market conditions. As of Apr 26, 2024 04:02 PM the closing price of Easy Trip Planners Ltd was Rs.47.00.

What is the market cap of Easy Trip Planners Ltd ?

Market capitalization or market cap is determined by multiplying the current market price of a company�s shares with the total number of shares outstanding. As of Apr 26, 2024 04:02 PM, the market cap of Easy Trip Planners Ltd stood at Rs. 8,328.59.

What is the PE ratio of Easy Trip Planners Ltd ?

The latest PE ratio of Easy Trip Planners Ltd as of Apr 26, 2024 04:02 PM is 55.24

What is the PB ratio of Easy Trip Planners Ltd ?

The latest PB ratio of Easy Trip Planners Ltd as of Apr 26, 2024 04:02 PM is 0.07

What is the 52 - week high and low of Easy Trip Planners Ltd Share Price?

The 52-week high of Easy Trip Planners Ltd share price is Rs. 54.00 while the 52-week low is Rs. 37.00

Is Easy Trip Planners Ltd Share a good buy for the long term ?

According to analyst recommendations, Easy Trip Planners Ltd Share has a "Buy" rating for the long term.

Download Our

EASY TRIP PLANNERS LTD

Easemytrip chart, upcoming earnings, about easy trip planners ltd.

See all ideas

Analyst rating

Frequently asked questions.

- Login / Sign-up

- Logout Get Support

- All about Mutual Funds

- Know your Investor Personality

- Mutual Funds Home

- Explore Mutual Funds

- Check Portfolio Health

- Equity funds

- Hybrid funds

- Explore Genius

- Genius Portfolios

- MF Portfolios

- Stocks Portfolios

- Term Life Insurance

- Health Insurance

- SIP Calculator

- Mutual Fund Calculator

- FD Calculator

- NPS Calculator

- See all calculators

- Help & Support

Great! You have sucessfully subscribed for newsletters for investments

Subscribed email:

Easy Trip Planners Ltd.

Peer comparison

Comparison with stocks in same sector

1-yr return

Fundamentals.

5,000+ investors

- Tech Mahindra share price

- ₹ 1,277.45 7.34 %

- Wipro share price

- ₹ 464.65 0.79 %

- ITC share price

- ₹ 439.95 0.56 %

- Ultratech Cement share price

- ₹ 9,735.35 0.53 %

- Titan Company share price

- ₹ 3,584.40 0.33 %

- Ashok Leyland share price

- ₹ 185.10 4.16 %

- Tata Steel share price

- ₹ 165.85 -1.04 %

- Zee Entertainment Enterpri ...

- ₹ 145.95 2.24 %

- Indian Oil Corporation share price

- ₹ 171.55 0.73 %

- Bharat Electronics share price

- ₹ 238.90 0.50 %

Easy Trip Planners share price

Easy Trip Planners is trading 1.10 % upper at Rs 46.95 as compared to its last closing price. Easy Trip Planners has been trading in the price range of 47.36 & 46.00 . Easy Trip Planners has given 14.99 % in this year & 4.39 % in the last 5 days.

Easy Trip Planners has TTM P/E ratio 46.82 as compared to the sector P/E of 39.62 . There are 2 analysts who have initiated coverage on Easy Trip Planners . There are 0 analysts who have given it a strong buy rating & 0 analysts have given it a buy rating. 0 analysts have given the stock a sell rating.

The company posted a net profit of 45.66 Crores in its last quarter.

Listed peers of Easy Trip Planners include Indian Railway Catering & Tourism Corporation ( 1.62 %) , Thomas Cook India ( -3.33 %) , Easy Trip Planners ( 1.10 %) etc .

Easy Trip Planners has a 64.30 % promoter holding & 35.70 % public holding . The Mutual Fund holding in Easy Trip Planners was at 2.38 % in 31 Mar 2024 . The MF holding has increased from the last quarter. The FII holding in Easy Trip Planners was at 2.78 % in 31 Mar 2024 . The FII holding has increased from the last quarter.

Easy Trip Planners share price range

Easy trip planners share key metrics, easy trip planners stock analysis.

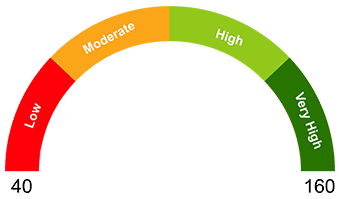

- 42 % Balanced risk

- Strong Sell

Technical Trends

Long term considers price movement over the last 6 months, short term considers price movement over the last 1-2 weeks.

- Moderately Bearish

- Moderately Bullish

Insight: Trends unavailable at the moment.

Easy Trip Planners share price news

Easemytrip share price jumps over 5% on proposed 5-star hotel in ayodhya, easemytrip q3 results: net profit rises by 9.5% to ₹45.7 crore; ebitda grows to ₹65.4 crore, over 45 nifty 500 stocks gained between 10% and 50% in jan so far; sobha, jbm auto among top gainers – check full list, easy trip planners stock spikes for 3rd consecutive day, gains over 5.5%; what's behind the rally, shares of easy trip planners to trade ex-dividend, paul merchants to trade ex-bonus today, easy trip planners financials.

- BALANCE SHEET

Easy Trip Planners forecast

Easy trip planners technical, easy trip planners shareholding, shareholding pattern, sbi nifty smallcap 250 index fund regular growth, motilal oswal nifty smallcap 250 index fund regular growth, hdfc nifty smallcap 250 index fund regular growth, edelweiss nifty smallcap 250 index fund regular growth, nippon india nifty smallcap 250 index fund reg gr, easy trip planners corporate actions.

- Board Meetings

Easy Trip Planners Company profile

About easy trip planners.

- Industry Personal Services

- ISIN INE07O001026

- BSE Code 543272

- NSE Code EASEMYTRIP

Easy Trip Planners Limited is an India-based company that operates online travel platform. The Company provides reservation and booking services related to travel and tourism through ease my trip-portal, ease my trip app or in-house call-center. Its Air Passage segment offers an Internet and mobile-based platform and call-centers that provide the facility to book and service international and domestic air tickets to consumers through business-to-customers (B2C) and business-to-business-customers (B2B2C) channels. Its Hotel Packages segment offers holiday packages and hotel reservations through call-centers and branch offices. Its Other services segment include booking of rail tickets, bus tickets, taxi rentals and ancillary value-added services, such as travel insurance, visa processing and tickets for activities and attractions. It also offers a range of travel-related services, ranging from Flight API, and holiday packages to Hotel API, white label, Bus API, and visa applications.

Easy Trip Planners Management

- Nishant Pitti Executive Chairman, Chief Executive Officer

- Ashish Bansal Chief Financial Officer

- Nutan Gupta Chief Operating Officer

- Naimish Sinha Chief Technology Officer

- Priyanka Tiwari Chief Compliance Officer, Company Secretary

- Umesh Mishra Vice President

- Prashant Pitti Managing Director, Whole-time Director

- Rikant Pittie Whole-time Director, Co-Founder

- Aditya Chawla Chief Commercial Officer

- Nitesh Gupta Chief Business Officer

FAQs about Easy Trip Planners share price

Easy Trip Planners is trading at 46.95 as on Fri Apr 26 2024 10:26:34 . This is 1.10 % upper as compared to its previous closing price of 46.44 .

The market capitalization of Easy Trip Planners is 8319.73 Cr as on Fri Apr 26 2024 10:26:34 .

The average broker rating on Easy Trip Planners is Sell . The breakup of analyst rating is given below -

- 0 analysts have given a strong buy rating

- 0 analysts have given a buy rating

- 1 analysts have given a hold rating

- 0 analysts have given a sell rating

- 1 analysts have given a strong sell rating

The 52 wk high for Easy Trip Planners is 54.00 whereas the 52 wk low is 37.01

Easy Trip Planners can be analyzed on the following key metrics -

- TTM P/E: 46.82

- Sector P/E: 39.62

- Dividend Yield: 0.22 %

- D/E ratio: -

Easy Trip Planners reported a net profit of 134.20 Cr in 2023 .

Easy Trip Planners Quick Links

Easy Trip Planners Dividend | Easy Trip Planners Bonus | Easy Trip Planners News | Easy Trip Planners AGM | Easy Trip Planners Rights | Easy Trip Planners Splits | Easy Trip Planners Board Meetings | Easy Trip Planners Key Metrics | Easy Trip Planners Shareholdings | Easy Trip Planners Profit Loss | Easy Trip Planners Balance Sheet | Easy Trip Planners Cashflow | Easy Trip Planners Q1 Results | Easy Trip Planners Q2 Results | Easy Trip Planners Q3 Results | Easy Trip Planners Q4 Results

Equity Quick Links

Top Gainers | Top Losers | Indian Indices | BSE Active Stocks | NSE Active Stocks

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

- Share Price

Easy Trip Planners Ltd

₹ 47.00 +0.60 (1.29%) updated on 28-04-2024 6:55 am.

Stock Rating

Price Performance

- Day's open ₹46.5

- Previous close ₹46.4

- VWAP ₹46.92

- Lower price band ₹37.6

- Upper price band ₹56.4

Today's Market Action

Medium and long term market action, fundamentals.

Market Cap (Cr): 8329

Book Value (₹):

Revenue (Cr):

Total Debt (Cr):

Face Value (₹):

Earnings (Cr):

Promoter’s Holdings (%):

Debt to Equity:

Dividend Yield (%):

Mutual fund holdings and trends

Shareholding pattern, similar stocks.

Data not available.

What is Share Price of Easy Trip Planners Ltd?

Easy Trip Planners Ltd share price is ₹47.00 As on 28 April, 2024|18:03

What is the Market Cap of Easy Trip Planners Ltd?

The Market Cap of Easy Trip Planners Ltd is ₹8,329 As on 28 April, 2024|18:03

What is PE Ratio of Easy Trip Planners Ltd?

The P/E ratio of Easy Trip Planners Ltd is 50 As on 28 April, 2024|18:03

What is PB Ratio of Easy Trip Planners Ltd?

The PB ratio of Easy Trip Planners Ltd is 13.58 As on 28 April, 2024|18:03

What is the CAGR of Easy Trip Planners Ltd?

Easy Trip Planners Ltd CAGR for 3 Years at 59%, and 1 Year at -2%

How to Buy Easy Trip Planners Ltd Share?

You can buy the Easy Trip Planners Ltd share at Samco by simply creating a Demat account. Once you create a demat account , ensure that your KYC is done to proceed further.

Quarterly results

Profit loss

Balance sheet

Cash flow statement

Consolidated Financial Performace In Graph (Net Profit)

Standalone Financial Performace In Graph (Net Profit)

Consolidated Financial Performace In Graph (Cash Flow)

Standalone Financial Performace In Graph (Cash Flow)

- No Data Available

Valuation Analysis

What is your opinion about this Stock?

Historical data, ₹ 47.00 +0.60 (1.29%), brokerage & taxes at samco, brokerage & taxes at other traditional broker, potential brokerage savings with samco ₹ 49.62( ).

Open a Demat Account For FREE with Samco – India’s Best Stockbroker

Free trading & demat account.

Complete your KYC in minutes and start investing.

log in to complete your existing account opening application

By proceeding, you agree to our Privacy Policy and Terms and Conditions .

Top Gainers (NIFTY 50)

Stock name change %, top losers (nifty 50).

Filing Complaints on SCORES

1. Register on SCORES portal

2. Mandatory details for filling complaints on SCORES

Name | PAN | Address | Mobile | Number | E-mail ID

3. Benefits

- Effective Communication

- Speedy redressal of the grievances

Easy & quick

- Register on SCORES portal

- Mandatory details for filling complaints on SCORES

- Name PAN Address Mobile Number E-mail ID

- link:https://scores.gov.in

- Easy Trip Planners

Easy Trip Planners Share Price

Company overview, fundamentals, what’s in news.

Livemint • 6d

Why EaseMyTrip shares will be in focus on Monday?

Moneycontrol • 1w

Why EaseMyTrip CEO Nishant Pitti wants to own an airline and make movies?

Upstox • 1mo

EaseMyTrip ties up with Zoomcar to provide pre-booked self-drive cars in India

Moneycontrol • 1mo

EaseMyTrip and PNB collaborate to launch travel-focused credit card

Livemint • 1mo

EaseMyTrip, Jeewani Group partner with Radisson Hotel Group!

What should investors do with EaseMyTrip, Hindustan Copper?

Easy Trip Planners stock jumps 7% on leap year travel discounts

Moneycontrol • 2mo

HFT Scan: Algo traders zoom in on Easy Trip Planners, Dish TV India

EaseMyTrip profit up 9.6% at Rs 46 crore in December quarter

Moneycontrol • 3mo

EaseMyTrip co-founder Rikant Pittie buys commercial property in Gurugram

Easy Trip Planners Limited owns the online travel platform EaseMyTrip.com. The travel platform, one of the largest and fastest-growing internet companies in India, provides end-to-end solutions such as rail & bus tickets, hotels and holiday packages, and air tickets as well as ancillary value-added services.

EaseMyTrip, which is listed on the National Stock Exchange and BSE, provides its users with access to over 400 foreign and Indian airlines and more than 20 lakh hotels. It also facilitates train tickets and taxi rentals for major Indian cities. The travel platform has reported a compounded annual growth rate of 59% in profit after tax during the FY20 to FY23 period.

Headquartered in New Delhi, EaseMyTrip was founded by Nishant Pitti, Rikant Pitti and Prashant Pitti in 2008. The company was started as an internet travel platform to provide complete solutions to users during a trip. From flight bookings to cabs for sightseeing, it offers one-stop solutions to users. The promoters have around 65% stake in the company while the public shareholders own the rest.

EaseMyTrip has offices in cities such as Delhi, Gurugram, Noida, Mumbai and Bengaluru. Its global offices are in the Philippines, Thailand, Singapore, UK, USA, New Zealand and UAE. Riding on the back of investments in modern technology and a strong business model, the company has been profitable since 2008.

Business operations

EaseMyTrip offers a range of travel-related products and services such as airline tickets, hotels, holiday packages, bus tickets, rail tickets and taxis. It also provides value-added services such as travel insurance, visa processing and tickets. The online travel agent operates across three distribution channels.

In FY23, acquired a 75% stake in Nutana Aviation, a chartered flight company based in Gujarat’s GIFT city.

Business to Business to Customer (B2B2C): Under this channel, the company provides travel agents access to its website to book domestic travel airline tickets to cater to the offline travel market in India. EaseMyTrip started as a B2B2C firm in 2008.

Business to Customer (B2C): The B2C distribution channel primarily focuses on the growing Indian middle-class population’s travel requirements. Started in 2011, the channel offers a host of services directly to users with the option of no-convenience fee.

Business to Enterprise (B2E): The distribution channel started in 2013 provides end-to-end travel solutions to corporates.

EaseMyTrip’s presence in three distinct distribution channels provides it with a diversified customer base and a wide distribution network.

The company claims a customer base of 14 million users and more than 1 million hotel partners in India and globally. It had a look-to-book ratio of 3.88% with a 98% booking success rate. It has 753 employees as of March 31, 2023.

EasyMyTrip share price has dropped around 30% since its listing in March 2021. The market capitalisation as of December 28 is around ₹6,875 crore.

Financial Highlights:

- The gross booking revenue was ₹8,050.6 crore for FY23 as against ₹3,715.6 crores, an increase of 116.7% YoY.

- The adjusted revenue was at ₹674.9 crore in FY23, a 68.6% increase YoY as compared to adjusted revenue of ₹400.4 crore in the previous fiscal.

- EBITDA for FY23 stood at ₹191.3 crore against ₹146.9 crore in FY22, a growth of 30%.

- EBITDA margins were at 41.2% against 58.8% in FY22.

- Profit after tax for FY23 stood at ₹134.1 crore as against ₹105.9 crore in the corresponding period.

Easy Trip Planners Key indicators

Featured in, investment checklist: (4/6).

Equity returns

Dividend returns

Safety factor

Growth factor

Debt vs Equity

Profit factor

The investment checklist helps you understand a company's financial health at a glance and identify quality investment opportunities easily

Analyst ratings: Sell

This analysis is based on the reviews of 2 experts in the last 7 days

Financial ratios

Profitability, operational, easy trip planners shareholder returns, revenue statement.

No data available at the moment

Balance sheet

Easy trip planners share price history, shareholding info, corporate actions, dividend • ₹0.1/share, ex date 19 dec 2023, bonus • 3:1, ex date 21 nov 2022, split • 1:2, ex date 18 nov 2022, bonus • 1:1, ex date 28 feb 2022, dividend • ₹1/share, ex date 18 nov 2021, ₹0.1 per share, similar stocks, people also bought, investment calculators.

Brokerage Calculator

Margin Calculator

MF Return Calculator

SIP Calculator

NPV Calculator

Future Value Calculator

SWP Calculator

ELSS Calculator

Option Value Calculator

NPS Calculator

PPF Calculator

Compound Annual

National Savings

Sukanya Samriddhi Yojana

Compound Interest Calculator

Atal Pension Yojana Calculator

Gratuity calculator

Simple Interest Calculator

Fixed Deposit Calculator

GST Calculator

HRA Calculator

Lumpsum Calculator

Upcoming IPOs

Bidding dates

Apr 30 - May 03

Price per share

₹73.00 - ₹78.00

₹52.00 - ₹55.00

Key indices

Nifty Next 50

Nifty Midcap 50

NIFTY SMLCAP 50

Frequently asked questions

What is the easy trip planners share price today, what is today’s high & low stock price of easy trip planners, what is the market capital of easy trip planners shares today, what is the easy trip planners stock price high and low in the last 52 weeks on the nse, what is the easy trip planners stock symbol, can i buy easy trip planners shares on holidays, can i do stock trading on my phone.

By signing up, you agree to receive transaction updates from Upstox.

EASY TRIP PLANNERS LTD

Easemytrip chart, upcoming earnings, about easy trip planners ltd.

See all ideas

Analyst rating

Frequently asked questions.

Easy Trip Planners collaborates with Adani Digital Labs to offer duty-free shopping benefits to customers

Easy trip share price | this service is accessible through pre-ordering on the easemytrip website's airport services page, the company said in a stock exchange filing. .

Share Market Live

IMAGES

VIDEO

COMMENTS

Easy Trip Share Price: Find the latest news on Easy Trip Stock Price. Get all the information on Easy Trip with historic price charts for NSE / BSE. Experts & Broker view also get the Easy Trip ...

Get the latest Easy Trip Planners Ltd (EASEMYTRIP) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

What's the Easy Trip Planners share price today? Easy Trip Planners share price was Rs 46.40 as on 25 Apr, 2024, 04:05 PM IST. Easy Trip Planners share price was down by 1.18% based on previous share price of Rs. 47.15. In last 1 Month, Easy Trip Planners share price moved up by 6.06%.

Easy Trip Planners Limited Share Price Today, Live NSE Stock Price: Get the latest Easy Trip Planners Limited news, company updates, quotes, offers, annual financial reports, graph, volumes, 52 week high low, buy sell tips, balance sheet, historical charts, market performance, capitalisation, dividends, volume, profit and loss account, research, results and more details at NSE India.

Find the latest Easy Trip Planners Limited (EASEMYTRIP.NS) stock quote, history, news and other vital information to help you with your stock trading and investing.

Easy Trip Planners Ltd Live BSE Share Price today, Easemytrip latest news, 543272 announcements. Easemytrip financial results, Easemytrip shareholding, Easemytrip annual reports, Easemytrip pledge, Easemytrip insider trading and compare with peer companies.

A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). Easy Trip Planners has a PE ratio of 49.89 which is high and comparatively overvalued . Share Price: - The current share price of Easy Trip Planners is Rs 46.90. One can use valuation calculators of ticker to know if Easy Trip Planners ...

Get the latest Easy Trip Planners Ltd.(EASEMYTRIP) BSE:543272 live share price as of 3:31 p.m. on Apr 26, 2024 is Rs 47.00. Day high is 47.35 and Day low is 46.00. Explore stock analysis, price chart, scores, SWOT, financials, technicals

Check EaseMyTrip live BSE/NSE stock price along with it's performance analysis, share price history, market capitalization, shareholding & financial report on ICICI Direct. ... Easy Trip Planners share price as on 17 Apr 2024 is Rs. 44.6. Over the past 6 months, the Easy Trip Planners share price has increased by 4.33% and in the last one year ...

Easy Trip Planners Ltd share price live 46.25, this page displays NS EASM stock exchange data. View the EASM premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Easy Trip Planners Ltd real time stock price chart below. You can find more details by visiting the additional ...