Daily Sabah

- Transportation

- News Analysis

World travel jewel Istanbul attracts record 17.4M tourists in 2023

By daily sabah with agencies.

Turkish sprawling metropolis Istanbul, one of the most visited cities in the world, broke an all-time record in the number of foreign tourists with nearly 17.4 million individuals arriving in 2023, according to the official data shared Tuesday.

The Provincial Culture and Tourism Directorate said some 17.37 million visited the vibrant city straddling Europe and Asia throughout last year, indicating an 8.44% increase compared to the same period a year earlier.

Leading the list of arrivals to the city were visitors from Russia with 1.99 million, followed by arrivals from Germany with 1.28 million, while Iran came in third with 1.05 million.

Adding to the momentum, besides the top three countries whose tourist counts surpassed the 1 million figure were notable arrivals from the United States (853,766), the United Kingdom (701,361), Saudi Arabia (604,509) and France (589,149).

Türkiye welcomed around 49.2 million foreign tourists in 2023, a year officials dubbed the best year ever for the industry, surpassing the figure of 44.6 million foreigners who arrived in 2022. At the same time, it achieved an all-time high tourism revenue amounting to $54.32 billion, a 17% rise year-over-year.

The foreign exchange it brings in makes tourism income vital to Türkiye's economy, as the government focuses on flipping the current account deficits to a surplus, prioritizing exports, production and investments while curbing inflation.

Arrivals via air contributed the most to the booming figures in Istanbul with a total number of foreigners who arrived this way at 16.96 million, according to the data.

Looking at share among air hubs, it was observed that the new mega Istanbul Airport emerged as the frontrunner, attracting 71.78% of tourists, equivalent to 12.17 million. The remainder of 28.12% or 4.77 million tourists arrived at the city via Sabiha Gökçen Airport, situated on the city's Anatolian side.

Meanwhile, the number of foreign visitors arriving in Istanbul by sea last year was 405,598.

Accounting for nearly a third of all visits to the country in 2023, the culturally rich metropolis and major commercial hub emerged along with the Mediterranean gem Antalya as one of the 10 most visited cities in the world last year, according to a recent report by British Broadcasting Company (BBC) Travel service.

The report, which cited growing travel demand due to the easing effects of COVID-19, listed Türkiye as a prospective destination that is likely to welcome even more tourists in 2024.

"But travelers aren't just headed to Istanbul and Antalya. According to data by the State Airports Authority Directorate General, domestic and international flight landings across Türkiye jumped 16.3% year-over-year in 2023, and the nation seems poised to welcome even more international visitors this year," it said.

It also highlighted the country's strides in medical tourism as some 1.2 million people traveled to Türkiye in 2022 for medical tourism – a 308% increase compared to 2021.

- shortlink copied

- tourism in Türkiye

- türkiye

- foreign arrivals

Istanbul is a top holiday spot for summer 2022, with hair transplants a major driver

Foreign arrivals in the Turkish city have surpassed pre-pandemic levels.

The number of tourists arriving in Istanbul has more than doubled from a year ago, recovering from a COVID-driven slump.

Foreign arrivals to Turkey's largest city - and the third largest in the Middle East - have surpassed pre-pandemic levels, in a much-needed rebound for the Turkish economy.

Arrivals to Istanbul double compared to 2021

Istanbul, which has long drawn international crowds for its culture, art and history, saw foreign arrivals soar in the lead up to the pandemic, with foreigners increasingly coming for shopping , sighseeing and health tourism.

There was a sharp drop off in 2020 but visitor numbers are now higher than they were pre-pandemic, in 2019.

Driven by tourists from Europe and the US, the number of foreign visitors in Istanbul surged nearly 115% in June to 1.47 million, according to data from Istanbul's culture and tourism directorate .

This figure was more than double the approximately 680,000 arrivals in June last year.

German tourists topped the list in June with 126,507 arrivals, followed by 117,169 arrivals from Russia, 99,115 from Iran , 96,604 from the United States and 59,901 arrivals from the United Kingdom , the data showed.

- How is the Ukraine invasion shutting down tourism in Turkey and Cuba?

- Cyprus, Turkey and Thailand: Top holiday spots feeling fallout from Ukraine-Russian war

Hair transplants are a major driver of tourist visits to Istanbul, with more than 250,000 people a year travelling to the economic capital for a makeover.

Turkey is set to be the fourth most popular European destination this summer, according to a World Travel & Tourism Council report.

The country's tourism revenues nearly tripled in the second quarter of 2022, with foreign visitor numbers surging close to 2019 levels, found the report. Revenues surged to $8.7 billion (€8.5 billion) between April and June - up 190% compared to the same period last year.

- Hawaii overtourism: Residents beg tourists to stop visiting amid post-pandemic boom

- Overtourism: As digital nomads flock to Mexico City, locals face rising rents

On Monday, Turkish President Recep Tayyip Erdogan said Turkey aimed to generate $37 billion (€36.3 billion) in tourism revenue and attract 47 million tourists this year, revising the previous targets of $35 billion (€34.3 billion) and 45 million visitors.

Officials had wanted tourism this year to match or surpass 2019's numbers, when some 52 million visitors brought in $34 billion (€33.3 billion) in revenue.

In 2021, tourism revenues doubled to almost $25 billion (€24.5 billion), recovering from the worst of the COVID impact, but remaining far below the levels experienced in 2019.

You might also like

How do airlines think the EES launch will impact passengers?

French air traffic controllers set to strike again next week

Alaskans call for 'ship-free Saturdays' as cruise tours crowd in

Turkey Tourism Revenues

Tourism revenues in turkey rose 6.8 percent year-on-year to usd 12.27 billion in the fourth quarter of 2023, of which 84.8 percent came from foreign visitors while 15.2 percent came from turkish citizens residing abroad. moreover, the number of visitors recorded a 4.1 percent growth, totaling usd 12.47 million, with the average per capita spending rising by 2.5 percent to reach usd 984. expenditure on sports, education & cultural activities surged by 49.4 percent, accommodation expenses saw an increase of 14.3 percent, and food & beverages expenditures rose by 12.9 percent. for the whole 2023, tourism revenues expanded by 16.9 percent to reach usd 54.32 million. source: turkish statistical institute, tourism revenues in turkey decreased to 8780 usd million in the first quarter of 2024 from 12270 usd million in the fourth quarter of 2023. tourism revenues in turkey averaged 4714.43 usd million from 1990 until 2024, reaching an all time high of 20230.00 usd million in the third quarter of 2023 and a record low of 294.00 usd million in the first quarter of 1990. this page provides - turkey tourism revenues- actual values, historical data, forecast, chart, statistics, economic calendar and news. turkey tourism revenues - data, historical chart, forecasts and calendar of releases - was last updated on june of 2024., tourism revenues in turkey decreased to 8780 usd million in the first quarter of 2024 from 12270 usd million in the fourth quarter of 2023. tourism revenues in turkey is expected to be 14800.00 usd million by the end of this quarter, according to trading economics global macro models and analysts expectations. in the long-term, the turkey tourism revenues is projected to trend around 16500.00 usd million in 2025 and 18900.00 usd million in 2026, according to our econometric models., markets, gdp, labour, prices, money, trade, government, business, consumer, housing, taxes, health, climate.

This website stores cookies on your computer. These cookies are used to collect information about how you interact with our website and allow us to remember you. We use this information in order to improve and customize your browsing experience and for analytics and metrics about our visitors both on this website and other media. To find out more about the cookies we use, see our Cookies Policy .

If you decline, your information won’t be tracked when you visit this website. A single cookie will be used in your browser to remember your preference not to be tracked.

Turkey Tourism Revenue

- Turkey's Tourism Revenue reached 3 USD bn in Mar 2024, compared with 3 USD bn in the previous month

- Turkey's Tourism Revenue data is updated monthly, available from Jan 2001 to Mar 2024

- The data reached an all-time high of 8,455 USD mn in Aug 2023 and a record low of 177 USD mn in Apr 2020

View Turkey's Tourism Revenue from Jan 2001 to Mar 2024 in the chart:

What was Turkey's Tourism Revenue in Mar 2024?

Turkey's Tourism Revenue reached 3 USD bn in Mar 2024, compared with 3 USD bn in the previous month See the table below for more data.

Tourism Revenue by Country Comparison

Buy selected data, accurate macro & micro economic data you can trust.

Explore the most complete set of 6.6 million time series covering more than 200 economies, 20 industries and 18 macroeconomic sectors.

Turkey Key Series

More indicators for turkey, request a demo of ceic.

CEIC’s economic databases cover over 200 global markets. Our Platform offers the most reliable macroeconomic data and advanced analytical tools.

Explore our Data

Roundup: Istanbul's number of tourists breaks record, signaling promising year

Source: Xinhua

Editor: huaxia

2024-06-04 22:30:30

ISTANBUL, June 4 (Xinhua) -- Türkiye's bustling city Istanbul set a record high by welcoming 5.2 million foreign visitors in the first four months of 2024, signaling promising prospects for the country's ambitious goal of tourism for this year.

Istanbul's unique allure has resulted in a notable 10-percent increase in visitors during the January-April period compared with last year, according to data from the Ministry of Culture and Tourism.

The ministry's recent data also revealed that the number of foreign tourists increased by 11.75 percent in the whole country, reaching 10.7 million in the same period.

Hamit Kuk, chief adviser to the president of the Turkish Travel Agencies Association (TURSAB), said this remarkable influx underscored Istanbul's enduring appeal, signaling a broader rebound in tourism.

"Achieving an annual growth rate of 10 percent is not just desirable, but (also) essential for our industry's revitalization after the pandemic," Kuk told Xinhua in a recent interview.

"June appears hovered for exceptional occupancy rates, and as we approach July and August, the peak of the tourism season, optimism is already soaring in the city," he said.

Spanning across the continents of Europe and Asia, Istanbul with a population of 16 million people is uniquely situated along the Bosphorus Strait, adding to its rich cultural and geographical significance, Kuk noted.

Istanbul, a captivating metropolis, pulsates with life round the clock and boasts a history, rendering it one of the world's oldest cities, Kuk noted, adding that "its alluring charm also lies in its vibrant culinary scene, offering a tapestry of flavors that enchant visitors from around the globe."

Russia, Germany and Iran had the highest number of visitors to Istanbul this year, followed by the United States, France, Britain, and Saudi Arabia.

Yildirim Tas, a TURSAB board member, emphasized that Istanbul should increase its promotional activities to attract tourists from diverse regions worldwide.

"Travel agencies can arrange charter planes for destinations within a four-hour flight radius. However, we encounter challenges in enticing tourists from more distant regions due to the higher cost of flight tickets beyond this duration," Tas said.

To tackle this obstacle, he suggested that Türkiye ramp up its promotional efforts, like producing documentaries showcasing Istanbul on YouTube and other online platforms.

Speaking at a gastronomy event in Istanbul last Thursday, Culture and Tourism Minister Mehmet Nuri Ersoy said Türkiye's tourism income reached some 56 billion U.S. dollars in 2023, up 12 percent from the previous year, while the number of tourists hit 56.7 million.

Türkiye's tourism target for 2024 is 60 billion dollars in revenue and 60 million tourists, he said. ■

- Roundup: Istanbul's number of tourists breaks record, signaling promising year

ISTANBUL, June 4 (Xinhua) -- Türkiye's bustling city Istanbul set a record high by welcoming 5.2 million foreign visitors in the first four months of 2024, signaling promising prospects for the country's ambitious goal of tourism for this year.

Istanbul's unique allure has resulted in a notable 10-percent increase in visitors during the January-April period compared with last year, according to data from the Ministry of Culture and Tourism.

The ministry's recent data also revealed that the number of foreign tourists increased by 11.75 percent in the whole country, reaching 10.7 million in the same period.

Hamit Kuk, chief adviser to the president of the Turkish Travel Agencies Association (TURSAB), said this remarkable influx underscored Istanbul's enduring appeal, signaling a broader rebound in tourism.

"Achieving an annual growth rate of 10 percent is not just desirable, but (also) essential for our industry's revitalization after the pandemic," Kuk told Xinhua in a recent interview.

"June appears hovered for exceptional occupancy rates, and as we approach July and August, the peak of the tourism season, optimism is already soaring in the city," he said.

Spanning across the continents of Europe and Asia, Istanbul with a population of 16 million people is uniquely situated along the Bosphorus Strait, adding to its rich cultural and geographical significance, Kuk noted.

Istanbul, a captivating metropolis, pulsates with life round the clock and boasts a history, rendering it one of the world's oldest cities, Kuk noted, adding that "its alluring charm also lies in its vibrant culinary scene, offering a tapestry of flavors that enchant visitors from around the globe."

Russia, Germany and Iran had the highest number of visitors to Istanbul this year, followed by the United States, France, Britain, and Saudi Arabia.

Yildirim Tas, a TURSAB board member, emphasized that Istanbul should increase its promotional activities to attract tourists from diverse regions worldwide.

"Travel agencies can arrange charter planes for destinations within a four-hour flight radius. However, we encounter challenges in enticing tourists from more distant regions due to the higher cost of flight tickets beyond this duration," Tas said.

To tackle this obstacle, he suggested that Türkiye ramp up its promotional efforts, like producing documentaries showcasing Istanbul on YouTube and other online platforms.

Speaking at a gastronomy event in Istanbul last Thursday, Culture and Tourism Minister Mehmet Nuri Ersoy said Türkiye's tourism income reached some 56 billion U.S. dollars in 2023, up 12 percent from the previous year, while the number of tourists hit 56.7 million.

Türkiye's tourism target for 2024 is 60 billion dollars in revenue and 60 million tourists, he said. Enditem

Go to Forum >> 0 Comment(s)

Add your comments....

- User Name Required

- Your Comment

- Türkiye

Middle East

Asia - Pacific

- Infographics

Environment

Science-Technology

Company News

Finance Terminal

Anadolu Images

Energy Terminal

Discrimination Line

Fact Check Line

Corporate News

Türkiye targets $60B in tourism revenue with 60M tourists in 2024

Tourism investments reach approximately $90b, with tourism employees increasing to 1.5m, says chairman of turkish travel association.

Türkiye targets $60 billion in tourism revenue in 2024, as there has been a significant increase in bookings in the country.

Firuz Baglikaya, chairman of the Association of Turkish Travel Agencies (TÜRSAB), told Anadolu that they are working closely with member travel agencies to reach the revenue target in 2024, with an aim to reach 60 million tourists this year.

“Nearly 1.5 billion international trips are made yearly, and with tourism being a highly strategic sector thanks to its employment-creating and value-added structure, competition in the sector is increasing day by day worldwide,” he said.

He stated that the distribution of tourists to Türkiye is mainly concentrated in three to four cities, which needs to change.

“We need to attract tourists from high-spending income groups to Türkiye and increase the share of high-value tourism types, such as cultural, health, and more,” said Baglikaya.

“We aim to ensure with the ‘Century of Tourism’ project that the sector booms all over the country and throughout the year,” he added.

‘Tourism to continue to determine Türkiye’s future’

Baglikaya mentioned that the tourism sector will grow to be even more important than it is today, as the competition in the sector is expected to become intense.

He noted that Türkiye aims to host 100 million tourists in the future, and in the scope of this mission, the tourism sector in the country will advance further.

“We expect that tourism employment, which is at 1.5 million, will at least double with these targets; and therefore, tourism will continue to be one of the sectors that determine Türkiye’s future,” he said

‘Total cost of tourism investments stands at approximately $90B’

“Tourism in Türkiye grew from 2 million tourists to 50 million, and today, the total cost of tourism investments has reached approximately $90 billion, and the number of people employed has increased to approximately 1.5 million,” Muberra Eresin, president of the Hotel Association of Türkiye (TÜROB), told Anadolu.

“Our goal is to reach $60 billion in tourism revenue and 60 million tourists this year, in line with the target of the Ministry of Culture and Tourism, and we believe that the sector will continue to reach its targets and to provide strong support to the country's economy, employment, and development,” she said.

“The 12% increase in the number of visitors to Türkiye in the first two months of this year also supports our expectations. Signals from international tourism expos are also positive, hence, we expect an increase in hotel occupancy in 2024,” she added.

‘Türkiye has many advantages’

Adviye Bergemann, founding president of the International Sustainable Tourism Association (USTUD), stated that Türkiye has very different dynamics within itself.

“The tourism sector was more cautious in its planning and preparations in 2024, and Europe is doing much better in luxury tourism compared to previous years, with demand showing increased momentum,” she said.

“Despite the many competitors in the sector, Türkiye has many advantages,” she added.

*Writing by Emir Yildirim

Related topics

Bu haberi paylaşın.

UN chief condemns Israel's deadly attack on UNRWA school-turned-shelter in Gaza

Pivotal rights group urges biden to 'indefinitely' suspend arms shipments to israel as election nears, zelenskyy vows work will be done to bring russia to ‘justice’ for kakhovka dam blast, azerbaijan hosts 13th general assembly of parliamentary assembly of turkic states, hungary categorically rejects sending troops to ukraine if nato intervenes in war with russia, changing cookie preferences, your opinions matter to us.

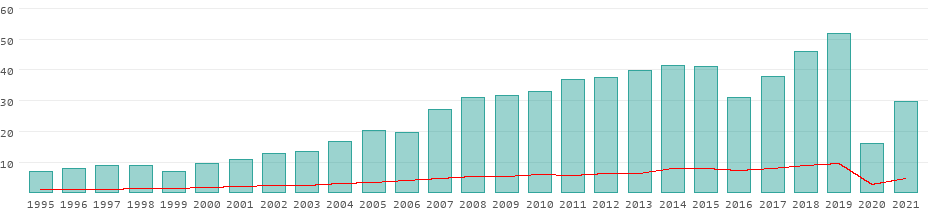

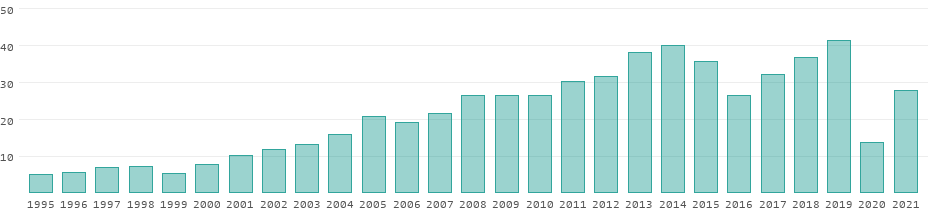

Tourism in Turkey

Development of the tourism sector in turkey from 1995 to 2021.

Revenues from tourism

All data for Turkey in detail

- My View My View

- Following Following

- Saved Saved

Turkey's tourism revenues jump 27.1% in Q3

- Medium Text

Sign up here.

Reporting by Gdansk newsroom; Writing by Ali Kucukgocmen; Editing by Daren Butler

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

South Africa's ANC to invite other parties to form government of national unity - Ramaphosa

South Africa's African National Congress (ANC) will invite other political parties to form a government of national unity, its leader Cyril Ramaphosa said on Thursday, after a meeting of the ANC's National Executive Committee.

EKOIST Journal of Econometrics and Statistics

Research article, stationarity of turkey’s tourism revenues series: fourier kpss stationarity test.

In this study, the stationarity of tourism income monthly series covering the 2012-2019 period in Turkey were examined. When developing tourism policies, it is important for policy makers whether the tourism income series used for forecasting is stationary. Nonstationary series indicate that the effect of incoming shocks is permanent and prevents predictions for the future. Therefore, the stationarity of the tourism income series is important for forecasting modeling. In this regard, the stationarity of Turkey’s tourism income is tested using Fourier series KPSS stationarity test. Becker et al. (2006) developed by Kwitkowski et al. (1992) is based on the stationarity test KPSS type proposed. In the literature, most of the studies that test the stationarity of tourism income series are included in the convergence hypothesis and regression. In this study, the test using Fourier stationarity test of the stationarity of Turkey’s tourism income series, examined the literature of Turkey’s tourism income series of time-series feature a powerful test will contribute to respect. The obtained results indicate that Turkey’s stable of monthly data covering the period 2012-2019. This result shows that regression analyzes and future forecasts using tourism income series will be reliable for the mentioned periods.

Türkiye’nin Turizm Geliri Serisinin Durağanlığı: Fourier KPSS Durağanlık Test

Bu çalışmada Türkiye’nin 2012-2019 dönemini kapsayan aylık turizm geliri serisinin durağanlığı incelenmiştir. Turizm politikaları geliştirilirken, öngörü için kullanılan turizm serisinin geçmiş değerlerinin gelen şoklardan kalıcı olarak etkilenip etkilenmediği politika yapıcılar açısından önem taşımaktadır. Durağan olmayan seriler gelen şokların etkisinin kalıcı olduğunu gösterirken gelecek ile ilgili öngörüde bulunulmasını engeller. Bu yüzden turizm geliri serisinin durağanlığı öngörü modellemeleri için önemli bir sınama türüdür. Bu bakımdan Türkiye’ye ait turizm geliri serisinin durağanlığı Fourier KPSS durağanlık testi kullanılarak sınanmıştır. Becker vd. (2006) tarafından geliştirilen bu durağanlık testi, Kwitkowski vd. (1992) tarafından önerilen KPSS tipi durağanlık testine dayanır. Literatürde turizm geliri serisinin durağanlığının sınandığı çalışmaların genelinin yakınsama hipotezi sınamaları ve regresyon ilişkileri içerisinde yer aldığı görülmektedir. Bu çalışmada, Türkiye’nin aylık turizm geliri serisinin durağanlığının Fourier birim kök testi kullanılarak sınanması, literatüre Türkiye’nin turizm geliri serisinin zaman serisi özelliğinin ayrı olarak güçlü bir testle incelenmesi bakımından önemli bir katkı sunacaktır. Fourier birim kök testi yapılarak elde edilen sonuçlar Türkiye’nin 2012-2019 dönemini kapsayan aylık verisinin durağan olduğunu göstermektedir. Bu sonuç bize belirtilen dönemler için turizm geliri serisi kullanılarak yapılacak regresyon analizlerinin ve gelecek tahminlerinin güvenilir olacağı sonucunu vermektedir.

EXTENDED ABSTRACT

Recently, the tourism sector has started to become an important sector for the economy of the countries. Sustainability of economic growth is one of the most important targets to be achieved for countries. When the economic growth of countries enters a systematic stalemate in certain periods, the tourism sector is seen as an alternative solution to overcome this dilemma. The reason why countries have increased the importance they attach to the tourism sector in recent times includes not only economic but also political, cultural and social reasons. Cultural, social and economic interactions between countries can be realized through tourism activities in the most effective way. With the increasing importance of the tourism sector in the economy, the number of studies examining the place of tourism indicators in the economy has increased. In this context, econometric analysis of tourism related indicators in the determination of tourism policies can draw a road map for decision makers. The course of tourism income over time attracts the attention of academicians and decision-makers. Because the course of this variable over time gives strong ideas for making predictions and decisions about the future. By using the previous period values of tourism income series, tourism incomes in the future can be predicted or the changes that will be made in tourism incomes by tourism investments can be estimated by econometric modeling. However, in order for the predictions and model estimations to yield reliable results, the average and variance of the tourism income series over time should remain constant, that is, it should be stable. Otherwise, the predictions made using the non-stationary tourism income series may be wrong and the estimation of the relationship between the tourism income variable and other variables may be false. In order to avoid these stalemates, the stagnation of the tourism income series should be examined to see whether the effects of sudden shocks on tourism incomes are permanent.

In this context, this study, Turkey’s tourism incomes series of monthly time series properties have been previously studied using fourier stationarity test used not for tourism income series. In the studies examining the stagnation of the tourism income series, it is seen that unit root tests, which make seasonal adjustments, are generally used (Kulendran & Wong, 2005; Nikolaos, 2008; Hepkorucu & Doğan, 2019). Or, unit root tests of tourism series were used to examine structural changes using dummy variables (Narayan, 2005; Lean & Smyth, 2008; Lee & Chien, 2008). However, in cases where the number and location of structural changes are not known in the course of time, the use of dummy variables or using only seasonally corrected unit root tests may give unreliable results regarding the unit root process of the series. Fourier unit root tests, which allow accurate estimation of structural changes even in cases where the structure and location are not known, have shown strong results in the process followed by the data. Therefore, in this study, the unit root process of the tourism income series was examined by the stationarity test using fourier functions. The fourier stationarity test used in this study was performed by Becker et al. (2006). This stability test proposed by Becker et al. (2006) is an extension of the stability test developed by Kwitkowski et al. (1992) with fourier functions. In the Fourier KPSS stationarity test, structural changes were taken into account by using the Fourier function. The changes in the series can be predicted precisely by Fourier functions. In this study, Turkey’s stability characteristics of the data for the years 2012-2019 monthly tourism income variable is tested using fourier KPSS said stability test due to the strong features. According to the results of the KPSS Fourier stability test, the appropriate frequency for Turkey’s tourism serial number is calculated as 1. For the significance of Fourier terms, the F test statistic was calculated. Becker et al. (2006) ‘s study by comparing the critical values of the fourier terms were found to be significant. In this respect, it can be said that it is appropriate to use the fourier terms in the data creation process of the KPSS model used in stasis testing. Since the obtained Fourier KPSS test statistic was smaller than the critical values, the basic hypothesis could not be rejected. Turkey’s observed monthly data for the period 2012-2019, it has been concluded that there is stationary. The results obtained with this series is that Turkey’s tourism income stationary for the period studied. In other words, the effect of incoming shocks was temporary. This means that, in studies for Turkey and the policy decisions taken, predictions to be made by looking at the tourism income serial and model predictions will give reliable results.

- Bal, H., Akça, E. E., & Bayraktar, M. (2016). The contribution of tourism to economic growth: a research on the Turkey. Akademik Yaklaşımlar Dergisi, 7(1), 1–20. google scholar

- Becker, R., Enders, W., & Lee, J. (2006). A stationary test in the presence of an unknown number of smooth breaks. Journal of Time Series Analysis, 27(3), 381–409. google scholar

- Caglayan, E., Sak, N., & Karymshakov, K. (2012). Relationship between tourism and economic growth: A panel Granger causality approach. Asian economic and financial review, 2(5), 591. google scholar

- Erkan, B., Oğuz, K. A. R. A. ve Harbalıoğlu, M. (2013). Türkiye’de turizm gelirlerinin belirleyicileri. Akademik Bakış Uluslararası Hakemli Sosyal Bilimler Dergisi, 39, 1–20. google scholar

- Eugenio-Martin, J. L., Martín Morales, N., & Scarpa, R. (2004). Tourism and economic growth in Latin American countries: A panel data approach. Nota di Lavoro, No.26.2004, Fondazione Eni Enrico Mattei, Milano. google scholar

- Gunduz, L., & Hatemi, J. A. (2005). Is the tourism-led growth hypothesis valid for Turkey? Applied Economics Letters, 12(8), 499–504. google scholar

- Hepkorucu, A. ve Doğan, Ö. (2019). Turizm gelirleri için mevsimsel birim kök yapısının incelenmesi. Journal of International Social Research, 12(62). google scholar

- Husein, J., Kara, S. M. (2011). Research note: Re-examining the tourism-led growth hypothesis for Turkey. Tourism Economics, 17(4), 917–924. google scholar

- Kamacı, A. ve Oğan, Y. (2014). Turizm gelirlerinin ekonomik büyüme üzerine etkileri: Panel eşbütünleşme ve nedensellik Analizi. The affects of tourism revenues on economic growth: A panel cointegration and causality analysis. International Conference on Eurasian Economies. google scholar

- Kanca, O. C. (2015). Turizm gelirleri ve ekonomik büyüme: Türkiye örneği. Marmara Sosyal Araştırmalar Dergisi, 8, 1–14. google scholar

- Kara, O., Çömlekçi, İ. ve Kaya, V. (2012). Turizm gelirlerinin çeşitli makro ekonomik göstergeler ile ilişkisi: Türkiye örneği (1992–2011). Ekonomik ve Sosyal Araştırmalar Dergisi. google scholar

- Khalil, S., Kakar, M. K., & Malik, A. (2007). Role of tourism in economic growth: Empirical evidence from Pakistan economy [with comments]. The Pakistan Development Review, 985–995. google scholar

- Kızılgöl, Ö. ve Erbaykal, E. (2008). Türkiye’de turizm gelirleri ile ekonomik büyüme ilişkisi: Bir nedensellik analizi. Süleyman Demirel Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi, 13(2), 351–360. google scholar

- Kızılkaya, O. (2018). Türkiye’de turizm gelirleri ve büyüme ilişkisinin bootstrap nedensellik analizi ile incelenmesi. Dicle Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 21, 218–227. google scholar

- Kulendran, N., & Wong, K. F. F., (2005). Modeling seasonality in tourism forecasting. Journal of Travel Research, 44(2), 163–170. google scholar

- Kwiatkowski, D., Phillips, P. C., Schmidt, P., & Shin, Y. (1992). Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of econometrics, 54(1-3), 159–178. google scholar

- Lean, H. H., & Smyth, R. (2008). Are Malaysia’s tourism markets converging? Evidence from univariate and panel unit root tests with structural breaks. Tourism Economics, 14(1), 97–112. google scholar

- Lee, C. C., & Chien, M. S. (2008). Structural breaks, tourism development, and economic growth: evidence from Taiwan. Mathematics and Computers in Simulation, 77, 358–368. google scholar

- Narayan, P. K. (2005). The structure of tourist expenditure in fiji: Evidence from unit root structural break tests. Applied Economics, 37, 1157–1161. google scholar

- Nikolaos, D. (2008). Seasonal analysis of tourist revenues: An empirical research for Greece. Tourismos: An International Multidisciplinary Journal of Tourism, 3(2), 57–70. google scholar

- Özcan, C. C. (2015). Türkiye’de turizm gelirinin makroekonomik belirleyicileri: panel veri analizi. Çukurova Üniversitesi Sosyal Bilimler Enstitüsü Dergisi, 24(1), 203–220. google scholar

- Samimi, A. J., Sadeghi, S., & Sadeghi, S. (2011). Tourism and economic growth in developing countries: P-VAR approach. Middle-East Journal of Scientific Research, 10(1), 28–32. google scholar

- Şen, A., & Şit, M. (2015). Reel döviz kurunun Türkiye’nin turizm gelirleri üzerindeki etkisinin ampirik analizi. Journal of Yasar University, 10(40). google scholar

- Tabash, M. I. (2017). The role of tourism sector in economic growth: an empirical evidence from Palestine. International Journal of Economics and Financial Issues, 7(2), 103–108. google scholar

- Uysal, D., Erdoğan, S., Mucuk, M. (2004). Türkiye’de turizm gelirleri ile ekonomik büyüme arasındaki ilişki (1992-2003). Sosyal Ekonomik Araştırmalar Dergisi, 4(8), 162–170. google scholar

- Yavuz, N. Ç. (2006). Türkiye’de turizm gelirlerinin ekonomik büyümeye etkisinin testi: yapısal kırılma ve nedensellik analizi. Doğuş Üniversitesi Dergisi, 7(2), 162–171. google scholar

- Yılancı, V., & Eriş, Z. A. (2012). Are tourism markets of turkey converging or not? A fourier stationary analysis. Anatolia- An International Journal of Tourism and Hospitality Research, 23(2), 207–216. google scholar

Copy and paste a formatted citation or use one of the options to export in your chosen format

Fendoğlu , E . , & Canpolat Gökçe , E . ( 2019 ). Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test . EKOIST Journal of Econometrics and Statistics , 0 ( 31 ) , 17 - 28 . https://doi.org/10.26650/ekoist.2019.31.0020

Fendoğlu E , Canpolat Gökçe E . Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test . EKOIST Journal of Econometrics and Statistics . 2019 ; 0 ( 31 ): 17 - 28 . https://doi.org/10.26650/ekoist.2019.31.0020

Fendoğlu , E . ; Canpolat Gökçe , E . Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test . EKOIST Journal of Econometrics and Statistics , [Publisher Location], v. 0 , n. 31 , p. 17 - 28 , 2019 .

Chicago: Author-Date Style

Fendoğlu , Eda , and Esra Canpolat Gökçe . 2019 . “ Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test .” EKOIST Journal of Econometrics and Statistics 0 , no. 31 : 17 - 28 . https://doi.org/10.26650/ekoist.2019.31.0020

Chicago: Humanities Style

Fendoğlu , Eda , and Esra Canpolat Gökçe . “ Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test .” EKOIST Journal of Econometrics and Statistics 0 , no. 31 ( Jun. 2024 ): 17 - 28 . https://doi.org/10.26650/ekoist.2019.31.0020

Harvard: Australian Style

Fendoğlu , E & Canpolat Gökçe , E 2019 , ' Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test ', EKOIST Journal of Econometrics and Statistics , vol. 0 , no. 31 , pp. 17 - 28 , viewed 6 Jun. 2024 , https://doi.org/10.26650/ekoist.2019.31.0020

Harvard: Author-Date Style

Fendoğlu , E . and Canpolat Gökçe , E . ( 2019 ) ‘ Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test ’, EKOIST Journal of Econometrics and Statistics , 0 ( 31 ), pp. 17 - 28 . https://doi.org/10.26650/ekoist.2019.31.0020 ( 6 Jun. 2024 ).

Fendoğlu , Eda , and Esra Canpolat Gökçe . “ Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test .” EKOIST Journal of Econometrics and Statistics , vol. 0 , no. 31 , 2019 , pp. 17 - 28 . [Database Container], https://doi.org/10.26650/ekoist.2019.31.0020

Fendoğlu E , Canpolat Gökçe E . Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test . EKOIST Journal of Econometrics and Statistics [Internet]. 6 Jun. 2024 [cited 6 Jun. 2024 ]; 0 ( 31 ): 17 - 28 . Available from: https://doi.org/10.26650/ekoist.2019.31.0020 doi: 10.26650/ekoist.2019.31.0020

Fendoğlu , Eda - Canpolat Gökçe , Esra . “ Stationarity of Turkey’s Tourism Revenues Series: Fourier KPSS Stationarity Test ”. EKOIST Journal of Econometrics and Statistics 0 / 31 ( Jun. 2024 ): 17 - 28 . https://doi.org/10.26650/ekoist.2019.31.0020

Destination readiness: Preparing for the tourist flows of tomorrow

Tourism can help build a more connected, more vibrant world. But as tourism grows rapidly, the most visited destinations are experiencing more concentrated flows (Exhibit 1). Recent satellite data suggests that 80 percent of travelers visit just 10 percent of the world’s tourist destinations. The number of travelers and the frequency of their trips are only set to increase.

A large flow of tourists, if not carefully channeled, can encumber infrastructure, harm natural and cultural attractions, and frustrate locals and visitors alike. Today’s tech-enabled travel landscape can exacerbate this issue: one eye-catching photo on a social media network can make a little-known attraction go viral.

About the authors

This article is a collaborative effort by Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann , with Ivan Gladstone and Jasperina de Vries, representing views from McKinsey’s Travel, Logistics & Infrastructure Practice.

Against this backdrop, now is the time for tourism stakeholders to combine their thinking and resources to look for better ways to handle the visitor flows of today—while properly preparing themselves for the visitor flows of tomorrow. We offer a diagnostic that destinations can use to spot early-warning signs about tourism concentration, followed by suggestions for funding mechanisms and strategies to help maximize the benefits of tourism while minimizing its negative impacts.

Carrying capacity and its impact on destination readiness

Carrying capacity refers to the maximum number of visitors that a destination can accommodate without causing harm to its physical, economic, and sociocultural environment or compromising the quality of visitors’ experiences. To effectively manage carrying capacity, destinations must first understand their specific limits—then actively work to stay within them.

When a destination exceeds its carrying capacity, the negative effects of tourism may begin to outweigh the benefits (Exhibit 2). Shutting down tourism isn’t always feasible or sustainable. Instead, destinations should focus on increasing their carrying capacity to enable more growth. By adopting early-detection mechanisms and attentively managing carrying capacity, destinations can strike a balance between welcoming visitors and preserving natural and cultural assets and quality of life for residents.

In 2017, leveraging the growing availability of data about travelers, McKinsey, in collaboration with the World Travel & Tourism Council, developed a diagnostic tool to help spot early-warning signals that a destination is under stress from tourism. 1 “ Coping with success: Managing overcrowding in tourism destinations ,” McKinsey, December 14, 2017. This year, we have updated this tool to address the evolving nature of the challenge and the accessibility of more nuanced and precise data (see sidebar “Methodology for assessing destination readiness”).

Methodology for assessing destination readiness

Utilizing information from vendors, publicly available databases, and press searches, we measured airline traffic, accommodation booking activity, and traveler sentiment. 1 Diio Mi; International Air Transport Association; Mabrian Technologies; Oxford Economics; Tripadvisor; UN World Tourism Organization; World Travel & Tourism Council. We also incorporated analysis of data sets obtained from travel-focused groups such as the UN World Tourism Organization and the World Travel & Tourism Council.

Our intent was to identify metrics that indicate the potential effects of concentrated tourism. We examined metrics affecting the following six categories:

- Local economy: measuring the potential risk of dependence on tourism based on the speed of tourism growth over the past five years and tourism’s contribution to direct employment and GDP.

- Local community: measuring the concentration of tourism in city centers based on inbound arrivals, nights stayed, and tourism accommodations per square kilometer.

- Tourist experience: measuring overall tourist sentiment based on reviews of top 20 attractions and guest satisfaction regarding accommodations.

- Infrastructure: measuring potential overloading risks caused by tourism based on the seasonal intensity and geographic concentration of visitor arrivals.

- Nature and the environment: measuring risks to nature based on carbon emissions generated by travel and sustainability commitments pledged by local hotels.

- Culture and heritage: measuring potential threats to cultural sites based on the concentration of visitors at these sites.

Starting with a list of 65 major, representative cities, we’ve separated locations into quintiles indicating levels of potential risk and negative impact stemming from tourism flows (Exhibit 3). While this data is focused on metropolitan areas, the approach can be replicated for all sorts of popular destinations—from beach towns to mountain villages to religious sites.

Destinations can be grouped into the four following archetypes, based on whether they are struggling with visitor flow and whether they have developed tools to manage it:

- Seasonally overloaded destinations pair high visitor concentrations with limited tourist-flow-management capabilities. These cities may have room to expand their visitor management tool kits to enhance the experiences of both locals and tourists. Representative examples include Cancún, Dubrovnik, and Marrakech.

- Increasingly stressed destinations currently receive limited numbers of visitors but exhibit signs of stressed infrastructure resulting from limited tourism flow management. These cities could both boost their visitor numbers and improve their visitor infrastructure. Representative examples include Los Angeles, Manila, and Mumbai.

- Actively managed destinations receive high concentrations of visitors and have developed robust visitor management flows in response. Continuous monitoring and innovation could help these cities continue to adequately manage carrying capacity. Representative examples include Amsterdam, Bangkok, and Dubai.

- Balanced-capacity destinations receive relatively fewer visitors but have already implemented sophisticated tourism-flow-management systems. These cities can focus on boosting their visitor numbers while actively monitoring the impact of this growth. Representative examples include Abu Dhabi, Lima, and Singapore.

Seasonally overloaded: Dubrovnik

Dubrovnik is an intensely seasonal destination, with roughly 20 times more inbound airline seats made available for sale during its peak season (July and August) than during low season (January and February). The density of vacation rentals can reach about 90 postings per square kilometer in summer. The city is a popular stop for Mediterranean cruises, and its small, history-laden center can experience concentrated tourist footfalls when a ship is in port.

Dubrovnik falls in the top quintile of risk in four of our six categories, although it has begun taking significant steps to combat overcrowding. The city recently banned new private-rental permits in its historic Old Town neighborhood to counter rising rent costs for locals, 1 Sanjana Shenoy, “Croatia: Historic city Dubrovnik bans new rental permits to curb overtourism & help locals,” Curly Tales, March 15, 2024. and it’s also reorganizing cruise schedules to better stagger visitor flows.

Increasingly stressed: Mumbai

Mumbai is well positioned to capitalize on booming Indian tourism, but the city could benefit from building out its visitor-management-flow systems. Mumbai has the lowest tourism density relative to its population of all cities in our data set, yet visitors report some of the same concerns seen in more popular tourism hot spots, including long waits for entrance to attractions and a plethora of guides and vendors competing for attention. Road traffic is a major detriment to the visitor experience, with tourists in 2023 experiencing an average travel time of 20 minutes to cover ten kilometers.

The city has ambitious plans to reduce congestion with new metro and highway systems that could benefit both locals and tourists. It might have additional room to increase carrying capacity by addressing current visitor pain points—for example, by installing modernized metal detectors to smooth entry into major attractions or by creating centralized guide booths at attractions to help visitors find licensed guides.

Actively managed: Amsterdam

Given Amsterdam’s small geographic footprint, its extreme concentration of visitors puts significant pressure on local infrastructure—affecting the daily experiences of both tourists and residents. It has tried to actively manage tourism through measures such as its recently announced moratorium on hotel development 1 Charlotte Van Campenhout, “Amsterdam bans new hotels in fight against mass tourism,” Reuters, April 17, 2024. and a ban on public smoking of cannabis in its red-light district. 2 “Amsterdam to ban cannabis outdoors in red-light district,” Reuters, February 10, 2023. It has also used marketing to promote less-well-known areas in an effort to channel some visitors away from the most crowded neighborhoods. Amsterdam uses data gleaned from social media and behavior tracked on its tourist-friendly city card to analyze tourist flows and spot areas under stress.

Balanced capacity: Singapore

Renowned for an automated metro train line, futuristic downtown core, and cutting-edge innovation, Singapore has the infrastructure, resources, and practices in place to grow and support larger tourism flows. It currently ranks 56th out of the 65 cities we analyzed in terms of inbound visits per square kilometer.

Singapore’s limited land mass does tend to concentrate visitor flows at top attractions, which could create threats to cultural sites and negatively affect the experiences of both visitors and locals. Recent development projects have expanded the depth and breadth of tourist offerings, creating new attractions that could help increase the city’s carrying capacity and keep it primed for future growth.

Funding destination readiness

Once the need for destination readiness has been identified, questions turn to funding. Destinations should carefully consider which sources and mechanisms to use to generate the revenue needed to address the impacts of tourism—and ensure that the burdens don’t fall disproportionately.

Devise permit systems for individual attractions

Requiring visitors to obtain a paid permit before viewing an attraction can generate revenue while simultaneously helping to manage capacity. Permitting systems are most effective in places where demand frequently exceeds capacity and, if left unchecked, could risk causing harm to ecologically or culturally sensitive locales. Galapagos National Park in Ecuador, for instance, uses a strict permitting system with entrance fees that are applied directly toward preservation efforts.

A potential downside of permit requirements is the financial barrier for tourists who have less ability to pay. Many destinations have instituted lotteries that govern the opportunity to purchase an affordable permit, though this also reduces the funding generated by this strategy. It’s worth noting that there can be limits to the effectiveness of permitting systems: Mount Everest’s sky-high fees haven’t reduced demand from climbers.

Capitalize on major, one-off events

The city of Vancouver was able to use the planning process for the 2010 Winter Olympic Games as a catalyst to unlock government funding for long-desired infrastructure development—including road and train projects that had been stalled for more than a decade. While there’s risk that any given future mega-event won’t lead to sustained tourism demand, it can lead to lasting infrastructure improvements that benefit locals 2 Nelson Bennett, “Path to 2010 Olympics built from asphalt, steel,” Vancouver Is Awesome , February 11, 2020. for years to come.

Explore public–private partnerships

Destinations can pursue public–private partnerships to accelerate development and spread out risk. Common examples of this approach include cofunded or cobuilt event centers or museums. Exclusive concessions established and granted by destinations can provide revenue-generating opportunities to operators or leaseholders in exchange for financial returns and other commitments, such as pledges to sustainably develop and maintain a location or to support local education, infrastructure, and healthcare.

Ensure proceeds from tourism are invested where they are needed

Cities shouldn’t underestimate the strain on waste, water, and road infrastructure that tourism can create. In places where visitors significantly exceed local populations, tourism tax revenue can be budgeted into core municipal expenses, such as road maintenance and waste management, so that repairing wear and tear caused by visitors doesn’t fall entirely on locals. Tourism taxes and entry fees can be redistributed to local communities or used for preservation or restoration projects.

Managing capacity and mitigating negative impacts from growing tourist flows

After risks and funding sources have been identified, there are several promising strategies that the tourism ecosystem can employ to prepare for growing tourist volumes. They are most effective when coordinated across a broad set of stakeholders, including city governments, destination management organizations, hospitality companies, experience providers, transportation authorities, and airlines:

- Build and equip a tourism-ready workforce.

- Use data to manage and forecast visitor flows.

- Be deliberate about which tourist segments to attract.

- Distribute visitor footfall over space.

- Distribute visitor footfall over time.

- Be prepared for sudden, unexpected fluctuations.

- Preserve cultural and natural heritage.

Build and equip a tourism-ready workforce

Preparing a tourism workforce goes well beyond making sure that staff at a reception desk are polite. Tourism stakeholders should strive to ensure sufficient labor supply by fostering interest in the tourism sector, training entry-level workers in soft skills, and providing ample opportunities for career advancement. Training can be a collaborative effort by the public and private sectors.

Africa’s not-for-profit Female Guide program partners with leading safari providers to sponsor, train, and employ African women who are interested in conducting safari tours. 3 Sandra MacGregor, “I went on a safari in Botswana with a female guide—here’s why it made all the difference,” Travel + Leisure , December 23, 2023. The alcoholic-beverage company Diageo hosts training for hospitality students near Da Nang, a tourism hot spot in Vietnam, covering bar knowledge, teamwork, and customer service skills.

Regulating and credentialing locals who are part of informal tourism economies can help raise service standards and create more positive tourist experiences. For example, Singapore’s efforts to legalize and license street vending resulted in UNESCO recognition of its street hawker culture. 4 “Hawker culture in Singapore,” National Heritage Board, accessed May 2024.

Use data to manage visitor flows

Destinations can build and continuously improve holistic data monitoring and forecasting systems. Data can be gathered from governments (visa tracking), businesses (accommodation bookings and event ticket purchases), social media platforms (user behavior), and other sources. Crowd monitoring tools can provide real-time data about the location of mobile phones to help forecast and manage visitor flows.

Some destinations provide value in exchange for data. For instance, the I amsterdam City Card offers tourists access and discounts to attractions while tracking where the card is used (see sidebar “How Amsterdam handles its tourist flows”).

How Amsterdam handles its tourist flows

Geerte Udo was CEO of Amsterdam & Partners until earlier this year, when she stepped down after 17 years. Amsterdam & Partners is a public–private foundation that focuses, in part, on managing tourism in the Amsterdam metropolitan area. McKinsey spoke with Udo about Amsterdam’s efforts to handle its large tourist flows. The following is an edited version of the conversation.

McKinsey: How does Amsterdam balance the positive aspects of tourism with some of the challenges that hosting large numbers of visitors can create?

Geerte Udo: We’re very lucky in that we have a beautiful city that sells itself. People want to come here. And the visitor economy has a lot of benefits. It creates jobs, it pays taxes, and 30 percent of our public transport is financed by visitors. Our residents love the cultural infrastructure we have here, and we couldn’t support it by ourselves. We love the diversity and quality of our restaurants and bars, which are also supported by visitors. We need our visitors because they raise the quality of life for our residents.

But there are elements of the visitor economy that can harm the quality of life in the city. We’re seeing more and more visitors because the general income of people across the world is rising, and everybody wants to travel. Like other European cities that are old harbor cities with narrow streets, we have moments where we deal with overcrowding. This is mostly in the old city center, on a few narrow streets, at certain days and times. But the public space there isn’t well organized and can’t handle the number of people who want to go there.

Another issue we have is nuisance. Our city has a reputation: if you want to have a party, come to Amsterdam. It can be very annoying for residents in certain neighborhoods when visitors come to party from Thursday through Sunday evening. It makes it hard for people to live there.

There’s also an issue with managing the amount of waste in the city. Because we have more guests, there’s more waste in the street. And there’s a separate issue with private, short-term rental properties, which can sometimes crowd out housing that’s built for residents.

McKinsey: Are you able to gather data and use it to get insights that can help you handle tourist flows?

Geerte Udo: We have a lot of sources of data. At a European level, we share data with 110 European cities to see what the latest traveler trends are. We can learn from one another and understand, for instance, if a trend is only happening in the northern part of Europe or also in the southern part. More locally, we have a national data center that can tell us how many people visit the city, how long they stay, which countries they come from, their ages, and other factual information.

Our organization also does its own research on visitor behavior. For instance, we sell an I amsterdam City Card. It gives visitors free access to public transport, museums, and various attractions. We sell about 150,000 to 200,000 cards a year, and because people need to check in with our card at the locations, we can see their movement patterns. Over time, we’re able to anticipate when and where people will go. For instance, many people visit museums in the morning and then go on a canal boat ride in the afternoon. We can advise first-time visitors to reverse that order because they’re likely to have better, less crowded experiences that way.

But nudging people only works if you can connect to their needs. We wouldn’t tell a first-time visitor to venture out to a neighborhood that’s not well-known—we understand that if they’re here for the first time, they really want to see the highlights. Whereas if you’re here for the third time, and we know what you’ve been doing and a little bit about your preferences, we can guide you to other neighborhoods and areas we think you’ll enjoy.

We know from data that there’s a trend in behavior where, after 2.4 days, people are often ready to explore beyond the city. This number is similar in other cities, as well. After 2.4 days, people start to ask, “Can you show me where I can get some fresh air for a half day?” And we can then offer them guidance on visiting beaches, windmills, and so forth.

McKinsey: What are some mitigation strategies that you’ve tried or considered?

Geerte Udo: One thing we’ve put effort into is branding and marketing concepts. If people come to our city thinking that everything is in the canal district, it’s hard to guide them to other areas. So we’ve tried to build our image into much more than the canal district, expanding interest into other areas that all have different identities and different flavors.

There have been years of discussions about gating certain areas and charging fees to enter them. That might help generate revenue that the city can spend on cleaning streets and improving the subways, which would be beneficial for the tourism industry. But in my opinion, charging fees or raising tourist taxes won’t reduce visitor numbers at all.

We’ve spent a lot of time with city hall looking into the best ways to organize public spaces. For a long time, urban planning didn’t even take visitors into account when thinking about how to arrange public space. To truly manage visitor flows, there needs to be a bigger-picture, integrated approach to how a city is organized.

None of this will reduce the number of travelers because travel is growing so fast. But we can guide visitors to disperse them across time and space, minimize overcrowding, and put less pressure on the old city center. I think guiding and spreading tourism really can work if we manage to match supply and demand.

Comments and opinions expressed by interviewees are their own and do not represent or reflect the opinions, policies, or positions of McKinsey & Company or have its endorsement.

Be deliberate about which tourist segments to attract

Different tourists arrive with different kinds of baggage—literally and metaphorically. Destinations can be strategic in identifying the types of tourism they want to encourage. Some destinations might welcome (and be able to handle) party crowds, while others might be more interested in attracting families or older travelers. Destinations should work to understand the demographics, preferences, and behaviors of their target customers before tailoring offerings and communications that will appeal to them.

Bhutan requires a sustainable development fee of $100 per day from visitors. This requirement serves to limit the number of visitors and their impact on the small nation while simultaneously creating a sense of exclusivity that spurs increased interest from international travelers.

Distribute visitor footfall over space

Nudging tourists to visit less trafficked areas can help ease congestion at the most famous and popular attractions. This can work at a neighborhood level: pop-up experiences and off-the-beaten-path tours hosted by local guides can entice tourists to explore farther afield. It can also work on a wider geographic scale: TikTok’s “destination dupe” trend surfaces less expensive, less crowded locales that offer many of the same experiences as more crowded destinations (for instance, Taipei instead of Seoul).

Marketing campaigns can frame a destination as a place where visitors chart their own paths. The “I amsterdam” campaign, for example, encourages tourists to create their own personalized versions of the city. AI-powered tools can help craft bespoke itineraries based on visitors’ preferences and interests, matching travelers with unexpected neighborhoods, accommodations, and restaurants that will appeal to their individual tastes.

Developing accommodations and attractions in less dense areas by repurposing assets can also help distribute footfall. Istanbul helped facilitate the restoration of a 1930s tobacco factory and warehouse that became a hotel. The Maboneng Precinct in Johannesburg was a run-down cluster of warehouses before being repurposed to create art galleries, restaurants, and retail spaces.

Distribute visitor footfall over time

Seasonal concentration of tourist activities can cause inefficient use of infrastructure and overload destinations’ ecological, social, and cultural systems. Forty-three percent of travelers already choose to travel off-season to avoid overcrowding. 5 “How to travel: a look at sustainable travel habits,” Booking.com, October 3, 2023. Stakeholders can take steps to encourage even more shifting of visits to off-peak periods. Iceland, for instance, has heavily promoted winter visits to see the Northern Lights, drawing on collaboration across the entire tourism ecosystem—from tour operators developing ice cave excursions to airlines promoting reduced winter airfares.

Distributing visitors across hours is another powerful strategy. The Hanauma Bay Nature Preserve in Hawaii has timed reservations, which smooth visitor numbers across the day and enable a better experience for all. The Petra archaeological site in Jordan has taken a different approach: by creating an evening light and sound show, this popular attraction has expanded the breadth of attractive visitation times.

Because domestic travel represents the bulk of trips, governments might be able to help distribute visitors by carefully managing holiday schedules. For example, the French government has split school holidays so that different regions are on break at different times, which helps mitigate overcrowding during ski season.

Be prepared for sudden, unexpected fluctuations

A viral social media post can send travelers flocking to a destination that might not be prepared for the influx. One beautiful block in Brooklyn’s Dumbo neighborhood earned the nickname “selfie street” when visitors—having seen other tourists’ picturesque selfies on social media—flooded it with phones in hand. Footfall data shows that Dumbo saw an 86 percent increase in visits from 2022 to 2023.

In some instances, this type of behavior can cause significant harm. Access to the secluded Burney Falls waterfall in Northern California was shut down this year in part because of trail damage caused by heavy visitor flows. Data shows that interest in this photogenic spot took off on social media during the COVID-19 pandemic, with peak season in 2023 seeing three to four times as many weekly visitors as in 2019.

Destinations should keep tabs on social media activity and cultural trends that pertain to them. They might consider developing playbooks in advance with planned procedures for handling viral surges. Local tourism stakeholders can attempt to anticipate this type of sudden interest and actively channel it in ways that will mitigate negative impacts. It’s important to be mindful that virality can have different levels of staying power—ranging from a brief phenomenon to an enduring trend.

Preserve cultural and natural heritage

Destinations need to weigh considerations of both accessibility and preservation as they manage tourists’ engagement with natural and cultural attractions. One option is to designate culturally or ecologically significant land and then engage locals in finding ways to strike this balance. Legally protecting lands is a long-standing conservation practice, and governments have increasingly turned to Indigenous populations to better understand cultural sensitivities around specific sites. For example, Indigenous Tourism Alberta partners with Indigenous groups to offer tourists authentic experiences—such as fishing, jewelry making, and hiking—while minimizing negative impacts on nature and culture.

Although tourists often prefer to roam freely around natural sites, limiting access—either geographically or temporally—can be critical to preservation. Creating specific pathways (with showcases for educational material along the way) can allow guests to safely and efficiently walk through a site without causing damage or disturbing wildlife habitats. Sometimes a digital substitute can be an effective solution: Digital Giza lets tourists experience a re-creation of the Egyptian tombs without needing to actually enter them.

Sensitive areas can be closed for predetermined time periods to allow for rejuvenation and sustainable development. And naturally seasonal sites can take advantage of off-peak downtime to fully close and refresh attractions. For example, the Inca Trail in Peru shuts for one month every year during the rainy season to allow nature to recuperate from heavy footfall on the trail. Ideally, these downtimes should be established preventatively and communicated to tourists well in advance, but in some instances, they may need to be prescribed on short notice to prevent imminent damage or rectify harm already done.

As global travel continues to grow, it’s crucial for stakeholders in the tourism ecosystem to be ready for the challenges that could arrive alongside increased visitor flows. By understanding the risks and opportunities, implementing funding strategies, and collaborating across sectors, popular destinations can take steps to preserve their cultural, economic, and environmental assets.

Caroline Tufft is a senior partner in McKinsey’s London office, Margaux Constantin is a partner in the Dubai office, Matteo Pacca is a senior partner in the Paris office, Ryan Mann is a partner in the Chicago office, Ivan Gladstone is an associate partner in the Riyadh office, and Jasperina de Vries is an associate partner in the Amsterdam office.

The authors wish to thank Abdulhadi Alghamdi, Alessandra Powell, Alex Dichter, Cedric Tsai, Diane Vu, Elisa Wallwitz, Lily Miller, Maggie Coffey, Nadya Snezhkova, Nick Meronyk, Paulina Baum, Peimin Suo, Rebecca Stone, Sarah Fellay, Sarah Sahel, Sophia Wang, Steffen Fuchs, Steffen Köpke, Steve Saxon, and Urs Binggeli for their contributions to this article. The authors also wish to thank Mabrian for providing data.

This article was edited by Seth Stevenson, a senior editor in the New York office.

Explore a career with us

Related articles.

Coping with success: Managing overcrowding in tourism destinations

Tourism in the metaverse: Can travel go virtual?

The future of tourism: Bridging the labor gap, enhancing customer experience

Let the vibrant spirit ignite your sense of experience

Step into Istanbul, where history and the future intertwine, ancient legends meet contemporary dreams.

are you ready to write your own story

Through the eyes of creators.istanbul.

together we create

Trending now.

Take an unforgettable journey of history and architecture

Hagia Sophia Mosque

Flower Passage

Basilica Cistern

Galata Tower

The Blue Mosque

Maidens Tower

Topkapı Palace

Historical Places

Cultural heritage, witness history in the making.

Heritage points restored with loyalty, pride and love are being prepared to provide magical experiences through the spirit of a damaged history.

5 exciting art galleries in Istanbul

Pilevneli Gallery

Borusan Contemporary

Zilberman Gallery

PG Art Gallery

A travel experience integrated with art.

In Istanbul, history is full of art, art is full of streets, and streets are full of new discoveries. Come and be a part of thousands of years of culture and art; Let Istanbul surround your soul with art. Be Part

Explore the Neighbourhood

kuz gun cuk

What a delicious travel plan, land of delicious, unreveal the, yummy tasty.

- Live İstanbul

- The Stories

© 2023 Powered by Hybrid

- Travel, Tourism & Hospitality ›

Leisure Travel

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Total tourism income in Turkey 2001-2023

The income generated by the tourism sector in Turkey roughly doubled in 2021 over the previous year, after having dropped sharply in 2020 due to the coronavirus (COVID-19) pandemic. Overall, the total tourism spending by international travelers and Turkish citizens resident abroad amounted to nearly 56 billion U.S. dollars in 2023.

Has the Turkish tourism sector recovered after the coronavirus (COVID-19) pandemic?

As a result of travel bans, border closures, and national and international quarantines imposed due to the pandemic, in the spring of 2020, tourism movements came to a halt in Turkey like many other countries. Yet, Turkey demonstrated significant signs of recovery from 2022, with the volume of inbound travelers matching pre-pandemic levels again. In that sense, Turkey ranked fifth among other European countries in terms of international tourist arrival growth in 2023. Welcoming over 57 million inbound visitors in 2023 , the country’s key sector shows positive signs of recovery.

The hotel market trends

In line with the developments in the tourism sector, and the increasing number of visitors, the hotel industry in Turkey has been an attractive investment opportunity. Some of the largest hotel chains such as Hilton, Marriott, and Radisson have opened their branches in many provinces of the country. Meanwhile, in 2023, 5-star hotels had the highest occupancy rate in Turkey . In the same year, 51 percent of international and local visitors arriving to tourist accommodation preferred to stay in hotels , which indicates that the hotel market is a strong pillar of the Turkish tourism sector

Annual tourism income in Turkey from 2001 to 2023 (in billion U.S. dollars)

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

2001 to 2023

tourism income from international tourists and Turkish citizens resident abroad

*Annual data for 2020 does not include the second quarter due to the coronavirus (COVID-19) pandemic. Figures prior to 2020 were previously published by the source.

Other statistics on the topic Travel and tourism in Turkey

- Leading European city tourism destinations 2019-2022, by number of bed nights

- Number of international tourist arrivals in Turkey 2000-2023

Travel, Tourism & Hospitality

- Travel and tourism's total contribution to GDP in Turkey 2019-2023

- Number of foreign tourist arrivals to Istanbul 2014-2023

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Travel and tourism in Turkey "

- Share of the GDP of the tourism sector in Turkey 2013-2028

- Distribution of travel and tourism expenditure in Turkey 2019-2022, by type

- Distribution of travel and tourism expenditure in Turkey 2019-2022, by tourist type

- Tourism income in Turkey 2019-2022, by type of expenditure

- Travel and tourism's total contribution to employment in Turkey 2019-2023

- Number of employees in tourism industries in Turkey 2015-2021, by service

- Inbound visitor arrivals in Turkey 2008-2023

- Inbound day visitor arrivals in Turkey 2008-2022

- Number of foreign tourist arrivals in Turkey monthly 2020-2023

- Number of international visitors in Turkey 2022, by purpose of visit

- Leading inbound travel markets in Turkey 2019-2023

- Inbound tourist expenditure in Turkey Q1 2017-Q4 2021

- Average tourist expenditure per capita of inbound visitors in Turkey 2003-2023

- Number of domestic trips in Turkey 2009-2023

- Domestic overnight stays in Turkey 2009-2023

- Average number of domestic overnight stays in Turkey 2023, by age group

- Domestic tourism spending in Turkey 2019-2023, by type

- Domestic tourism expenditure on leisure and vacation trips in Turkey 2009-2022

- Number of residents traveling abroad from Turkey 2006-2023

- Leading outbound destinations visited by residents of Turkey 2019-2023

- Overnight stays of Turkish citizens traveling abroad 2019-2023, by accommodation type

- Outbound tourism expenditure from Turkey 2003-2023

- Outbound tourist expenditure from Turkey Q1 2017-Q1 2024

- Average tourist expenditure per capita of outbound travelers from Turkey 2003-2023

- Number of arrivals to tourist accommodations in Turkey 2013-2022

- Number of arrivals to tourist accommodations in Turkey 2023, by type of establishment

- Inbound overnight hotel stays in Turkey 2014-2022

- Number of hotel rooms in Turkey 2010-2021

- Number of hotel bed-places in Turkey 2010-2021

- Occupancy rate of star-rated hotels in Turkey 2023, by rating

- Most affordable cities for backpacking in Europe 2024

- Most competitive European cities for business events 2021

- Most visited destinations by international tourists in Turkey 2019-2023

- Number of foreign tourist arrivals to Istanbul 2020-2023

- Overnight accommodation costs in Istanbul 2019-2023, by month

- Most visited museums in Istanbul 2022

- Attitudes towards traveling in Turkey 2023

- Travel frequency for private purposes in Turkey 2023

- Travel frequency for business purposes in Turkey 2023

- Travel product bookings in Turkey 2023

Other statistics that may interest you Travel and tourism in Turkey

- Basic Statistic Travel and tourism's total contribution to GDP in Turkey 2019-2023

- Premium Statistic Share of the GDP of the tourism sector in Turkey 2013-2028

- Basic Statistic Distribution of travel and tourism expenditure in Turkey 2019-2022, by type

- Basic Statistic Distribution of travel and tourism expenditure in Turkey 2019-2022, by tourist type

- Premium Statistic Total tourism income in Turkey 2001-2023

- Premium Statistic Tourism income in Turkey 2019-2022, by type of expenditure

- Basic Statistic Travel and tourism's total contribution to employment in Turkey 2019-2023

- Premium Statistic Number of employees in tourism industries in Turkey 2015-2021, by service

Inbound tourism

- Premium Statistic Inbound visitor arrivals in Turkey 2008-2023

- Premium Statistic Number of international tourist arrivals in Turkey 2000-2023

- Premium Statistic Inbound day visitor arrivals in Turkey 2008-2022

- Premium Statistic Number of foreign tourist arrivals in Turkey monthly 2020-2023

- Premium Statistic Number of international visitors in Turkey 2022, by purpose of visit

- Premium Statistic Leading inbound travel markets in Turkey 2019-2023

- Premium Statistic Inbound tourist expenditure in Turkey Q1 2017-Q4 2021

- Premium Statistic Average tourist expenditure per capita of inbound visitors in Turkey 2003-2023

Domestic tourism

- Premium Statistic Number of domestic trips in Turkey 2009-2023

- Premium Statistic Domestic overnight stays in Turkey 2009-2023

- Premium Statistic Average number of domestic overnight stays in Turkey 2023, by age group

- Premium Statistic Domestic tourism spending in Turkey 2019-2023, by type

- Premium Statistic Domestic tourism expenditure on leisure and vacation trips in Turkey 2009-2022

Outbound tourism

- Premium Statistic Number of residents traveling abroad from Turkey 2006-2023

- Premium Statistic Leading outbound destinations visited by residents of Turkey 2019-2023

- Premium Statistic Overnight stays of Turkish citizens traveling abroad 2019-2023, by accommodation type

- Premium Statistic Outbound tourism expenditure from Turkey 2003-2023

- Premium Statistic Outbound tourist expenditure from Turkey Q1 2017-Q1 2024

- Premium Statistic Average tourist expenditure per capita of outbound travelers from Turkey 2003-2023

Accommodation

- Premium Statistic Number of arrivals to tourist accommodations in Turkey 2013-2022

- Premium Statistic Number of arrivals to tourist accommodations in Turkey 2023, by type of establishment

- Premium Statistic Inbound overnight hotel stays in Turkey 2014-2022

- Premium Statistic Number of hotel rooms in Turkey 2010-2021

- Premium Statistic Number of hotel bed-places in Turkey 2010-2021

- Premium Statistic Occupancy rate of star-rated hotels in Turkey 2023, by rating

Tourism in Istanbul

- Basic Statistic Leading European city tourism destinations 2019-2022, by number of bed nights

- Basic Statistic Most affordable cities for backpacking in Europe 2024