- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore blockchain, client service, process payments, manage funds, safeguard information, banking-as-a-service, send payments.

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve

INDUSTRIES WE SERVE

Explore a variety of insights.

Global Research

- Newsletters

Insights by Topic

Explore a variety of insights organized by different topics.

Insights by Type

Explore a variety of insights organized by different types of content and media.

- All Insights

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Is the outlook for the cruise industry plain sailing?

Key takeaways

- While Baby Boomers once formed the core consumer base for the cruise industry, an increasing number of younger travelers and first-time passengers are now coming on board.

Cruise operators are investing in new hardware, including mega-ships and private destinations, to acquire new customers.

- Against a tighter consumer spending backdrop, cruise voyages — which often work out cheaper than land-based vacations — are growing in popularity.

Looking ahead, J.P. Morgan Research estimates the cruise industry will capture ~3.8% of the $1.9T global vacation market by 2028.

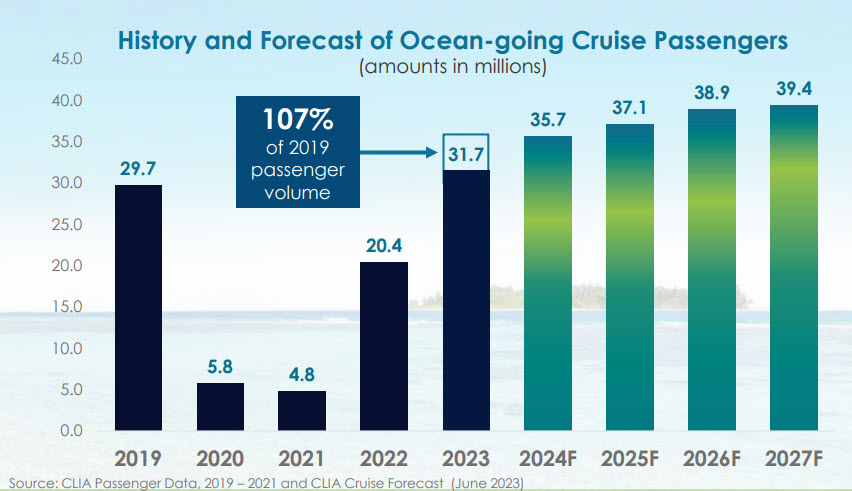

The cruise industry has markedly picked up speed after taking a major hit during the COVID-19 pandemic. According to the Cruise Lines International Association (CLIA), about 35.7 million passengers are expected to set sail in 2024, 6% more than in 2019. Indeed, major cruise lines have enjoyed a successful 2024 wave season — the period from January to March, when operators offer their best deals.

“An important point underscoring our more constructive view of the cruise industry post-pandemic is market share gains from the larger $1.9T global vacation market and accelerated new-to-cruise customer acquisition,” said Matt Boss, Head of Leisure and Retailing (Department Stores & Specialty Softlines) at J.P. Morgan. “Demand remains robust, with not a single historical lead indicator in the business, notably booking curve and on-board spend, signaling any softening.”

Ahead of the summer travel season, what is the outlook for the cruise industry, and what’s driving its rebound?

The cruise industry is picking up speed, with about 35.7 million passengers expected to set sail in 2024. (Source: Cruise Lines International Association)

While Baby Boomers once formed the industry's core consumer base, an increasing number of young travelers and first-time passengers are coming on board.

The number of cruise passengers is growing

The annual number of cruise passengers from 2023 to 2027 is expected to exceed pre-COVID levels.

Positive demographic shifts

In the past, Baby Boomers formed the core consumer base for the cruise industry. Today however, an increasing number of younger travelers are coming on board. According to the CLIA, 73% of Millennials and Gen X travelers say they would consider a cruise vacation. And during its first-quarter earnings call, Royal Caribbean International noted that half of its cruise customers are Millennials or younger.

This is in part due to rising affluence. “Importantly, the spending capacity of the Millennial customer has grown ~49% since 2019, with the average net worth today for an individual aged 40 or under now standing at ~$259K,” Boss observed.

Cruises are also attracting more first-time passengers. During its first-quarter earnings call, Carnival Cruise Line noted there was a healthy mix of “new-to-cruise” in its 2025 bookings to date, with the customer group increasing by over 30% versus a year ago.

Elevated product and destination offerings

Cruise operators are overhauling their offerings in order to appeal to consumers. “Key operators are investing in new hardware, notably mega-ships and private destinations. This is driving more eyeballs to the industry, accelerating new-to-cruise acquisition,” Boss said.

In April 2024, Norwegian Cruise Line placed the largest ship order in its history to meet rising demand for cruise travel. The company will receive eight new vessels between 2026 and 2036.

Investments in land-based offerings are burgeoning, too. For instance, Royal Caribbean’s private island in the Bahamas, Perfect Day at CocoCay, is expected to draw over 3 million visitors in 2024. In the same vein, Carnival Cruise Line is developing a private beach destination, Celebration Key, on Grand Bahama. Opening in 2025, it will feature five areas, each with its own distinct amenities. “Investments in such attractions provide the cruise industry with the improved ability to give customers an experience that is better able to compete with land-based alternatives,” Boss added.

“Key operators are investing in new hardware, notably mega-ships and private destinations. This is driving more eyeballs to the industry, accelerating new-to-cruise acquisition.”

Head of Leisure and Retailing (Department Stores & Specialty Softlines), J.P. Morgan

Consumers favor cruises over land-based activities

According to J.P. Morgan Research’s recent Cost of Living survey conducted in April, only 29% of respondents still have excess savings, and 45% expect to spend less in discretionary categories over the next 12 months. This illustrates an increasingly cautious spending environment even in the face of moderating inflation.

This puts cruise voyages, which often work out cheaper than land-based vacations, in good stead. “We see the consumer increasingly focused on value within discretionary categories, with the value spread between cruises and land-based alternatives standing at 25–30% today versus 10–15% pre-pandemic,” Boss noted. “Cruise lines have focused on improved experiences with no step down in quality or service despite inflation, further amplifying their value.”

Despite the tighter consumer spending environment however, both ticket and onboard prices have increased in recent months. Royal Caribbean International cited that in addition to record ticket pricing, consumer spending onboard and pre-cruise purchases continue to exceed prior years. In the same vein, Carnival Cruise Line’s onboard revenue in the first quarter of 2024 was +17.6% versus the first quarter of 2019.

Overall, the demand backdrop remains robust for the cruise industry. “We estimate that 85%+ of tickets have been booked for 2024, and the focus is turning to 2025, with bookings to date already ahead of historical levels,” Boss said. “Looking ahead, we see the industry growing revenues by high-single digits over the next five years, capturing ~3.8% of the global vacation market by 2028.”

Related insights

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

Will rising cocoa prices trigger a chocolate crisis?

April 03, 2024

Are sweet treats about to get more expensive? Discover why cocoa prices are rising and what chocolate brands are doing to adapt.

Will the US labor market boom continue?

April 18, 2024

The U.S. labor market has remained surprisingly resilient. What’s behind the tight labor market and will it begin to tail off?

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Copyright 2024 JPMorgan Chase & Co. All rights reserved.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

Related Travel Research

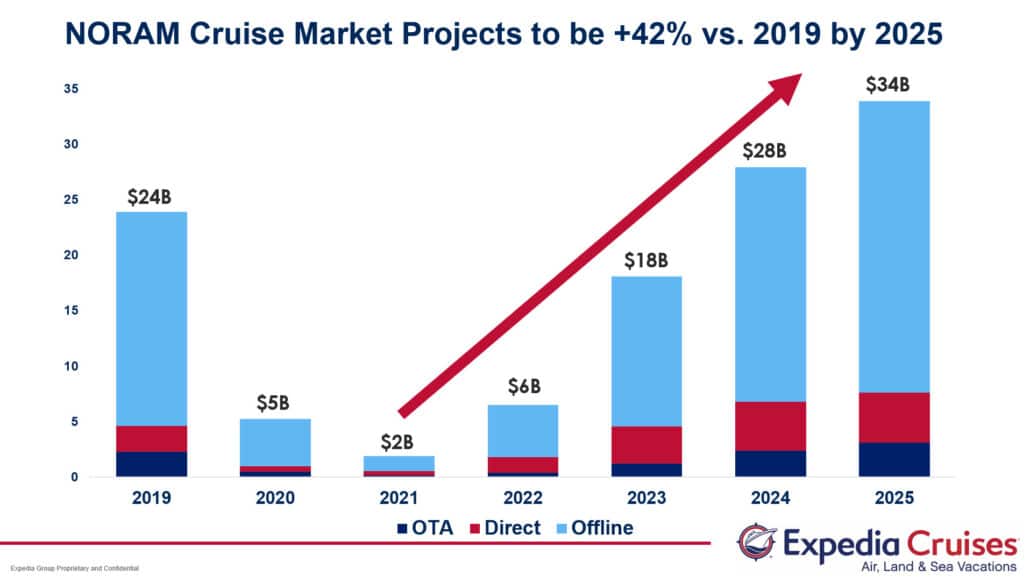

U.s. cruise market report 2020-2024.

Free for Open Access Subscribers

Prior to the pandemic, the cruise industry was arguably the fastest-growing travel segment, until it was stopped dead in its tracks in March 2020. Gross bookings crashed nearly 80% year over year, with all sailings occurring in the first quarter. For 2021, the recovery requires multiple elements working together to get ships back in the water. This report provides an overview of the U.S. cruise segment, including market sizing and projections through 2024, analysis, key trends, distribution dynamics and more.

For more on the U.S. travel marketplace, check out the following:

- U.S. Travel Market Report 2020-2024

- U.S. Airline Market Report 2020-2024

- U.S. Hotel & Lodging Market Report 2020-2024

- U.S. Online Travel Agency Market Report 2020-2024

- U.S. Car Rental Market Report 2020-2024

- U.S. Packaged Travel Market Report 2020-2024

- U.S. Travel Market Data Sheet 2020-2024 (subscriber only)

What is Open Access

An Open Access subscription provides company-wide access to the whole library of Phocuswright’s travel research and data visualization.

Curious? Contact our team to learn more:

What is open access+.

With Open Access+, your company gets access to Phocuswright's full travel research library and data visualization PLUS Special Project deliverables.

Provide your information and we'll contact you:

Curious contact our team to learn more:.

Advertisement

Supported by

The Cruise Industry Stages a Comeback

After watching thousands of passengers get ill and more than a year of devastating financial losses, the global cruise industry is coming back to life. And it says it knows how to deal with the coronavirus.

- Share full article

By Ceylan Yeginsu and Niraj Chokshi

Nothing quite demonstrated the horrors of the coronavirus contagion in the early stages of the pandemic like the major outbreaks onboard cruise ships , when vacation selfies and videos abruptly turned into grim journals of endless days spent confined to cabins as the virus raged through the behemoth vessels, eventually infecting thousands of people, and killing more than 100.

Passengers on the Diamond Princess and Grand Princess, two of the worst-hit ships, were forced to quarantine inside their small staterooms — some without windows — as infections on board spiraled out of control. Every day anxiety and fear mounted as the captains of the ships announced new cases, which continued to spread rapidly through ventilation systems and among crew members, who slept in shared quarters and worked tirelessly throughout the day to deliver food to guests.

At the time, it was difficult to imagine how the ships, which carry millions of passengers around the world each year, would be able to sail safely again. Even after the vaccination rollout gained momentum in the United States in April, allowing most travel sectors to restart operations, cruise ships remained docked in ports, costing the industry billions of dollars in losses each month.

Together, Carnival , the world’s largest cruise company, and the two other biggest cruise operators, Royal Caribbean and Norwegian Cruise Line , lost nearly $900 million each month during the pandemic, according to Moody’s, the credit rating agency. The industry carried 80 percent fewer passengers last year compared to 2019, according to the Cruise Lines International Association, a trade group. Third-quarter revenues for Carnival showed a year-to-year decline of 99.5 percent — to $31 million in 2020, down from $6.5 billion in 2019.

And yet in June, Richard D. Fain, chairman and chief executive of Royal Caribbean Cruises, was beaming with excitement as he sat sipping his morning coffee onboard Celebrity Edge, which became the first major cruise ship to restart U.S. operations, with a sailing out of Fort Lauderdale, Fla. “At the beginning we didn’t have testing capabilities, treatments, vaccines or a real understanding of how the virus spread, so we were forced to shut down because we didn’t know how to prevent it,” he said.

Several epidemiologists questioned whether cruise ships, with their high capacities, close quarters and forced physical proximity, could restart during the pandemic, or whether they would be able to win back the trust of travelers traumatized from the initial outbreaks.

Now, said Mr. Fain, the opposite has proved true. “The ship environment is no longer a disadvantage, it’s an advantage because unlike anywhere else, we are able to control our environment, which eliminates the risks of a big outbreak.”

Cruise companies restarted operations in Europe and Asia late last year, and, after months of preparations to meet stringent health and safety guidelines set by the Centers for Disease Control and Prevention, cruise lines have started to welcome back passengers for U.S. sailings, where demand is outweighing supply, with many itineraries fully booked throughout the summer.

Carnival said bookings for upcoming cruises soared by 45 percent during March, April and May as compared to the three previous months, while Royal Caribbean recently announced that all sailings from Florida in July and August are fully booked.

Several coronavirus cases have been identified on cruise ships since U.S. operations restarted in June, including six passengers who tested positive on Royal Caribbean’s Adventure of the Seas recently, testing the cruise lines’ new Covid-19 protocols, which include isolating, contact tracing and testing passengers to prevent the virus from spreading. Most ships were able to complete their itineraries without issues, but American Cruise Lines, a small ship company, cut short an Alaska sailing earlier this month after three people tested positive for the virus.

The industry’s turnaround is far from guaranteed. The highly contagious Delta variant, which is causing surges of the virus around the world, could stymie the industry’s recovery, especially if large outbreaks occur on board. But analysts are generally optimistic about its prospects and the potential for passenger numbers to recover to prepandemic levels, perhaps as soon as next year. That optimism is fueled by what may be the industry’s best asset: an unshakably loyal customer base.

Even during the pandemic, huge numbers of people who had booked opted against taking refunds , instead converting payments already made into credit for future travel, which the companies often offered at a higher value as an incentive. Last fall, Carnival reported that about 45 percent of customers with canceled trips had opted for credit instead of cash back. About half of customers in a similar position with Royal Caribbean Cruises did the same by the end of last year, the company said at the time.

“The demand is there,” said Jaime Katz, an analyst with Morningstar. “You know that there have been 15 months of people who have had cruises booked that have been canceled.”

No U.S. bailout for the cruise companies

By April 2020, the industry was in crisis. Cruises were halted around the world after the alarming outbreaks on ships, leading to sailing bans from the C.D.C. and other global authorities.

While they employ many Americans, the major cruise companies are all incorporated abroad and were ultimately left out of the $2 trillion federal stimulus known as the CARES Act, with lawmakers chafing at the prospect of bailing out foreign corporations largely exempt from income taxes. Environmentalists lobbied against the aid, citing the industry’s poor track record on climate issues. And criticism over how the companies handled early virus outbreaks on board ships sapped any remaining political will to help. Huge losses mounted as questions swirled about whether cruise lines could avoid bankruptcy.

“All our conversations here were, ‘At this cash burn rate for each of these companies, how long can they survive?’” said Pete Trombetta, an analyst focused on lodging and cruises at Moody’s.

Cruise lines were forced to send most cruise workers home, keeping small skeleton crews on board to maintain their ships. After months without work or an income, many of the workers, who are frequently drawn from countries like the Philippines, Bangladesh and India, fell into debt and struggled to provide for their families.

The timing couldn’t have been worse for Virgin Voyages , the new cruise company founded by the British billionaire Richard Branson, which had planned to launch its inaugural ship, Scarlet Lady, with a sailing from Miami in March 2020. The ship’s official U.S. debut has been delayed until October, but a series of short sailings will take place in August out of Portsmouth, England, for British residents.

“It’s been a very difficult 15 months and we had to make some very tough cuts along the way like the rest of the industry,” said Tom McAlpin, president and chief officer of Virgin Voyages.

In the end, most cruise companies made it through the pandemic intact, but only after receiving help. That came in the form of assistance from governments abroad or money raised from investors emboldened by efforts to backstop the economy from the Federal Reserve and others. The cash wasn’t cheap, though. When Carnival Corp. sold $4 billion in bonds in April 2020, it agreed to interest on those bonds of 11.5 percent — more than half of which it recently refinanced at a more reasonable rate of 4 percent.

Carnival, which operates under nine brands globally, has lost more than $13 billion since the pandemic began and said in a securities filing last month that it expects those losses to continue at least through August. The company amassed more than $9 billion in cash and short-term investments as of the end of May — enough, it said last month, to pay its obligations for at least another year. It says it expects to have at least 42 ships carrying passengers by the end of November, representing just over half of its global fleet.

The industry faces a long road back to normal. Moodys downgraded ratings for each of the big three cruise companies during the pandemic and says it will probably take until 2023 for the major cruise operators to start substantially reducing their debt, which had nearly doubled during the pandemic.

The companies have also been caught up in a series of legal battles in Florida, the biggest base of operations in the United States, that has them sometimes allied with the administration of Gov. Ron DeSantis, and sometimes opposing it.

In June, Florida sued the C.D.C., saying the agency’s guidelines for how cruising could restart were burdensome and harmed the multi-billion-dollar industry that provides about 159,000 jobs for the state. The C.D.C. guidelines require 98 percent of crew and 95 percent of passengers to be fully vaccinated before a cruise ship can set sail, otherwise the cruise company must carry out test voyages and wait for approval.

So far, the state has prevailed in the courts, with a ruling from a federal judge that prevented the C.D.C.’s vaccine requirements from going into effect after July 18. A federal appeals court upheld that ruling on July 23.

Despite the court’s decision, Cruise Lines International Association, the trade group, said cruise companies will continue to operate in accordance with the C.D.C. requirements. The cruise lines found the C.D.C.’s initial guidance too onerous, but once the agency made revisions to factor in the U.S. immunization program, the companies agreed to comply and said they preferred passengers to be vaccinated, because it simplifies the onboard experience.

As that suit was making its way through the courts, Norwegian filed suit on July 13 against the state of Florida, saying that a law banning business from requiring proof of immunization from people seeking to use their services prevented the company from “safely and soundly resuming passenger cruise operations.”

There has yet to be a ruling in the case.

Hurdles remain

Several other hurdles could also derail the rebound of the industry. While cruising has resumed, operators still have to contend with a patchwork of domestic and international rules, some of which impose strict conditions on passengers who go on shore excursions. A serious and widespread outbreak aboard a ship, or a broader communitywide surge in virus infections, could drive away potential customers and stall the momentum of the cruise comeback.

But despite the delays and potential for further disruptions, Virgin Voyages is hopeful for a successful launch of its new brand. Virgin’s Scarlet Lady adult-only ship, which was inspired by a superyacht design, aims to attract a hip and younger crowd, offering 20 different buffet-free dining options and a range of entertainment, including D.J. sets and immersive experiences.

“We have a fantastic set of investors behind us, and I think we are well positioned to make a big comeback because people are ready to travel and cruise again and we are launching a very attractive new onboard product right in the middle of it all,” Mr. McAlpin said.

Two new cruise ships, Carnival’s Mardi Gras and Royal Caribbean’s Odyssey of the Seas are set to launch in the U.S. this week.

And cruise workers, many of whom burned through savings and went into debt during their enforced layoff, are thrilled to be back. “I can’t believe the day has come when I have been called back to work,” said Alvin Villorente, a wine steward for Norwegian Cruise Line, who spent the last year at home in the Philippines, carrying out odd jobs to pay his bills.

“It felt too good to be true,” he continued. “I made my wife read the email to make sure I understood correctly and when I saw her smile everything suddenly went from black to bright colors. I could look after my family again.”

At a time when airports are busy and chaotic and hotels and holiday rentals are expensive and booked up, cruise companies hope to appeal to people who wouldn’t normally consider a cruise vacation.

“I’m still on the fence about booking any travel because of the constantly changing rules around the world, but an adult-only cruise with some friends could be fun, especially if it meant not having to fly anywhere,” said Crystal Marks, a 37-year-old personal trainer from Miami who went on a cruise once as a child and has been looking at Virgin sailings for early next year after a friend sent her a promotional video.

“Yoga classes at sunrise, fitness throughout the day, city-style restaurants, spa treatments, it sounds pretty perfect to me,” she added with a laugh. “If everyone on board is vaccinated and tested regularly it’s probably one of the safer options for international travel.”

Follow New York Times Travel on Instagram , Twitter and Facebook . And sign up for our weekly Travel Dispatch newsletter to receive expert tips on traveling smarter and inspiration for your next vacation. Dreaming up a future getaway or just armchair traveling? Check out our 52 Places list for 2021 .

Ceylan Yeginsu is a London-based reporter. She joined The Times in 2013, and was previously a correspondent in Turkey covering politics, the migrant crisis, the Kurdish conflict, and the rise of Islamic State extremism in Syria and the region. More about Ceylan Yeginsu

Niraj Chokshi covers the business of transportation, with a focus on autonomous vehicles, airlines and logistics. More about Niraj Chokshi

- Travel, Tourism & Hospitality ›

Leisure Travel

- Revenue of the cruises industry in the U.S. 2020-2029

Revenue of the cruises market in the United States from 2020 to 2029 (in billion U.S. dollars)

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Definition:

Additional Information:

The main performance indicators of the Cruises market are revenues, average revenue per user (ARPU), users and user penetration rates. Additionally, online and offline sales channel shares display the distribution of online and offline bookings. The ARPU refers to the average revenue one user generates per year while the revenue represents the total booking volume. Revenues are generated through both online and offline sales channels and include exclusively B2C revenues. Users represent the aggregated number of guests. Each user is only counted once per year.

The booking volume includes all booked travels made by users from the selected region, independent of the departure and arrival. The scope includes domestic and outbound travel.

For further information on the data displayed, refer to the info button right next to each box.

Other statistics on the topic Cruise industry in the United States

- Number of global ocean cruise passengers 2009-2027

- Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Revenue of Carnival Corporation & plc worldwide 2008-2023

- Number of global ocean cruise passengers 2019-2023, by source market

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

Statistics on " Cruise industry in the United States "

- Main global cruise destinations 2019-2023, by number of passengers

- Revenue growth of cruises in the U.S. 2020-2029

- Direct spending in the cruise industry in the U.S. 2021-2022, by type

- Businesses in the cruise line operator industry in the U.S. 2022-2024

- Employment in the cruise line operator industry in the U.S. 2023-2024

- Number of cruise passengers from North America 2016-2023

- Number of cruise passengers from the U.S. 2016-2023

- Growth rate of the cruise passenger volume from the U.S. 2017-2023

- Cruise passenger movements at leading ports worldwide 2019-2023

- Interest in taking a cruise vacation in the U.S. 2024

- Net income of Carnival Corporation & plc 2008-2023

- Net income of Royal Caribbean Cruises worldwide 2007-2023

- Revenue of Norwegian Cruise Line worldwide 2011-2023

- Net income of Norwegian Cruise Line worldwide 2011-2023

- Tour revenue of Lindblad Expeditions Holdings worldwide 2014-2023

- Net income of Lindblad Expeditions Holdings worldwide 2014-2023

- Key factors that would enhance the appeal of cruises in the U.S. 2024

- Ideal length of time to spend on a cruise vacation in the U.S. 2024

- Main cruise lines chosen by cruise travelers in the U.S. 2024

- Best-rated mega-ship cruise lines by travelers worldwide 2024

- Best-rated large-ship cruise lines by travelers worldwide 2024

- Best-rated midsize-ship cruise lines by travelers worldwide 2024

- Best-rated small-ship cruise lines by travelers worldwide 2024

- Best-rated river cruise lines by travelers worldwide 2024

Other statistics that may interest you Cruise industry in the United States

- Premium Statistic Number of global ocean cruise passengers 2009-2027

- Premium Statistic Number of global ocean cruise passengers 2019-2023, by source market

- Premium Statistic Main global cruise destinations 2019-2023, by number of passengers

- Premium Statistic Revenue of the cruises industry in the U.S. 2020-2029

- Premium Statistic Revenue growth of cruises in the U.S. 2020-2029

- Premium Statistic Direct spending in the cruise industry in the U.S. 2021-2022, by type

- Premium Statistic Businesses in the cruise line operator industry in the U.S. 2022-2024

- Premium Statistic Employment in the cruise line operator industry in the U.S. 2023-2024

Cruise passengers

- Premium Statistic Number of cruise passengers from North America 2016-2023

- Premium Statistic Number of cruise passengers from the U.S. 2016-2023

- Premium Statistic Growth rate of the cruise passenger volume from the U.S. 2017-2023

- Premium Statistic Cruise passenger movements at leading ports worldwide 2019-2023

- Premium Statistic Interest in taking a cruise vacation in the U.S. 2024

Cruise companies

- Premium Statistic Revenue of Carnival Corporation & plc worldwide 2008-2023

- Premium Statistic Net income of Carnival Corporation & plc 2008-2023

- Premium Statistic Revenue of Royal Caribbean Cruises worldwide 1988-2023

- Premium Statistic Net income of Royal Caribbean Cruises worldwide 2007-2023

- Premium Statistic Revenue of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic Net income of Norwegian Cruise Line worldwide 2011-2023

- Premium Statistic Tour revenue of Lindblad Expeditions Holdings worldwide 2014-2023

- Premium Statistic Net income of Lindblad Expeditions Holdings worldwide 2014-2023

Consumer opinions

- Premium Statistic Key factors that would enhance the appeal of cruises in the U.S. 2024

- Premium Statistic Ideal length of time to spend on a cruise vacation in the U.S. 2024

- Premium Statistic Main cruise lines chosen by cruise travelers in the U.S. 2024

- Basic Statistic Best-rated mega-ship cruise lines by travelers worldwide 2024

- Basic Statistic Best-rated large-ship cruise lines by travelers worldwide 2024

- Basic Statistic Best-rated midsize-ship cruise lines by travelers worldwide 2024

- Basic Statistic Best-rated small-ship cruise lines by travelers worldwide 2024

- Basic Statistic Best-rated river cruise lines by travelers worldwide 2024

Further related statistics

- Basic Statistic Distribution of global cruise embarkations in 2013, by port/region

- Basic Statistic Direct expenditures of the U.S. cruise industry 2011-2019

- Basic Statistic Spending of the North American cruise industry in the U.S. from 2006 to 2013

- Premium Statistic Lower berth capacity of the North American cruise industry from 1995 to 2017

- Basic Statistic Distribution of U.S. cruise embarkations in 2014, by port/region

- Premium Statistic North America: cruise class most commonly used as of August 2017

- Premium Statistic Average cruise passenger spend in Canada in 2016, by region

- Premium Statistic Total number of jobs created by the cruise industry in Canada in 2016, by job sector

- Premium Statistic Age distribution of cruise passengers in Canada 2016

- Premium Statistic Number of Canadian residents purchasing cruise trips, by province 2016

- Premium Statistic Cruise passenger expenditures in Canada, by destination 2016

- Premium Statistic Number of guests of the global cruise industry 2007-2016, by source region

- Premium Statistic Cruise passenger arrivals in Canada 2003-2016

- Premium Statistic Cruise passenger arrivals in Canada in 2016, by region

- Premium Statistic Direct cruise-related expenditures in Canada in 2016, by source

- Premium Statistic Industry revenue of “Manufacturing“ in Mexico 2012-2024

- Premium Statistic Mexico: petrochemicals export value 2014-2018

- Premium Statistic U.S. consumers' degree of quality association with "limited edition" 2015

- Premium Statistic Number of furniture manufacturing employees in the U.S. 2000 and 2011

Further Content: You might find this interesting as well

- Distribution of global cruise embarkations in 2013, by port/region

- Direct expenditures of the U.S. cruise industry 2011-2019

- Spending of the North American cruise industry in the U.S. from 2006 to 2013

- Lower berth capacity of the North American cruise industry from 1995 to 2017

- Distribution of U.S. cruise embarkations in 2014, by port/region

- North America: cruise class most commonly used as of August 2017

- Average cruise passenger spend in Canada in 2016, by region

- Total number of jobs created by the cruise industry in Canada in 2016, by job sector

- Age distribution of cruise passengers in Canada 2016

- Number of Canadian residents purchasing cruise trips, by province 2016

- Cruise passenger expenditures in Canada, by destination 2016

- Number of guests of the global cruise industry 2007-2016, by source region

- Cruise passenger arrivals in Canada 2003-2016

- Cruise passenger arrivals in Canada in 2016, by region

- Direct cruise-related expenditures in Canada in 2016, by source

- Industry revenue of “Manufacturing“ in Mexico 2012-2024

- Mexico: petrochemicals export value 2014-2018

- U.S. consumers' degree of quality association with "limited edition" 2015

- Number of furniture manufacturing employees in the U.S. 2000 and 2011

The Global Cruise Industry in Numbers: 2021 Annual Report Out Now

- February 17, 2021

The 2021 Cruise Industry News Annual Report is now available, projecting the growth and ship deployment of every cruise brand and cruise company.

The 34th edition of the 400-page Cruise Industry News Annual Report projects the industry’s growth through 2027 based on new ship orders (there are no orders past 2027) and known or expected ship deployments. The report is available in print and via digital access.

Preview Pages of the Report | Table of Contents | Order Now

The projections track every company, every brand and every ship year-by-year and region by region for every market segment, from contemporary to luxury, expedition and niche products in North America, Europe, Asia-Pacific and elsewhere.

The top 20 sailing regions are also analyzed, comparing year-over-year capacity for 2021 and going as far back as 1990 from the Caribbean to Antarctica.

Furthermore, the major brands’ deployments are broken down: where the ships are deployed, passenger capacity and the changes over a four- and five-year window,

The 2021 Cruise Industry News Annual Report is based on Cruise Industry News ’ independent research and shows the direction the industry is most likely to sail in the coming years, who the dominant players will be overall and in the different markets and market segments, and also the roles startups and niche players are expected to play.

This is the global cruise industry in a nutshell in the foreseeable future and the present.

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

67 Ships | 172,156 Berths | $57.1 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Instant Access

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

2024 Cruise Industry Update

Last updated on July 3rd, 2024

Cruise Industry Present Day & Forecast

Cruise tourism is booming once again and is rebounding faster than other forms of travel and tourism! With 31.5 million passengers having sailed in 2023 and 35.7 million expected to sail in 2024 ( CLIA ), there’s no denying that the future of cruising is bright. Cruise is a resilient industry, and it continues to be one of the fastest-growing sectors of tourism.

Cruise Industry Overview Quick Facts ( CLIA ):

- 31.5 million cruise passengers sailed in 2023

- 35.7 million cruises passengers expected to sail in 2024

- 56 new cruise ships on order between now and 2028

- 73% of cruise travelers say travel advisors have a meaningful impact on their decision to cruise

- 82% of travelers who have cruised before say they will cruise again

- 75% of the U.S. population is within driving distance of a cruise port

- 10% of cruise travelers take three to five cruises a year

- 27% of cruisers over the past two years are new-to-cruise (an increase of 12%)

- Passengers sailing on expedition itineraries has increased 71% from 2019-2023

- Millennials are the most enthusiastic about planning a cruise holiday

- North America remains the largest cruise market

- Caribbean remains the top destination for cruisers

- Average age of a cruiser is 46 years old

- Cruise industry is expected to reach $28B in revenue by the end of 2024

- Cruise industry supports over 1.2M jobs worldwide

Cruise Industry Investment

The cruise industry has invested over $50 billion dollars towards driving innovation and transformations over the next 4 years. In pursuit of a more responsible, efficient, inclusive, and enjoyable vacation experience, cruise lines are investing in LNG-powered ships, eco-friendly cruise travel, enhanced use of technology onboard, more onboard entertainment and activities, multi-generational experiences, and much more!

One of the main areas that cruise lines have, and will continue to, invest heavily in is their ships! A fleet of brand-new cruise ships will set sail, bringing with them a wave of excitement, relaxation, and unforgettable experiences. Cruisers will have the opportunity to immerse themselves in a world of advanced technology and unparalleled comfort, indulging in luxury as they soak up the local culture, or embark on thrilling adventures. To read more about the new ships of 2024, head over to our blog: The 7 Most-Anticipated Cruise Ships of 2023 .

Private Islands

The private islands of cruise lines have always been some of the top destinations for travelers sailing to the Caribbean or Panama Canal. These exclusive retreats have something for everyone, from eco-tours and water excursions to theme park thrills and beach side lounging. With the rise of popularity of these private islands, cruise lines have invested billions of dollars into enhancing and expanding their private islands; creating over-the-top experiences to all those who visit. Here are a few cruise lines and their private islands (plus, 5 new private islands and beach clubs opening in the next two years):

- Azamara Club Cruises – Labadee, Haiti

- Carnival Cruise Line – Amber Cover, Dominican Republic / Mahogany Bay, Isla Roatan / Puerta Maya, Cozumel / Princess Cays, Bahamas / Half Moon Cay, Bahamas / Grand Turk Cruise Center, Turks and Caicos / Celebration Key, Grand Bahama*

- Disney Cruise Line – Castaway Cay, Bahamas / Lookout Cay Lighthouse Point, Bahamas*

- Holland America Line – Half Moon Cay, Bahamas

- MSC Cruises – Ocean Cay, Bahamas

- Norwegian Cruise Line – Great Stirrup Cay, Bahamas / Harvest Caye, Belize

- Princess Cruises – Princess Cays, Bahamas

- Regent Seven Seas Cruises, Oceania Cruises – Harvest Caye / Great Stirrup Cay, Bahamas

- Royal Caribbean International – Perfect Day at CocoCay, Bahamas / Royal Beach Club, Nassau / Labadee, Haiti

- Virgin Voyages – The Beach Club at Bimini

* Coming Soon

New Ports/Port Enhancements

Is there a better sign of a booming cruise industry than cruise lines adding/enhancing their embarkation and disembarkation ports? Royal Caribbean Group is a great example of how cruise lines are investing in the future by partnering with large infrastructure companies to withstand the volume of cruise passengers expected in the next few years.

“Our partnership with iCON is a unique opportunity to catapult us into the coming decades of port investments, build further financial strength, and provide exceptional cruising experiences, responsibility, to our guests at the best destinations in the world” – Jason Liberty, President and CEO of Royal Caribbean Group ( cruisehive )

Several other cruise lines including, Carnival Corporation, Virgin Voyages, MSC Cruises, and Norwegian Cruise Line have invested, or are committed to invest, hundreds of millions of dollars in the coming years to enhance their port presence.

Industry Trends

Each year new trends emerge in the cruising industry that pave the way for the future of cruising. In 2019, we saw an increased demand for off the beaten path destinations, tech-driven features on ships, and an increase in working nomads – to name a few. 2023 trends included a focus on sustainable and responsible tourism, the use of tech onboard, and longer and more luxurious cruises for the seasoned travelers, and shorter cruises for first timers. Fast forward to 2024, cruising trends today include sustainable and responsible tourism, younger generations being the future of cruise, the rise of expedition cruising, multi-generational traveling, solo cruising, and accessible shore excursions.

Environmental Sustainability

With a goal of net carbon neutral cruising by 2050, cruise lines are pursing innovative solutions, and investing billions, into sustainable cruising. But what exactly does this mean? For starters, almost all cruise lines are opting to use LNG for all new ships being built in the future. Liquified Natural Gas (LNG) are natural gasses that are drawn from the earth’s core and then are super cooled to become liquified natural gas. This liquified state makes the gas odorless, colorless, non-toxic, and non-corrosive. The advantages of adopting LNG are impressive as it creates a cheaper, more efficient, and more environmentally friendly gas. LNG releases zero sulfur, has 99% less particulate emissions, 85% less nitrogen oxide emissions, and 25% less greenhouse gas emissions. Using LNG will also result in a longer lifespan with less wear and tear on the engine, low maintenance costs, and cleaner emissions. For existing ships, the cost of converting to LNG would be too substantial so cruise lines are looking to other methods for these ships, such as exhaust gas cleaning systems.

An exhaust gas cleaning system, also known as a scrubber, allows ships to continue using heavy fueled oil, while reducing their Sulphur oxide and particulate matter emissions. In short, this scrubber will literally scrub away harmful sulfur oxides from exhaust gases. Adopting ECGS will allows ships to reduce their sulfur oxide levels by 98%, reduce total particulate matter by 50%, and reduce nitrogen oxides by 12%.

Furthermore, more and more ships are being fitted with advanced wastewater treatment systems, to ensure the quality of treated wastewater and equipped with the ability to receive shoreside power connectivity which allows ships to turn off their engines and tap into cleaner energy available at ports, cutting emissions and harmful toxins.

For more details on what cruise lines are doing to lessen their impact on the environment, here are a few cruise line sustainability websites:

- https://carnivalsustainability.com/

- https://www.celebritycruises.com/ca/about-us/sustainability-efforts/environmental-Initiatives

- https://disneyparksnews.com/uploads/sites/4/2019/07/DCL_Env_Fact_July-2019.pdf

- https://www.msccruisesusa.com/en-us/About-Msc/MSC-Sustainability.aspx

- https://www.ncl.com/about/environmental-commitment

- http://sustainability.rclcorporate.com/

Responsible Tourism

Responsible, or sustainable tourism, is just as important as environmental sustainability, as these practices often go hand in hand. As economically advantageous as it to draw hundreds, if not thousands, of visitors to a destination, the disadvantages of overcrowding, and careless behaviors by tourists, are a detriment to the unique heritage, landscape, and way of life of the places visited. As the demand for cruising increases steadily with each passing year, cruise lines are aware of their responsibility to not only preserve the physical land they allow passengers to traverse, but also to respect, protect, and value the culture and environment of the places they visit.

Cruise lines are working with local communities to brainstorm creative ways to manage the flow of tourists they bring to shore, as well as implementing the highest standards of responsible tourism ( CLIA ). For example, Princess Cruises embodies a concept of “ socially conscious ” cruising.

“It’s about creating a small group that have immersive training onboard, and then when they go ashore, it’s about doing things that are good for the local communities,” Vice President of North American Sales for Carnival Corp. and Princess John Chernesky said.

Other examples include how CLIA Cruise Lines, in collaboration with the Mayor’s office and the City Council, developed new measures to alleviate tourism flow issues in Dubrovnik; in Santorini, the cruise industry worked with local authorities on a new ship arrival management system to spread the flow of tourists visiting the system; and in Alaska cruise lines have implemented more stringent waste water requirements than even the communities on land ( CLIA ). Royal Caribbean International also offers more than 3,500 shore excursions that are GSTC-certified. To be certified by the Global Sustainable Tourism Council (GSTC), a shore excursion must be a one-of-a-kind experience that respects local culture and its surroundings.

Catering to Younger Generations

Retirees, empty-nesters, and old couples – this is what most people considered to be the cruiser demographic in the past. But not anymore! The cruising world has drastically changed as younger generations are favoring experiences and adventures over material goods. And the numbers don’t lie – cruising demographic has changed over the last few years with the average age of a cruiser dropping down to 46! Gen-X and Millennials are the most enthusiastic about planning a cruise vacation with 84% of Gen-X and 81% of Millennials planning to cruise again ( CLIA ). As the preference for experiences becomes an increasing trend, cruise lines are adapting by creating innovative, cutting-edge, and entertaining ships, as well as itineraries that cater to a younger crowd. These include, but are not limited to, music festivals at sea, remote destination itineraries, tech-inspired ships, and endless activities onboard.

It’s important to note that with all this attention given to younger generations, cruise lines have NOT forgotten about the older generations; their bread and butter that brought cruising to the forefront of vacation planning. There are still plenty of cruise lines, ships, and itineraries that cater to a more refined taste and traditional way of cruising, with elegantly designed staterooms, traditional dining rooms, and culture-rich onboard and off-shore experiences.

Rise of Expedition Cruising

Who says you can’t have adventure AND luxury?! Small-ship expedition cruising is a hot trend that has slowly gained popularity over the past few years with the number of passengers sailing on expedition itineraries increasing 71% from 2019-2023 ( CLIA ). Although these cruises come with a higher price tag, more and more cruisers are flocking to these itineraries that offer once-in-a-lifetime experiences. From the Arctic to the Galapagos Islands, expedition cruising allows adventure enthusiasts the perfect opportunity for eco-discovery in exotic lands, along with luxurious accommodations. Seabourn, Viking, Silversea, Hurtigruten, and Scenic Luxury Cruises & Tours are just a few of the cruise lines offering expedition cruising.

Multi-Generational Traveling

Cruises have become a popular choice for multi-generational travelers – with 28% of travelers cruising with three to five generations in one group ( CLIA )! The rise in popularity of cruising is due to several factors including: variety and abundance of food choices for particular taste buds, entertainment and activities for all ages, optional private shore excursions, family-geared staterooms, and unpacking once while visiting multiple destinations!

Accessible Shore Excursions

With 45% of cruise travelers booking an accessible shore excursion in the past year ( CLIA ), accessibility is imperative to travel and something that cruise lines and tour companies are placing more of a focus on. Today, there are more than a 100 accessible shore excursions available in cruise ports and they all have the same objective in mind: to cultivate the best, and most comfortable, experiences possible for travelers with mobility disabilities.

Solo Cruising

Solo cabins, although much smaller than double-occupancy cabins, are the answer solo travelers have been waiting for. The ability to unpack once, have all your meals included, and explore multiple destinations, all without paying a single-supplement fee, has made cruising a much more affordable and exciting vacation option for those opting to travel alone. This is probably why 10-13% of cruise travelers from North America are traveling solo. Millennials and Gen Z are more likely to travel solo than any other generation ( CLIA ).

Here is a list of a few of the major cruise lines doing their part to assist solo travelers:

- Royal Caribbean International

- Norwegian Cruise Line

- Holland America Line

- Costa Cruises

- Cunard Line

- AmaWaterways.

If you’ve still got questions about why investing in a retail travel agency franchise is a great decision, we’d be happy to answer them! For more details about the Expedia Franchise opportunity fill out our request form or take a look at this six-step overview of our retail travel agency franchise opportunity here .

IMAGES