- HSBC in the USA

- Investor relations

- Moving Forward

- Management team

- Regulatory information

- Diversity and inclusion

- Community Reinvestment Act and HSBC Community Development

- Press releases

- Our stories

- Media contacts

- HSBC USA Inc.

HSBC Cookie Policy

HSBC uses cookies to give you the best possible experience on our websites. See our Cookie Policy .

- Main content

- Language selector

- Share on Facebook

- Share on LinkedIn

6 August 2024

HSBC announces new benefits for Premier and Elite credit cards to increase travel and lifestyle rewards

New card design includes 100% recycled plastic for the Premier card and added notch to help visually impaired cardholders orient for chip readers.

(NEW YORK) – HSBC today announced increased welcome bonus points and new and enhanced benefits for the HSBC Premier credit card , designed for everyday spending, and the HSBC Elite credit card , designed to enhance lifestyle and travel experiences.

The HSBC Premier credit card has an annual fee of $95 and is offering a welcome bonus of 50,000 points for eligible card members, worth over $1,200 in benefits in the first year and up to $600 every year thereafter. The HSBC Elite credit card has an annual fee of $495 and is offering a welcome bonus of 60,000 points worth over $2,900 in benefits in the first year and up to $2,000 every year thereafter.

New and updated credit card benefits include:

- 50,000 welcome bonus points

- 3X Points on gas and groceries

- $85 statement credit towards Global Entry, TSA PreCheck, TSA PreCheck by CLEAR, or NEXUS

- $60 annual TV subscription service credit

- 60,000 welcome bonus points

- 5X Points on travel

- Complimentary airport lounge access with Priority Pass for cardholder and up to 2 guests, worth over $469 annually

- $120 statement credit towards Global Entry, TSA PreCheck, TSA PreCheck by CLEAR, or NEXUS

- $120 annual rideshare credit

“The HSBC Premier and Elite credit cards deliver on our commitment to serve the banking needs of our globally connected clients who live and work across the U.S. and around the world,” said U.S. Head of Wealth and Personal Banking Racquel Oden. “These credit cards offer excellent value to our clients, rewarding them for their travel and everyday purchases and provides enhanced benefits for their lifestyle.”

“Whether you’re traveling around the world or simply shopping for everyday essentials, HSBC cardholders have the opportunity to earn incredible rewards for the activities they engage in as part of their daily lives”, said U.S. Head of Unsecured Lending Brian Ahearn.

New designs feature 100% recycled plastic for the HSBC Premier credit card and a distinctive metal design for the HSBC Elite credit card. Both cards have a specially designed notch at the bottom right to help cardholders with special needs supporting them to orient the card in chip readers.

Media enquiries to:

Matt Kozar Vice President, External Communications [email protected]

HSBC Holdings plc , the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 60 countries and territories. With assets of US$2,975bn at 30 June 2024, HSBC is one of the world’s largest banking and financial services organizations.

HSBC Bank USA , National Association (HSBC Bank USA, N.A.) serves customers through Wealth and Personal Banking, Commercial Banking, Private Banking, Global Banking, and Markets and Securities Services. Deposit products are offered by HSBC Bank USA, N.A., Member FDIC. It operates Wealth Centers in: California; Washington, D.C.; Florida; New Jersey; New York; Virginia; and Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC USA Inc., a wholly-owned subsidiary of HSBC North America Holdings Inc.

For more information, visit: HSBC in the USA

- Terms & Conditions

- HSBC Accessibility

You are about to e-mail us

Before sending us your information, please read our privacy policy .

You are leaving about.us.hsbc.com

Please be aware that the external site policies, or those of another HSBC group website, may differ from this website's terms and conditions and privacy policy. The next website will open in a new browser window or tab.

Note: HSBC is not responsible for any content on third party sites, nor does a link suggest endorsement of those sites and/or their content.

The best HSBC credit cards of 2020

Update : Some offers mentioned below are no longer available. View the current offers here .

HSBC is one of the world's largest banking and financial services institutions. Yet many U.S. consumers don't think of the company when shopping for a new rewards credit card . HSBC currently only offers six credit cards to U.S. consumers, so let's take a detailed look at these six cards and answer some common questions about them.

New to The Points Guy? Sign up for our TPG daily newsletter and check out our beginner's guide .

Best HSBC credit cards for 2020

- HSBC Gold Mastercard® credit card : Best for introductory APR

- HSBC Cash Rewards Mastercard® credit card : Best for cash-back rewards

- HSBC Cash Rewards Mastercard® credit card Student Account : Best for cash-back rewards for students

- HSBC Advance Mastercard® credit card : Best for dining and entertainment

- HSBC Premier World Mastercard® credit card : Best for travel

- HSBC Premier World Elite Mastercard® credit card : Best for premium travel rewards

To start our analysis, here is a comparison of the best HSBC credit cards currently accepting new applications.

Comparing the best HSBC credit cards

More details on the best hsbc credit cards.

Let's take a look at the details of each of these HSBC credit cards and offers, including rewards rates, benefits and annual fees.

HSBC Gold Mastercard credit card: Best for 0% introductory APR

Why this is the best for 0% introductory APR : This card offers 0% introductory APR on purchases and balance transfers for the first 18 months after account opening.

Introductory offer : 0% introductory APR on purchases and balance transfers for the first 18 months from account opening. Balance transfers must be posted within the first 60 days following account opening. Once the introductory period is over, a variable APR of 12.99%, 16.99% or 22.99% will apply. A balance transfer fee of either $10 or 4%, whichever is greater, applies on each balance transfer.

Rewards rate : None

Top benefits and perks :

- Check to see if you are prequalified , which only requires a soft credit check that has no impact on your credit score

- Late fee waiver, which means HSBC will waive the late fee once within a 12-month period

- No penalty APR, which means HSBC will not raise your APR if you pay late

- MasterRental coverage, which provides protection for physical damage and theft to most rental vehicles

- No foreign transaction fees

Annual fee : None

Is this card worth it? Whether you're looking to delay payment of a large purchase or you're working to pay off debt , the HSBC Gold Mastercard may be able to help with its 0% introductory APR on purchases and balance transfers for the first 18 months. However, some other cards offer lower balance transfer fees, so it may be worth considering other options.

Related reading: The best balance transfer credit cards

HSBC Cash Rewards Mastercard credit card: Best for cash-back rewards

Why this is the best for cash-back rewards : This card provides 3% cash back on up to $10,000 in purchases made within your first 12 months and 1.5% cash back after that.

Introductory offer : Earn 3% cash back on up to $10,000 in purchases within your first 12 months from account opening. Plus, get 0% introductory APR on purchases and balance transfers for the first 12 months from account opening. Balance transfers must be posted within the first 60 days following account opening. After that, a variable APR of 12.99%, 16.99% or 22.99% will apply. A balance transfer fee of either $10 or 4%, whichever is greater, applies on each balance transfer.

Rewards rate : Earn 1.5% cash back on all purchases (after the 3% introductory period ends)

- $5 off on Postmates orders of $25 or more for delivery of food, drinks and groceries (not including taxes, delivery fees, and tips)

- Cellular wireless telephone protection that may provide reimbursement up to $600 per claim if your cellphone is stolen or damaged

- Complimentary ShopRunner membership for unlimited, free two-day shipping and free return shipping at over 140 online stores

Is this card worth it? The introductory 3% offer provides solid cash-back earning during your first year, and 1.5% cash back long-term is also strong. If you're looking for a simple no annual fee card that earns flat-rate cash back, this is a solid choice. However, you can do slightly better with some other cards such as the Citi® Double Cash Card that provides up to 2% cash back on everything as 1% when you buy and 1% as you pay.

Related reading: The best cash-back credit cards

HSBC Cash Rewards Mastercard credit card Student Account: Best for cash-back rewards for students

Why this is the best for cash-back rewards for students : Students can be approved without any credit history. Plus, the card offers 1.5% cash back on all purchases.

Introductory offer : None

Rewards rate : Earn 1.5% cash back on all purchases

- No credit history required for approval

- Unlimited access to online tools to learn about credit

- Get your FICO Credit Score for free each month on your HSBC credit card statement

- Graduate to the standard HSBC Cash Rewards Mastercard credit card after four years if your account is in good standing

- Complimentary ShopRunner membership

Is this card worth it? The HSBC Cash Rewards Mastercard credit card Student Account can be a good option for students who have an existing HSBC deposit account. Eligible students may be able to open this unsecured credit card without credit history and earn 1.5% cash back while building their credit .

Related reading: Best credit cards for college students

HSBC Advance Mastercard credit card: Best for dining and entertainment

Why this is the best for dining and entertainment : This card earns 3x points on dining and select entertainment during your first 12 months and then 2x points once the introductory period is complete. You must have a qualifying HSBC Advance or Premier checking account relationship to be eligible for this card.

Introductory offer : Earn an introductory 3x points on dining and select entertainment purchases plus 2x points on all other purchases in the first 12 months from account opening, up to the first $25,000 in purchases. Plus, get 0% introductory APR on credit card purchases and balance transfers for the first 12 months from account opening.

Balance transfers must be posted within the first 60 days following account opening. After that, a variable APR of 14.99% or 18.99% will apply. A balance transfer fee of either $10 or 4%, whichever is greater, applies on each balance transfer.

Rewards rate : Earn 2x Rewards Program Points on dining and select entertainment purchases after the intro period. Plus, earn 1x on all other purchases after the intro period.

- 10% off when booking luxury hotel stays through onefinestay

Annual fee : $0 during the first year of account opening, then $0 for cardholders who have a qualifying U.S. HSBC Advance or Premier checking account relationship and $45 for cardholders who no longer have a qualifying checking account relationship

Is this card worth it? If you are eligible for this card with a $0 annual fee, it can be a good way to earn bonus points on dining and entertainment. But, it's unclear from publicly available materials what type of redemption value you'll get from Rewards Program Points. So, it may be better to opt for a more straightforward rewards credit card that earns bonus rewards on dining and/or entertainment such as the Capital One Savor Cash Rewards Credit Card or the Capital One SavorOne Cash Rewards Credit Card.

The information for the Capital One Savor card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Related reading: Credit card showdown: Capital One Venture vs. Capital One Savor

HSBC Premier World Mastercard credit card: Best for travel

Why this is the best for travel : This card offers 2x points on travel purchases as well as various travel-related perks. You must have a qualifying HSBC Premier checking account to be eligible for this card.

Introductory offer : Earn 35,000 Rewards Program Bonus Points -- worth at least $400 in air travel -- after spending $3,000 in the first three months from account opening.

Rewards rate : Earn 2x Rewards Program Points on travel purchases and 1x Points on all other purchases.

- Enjoy complimentary unlimited premium Wi-Fi at over a million secure hotspots worldwide with Boingo . Get simultaneous access for up to four devices.

- Receive up to $50 in statement credits annually for rides with Uber and Lyft

- Get a statement credit of $85 every five years as reimbursement for a TSA PreCheck application fee

- 10% discount when you book your hotel or vacation home stay through Expedia, Agoda or onefinestay

- Trip cancelation insurance that may reimburse you for your prepaid, non-refundable expenses in case you have to cancel your trip for a covered reason

- Hotel and motel burglary insurance that may reimburse you up to $1,500 per claim for personal property stolen or damaged from your hotel or motel room as a result of burglary by forcible entry

- Lost luggage insurance that may reimburse you up to $1,500 per claim for checked or carry-on luggage that is lost or damaged while traveling on a common carrier

- Baggage delay insurance that may reimburse you up to $250 per claim for the cost of essential items such as clothing and toiletries if your luggage is delayed in getting to your scheduled destination

- Purchase assurance that may reimburse you when an item you bought with your card is damaged or stolen within 90 days of purchase

Annual fee : $0 during the first year of account opening, then $0 for cardholders who have a qualifying U.S. HSBC Premier checking account relationship and $95 for cardholders who no longer have a qualifying HSBC relationship.

Is this card worth it? If you have a qualifying U.S. Premier checking account with HSBC, you might as well open the HSBC Premier World Mastercard credit card for its travel-related benefits and shopping benefits. But, if you aren't already an eligible HSBC customer, you may want to consider other travel credit cards with stronger earning rates and additional perks such as a Global Entry application fee credit .

Related reading: Best travel rewards credit cards

HSBC Premier World Elite Mastercard credit card: Best for premium travel rewards

Why this is the best for premium travel rewards : This card provides 3x earning on travel purchases , 2x earning on dining purchases and various travel and shopping benefits. You must have a qualifying HSBC Premier checking account to be eligible for this card.

Introductory offer : Earn 50,000 Rewards Program Bonus Points -- worth $750 in airfare when booked online through HSBC Rewards -- after spending $4,000 in the first three months of account opening.

Rewards rate : Earn 3x Rewards Program Points on travel purchases, 2x on dining purchases and 1x on all other purchases.

- Receive up to $100 in statement credits annually as reimbursement for air travel purchases charged to your card

- Receive up to $100 in statement credits annually for rides with Uber and Lyft

- Enjoy complimentary Lounge Key membership and get two free lounge visits per year. Additional visits are only $32 per person

- Get one Global Entry application fee statement credit or one TSA Precheck application fee statement credit every 54 months

- Enjoy complimentary unlimited premium Wi-Fi at over a million secure hotspots worldwide with Boingo. Get simultaneous access for up to four devices

- Price protection that may reimburse you when you purchase an item with your card and then see a printed advertisement or non-auction Internet advertisement for the same product at a lower price within 60 days from the date of purchase

- Extended warranty that may double the original manufacturer warranty up to a maximum of 24 months when you purchase an eligible item with your card

- Purchase assurance that may reimburse you when an item you bought with your covered card is damaged or stolen within 90 days of purchase

- Cellular wireless telephone protection that may provide reimbursement up to $800 per claim if your cellphone is stolen or damaged

- Earn $5 in Fandango rewards for every two movie tickets purchased

Annual fee : $395 plus $65 per authorized user

Is this card worth it? This card offers some perks that aren't commonly found on credit cards anymore such as Boingo Wi-Fi access and price protection . Plus, the card offers 3x earning on travel purchases as well as 2x earning on dining purchases and allows redemption for 1.5 cents per point when you book through HSBC Rewards. However, you'll need to have a qualifying HSBC's Premium checking account to get this card.

Related reading: Battle of the premium travel rewards cards: Which is the best?

How we chose the best HSBC credit cards

HSBC currently only offers six credit cards in the United States. And, only two of these cards are available to consumers without an existing HSBC relationship. So, in this guide we decided to analyze all six of the currently available HSBC credit cards and determine for whom each card might be best.

Benefits available on all HSBC credit cards

All of the currently available HSBC credit cards offer some basic benefits. In particular, you'll find the following perks available on all of the HSBC cards:

- Contactless-chip enable cards that allow you to tap and pay

- See your FICO score for free on your monthly statement

- MasterRental car rental insurance

- Travel accident insurance

- Mastercard ID theft protection that can provide identity theft resolution services

- Automatic enrollment in HSBC's fraud alert program

- Access to Mastercard global services which can assist with lost and stolen card reporting, emergency card replacement and emergency cash advance

- Access to Mastercard's Priceless Cities program which can provide exclusive access to more than 2,000 priceless experiences around the globe

- Access to Mastercard's Priceless Golf program which can provide exclusive access to iconic destinations and discounts on public tee times

- Access to Mastercard's airport concierge services including a discount on airport meet and greet services

Related reading: World Elite vs. World Mastercard: Benefits and value

HSBC Premier and Advance relationships

The HSBC Premier World Mastercard and HSBC Premier World Elite Mastercard require you to have an HSBC Premier relationship to apply, while the HSBC Advance Mastercard requires you to have an HSBC Advance relationship to apply. Here's what you need to know about both of these HSBC relationships.

HSBC Advance

With HSBC Advance, you won't need to pay any HSBC fees when using a third-party ATM and you can get up to four third-party ATM surcharge fees reimbursed per month. You'll also get access to preferred saving rates.

However, if you don't maintain a combined balance of at least $5,000 in your HSBC deposit and investment accounts, have a recurring direct deposit from a third party to an HSBC Advance checking account once per calendar month or have an HSBC U.S. residential mortgage loan, you'll need to pay a monthly maintenance fee of $25.

Related reading: The best checking accounts

HSBC Premier

With HSBC Premier, you won't have fees on everyday banking transactions, no HSBC ATM fees worldwide and unlimited third party ATM rebates within the U.S. You can extend your Premier status to up to four family members and you have automatic Premier status in all countries where you bank with HSBC affiliates.

However, to become an HSBC Premier client you must have at least $75,000 in total deposits and/or investments, have at least $5,000 in total direct deposits per month or maintain a U.S. residential mortgage loan with an original loan amount of at least $500,000. A monthly maintenance fee of $50 will be incurred if one of these requirements is not maintained.

Frequently asked questions about HSBC credit cards

What is the best hsbc credit card.

The best HSBC credit card is the HSBC Premier World Elite Mastercard credit card, due to its travel and shopping perks. But, this card requires you to have an HSBC Premier relationship, which may be difficult for many consumers. The best card for you depends on what factors you're looking for in a card.

Related reading: Best credit cards

Does HSBC have secured credit cards?

HSBC doesn't currently offer any secured credit cards. But, there are plenty of good secured credit cards offered by other issuers.

Is HSBC Gold Mastercard a good credit card?

The HSBC Gold Mastercard credit card can be a good option if you're looking for a no-annual-fee credit card that has a 0% introductory offer for purchases and balance transfers. But if you're looking to do a balance transfer , you may prefer a card with a lower or even waived balance transfer fee.

Is HSBC Premier World Elite Mastercard worth it?

If you have an HSBC Premier relationship and will take advantage of the HSBC Premier World Elite Mastercard's travel and shopping benefits, then the card can certainly be worth it. But, if you don't already have an HSBC Premier relationship, you may want to consider other premium travel rewards cards such as the Chase Sapphire Reserve or the UBS Visa Infinite Credit Card .

The information for the UBS Visa Infinite card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Are HSBC credit cards easy to get?

The HSBC Gold Mastercard and HSBC Cash Rewards Mastercard both allow potential applicants to check whether they're prequalified with just a soft credit pull . So, if you're worried about whether you'll be approved for an HSBC credit card, you may want to check whether you're prequalified for one of these cards.

Alternatively if you're a student you may want to consider the HSBC Cash Rewards Mastercard credit card Student Account since this card doesn't require any credit history. However, note that you need to have a consumer deposit relationship with HSBC to qualify for this card.

Can Wisconsin residents get an HSBC credit card?

Currently, all of the HSBC credit cards have a note in their Summary of Terms that states the offer is void in Wisconsin.

Related reading: The ultimate guide to credit card application restrictions

How do I pay my HSBC credit card?

You can pay your HSBC credit card using a checking account or savings account , by mail, by phone or by enrolling in autopay . Here's how to do each:

- Using an HSBC checking or savings account : Log-in to your HSBC account, select your credit card and click Move money

- Using a non-HSBC checking or savings account : Log-in to your HSBC account, select your credit card, click My Account, select Payments and then click Make a Payment

- By mail : Fill in the remittance stub and mail it along with your payment to HSBC Bank USA, N.A., PO Box 4657, Carol Stream, IL 60197-5255

- By phone : Call the number on the back of your credit card

- Enroll in autopay : You can enroll in EZ-Pay autopay by logging in to your HSBC account, selecting your credit card, clicking My Account, selecting Payments and then clicking Schedule EZ-Pay

Related reading: The right way to pay your credit card bills

Bottom line

HSBC offers six credit card products currently, although all but two of these products require an existing HSBC relationship. This means that most HSBC credit card products will be primarily useful to existing HSBC clients.

But, if you are looking for a no annual fee card with a 0% introductory APR offer on purchases and balance transfers, it may be worth checking whether you're prequalified for one of the two credit cards that are open to non-HSBC consumers.

Anti-fraud measures

Please make sure your web browser is up to date for uninterrupted access to HSBC Malaysia Online Banking. To protect yourself, don't visit unknown links or download apps from unknown sources. Don't share your credentials, account details or authentication codes with unknown websites or apps either. Learn more

We use cookies to give you the best possible experience on our website. For more details please read our cookie policy . By continuing to browse this site, you give consent for cookies to be used.

Our website doesn't support your browser so please upgrade.

- HSBC Malaysia online banking

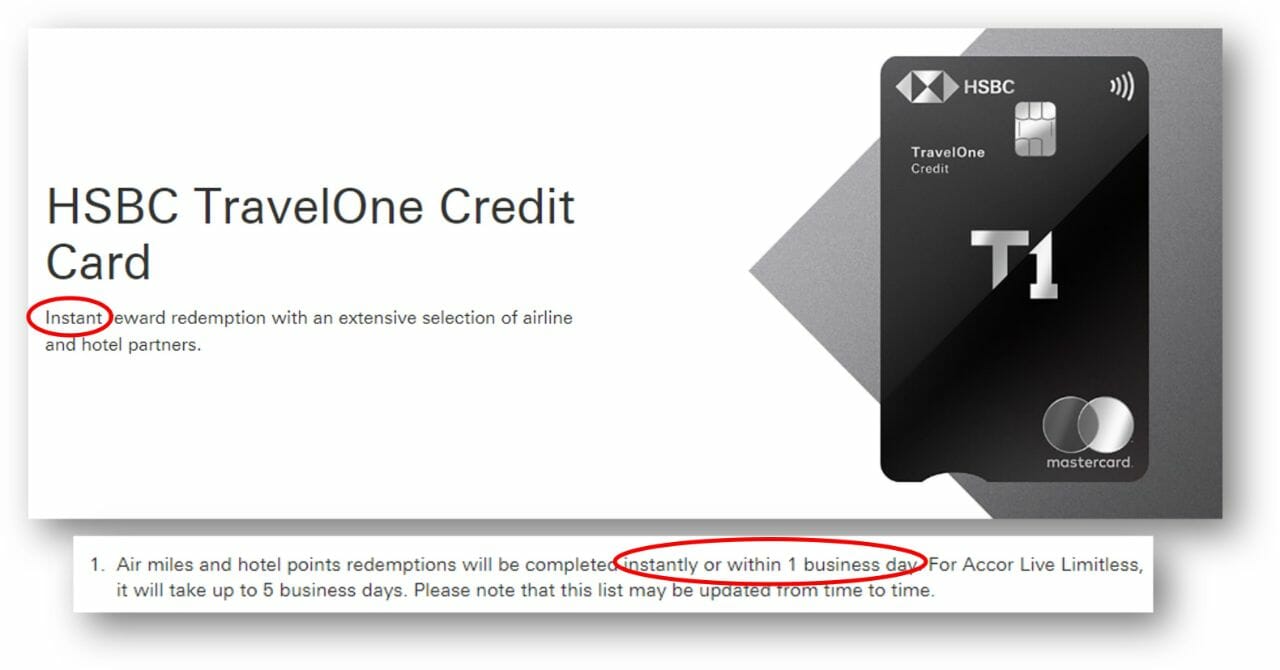

HSBC TravelOne Credit Card

Instant reward redemption with an extensive selection of airline and hotel partners.

Find out more via your eWelcome pack

Unlock a world of travel freedom

Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.

Apply online today and enjoy our exclusive sign-up offer

Open up a world of elevated travel.

Instant redemption

Earn accelerated points

Travel privileges

Split flexibly

Spend, earn, and go further, earn points and redeem them instantly.

Be spoilt for choice when you redeem instant miles and hotel points with an extensive range of airline and hotel partners such as Malaysia Airlines, airasia, Singapore Airlines, Marriott Bonvoy and more[@credit-cards-travelone-reward-programme-tncs].

- 8× Reward points on all foreign currency spend

- 5× Reward points on local travel spend (hotels, airlines and travel agencies)

- 5× Reward points on local dining spend

- 1× Reward points on all other eligible spend

- Find out how to redeem

Travel in style

- Airport lounge access[@credit-cards-plaza-premium-lounge-tncs]: You and your supplementary cardholder can enjoy a combined 6 complimentary visits per year at selected Plaza Premium airport lounge for international flights – terms and conditions apply

- Travel offers: Enjoy exclusive travel discounts on Agoda – learn more on the Agoda website

- Priceless™ Specials: discover top-tier benefits and a world of privileged access with curated offers and benefits from Mastercard – explore all offers

Put your mind at ease

- Travel insurance: Register to enjoy complimentary travel insurance coverage (including COVID-19)[@credit-cards-travelone-travel-insurance-tncs] of up to USD250,000 for you and your family when you charge the full cost of your air ticket to your HSBC TravelOne Credit Card – Mastercard T&Cs apply

- ID Theft Protection™: Enjoy peace of mind when surfing and shopping online. Proactive monitoring and alerts help to ensure the security of your personal data from identity theft or fraud. Online enrolment is required – find out more on the Mastercard website

- Complimentary E-Commerce Purchase Protection: Rest easier when you shop online with up to USD1,000 coverage – find out more on the Mastercard website

More card benefits

- Blind notch Designed to increase accessibility and demonstrate our commitment to inclusivity. The notch signals the correct end of the card to insert into card readers and ATMs

- We're finding ways to reduce plastic waste. Your HSBC TravelOne Credit Card is made from 100% recycled plastic.

Enjoy 50% off green fees at 42 golf clubs and golf lessons at 1 participating golf academy in Singapore – Book now . Terms & Conditions apply.

Valid until: 15 January 2025

Who can apply?

- A minimum annual income of RM60,000 p.a. is required

- Primary cardholder must be at least 21 years of age; supplementary cardholder must be at least 18 years old

What you'll need

Salaried employee .

If you're working for a multinational, public-listed, government or semi-government company or office, you'll need:

Photocopy of MyKad (both sides) AND any 1 from below:

- EPF statement - latest original PDF copy of non-password protected statement downloaded from KWSP website/App OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit OR

- Letter of confirmation from employer or latest month salary slip if employed less than 3 months OR

- Latest Income Tax Return Form (Form BE with tax receipt) OR

For all other companies, you'll need:

Photocopy of MyKad (both sides) AND any 2 from below:

- EPF statement - latest original PDF copy of non-password protected statement (latest 2 years EPF statement if contribution less than 6 months) downloaded from KWSP website/App AND/OR

- Bank statement - original PDF copy of non-password protected statement downloaded from online banking website/App showing latest 3 months salary credit AND/OR

- Latest 3 months salary slip AND/OR

- Latest Income Tax Return Form (Form BE with tax receipt) AND/OR

Self-employed

If you're self-employed , you'll need:

Photocopy of MyKad (both sides) AND Photocopy of Business Registration Form (established minimum 3 years) AND any 1 from below:

- Bank statement - latest 6 months original PDF copy of non-password protected statement downloaded from online banking website/App AND/OR

- Latest Income Tax Return Form (EPF Statement or Form B with payment receipts or CP02 attached)

Foreign passport holders

If you hold a foreign passport , you must be working for a multinational, public-listed, government or semi-government company or office, or HSBC corporate lending employer. You'll also need:

Copy of passport showing personal details and work permit (must be valid for at least one year) AND

Letter of confirmation from employer stating position, remuneration and duration of employment AND any 1 from below:

- Latest month salary slip

(Minimum RM10k income per month AND working for multinational/public listed companies/government/semi-government/HSBC corporate lending employers only)

Important documents

- Product disclosure sheet (PDF) (EN)

- Product disclosure sheet (PDF) (BM)

Apply online in 10 minutes or less.

You might also be interested in

Cash instalment plan , balance transfer instalment (bti) , cash advance , more about credit cards , important notes, connect with us.

WealthRocket is reader-supported. When you buy through links on the website, we may earn an affiliate commission.

HSBC Travel Rewards Mastercard® Review

Victor Irungu

- WealthRocket Staff

Why you can trust us

The team at WealthRocket only recommends products and services that we would use ourselves and that we believe will provide value to our readers. However, we advocate for you to continue to do your own research and make educated decisions.

HSBC Travel Rewards Mastercard®

Rated 1.8/5 stars.

- 3 pts Earn 3 points per $1 spent on eligible travel-related purchases.

- 2 pts Earn 2 points per $1 spent on gas and transportation.

- 1 pt Earn 1 point per $1 spent on all other eligible everyday purchases.

- Welcome Bonus None

- Annual Rewards $142 Learn how we calculate this.

- Annual Fee $0

- Minimum Income Required None

- No annual fee

- $0 supplementary card fee

Travel insurance

- Extensive list of partners for rewards

- 2.5% foreign transaction fee

- Capped travel rewards amount of $6,000

- Low rewards for non-travel-related purchases

The HSBC Travel Rewards Mastercard is designed for the frequent traveller. This travel rewards credit card allows you to earn points on every purchase. You can use your points in one of three ways: for travel, for a statement or loan credit, convert into cash and save, or redeem for gift cards and merchandise at select partners.

In This Article

Hsbc travel rewards mastercard: an overview, hsbc travel rewards mastercard rewards, hsbc travel rewards eligibility, hsbc travel rewards interest rates and fees, hsbc travel rewards mastercard perks, compare hsbc travel rewards mastercard alternatives, our final thoughts.

The Royal Bank of Canada (RBC) will be purchasing HSBC Canada. As a result, HSBC products will be discontinued shortly. Please refer to the best credit cards in Canada for alternatives.

Are you looking for a credit card that rewards you for travelling? With generous discounts on travel bookings, valuable travel insurance, and a variety of rewards points, the HSBC Travel Rewards Mastercard ® is an all-in-one travel card that can help you save on your next trip.

This HSBC Travel Rewards Mastercard review discusses the features and benefits of this card. It outlines the rewards you can earn, explains how to redeem your points, and provides an overview of any additional perks or discounts associated with the card. Read on to learn more about this travel rewards credit card and if it’s right for you.

The HSBC Travel Rewards Mastercard is an excellent choice for travel junkies who want to maximize travel rewards. This card offers points on every purchase, additional points for travel-related purchases, and no annual fee. To redeem points for the best value, cardholders can apply their points to travel related purchases. This includes purchases made from airlines, hotels, campgrounds cottages, cruise lines, and more.

The HSBC Travel Rewards Mastercard offers points on almost all purchases made.

Eligible travel: 3 points per dollar spent with a cap amount of $6,000 per calendar year (after you reach the cap amount, you’ll earn 1 point per dollar)

Eligible gasoline and daily transit: 2 points per dollar spent

All other eligible purchases: 1 point per dollar spent

Redeeming rewards with the HSBC Travel Rewards Mastercard is simple. Your earned points will appear on your account, and you can redeem them either online or over the phone.

For travel-related purchases, your online account will have a tab titled “Redeem Now.” From there you can select “Travel” to find travel purchases or to book directly using your HSBC credit card. For a statement credit, cardholders can find all travel-related transactions made in the last 60 days to apply points directly to their purchase. This is useful because cardholders are not restricted to specific companies for travel expenses. All purchases of goods and services from airlines, car rental agencies, hotels, cottages, campgrounds, and more will show up as a travel-related purchase that users can apply points to.

Cardholders can use their points in three different ways:

- Travel: HSBC points can be used for all things travel related. Book transportation, hotels, cruises, rail tickets, and more directly on the rewards site. You can also redeem points for a statement credit toward travel purchases made online or through travel agents and charged to the card.

- Financial: Use your points to achieve your financial goals. Convert your points for a credit toward your HSBC Bank Canada residential mortgage, credit card balance, or add the points to your HSBC personal savings account in the form of cash.

- Gift cards and merchandise: With an extensive list of exclusive partners, HSBC points can be used for Apple products, other electronics, accessories, home and beauty essentials, and hundreds of other items. Don’t see an item you like? HSBC has more than 50 gift card options and 3 charities to put points toward.

To apply for the HSBC Travel Rewards Mastercard, you must be of legal age and have a good credit score of around 670 to 739. There is no minimum income requirement to qualify for the card or annual fee.

- Annual fee: $0

- Foreign transaction fee: 2.5%

- Extra card fe e: $0

- Cash advance fee: $5 (doesn’t apply to Quebec)

Interest rates

- Purchases: 20.99%

- Cash advances: 22.99%

- Cash advances (Quebec): 21.99%

- Balance transfers: 22.99%

- Balance transfers (Quebec): 21.99%

- Penalty APR: 25.99%

In addition to its rewards, this card offers a few extra benefits for travellers.

The HSBC Travel Rewards Mastercard comes with baggage delay, trip interruption, and hotel/motel burglary travel insurance. For a low annual premium of $69, you can tack on emergency medical coverage, too.

Extended warranty coverage

Extended warranty coverage, and purchase assurance offers extra security when making purchases with your card.

- Annual Rewards $142

TD First Class Travel® Visa Infinite* Card

- Welcome Offer Up to $800 value, including up to 100,000 Aeroplan points.

- Annual Fee $139

- Interest Rates Purchases: 20.99%, Cash Advances: 22.99%

- Recommended Credit Score 760 - 900

American Express Cobalt Credit Card

- Welcome Offer Up to 30,000 Membership Points

- Annual Rewards $1029

- Annual Fee $155.88

The HSBC Travel Rewards Mastercard is a good choice for those looking for an easy way to earn rewards points on travel-related purchases. The capped rewards amount may be an issue for some. However, the card provides a lot of value that can outweigh this factor. All in all, it’s a great option if you’re looking for an easy way to maximize your rewards while travelling.

Victor is a freelance content/SEO writer based in Kenya. He has 10 years’ experience covering financial topics such as cryptocurrency, forex trading, insurance, mortgages, and investing.

Related Articles

Cibc aeroplan® visa* card for students review.

Barry Choi August 30, 2024

EQ Bank Card Review in 2024

Sandra MacGregor August 2, 2024

CIBC Dividend® Visa Infinite* Card Review 2024

Steven Brennan March 15, 2024

BMO Air Miles Mastercard Review

Sandra MacGregor August 12, 2024

SimplyCash® Preferred Card from American Express Review

H.G. Watson August 2, 2024

Neo Secured Credit Card Review

Rachel Morgan Cautero July 11, 2024

HSBC VIP Travel and Expense Card

HSBC VIP Travel and Expense Card: Introducing the perfect travel companion – your new HSBC VIP Travel & Expense Mastercard© credit card.

Designed to make your business travel as convenient and seamless as possible, your new card includes exclusive benefits, such as airport lounge access, trip delay and cancellation insurance, complementary Boingo Wi-Fi in all major airports, premier customer service access and more.

Travel boldly with the card that offers benefits beyond the ordinary with the HSBC name that is instantly recognized and respected around the globe.

Introducing the perfect travel companion – your new HSBC VIP Travel & Expense Mastercard© credit card.

Mastercard© Coverage Brochure (PDF, 1.29MB)

Mastercard© Guide to Benefits (PDF, 389KB)

Mastercard© Guide to Benefits – Trip Cancellation & Trip Interruption (PDF, 1.43MB)

To file a claim visit: www.mycardbenefits.com or call 1-800-Mastercard

Mastercard Concierge

Priority Pass Registration

Priority Pass Member Support (FAQs, Priority Pass App, Contact)

Flight Delay Pass Registration

Flight Delay Pass Terms of Use (PDF, 438KB)

Boingo Wi-Fi for Mastercard Cardholders

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Privacy Policy .

HSBC TravelOne Credit Card

Information

For HSBC TravelOne Credit Card Campaign 2024, please click here .

Unlock a world of travel freedom

Unlock instant travel rewards and elevated travel experiences everywhere you go with the one and only travel card you need.

Welcome gift

Apply now and enjoy instant approval[@cards-instant-approval-tnc]. What's more, receive 30,000 miles – in the form of 75,000 Reward points – when you meet these criteria:

- pay the annual fee of SGD196.20 (inclusive of GST)

- spend at least SGD500 in qualifying transactions within the qualifying spend period

- provide marketing consent when you apply

That's equivalent to a round trip air ticket to Bangkok!

Open up a world of elevated travel

Instant redemption

The first HSBC credit card to offer instant redemptions with an extensive selection of airline and hotel partners, all within the convenience of your mobile app.

Earn accelerated points

Get up to 2.4 miles (6X Reward points) for your spending.

Travel privileges

Complimentary travel insurance coverage, airport lounge visits and more.

Split flexibly

Split your purchases across a range of flexible tenors that suits your needs with HSBC Instalment Plans – find out more .

dpws-tools-calculator-creator

The calculated amount shown is indicative only, based on qualifying transactions. Terms and conditions apply .

How many miles you'll need to redeem a flight?

Note: The miles shown in the table are indicative only, based on the 'Miles Calculator – Redeem Miles' by Singapore Airlines as of 4 September 2023. The miles indicated are for an entire journey for 1 passenger from Singapore and they do not include taxes, fees or any promotional discounts that may apply.

Spend, earn, and go further

Earn points and redeem them instantly[@cards-instantly].

- 2.4 miles (6× Reward points)[@cards-travelonetnc] per SGD1 charged on foreign currency spend.

- 1.2 miles (3× Reward points)[@cards-travelonetnc] per SGD1 charged on local spend.

- Share the perks with a supplementary card[@cards-supplementarycard].

- No redemption fee when you redeem for air miles or hotel points. This offer ends on 31 January 2025.

Be spoilt for choice with instant miles and hotel points redemption with a wide range of airline and hotel partners such as Cathay Pacific, Singapore Airlines, Marriott Bonvoy and more.

- Find out how to redeem instantly

Travel in style

- Airport lounge: enjoy 4 complimentary lounge visits per year to over 1,300 global airport lounges for primary cardholders – register now .

- Priceless™ Specials: discover top-tier benefits and a world of privileged access with curated offers and benefits from Mastercard – explore all offers .

- Travel offers: enjoy a variety of travel privileges when you plan your trip – find out more .

Put your mind at ease

- Travel insurance[@cards-travelinsurancecoverage]: enjoy complimentary travel insurance with coverage of up to SGD150,000 for Overseas Medical Expenses when you charge the full cost of your air ticket to your HSBC TravelOne Credit Card - read the full policy . Read Frequently asked questions .

- ID Theft Protection™: enjoy peace of mind when surfing and purchasing online. Proactive monitoring and alerts help to ensure the security of your personal data from identity theft or fraud. Enrol online for complimentary access – find out more .

Who can apply?

To apply for an HSBC TravelOne card, you must be aged 21 or above and have a minimum annual income of:

- SGD30,000, if you're a Singaporean or Permanent Resident

- SGD40,000, if you're a self-employed or commission-based Singaporean or Permanent Resident

- SGD40,000, if you're a foreigner residing in Singapore

If you do not meet these income requirements, a minimum fixed deposit collateral of SGD10,000 will apply.

What you need to apply

Apply using MyInfo via Singpass and save the hassle of providing supporting documents.

Alternatively, prepare the following supporting documents with your application.

- ID documents of the primary and any supplementary applicants

- income documents of the primary applicant

What documents are acceptable?

Important documents

- ABS consumer guide for credit cards (PDF) ABS consumer guide for credit cards (PDF) Download

- Consumer guide for credit cards Consumer guide for credit cards Modal

- Credit card FAQs Credit card FAQs Modal

- Credit card security Credit card security Modal

- Credit card terms (PDF) Credit card terms (PDF) Download

- TravelOne credit card reward points programme terms and conditions (PDF) TravelOne credit card reward points programme terms and conditions (PDF) Download

- TravelOne sign-up gift offer terms and conditions (PDF) TravelOne sign-up gift offer terms and conditions (PDF) Download

What you need to know

Your credit limit

Your credit limit is subject to our review and approval. Where you've stated a preferred credit limit, the amount we grant may be lower than what you requested.

Finance charges

A finance charge will be imposed based on the amount withdrawn, from the date the transaction is posted to your account to the date the payment is made in full or the next statement date, whichever is earlier.

Effective rate: 27.8% p.a. (minimum)

Minimum charge: SGD2.50

The annual fee is at SGD196.20 including GST, starting from the issue date for your credit card. From the second year onwards, we'll waive the annual fee for your card if you spend more than SGD25,000 per year.

Receive 10,000 miles (in the form of 25,000 Reward points) when you pay for your annual fee from the second year onwards. The Reward points will be credited to your account within the next 2 months after the annual fee is charged to your card. Valid till 31 December 2024.

No Reward points will be awarded if your annual fee is waived when you spend more than SGD25,000 per year.

Get the miles

Get up to 30,000 miles (in the form of 75,000 Reward points) when you successfully apply for the HSBC TravelOne Credit Card, pay the annual fee of SGD196.20 (including GST), spend a minimum of SGD500 in qualifying transactions and provide marketing consent when you apply!

Share the perks with a supplementary card

Our HSBC credit cards open up a world of banking convenience, benefits and privileges. And now, you can share it with your family too.

- Earn reward points each time your loved ones spend on their cards

- Get up to 5 supplementary cards, free to you and your family for life

- Any loved one can hold a supplementary credit card as long as they're aged 18 or above

Other ways to apply

Leave us your contact details online or by SMS, and we'll give you a call within 3 working days to help you apply for this card.

Text HSAPP <space> Name <space> to 74722, or request a callback online .

Why bank with us

AsiaMoney Best Bank For Digital Solutions – Singapore

HSBC is the recent recipient of the 'AsiaMoney Best Bank For Digital Solutions – Singapore' Award 2023

Customer Satisfaction Index

HSBC ranked #1 in Credit Card sector for 3 consecutive years (2020 to 2022) in the Customer Satisfaction Index of Singapore.

Additional information

How can i enjoy the complimentary airport lounge .

Start enjoying your benefit

- Step 1: download Mastercard Travel Pass app (available on the Apple App Store and Google Play)

- Step 2: select 'Sign up' to register for the programme, or log on to your account if you're already a member

- Step 3: enter your HSBC TravelOne Credit Card details for a one-time verification

- Step 4: complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: set your account password

Simply use the membership number stored under 'my visits' when visiting airport lounges.

With the app, you can also view the airport lounges and restaurants available, keep track of your usage history and access many more services.

Note: Primary cardholders may use their complimentary lounge visits to redeem free meals at selected airport restaurants.

Terms and conditions apply .

Check out Mastercard Travel Pass

You might also be interested in

Entertainer with hsbc entertainer with hsbc this link will open in a new window, credit card features , hsbc singapore app .

Discover Campaign 2024

For TravelOne credit cardholders who receive an eDM and/or push notification from HSBC on this campaign, please see the details, terms and conditions .

Escapade Campaign 2024

Voyage Campaign 2024

Note: The code to access the relevant page is indicated in the eDM and push notification.

The miles shown are for illustrative purposes only, based on the redemption rate of 25,000 HSBC Reward points to 10,000 air miles from Cathay Pacific – Asia Miles and Singapore Airlines – KrisFlyer in any brochures, marketing or promotional materials. Visit our full list of airlines and hotel partners' programmes' redemption rate.

Connect with us

Our website doesn't support your browser so please upgrade .

Global Money

Access the world with one account

Spend, send and manage your currencies in one place using the HSBC UK Mobile Banking app.

Join the many customers who are benefitting from HSBC UK's best exchange rates, and access to more than 200 countries and regions worldwide.

Spend money at home or abroad using your Global Money debit card, or simply add it to your digital wallet for spending free from HSBC fees. Non-HSBC fees may apply.

Your currency balances are protected by the Financial Services Compensation Scheme.

Available exclusively via the latest version of the HSBC Mobile Banking app.

Here's what you get with a Global Money Account

Send money internationally without any HSBC or intermediary fees

- Send money abroad via the HSBC UK Mobile Banking app with a Global Money Account with no HSBC or intermediary bank fees

- Send money free from HSBC fees in more than 50 currencies to 200 countries and regions with Global Money transfers. You can also hold up to 18 currencies securely to use at any time

- Live exchange rates during market hours so you know exactly how much you're sending

- Send up to GBP50,000 per day (or currency equivalent)

- See the estimated arrival time on screen when you send a payment

More than just a travel money card

- Order your Global Money multi-currency debit card when you apply at no extra cost and add it immediately to your digital wallet. It can be used at home, abroad and online

- With your Global Money debit card, you can spend or withdraw cash with no HSBC fees. Check for other non-HSBC charges, for example when using cash machines

- Use your card abroad and spend like a local. We'll debit the payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance

HSBC UK's best exchange rates

- Benefit straight away from our competitive live exchange rates

- You can view these rates in the HSBC UK Mobile Banking app before you convert

- You can add or convert currency at any time, storing it until you need it. Convert on the go or when the rate is right for you

- When you're using your card abroad and have the funds in the currency balance you are spending in, there won't be a conversion

- If there aren't enough funds in the right currency balance, but you have funds in GBP and spend in one of the currencies you can hold with us, the conversion will be done using the HSBC Global Money Exchange Rate. Any other currencies will be converted using the VISA exchange rate

Before you apply

Who can apply.

You can apply for an HSBC Global Money Account if you have:

- An active HSBC UK current account (excluding Basic Bank Account, Amanah, Appointee and MyAccount)

- A valid email address that's on our records

- A valid mobile number on our records

- The HSBC UK Mobile Banking app (Global Money is only available via the app)

Find out how to add or update your contact details .

You must also read the important documents.

Important documents

- HSBC Global Money Account Terms and Conditions (PDF, 582 KB) HSBC Global Money Account Terms and Conditions (PDF, 582 KB) Download

- HSBC Global Money Account fee information document (PDF, 181 KB) HSBC Global Money Account fee information document (PDF, 181 KB) Download

- UK FSCS Information Sheet and Exclusions List (PDF, 106 KB) UK FSCS Information Sheet and Exclusions List (PDF, 106 KB) Download

- Privacy notice (PDF, 498 KB) Privacy notice (PDF, 498 KB) Download

Apply for a Global Money Account

Already an hsbc customer.

On your mobile and have our app?

New to HSBC?

If you're not yet an HSBC customer with an eligible current account, find out more about our current accounts and how to apply.

Not on your mobile?

Scan the code to get started.

Frequently asked questions

What is an hsbc global money account .

It's a digital account you can use to hold money in different currencies. It's also an easy-to-use instant payment service that lets you manage, send and spend money in different currencies securely. It's free from HSBC fees. Non-HSBC fees may apply. If a payment is sent to your Global Money Account in a non-GBP currency it will be received, but will be converted into GBP. In the future you’ll be able to receive foreign currency into your account without it being converted to GBP.

What currencies can I hold and use with an HSBC Global Money Account?

You can send and spend money in more than 50 currencies to 200 countries and regions. If you don't hold a balance in the currency you are spending in, simply ensure funds are available in your GBP wallet.

You can hold balances in these currencies:

- GBP - pound sterling

- USD - US dollar

- AUD - Australian dollar

- ZAR - South African rand

- PLN - Polish zloty

- CAD - Canadian dollar

- NZD - New Zealand dollar

- CHF - Swiss franc

- SEK - Swedish krona

- HKD - Hong Kong dollar

- AED - UAE dirham

- CZK - Czech koruna

- NOK - Norwegian krone

- DKK - Danish krone

- SGD - Singapore dollar

- JPY - Japanese yen

- CNY* - Chinese yuan renminbi

*Whilst you can hold a CNY balance, there are are regulatory restrictions that prevent you being able to send or spend inside or outside China. Chinese regulations only allow for payments in GBP, USD or EUR, so you will need to ensure you have funds available in these currencies.

How do I use my Global Money card?

Simply add GBP or any supported currency to your HSBC Global Money Account. Use your debit card as you would at home. We'll debit payment from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.

If using local currency where you don't hold a balance, this will debit your GBP balance and not any other currency balance. For example, if you use Mexican pesos this will be debited from your GBP balance and not your USD balance.

Please bear in mind spending limits may apply.

Is a Global Money debit card the same as a travel money card?

Global Money is more than just a travel card. You can convert currency as and when you need to, even on the go. You can use your Global Money debit card like a local, at home or abroad with no HSBC fees including at cash machines. Non-HSBC fees may apply. We'll debit payments from your currency balance if funds are available. If not, or if the transaction is in a currency you can't hold a balance in, we'll debit your GBP balance.

If using local currency where you don't hold a balance, this will debit your GBP balance and not any other currency balance. For example, if you use Mexican pesos this will be debited from your GBP balance and NOT your USD balance.

Are my balances in Global Money protected?

Yes, they're covered up to £85,000 by the Financial Services Compensation Scheme. You can find the UK FSCS Information Sheet and Exclusions List under Important documents on this page where you can, view, print and download the document.

What exchange rate will I get when I use my Global Money Account?

The HSBC Global Money Exchange Rate is made up of the cost to HSBC and a foreign currency conversion margin that we include.

Sending money - international payments

The HSBC Global Money Exchange Rate is a live rate updated by the second during market hours. This means we can always offer our most up-to-date rate. This provides you with visibility and certainty of how much you're sending. The exchange rate will be displayed in the mobile app before you confirm your payment and will be valid for 40 seconds before refreshing. This rate is quoted to you before you complete any foreign currency transaction using Global Money.

Spending – card transactions.

If you have enough funds in the currency of the transaction, no exchange rate will apply. If the transaction is in one of the 17 currencies you can hold a balance in and you don't have enough funds in that currency to cover it, we'll convert available GBP funds using the HSBC Global Money Exchange Rate to cover the transaction. If the transaction is in a currency you can't hold a balance in, it'll be converted using the VISA exchange rate.

Is the Global Money debit card a prepaid debit card?

No, but you can convert currency before you go, and hold it in your currency balance ready to use at any time. This can help you control your budget by choosing how much you want to spend. Alternatively, you could choose to convert currency as and when you need it.

Are there any fees for using a Global Money Account?

You can send money internationally without any HSBC or Intermediary fees. However, other banks may charge to receive a payment.

With your Global Money debit card, you can spend or withdraw cash with no HSBC fees. Check for other non-HSBC charges, for example when using cash machines.

Winner at the 2024 Card and Payments Awards

Our Global Money Account was awarded 'Best Industry Innovation' for making everyday international banking easier.

- Find out more about the awards Find out more about the awards This link will open in a new window

You might also be interested in

Using your card abroad vs travel money , using your card outside the uk , starting a new journey , customer support.

- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

My thoughts on the HSBC TravelOne Card

The HSBC TravelOne Card is a great general spending card- and maybe that's the problem.

This week saw the launch of the TravelOne Card, HSBC’s first mass market miles card in Singapore. HSBC certainly took its time entering this segment — almost every other bank already has one — but hey, there’s no harm in being fashionably late.

I’ve spent the past couple of days poring over the details of this card and analysing its use cases. Like every new launch, the TravelOne has generated a ton of online discussion, which has been very helpful in spotting things I missed the first time round!

And as I was drafting this post, I suddenly had an epiphany.

The biggest strength of the HBSC TravelOne? It’s a great general spending card. The biggest weakness of the HSBC TravelOne? It’s a great general spending card.

If that sounds confusing, don’t worry- it’ll get clearer as we go along.

The earn rates are great (for a general spending card)

HSBC TravelOne Cardholders earn:

- 3X HSBC points per S$1 (1.2 mpd) on local spend

- 6X HSBC points per S$1 (2.4 mpd) on foreign currency spend

There is no minimum spend required, nor cap on the points that can be earned.

It speaks volumes about where the market is right now that more than a few comments have basically said “Not 4 mpd? Pfffft”. But that’s understandable in a way. Cards like the UOB Preferred Platinum Visa and UOB Visa Signature have made us so accustomed to earning 4 mpd almost everywhere that it’s become the de facto expectation for some.

And yet, it’s important to remember that the TravelOne is intended to be a general spending card , and we need to benchmark it to the appropriate segment.

In fact, given its earn rates and rounding policies, I’d say it more than holds its own against the competition; all the more so for HSBC Everyday Global Account customers who can earn a bonus 1% cashback on all transactions (capped at $300 per month).

Furthermore, I’m quite amazed that the HSBC TravelOne outearns the top-of-the-line HSBC Visa Infinite (1/2 mpd on local/overseas spend, upgraded to 1.25/2.25 mpd on local/overseas spend with a hefty minimum spend of S$50,000 in a membership year). That must have been a fascinating internal discussion, since product managers are loath to have their baby upstaged- especially by a card for the unwashed masses!

It’s not just raw earn rates, mind you. Quality of points matters as much as quantity .

If HSBC had launched a card with 1.6/2.4 mpd earn rates, yet kept Asia Miles and KrisFlyer as its only transfer partners, I’d be much more indifferent. Yes, those would be excellent earn rates for a general spending card, but at the end of the day what’s changed? It’s not breaking any new ground.

The TravelOne’s claim to fame is not its earn rates, solid though they may be. It’s the new transfer partners it’s added and will continue to add throughout 2023 (more on that later). That, to me, is more important than incrementally higher earn rates.

I’ve often believed that banks are getting the market for general spending cards wrong. It seems as if the thought process goes something like, “What’s better than 1.2 mpd? 1.3 mpd. What’s better than 1.3 mpd? 1.4 mpd…”

While this might be good for consumers in the short run, it’s ultimately not sustainable (just look at the BOC Elite Miles Card as an example). Margins get squeezed, banks have to come up with shenanigans to advertise higher rates while awarding less in practice (e.g. OCBC/UOB and their S$5 earning blocks), and it limits the scope to add other benefits that customers might value more, such as lounge visits or airport limo rides.

A much more sustainable approach would be to compete not on headline earn rates, but card features . In other words: “I can make my 1.2 mpd better than your 1.3 mpd if I offer more partners, if I offer free conversions, if I offer instant transfers.” That’s exactly what HSBC is attempting with the TravelOne.

Still, not everything is hunky dory.

- HSBC TravelOne Card does not have a bonus earn category

- HSBC excludes CardUp/ipaymy transactions from earning rewards

- HSBC no longer offers a tax payment facility

- HSBC points don’t pool (though it’s on the roadmap…more on that later)

This means there’s currently no way of turbocharging your accumulation, and at a pace of 1.2/2.4 mpd, it’d take a lot of spending to reach the critical mass needed for a redemption (especially if you’re redeeming for a family).

It’s what I call the “AMEX Platinum Problem”. While Membership Rewards points are extremely valuable, it’s hard to earn them at a decent rate (0.69 mpd for AMEX Platinum Credit Card , 0.78 mpd for AMEX Platinum Charge ). But even then, at least AMEX has 10Xcelerator partners (3.47 mpd for AMEX Platinum Credit Card , 7.8 mpd for AMEX Platinum Charge )- something HSBC lacks!

A solid sign-up bonus, with a quirk

From now till 31 August 2023 , customers who apply for a HSBC TravelOne Card will enjoy 20,000 bonus miles (in the form of 50,000 HSBC points) when they:

- Pay the annual fee of S$194.40

- Spend at least S$800 by the end of the month following approval

- Opt-in for marketing communications during the sign-up process

Since the annual fee must be paid, you’re basically buying miles at a cost of 0.97 cents each (S$194.40/20,000 miles), or 1.09 cents if you want to adjust for the opportunity cost of spending on a 4 mpd card (S$194.40/(20,000-800*2.8) miles).

That’s a very good price indeed, and before someone says “but Citi PayAll”, remember the S$8,000 minimum spend for the current offer.

What’s noteworthy about this offer is that it’s available to both new and existing HSBC cardholders . Most of the time, the latter get left out in the cold.

But offering the same sign-up bonus to new and existing customers also creates a strange quirk. If you count as a new HSBC cardholder, you might want to apply for a HSBC Revolution Card first (seriously, why don’t you have one yet?).

New cardholders will receive:

- S$30 cash from SingSaver, no min. spend (T&Cs)

- S$150 cashback from HSBC with a min. spend of S$1,000 (T&Cs)

After the Revolution is approved, you can then apply for the TravelOne as an existing customer, since you enjoy the same 20,000 bonus miles as a new cardholder anyway.

Don’t sweat the annual fee

And since we’re talking annual fees: the HSBC TravelOne Card is not offering a first year fee waiver option at the moment. In other words, if you want the card, you have to pay the S$194.40 annual fee, though with 20,000 miles + eight lounge visits in the first membership year (not four- see below), I’d argue you’re still coming out on top.

What happens in the second year, though?

At this point, we don’t know. The official stance is that cardholders who spend at least S$25,000 in a membership year will receive a fee waiver for the second year. However, many other banks say similar things, yet offer waivers nonetheless to those who fall short of the minimum spend (either automatically or on request).

I’m not that concerned at the moment, quite frankly. The card is virtually brand new; we’ll cross that bridge when we come to it. I certainly wouldn’t pay S$194.40 just for a few lounge visits, and I suspect that HSBC knows that unless there’s a very compelling reason to pay the second year’s annual fee, the lack of waiver could spark a significant exodus.

The market has already demonstrated it’s not willing to pay annual fees in the S$30,000 card segment. OCBC tried it for a while with their 90°N Card by adding a non-waivable S$53.50 annual fee (with a further S$139 top-up to buy 10,000 miles). That experiment didn’t last very long.

So the way I see it, why not just take it one year at a time? It’s hardly something to get worked up about at this point. If the value proposition doesn’t make sense in the second year, you still have the freedom to walk away.

Expiring points aren’t a deal-breaker

Points earned on the HSBC TravelOne Card expire after 37 months , the same as other HSBC cards.

Some don’t like expiring points, but it’s not that big a deal for me. As I’ve explained in this article, non-expiring points don’t really influence my decision whether or not to get a card. Granted, nothing beats evergreen, but 37 months is a long time, and you still have additional validity once points are transferred to the airline side.

However, an argument could be made that because of the 1.2/2.4 mpd earn rates, you’d need to keep the points on the bank side for a longer time before transferring. Fair enough, though at most it means paying an additional conversion fee at the end of 37 months; not really something to lose sleep over.

Moreover, with the pace of frequent flyer devaluations, holding on to your points too long is a bad idea. The golden rule is still to earn and burn!

First year sweet spot for lounge visits

HSBC TravelOne Cardholders enjoy four lounge visits per year, a relatively generous allowance for the segment in which the card competes.

What’s more, the allowances are granted on a calendar year basis instead of membership year. This means that a cardholder can enjoy eight visits in their first membership year, regardless of whether they choose to renew.

For example, when you’re approved in 2023 you get four visits to use till 31 December 2023, and on 1 January 2024 you get another four visits to use till 31 December 2024. Whether or not you renew the card in 2024 is irrelevant.

There’s also a qualitative aspect to this: TravelOne lounge visits are provided by DragonPass, which is the only major lounge network to retain access to Plaza Premium Lounges after the operator terminated its agreements with Priority Pass and Lounge Key. In some airports (e.g. Penang, Phnom Penh) Plaza Premium lounges are the only contract lounge option (or even the only lounge option).

If there’s one fly in the ointment, it’s that lounge visits cannot be shared with a guest. Whether that’s a HSBC or DragonPass restriction I do not know, but it feels odd: if I have four visits in total, who cares whether I use all four on myself or split them with my companion for two visits together?

Fast, free points conversions

There’s three things I look for in a card:

Conversion speed

Conversion fees, conversion blocks.

The HSBC TravelOne gets two out of three right, with the last one coming agonisingly close.

The HSBC TravelOne Card has a bit of a semantics issue when it comes to conversions.

In some places, it advertises “ instant” rewards redemptions. In others, it says “instantly or within 1 business day”. The two, obviously, are not the same, and in the miles game where award space can disappear as fast as it pops up, can make all the difference.

Having spoken to both the product team as well as Ascenda (the loyalty company that’s behind the new partners), the overall sense I got was that this is a CYA thing, just in case something goes wrong.

Given the API integration Ascenda has with its partners, there’s really no reason not to expect instant conversions for all programmes except Accor Live Limitless (where transfers take up to five business days).

In any case, I’ll be testing this soon and posting the results, and I’m sure the Telegram Group will be full of data points as well.

HSBC normally requires cardholders to join its Mileage Programme to convert points, which costs S$43.20 a year for unlimited conversions to Asia Miles or KrisFlyer. You only pay one fee, regardless of how many HSBC cards you have.

With the TravelOne Card, all conversion fees are waived till 31 December 2023 . That reduces the friction in making ad-hoc top-ups to your frequent flyer account.

It’s not been confirmed whether HSBC will switch to a “per conversion” model come 1 January 2024, but if you ask me, it looks more likely than not. I’d expect to pay the usual S$25 + GST.

Unfortunately, it’s the last leg of the triangle that’s missing. While the TravelOne offers fast, free top-ups, the minimum conversion block is 10,000 miles.

While that’s on par with the market, I feel they’ve missed a great opportunity here. 10,000 miles, after all, is a significant chunk of change to move at one go. If they broke it down into smaller blocks, the utility of the card would be even greater.

If it’s any consolation, after the first 10,000 miles the subsequent conversion block is just 2 miles. This is confirmed in the FAQs:

In other words, you could convert 25,005 points to 10,002 air miles. This is great news for anyone intending to spend S$800 for the sign-up bonus in local currency then cash out. You’d have:

- 50,000 bonus points (for meeting min. spend)

- 2,400 base points (S$800 @ 3 points per S$1)

52,400 points can be cashed out exactly for 20,960 miles, avoiding orphan points.

I just wish they’d gone one step further and made the minimum conversion block 2 miles, though that may be wishful thinking on my part.

By the way, this also means that if you want an insurance policy against orphan miles, one thing you can do is keep a minimum of 25,000 points in your account at all times.

Transfer partner bonanza

HSBC TravelOne Cardholders can transfer points to a total of 12 different partners : nine airlines and three hotels.

This takes the crown of “most transfer partners” from Citi (10 airlines, 1 hotel), and HSBC isn’t done. The plan is to have more than 20 airline and hotel partners by the end of 2023.

That’s the real game-changer here. For too long, we’ve seen new partners added at a glacial pace ( Standard Chartered and OCBC (eventually) being the notable exceptions; no surprise it was Ascenda behind those too). Now HSBC has kicked things into overdrive, and while not every new partner will be “useful” from a miles chaser perspective, more options can only be a good thing.

At the same time, there’s one thing I want to make abundantly clear: there’s little point in using the HSBC TravelOne Card if all you want is Asia Miles and KrisFlyer. If that’s your goal, you’d do much better by sticking with other cards on the market. Why earn KrisFlyer miles at 1.2/2.4 mpd when you can earn them at 4/6 mpd elsewhere?

Getting the most out of TravelOne means exploring other programmes, and I can’t help but wonder if there’s an inherent paradox. Are the people most likely to give a general spending card heavy usage also the same people who would default to familiar programmes like Asia Miles and KrisFlyer?

How you feel about the HSBC TravelOne Card really boils down to what standards you’re measuring it by.

Compared to general spending cards, it excels: 1.2/2.4 mpd earn rates, 1% extra cashback for EGA customers, a favourable rounding policy, four lounge visits per calendar year, fast and free conversions, and a 20,000 miles sign-up bonus even for existing customers. I’m not about to say it’s the absolute best — the Citi PremierMiles Card may have lower earn rates and fewer lounge visits, but Citi PayAll is a fearsome beast — though it certainly ticks all the right boxes.

Compared to specialised spending cards , it pales in comparison, obviously. No general spending card, no matter how good, is going to beat 4/6 mpd!

Here’s the thing though: even if the HSBC TravelOne isn’t directly competing with a specialised spending card, it’s indirectly competing for share of wallet, because in most cases, every S$1 I put on the TravelOne is S$1 I could have put on a 4/6 mpd card.

That’s a problem that all general spending cards face, not just the HSBC TravelOne. It begs a more existential question: do you even need a general spending card?

To be sure, there are situations where it can come in useful:

- Maybe you’ve busted the 4/6 mpd caps on your specialised spending card

- Maybe the bank affiliated with your general spending card has some sort of tie-up with the merchant that grants an additional discount that would more than offset the lost miles

- Maybe this particular category of spend doesn’t qualify for any bonuses (though it’s hard to think of an example, given the wide coverage of specialised spending cards)

- Maybe you don’t know the MCC of a given merchant, and just want to be safe (but you could always find out for free )

I don’t know how common those scenarios are for you, but keep in mind this won’t even be a dilemma for the vast majority of cardholders out there. If you read this blog, chances are you’re in the minority- not just in terms of looks, charisma and sheer muscle mass, but also in terms of card usage. For every one of us who obsessively optimises each and every transaction, there’s five, maybe ten people who just put everything on their DBS Altitude, Citi PremierMiles or UOB PRVI Miles Card and call it a day.

All the same, it’d be horribly premature to write it off. My understanding is that HSBC is working on adding points pooling , and if they pull that off, a lot of things would fall into place.

Imagine what you could do with Revolution earn rates, 20+ partners and instant transfers. Imagine being able to avoid fuel surcharges and tap new sweet spots by choosing the right frequent flyer programme. Imagine a spillover effect on the rest of the market, where other banks look at the HSBC, StanChart and OCBC case studies and decide there’s value in partnering with a platform like Ascenda and bringing dozens of partners onboard at once instead of negotiating individual contracts.

As John Lennon once said “That’s very nice Yoko but I’m trying to perform with Chuck Berry” “You can say that I’m a dreamer, but I’m not the only one”.

The HSBC TravelOne poses a crucial question: is there space for a general spending card in the wallet of a miles optimiser? Or perhaps more accurately: is there space for another general spending card in the wallet of a miles optimiser?

That’s something well worth thinking about this weekend, but I personally pulled the trigger yesterday and sent in my application. I’m not about to say no to that kind of sign-up bonus, and if things work out the way I hope they will, having an extra 50,000 HSBC points in the bag would be very welcome come end-2023. HSBC has ambitious plans that go beyond just the TravelOne, and if they can deliver on that, it’d be a huge shake-up to the miles game in Singapore.

Scoffers gonna scoff, but I like what I see so far.

- credit cards

Similar Articles

Upgraded: maybank world mastercard now offers uncapped 3.2 mpd on fcy spend, dbs cards offering s$88 bonus cashback for dining, shopping & travel, 24 comments.