JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

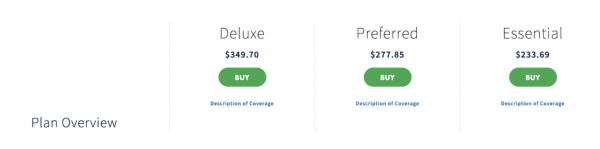

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

Corporate Accident & Health Insurance

Insurance for Individuals and Families

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

Are you sure you want to log out of your account?

- Search for:

- Key Milestones

- General Committee

- Our Subsidiaries

- Membership Categories

- Constitution & Bye-laws

- Renew AA Membership

- Publications

- Traffic Conditions

- ERP Information

- Where To Park

- Motoring Tips

No products in the cart.

HOME • TRAVEL INSURANCE • TRAVEL GUARD

Travel Guard

TRAVEL GUARD Now with COVID-19 cover

Travel Guard is now enhanced with COVID-19 coverage. Better coverage, same great service and experience. As you look forward to travelling again, you can travel confidently with AIG’s Travel Guard for your next getaway. Our wholly owned assistance centers are equipped to assist you 24 hours a day, 7 days a week.

Enjoy world-class travel protection with worldwide coverage

AIG’s Travel Guard helps keep unexpected problems off your itinerary with 24/7 worldwide assistance. From minor inconveniences to major emergencies, we are prepared for what may go wrong, so you can enjoy your holiday.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

AA Travel Insurances

AA Tourcare Plus

TM Xplora Plus

AA Student Assist

AA Overseas Student

Enhanced AA AutoPlan

AA Senior Motor Plus

AA Motor 365

AA Motor Plus

Commercial Insurance

Speak To Us To Find Out More

Contact us at the following

Save 10% More as AA Member

Sign in to your account using Membership ID or email and password.

Don't have an account? Sign up

Username or email address *

Password *

Remember me Log in

Lost your password?

Submit Your Motor Insurance Quote Request

Submit Quote

AIG Travel Insurance Singapore: Covid-19 Coverage Review, Promotion (2022)

If you have ever gone on group tours through travel agents, AIG travel insurance (or the AIG Travel Guard) might ring a bell because AIG works with a lot of agents in Singapore.

For the risk-averse, it’s pretty hard to beat AIG travel insurance for peace of mind as they have an 24-hour in-house emergency assistance network called AIG Travel Asia Pacific (ATAP) with 8emergency centres worldwide – whereas the overwhelming majority of insurance companies work with third-party rescue service providers like ISOS.

Naturally, AIG travel insurance also has a reputation for being expensive. To combat this, they have introduced a lower Basic tier to try to capture the “price-conscious” (okay, cheapskates).

- AIG Travel Insurance Summary

- AIG Travel Insurance Covid Cover

- Extreme Sports and Outdoor Adventure

- AIG Travel Insurance Terms and Conditions

- AIG Travel Insurance Claim Review

- AIG vs Allianz Travel Insurance

- AIG Travel Insurance Promotion

- AIG Travel Insurance Review

1. AIG Travel Insurance: Summary

Unlike other insurance providers such as NTUC and MSIG with multiple travel insurance plans for you to choose from, AIG only has one travel insurance plan called the AIG Travel Guard which comes in four tiers:

- Basic (cheapest)

- Supreme (too expensive, not reviewing in this article)

The price of your AIG travel insurance largely depends on which country you’ll be travelling to. As with all travel insurance companies, AIG has divided their prices into three regions of travel:

- Region 1, ASEAN : Malaysia, Indonesia, Vietnam, Cambodia, Philippines, Brunei, Laos and Myanmar

- Region 2, Asia : China (excluding Tibet), Hong Kong, Taiwan, Thailand, Macau, Maldives, Bangladesh, India, Mongolia, Pakistan, Sri Lanka, Bahrain, Kuwait, Qatar, Oman, the United Arab Emirates, Argentina, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Guyana, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Suriname, Uruguay and Venezuela

- Region 3, Worldwide : Australia, Japan, South Korea, New Zealand, Nepal, Tibet and the rest of the world (excluding Cuba, Iran, Syria, North Korea and the Crimea region)

AIG Travel Guard® Direct - Enhanced

[Receive your cash as fast as 30 days*] • Get up to 52% worth of cashback with eligible premiums spent. • Additionally, receive S$88 Revolut Cash Award* and an Eskimo Global 1GB eSIM with every policy purchased. T&Cs apply. PLUS, get S$100 Revolut Cash Award when you are the 8th and 88th Successful Applicant each week to sign up for a new Revolut account in our Giveaway. T&Cs apply.

Key Features

Voted TripZilla's Best Travel Insurance (Single Trip).

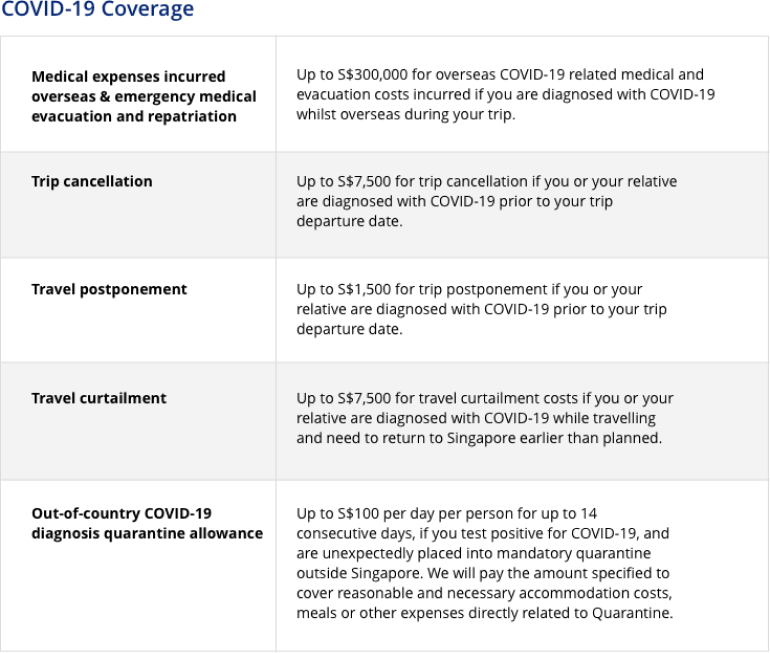

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

Here’s a summary of the main travel insurance coverage that AIG TravelGuard offers:

Other useful benefits such as pregnancy-related medical expenses, hospitalisation allowance, compassionate visit, credit card fraud are only found in the Enhanced plan.

- Overseas hospitalisation cash allowance : $200/24 hours, maximum of $10,000 (Standard plan) and $30,000 (Enhanced plan)

- Medical expenses for women : Up to $5,000 if you get the Enhanced plan

- Compassionate visit : $3,000 to $5,000 for a family member to visit you if you passed away overseas alone

- Medical expenses in Singapore : $10,000 (Standard) or $25,000 (Enhanced) if you need to continue treatment for injuries after returning to Singapore. $2,000 (Standard) or $5,000 (Enhanced) for illnesses that you got overseas.

- Credit card fraud : Up to $2,000 if you get the Enhanced plan

- Pet care : $50/6 hours, maximum of $500 for Enhanced plan only

AIG’s travel insurance coverage pales in comparison, since competitors such as Great Eastern travel insurance offer $50/day overseas hospitalisation allowance even for their lowest tier Classic plan. AIA travel insurance , on the other hand, offers women’s overseas medical expenses coverage of $2,000 even for their most basic plan.

2. AIG Travel Insurance Covid Cover

Here’s a summary of AIG travel insurance’s Covid coverage:

AIG travel insurance’s Covid-19 coverage is very limited with only $50,000 in overseas medical claims (Basic). If you’re hospitalised overseas due to Covid-19, you’d probably have to foot part of the bill yourself. Touch wood, but if you passed away due to Covid-19 or need to be medically flown back to Singapore, this AIG Covid-19 travel insurance may not be sufficient to cover your medical evacuation expenses.

Compared to other travel insurance plans, AIG travel insurance’s Covid-19 coverage is sorely lacking.

Sompo’s lowest tier Essential travel insurance plan , for example, offers $100,000 in overseas medical Covid-19 expenses, and another $100,000 for medical evacuation – so much more than the $50,000 in overseas medical expenses and evacuation that AIG is offering.

3. Outdoor Adventure and Extreme Sports

The AIG Travel Guard travel insurance plan’s outdoor adventure and extreme sports coverage is sufficient for the normal traveller.

Here are the outdoor adventure activities that AIG travel insurance covers:

AIG covers some sports and adventure activities done at leisure level, including sailing, hiking, skiing, snowboarding, white water rafting and scuba diving. That should be good enough for most travellers.

But there are some restrictions for aerial or airborne activities. You can go parachuting or skydiving with registered companies but forget about hang-gliding, paragliding, etc. The list of covered activities and their limitations is in the AIG policy wording.

4. AIG Travel Insurance Terms and Conditions

Before you purchase any travel insurance, you should watch out for the terms and conditions which may affect your travel plans adversely. Here are some terms and conditions from AIG travel insurance that might matter to you:

- No Post Trip Covid Coverage : If you returned to Singapore and tested Covid positive, your AIG travel insurance will not be able to cover your medical expenses.

- Length of Trip : You will only be covered for a maximum of 182 days if you purchased a single trip plan, and 90 days each trip if you got an annual multi-trip plan.

- Claim within 30 Days : You’ll need to ensure that your claim documents reach AIG’s office within 30 days of your incident. If you’re ill and not able to do that, your reason for submitting your claims late (no later than 1 year) will have to be “reasonable” to AIG.

- No Pre-Existing Conditions will be covered. If you need travel insurance for pre-existing medical conditions, try MSIG or NTUC travel insurance plans instead.

- Overseas Medical Expenses for Pregnancy : Covers pregnancy-related illness or injuries you suffered while overseas for 90 days. Doesn’t include first trimester, ectopic pregnancy, miscarriage.

- Air Miles and Hotel Reward Points : If you booked your flight tickets or hotel stays with miles or points, your flight tickets or hotel bookings will not be covered.

- Call AIG Travel Asia Pacific Before Hospitalisation : You must inform AIG before you get hospitalised (means you stay in the hospital as an in-patient for over 24 hours) else your hospitalisation cannot be claimed.

5. AIG Travel Insurance Claims Review

Claims is, perhaps, one of the most important part of a travel insurance plan. I mean, you can get $2 billion in medical coverage but if the claims process is notoriously difficult, then what is the point?

And, alas, AIG’s travel insurance claims reviews are all pretty bad. A quick search through forums such as Reddit and Hardwarezone will reveal many users with their AIG travel insurance claims denied or rejected, citing pretty intricate and complex (at least to a regular folk) terms and conditions in the policy wording.

To be honest, as a regular Singaporean, I won’t spend 3 days studying the AIG travel insurance policy wording before I purchase it or jet off. I mean, if claims are so difficult… then just steer clear of it like your ex-girlfriend.

AIG Overseas emergency hotline: Call +65 6733 2552 for 24-hour medical and emergency help

AIG Claims hotline: Call +65 6224 3698 to get help with your AIG travel insurance claims

AIG Online claims: Submit your claims with all supporting documents through AIG’s online claims submission form

Hard copy claims : Download the hard copy claim form and mail them with your documents to AIG

Travel Claims Department AIG Asia Pacific Insurance Pte Ltd AIG Building 78 Shenton Way, #07-19 Singapore 079120

Things to note: Claims must be made within 30 days of the event, incident, loss, or hospitalisation etc.

How long does AIG take to process claims? Within 10 business days. If it takes longer, try calling the AIG travel insurance claims hotline at +65 6224 3698 for your claims’ status update.

6. AIG vs Allianz Travel Insurance

A popular rival for AIG’s travel insurance is the German multinational insurance company, Allianz’s travel insurance. Here, we compare the main travel insurance coverage for AIG travel insurance vs Allianz travel insurance:

Total Premium

Allianz Travel Silver

[Receive your cash as fast as 30 days*] • Enjoy an exclusive 57% off your policy premium • Get S$88 Revolut Cash Award* and an Eskimo Global 1GB eSIM with every policy purchased. • Additionally, receive up to S$40 via PayNow with eligible premiums spent. T&Cs apply. PLUS, get S$100 Revolut Cash Award when you are the 8th and 88th Successful Applicant each week to sign up for a new Revolut account in our Giveaway. T&Cs apply.

Plans start from $28

All Plans Provide Unlimited Emergency Transportation (Includes Covid-19 Coverage)

Allianz Travel Insurance will cover you against medical costs, cancellations and curtailments due to COVID-19, or being impacted by other pandemic or epidemic, when you are diagnosed with the disease

24/7 Medical Assistance - helping you organise things like trusted medical expertise, appointments and making direct payments (to selected medical providers)

Frequent Travellers: Get covered for an unlimited number of trips with Annual Plans (up to 90 days’ duration each trip).

The Family Plan provides cover for you and the members of your family who are travelling with you on your journey. Insured persons may comprise a maximum of two adults, who need not be related. Insured persons may also include ANY number of dependents of the two named adults. Note that ALL insured persons, including dependents, must be named on the certificate of insurance.

Compared to AIG travel insurance, Allianz travel insurance’s medical-related claims are way more comprehensive. The trip cancellation and disruption related claims run up to a whopping $15,000 or $25,000 – great if you are staying in an expensive Maldives resort or the famed Crosby Hotel in New York City.

Allianz’s travel insurance premiums are way more expensive than AIG’s. However, there’s a silver lining – Allianz runs frequent promotions and promo codes for their travel insurance plans.

Although their claims process seems slow (racks up to 6 months), online users on Reddit have shared that they’ve successfully managed to get their claims from Allianz… with very much patience.

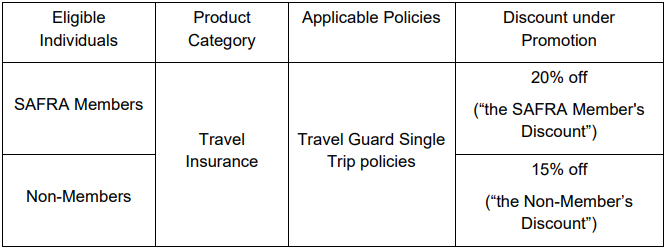

7. AIG Travel Insurance Promotion

AIG has an ongoing travel insurance promotion right now which offers you $30 or $50 in Grab vouchers . Use the promo code AIGTGB when you book your single-trip AIG travel insurance plan. If you’re thinking of using these Grab vouchers to offset your Grab ride to Changi Airport, we’re sorry to break the news to you – the Grab voucher will only be sent to you via email 6 to 8 weeks after you buy the travel insurance plan. (Unless you buy early.) Promo ends soon on 30 June 2022.

The other promotion they have is that you can get preferred rates for pre-departure PCR tests at $112 (includes GST). Your AIG travel insurance confirmation email will come with a link for you to book your pre-trip PCR test. You’ll need to get it done at one of the 36 Raffles Medical clinics around Singapore.

8. AIG Travel Insurance Review

In all honesty, the AIG Travel Guard plans offer really poor value on their Basic plan, and only so-so on the Standard plan. So if you’re looking for a cheap and good deal, you can skip AIG completely.

The basic plan may be cheap but it is most definitely not good; while the Standard plan is acceptable but a good deal pricier than similar products on the market.

The only reason you might want to get the low- to middle-tier AIG travel insurance is if you booked your trip via a travel agency and they have some kind of exclusive discount that’ll put it back in the competition.

That said, the AIG Enhanced travel insurance plans have surprisingly good coverage , so if you want to buy from AIG, go big or go home. AIG seems to concentrate all their resources on the upper tier plans. Speaking of going big, AIG has been awarded the Best Travel Insurance by Tripzilla in 2022 and won Reader’s Digest Trusted Brands Gold Award for Travel Insurance for 4 straight years.

Plus, in terms of promised turnaround time, AIG states that they’re willing to commit to a 10 working day turnaround time from claim to settlement. However, online reviews seem to claim otherwise.

Looking to buy travel insurance? Compare all Covid travel insurance plans here.

Related Articles

Travel Insurance Singapore Guide (2023): Must-Knows for Choosing the Best Travel Insurance

Airline Travel Insurance – What does SIA, Scoot, Jetstar travel insurance cover?

Best Travel Insurance Plans in Singapore [content outdated due to Covid]

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

AIG Travel Guard Insurance Review: What to Know

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Coronavirus considerations

Travel insurance plans offered by aig travel guard, how to buy a travel guard policy, additional travel insurance options and add-ons, what’s not covered by a travel guard plan, who should get a travel guard insurance policy, travel guard, recapped.

Travel Guard by AIG

- Offers last-minute coverage.

- Pre-Existing Medical Conditions Exclusion Waiver available at all plan levels.

- Plan available for business travelers.

- Cancel For Any reason coverage only available for higher-level plans, and only reimburses up to 50% of the trip cost.

- Trip interruption coverage doesn't apply to trips paid for with points and miles.

As one of the world’s largest insurance companies and with a 100-year history, it makes sense that AIG would offer travel insurance. AIG’s travel insurance program, called Travel Guard, provides a number of coverage options to offer peace of mind on your trips.

Travel insurance helps you get some money back if anything goes wrong on your trip. If you’re thinking about buying coverage for an upcoming trip, first look into the coverage you may get from your travel credit cards . Many basic protections are offered on cards that you may already have.

If you’re looking for additional coverage, AIG travel insurance is a solid choice. Consumers Advocate rated AIG’s plans at 4.4 stars out of 5 stars.

» Learn more: The majority of Americans plan to travel in 2022

Importantly, if you catch COVID-19 before or during your trip, you will be covered under Travel Guard’s trip cancellation benefit. If you become sick with COVID-19 during the trip, the medical expenses and trip interruption benefits will kick in. However, Travel Guard considers COVID-19 a foreseen event and as a result, certain other coronavirus-related losses may not be covered. Given the constantly evolving travel environment, review the Travel Guard’s coronavirus coverage policies so that you’re award of what is and isn’t covered.

Here’s what you need to know about AIG's Travel Guard insurance plans.

AIG travel insurance’s Travel Guard plans cover you if you need to cancel (or interrupt) your trip due to illness, injury or death of a family member. Inclement weather that causes a trip delay or cancellation is covered by all Travel Guard policies as well.

Travel Guard offers three main AIG travel insurance plans, plus a host of add-on options. Here are the most essential benefits:

Travel Guard Essential - The most basic level of coverage

Covers 100% of the cost of your trip if it gets canceled or interrupted due to illness.

Includes a $100 per day reimbursement for any delays in your trip (max $500 total).

Covers up to $15,000 in medical expenses ($500 dental), plus a $150,000 maximum for emergency medical evacuation.

Covers up to $750 in compensation for stolen luggage and a maximum of $200 if your bags get delayed by more than 24 hours.

Travel Guard Preferred - This midlevel plan gives many of the same basic coverages as the Essential, but at higher levels.

Trip cancellation pays out at 100%. If your trip gets interrupted, you’ll get 150% of the cost of the trip.

Trips delayed by more than five hours will get you up to $800 ($200/day).

You’ll be covered up to $50,000 for medical expenses ($500 dental) and up to $500,000 for emergency evacuation.

This plan offers $1,000 for lost or stolen bags and $300 for baggage delays longer than 12 hours.

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan.

Like the Preferred, you’ll get 100% coverage for trip cancellation and 150% of the cost of your insured trip in the event of a trip interruption.

Up to $1,000 ($200/day) for a trip delay of five hours or more.

Up to $100,000 for medical expenses ($500 dental), $1,000,000 for emergency evacuation and $100,000 in coverage for a flight accident.

Coverage for lost or stolen bags jumps up to $2,500 and $500 for baggage delay of more than 12 hours.

A long list of "Travel Inconvenience Benefits" are also included (such as runway delays, closed attractions, diversions, etc.)

This plan also offers roadside assistance coverage for the duration of your trip, which isn't included in the other two plans.

» Learn more: How to find the best travel insurance

Travel Guard’s website is simple to navigate and provides instant quotes that clearly spell out what's covered. You’ll need to enter basic information about the trip you want coverage for, including:

Destination.

How you’re getting there (airplane, cruise or other).

Travel dates.

Your home state.

Date of birth.

How much you paid for the trip.

The date when you paid for the trip.

Once you answer the questions, you’ll instantly get price quotes for different options of insurance for your trip. Each column clearly shows what’s covered for all options in a long list, so you can quickly compare.

This example shows options based on a two-week $5,000 trip to Spain for someone who is 40 years old. In this case, the mid-tier plan costs about 6% of the total trip cost.

It’s also important to know that plan offerings change based on what state you live in; not all states are covered.

If you purchase a Travel Guard plan and need to file a claim, you can do it on their website or by calling (866) 478-8222. You can also track the status of the payment of your claim on the site.

If you’re planning multiple trips that you would like covered, look at Travel Guard’s Annual Travel Insurance Plan. This 12-month option covers multiple trips and could save you money over insuring each trip separately.

Another option is the "Pack and Go" plan, which is a good choice if you’re going on a last-minute getaway and don’t need trip cancellation protection.

There are also options to add rental vehicle damage coverage, Cancel For Any Reason coverage, and medical and security bundles to the plans. You’ll be able to select these add-ons when you’re purchasing a policy.

» Learn more: Cancel For Any Reason (CFAR) travel insurance explained

While the Essential, Preferred and Deluxe plans all offer varying degrees of coverage for your trip, there are some things that won’t be covered by any of the plans. Here are a few highlights of things that aren't included; you’ll find full lists on each policy:

Coverage for trips paid for with frequent flyer miles or loyalty rewards programs: Travel Guard will only protect the trips you pay for with cash. If you’re redeeming your points for that bucket list trip, unfortunately, you won’t qualify for coverage. However, the cost of redepositing miles back into your account is covered.

Baggage loss for eyeglasses, contact lenses, hearing aids or false teeth: These items should be kept with you in your carry-on as a general rule, since a Travel Guard policy won’t cover them.

Known events: If you knowingly book a trip with some inherent risks, it won’t be covered. For example, once the National Weather Service issues a warning for a hurricane, it becomes a known event. Once COVID-19 became a pandemic, it was categorized as a foreseeable event and was no longer covered. You can cancel the policy you purchase up to 15 days prior to your trip to receive a refund for the premium paid.

» Learn more: Does travel insurance cover award flights?

Many trips may be sufficiently covered by your credit card benefits, but you should do research to see which cards provide the best options (and remember to use that card to book the trip).

However, if you’re planning major international travel or embarking on a big cruise trip, Travel Guard's Preferred and Deluxe plans may offer better coverage than your credit card. Overall, Travel Guard plans offer a variety of coverage options with an easy-to-navigate website that could be a good fit for your next trip.

If you’re not finding what you’re looking for with a Travel Guard plan, check out an insurance comparison site like Squaremouth, where you will have a lot of different plan options to choose from.

» Learn more: Is travel insurance worth it?

Travel Guard offers several trip insurance plans with varying degrees of coverage. Some plans also allow you to purchase optional upgrades such as CFAR and auto rental coverage. Plan availability differs by state, so make sure you input your trip details to see what plans are available to you.

If you have a premium travel credit card, you may already have some elements of travel insurance coverage included for free. Before you decide to purchase a comprehensive policy, check what coverage you may already have from your credit card.

Travel Guard’s insurance plans offer trip cancellation, trip interruption, emergency medical coverage and evacuation, baggage delay, baggage loss, and more. Some policies may also allow you to add on benefits like Cancel For Any Reason and car rental damage coverage.

If you need to cancel your trip for a covered reason (e.g., unforeseen sickness or injury of you or your family member, required work, victim of a crime, inclement weather, financial default of travel supplier, etc.) you will be covered. To see the whole list of covered reasons, refer to the terms and conditions of your policy.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online at its claims page . You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time on Travel Guard’s website .

The Cancel For Any Reason optional upgrade is available on certain Travel Guard plans. Travel Guard’s CFAR add-on allows you to cancel a trip for any reason whatsoever and get 50%-75% of your nonrefundable deposit back as long as the trip is canceled at least two days prior to the scheduled departure date.

To get a refund, you will need to file a claim by either calling (866) 478-8222 or submitting it online

at its claims page

. You may be required to provide verifying documentation to substantiate your claims so keep any receipts that you intend to submit. You can also check the status of your claim at any time

on Travel Guard’s website

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

To offer you a better experience, this site uses cookies. Read more about cookies in our Privacy Policy .

- Register for SAFRA membership

- Login to my SAFRA membership

- SAFRA Choa Chu Kang

- SAFRA Mt Faber

- SAFRA Jurong

- SAFRA Punggol

- SAFRA Tampines

- SAFRA Toa Payoh

- SAFRA Yishun

- SAFRA@29 Carpenter Street

Travel Guard Plan

JOIN SAFRA NOW

AIG Travel Guard®

ALL SAFRA Members can now enjoy 20% off with purchase of any Single Trip plan!

Special features of Travel Guard plans:

- Now with COVID-19 cover

- 24/7 worldwide assistance services just a call away at +65 6733 2552

- Cover losses arising directly from act of terrorism during the trip

- Cover for leisure sports

- Unlimited emergency medical evacuation

Click on the link below to enjoy this exclusive promotion.

- Members (20% off): Click here!

- Non-Members (15% off): Click here!

*Please note that you will be directed to external websites hosted by AIG which are not managed by SAFRA. Note that you are solely responsible for the personal data that you provide and your personal data shall be subject to their personal data policies.

Common Questions

Will my medical expenses be covered if I fall sick during my trip?

Yes, Travel Guard plans cover medical expenses incurred overseas, up to S$2,500,000 depending on the plan type purchased.

Will my medical expenses be covered if I visit a doctor only when I return to Singapore?

Yes, Travel Guard plans cover post-trip medical expenses incurred in Singapore. You are required to seek medical treatment in Singapore within 48 hours upon your arrival in Singapore. After which, you will have up to a maximum of 30 days to continue medical treatment in Singapore.

Does Travel Guard cover my cruise?

Yes, Travel Guard provides coverage whether you are travelling by cruise, plane, train or automobile.

COVID-19 FAQ

Product Brochure

Policy Wording

Important Notes:

AIG's Travel Guard® is underwritten by AIG Asia Pacific Insurance Pte. Ltd. (AIG). SAFRA does not hold itself out to be an insurer, insurance broker or insurance agent. Please refer to the Policy for the specific terms, conditions and exclusions of this Plan. No insurance is in force until the Proposal Form is accepted by AIG in accordance with the Policy terms and conditions. AIG’s Travel Guard policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for these Policies is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.aig.sg , www.gia.org.sg or www.sdic.org.sg ).

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Pet Week 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

AIG Travel Guard insurance review: What you need to know

Whether you need an annual plan or a policy for a last-minute trip, travel guard can deliver..

Travel Guard is one of CNBC Select 's picks for best travel insurance , thanks to its wide range of customizable policies. But are any of them right for you? Below, we review the provider and its offers and how they compare to the competition to help you choose the right travel insurance for your next trip.

Travel Guard review

Other insurance offered, how it compares, bottom line, travel guard® travel insurance.

The best way to estimate your costs is to request a quote

Policy highlights

Travel Guard offers a variety of plans to suit travel ranging from road trips to long cruises. For air travelers, Travel Guard can help assist with tracking baggage or covering lost or delayed baggage.

24/7 assistance available

- A variety of plans are available to help cover different types of trips

- Not all products are available for purchase online

Travel Guard® is a global travel insurance provider specializing in plans for leisure and business travelers. Its online travel insurance packages include five options, from basic and last-minute trip coverage to more comprehensive plans. This allows travelers to pick a plan that best matches their situation.

For example, budget-minded travelers might go for the Essential Plan which offers basic protections, such as trip cancellation, interruption and delay insurance, coverage for lost, damaged and delayed baggage, and medical, evacuation and death coverage.

On the other hand, the Deluxe Plan — the most comprehensive option — adds such extras as missed connection coverage, security evacuation, travel inconvenience benefits and more. It also boosts high limits for essential coverages.

Last-minute travelers can opt for the Pack N' Go Plan which only includes certain post-departure coverages. Or, if you travel often, the Annual Plan can cover your trips throughout the year.

Finally, Travel Guard offers "offline" travel insurance packages, meaning you'll have to call if you're looking for a specialty plan.

Coverage types

Depending on the plan, here are the types of protection Travel Guard can include in your package:

- Trip cancellations

- Trip interruption

- Baggage coverage

- Baggage delay

- Travel medical expenses

- Travel inconvenience benefits (reimbursement for such situations as runway delays, cruise diversion and other unforeseen situations)

- Medical evacuation

- Trip Saver (reimbursement for meals, hotels and transportation if you need to begin your trip sooner due to weather or airline changes)

- Trip exchange (reimbursement in case you have to cancel your trip and book a new one due to covered unforeseen circumstances)

- Security evacuation (due to a riot or civil disorder)

- Flight guard (coverage for accidental death or dismemberment that occurs when traveling by plane)

- Pre-existing medical conditions exclusion waiver

You can also customize your plan with add-ons, such as car rental insurance and "cancel for any reason" coverage .

Travel Guard landed on our list of the best travel insurance companies thanks to its variety of coverage. With plenty of options to choose from, both online and offline, it's easy to build a policy that meets your needs.

Travel Guard also features 24-hour concierge services that you can use to book a new flight in case of an emergency or delay.

The provider's website also offers informational resources — here, you can check travel news, read safety tips and find general travel advice. Additionally, the website lets you modify your plan, file a claim and check its status, or apply for a voucher or refund.

As of writing, Travel Guard doesn't offer any discounts. That's common for travel insurance — you're more likely to find deals when shopping for other types of insurance, such as home and auto insurance .

Travel Guard is a portfolio of travel insurance and travel-related services offered by AIG Travel, a member of American International Group (AIG). AIG also offers life insurance and a variety of business insurance products.

Travel Guard makes it easy to get a travel insurance policy customized to your needs. But before you purchase coverage, it's always a good idea to shop around.

For example, if you're going on a cruise, you might want to look at Nationwide Travel Insurance . The provider advertises cruise-specific insurance with three plan options available. This type of coverage is designed with issues unique to cruises in mind — from ship-based breakdowns to missed pre-pard excursions.

If you're planning a more active trip filled with rock climbing or sky diving, Berkshire Hathaway offers the AdrenalineCare® plan which features coverage for unforeseen costs that result from participating in extreme sports on your trip, as well as reimbursement for sporting equipment delay. Pre-existing conditions are covered under this plan (if you meet qualifying conditions).

Berkshire Hathaway Travel Protection

Berkshire Hathaway Travel Protection has multiple plans to cover vacations from luxury travel to adventure travel. The brand's LuxuryCare offers the highest limits of travel insurance coverage offered by the company. Quotes and policies are available online.

As you can see, offerings vary by provider. It can be helpful to compare multiple companies and the plans they offer to find what works best for you. It's even better if you gather several quotes to ensure you're getting a good price for your policy.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Travel Guard offers plenty of ways to customize your policy, making it a solid choice for travel insurance. You can also access additional options by giving Travel Guard a call. However, make sure to check out other travel insurance companies too — comparison shopping is essential when picking any type of financial product.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of insurance products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

- Here are the best corporate credit cards of 2024 Jason Stauffer

- Here are the best commercial auto insurance companies Liz Knueven

- Kasasa bank accounts: Get up to 6% APY with this high-yield checking account Elizabeth Gravier

AIG Travel Guard Insurance | Money

W e’ve reviewed Travel Guard from AIG as part of our exploration of the best travel insurance companies of 2023. This review will cover the pros, cons and features of AIG Travel Guard to help you decide if it’s the best travel insurance provider for you.

Best for Add-Ons

AIG travel insurance stands out for its wide variety of add-on options. Travel Guard offers a security bundle, pet bundle, sports bundle and many other add-ons to customize your travel insurance.

AIG Travel Guard Travel Insurance Pros and Cons

AIG Travel Guard is one of many insurance providers that support international travelers while they’re abroad. It isn’t your only option, so let’s take a look at how the company’s policies compare to competitive offerings. Here’s an overview of what you can expect from a Travel Guard travel insurance policy.

- Up to $1 million in evacuation coverage

- Plenty of add-on options

- Optional waiver for pre-existing conditions

- CFAR upgrade doesn't cover the entire trip

- Premiums can get expensive

Pros explained

AIG Travel Guard insurance is highly rated across review platforms. This might be the right insurance company for you if you’re looking for a policy with high coverage for medical evacuations, a range of add-ons and waivers for pre-existing conditions.

$1 million medical evacuation coverage

One of the main reasons people buy travel insurance is to pay for an emergency medical evacuation. If you get sick or injured while abroad, you may need to be evacuated for your safety.

With Travel Guard Deluxe from AIG, you get up to $1 million in coverage for medical evacuations. Travel Guard Preferred offers $500,000 for evacuations, and Travel Guard Essential offers $150,000. That coverage goes toward flights and other costs to get you to a safe location where you can receive high-quality medical care.

Offers a variety of special add-on coverages

AIG Travel Guard Insurance offers a wide variety of add-on coverage options. These riders can be added to your plan to customize your trip. These include:

- Medical bundle: This supplies extra coverage for medical costs and the option to choose your hospital.

- Wedding bundle: This allows you to cancel your trip if a destination wedding is canceled.

- Pet bundle: This provides a daily benefit for the costs of traveling with a dog or cat, plus coverage for veterinary bills.

- Inconvenience bundle: This covers certain problems that don’t end your trip, such as credit card cancellations, closed attractions and trip delays.

- Adventure sports bundle: This removes coverage exclusions for injuries caused by extreme sports such as scuba diving, skydiving and rock climbing.

- Baggage bundle: This gives increased coverage for baggage loss and delays.

Pre-existing medical conditions waiver available for purchase

If you have a pre-existing condition that could lead to medical costs during your trip, Travel Guard offers waivers to extend coverage for those expenses. The waiver must be bought before your trip. It might be worthwhile for travelers with chronic conditions, immune system deficiencies, and other conditions that can make traveling especially dangerous.

Cons explained

AIG travel insurance isn’t right for everyone. Before you buy a Travel Guard plan, you should be aware that you can’t get a full reimbursement when you cancel for any reason and that your premium might be more expensive than other options.

Cancel for Any Reason upgrade only covers 50% of trip costs

Cancel for any reason (CFAR) policies are common with travel insurance companies. This add-on allows you to be reimbursed no matter why you cancel your trip.

A standard travel insurance plan only offers reimbursements for a prescribed list of eligible reasons for canceling. These include medical or weather-related emergencies and the death of a close family member or traveling companion. But with CFAR, you can cancel under any circumstances and still receive coverage — as long as you do so 48 hours before departure.

Unfortunately, AIG Travel Guard with CFAR only offers a 50% reimbursement of your prepaid travel expenses. Other companies offer a higher reimbursement percentage, so consider whether you want more comprehensive protection before signing up for this insurance.

Expensive premiums

AIG Travel Guard is not the cheapest travel insurance company out there. Your exact premium depends on several factors, including your destination, plan type, add-ons and age. But based on our sample quotes, AIG travel insurance plans are slightly more expensive, on average, than other insurers’ plans.

AIG Travel Guard Travel Insurance Plans

Like shopping for the best travel credit cards , choosing the best travel insurance plan takes time and research. The best plan will save you money and give you peace of mind, while the wrong plan could be an unnecessary expense. That’s why looking for insurance companies offering multiple policy options is best.

AIG Travel Guard offers three main plans plus two bonus plans for international travel insurance. Let’s break those options down in detail.

Travel Guard Essential is a very basic travel plan offered by AIG. This budget-friendly plan comes with standard coverage for trip cancellations, interruptions and delays. Medical coverage goes up to $15,000 plus $500 for dental costs and $200 for lost or damaged baggage.

The Essential plan is best for a tourist or short-term traveler who is willing to sacrifice comprehensive coverage for a lower insurance premium. The plan can be beefed up with any of AIG’s add-on bundles.

Travel Guard Preferred is a mid-priced option for someone who wants more coverage. This policy comes with medical coverage of up to $50,000 and evacuation coverage of up to $500,000. Damaged, lost or stolen baggage is covered up to $1,000.

Travel Guard Deluxe, the most expensive plan offered by AIG, comes with a wide range of benefits and includes security evacuation, missed-connection coverage, trip-saver coverage and more. This plan offers up to $1 million for a medical evacuation.

Travel Guard Deluxe is a good choice for someone traveling to rural or dangerous areas. It covers almost any emergency and even includes robust coverage for your beneficiaries in case of a fatal accident.

AIG’s Pack N’ Go plan is designed for travelers who buy their insurance at the last minute. There is no cancellation coverage, but this plan offers up to $25,000 in medical coverage plus $500 for lost or damaged baggage. Buying travel insurance at the last minute is not recommended, but this is a helpful option if you plan a trip quickly.

You can purchase an annual travel insurance plan through AIG. An annual plan is ideal for someone who travels frequently, especially to dangerous areas. With Travel Guard’s annual plan, you’ll get:

- Trip delay coverage: $150 per day, up to $1,500

- Trip interruption coverage: up to $2,500

- Lost baggage coverage: up to $2,500

- Baggage delay coverage: up to $1,000

- Medical expenses coverage: up to $500,000 (dental coverage up to $500)

- Accidental death coverage: up to $50,000

- Emergency evacuations and repatriation of remains: up to $500,000

These benefits apply to multiple trips within the same year. You can renew your coverage annually or cancel at the end of a payment period. Purchasing an annual plan is usually less costly than insuring two trips individually.

AIG Travel Guard Travel Insurance Pricing

AIG travel insurance is comprehensive but on the higher end of the price spectrum. Premiums for Travel Guard Essential and Premium are on par with industry standards. Travel Guard Deluxe is slightly more expensive because of the added coverage that comes with it.

For example, our quote for a month-long vacation in Europe for two people costing around $5,000 came to around $300 with Travel Guard Premium and $560 with Travel Guard Deluxe. Add-on bundles will add a flat rate to that price. Our quotes for the same trip came out to around $150–$300 with other travel insurance companies.

Of course, that’s just an estimation. Your exact premium will vary depending on your travel dates, destination, age, number of people in your party and other factors. AIG family travel insurance goes up in price for each family member added.

Talk to an AIG Travel Guard representative to get a personalized quote for your travel insurance. You can also request a quick quote online for a basic estimate.

AIG Travel Guard Travel Insurance Financial Stability

AIG Travel Guard is an established insurance provider and a publicly traded company. It has an A rating from AM Best, which reflects a high degree of financial strength and stability. AIG also has a rating of A2 from Moody’s and an A+ from Standard and Poor’s. Because Travel Guard is a product of AIG, you should expect this insurer to remain stable in the future.

AIG Travel Guard Travel Insurance Accessibility

Here’s how AIG Travel Guard compares with other top insurers in terms of accessibility.

Availability

AIG travel insurance offers coverage on six continents. You can search for your destination country on AIG’s website to ensure coverage is available, but remember that not all coverage is available in all destinations.

When it comes to buying travel insurance, AIG is only available to residents of the U.S.

Contact information

You can call AIG’s travel insurance phone number any time to get more information about your policy or request help. Both of these numbers have 24/7 availability:

- U.S. toll-free, 1-855-203-5962

- U.S. and international collect, 1-715-345-0505

If you need to file an AIG travel insurance claim, you can connect with a customer service agent online or over the phone. You can also reach AIG by mail at:

Travel Guard

3300 Business Park Drive

Stevens Point, WI 54482

User experience

While it does offer a travel-assistance app, this insurer isn’t as up-to-date with modern technology as other options. Its Travel Assistance app has 2-star ratings on both Google Play and the App Store and is difficult to navigate. The website is also slightly confusing and has several pages stating the same information. On top of that, AIG travel insurance claims must be filed directly with an agent.

However, getting a quote on the AIG website is easy. It takes less than a minute, and you don’t need to provide your name or any contact information.

AIG Travel Guard Travel Insurance Customer Satisfaction

AIG Travel Guard receives a high rate of customer complaints. It’s rated 1.01/5 stars with the Better Business Bureau. Some reviewers report a lack of helpful customer service and problems getting their AIG travel insurance refund for a canceled trip.

Keep in mind that these complaints are fairly standard in the travel insurance industry. Your individual experience will vary depending on your plan and other details.

AIG Travel Guard Travel Insurance FAQ

What does aig travel guard travel insurance not cover.

- Pre-existing conditions (without an optional waiver)

- Traveling against your doctor's advice

- Traveling against warnings about war or other dangerous conditions

- Trip cancellation due to concerns over a COVID-19 outbreak at home or in your destination country. You may be eligible for cancellation coverage if you have a confirmed diagnosis of COVID-19 before your departure.

What is the AIG Travel Guard claims process like?

Is aig travel guard travel insurance worth it, how we evaluated aig travel guard travel insurance.

We evaluated AIG Travel Guard for this review based on several factors, including:

- Range of plan options

- Accessibility

- Customer reviews and complaints

- Claims filing process

- The extent of coverage for the cost

Summary of Money’s AIG Travel Guard Travel Insurance Review

AIG Travel Guard stands out for its variety of add-ons. Its optional bundles allow you to customize your plan to meet your travel needs. While the Deluxe plan is a little more expensive than other options, Travel Guard could be the right choice for you if you value flexibility and extensive coverage.

Whichever insurance policy you choose, be sure to plan ahead and buy your insurance far in advance. Keep an eye out for other ways to save on your trip, including the best travel rewards credit cards and travel booking sites .

© Copyright 2023 Money Group, LLC . All Rights Reserved.

This article originally appeared on Money.com and may contain affiliate links for which Money receives compensation. Opinions expressed in this article are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Offers may be subject to change without notice. For more information, read Money’s full disclaimer .

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

The GST rate will increase to 9% on 1 January 2024. Visit this page for more information.

Travel Guard ®

Now with COVID-19 Cover

TRAVEL GUARD

Travel alerts.

Please be advised that the military conflict between Russia and Ukraine may impact travel insurance coverages and benefits, and AIG’s ability to provide certain travel-related assistance services, for travel to, from or within the affected areas.

Now with COVID-19 cover

Travel Guard is now enhanced with COVID-19 coverage. Better coverage, same great service and experience.

As you look forward to travelling again, you can travel confidently with AIG's Travel Guard for your next getaway.

Our wholly owned assistance centers are equipped to assist you 24 hours a day, 7 days a week.

QUICK QUOTE

Single trip coverage.

The maximum length of each insured trip is 182 days.

ANNUAL COVERAGE

The Insured Policyholder(s) will be covered for an unlimited number of trips made during the Policy Period. The maximum length of each insured trip is 90 days

POLICY TYPE

The policy type shows which people are insured under the policy. You can choose from either Individual or Family cover.

If you choose Individual cover this policy insures you only.

If you choose Family cover this policy insures you and/or your spouse and/or your children.

• Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply.

• Under an Annual Multi-Trip policy, cover will apply to you or your spouse whilst travelling separately of each other; however your children must be accompanied by you and/or your spouse for the entire trip for cover to apply.

GROUP/ COUPLE

Select this option if you have individuals travelling together on the same dates and to the same destination.

For group/ couple up to a maximum of 50 individual policies on the same transaction.

Zone 1 Destinations

Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Thailand, Vietnam

Zone 2 Destinations

Zone 1, Argentina, Australia, Bahrain, Bangladesh, Belize, Bolivia, Brazil, Chile, China (excluding Tibet), Colombia, Costa Rica, Ecuador, El Salvador, Guatemala, Guyana, Honduras, Hong Kong SAR - China, India, Japan, Kuwait, Macau SAR - China, Maldives, Mexico, Mongolia, New Zealand, Nicaragua, Oman, Pakistan, Panama, Paraguay, Peru, Qatar, Sri Lanka, Suriname, Taiwan - China, United Arab Emirates, South Korea, Uruguay, Venezuela

Zone 3 Destinations

Zone 1, Zone 2, Nepal, Tibet - China, Rest of the World

AIG Asia Pacific Insurance Pte. Ltd. will not cover any loss, injury, damage or legal liability arising directly or indirectly from travel in, to, or through Cuba, Iran, Syria, North Korea, and the Crimea region.

Modal Message

We do not offer Annual Multi Trip for Group

travelCoverageType

We do not provide Annual Multi Trip for Group

travelPolicyType

Zone is a Mandatory Field

Please provide start date

Please provide end date

Travel Cruise is a Mandatory Field

Adult Travelling is a Mandatory field

Please enter age of traveller

less than or equal to

Please enter a valid age of traveller

Please enter age of at least 2 travellers

Annual Plan for Individual is only applied to Superior and Premier to destination Zone 2 and Zone 3

Annual Plan for Family is only applied for Premier to destination Zone 2 and Zone 3

Please select no of travellers

Enjoy world-class travel protection with worldwide coverage

AIG’s Travel Guard helps keep unexpected problems off your itinerary with 24/7 worldwide assistance. From minor inconveniences to major emergencies, we are prepared for what may go wrong, so you can enjoy your holiday.

COVID-19 Coverage

Key benefits.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.AIG.sg or www.gia.org.sg or www.sdic.org.sg ).

Learn more about AIG's Travel Guard

- Application Form

- Policy Wording (issued before 1 Dec 2023)

- Policy Wording (issued on/after 1 Dec 2023)

Buy this plan

Renew your existing aig annual travel insurance.

Enquiries: 6419 3000 24-hour overseas emergency assistance hotline : 6733 2552 Travel claims : 6224 3698

Enquire online

Send an enquiry

Policy Changes

Make changes to your policy

Make a claim

"I have been an AIG customer for more than two decades. I am delighted to share that AIG has never once let me down during my times of need. AIG has gained my trust and loyalty as a customer. Well done and keep up the excellent work!" SL Tang, Jun 2023

"aig’s travel assistance team is prompt and efficient in times of emergencies. i feel assured that in times of need, aig will be there for me. alfred g, aug 2023, "aig’s travel guard is the perfect insurance for overseas travel. the staff are efficient and provide excellent support service." mm lim, dec 2023.

- Testimonial 1

You might like

AIG On the Go driving app

Score your driving performance and get up to 15% off your AIG vehicle insurance premium.

IMAGES

VIDEO

COMMENTS

Travel Guard ® Direct. √ Up to $ ... Under a Per Trip policy, the family must depart from and return to Singapore on the same itinerary together as a family for cover to apply. ... Learn more about AIG's Travel Guard Direct. Policy Wording (issued on/after 24 September 2022) Policy Wording (issued on/before 23 September 2022) ...

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

AIG Travel Insurance provides a 24/7 global assistance hotline staffed by multilingual operators based in Singapore who can provide assistance with medical emergencies and other travel-related issues. Should you require any emergency assistance, you may contact their 24/7 number at +65 6733 2552.

AIG's Travel Guard helps keep unexpected problems off your itinerary with 24/7 worldwide assistance. From minor inconveniences to major emergencies, we are prepared for what may go wrong, so you can enjoy your holiday. This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit ...

If you have ever gone on group tours through travel agents, AIG travel insurance (or the AIG Travel Guard) might ring a bell because AIG works with a lot of agents in Singapore. For the risk-averse, it's pretty hard to beat AIG travel insurance for peace of mind as they have an 24-hour in-house emergency assistance network called AIG Travel Asia Pacific (ATAP) with 8emergency centres ...

Travel Guard Deluxe - The biggest benefits can be found in this highest level plan. Like the Preferred, you'll get 100% coverage for trip cancellation and 150% of the cost of your insured trip ...

Travel Claims Department AIG Asia Pacific Insurance Pte. Ltd. AIG Building, 78 Shenton Way, #09-16 Singapore 079120. What to expect. We process most straightforward travel insurance claims within 10 business days if they are submitted with complete documentation. It may take longer to process a claim if we require additional information or ...

You are returning to Singapore at the end of your travel, or be intending to return to Singapore on completion of your travel; and; Your pre-trip arrangements are made and paid for in Singapore and your trip commences in Singapore. Travel Guard Direct is for travelers of all ages, with no age limit.

Our products and plans are tailored to fit your needs based on your country of residence. If you are not a US resident, please select your country of residence below to receive travel insurance plans tailored to your needs.

Call us at: 800-826-5248. Travel Guard is America's leading travel insurance plan provider. We specialize in providing innovative travel insurance, assistance and emergency travel service plans for millions of travelers and thousands of companies throughout the world.

AIG Travel Guard® ALL SAFRA Members ... Will my medical expenses be covered if I visit a doctor only when I return to Singapore? Yes, Travel Guard plans cover post-trip medical expenses incurred in Singapore. You are required to seek medical treatment in Singapore within 48 hours upon your arrival in Singapore. After which, you will have up to ...

Travel Guard Travel Insurance plans offer the industry standard in travel and trip insurance; browse our insurance plans today! ... Singapore; Thailand; UAE; Remain on TravelGuard.com (US) Site. ... AIG Travel was awarded top honors by Forbes Advisor in their Best Travel Insurance providers list for consumers. Out of 15 travel insurance ...

AIG Travel Guard Preferred: Medical expenses up to $50,000, dental expenses up to $500 and emergency evacuation compensation of $500,000 are just a few of the benefits in this policy. It also ...

Not sure what travel insurance you want? Compare quotes on our most popular plans. Travel Guard offers over 20 products, ranging from our most popular all-inclusive plans, to rental car and flight insurance plans. Coverages may include: Trip cancellation and delay, lost baggage, medical emergency, international terrorism and any other unforeseen event or accident.

Travel Guard Claims Department . AIG Asia Pacific Singapore Insurance Pte. Ltd. AIG Building, 78 Shenton Way, #09-16, Singapore 079120 . Tel: 6224 3698 . Email: [email protected] The acceptance of this Form is NOT an admission of liability on the part of AIG Asia Pacific Insurance Pte. Ltd. ("the Company"). Any documentary proof

AIG Travel Guard insurance review: What you need to know Whether you need an annual plan or a policy for a last-minute trip, Travel Guard can deliver. Published Mon, Apr 22 2024.

Singapore; Thailand; UAE; Remain on TravelGuard.com (US) Site. ... About AIG Ads Coverage available to U.S. residents of the U.S. states and District of Columbia only. ... Coverage is offered by Travel Guard Group, Inc. (Travel Guard). California lic. no.0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, travelguard.com. CA DOI toll ...

AIG Travel Guard is an established insurance provider and a publicly traded company. It has an A rating from AM Best, which reflects a high degree of financial strength and stability. AIG also has ...

Singapore; South Africa; Suomi; ... To purchase this policy, you will need to mail Travel Guard a paper application for insurance, a Cuba Travel Compliance Certification (Travel Guard version) and, if you are traveling under a specific OFAC license, additional documentation. Please contact our sanctioned countries hotline at 866.375.2546 for ...

AIG is one of the leading travel insurer in Singapore with its own global assistance service centre. With eight locations worldwide, help is always at hand. ... "AIG's Travel Guard is the perfect insurance for overseas travel. The staff are efficient and provide excellent support service." MM Lim, Dec 2023. Previous Next.